40 self employed expense worksheet

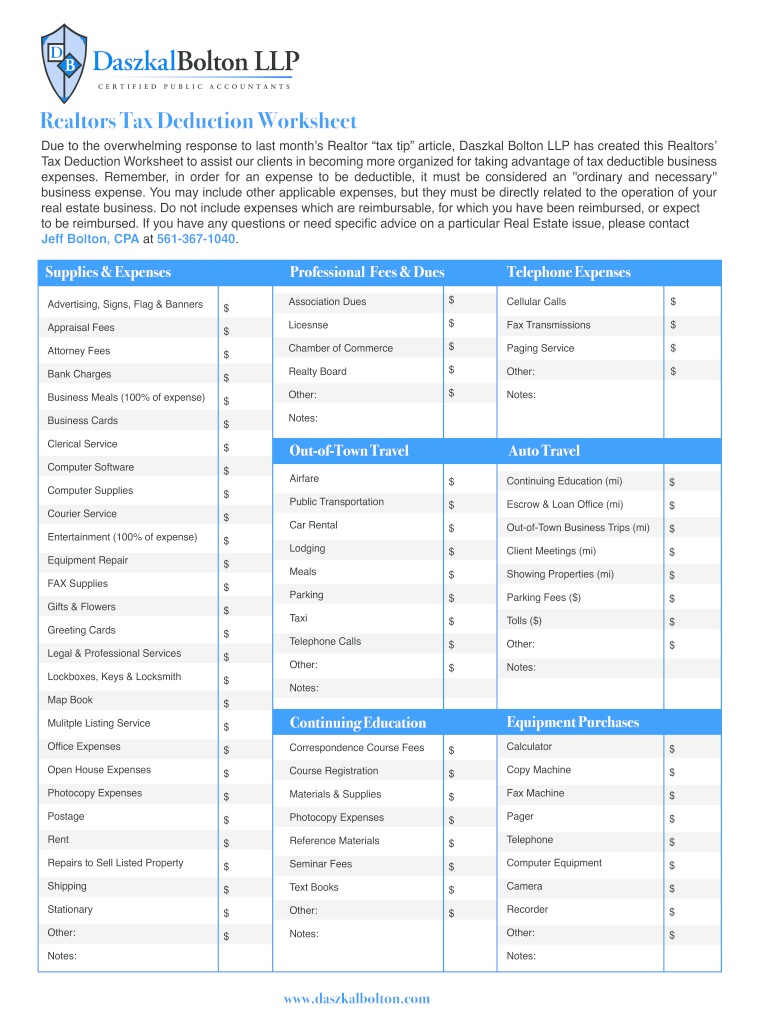

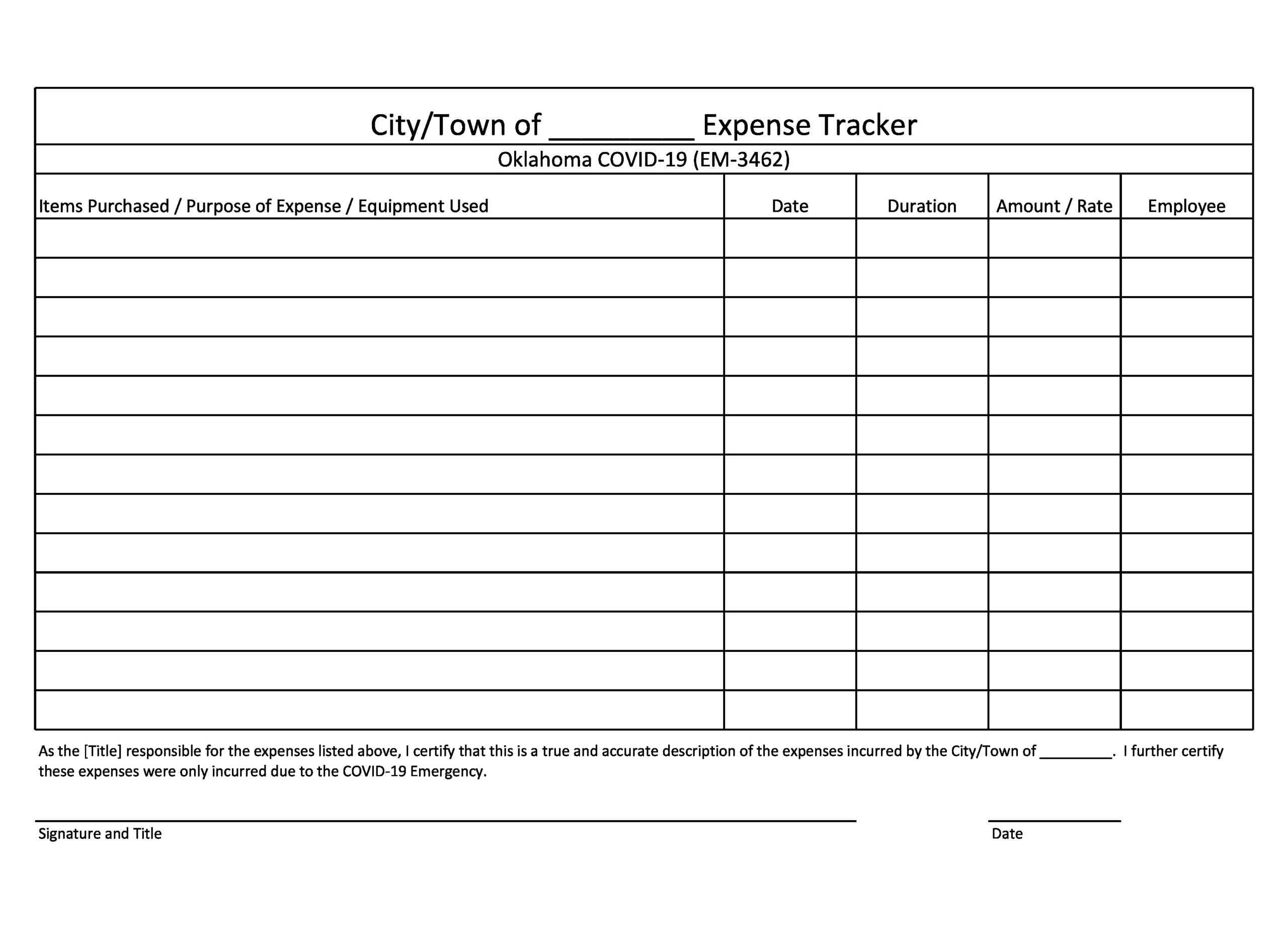

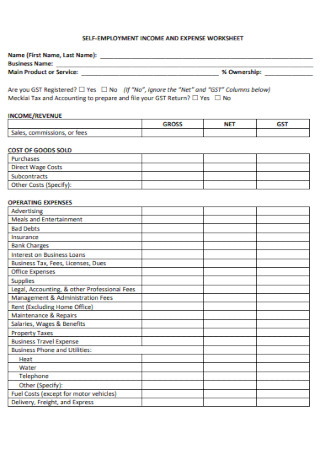

PDF Self Employment Income Worksheet - Entertainment Expenses - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify ... PDF Self-Employed Worksheet - MB Tax Pro - Home Self-Employed Worksheet Client: _____ Tax Year: _____ Did you make any payments that would require you to file Form 1099? YES_____ NO_____ Income: Office Expense Office Supplies Outside Services Parking & Tolls Expenses: Postage Accounting Printing

Self Employed Tax Deductions Worksheet - Fill Out and Sign ... The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill & Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the editable PDF template. Enter your official contact and identification details.

Self employed expense worksheet

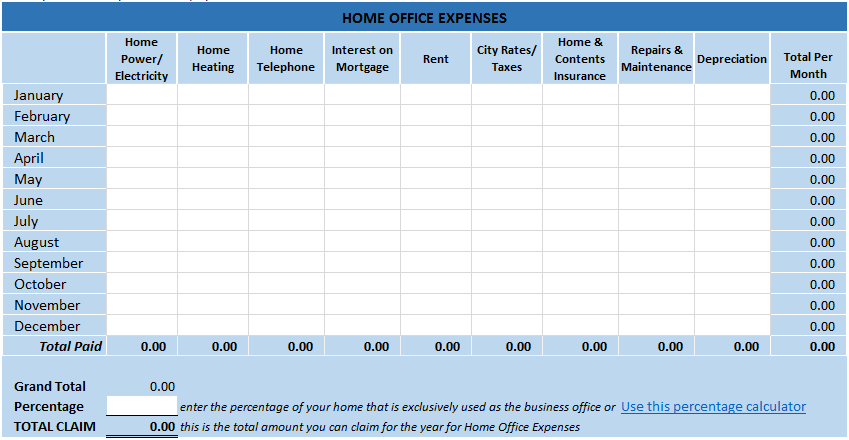

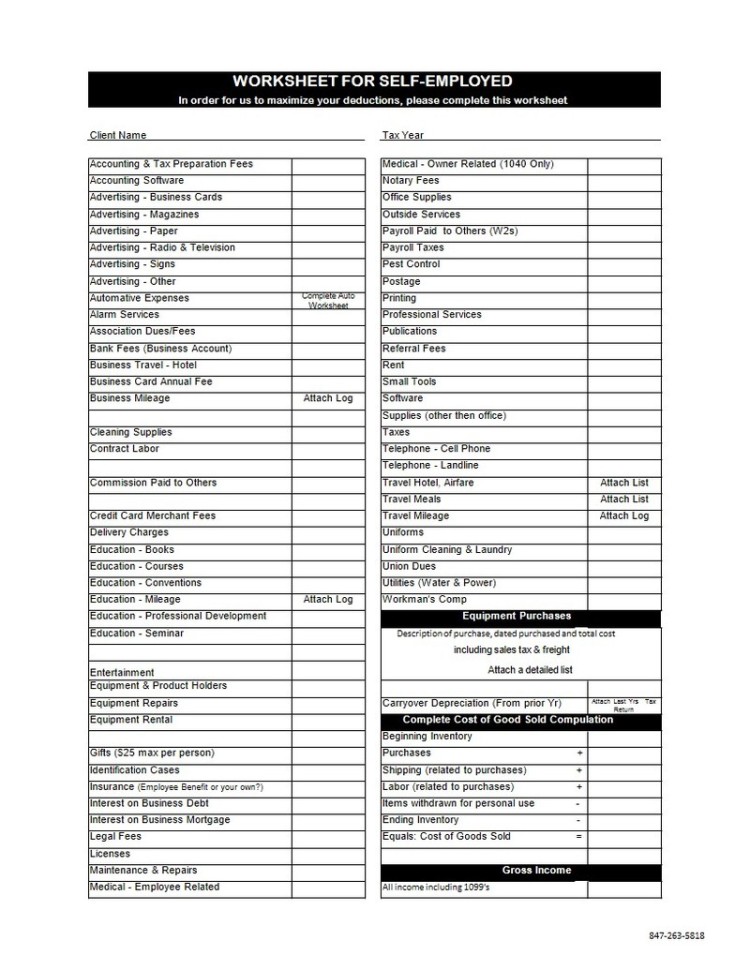

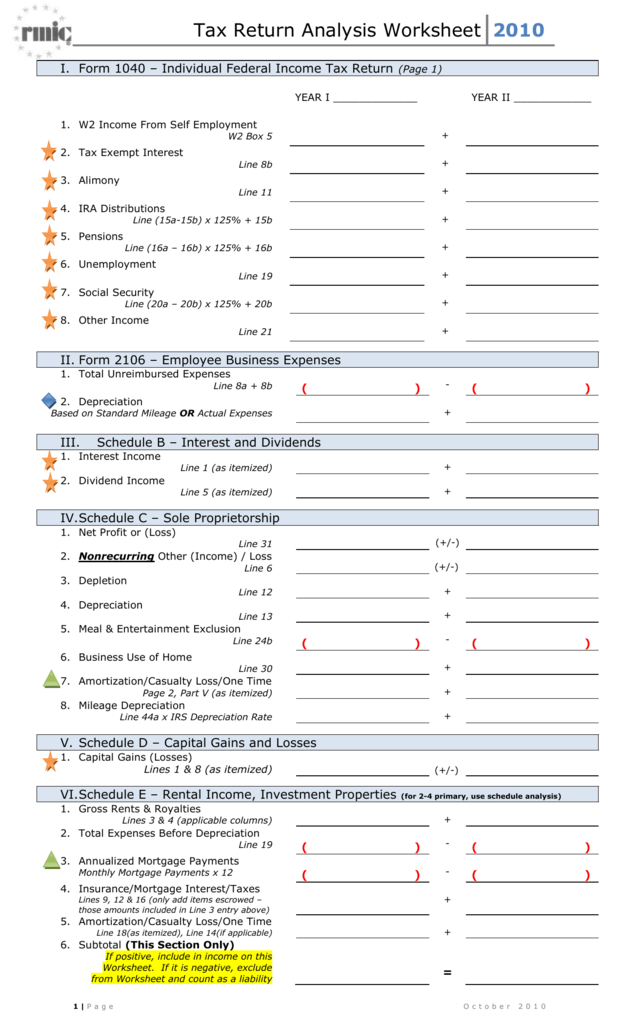

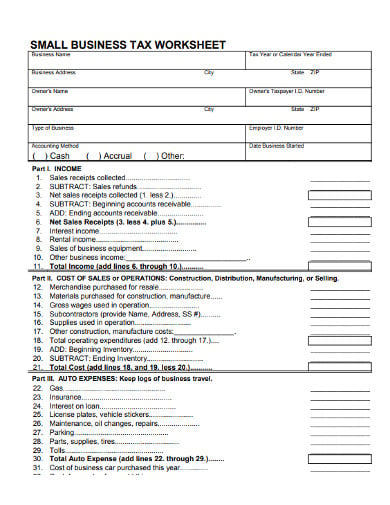

PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate. Home Office Deduction Worksheet (Excel) - Keeper Tax To simplify things for self-employed independent contractors, we provide a home office deduction Google Doc worksheet in excel that will help you track your expenses over the course of the year in one convenient Excel spreadsheet. PDF Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

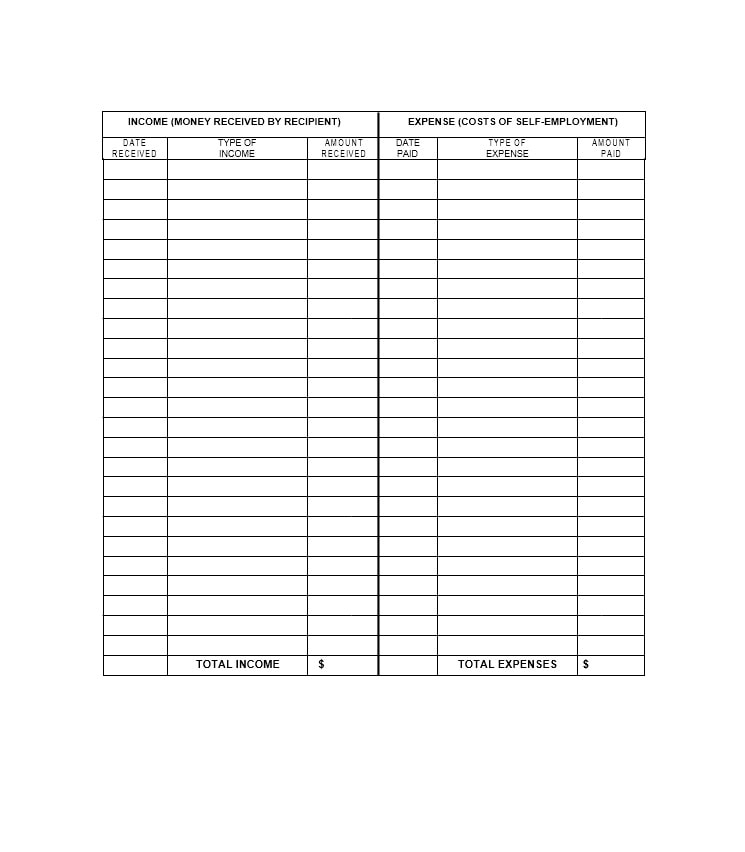

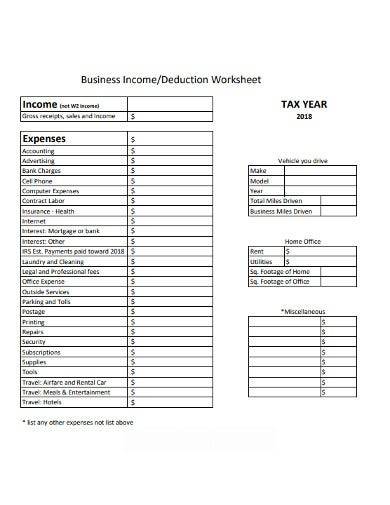

Self employed expense worksheet. PDF SELF EMPLOYED INCOME/EXPENSE SHEET - CPA Accounting This form is meant to assist clients with properly catagorizing their income and expenses and nothing more. List on back purchases of: Equipment, Furniture, Vehicles or Leasehold Improvements Mortgage Interest (Paid to Financial Institution) ‐ Business Only Depreciation ‐ If Predetermined (Attach Schedule) SELF EMPLOYED INCOME/EXPENSE SHEET PDF Self-Employed Tax Organizer The Self‐Employed Tax Organizer should be completed by all sole proprietors or single member LLC owners. It has been designed to help collect and organize the information that we will need to prepare the ... Insurance (other than health) Travel (Complete Travel Expense Internet service Worksheet on page 4) Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes. Self Employment Income Expense Tracking Worksheet Excel ... December 31, 2021 · Excel Worksheet Self Employment Income Expense Tracking Worksheet Excel - We developed a sailor-shaped multiplication worksheet to make an on the internet beginning to learn more enjoyable. The 2nd worksheet, that's even more like an evaluation worksheet, can assist your kid bone up on their knowledge.

Publication 535 (2021), Business Expenses | Internal ... Self-Employed Health Insurance Deduction. Qualified long-term care insurance. Qualified long-term care insurance contract. Qualified long-term care services. Worksheet 6-A. Self-Employed Health Insurance Deduction Worksheet; Chronically ill individual. Benefits received. Other coverage. Effect on itemized deductions. Effect on self-employment tax. PDF 2021 Self-Employed (Sch C) Worksheet 2021 Self-Employed (Sch C) Worksheet (type-in fillable) (Complete a separate worksheet for each business) Business owner's name: _____ If you checked any of the above, please stop here and speak with one of our Counselors. If you checked none of these above, please continue by completing the worksheet below for each business. PDF Sole Proprietorship/ Self-employed Worksheet Sole Proprietorship/ Self-employed Worksheet If you have a Profit and Loss statement, please supply us with a copy. ... Expenses (provide the total for each expense category) Cost of Goods Sold (for direct sales business) Commissions Paid Advertising Publications and Forms for the Self-Employed | Internal ... Instructions for Schedule F (Form 1040 or 1040-SR), Profit or Loss from Farming PDF. Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF. Instructions for Schedule SE (Form 1040 or 1040-SR), Self-Employment Tax PDF. Schedule K-1 (Form 1065), Partner's Share of Income, Credits, Deductions, etc. PDF. Instructions for Schedule K-1 (Form ...

Solved: When is schedule d not required - Intuit Jun 07, 2019 · Also use the Qualified Dividends and Capital Gain Tax Worksheet in the Form 1040 instructions to figure your tax. You can report your capital gain distributions on line 10 of Form 1040A, instead of on Form 1040, if none of the Forms 1099-DIV (or substitute statements) you received have an amount in box 2b, 2c, or 2d, and you do not have to file ... PDF Self-Employed Business Expenses (Schedule C) Worksheet Self-Employed Business Expenses (Schedule C) Worksheet 1 Self-Employed Business Expenses (Schedule C) Worksheet for unincorporated businesses or farms. Use separate sheet for each type of business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Tracking your self-employed income and expenses - Viviane ... For specific information on what expenses can be claimed, please see my Self-employed income and expense worksheets. In general, there are four main categories of expenses: Expenses that are 100% related to the business and will be deducted fully in the year incurred (e.g. stationery, business cards, travel). PDF Self-employment Expense Worksheet Revised 10/2018 SELF-EMPLOYMENT EXPENSE WORKSHEET Applicant's name: _____ Name of self-employed person: _____

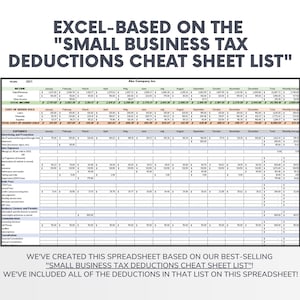

Self-Employed Tax Deductions Worksheet (Download FREE) The team at Bonsai organized this self-employed tax deductions worksheet (copy and download here) to organize your deductible business expenses for free. Simply follow the instructions on this sheet and start lowering your Social Security and Medicare taxes.

PDF Self Employment Income Worksheet - mytpu.org Self Employment Income Worksheet . Self Employed Applicants Name: _____ Home Address: _____ ... Allowable expenses that can be deducted from income are listed below within the worksheet. Tacoma Public Utilities does not allow the same business deductions as the IRS.

Quiz & Worksheet - Conflicts of Interest at Work | Study.com A situation where someone has personal interests (which may be other professional interests) that trump those of professional ones at the expense of the organization they are employed in.

PDF Self Employment Monthly Sales and Expense Worksheet SELF EMPLOYMENT - MONTHLY SALES AND EXPENSE WORKSHEET DSHS 07-098 (REV. 09/2015) Worksheet Self Employment Monthly Sales and Expense NAME MONTH CLIENT ID NUMBER 1. Self Employment Income You must tell us about your monthly self employment income. • If you provide us copies of your business ledgers or profit and loss statements, you do not

42 self employed expense worksheet - Worksheet For You 42 self employed expense worksheet. Self Employed Tax Deductions Worksheet - Fill Out and Sign ... The way to complete the Self employment income expense tracking worksheet form online: To start the blank, use the Fill & Sign Online button or tick the preview image of the form. The advanced tools of the editor will direct you through the ...

PDF Self Employed Income/Expense - Lake Stevens Tax Service Self Employed Income/Expense Author: SannaE Created Date: 11/30/2001 6:52:18 PM ...

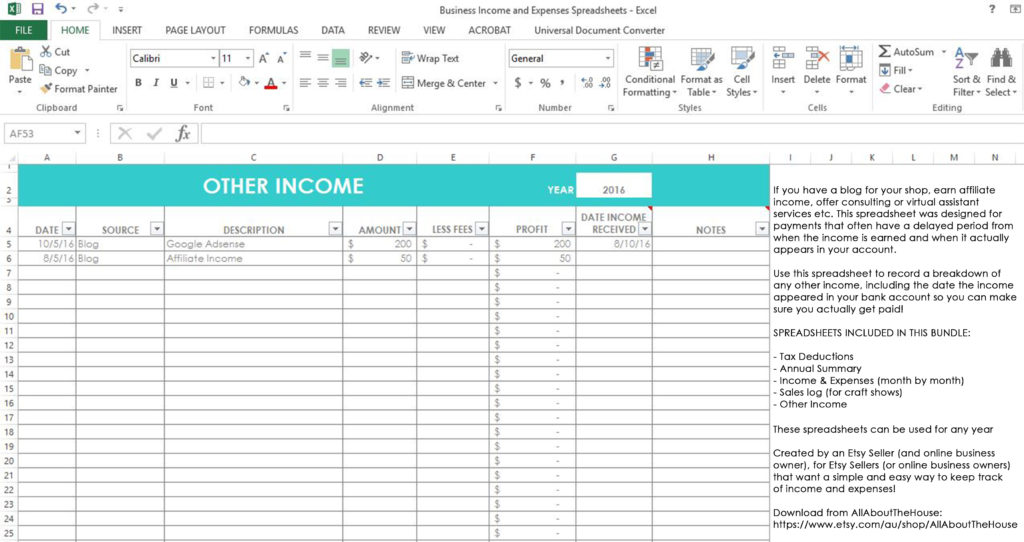

Free expenses spreadsheet for self-employed - Hello Bonsai Expenses Spreadsheet for Self-Employed Whether it's for your own accounting or to manage your billable expenses, an expenses spreadsheet can help you stay organized and maximize your tax deductions in preparation for your self employment taxes. We've built it to help you get peace of mind and get on with your work.

PDF (Schedule C) Self-Employed Business Expenses Worksheet for ... (Schedule C) Self-Employed Business Expenses Worksheet for Single member LLC and sole proprietors. Use separate sheet for each business. Use a separate worksheet for each business owned/operated. Do not duplicate expenses. Name & type of business: _____ Owned/Operated by: Client Spouse Income: Total ...

39 self employed business expenses worksheet - Worksheet ... self-employed business expenses worksheet The management of the income and the expenses that are to be managed and kept records of in the worksheet so that you can avoid the unnecessary wastage of the money. There is the worksheet that will involve in it the expenses done on the business and its related affair.

PDF Self-employed Income and Expense Worksheet SELF-EMPLOYED INCOME AND EXPENSE WORKSHEET TAXPAYER NAME SSN PRINCIPAL BUSINESS OR PROFESSION BUSINESS NAME EMPLOYER ID NUMBER BUSINESS ADDRESS BUSINESS ENTITY (CIRCLE ONE) INDIVIDUAL SPOUSE JOINT BUSINESS CITY, STATE, ZIP CODE INCOME EXPENSES $ GROSS RECEIPTS OR SALES $ ADVERTISING $ RETURNS & ALLOWANCES AUTO & TRAVEL $

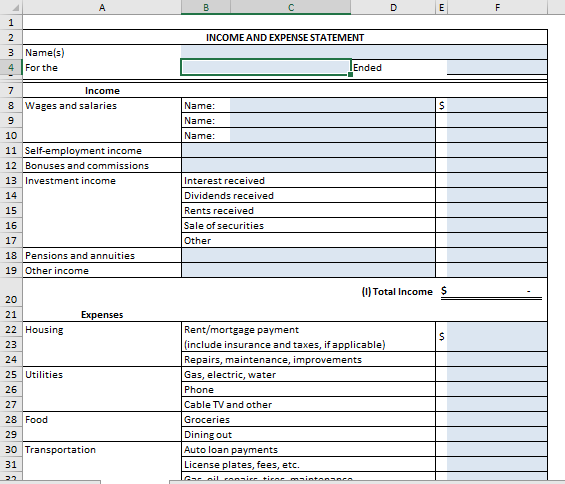

PDF Monthly Expenses Worksheet - AARP If self-employed, business expense Calculate Your Total Monthly Expense: Total from Column A: $ _____ Total from Column B: + $ _____ Equals Total Monthly Expenses: $ _____ Title: Microsoft Word - Monthly_Expenses_Worksheet.doc Author: equalls Created Date: 12/19/2005 1:21:24 PM ...

PDF Self-Employed/Business Monthly Worksheet - Mirto CPA Self-Employed/Business Name of Proprietor Social Security Number Monthly Worksheet Principal Business or Profession, Including Product or Service Income January February March April May June July August Sept October Nov Dec TOTALS Gross Sales Expenses January February March April May June July August Sept October Nov Dec TOTALS Accounting Advertising

39 self employed expenses worksheet - Worksheet For Fun Self Employed Expense Worksheet - Promotiontablecovers. Title pretty much says it. Free Excel Bookkeeping Templates | 3. Expense Form Template 3. Expense Form Template. This excel bookkeeping template is a cash book specifically for tracking income and expenses off a credit card. We tell you how to calculate that and include it in the template ...

PDF Schedule C Worksheet for Self Employed Businesses and/or ... Schedule C Worksheet for Self Employed Businesses and/or Independent Contractors ... I certify that I have listed all income, all expenses, and I have documentation to back up the figures entered on this worksheet. For tax year _____ Printed Name_____ Signature_____ Date _____ ...

Home Office Deduction Worksheet (Excel) - Keeper Tax To simplify things for self-employed independent contractors, we provide a home office deduction Google Doc worksheet in excel that will help you track your expenses over the course of the year in one convenient Excel spreadsheet.

PDF Tax Worksheet for Self-employed, Independent contractors ... Tax Worksheet for Self-employed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099-MISC with box 7 income listed. Try your best to fill this out. If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rate.

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

![Budget Worksheet] How to Budget With Irregular Income to ...](https://www.carefulcents.com/wp-content/uploads/2017/09/budget-worksheets.png)

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b30151dff905f0198f6a_1099-template-excel.png)

![1099 Excel Template [Free Download]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/5f63b6bbc9752d68cdd11bac_excel-template-1099.png)

0 Response to "40 self employed expense worksheet"

Post a Comment