42 airline pilot tax deduction worksheet

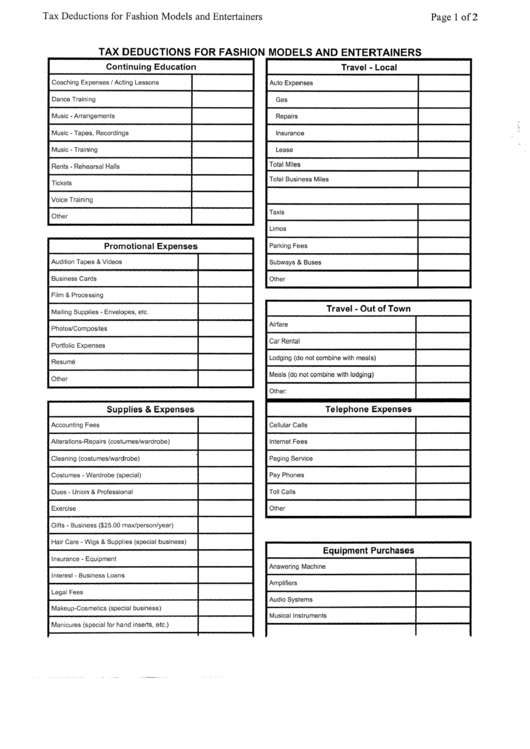

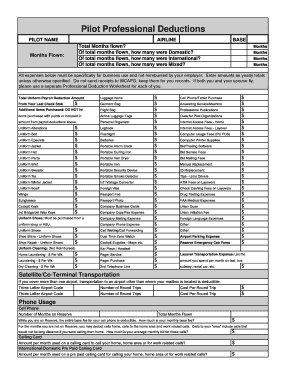

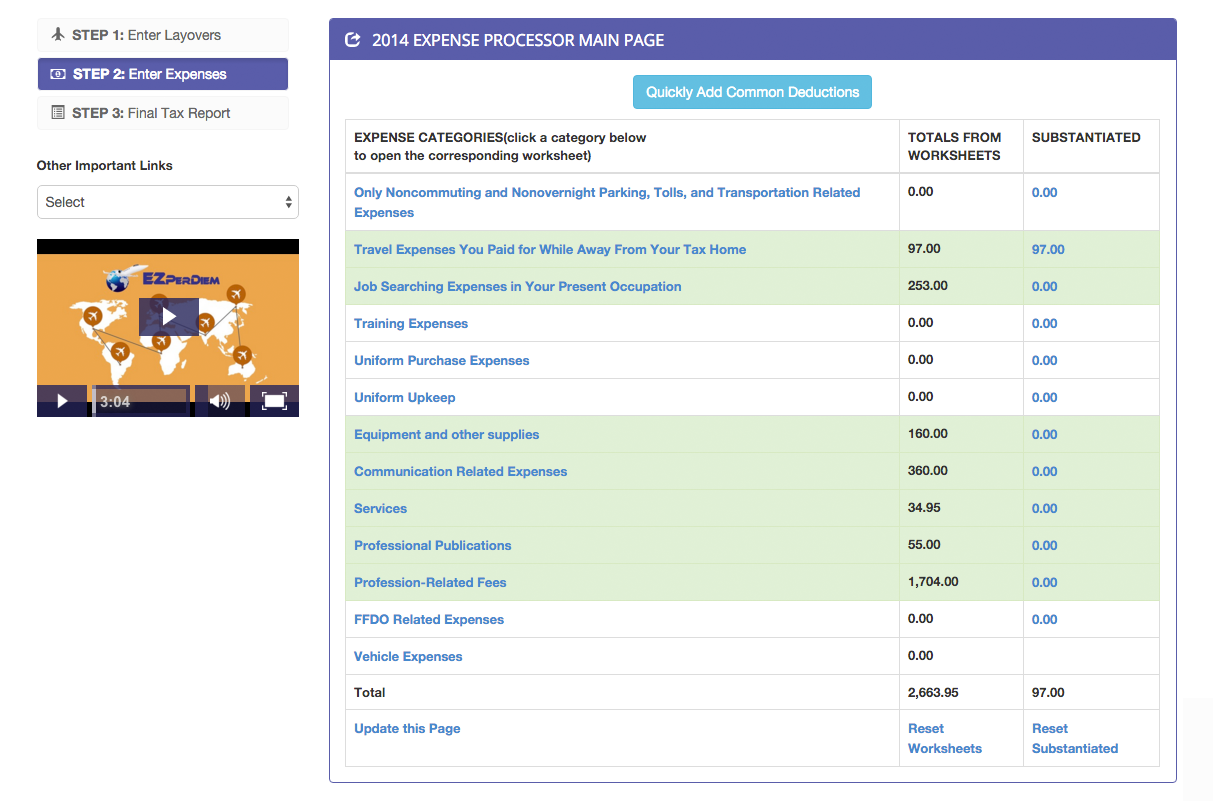

Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Dry Cleaning Curling Iron - Portable, Multi-voltage Continuing Education Correspondence Course Fees Materials & Supplies Equipment Publications - FAA Luggage Carts Luggage Locks Luggage Tags Publications - Entertainment (flight related) Alarm Clock - Portable ... A company called Tax Crew out in California has a great worksheet called the "2005 Tax Organizer" that you can get from there web page. They also have ones for prior tax years if needed, but I think they are all relatively the same.

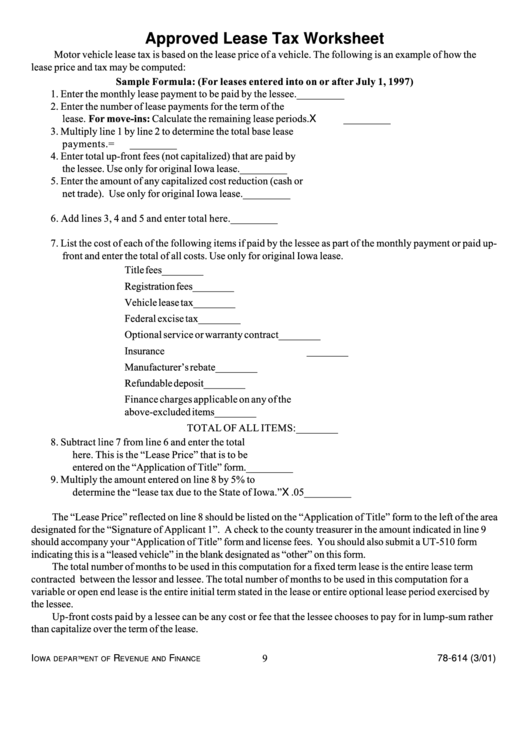

Flight attendant tax deductions worksheet. By using the itemized deductions a flight crewmember is able to deduct all of their aviation related employee business expenses and travel expenses. Enter your sabre login. Download fill in and print tax deduction worksheet for pilots flight attendants other airline personnel pdf online here for free.

Airline pilot tax deduction worksheet

Itemized Deduction Worksheet 2015 - Printable Paper Template. IRS Form 1040 Schedule 1 Download Fillable PDF or Fill ... Form 1040-ME-Wkst Minimum Tax Worksheet. Income Tax Forms: Federal Income Tax Forms 1040a. ... Form 1040-ES - Estimated Tax for Individuals Form (2014 ... Small Business & Self Employed Deduction Fillable Worksheet; Pilot Professional Deduction Fillable Worksheet; Flight Attendant Professional Deduction Fillable Worksheet; United Pilot and Flight Attendant Per Diem Reports (GO TO MY INFO PER DIEM REPORT) Rental Real Estate Deduction Fillable Worksheet; Military Deduction Worksheet Signature is required to process this tax deduction I understand that to deduct these expenses, my employer would agree that these non-reimbursed expenses were needed to perform my job. You should retain all original receipts, checks, bank statement and mileage logs to support these deductions. I declare that the

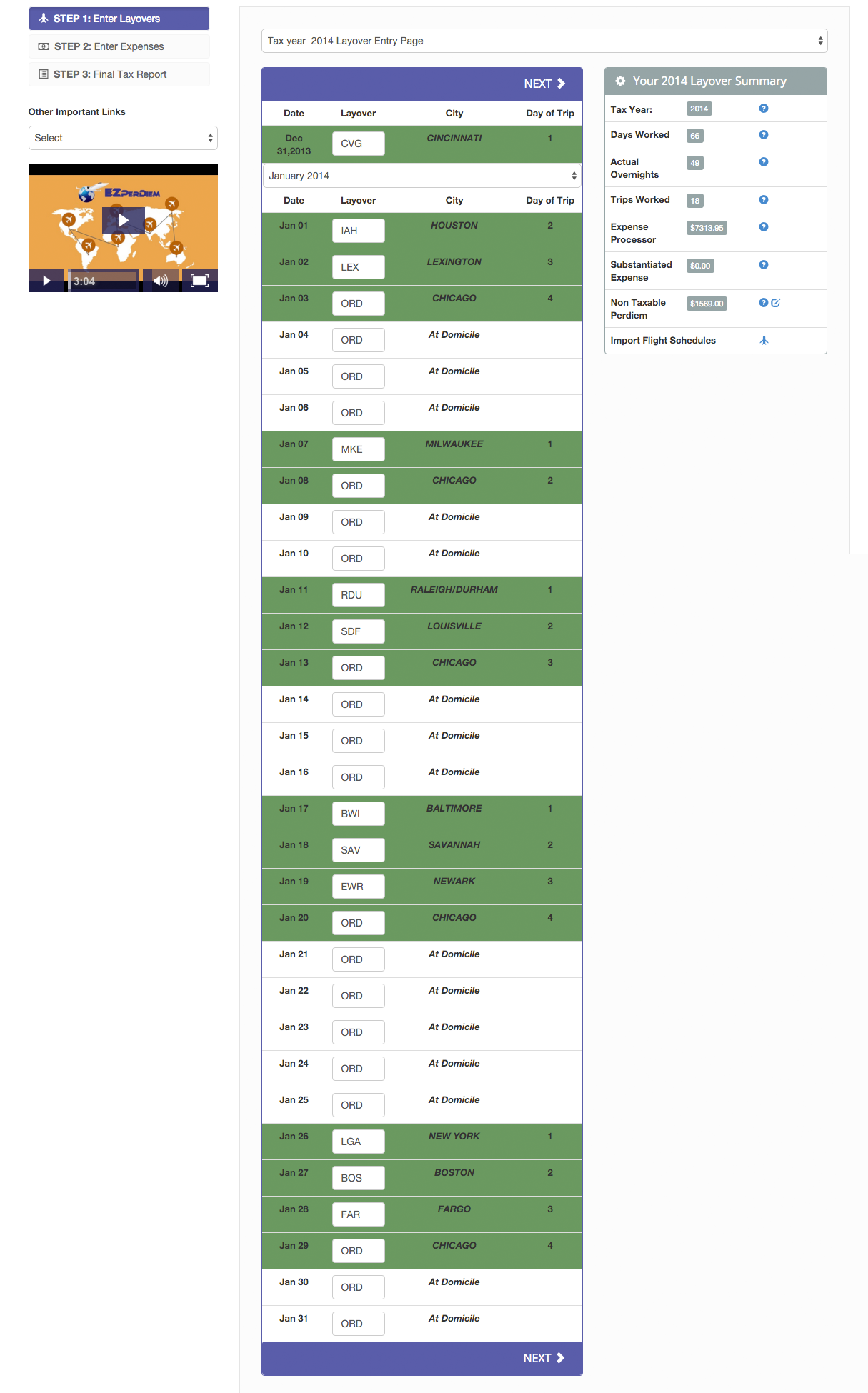

Airline pilot tax deduction worksheet. Deductible pilot or flight attendant expenses. Airline pilot tax deduction worksheet. This is a travel expense. Under the new tax law professional deductions ... How Rockwool Took the PILOT Seat County Commission Approves Tax Incentives for Roxul. Excerpt from August 4th, 2017 Journal News by Tim Cook. The "payment in lieu of taxes" agreement (PILOT) will allow Roxul Inc. to either completely or partially avoid paying local real estate or personal property taxes from 2018 through 2029. "There have been so many lawyers looking at this (agreement ... My company pays me between $9000 and $10,000. With a difference of about $9000, I take 80% of that and end up with a deduction of roughly $7,000. A domestic flyer is going to see smaller numbers, for sure. However, even if you ended up with a $3000 deficit, that’s still going to be a ~$2400 deduction. The U.S. Department of Transportation recently released SIFL rates for the six-month period from Jan 1 to June. 30, 2021. These rates are necessary when applying the IRS aircraft valuation formula to compute values of non-business transportation aboard employer-provided aircraft. Standard Industry Fare Level (SIFL) Rates for the Second Half of ...

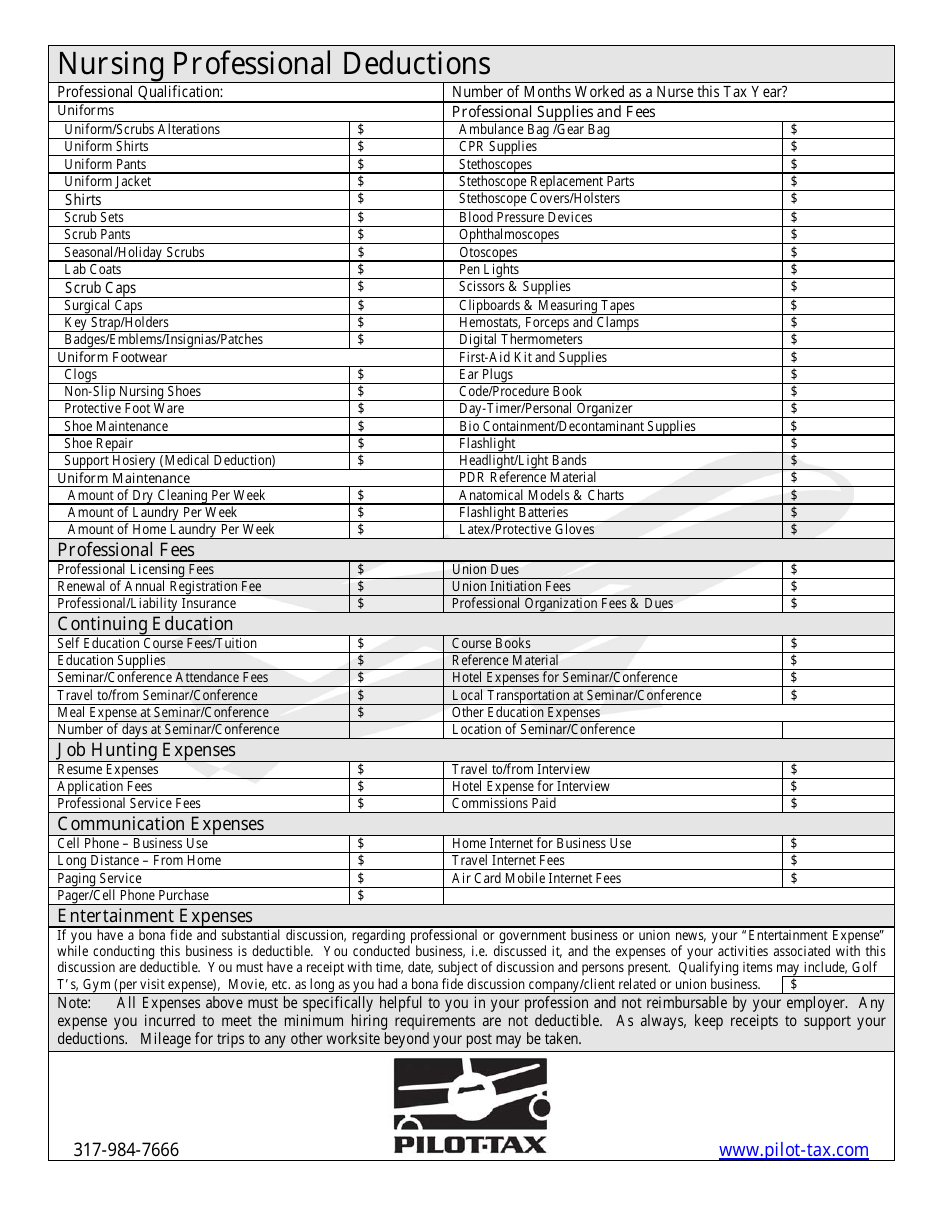

Download, Fill In And Print Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Pdf Online Here For Free. Tax Deduction Worksheet For Pilots, Flight Attendants, & Other Airline Personnel Is Often Used In Tax Worksheet Template, Tax Forms And Tax. Full Client Organizer for both Pilots and Non-Flight clients. Dependent Worksheet If you are claiming a dependent or you are Head of Household and claiming a dependent, you must complete this form and list each dependent. Flight Deductions If you live in AL, AR, CA, HI, NY, MN or PA, your state will allow Flight Deductions. Pilot-Tax – Your Tax Professionals. Home Kristen Baker 2021-06-23T18:55:43+00:00. Update: We are open Monday thru Thursday, 9am–5pm EST. Reach us by phone at 317-984-7666 or by email at info@pilot-tax.com. Pilots and flight attendants can write of many expenses from their taxes. To determine whether or not an expense is deductible, consider four tests for the ...

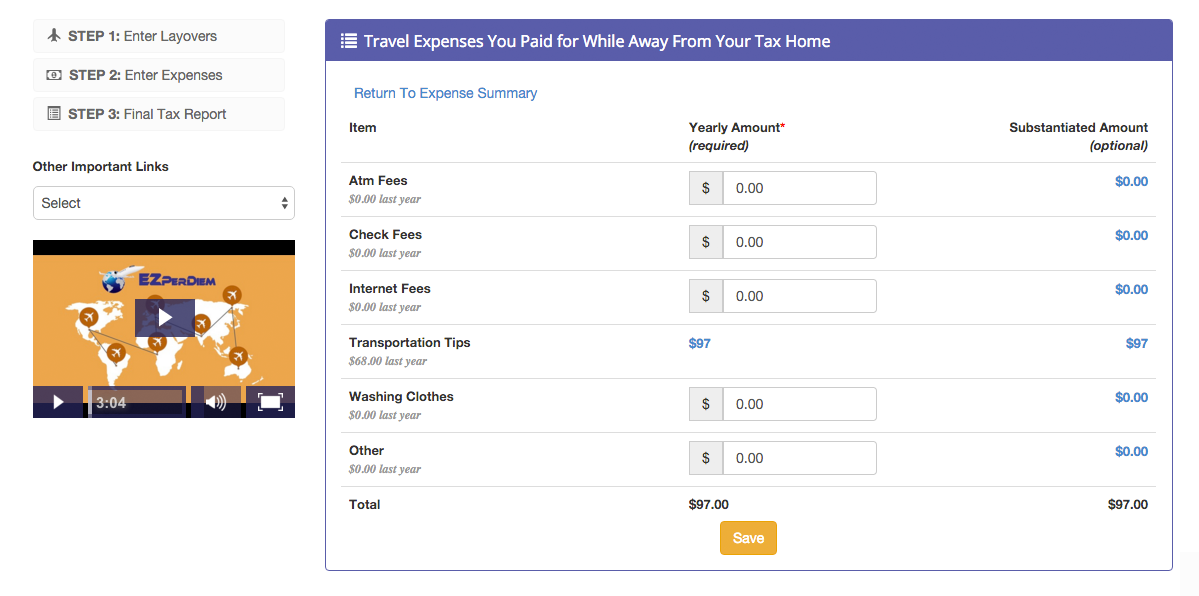

Airline pilot tax deduction worksheet. Client Number Column Restore to Consecutive Numbering. Sorting the display screen by client number has been practical and useful for many years. The 2021 program seems to have been changed. Client numbering is no lo... read more. housecallstax Level 1. Ease of Use. posted Dec 17, 2021. Flight Attendant Professional Deductions Receipts are not required for travel expenses under $75 if entered into your logbook, including item, date & cost. Do not send receipts; keep them for your records. TOTAL BLOCKS will be completed by Tax Preparer Married Pilots – If both you and your spouse fly, use an additional Professional Deduction ... Faqs Flight Crew Tax Preparation With A Flight Crew And Per Diem Deductible pilot or flight attendant expenses. Flight attendant tax deductions worksheet. Enter your sabre login. Download fill in and print tax deduction worksheet for pilots flight attendants other airline personnel pdf online here for free. Airline pilot tax deduction worksheet. Are you an airline pilot or flight attendant. Signature is required to process this tax deduction i understand that to deduct these expenses my employer would agree that these non reimbursed expenses were needed to perform. Airline pilot worksheet name. Pilots and flight engineers can claim a deduction for ...

Learn more about the tax deductions commercial and private airline pilots can claim during tax time. Includes information on what you can and cannot claim, ...

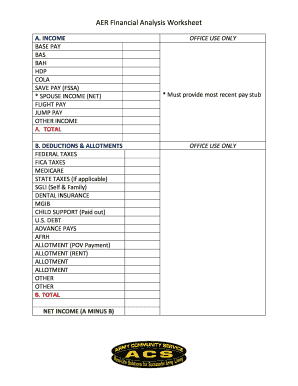

can access our online submit forms and submit this worksheet electronically here- www.watsoncpagroup.com/FCER . There are two types of deductions for pilots and flight attendants. First is out of pocket expenses such as uniforms, cell phone, union dues, etc. The second is the per diem allowance and deduction. We need both to prepare your tax returns.

Tax deduction worksheet for pilots flight attendants other airline personnel is often used in tax worksheet template tax forms and financial. The second is the per diem allowance and deduction. For airline pilots and flight attendants to use the itemized deductions the flight crewmember must be able to exceed the standard deduction amount that is published by the irs for each given year.

Airline pilot tax deduction worksheet. The expense must not be prohibited by the tax code. If the pilot or flight attendant cannot itemize then none of the employee business expenses or travel expenses including the per diem deduction can be written off the flight crewmember taxes. Do you pay taxes.

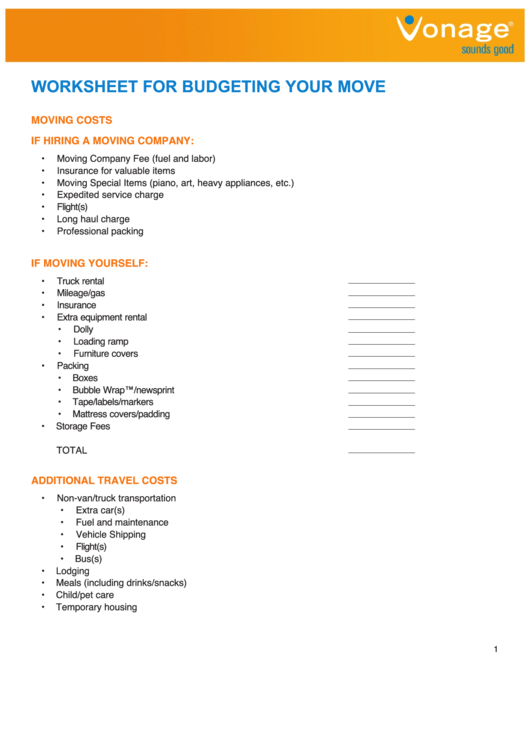

Business Use Of Home Worksheet - Tax Deduction Worksheet For Pilots Flight Attendants Other Airline Personnel Download Printable Pdf Templateroller : When it comes to moving to a larger home, many people decide to simply stay in their existing homes and add onto them.

and preparation available. My relationship with Pilot-Tax started after a long time family accountant was making mistakes on my returns that led to an audit. He (past accountant) just didn't understand the whole airline (tax detail) and international tax returns. Pilot-Tax has been doing my returns for over 10 years.

Association Dues. Tax Deduction Worksheet For. Pilots, Flight Attendants, & Other Airline Personnel. Dry Cleaning. Curling Iron - Portable, Multi-voltage.1 page

Bigger Refunds - Maximizing all deductions, tax credits, and write-offs available. Faster Refunds - With electronic filing and direct deposit, money in 14 to 21 days from filing date. Low Fees - Competent, professional service at half the cost of comparable tax firms. If you do your own taxes, you could be costing yourself $100s or even $1000s.

Tax Deductions for Airline Flight Crew Personnel. Professional Fees & Dues: Dues paid to professional societies related to your occupation are deductible.

Animal Body Parts Worksheet Worksheets Educational Games Grade Algebra Multiplication Animal Body Parts Worksheets For Grade 2 Worksheets noun worksheet for ...

If both Taxpayer and Spouse are pilots, use an additional Professional Deduction sheet. DO NOT combine expenses on this form! AIRLINE EMPLOYEED BY:.1 page

Apr 15, 2021 · If you are subject to paying self-employment tax, you can deduct one-half (50%) of the self-employment tax you pay on line 27 of your Form 1040, regardless of whether you itemize or take the standard deduction.

We cannot take a deduction for any expense for which you COULD have been reimbursed. For example: if your airline will reimburse you for your uniform alteration expenses but you just did not get around to submitting your receipts for reimbursement. The IRS will not allow this expense as a deduction because you 'could' have been reimbursed.

The T2202 tax form is issued to students at the end of February each year, for the previous calendar tuition costs, if enrolled in the Professional Pilot Course and/or Commercial Flight Training. Please note that the ability to claim tuition fees is only available IF / WHEN the student is advancing to Commercial Flight Training in pursuit of an occupational skill.

Signature is required to process this tax deduction I understand that to deduct these expenses, my employer would agree that these non-reimbursed expenses were needed to perform my job. You should retain all original receipts, checks, bank statement and mileage logs to support these deductions. I declare that the

Small Business & Self Employed Deduction Fillable Worksheet; Pilot Professional Deduction Fillable Worksheet; Flight Attendant Professional Deduction Fillable Worksheet; United Pilot and Flight Attendant Per Diem Reports (GO TO MY INFO PER DIEM REPORT) Rental Real Estate Deduction Fillable Worksheet; Military Deduction Worksheet

Itemized Deduction Worksheet 2015 - Printable Paper Template. IRS Form 1040 Schedule 1 Download Fillable PDF or Fill ... Form 1040-ME-Wkst Minimum Tax Worksheet. Income Tax Forms: Federal Income Tax Forms 1040a. ... Form 1040-ES - Estimated Tax for Individuals Form (2014 ...

0 Response to "42 airline pilot tax deduction worksheet"

Post a Comment