38 realtor tax deduction worksheet

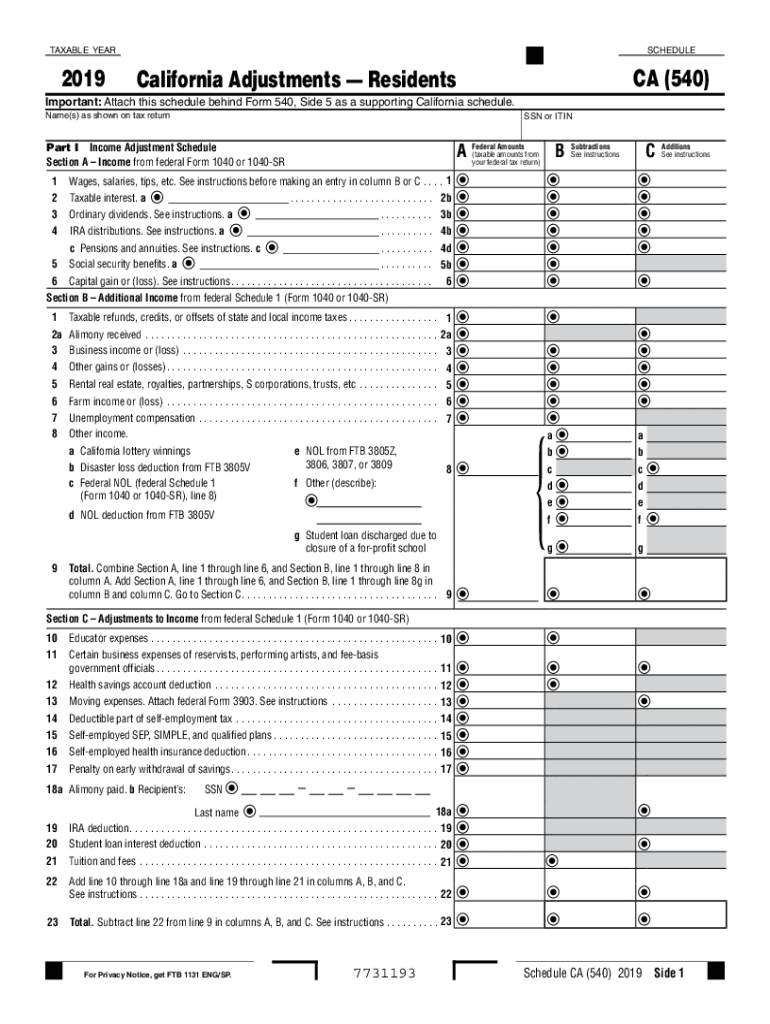

Below are forms and worksheets to help you keep track of your expenses: Real Estate Professional Expense Worksheet (.xls) Re... Jul 06, 2020 · Foreign properties may also be subject to the tax laws of the country they’re located in, which means you could potentially be taxed twice on the same property. The IRS offers a potential solution for double taxation in the form of foreign tax credits and deductions. To claim the foreign tax credit, you must file Form 1116, Foreign Tax Credit.

Apr 15, 2021 · If you are subject to paying self-employment tax, you can deduct one-half (50%) of the self-employment tax you pay on line 27 of your Form 1040, regardless of whether you itemize or take the standard deduction. For Example. Annie Agent, a single Washington D.C. based realtor, took home $400,000 in commissions last year net of all business expenses.

Realtor tax deduction worksheet

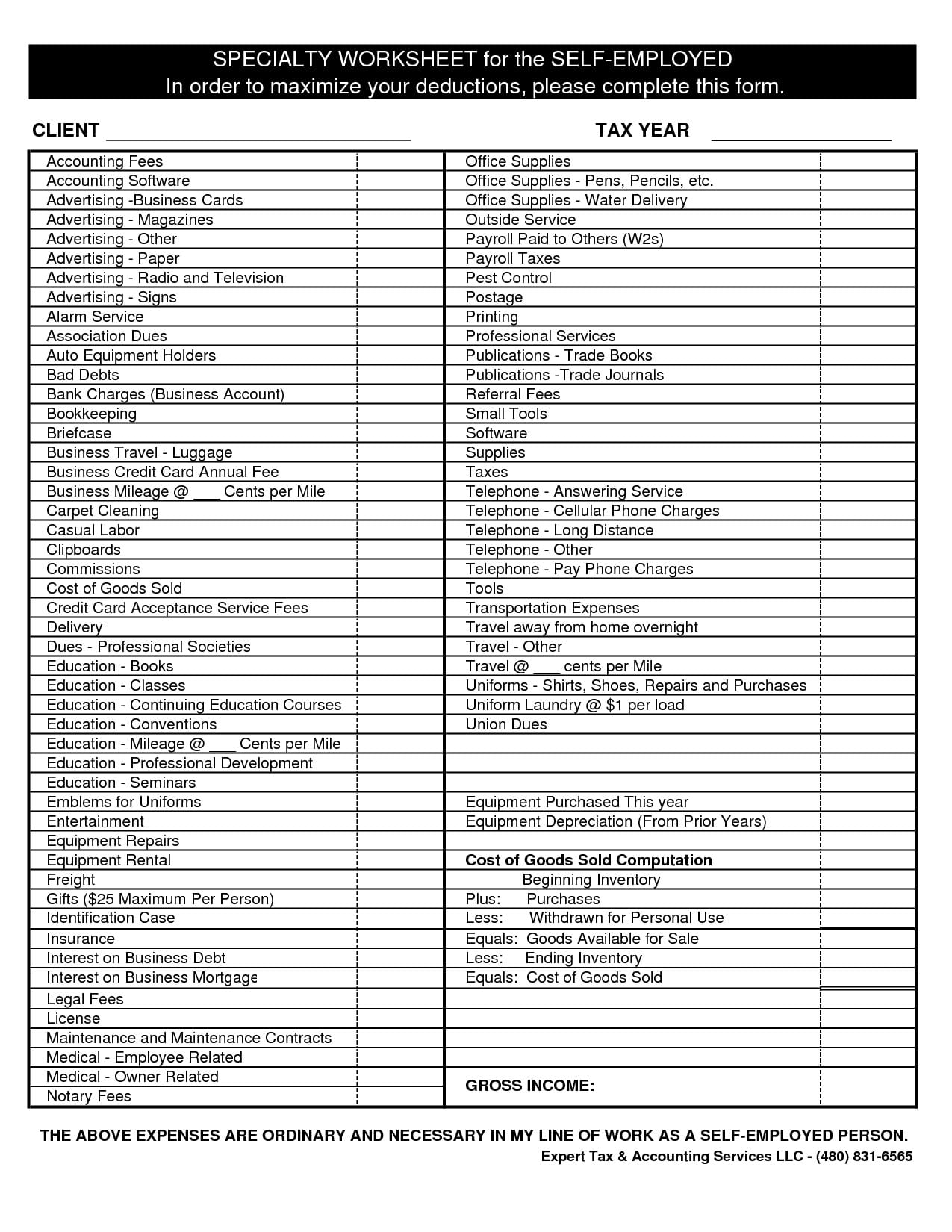

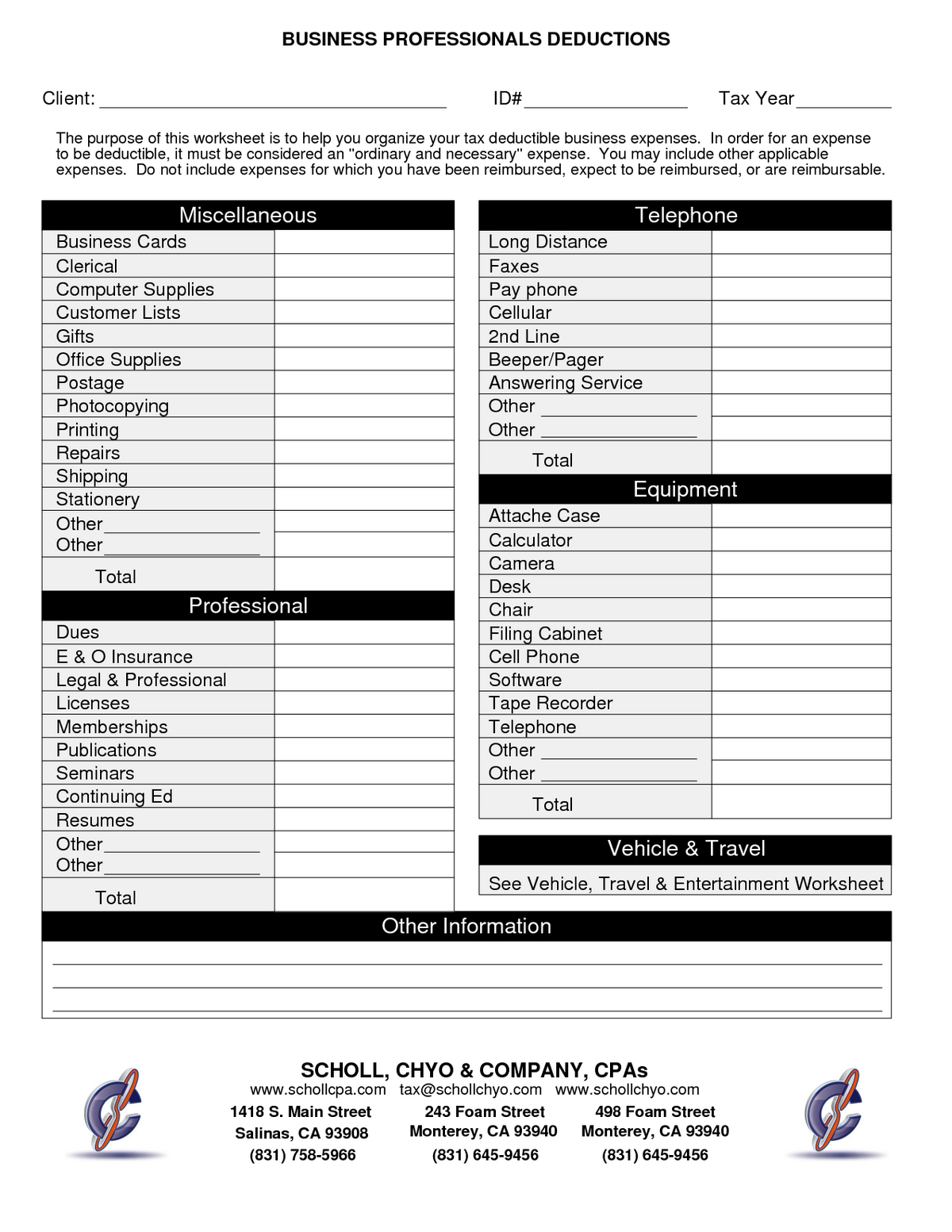

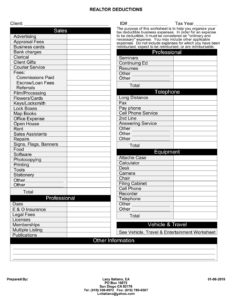

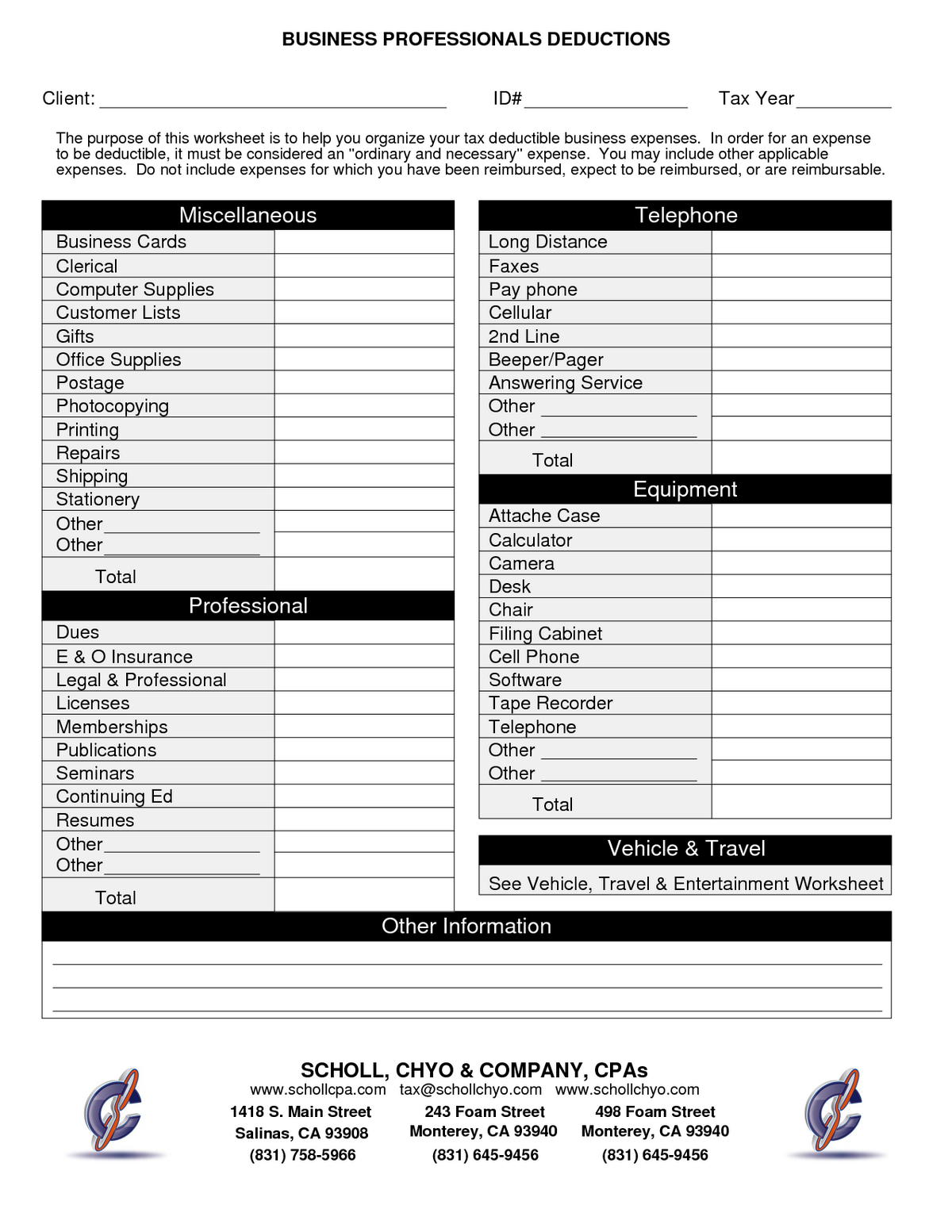

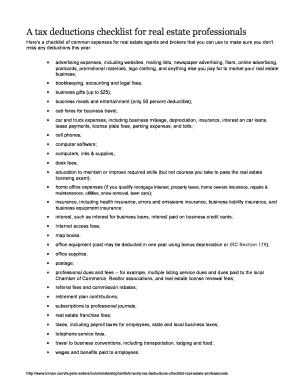

REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ... The lender may consider the applicant’s potential tax benefits from obtaining the loan (for example, mortgage interest deduction) in the analysis. To do so: determine what the applicant’s withholding allowances will be, using the instructions and worksheet portion of IRS Form W-4, Employee’s Withholding Allowance Certificate, and Sheet1 Sales,Professional Advertising,seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers

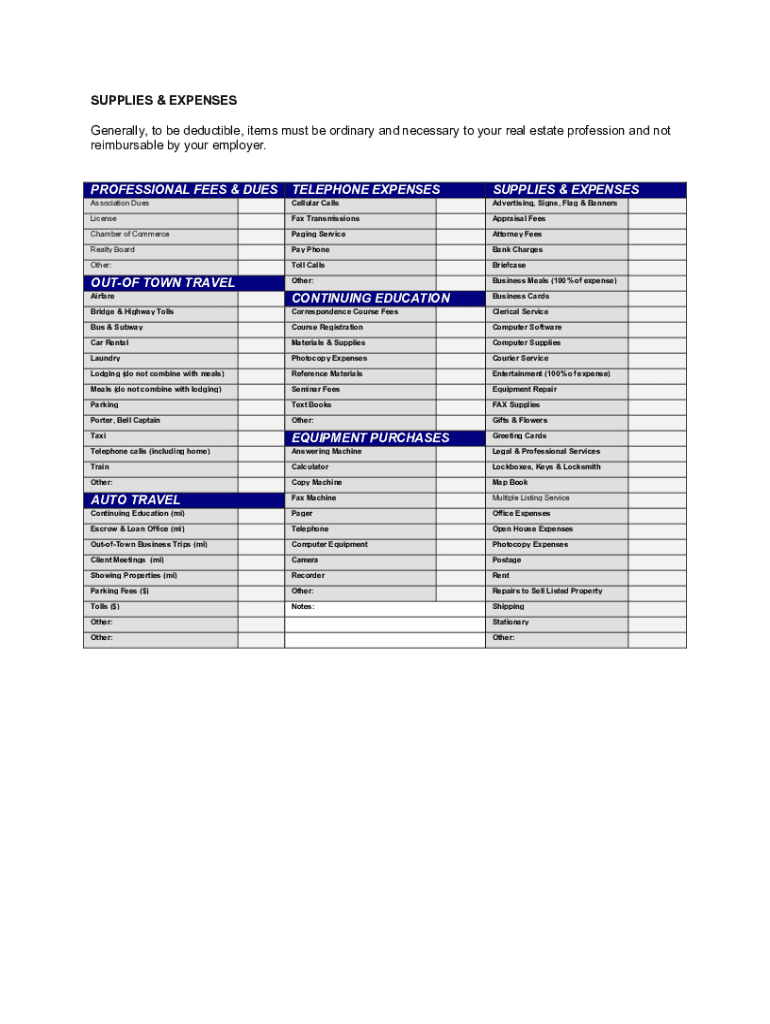

Realtor tax deduction worksheet. Fill Real Estate Agent Tax Deductions Worksheet 2020, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Realtors Tax Deductions Worksheet. Houses (8 days ago) Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. This is an ultimate guide to tax deductions for real estate agents that'll help you lower your tax bill and keep more of your hard-earned money! Licences & fees. Your state license renewal, MLS dues, and professional memberships, are deductible. Property marketing. Automobile And Transportation. The best car for real estate agents will depend on your needs. This includes taxes. Automobiles can be a tricky tax deduction for real estate agents. Leave it to me; I've purchased over 15 cars in the last 11 years, so I'd know what a mess they make on deductions, especially when you change them out as frequently as I tend to do.

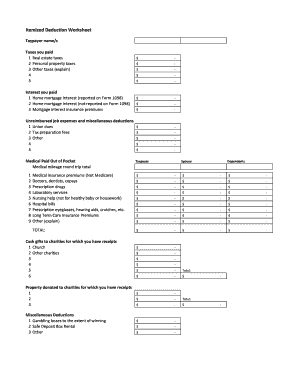

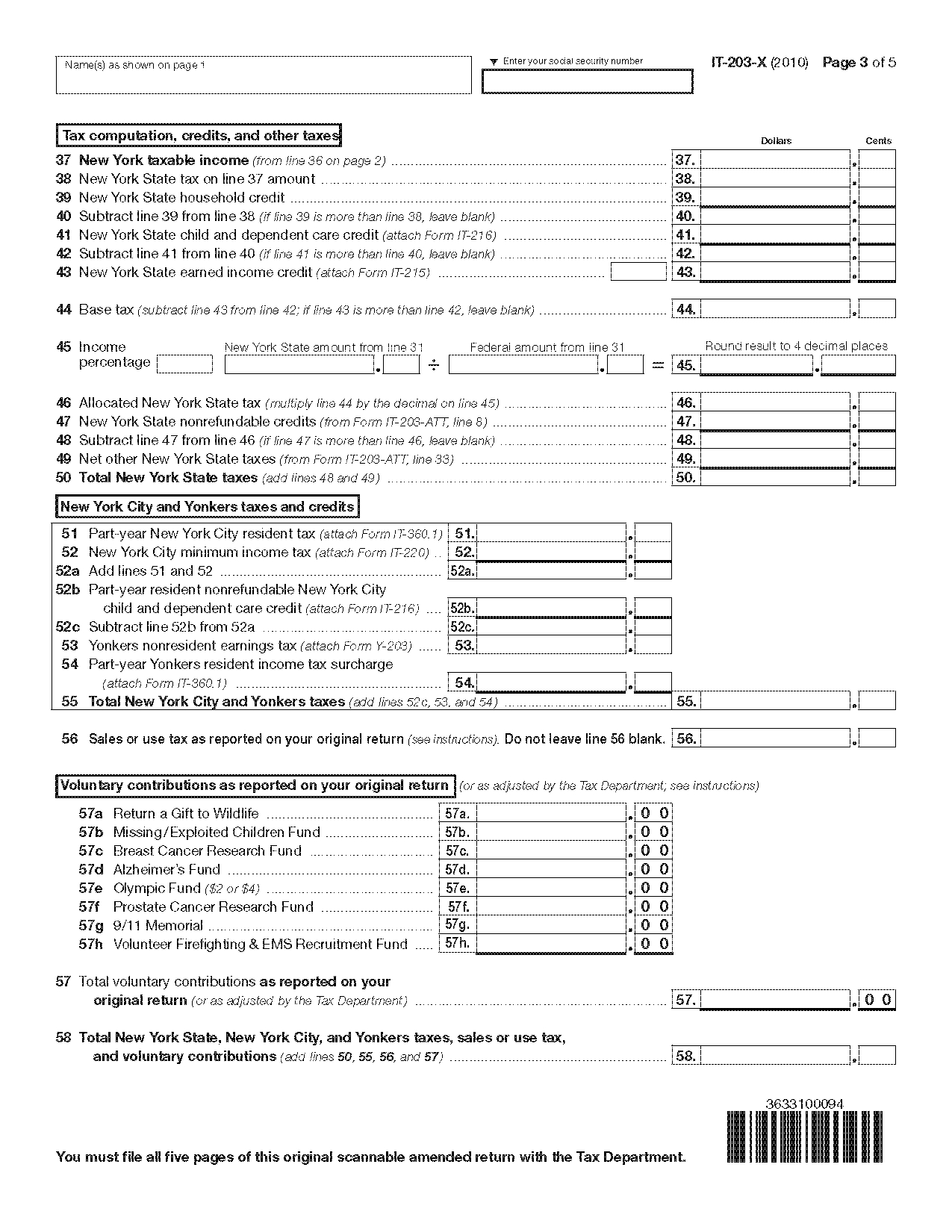

Realtors Tax Deduction Worksheet Due to the overwhelming response to last month s Realtor tax tip article Daszkal Bolton LLP has created this Realtors Tax Deduction Worksheet to assist our clients in becoming more organized for taking advantage of tax deductible business expenses. Realtor Tax Deductions Worksheet. Want our Realtor tax deduction worksheet? Check it out right here: Little-Known Realtor Tax Deductions . One of the key strategies in getting better tax returns is starting New Years Day. Your tax strategy starts from day #1. Keep is simple and keep every single receipt for transactions starting today! Real estate taxes reported on line 7. Enter the smaller of line 6 or line 8 here and in column (a) of line 7 of the Worksheet To Figure the Deduction for Business Use of Your Home: 9. 10. Excess real estate taxes reported on line 15. Subtract line 9 from line 6 : 10. _____ Real Estate Tax Deduction. If you own fixed property that is legally under your name or your businesses name, you may be subject to real estate tax. Find out how to calculate your tax bill! DEPRECIATION, VEHICLE Standard Mileage Rate Deductions.

Tax Deduction Worksheet For Realtors Fill Out and Sign . Business Signnow.com Show details . 6 hours ago Get and Sign Real Estate Agent Tax Deductions Worksheet Form Book as follows 1 give the date and business purpose of each trip 2 note the place to which you traveled 3 record the number of business miles and 4 record your car s odometer reading at both the beginning and end of the tax year. Dec 23, 2021 · Follow the instructions and use the tax table included on the worksheet to determine the withholding amount. Enter the result on line 4(c). Step 4(b) — Deductions Worksheet. Click to get the latest Buzzing content. Take A Sneak Peak At The Movies Coming Out This Week (8/12) Minneapolis-St. Paul Movie Theaters: A Complete Guide Income Tax Deduction Checklist --- REALTORS Author: Joseph J. Gawalis Jr., MBA, CPA-NJ Last modified by: Joseph J. Gawalis Jr., MBA, CPA-NJ Created Date: 6/25/2004 2:27:00 PM Company: Accountancy Consultants of New Jersey, LLC Other titles: Income Tax Deduction Checklist --- REALTORS

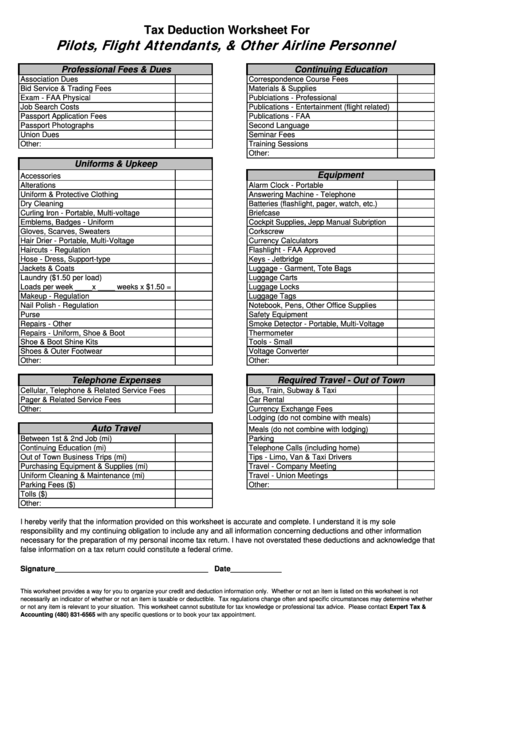

Get and Sign Tax Worksheet Realtors Form . Rental Laundry Lodging (do not combine with meals) Meals (do not combine with lodging) Parking Telephone Calls (including home) Other: Advertising, Signs, Flags & Banners Appraisal Fees Attorney Fees Bank Charges Briefcase Business Cards Business Meals (enter 100% of expense) Clerical Service Computer Software & Supplies Courier Service Entertainment ...

Realtors Tax Deductions Worksheet AUTO TRAVEL Your auto expense is based on the number of qualified business miles you drive. Expenses for travel between business locations or daily transportation expenses between your residence and temporary work locations are deductible; include them as business miles. Expenses for your trips between home and

To download the free rental income and expense worksheet template, click the green button at the top of the page. ... REALTORS®, and the REALTOR® logo are controlled by The Canadian Real Estate Association (CREA) and identify real estate professionals who are members of CREA. The trademarks MLS®, Multiple Listing Service® and the associated ...

How to create an electronic signature for the Realtor Tax Deduction Worksheet Form on iOS devices realtor tax deduction worksheetiPhone or iPad, easily create electronic signatures for signing a real estate agent tax deductions worksheet 2020 in PDF format. signNow has paid close attention to iOS users and developed an application just for them.

Get a Real Estate Agent Tax Deductions Worksheet 0 template with signNow and complete it in a few simple clicks. Get form Book as follows 1 give the date and business purpose of each trip 2 note the place to which you traveled 3 record the number of business miles and 4 record your car s odometer reading at both the beginning and end of the tax ...

Download our 12 month expense worksheet Excel Worksheet. Tradesmen (Plumbers, Carpenters, etc.) Download our expense checklist PDF Download our expense checklist Excel Worksheet Download our 12 month expense worksheet Excel Worksheet. Other Tax Checklists. Rental Real Estate Deductions (Word Document)

Commissions are subject to a variety of taxes Federal Income Tax (Average 25%) Self Employment Tax (15.3%) State Income Tax (DC: 8.5%/MD: 7.5%/VA 5.75%) Total Tax: 46%-49% Reduce your taxes by tracking your tax deductions (see page 2) Learn how to stay organized (bookkeeping, filing systems, etc.) Contribute to deductible retirement plans (401K or SEP)

realtor tax deduction worksheet Small Business Tax, Real Estate Business, Real Estate Marketing,. easyagentpro. Easy Agent PRO - Better Digital Marketing.

Feb 19, 2021 · This deduction is capped at $10,000, Zimmelman says. So if you were dutifully paying your property taxes up to the point when you sold your home, you can deduct the amount you paid in property ...

Real estate agents, who are by and large self-employed, can relate to the importance of tax deductions. By reducing your taxable income, deductions ...

May 12, 2010 · Letter 4053, Conditional Commitment to Subordinate Federal Tax Lien, and Form 669-D, Certificate of Subordination of Property from Federal Tax Lien. 6325(d)(3) It is determined that the United States will be adequately secured after subordination of a lien imposed by IRC § 6324B. Form 669-F, Certificate of Subordination of Federal Estate Tax Lien

Sheet1 Sales,Professional Advertising,seminars Appraisal Fees,Continuing Ed Business Cards,Resumes Bank Charges,Teleophone Clerical,Cell Phone Client Gifts,Cell Plan Courier Services,Equipment Commission Fees,Office Supplies Escrow Fees,Computer Referral Fees,Tablet Flim Production,Vehicle Flowers

The lender may consider the applicant’s potential tax benefits from obtaining the loan (for example, mortgage interest deduction) in the analysis. To do so: determine what the applicant’s withholding allowances will be, using the instructions and worksheet portion of IRS Form W-4, Employee’s Withholding Allowance Certificate, and

REALTOR/REAL ESTATE AGENT - TAX DEDUCTION CHEAT SHEET Advertising Billboards Brochures/Flyers Business Cards Copy Editor Fees Direct Mail Email Marketing & Newsletters Graphic Designer Fees Internet Ads (Google, Facebook, etc) Leads/Mailing Lists ...

0 Response to "38 realtor tax deduction worksheet"

Post a Comment