44 clergy tax deductions worksheet

Schedule SE - Clergy Self-Employment Tax Adjustment Worksheet Start your TaxAct Desktop program, then click Forms in the top left corner. Click to expand the Federal folder, then click to expand the Worksheets folder. Scroll down and double-click Schedule SE - Adjustments - Self-Employment Adjustment Worksheet. In the print dialog box that appears, you can send the output to a printer or a PDF document. Reporting Housing and Utility Allowances for Members of the Clergy Then, transfer your housing and/or utility allowance from box 30 of your T4 slip to line 10400 of your income tax return. Finally, complete Form T1223, Clergy Residence Deduction, to calculate your deduction. Report your deduction from this form on line 231 of your income tax return. Your employer must fill out part B of this form.

Tax Information | Wespath Benefits & Investments This is an important issue for United Methodist Church congregations, because offering clergy housing allowances can be a factor in retaining clergy and helping them live in the communities they serve. For more than 60 years, federal law recognized that housing allowances for clergy be excluded from income tax.

Clergy tax deductions worksheet

Minister's Housing Expenses Worksheet | AGFinancial This worksheet will help you determine your specific housing expenses when filing your annual tax return. Minister's Housing Expenses Worksheet. Download the free resource now. Did you know we have a wide array of products and services to help you on your financial journey? Learn how we can help. Explore Services. Documenting Clergy Meal Expenses - Clergy Financial Resources As Self-Employed individuals, members of the clergy are allowed to deduct some out-of-pocket ministry expenses on Schedule C or Schedule SE. One expense that many forget to track is the meal expense. If you are meeting others for church-related discussions or activities, you can deduct 50% of the meal costs on your return. PDF 2021 Clergy Tax Return Preparation Guide for 2020 Returns - MMBB Clergy Tax Return Preparation Guide for 2020 Returns PART 1 INTRODUCTION All references in this publication to line numbers on IRS forms are for the "draft" versions of the 2020 forms since the final forms had not been released by the IRS as of the date of publication. How to use this guide

Clergy tax deductions worksheet. Basic personal amount - Canada.ca Dec 09, 2019 · T4127, Payroll Deductions Formulas, has been updated to reflect the new BPA. In January 2020, the CRA will update Form TD1, 2020 Personal Tax Credits Return, and the accompanying worksheet, its Payroll Deductions Online Calculator (PDOC), T4032, Payroll Deductions Tables and T4008, Payroll Deductions Supplementary Tables to reflect the new BPA. Clergy expenses - Intuit Third, clergy are still allowed to deduct work related expenses from their income subject to self-employment tax, even though they can't deduct expenses from income subject to income tax. In TurboTax, this requires a manual entry on line 5c of the schedule C adjustment worksheet, which the program will carry over onto schedule C. PDF CLERGY INCOME & EXPENSE WORKSHEET YEAR - Cameron Tax Services 1099s: Amounts of $600.00 or more paid to individuals (notDue date of return is January 31. Nonfiling penalty can be $150 percorporations) for rent, interest, or services rendered to you in yourrecipient. If recipient does not furnish you with his/her Social Securitybusiness, require information returns to be filed by payer.Number, you are req... Tax Calculators - Dinkytown.net Use this calculator to determine your potential tax savings with a tax deductible gift to charity. This calculator sorts through the tax brackets and filing options to estimate the actual tax savings of your charitable gift. Clergy Housing Allowance Worksheet

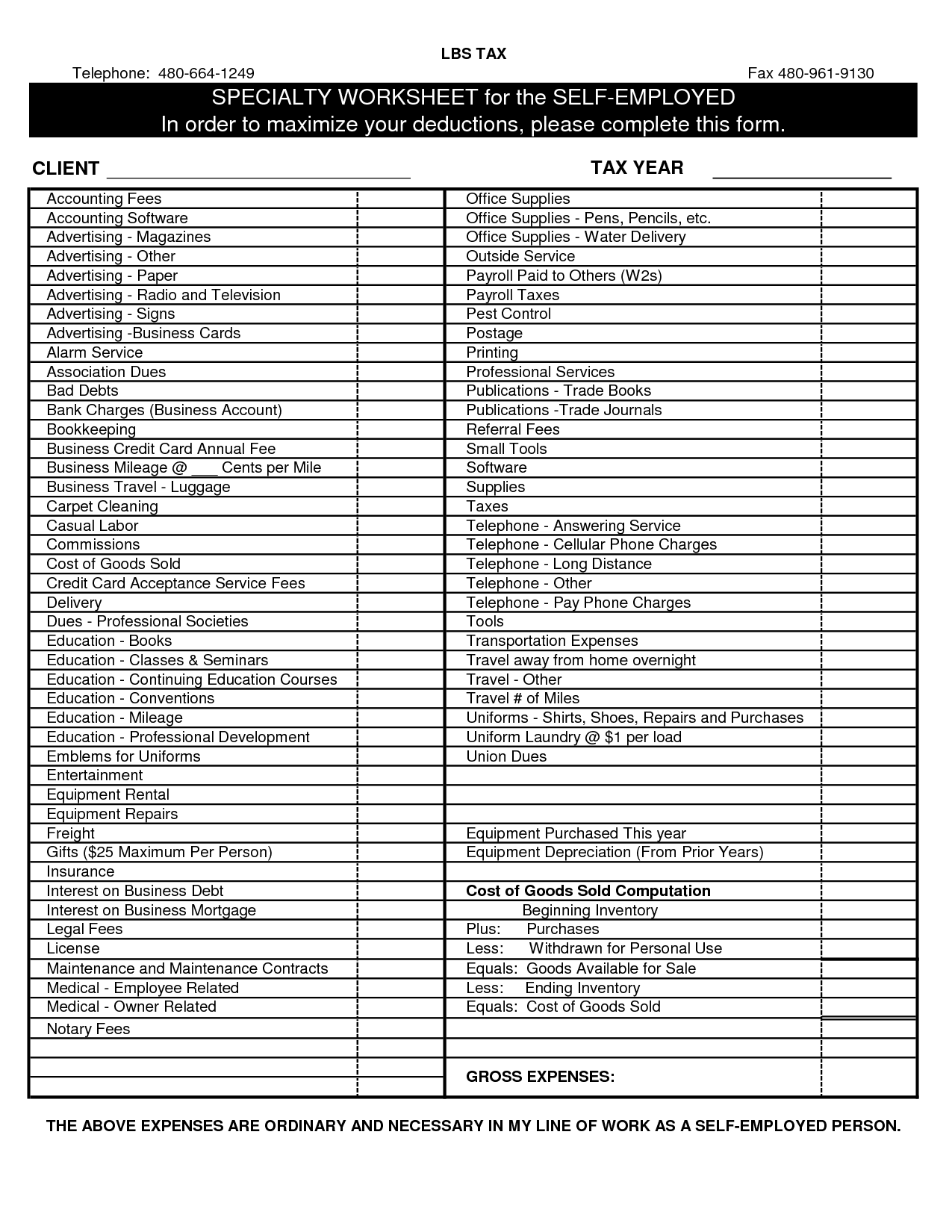

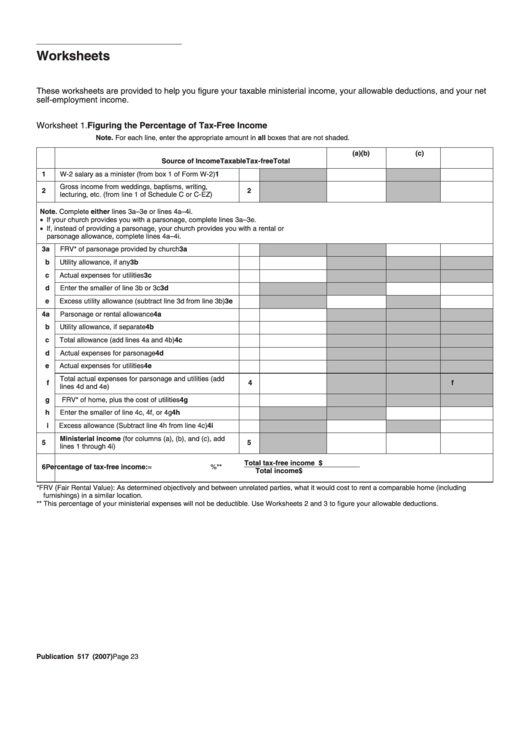

PDF Clergy Tax Worksheet - Whittier IRS Tax Debt Relief Tax Deductions for Clergy Parsonage Allowance: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities, etc.). Alternatively, some may live in a parsonage owned by the church. Pastoral Care, Inc. - Minister Expense Form The 2018 Tax Laws may affect most of our pastors. The Standard Deduction for 2018 will double to $24,000 (married filing jointly), which will affect most pastors on them deducting certain items (mileage, dues, ministry expenses, etc) from their Schedule A. Beginning on January 1, 2018, Unreimbursed Business Expenses are gone! 1040-US: IRS Publication 517 Clergy Worksheets - Thomson Reuters Check out the IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income) 7 Top Minister Tax Deductions - freechurchaccounting.com To claim this deduction or reimbursement, you must include the following information in your mileage log: The date The place of the travel The business purpose Relationship to individual such as church member The mileage or miles traveled for each business trip The total miles for the year.

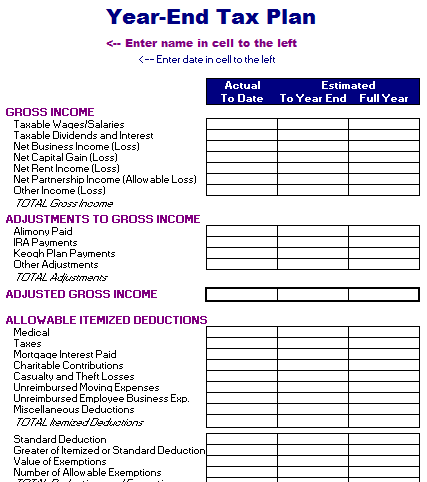

PDF 2022 Clergy Tax Return Preparation Guide for 2021 Returns - MMBB For contributions in 2021 to a traditional IRA, the deduction phaseout range for an individual covered by a retirement plan at work begins at income of $105,000 for joint filers and $66,000 for a single person or head of household. These are 2021 amounts that increase to $109,000 for joint filers and $68,000 for a single person or Tax and Payroll Worksheets - Clergy Financial Resources View our collection of clergy tax and church payroll resources, including worksheets for charitable donations, expense reporting, mileage logs and more. 1040-US: IRS Publication 517 Clergy Worksheets - Thomson Reuters IRS Publication 517 Clergy worksheets related to income and deduction items for ministers and religious workers are included in individual tax returns. These worksheets are used to calculate: the minister's percentage of tax-free income (Worksheet 1, Figuring the Percentage of Tax-Free Income) Tax Considerations for Ministers - The Tax Adviser An individual must reduce total miscellaneous itemized deductions by 2% of adjusted gross income. 29 The taxpayer in Weber was an ordained minister who worked full time in one church. He was not a traveling minister. The court found that his duties were under the control of a bishop.

Workers Religious Clergy and and Other - IRS tax forms income that are subject to Medicare tax are subject to a 0.9% Additional Medicare Tax to the extent they exceed the applicable threshold for an individual's filing status. Medicare wages and self-employment income are combined to determine if income exceeds the threshold. A self-employment loss isn't considered for pur-poses of this tax.

Topic No. 417 Earnings for Clergy | Internal Revenue Service You must file it by the due date of your income tax return (including extensions) for the second tax year in which you have net earnings from self-employment of at least $400. This rule applies if any part of your net earnings from each of the two years came from the performance of ministerial services. The two years don't have to be consecutive.

T1223 Clergy Residence Deduction - Canada.ca If you are a clergy member, use this form to claim the clergy residence deduction. This form will help you calculate the expenses you can deduct.

Everything Ministers/ Clergy Should Know About Their Housing Allowance To take advantage of any tax deductions, churches, ministers and members of the clergy (or their tax professionals) should have a thorough understanding of what can be included in an allowance and how to account for it on a W-2. ... Download: Housing Allowance Worksheet Package for Clergy and Churches. If tax preparation is challenging for the ...

Desktop: Minister / Clergy Member Tax Return - Support Ministers are not subject to federal income tax withholding, although the minister and employer may agree to voluntary withholding to cover any income and self-employment tax. If Form W-2 Boxes 3-6 are empty, you will need to complete Schedule SE using the tax-free income worksheet to determine the taxable amount of their minister income.

Clergy - Exempt Wages and Housing Allowance - TaxAct Clergy housing allowance Generally, the housing allowance is reported in Box 14 of the W-2 and is not included in Boxes 1, 3, or 5. The fair rental value of a parsonage or the housing allowance can be excluded from income only for income tax purposes. >No exclusion applies for self-employment tax purposes.

Deductions for Ministers and Other Clergy | Nolo Before this change, these expenses were deductible as a miscellaneous itemized deduction on Form 1040 Schedule A. Employee ministers should seek to have their work-related expenses reimbursed by their church. Such reimbursements are tax-free so long as the expenses are properly documented. Common deductions for self-employed ministers include:

CLERGY HOUSING ALLOWANCE WORKSHEET You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return.

PDF CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year:

OLT Free File Supported Federal Forms - OLT.COM Schedule D Tax Worksheet: Worksheet for Household Employers in a Credit Reduction State: Credit for Qualified Sick and Family Leave Wages for Leave Taken Before April 1, 2021: Credit for Qualified Sick and Family Leave Wages for Leave Taken After March 31, 2021: Credit Limit Worksheet: Earned Income Worksheet: Additional Medicare Tax and RRTA ...

PDF Clergy Tax Worksheet Clergy Tax Worksheet PARSONAGE ALLOWANCE: Many members of the clergy are paid a cash "housing allowance," which they use to pay the expenses related to their homes (e.g. interest, real property taxes, utilities etc.). Alternatively, some may live in a parsonage owned by the church.

TTB - Products - TheTaxBook Deductions; Comprehensive Example; Final Return for Decedent—Form 1040; Estate Income Tax Return—Form 1041; Estate Tax Return—Form 706; Death of a Taxpayer—Common Forms and Returns; Reconcile Amounts Reported in Name of Decedent on Information Returns Worksheet (Forms W-2, 1099-INT, 1099-DIV, etc.) Estate Inventory Worksheet

PDF Clergy Housing Allowance Worksheet NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources Rev. 11/2010

Clergy housing allowance - Intuit Look at the schedule SE adj sheet in section 2, line 5B. if you are seeing your housing allowance twice what you expect, you need to take additional action. Go to the W2 for that income. On the wks (worksheet) make sure you 0 out the housing allowance (since it already has it) but do enter the amount you spent of qualifying expense. This sorted ...

QBI Deduction - Frequently Asked Questions (K1, QBI ... In Drake19, if the income is subject to SE tax, the taxpayer (spouse) is taking a self-employed health insurance deduction, or they have SEP or Simple Contributions, this subtraction from ordinary business income will be shown on the QBI Explanation worksheet (lines 9, 10, 11, as applicable) and the QBI amount is carried to Form 8995 to ...

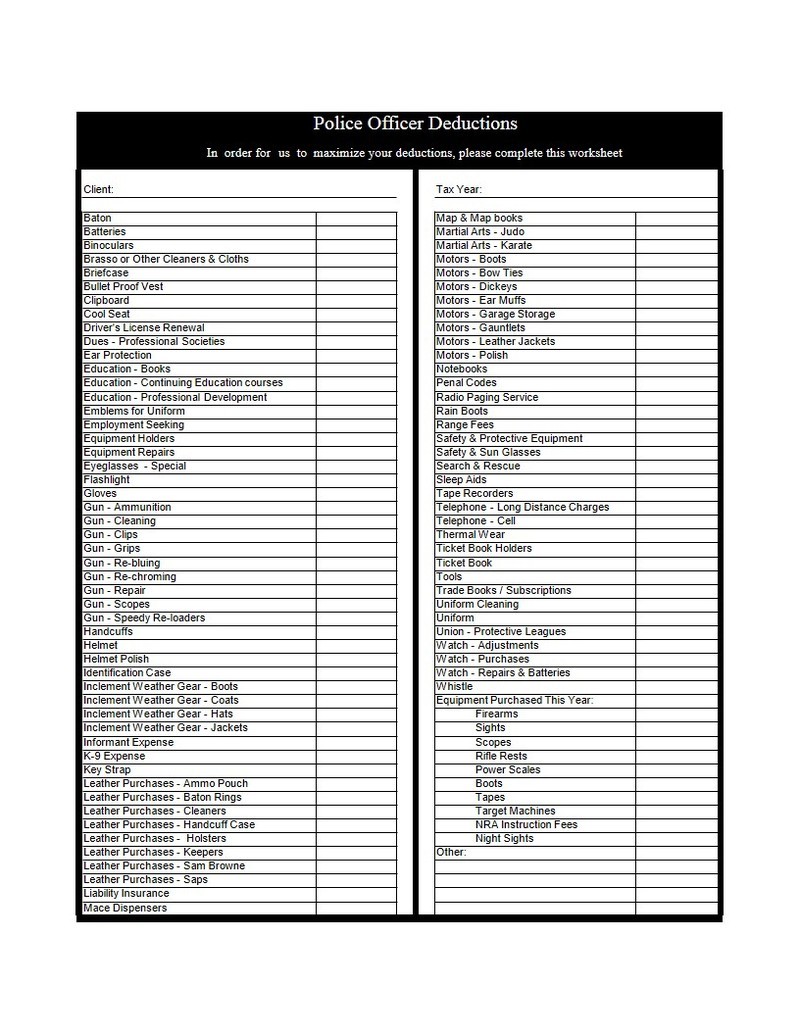

CLERGY INCOME & EXPENSE WORKSHEET CLERGY INCOME & EXPENSE WORKSHEET. YEAR JJJJJJJJJJJJJJJ ... Deductible mileage includes: ... TAXES: Personal Property. Licenses (not auto/truck).

A Guide to Self-Employment Tax & Deductions for Clergy and Ministers A Guide to Self-Employment Tax & Deductions for Clergy and Ministers If you are a member of the clergy, you should receive a Form W-2, Wage and Tax Statement, from your employer reporting your salary and any housing allowance. Generally, there are no income or Social Security and Medicare taxes withheld on this income.

Top 10 Tax Deductions - Clergy Financial Resources The credit is a percentage of your eligible work-related child or dependent care expenses, ranging from 20% to 35%, depending on your income. There is a dollar limit on the amount of expenses for which you can claim the credit. The limit is $3,000 of the expenses paid in a year for one person, or $6,000 for two or more.

PDF 2021 Clergy Tax Return Preparation Guide for 2020 Returns - MMBB Clergy Tax Return Preparation Guide for 2020 Returns PART 1 INTRODUCTION All references in this publication to line numbers on IRS forms are for the "draft" versions of the 2020 forms since the final forms had not been released by the IRS as of the date of publication. How to use this guide

Documenting Clergy Meal Expenses - Clergy Financial Resources As Self-Employed individuals, members of the clergy are allowed to deduct some out-of-pocket ministry expenses on Schedule C or Schedule SE. One expense that many forget to track is the meal expense. If you are meeting others for church-related discussions or activities, you can deduct 50% of the meal costs on your return.

Minister's Housing Expenses Worksheet | AGFinancial This worksheet will help you determine your specific housing expenses when filing your annual tax return. Minister's Housing Expenses Worksheet. Download the free resource now. Did you know we have a wide array of products and services to help you on your financial journey? Learn how we can help. Explore Services.

0 Response to "44 clergy tax deductions worksheet"

Post a Comment