39 car and truck expenses worksheet

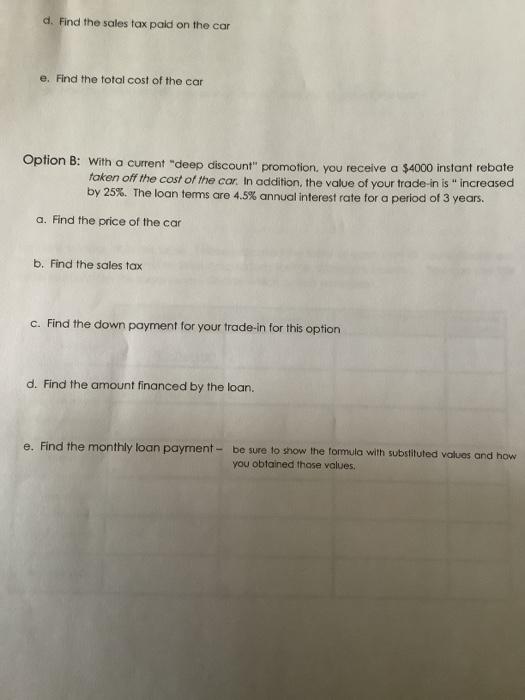

Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep ... Sch C Wks -- Car & Truck Expenses Worksheet: AMT dep allowed/allowable-1 is too large. I have tried all of this and it does not work. There is no drop down menu to override it and I did not put in a depreciation value. Turbotax did and it still says it is too high. I traded in an older car for a new car for my business. 8+ Auto Expense Report Templates (Word | Excel) 8+ Auto Expense Report Templates (Word | Excel) Every individual or business out there does want to maintain very good business mileage tracking records for themselves. This is what the creation of business mileage tracking logs does allow them to do. The reason that they need to keep their business mileage perfectly organized is very clear.

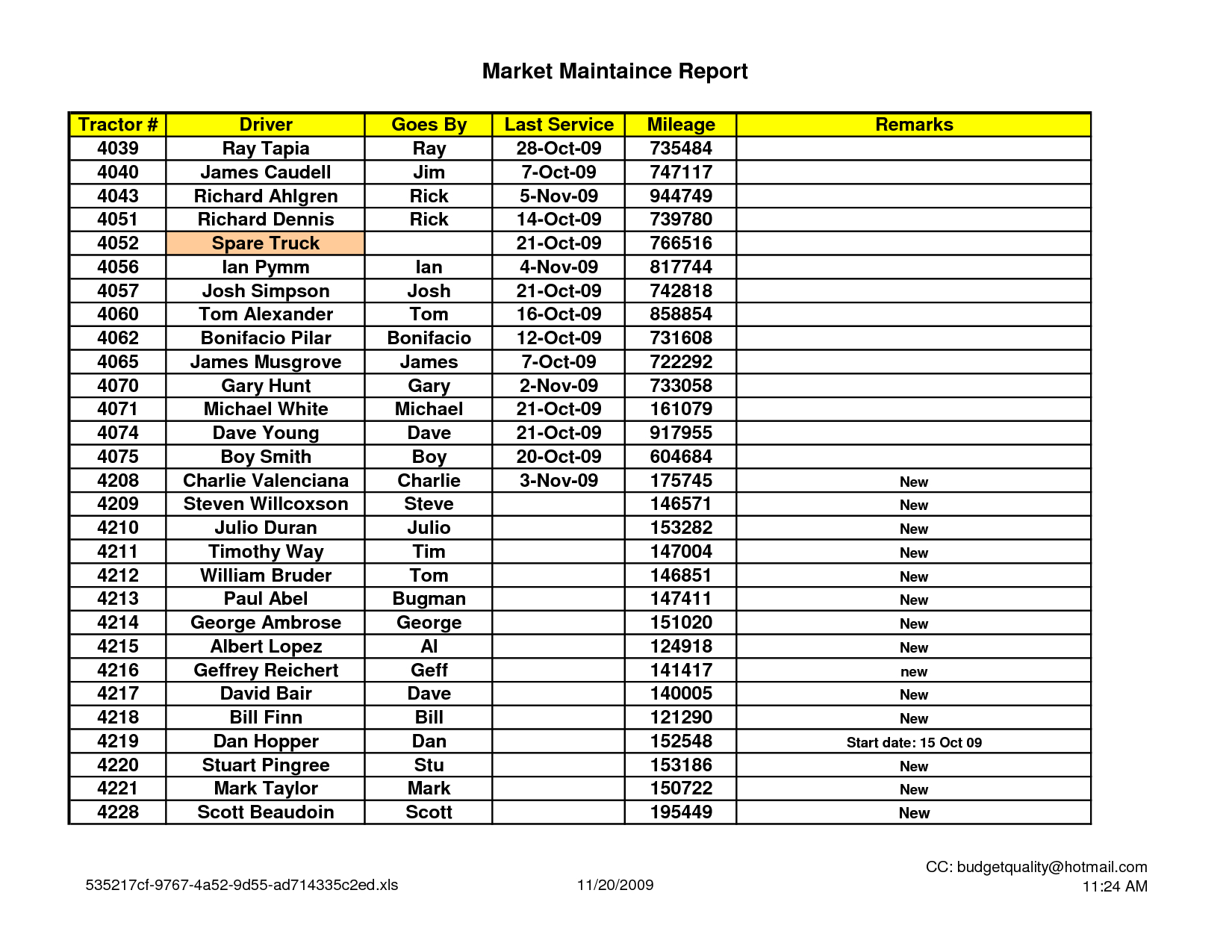

Vehicle Expense Spreadsheet Excel Template (Free) This helps to minimize partial or complete failure, and thus minimize business interruption. It acts as a preemptive insurance policy against catastrophic failures. Excel Vehicle Expense Spreadsheet Template Download (Simply enter your name and email address) Video on how to create the Vehicle Expense Tracker (Part 1)

Car and truck expenses worksheet

PDF 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET Title: 2020 TAX YEAR CAR and TRUCK EXPENSE WORKSHEET.xlsx Author: jodi Created Date: 1/29/2021 8:33:36 AM What does this mean? Car and Truck Expenses Worksheet Jun 1, 2019 — Car and Truck Expenses Worksheet: Use for hire? ... It means, "Are your cars rented out to other people or are you a taxi type service?". Deducting Business Vehicle Expenses - H&R Block $19,500 for trucks or vans; This applies to leases beginning in 2021. For tables with lease-inclusion amounts, see Publication 463: Travel, Entertainment and Gift Expenses at . You can't use the standard mileage rate if you: Used the actual expenses method in the first year you placed the car in service

Car and truck expenses worksheet. PDF Trucker'S Income & Expense Worksheet &$/,)251,$ 7$; %287 ... T CAR and TRUCK EXPENSES (personal vehicle) T VEIDCLEl Year and Make of Vehicle Date Purchased (month, date and year) Ending Odometer Reading (December 31) Beginning Odometer Reading (January 1) - Total Miles Driven (End Odo -Begin Odo) Total Business Miles (do you have another vehicle?) Income Statement Definition: Uses & Examples Mar 16, 2021 · The next section called “Operating Expenses” again takes into account the cost of revenue ($38.353 billion) and total revenue ($110.360 billion) to arrive at the reported figures. PDF Vehicle Expense Worksheet - ACT CPA Car and Truck Expense Worksheet GENERAL INFO Vehicle 1 Vehicle 2 * Must have to claim standard mileage rate Dates used if not for the time period Description of Vehicle * Date placed in service* Total Business miles* Total Commuting Miles* Other Miles* Total Miles for the period* Deducting Auto Expenses - Tax Guide • 1040.com - File Your ... For 2020, the rate is 57.5 cents per mile. With the mileage rate, you won't be able to claim any actual car expenses for the year. You cannot also claim lease payments, fuel, insurance and vehicle registration fees. Also, if you use your vehicle for both business and personal use, you can deduct only the business miles.

Car and Truck Expense Deduction Reminders - IRS tax forms Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, “Travel, Entertainment, Gift, and Car Expenses.” However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ... PDF Car and Truck Expense Deduction Reminders Expenses related to travel away from home overnight are travel expenses. These expenses are discussed in Chapter One of Publication 463, "Travel, Entertainment, Gift, and Car Expenses." However, if a taxpayer uses a car while traveling away from home overnight on business, the rules for claiming car or truck expenses are the same as stated ... PDF Trucker'S Income & Expense Worksheet!!!!!!!!!!!!!! TRUCKER'S INCOME & EXPENSE WORKSHEET!!!!! YEAR_____ NAME ... TRUCK RENTAL FEES individual at any one time—or in ... Kind of Property Date Acquired Date Sold Gross Sales Price Expenses of Sale Original Cost and ! CAR TRUCK EXPENSES (personal vehicle) ! VEHICLE 1 VEHICLE 2 " BUSINESS MILES (examples) Year and Make of Vehicle ____ Job seeking ... What expenses can I list on my Schedule C? - Support Car and Truck Expenses: There are two methods you can use to deduct your vehicles expenses, Standard Mileage Rate or Actual Car Expenses.You may only use one method per vehicle. To use the Standard Mileage Rate, go to the Car and Truck Expenses section of the Schedule C and enter your information.To use the standard mileage rate, this must be chosen the first year the car is available for use ...

Turbo tax 2021 Car and Truck Expenses Worksheet sh... Mar 19, 2022 — Turbo tax 2021 Car and Truck Expenses Worksheet showing 0.58 cents per mile vs IRS.gov is showing 0.56 cents? Why is turbo tax 2021 Car and ... Federal Form 1040 Schedule A Instructions The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons is 23.5 cents per mile. The business standard mileage rate is 56 cents per mile. The 2014 rate for use of your vehicle to do volunteer work for certain charitable organizations remains at 14 cents per mile. Medical and Dental Expenses Schedule C Worksheet - Pro˜t or Loss From Business Total Other Expenses Purchased Equipment, Furniture, Fixtures, Improvements, Vehicles during 2020 (not included in expenses) Miscellaneous Auto Licenses (other than personal property txs) Personal Property Taxes (on car value) Vehicle rent or lease payments Interest (car loan) Total Actual Auto Expenses Vehicle Information Questions Enter Y or N Completing the Car and Truck Expenses Worksheet in ... For entering vehicle expenses in an individual return, Intuit ProSeries has a Car and Truck Expense Worksheet. You should use this worksheet if you're claiming actual expenses or the standard mileage rate.

PDF Car and Truck Expenses Worksheet (Complete for all vehicles) Car and Truck Expenses Worksheet (Complete for all vehicles) 1 Make and model of vehicle 2 Date placed in service 3 Type of vehicle 4a Ending mileage reading b Beginning mileage reading cTotal miles for the year

PDF NEW CLIENT Car And Truck Expenses ORG18 (Employees use ... Car And Truck Expenses (Employees use ORG17 ' Employee Business Expenses) ORG18 VEHICLE QUESTIONS Vehicle 1 Vehicle 2 Vehicle 3 ... Expense of sale ..... 32 Gain/loss basis, if different (Preparer Use). AMT gain/loss basis, if different (Preparer Use). b a ...

PDF Schedule C Worksheet - Pro˜t or Loss From Business Expenses Advertising Car and truck expenses Commissions & fees Contract Labor Depreciation (to be calculated by IFA Taxes) Employee bene˚t programs Insurance (other than health) Interest Legal and professional fees O˛ce expense Pension & pro˚t sharing plans (for employees) Auto Mileage Calculator Enter total # of miles driven for the year

PDF VEHICLE EXPENSE WORKSHEET - Beacon Tax Services VEHICLE EXPENSE WORKSHEET (If claiming multiple vehicles, use a separate sheet for each) Required for all claims: • Do you have any other vehicle available for personal use? Yes No • Do you have written mileage records to support your deduction? Yes No

SCHEDULE C Profit or Loss From Business 2019 - IRS tax forms Method Worksheet in the instructions to figure the amount to enter on line 30 . . . . . . . . . 30 . ... if you are claiming car or truck expenses on line 9

Solved: Car & Truck Expenses Worksheet: Cost must be enter... "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return electronically.

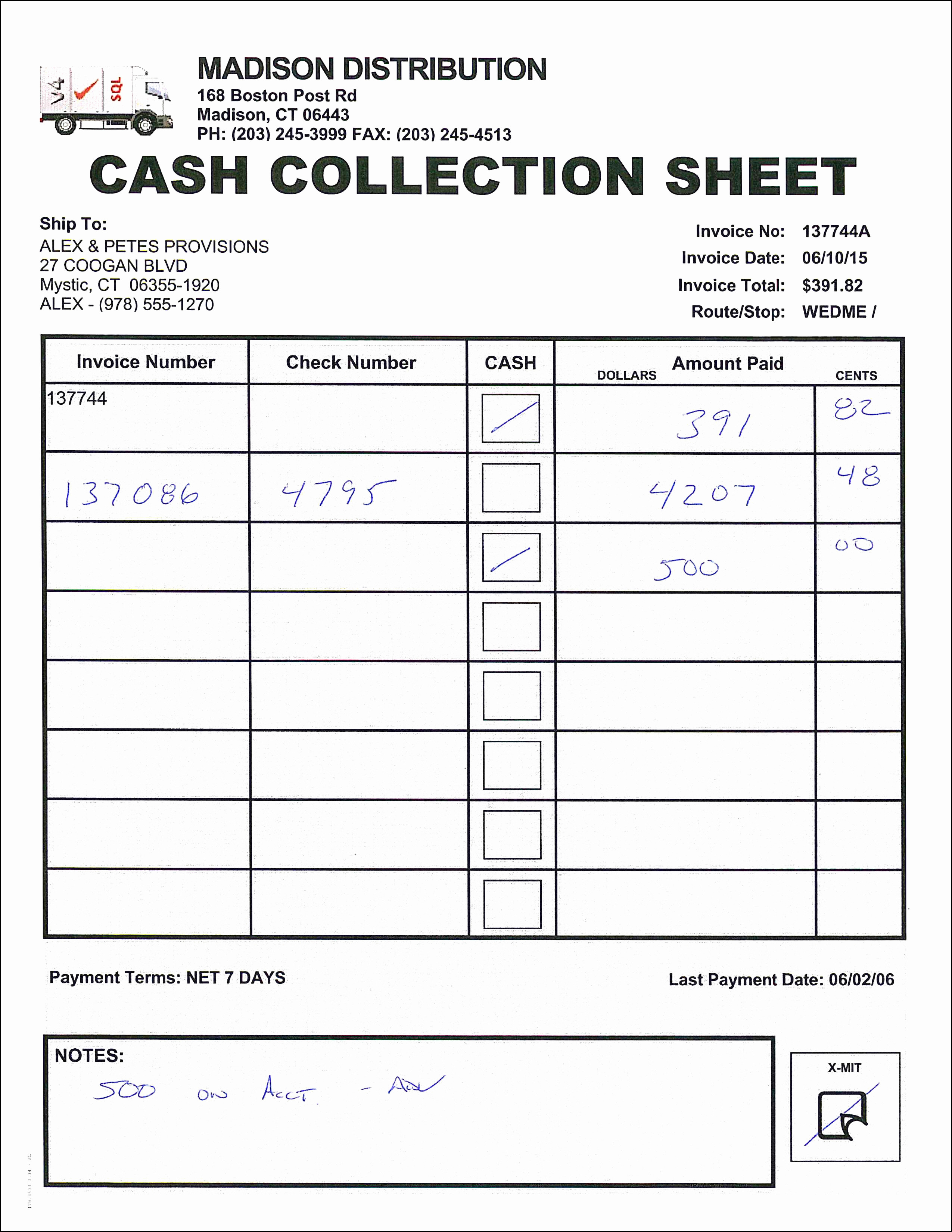

Cash To Close: Breaking It Down | Rocket Mortgage 06/07/2020 · Your cash to close and closing costs are interconnected but are still different. Closing costs refer to the fees you pay to your mortgage company to close on your home loan. On the other hand, the cash to close is the total amount – including closing costs – that you’ll need to bring to your closing to complete your real estate purchase.

FARM BUSINESS PLAN WORKSHEET Projected/Actual Income … B - EXPENSES $ Amount $ Amount 11. Car and Truck 12. Chemicals 13. Conservation 14. Custom Hire 15. Feed Supplement 16. Feed Grain and Roughage 17. Fertilizers and Lime 18. Freight and Trucking 19. Gas/Fuel/Oil 20. Insurance Expenses 21. Labor Hired 22. Rent - Machinery/Equipment/Vehicles 23. Rent - Land/Animals 24. Repairs and Maintenance 25 ...

Federal Form 1040 Schedule A Instructions The standard mileage rate allowed for operating expenses for a car when you use it for medical reasons is 23.5 cents per mile. The business standard mileage rate is 56 cents per mile. The 2014 rate for use of your vehicle to do volunteer work for certain charitable organizations remains at 14 cents per mile. Medical and Dental Expenses. You generally can deduct only the part of your …

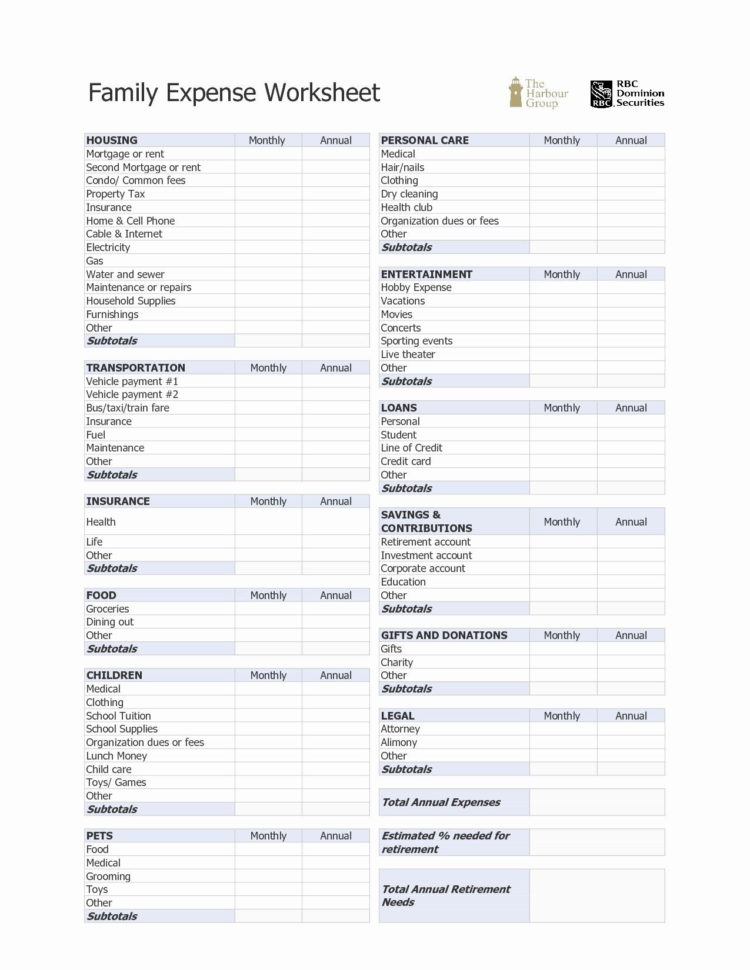

Free Printable Personal Budget Worksheet | Car Buying Comparison | Car buying, Buying first car ...

11459: 1065 - Mileage and Automobile/Truck Expenses 23/07/2021 · You must calculate and enter the total car and truck expenses on the DED screen directly. If you complete Form 4562 outside of Drake and want to enter the information directly on the form for record keeping purposes, actual mileage can be entered on override screen 9 4562 Parts 5b and 5c (on the Assets-Sales-Recapture tab under the Depreciable Assets section).

Car and Truck Expenses Worksheet Line 9 - TurboTax Feb 17, 2020 — Car and Truck Expenses Worksheet Line 9. This should be a simple calculated percentage, but it has the wrong number.

1040 - Auto Expenses (K1, ScheduleC, ScheduleE, ScheduleF) When a vehicle is used for business, the taxpayer may qualify to deduct either mileage or actual expenses (including depreciation, if applicable) for a car or truck on their tax return. To enter this information in Drake Tax, follow these steps. Enter information about the vehicle on the 4562 screen (even if only deducting mileage).

Cash To Close: Breaking It Down | Rocket Mortgage Jul 06, 2020 · You can determine how much you need to pay for each of your closing costs by looking at your Closing Disclosure.You should review it closely to make sure your lender credited you any prepayments.

PDF Car Truck Expense Worksheet 2018 - fs1040.com car & truck expenses worksheet 2018 information submitted by:_____ vehicle 1 vehicle 2 vehicle 3 make & model of vehicle date placed in business use if truck, please list 1/2, 3/4 or 1 ton odometer reading as of 12-31-18 odometer reading as of 01-01-18 total miles for the year ...

2021 Instructions for Schedule C (2021) | Internal Revenue ... Figuring your allowable expenses for business use of the home. Using Form 8829. Using the simplified method. Shared use (for simplified method only). Example. Part-year use or area changes (for simplified method only). Example 1. Example 2. Example 3. Reporting your expenses for business use of the home. If you used the simplified method.

16 Best Images of Expense Tracker Worksheet - Mileage Log Sheet Template, Blank Monthly Budget ...

Rules for Deducting Car and Truck Expenses on Taxes You have two options for deducting car and truck expenses. You can use your actual expenses, which include parking fees and tolls, vehicle registration fees, personal property tax on the vehicle, lease and rental expenses, insurance, fuel and gasoline, repairs including oil changes, tires, and other routine maintenance, and depreciation.

SCHEDULE C Profit or Loss From Business 2014 - IRS tax forms Method Worksheet in the instructions to figure the amount to enter on line 30 . . . . . . . . . 30 . ... if you are claiming car or truck expenses on line 9

0 Response to "39 car and truck expenses worksheet"

Post a Comment