39 student loan interest deduction worksheet 1040a

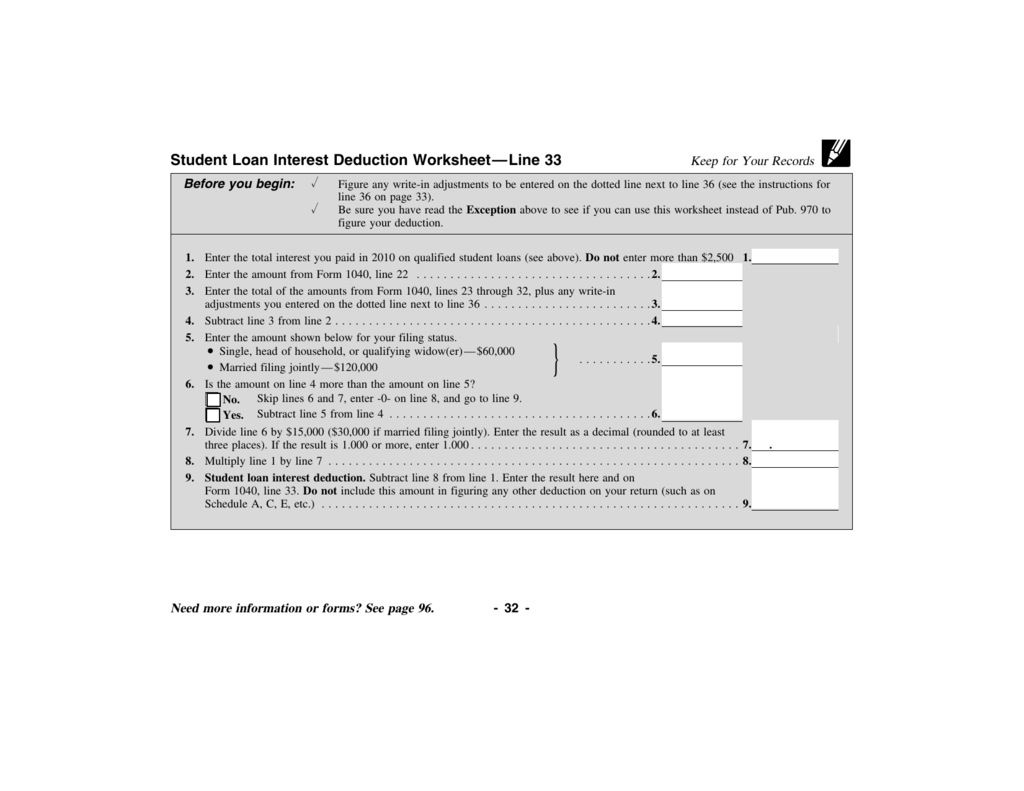

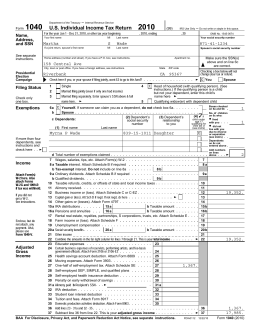

Form 1098-E will provide you with the amount of interest you paid. The Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions can assist in calculating your deductions. Student Loan Cancellations and Repayment Assistance Loan Cancellation Student Loan Interest Deduction Worksheet—Line 18 Before you begin: Keep for Your Records. See the instructions for line 18. 1. Enter the total interest you paid in 2013 on qualified student ...

Generally, you figure the deduction using the Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions. However, if you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income from sources within Puerto Rico, you must complete Worksheet 3-1 in this publication.

Student loan interest deduction worksheet 1040a

See the "Student Loan Interest Deduction Worksheet" that accompanies your 1040 or 1040A form, as well as IRS Publication 970, Tax Benefits for Education . Note that this link may not contain information about the newest Tax Cuts and Jobs Act passed in December 2017. Why did I receive a 1098-E form from Cornell? Tax Form 1040 Student Loan Interest. Updated August 20, 2021. Most interest that you pay throughout the year isn't tax-deductible. However, for some people, there's a special deduction they can take for paying interest on a student loan when they file the standard federal income tax form 1040. This can reduce your income tax by up to $2,500. Instead, for more information, see Pub. 970, and the Student Loan Interest Deduction Worksheet in your Form 1040 or 1040A instructions.US federal income tax law allows, in most situations, for individuals who pay interest on a "qualified student loan" to exclude some or all of their income that was used to pay that interest from their ...

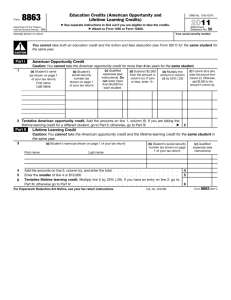

Student loan interest deduction worksheet 1040a. The only adjustment to income you can claim are educator expenses, IRA deduction, student loan interest deduction, or tuition and fees deduction. The only tax credits you can claim are the child tax credit, additional child tax credit, education credit, earned income credit, child and dependent care credit, or retirement savings contributions ... Student loan interest deduction. • For 2020, the amount of your student loan interest de-duction is gradually reduced (phased out) if your MAGI is between $70,000 and $85,000 ($140,000 and $170,000 if you file a joint return). You can't claim the deduction if your MAGI is $85,000 or more ($170,000 or more if you file a joint return). • The "student loan interest received by lender" line item on my 1098-E form does not match the "student loan interest deduction" (line item 33) on my completed 1040 form. The "student loan interest received by lender" is much higher. Is my 1040 form correct? If so, how was this amount calculated? 5. Your taxes are only from the Tax Table, the alternative minimum tax, recapture of an education credit, Form 8615 (PDF) or the Qualified Dividends and Capital Gain Tax Worksheet 6. Your only adjustments to income are the IRA deduction, the student loan interest deduction, the educator expenses deduction, the tuition and fees deduction, and 7.

Student loan interest deduction worksheet 1040a. If you file a Form 1040 1040-SR or 1040-NR you can use the Student Loan Interest Deduction worksheet on page 94 of your 2020 tax return. Other parties need to complete fields in the document. With the student loan interest tax deduction, you can deduct the interest you paid during the year on a qualified student loan. As of 2019, you can deduct $2,500 or the actual amount of interest you paid during the year, whichever is less. However, not everyone will qualify for the deduction. The Student Loan Interest Deduction Worksheet in the Form 1040 or Form 1040A instructions can assist in calculating your deductions. Student Loan Cancellations and Repayment Assistance Loan Cancellation. If a loan you must repay is forgiven or cancelled, you may need to include the amount forgiven in your gross income for tax purposes ... Use the worksheet in these instruc-tions to figure your student loan interest deduction. Exception. Use Pub. 970 instead of the worksheet in these instructions to figure your student loan interest deduction if you file Form 2555, 2555-EZ, or 4563, or you exclude income from sources within Puerto Rico. Qualified student loan. A qualified

Student loan interest deduction. Subtract line 8 from line 1. Enter the result here and on Form 1040, line 33 or Form 1040A, line 18. Do not include this amount in figuring any other deduction on your return (such as on Schedule A, C, E, etc.) WK_SLID.LD Name(s) as shown on return Tax ID Number..... The max deduction is $2,500 for your 2020 tax return. This max is per return, not per taxpayer, even if both spouses on a joint return qualify for the deduction. The student loan interest amount goes on our Student Loan Adjustment screen. When you enter the interest amount, we'll figure the deduction for you automatically. Please log into your MyVSAC account to view the amount of interest paid. Fill out your 1040 or 1040A. To determine your student loan interest tax deduction, use the information from your 1098-E and follow the directions within the IRS Form 1040 or 1040A instruction booklet. Ask for help. Figure the deduction using the "Student Loan Interest Deduction Worksheet" in the Form 1040 or Form 1040A instructions. There are many other provisions to the Taxpayer Relief Act.Please consult with your tax advisor to be sure you are eligible for any of these taxpayer benefits.

Student loan interest is interest you paid during the year on a qualified student loan. It includes both required and voluntarily pre-paid interest payments. You may deduct the lesser of $2,500 or the amount of interest you actually paid during the year.

The student loan interest deduction can be claimed "above the line" as an adjustment to income. You can take it without itemizing, or take the standard deduction as well. It's subtracted on line 20 of the "Adjustments to Income" section of Schedule 1 of the 2020 Form 1040 .

The maximum available deduction is the total amount of student loan interest paid in the calendar year or $2,500, whichever is smaller, subject to the phase-out formula. PRACTICE TIP. The instructions to Form 1040, Form 1040A, and Form 1040NR include a Student Loan Interest Deduction Worksheet.

Copy of Student Loan Interest Deduction Worksheet, page 36 of the 2013 IRS 1040 Instructions. Copy of Student Loan Interest Deduction Worksheet, page 32 of the 2013 1040A instructions. Tuition and Fees. Copy of last filed IRS Form 1040 with this adjustment listed on line 34. Copy of last filed IRS Form 1040A with this adjustment listed on line 19

Adjusted gross income (AGI) from Form 1040 or Form 1040A (not taking into account any social security benefits from Form SSA-1099 or RRB-1099, any deduction for contributions to a traditional IRA, any student loan interest deduction, any tuition and fees deduction, any domestic production activities deduction, or any exclusion of interest from

Student Loan Interest Deduction Worksheet Form 1040 Line 33 or Form 1040A Line 18 2016 1. Student loans must furnish this statement to you. Student Loan Interest Deduction Worksheet 2016. You cant claim the deduction if your MAGI is 85000 or more 170000 or more if you file a joint return. Form 1040 2018 Student Loan Interest Deduction Worksheet.

You won't claim any adjustments to income (deduction for IRA contributions, a student loan interest deduction, etc.). You won't claim any credits other than the Earned Income Tax Credit. Form 1040A. If you're one of the 80% of Americans who earn less than $100,000 per

Student Loan Interest Deduction Worksheet—Schedule 1, Line 33. Figure any write-in adjustments to be entered on the dotted line next to Schedule 1, line 36 (see the instructions for Schedule 1, line 36). Be sure you have read the . Exception in the instructions for this line to see if you can use this worksheet instead of Pub.

Complete the "Student Loan Interest Deduction Worksheet" in the form's instructions to calculate the amount of your deduction. The amount listed in Box 1 of Form 1098-E is the total interest you paid on your student loan. If you paid interest to more than one lender and received more than one Form 1098-E, enter the total amount from all ...

The student loan interest deduction is taken as an adjustment to income. This means you can claim this deduction even if you do not itemize deductions on Schedule A (Form 1040). This chapter explains: What type of loan interest you can deduct, Whether you can claim the deduction, What expenses you must have paid with the student loan,

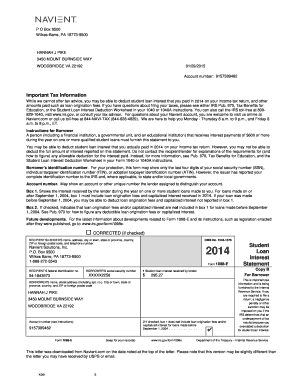

To help you figure your student loan interest deduction, you should receive Form 1098-E. Generally, an institution (such as a bank or governmental agency) that received interest payments of $600 or more during 2007 on one or more qualified student loans must send Form 1098-E (or acceptable substitute) to each borrower by January 31, 2008.

Instead, for more information, see Pub. 970, and the Student Loan Interest Deduction Worksheet in your Form 1040 or 1040A instructions.US federal income tax law allows, in most situations, for individuals who pay interest on a "qualified student loan" to exclude some or all of their income that was used to pay that interest from their ...

Tax Form 1040 Student Loan Interest. Updated August 20, 2021. Most interest that you pay throughout the year isn't tax-deductible. However, for some people, there's a special deduction they can take for paying interest on a student loan when they file the standard federal income tax form 1040. This can reduce your income tax by up to $2,500.

See the "Student Loan Interest Deduction Worksheet" that accompanies your 1040 or 1040A form, as well as IRS Publication 970, Tax Benefits for Education . Note that this link may not contain information about the newest Tax Cuts and Jobs Act passed in December 2017. Why did I receive a 1098-E form from Cornell?

:max_bytes(150000):strip_icc()/IRSForm1040-A2017Page1-331a31ffca9f4c4781e91f59968f5647.png)

0 Response to "39 student loan interest deduction worksheet 1040a"

Post a Comment