44 fannie mae rental income worksheet

Instructions On Fannie Mae Employment Verification WebIf you have additional questions, Fannie Mae customers can visit Ask Poli to get information from other Fannie Mae published sources.Fannie Mae Form 1037 02/23/16 Rental Income Worksheet Documentation Required: Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Step 1 When using Schedule E, determine the number of months the property ... FAQs: Positive Rent Payment History in Desktop Underwriter - Fannie Mae When a 12-month asset verification report is ordered for positive rent payment history, lenders do not need to review the full 12-months of report information. Fannie Mae requires lenders to: Confirm the borrower is an account holder on the account (s) provided. Ensure the account (s) represent those from which the borrower pays rent; and.

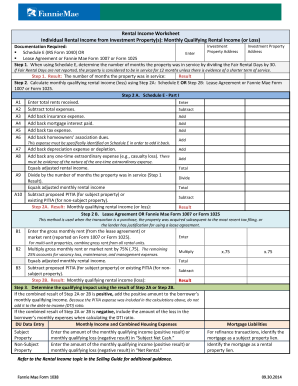

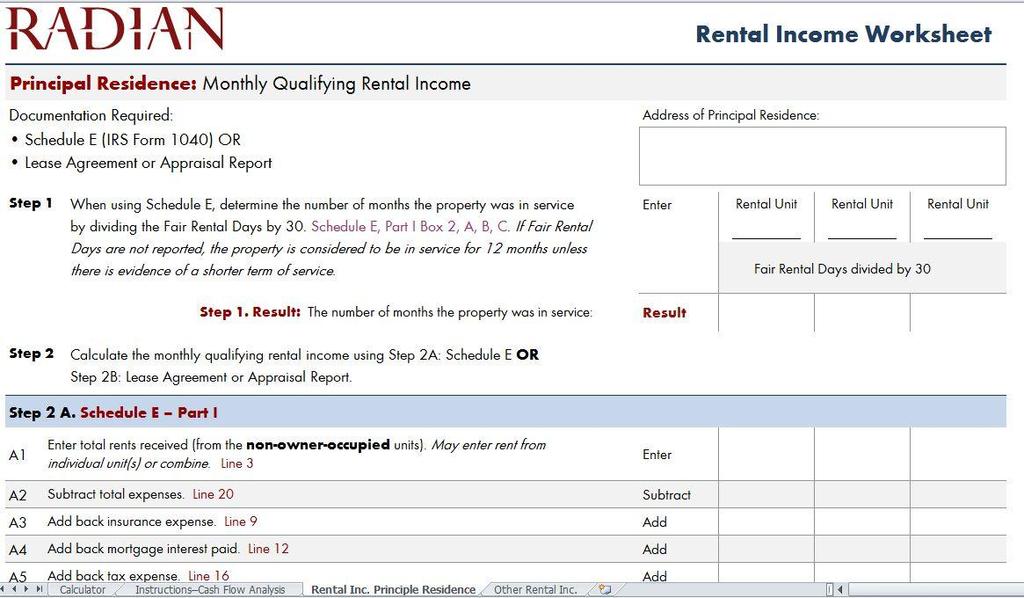

B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

Fannie mae rental income worksheet

Fannie Mae Rental Income Calculator Website Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Individual Rental Income from Investment Selling-guide.fanniemae.com Category: Website Detail Website Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, FAQ: Top Trending Selling FAQs | Fannie Mae The requirement to reduce the value of retirement assets consisting of stocks, bonds, and mutual funds by 30% when measuring the three-year continuance for retirement income was removed from the Selling Guide B3-3.1-09, Other Sources of Income in December 2020. Refer to Selling Guide Announcement SEL-2020-07.

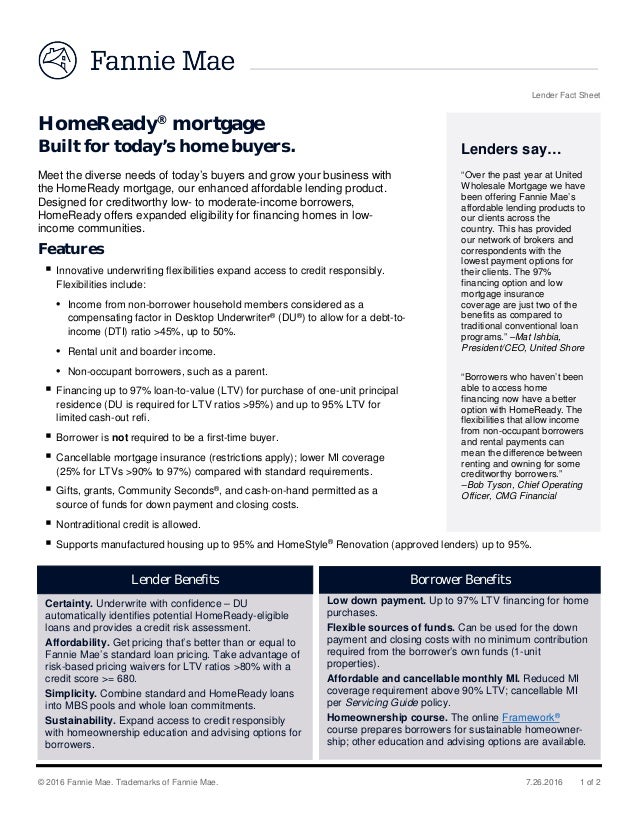

Fannie mae rental income worksheet. FAQs: HomeStyle Renovation | Fannie Mae Manufactured housing is eligible with HomeStyle Renovation, with the eligible renovation funds capped at the lesser of $50,000 or 50% of the "as-completed" appraised value. The new requirements for recourse removal are effective with deliveries on or after June 1, 2018. Once the recourse is removed, standard representation and warrant ... Fannie Mae Self-employed Worksheet - MyAns Complete Worksheet Database ... High Trending Promoting FAQs Fannie MaeFannie Mae Rental Earnings Worksheet Kind 2014 - Fill Out. Month-to-month Qualifying Rental Earnings or Loss Documentation Required. A lender could use Fannie Mae Rental Earnings Worksheets Kind 1037 or Kind 1038 or a comparable kind to calculate particular person rental earnings loss reported on Schedule E. What form can I use to evaluate income from self-employment? - Fannie Mae W-2 Income from Self-Employment: Schedule B - Interest and Ordinary Dividends (Lines 2a and 2b) Schedule C - Profit or Loss from Business: Sole Proprietorship (Lines 3a to 3g) Schedule D - Capital Gains and Losses (Line 4a) Schedule E - Supplemental Income and Loss (Lines 5a to 5c) Schedule F - Profit or Loss from Farming (Lines 6a to 6f) How do I calculate rental income? - Fannie Mae Lease Agreements or Form 1007 or Form 1025: When current lease agreements or market rents reported on Form 1007 or Form 1025 are used, the lender must calculate the rental income by multiplying the gross monthly rent (s) by 75%. (This is referred to as "Monthly Market Rent" on the Form 1007.)

B3-6-02, Debt-to-Income Ratios (05/04/2022) - Fannie Mae For manually underwritten loans, Fannie Mae's maximum total DTI ratio is 36% of the borrower's stable monthly income. The maximum can be exceeded up to 45% if the borrower meets the credit score and reserve requirements reflected in the Eligibility Matrix . For loan casefiles underwritten through DU, the maximum allowable DTI ratio is 50%. 30++ Fannie Mae Income Calculation Worksheet - Worksheets Decoomo Use fannie mae rental income worksheets (form 1037 or form 1038) to evaluate individual rental income (loss) reported on schedule e. Rental Income Worksheet Individual Rental Income From Investment Property (S): (biweekly gross pay x 26 pay periods) / 12 months. Fannie mae publishes four worksheets that lenders may use to calculate rental income. B3-3.4-01, Analyzing Partnership Returns for a Partnership ... - Fannie Mae The Quick Ratio (also known as the Acid Test Ratio) is appropriate for businesses that rely heavily on inventory to generate income. This test excludes inventory from current assets in calculating the proportion of current assets available to meet current liabilities. Quick Ratio = (current assets — inventory) ÷ current liabilities Selling Guide Announcement (SEL-2022-04) May 4, 2022 - Fannie Mae B8-6-02, Mortgage Assignment to Fannie Mae - Deleted topic B8-6-03, Authorized Use of Intervening and Blanket Assignments ( New number B8-6-01 B8-7-01, Mortgage Electronic Registration Systems (MERS), Inc. E-2-01, Required Custodial Documents E3, Glossary of Fannie Mae Terms: C . Purchase Terminology

What is the liquidity test for business income from a ... - Fannie Mae The Quick Ratio (also known as the Acid Test Ratio) is appropriate for businesses that rely heavily on inventory to generate income. This test excludes inventory from current assets in calculating the proportion of current assets available to meet current liabilities. Quick Ratio = (current assets — inventory) ÷ current liabilities B3-3.5-02, Income from Rental Property in DU (06/01/2022) - Fannie Mae The net rental income calculation is not reduced by the mortgage payment, which is always treated as a liability and included in the debt-to-income ratio. If Net Monthly Rental Income is not entered or is $0.00, DU will calculate it using this formula: Gross rental income — 75% Uniform Loan Delivery Dataset | Fannie Mae The Uniform Loan Delivery Dataset (ULDD), part of the Uniform Mortgage Data Program (UMDP), is the common set of data elements required by Fannie Mae and Freddie Mac for single-family loan deliveries. ULDD Phase 4a Specification Release B3-3.1-08, Rental Income (05/04/2022) - Fannie Mae Fannie Mae publishes four worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The worksheets are: Rental Income Worksheet - Principal Residence, 2- to 4-unit Property ( Form 1037 ), Rental Income Worksheet - Individual Rental Income from Investment Property (s) (up to 4 properties) ( Form 1038 ),

Fannie Mae Reports Net Income of $2.4 Billion for Third Quarter 2022 Fannie Mae advances equitable and sustainable access to homeownership and quality, affordable rental housing for millions of people across America. We enable the 30-year fixed-rate mortgage and drive responsible innovation ... Fannie Mae Reports Net Income of $2.4 Billion for Third Quarter 2022 Author: Fannie Mae Subject:

Sam Method Income Worksheet 2021 - MyAns Complete Worksheet Database ... This worksheet is meant that can assist you analyze self-employed debtors. Use our PDF worksheets to complete numbers by hand or let our Excel calculators do the be just right for you. Month-to-month Qualifying Rental Revenue or Loss. If the earnings is set to be recurring no adjustment is required.

What is required for foreign income? - Fannie Mae Foreign Income Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. For additional information, see B3-3.1-09, Other Sources of Income.

Fannie Mae Reports Net Income of $2.4 Billion for Third Quarter 2022 Fannie Mae Reports Net Income of $2.4 Billion for Third Quarter 2022 November 8, 2022 WASHINGTON, DC - Fannie Mae (FNMA/OTCQB) today reported its third quarter financial results and filed its third quarter 2022 Form 10-Q with the Securities and Exchange Commission.

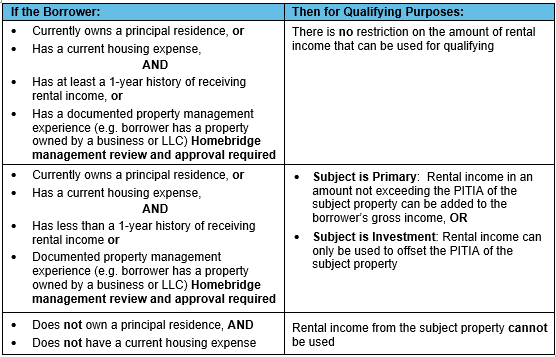

Fannie Mae Rental Income Guidelines And Requirements - GCA Mortgage What Are The New Changes On Rental Income By Fannie Mae This new guideline demonstrates how much qualifying income can be used for a borrower when purchasing a principal residence or a one to four-unit investment property. The lender must consider the following: If the borrower currently owns a principal residence or is paying rent where they live

FAQ: Top Trending Selling FAQs | Fannie Mae The requirement to reduce the value of retirement assets consisting of stocks, bonds, and mutual funds by 30% when measuring the three-year continuance for retirement income was removed from the Selling Guide B3-3.1-09, Other Sources of Income in December 2020. Refer to Selling Guide Announcement SEL-2020-07.

Where can I find rental income calculation worksheets? - Fannie Mae Fannie Mae publishes worksheets that lenders may use to calculate rental income. Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*,

Fannie Mae Rental Income Calculator Website Use of these worksheets is optional. The rental income worksheets are: Principal Residence, 2- to 4-unit Property (Form 1037)*, Individual Rental Income from Investment Property (s) (up to 4 properties) (Form 1038)*, Individual Rental Income from Investment Selling-guide.fanniemae.com Category: Website Detail Website

0 Response to "44 fannie mae rental income worksheet"

Post a Comment