44 1031 like kind exchange worksheet

Like-Kind Exchange Worksheet - Thomson Reuters Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement "like-kind" asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. 1031 Relinquished Property Worksheet. Read more. 1031 Replacement Property Worksheet. Read more. 1031 "Like-Kind" Exchange Best Practices. Raising the Bar for Secure, Transparent, and Compliant Exchanges. Read more. How to do a 1031 Exchange. The 1031 Forward Exchange Process.

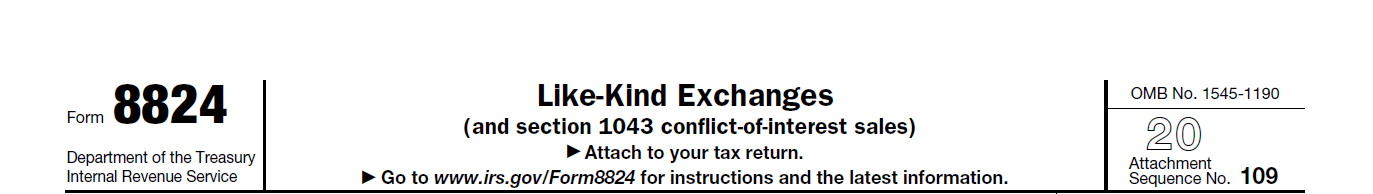

Form 8824: Do it correctly | Michael Lantrip Wrote The Book FORM 8824, THE 1031 EXCHANGE FORM The combination of the HUD-1 and the information on our Capital Gains Tax page will be all that you need for the completion of the form. For review, we are dealing with the following scenario. FORM 8824 EXAMPLE Alan Adams bought a Duplex ten years ago for $200,000 cash. He assigned a value of $20,000 to the land.

1031 like kind exchange worksheet

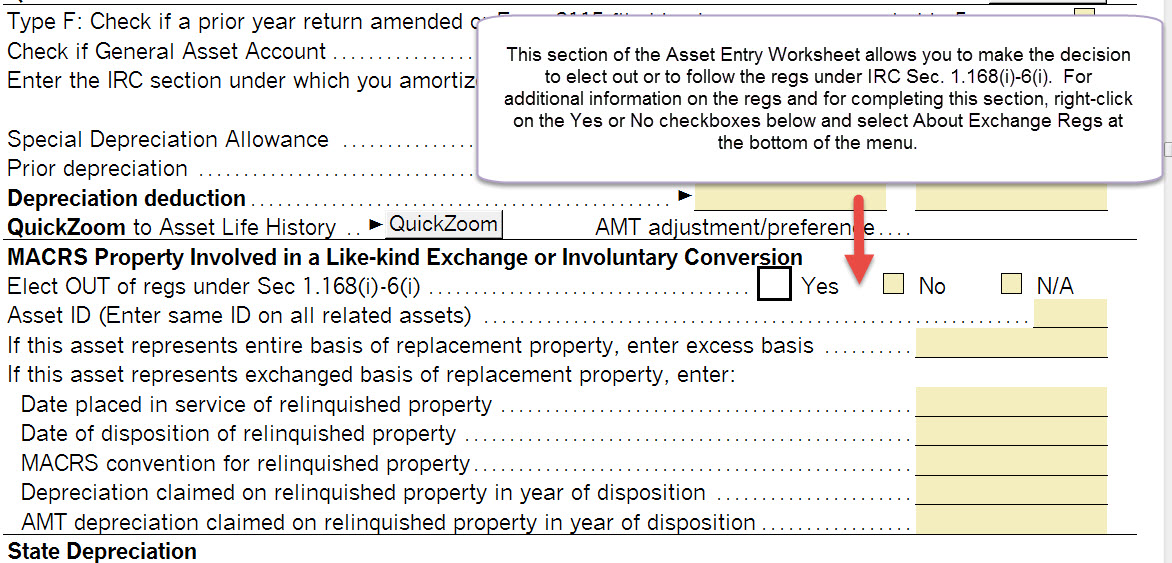

Solved: Like-Kind Exchange - Intuit Like-Kind Exchange. I believe that an asset is characterized as 'given away' by entering a zero sales price. But this will generate a loss, and will conflict with the entries on Form 8824. I filled out 8824 manually with my own adjusted basis calculations which included asset depreciation through the date of sale. Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded. PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

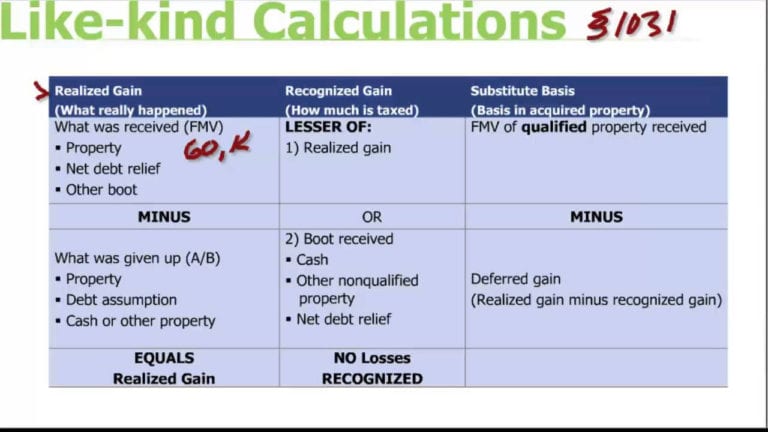

1031 like kind exchange worksheet. XLS Welcome - Hutchins, Canning & Company | CPA Services for Vacation Rental ... 1031 Worksheet 5 GAIN OR LOSS REALIZED (Line 7 less line 13 Date of Sale of Property Traded Date of Settlement of New Property Received Description of New Property Received Description of Old Property Traded Date New Property to be Received was Identified Fair Market Value of the new property received List any cash you received in the transaction 1 PDF Like-Kind Exchanges Under IRC Section 1031 - IRS tax forms as part of a qualifying like-kind exchange. Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind. If you receive cash, relief from debt, or Inspiration Like Kind Exchange Worksheet - Goal keeping intelligence Like-Kind Exchange Worksheet This tax worksheet examines the disposal of an asset and the acquisition of a replacement like-kind asset while postponing or deferring the gain from the sale if proceeds are re-invested in the replacement asset. Related Party Exchange Information Part III. Asset Worksheet for Like-Kind Exchange Asset Worksheet for Like-Kind Exchange. Asset IDs bundle your assets for sale. So any associated assets (improvements to a rental property and the rental property itself) would use the same ID in order to link them. You should cut all of the depreciation on the relinquished assets in two and apply the 50% to each of the new properties. 0. 2. 82.

1031 Exchange Examples | 2022 Like Kind Exchange Example This is known as a "Partial Exchange" and the portion the exchange proceeds that are not reinvested are referred to as "Boot" and are subject to taxes. Ron and Maggie believe their property can be sold for $2,850,000. Assuming the mortgage balance will be $800,000, their evaluation of a suitable Replacement Property will look like this: PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 - 1031 Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 7400 Heritage Village Plaza, Suite 102 Gainesville, VA 20155 800-795-0769 703-754-9411 Fax 703-754-0754 Compliments of Realty Exchange Corporation Your Nationwide Qualified Intermediary for the Tax Deferred Exchange of Real Estate 1031worksheet - Learn more about 1031 Worksheet 1031worksheet - Learn more about 1031 Worksheet 1031 Exchange Rules In all cases of a 1031 exchange, the owner must close on the identified replacement property (s) within 180 days from the sale date of the original property. The "three-property" 1031 exchange rule: the owner may identify up to three properties, regardless of their value. IRC Section 1031 Like-Kind Exchange Calculator: IRS Home Swapping Rules A 1031 exchange refers to Internal Revenue Service Code 1031 which allows like-kind exchanges on properties. This exchange defers capital gains on the property during the exchange and allows properties to be purchased temporarily tax-free with the capital gains on both investments to be collected when the second property is sold.

39 like kind exchange worksheet excel - Worksheet Online Learn More. Like kind exchange worksheet excel. Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free) ... 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template We always effort to show a picture with high resolution or with perfect images. 1031 Like Kind Exchange Worksheet And Form 8824 Worksheet Template can be beneficial inspiration for those who seek a picture according specific categories, you can find it in this website. Finally all pictures we've been displayed in this website will inspire you all. PDF 2019 - 1031 Corp We realize the form used to report your 1031 exchange is not the easiest form to complete so we have included line by line instructions to assist you. Additionally, we have developed a Microsoft Excel spreadsheet to help you with the preparation of IRS Form 8824 "LikeKind Exchanges." XLS 1031 Corporation Exchange Professionals - Qualified Intermediary for IRS ... 1031 Corporation Exchange Professionals - Qualified Intermediary for IRS ...

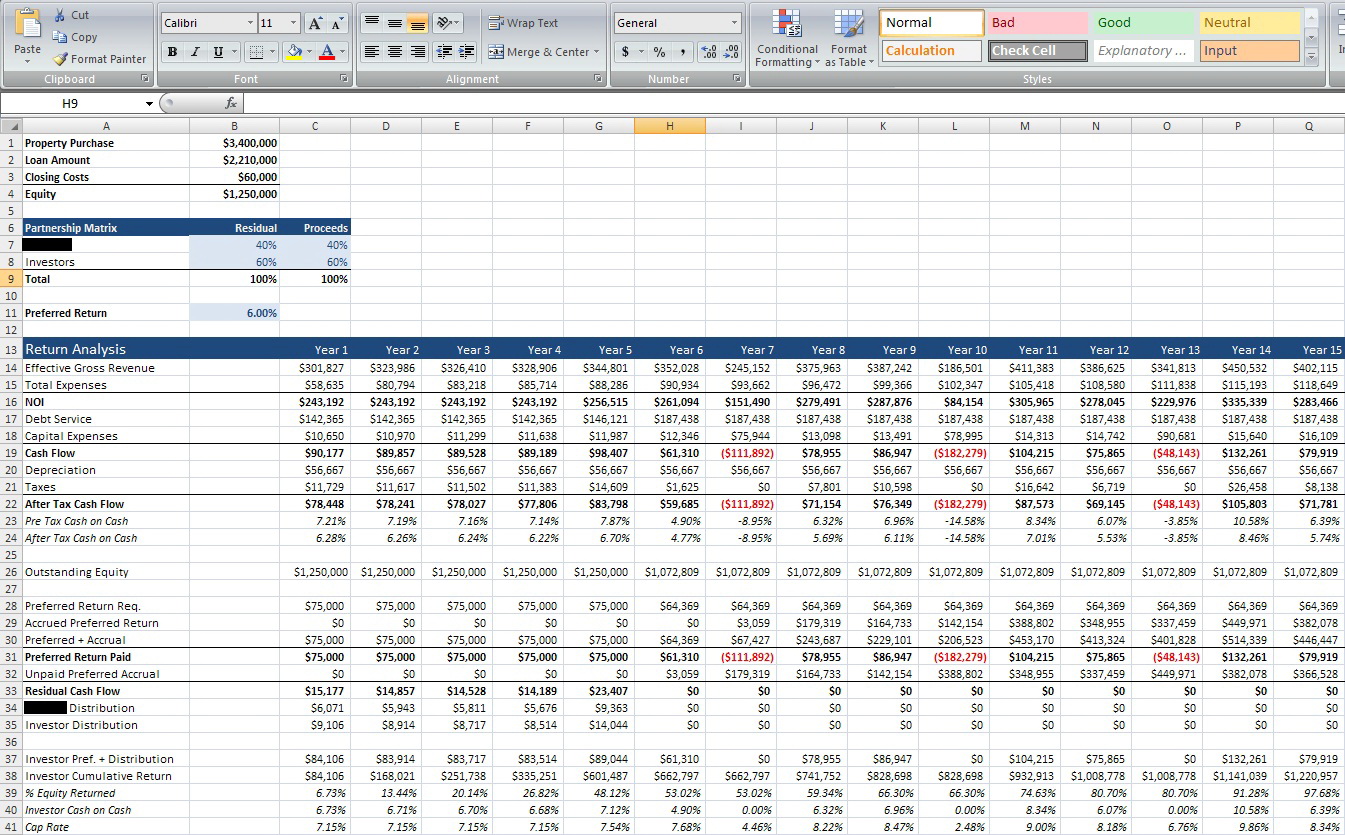

1031 Like Kind Exchange Calculator - Excel Worksheet 1031 Like Kind Exchange Calculator - Excel Worksheet Smart 1031 Exchange Investments We don't think 1031 exchange investing should be so difficult That's why we're giving you the same 1031 exchange calculator our exchange experts use to help investors find smarter investments. Requires only 10 inputs into a simple Excel spreadsheet.

Instructions for Form 8824 (2021) | Internal Revenue Service The final regulations, which apply to like-kind exchanges beginning after December 2, 2020, provide a definition of real property under section 1031, and address a taxpayer's receipt of personal property that is incidental to real property the taxpayer receives in the exchange. See Regulation sections 1.1031 (a)-1, 1.1031 (a)-3, and 1.1031 (k)-1.

IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example IRS 1031 Exchange Worksheet And Vehicle Like Kind Exchange Example can be beneficial inspiration for those who seek a picture according specific topic, you can find it in this site. Finally all pictures we have been displayed in this site will inspire you all. Thank you for visiting. Download by size: Handphone Tablet Desktop (Original Size)

PDF Reporting the Like-Kind Exchange of Real Estate Using IRS Form 8824 ... - 1031 Like-Kind Exchanges. The Form 8824 is divided into four parts: Part I. Information on the Like-Kind Exchange Part II. Related Party Exchange Information Part III. Realized Gain or (Loss), Recognized Gain, and Basis of Like-Kind Property Received Part IV. Not used for 1031 Exchange - Used only for Section 1043 Conflict of Interest Sales.

IRC 1031 Like-Kind Exchange Calculator Everything You Need to Know About 1031 Exchanges. 1031 tax-deferred swaps allow real estate investors to defer paying capital gains taxes when they sell a property that is used "for productive use in a trade or business," or for investment.This is due to IRC Section 1031, and when structured correctly, it lets you sell a property and reinvest the proceeds in a new property - while deferring ...

PDF FORM 8824 WORKSHEET Worksheet 1 Tax Deferred Exchanges Under IRC § 1031 Before preparing Worksheet 1, read the attached Instructions for Preparation Of Form 8824 Worksheets. Then, prepare Worksheet 1 after you have finished the preparation of worksheets 2 and 3. _____ 1031 Corporation - Longmont/Boulder, CO 303-402-1031 (Local) 888-367-1031 (Toll Free)

1031 Tool Kit - TM 1031 Exchange Click here for your 1031 Exchange Tool Kit including at 1031 checklist, qualified intermediary locator, close date form, 1031 identification form and more. Click here to schedule your free 1031 exchange and investment consultation.

Like Kind Exchange Calculator - cchwebsites.com Like Kind Exchange Calculator. If you exchange either business or investment property that is of the same nature or character, the IRS won't recognize it as a gain or loss. This calculator is designed to calculate recognized loss, gains and the basis for your newly received property.

Solved: 1031 exchange - Intuit Accountants Community A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

PDF WorkSheets & Forms - 1031 Exchange Experts Line 26-38 Not applicable to 1031 exchanges WorkSheet #10 for Buy-Down only. WorkSheet #10 - Calculation of Recapture for Form 8824, Line 21 A. Depreciation taken in prior years from WorkSheet #1 (Line D)$ _____ B. Taxable gain from ...

Completing a like-kind exchange in the 1040 return - Intuit A like-kind exchange, or 1031 exchange, can only be completed for real property. See here for more details. A like-kind exchange consists of three main steps. All three steps must be completed for the tax return to contain the correct information. Step 1: Disposing of the original asset Open the Asset Entry Worksheet for the asset being traded.

Solved: Like-Kind Exchange - Intuit Like-Kind Exchange. I believe that an asset is characterized as 'given away' by entering a zero sales price. But this will generate a loss, and will conflict with the entries on Form 8824. I filled out 8824 manually with my own adjusted basis calculations which included asset depreciation through the date of sale.

0 Response to "44 1031 like kind exchange worksheet"

Post a Comment