43 tax write off worksheet

Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Note: If you want to skip out on manually recording/organizing your business expenses, try Bonsai Tax. Our tax deduction finder would scan your credit card/ bank statements to find all the tax write-offs you qualify for and help you save thousands of dollars. In fact, users typically save $5,600 from their tax bill. Claim your 14-day free trial ... Tax Breaks You Can Claim Without Itemizing - SmartAsset 11.01.2022 · You might be able to write off the alimony payments you’ve made to an ex-spouse as long as your divorce agreement was finalized by the end of 2018. You could lose this deduction if changes to your divorce agreement were made after 2018. Note that if you get alimony payments from a finalized divorced before 2019 could qualify as income, and as the receiving …

Tax expense journal - templates.office.com Utilize this tax expense spreadsheet to keep a running total as you go. Take the stress out of filing taxes with this easy-to-use tax deduction spreadsheet. Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go.

Tax write off worksheet

Tax Deduction Worksheet for Police Officers - Fill and Sign Printable ... The following tips will allow you to complete Tax Deduction Worksheet for Police Officers easily and quickly: Open the form in the full-fledged online editing tool by clicking on Get form. Fill out the required boxes which are colored in yellow. Hit the green arrow with the inscription Next to jump from field to field. PDF The Tax Write-Off Checklist - Abundance Practice Building Tax Write-Off Checklist Melvin Varghese, Ph.D. The Tax Write-off Check List For Mental Health Private Practitioners The next few pages contain a list of tax write-offs created for mental health private practitioners. I've broken down items into sections and each section is in alphabetical order for your convenience. Hairstylist Tax Write Offs Checklist for 2022 | zolmi.com Hairstylist Tax Write Offs Checklist. 20 JAN 2022. For a self employed hair stylist, tax write offs can be a game changer. If you track your business expenses and put together a hairstylist tax write off list, you could save hundreds (or maybe thousands) of dollars when filing your taxes.

Tax write off worksheet. Tax Deductions for Photographers - FreshBooks - FreshBooks The list below includes some of the most common photographers tax deductions you can leverage. You may want to create a photography business expense list so you can track every expense throughout the year. Accounting for each expense will make completing your taxes much easier. 1. Photography Gear. 1040 (2021) | Internal Revenue Service - IRS tax forms IF YOU can claim a refundable credit (other than the earned income credit, American opportunity credit, refundable child tax credit, additional child tax credit, or recovery rebate credit), such as the net premium tax credit, health coverage tax credit, or qualified sick and family leave credits from Schedule H or Schedule SE. Have other payments, such as an amount paid with a request for … PDF Tax Worksheet for Self-employed, Independent contractors, Sole ... make sure I have your last year's tax return so I can follow it. Otherwise, answer the following: Date you purchased the property ... ***Please email or fax worksheet De'More Tax Service Office: 817-726-2181 Mobile: 972-885-9709 Fax: 206-736-0982 Email: taxes@demoretaxservice.com Email: demoretaxservice@gmail.com . Tax Deduction | Excel Templates The Tax Deduction Template is specially designed to provide you with an easier solution to your yearly deduction's calculator. It can be extremely difficult to keep track of all the standard yearly deductions you have, and the itemized deductions throughout the year. Keep track of your itemized deductions using our calculator will help you ...

Fill Online, Printable, Fillable, Blank - pdfFiller The Salvation Army Donation Guide Spreadsheet is helpful in terms of calculating the cash equivalent of the goods donated so that this amount can be reported as a desired tax write-off. The form lists the average prices of all the possible goods and the approximate amount that can be paid for certain items at thrift stores. PDF SMALL BUSINESS WORKSHEET - cpapros.com SMALL BUSINESS WORKSHEET Client: ID # TAX YEAR ORDINARY SUPPLIES The Purpose of this worksheet is to help you organize Advertising your tax deductible business expenses. In order for an Books & Magazines expense to be deductible, it must be considered an Business Cards "ordinary and necessary" expense. You may include Can I Deduct My Computer for School on Taxes? - TurboTax 16.10.2021 · Education tax credits. The government uses tax policy to encourage activities such as paying for education and saving for retirement. While the names and amounts vary, the IRS generally provides for some type of educational tax credit to help offset the costs of qualifying tuition and related expenses.. A computer for school purposes may or may not qualify for these … Write It Off - Property Depreciation Report | Quantity Surveyor ... Property tax deductions, including plant & equipment depreciation and building allowances, are a valuable aspect of any property investment. After interest expenses, depreciation is generally the largest deduction available to property investors. At Write It Off we accurately prepare property depreciation reports to allow you to maximise your depreciation deduction. Remember the …

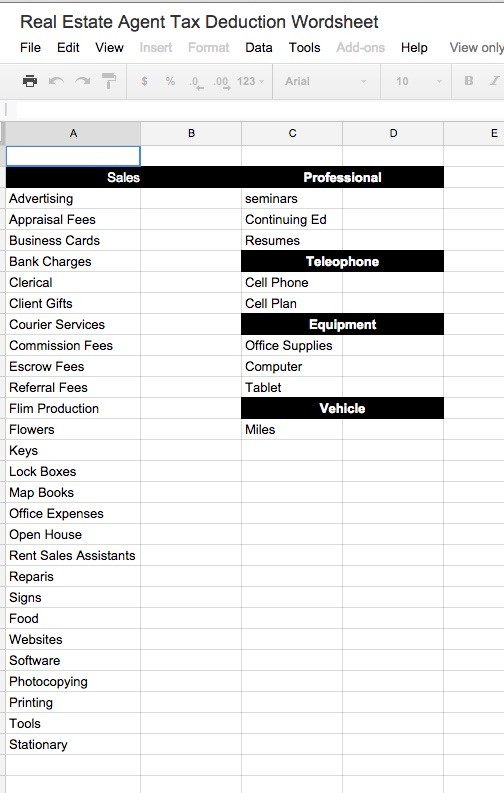

21 Tax Write-Offs for Real Estate Agents - Keeper Tax If you drive your own vehicle, you can write off the annual depreciation of its value! If you work from home ... If you do at least some of your work from a dedicated home workstation, don't forget to claim home office write offs. Note: this is mutually exclusive with the desk fee write off. Note: you don't need to work from a separate room to claim these write offs. A dedicated desk … 2021 Tax Return Preparation and Deduction Checklist in 2022 - e-File This is for the simple reason that all 2021 Forms need to be mailed to you before February 1, 2022. If an employer (s) do not provide you your W-2 forms or the issuer (s) of a 1099 Form does not mail them to you on time, contact them and request it. Step 2: View these important pre-eFile considerations; taxstimate your taxes, use simple tax ... TAX ORGANIZERS - Riley & Associates: Certified Public Accountants TAX ORGANIZERS. Client Tax Organizer Please note - current clients please e-mail us to request your own personalized paper organizer, please do not use this generic form! New! Excel Tax Organizer. 2021 Year-End Tax Letter. Universal Tax Deduction Finder 2021 (pdf) Tax Apps (pdf) Tax Organizer for Estates & Trusts (pdf) Tax Organizer for Small ... An Updated Tax Write-Off Worksheet, by the Nosiest Employee at the IRS ... Did you receive a stimulus payment (Notice 1444-C or Letter 6475)?; Did you receive wages (Form W-2)?; Did you receive state and city refunds (Form 1099-G)?; Did you receive Venmo payments from your ex (Handle @MattDereklol46) AFTER you broke up on July 23, 2021?. If "Yes," were the Venmo payments for previously shared household items, or was it just Matt Johnston trying to get your ...

PDF Tax Deduction Worksheet - Oxford University Press Tax Deduction Worksheet . This worksheet allows you to itemize your tax deductions for a given year. Tax deductions for calendar year 2 0 ___ ___ HIRED HELP SPACE $_____ Accountant

Tax Worksheet | Etsy Check out our tax worksheet selection for the very best in unique or custom, handmade pieces from our shops.

Claiming A Charitable Donation Without A Receipt | H&R Block To qualify for the H&R Block Maximum Refund Guarantee, the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete, inaccurate, or inconsistent information supplied by you, positions taken by you, your choice not to claim a deduction or credit, conflicting tax laws, or changes in …

Top 22 1099 Tax Deductions (And a Free Tool to Find Your Write-Offs) Introduced in 2018, the Qualified Business Income (QBI) deduction lets self-employed people write off up to 20% of their taxes. All you need to do to claim it is to fill out Form 8995 (or, if your income is really high, Form 8995-A .)

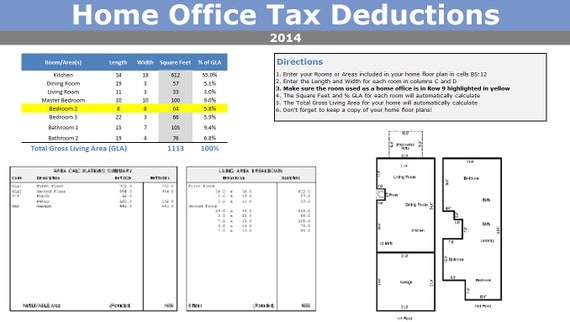

FREE Home Office Deduction Worksheet (Excel) For Taxes - Bonsai How to Calculate the Simplified Option and Important Tax Notes. To calculate the simplified home office deduction you simply multiply the square footage of your home used for business by $5 per square foot. As a result, your maximum deduction amount is $15,000. The maximum square footage you can use is 300 square feet.

Publication 560 (2021), Retirement Plans for Small Business Or you can write to: Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW, IR-6526 Washington, DC 20224 . Although we can’t respond individually to each comment received, we do appreciate your feedback and will consider your comments as we revise our tax forms, instructions, and publications. Don’t send tax questions, tax returns, or payments to the …

IRS Guidelines and Information | Donating to Goodwill Stores If you itemize deductions on your federal tax return, you may be entitled to claim a charitable deduction for your Goodwill donations. According to the Internal Revenue Service (IRS), a taxpayer can deduct the fair market value of clothing, household goods, used furniture, shoes, books and so forth. Fair market value is the price a willing buyer would pay for them. Value usually …

17 Big Tax Deductions (Write Offs) for Businesses - Bench A tax deduction (or "tax write-off") is an expense that you can deduct from your taxable income. You take the amount of the expense and subtract that from your taxable income. Essentially, tax write-offs allow you to pay a smaller tax bill. But the expense has to fit the IRS criteria of a tax deduction.

The Best Home Office Deduction Worksheet for Excel [Free ... - Keeper Tax The worksheet will automatically calculate your deductible amount for each purchase in Column F. If it's a "Direct Expense," 100% of your payment amount will be tax-deductible. If it's an expense in any other category, the sheet will figure out the deductible amount using your business-use percentage. Dragging down the deductible amount formula

6 Tax Breaks to Help Offset Capital Gains When Selling a Home 15.09.2021 · He works with his tax advisor and uses Worksheet 3 to determine how much of his gain is still taxable. Source: (Simon Hurry / Unsplash) 3. Capital improvements . If your home sale profits exceed the capital gains exemption threshold ($250,000 for single filers, and $500,000 for married filers), it’s time to review any capital improvements you made to the home while you …

Realtor Tax Deduction Worksheet Form - signNow Follow the step-by-step instructions below to design your rEvaltor tax deduction worksheet form: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

tax write off worksheet 35 Tax Write Off Worksheet - Notutahituq Worksheet Information notutahituq.blogspot.com. deduction calculator. Tax Worksheet.pdf - Module 4 Taxes Topic 1 Application Progressive Tax . Deduction calculator. Estimated prepare worksheet tax instructions pdf. 1099 business tax accounting printable list return contractors truck ...

Hairstylist Tax Write Offs Checklist for 2022 | zolmi.com Hairstylist Tax Write Offs Checklist. 20 JAN 2022. For a self employed hair stylist, tax write offs can be a game changer. If you track your business expenses and put together a hairstylist tax write off list, you could save hundreds (or maybe thousands) of dollars when filing your taxes.

PDF The Tax Write-Off Checklist - Abundance Practice Building Tax Write-Off Checklist Melvin Varghese, Ph.D. The Tax Write-off Check List For Mental Health Private Practitioners The next few pages contain a list of tax write-offs created for mental health private practitioners. I've broken down items into sections and each section is in alphabetical order for your convenience.

Tax Deduction Worksheet for Police Officers - Fill and Sign Printable ... The following tips will allow you to complete Tax Deduction Worksheet for Police Officers easily and quickly: Open the form in the full-fledged online editing tool by clicking on Get form. Fill out the required boxes which are colored in yellow. Hit the green arrow with the inscription Next to jump from field to field.

0 Response to "43 tax write off worksheet"

Post a Comment