40 ira deduction worksheet 2014

Feb 3, 2015 — See next page for retirement worksheets. Line 35 - RETIREMENT DEDUCTION FOR SOUTH. CAROLINA RESIDENTS. SC Net LT Capital Gain. 2014 SCHEDULE H WORKSHEET P3 Homeowner and Renter Property Tax Credit Revised 11/2014 *149980130002* z z z 2014 SCHEDULE H PAGE 3 Last name and SSN Federal Adjusted Gross Income of the tax fi ling unit (see instructions) - Report the AGI of every member of your tax fi ling unit, including income subject to federal but not DC income tax.

IRA - Allowable Contribution Options - 2014 Worksheet This tax worksheet computes a taxpayer's maximum allowable IRA contributions for the year. For further assistance on this topic, click the Tax Flowcharts item group button and view the IRA Contributions and Deductions tax flowchart.

Ira deduction worksheet 2014

If you used the IRA Deduction Worksheet in the Form 1040, 1040-SR, or 1040-NR instructions, subtract line 12 of the worksheet (or the amount you chose to deduct on Schedule 1 (Form 1040), line 19, if less) from the smaller of line 10 or line 11 of the worksheet. ... (your 2014 Form 8606, line 22, was less than line 19 of that Form 8606) The ... NOTE: Opting out may result in a balance due on your MI-1040 as well as penalty and/or interest. 2. Check here if you (or your spouse if older) were born before 1946. See instructions for line 2. 3. Check here if you (or your spouse if older) were born during the period 1946 through 1952 (deduction is $20,000 single/$40,000 joint). If your annuity starting date was before this year and you completed this worksheet last year, skip line 3 and enter the amount from line 4 of last year's worksheet on line 4 below (even if the amount of your pension or annuity has changed). Otherwise, go to line 3. 3. Enter the appropriate number from Table 1 below.

Ira deduction worksheet 2014. SEP-IRA ContRIbutIon WoRkShEEt 2013 EXAMPLE YOURSELF Step 1.Net Business Profits 1. $50,000 (From Schedule C, C-EZ, or K-1) Step 2.Deduction for Self-Employment Tax 2. $3,532 (From IRSForm 1040) Step 3.Adjusted Net Business Profits 3. $46,468 (Subtract Line 2 from Line 1) Step 4.Contribution Percentage (expressed as a decimal) 4. 0.25 IRA Deduction Worksheet—Continued Your IRA Spouse's IRA 7. Multiply lines 6a and 6b by the percentage below that applies to you. If the result isn't a multiple of $10, increase it to the next multiple of $10 (for example, increase $490.30 to $500). If the result is $200 or more, enter the result. But if it is less than $200, enter $200. See DOR's online tax form instructions for ... the deduction for health insurance costs of self- ... tax year 2014, the IRS has calculated, based on. 2014 IRA Deduction Worksheet. 2 pages. 2014 IRA Deduction Worksheet. Henan University of Science and Technology. TAXATION 204. homework. homework. Henan University of Science and Technology ...

a full deduction up to the amount of your contribution limit. Married filing jointly with a spouse who is covered by a plan at work. $181,000 or less. a full deduction up to the amount of your contribution limit. more than $181,000 but less than $191,000. a partial deduction. $191,000 or more. no deduction. You must prorate exemptions, deductions, credits, and the pen- sion/retirement and other retirement income exclusions based on the number of months you were ...68 pages View Homework Help - 2014 IRA Deduction Worksheet from TAXATION 204 at Henan University of Science and Technology. 2014 Form 1040Line 32 IRA Deduction WorksheetLine 32 Keep for Your Records a If you 2014 IRA Deduction Worksheet. Henan University of Science and Technology. TAXATION 204. homework

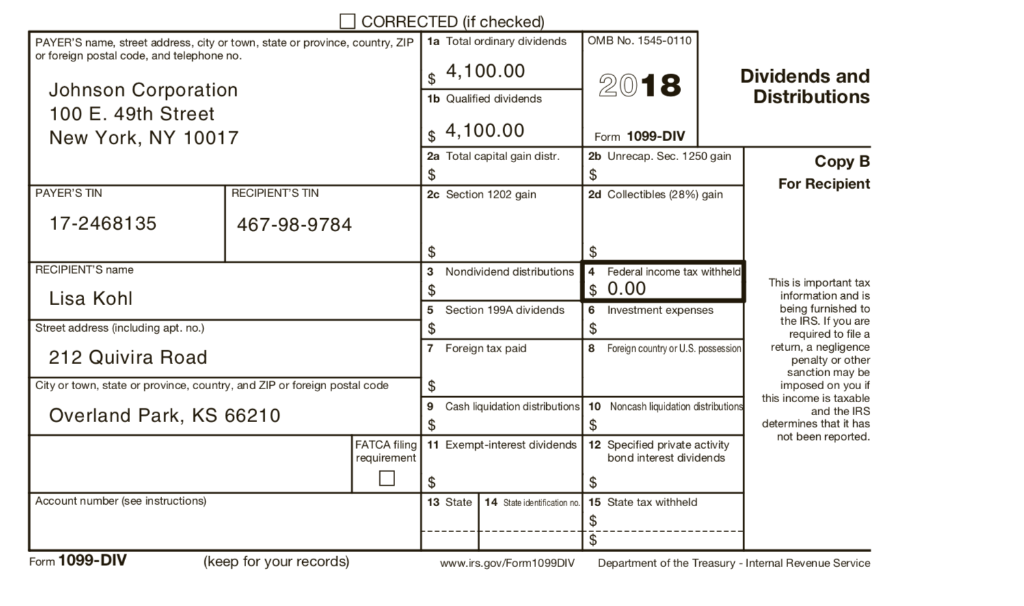

hired and employed a qualified veteran on or after January 1, 2014. IT-643 ... If Yes, enter the amount of 414(h) retirement contributions, if any,.72 pages The 2014 version of the spreadsheet includes both pages of Form 1040, as well as these supplemental schedules: Schedule A: Itemized Deductions. Schedule B: Interest and Ordinary Dividends. Schedule C: Profit or Loss from Business. Schedule D: Capital Gains and Losses (along with its worksheet) Schedule E: Supplemental Income and Loss. Earned Income Credit (EIC) Worksheet (2014) ... Deductions Worksheet. 2014 State and Local Sales Tax Deduction ... Deducting Traditional IRA Contributions. Roth IRA contribution if your modified AGI is $10,000 or more. What's New for 2022. Modified AGI limit for traditional IRA contributions in-creased. For 2022, if you are covered by a retirement plan at work, your deduction for contributions to a tradi-tional IRA is reduced (phased out) if your modified AGI is: •

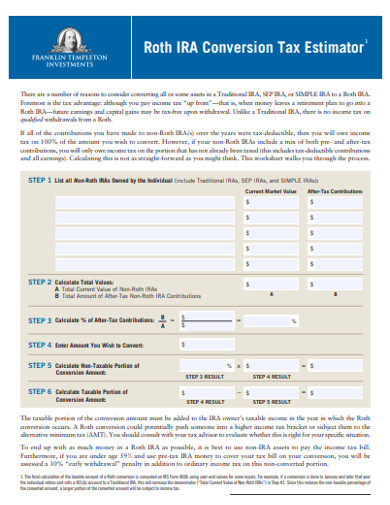

Jun 05, 2021 · Tax on Backdoor Roth IRA Conversion. Done properly, there is NO tax on a Backdoor Roth IRA conversion. Zero. Nada. Zilch. While the money you put into a Roth IRA (indirectly via the Backdoor in this case) was taxed when you earned it, it is NOT taxed when you contribute it directly to a Roth IRA or when you contribute it as a non-deductible IRA conversion nor when you subsequently convert that ...

Additional tax on a qualified plan, including an individual retirement arrangement (IRA), or other tax-favored account. But if you are filing a return only because you owe this tax, you can file Form 5329 by itself. c. Household employment taxes. But if you are filing a return only because you owe this tax, you can file Schedule H by itself. d.

Chapter 4 · Appendix A assists in recording contributions and distributions from a traditional IRA. · Worksheet 1 and Appendix B helps in calculating the modified ...

SEP IRA CONTRIBUTION WORKSHEET 2021 EXAMPLE YOURSELF Step 1. Net Business Profits 1. $50,000 (From Schedule C, C-EZ, or K-1) Step 2. Deduction for Self-Employment Tax 2. $3,532 (From IRS Form 1040) Step 3. Adjusted Net Business Profits 3. $46,468 (Subtract Line 2 from Line 1) Step 4. Contribution Percentage (expressed as a decimal) 4. 0.25

time in 2014. Use the Maximum Roth IRA Contribution Worksheet, later, to figure the maximum amount you can contribute to a Roth IRA for 2014. If you are married filing jointly, complete the worksheet separately for you and your spouse. If you contributed too much to your Roth IRA, see Recharacterizations, later. Modified AGI for Roth IRA purposes.

IRA Deduction if You Are NOT Covered by a Retirement Plan at Work - 2021 (deduction is limited only if your spouse IS covered by a retirement plan) See Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs) , for additional information, including how to report your IRA contributions on your individual federal income tax ...

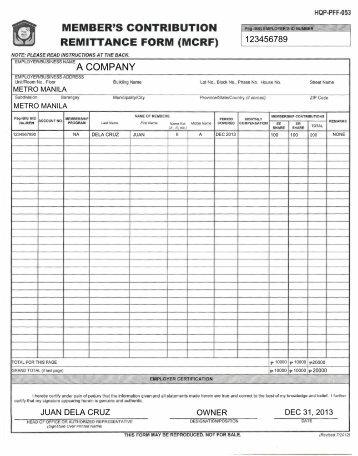

Page 11 IRA Deduction Worksheet Page 12 Self-employed SEP, SIMPLE, and Qualified Retirement Plan Deduction Worksheet ... 2014 CF-1040 INDIVIDUAL COMMON FORM (DRAFT VERSION 10/15/2014) Printed 10/15/14 Page 2 of 85. Page 14 Problems Noted on Past Common Forms Filed

2014 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre-

Traditional IRA contribution limit for 2014 age 50 or older: $6,500; ... $61,000 and $71,000 and between $98,000 and $118,000 can figure the amount of their IRA deductions by looking at the IRA deduction worksheet in the instructions for form 1040.

IRA Deduction Worksheet Qualified Dividends and Capital Gain Tax Worksheet Simplified Method Worksheet Social Security Benefits Worksheet Standard Deduction Worksheet for Dependents Student Loan Interest Deduction Worksheet. All of the 2014 federal income tax forms listed above are in the PDF file format. The IRS expects your 2014 income tax ...

Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2020, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2020—Example 1 Illustrated .

Jan 13, 2015 — first figure your modified adjusted gross income (AGI) appendix B, worksheet 1. then figure how much of your traditional IRA contribution you ...

Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2022 tax return and want to reduce your withholding to account for these deductions. This includes both itemized deductions and other deductions such as for student loan interest and IRAs. Step 4(c).

the Allocation Worksheet in the 2014 Form IL-1040 Instructions to ... Figure the amount of your non-Illinois IRA deduction by completing.

If your annuity starting date was before this year and you completed this worksheet last year, skip line 3 and enter the amount from line 4 of last year's worksheet on line 4 below (even if the amount of your pension or annuity has changed). Otherwise, go to line 3. 3. Enter the appropriate number from Table 1 below.

NOTE: Opting out may result in a balance due on your MI-1040 as well as penalty and/or interest. 2. Check here if you (or your spouse if older) were born before 1946. See instructions for line 2. 3. Check here if you (or your spouse if older) were born during the period 1946 through 1952 (deduction is $20,000 single/$40,000 joint).

If you used the IRA Deduction Worksheet in the Form 1040, 1040-SR, or 1040-NR instructions, subtract line 12 of the worksheet (or the amount you chose to deduct on Schedule 1 (Form 1040), line 19, if less) from the smaller of line 10 or line 11 of the worksheet. ... (your 2014 Form 8606, line 22, was less than line 19 of that Form 8606) The ...

:max_bytes(150000):strip_icc()/Form8606p1-91938646d41d4693afa0c5920662fdf0.png)

0 Response to "40 ira deduction worksheet 2014"

Post a Comment