45 foreign earned income tax worksheet

nationaltaxreports.com › earnedEarned Income Credit, EIC Table - National Tax Reports Nov 14, 2021 · Have less than $$10,000 of investment income for the tax year. Not file a Foreign Earned Income Form 2555 or Foreign Earned Income Exclusion. Have earned income and adjusted gross income within the IRS limits. See the Earned Income Tax Credit table below to see if you qualify for the income phase-out limits. Completing Form 1040 and the Foreign Earned Income Tax ... If you earned more than $100,000, use the tables found on page 77 of the IRS's Instructions for Form 1040. It is important to note that when you are claiming the Foreign Earned Income Exclusion, there is a special worksheet to complete to calculate your tax due for the year. This can be found on page 35 of the IRS's Instructions for Form 1040.

› forms › 21_formsMARYLAND RESIDENT INCOME 2021 FORM TAX RETURN 502 Local tax (See Instruction 19 for tax rates and worksheet.) Multiply line 20 by your local tax rate.0 or use the Local Tax Worksheet..... 28. 29. Local earned income credit (from Local Earned Income Credit Worksheet in Instruction 19.) .. 29. 30.

Foreign earned income tax worksheet

turbotax.intuit.com › tax-tips › militaryClaiming the Foreign Tax Credit with Form 1116 - TurboTax Nov 08, 2021 · Use Form 2555 to claim the Foreign Earned-Income Exclusion (FEIE), which allows those who qualify to exclude some or all of their foreign-earned income from their U.S. taxes. In most cases, choosing the FTC will reduce your U.S. tax liability the most. Foreign tax credit eligibility. Taxes paid to other countries qualify for the FTC when: Foreign tax credits and earned income FAQs (1040) UltraTax CS printed a Form 2555 Foreign Earned Income Allocation Worksheet and a Form 2555 Deductions Allocable to Excluded Income Worksheet. What is the purpose of these worksheets? I see force fields in Screen 2555-2 for wages, business income, and partnership income. How can I get the tax application to calculate these amounts? › support › 840FEC Worksheet - Entering Foreign Earned Income in the Program FEC Worksheet - Entering Foreign Earned Income in the Program There are certain requirements that must be present on a Form W-2 Wage and Tax Statement (or Form 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. ), including the Employer Identification Number (for a Form W-2) or ...

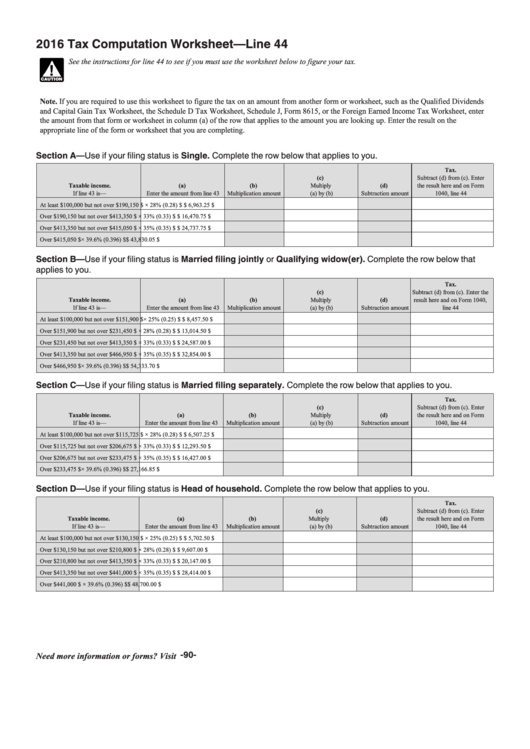

Foreign earned income tax worksheet. PDF Foreign Earned Income Tax Worksheet (PDF) - IRS tax forms Use the Tax Table, Tax Computation Worksheet, Qualified Dividends and Capital Gain Tax Worksheet,* Schedule D Tax Worksheet,* or Form 8615, whichever applies. See the instructions for line 11a to see which tax computation method applies. (Don't use a second Foreign Earned Income Tax Worksheet to figure the tax on this line.) Solved: Foreign Earned Income - Intuit Accountants Community That is because he would have the foreign earned income exemption and that is more than $24,553. But that is only if he is a bona fide resident of Germany. Or if he passes the physical presence test in Germany. As far as all zeroes. Just put $10 of interest. Then you can e-file and there is no tax due on $10 interest. 1 Cheer. ttlc.intuit.com › community › tax-credits-deductionsForm 1116 Foreign Tax Credit Form - Worksheet Bug - Intuit Feb 21, 2021 · I earned foreign interest income in 2020, which I reported on Schedule B and on Form 1116. In 2020 I did not pay any foreign taxes on my interest income though, but when I'm trying to file Form 1116 Turbo Tax asks me to check a box in Part II Foreign Taxes Paid or Accrued in computation worksheet, even if didn't pay any foreign taxes. Foreign Earned Income Tax Worksheet | Expat Forum For ... Foreign Earned Income Tax Worksheet. Jump to Latest Follow 1 - 8 of 8 Posts. U. USExpat777 · Registered. Joined Jan 12, 2017 · 22 Posts . Discussion Starter · #1 · Feb 24, 2021. Only show this user ...

Qualified Dividends and Capital Gains Worksheet - t6988 ... filing Form 2555 (relating to foreign earned income), enter the amount from. line 3 of the Foreign Earned Income Tax Worksheet..... 1. 2. Enter the amount from Form 1040 or 1040-SR, ... see the footnote in the Foreign Earned Income Tax Worksheet before completing this line.-33-Need more information or forms? Visit IRS.gov. 148782. 4200. 0. 4200 ... Instructions for Form 8615 (2021) - IRS tax forms If the Foreign Earned Income Tax Worksheet was used to figure the parent's tax, go to step 7 below. Otherwise, skip steps 7, 8, and 9 of these instructions below, and go to step 10. Determine whether there is a line 8 capital gain excess. To do this, subtract from line 1 of the worksheet the amount on line 2c of the parent's Foreign Earned ... PDF 2020 Tax Computation Worksheet—Line 16 and Capital Gain Tax Worksheet, the Schedule D Tax Worksheet, Schedule J, Form 8615, or the Foreign Earned Income Tax Worksheet, enter the amount from that form or worksheet in column (a) of the row that applies to the amount you are looking up. Enter the result on the appropriate line of the form or worksheet that you are completing. Section A— Line 44 is higher than amount computed from IRS tax table Foreign Earned Income Tax Worksheet. If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555 or 2555-EZ, you must figure your tax using the Foreign Earned Income Tax Worksheet. The TurboTax program calculates your tax based on the IRS Foreign Earned Income Tax Worksheet—Line 44

What is required for foreign income? - Fannie Mae Foreign Income. Foreign income is income that is earned by a borrower who is employed by a foreign corporation or a foreign government and is paid in foreign currency. Borrowers may use foreign income to qualify if the following requirements are met. Copies of signed federal income tax returns for the most recent two years that include foreign ... Figuring the Foreign Earned Income Exclusion - IRS tax forms For tax year 2021, the maximum foreign earned income exclusion amount is the lesser of the foreign income earned or $108,700 per qualifying person. Since you are excluding $108,700 of your $150,000 gross receipts, you will need to multiply that same ratio by the expenses that are directly related to your Schedule C gross receipts, as follows: About Form 2555, Foreign Earned Income - IRS tax forms Information about Form 2555, Foreign Earned Income, including recent updates, related forms, and instructions on how to file. If you qualify, you can use Form 2555 to figure your foreign earned income exclusion and your housing exclusion or deduction. sftaxcounsel.com › demystifying-irs-form-1116Demystifying IRS Form 1116- Calculating Foreign Tax Credits Similarly, an overall foreign loss reduces taxable U.S. source income in the year generated and thus the U.S. tax on U.S. source income earned in that year. Section 904(f) recaptures the loss, however, by re-sourcing foreign source income earned in a later year as domestic source.

Income Tax Excel Spreadsheet Spreadsheet Downloa income tax excel sheet ay 2018-19. income tax ...

Foreign Earned Income Tax Worksheet - TaxAct While the Foreign Earned Income (FEI) Tax Worksheet is linked to Federal Form 1040 U.S. Individual Income Tax Return, it is only used if the return reports an amount on Form 2555 Foreign Earned Income, Line 45 for the Foreign Earned Income Exclusion.If that information is not present on Form 2555, the tax amount will be determined directly from the tax tables put out by the IRS or Schedule D ...

1040-US: Form 2555 Foreign Earned Income Allocation ... The worksheets provide support for amounts reported on Form 2555 and Form 1116. All worksheets are designed to be submitted with the return. Form 2555 Foreign Earned Income Allocation Worksheet. The Form 2555 Foreign Earned Income Allocation Worksheet is designed to report the allocation between U.S. and foreign earned income.

Foreign Earned Income Tax Worksheet - Fill and Sign ... While the Foreign Earned Income Tax Worksheet is linked to Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion).

How to fill out Reduction in Foreign Taxes in Form... If one has foreign dividends income reported, and a form 1116 for reporting foreign tax has been generated for that first, before the foreign income tax in this phase, TT will not include the income tax paid in the calculation of the FTC. The 1116 form for the income tax has to be first in the list for TT to recognize it.

› instructions › i2555Instructions for Form 2555 (2021) | Internal Revenue Service See the Instructions for Form 1040 and complete the Foreign Earned Income Tax Worksheet to figure the amount of tax to enter on Form 1040 or 1040-SR, line 16. When figuring your alternative minimum tax on Form 6251, you must use the Foreign Earned Income Tax Worksheet in the Instructions for Form 6251.

Foreign Earned Income Exclusion - IRS tax forms Figuring the tax: If you qualify for and claim the foreign earned income exclusion, the foreign housing exclusion, or both, must figure the tax on your remaining non-excluded income using the tax rates that would have applied had you not claimed the exclusion(s). Use the Foreign Earned Income Tax Worksheet in the Form 1040 Instructions.

Foreign Earned Income Tax Worksheet - taxact.com While the Foreign Earned Income Tax Worksheet is linked to Line 44 of Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion). If Form 2555 does not apply to the return, the tax amount will be determined directly from ...

Foreign Earned Income Exclusion - Never As Good As You Think It Will be - Virginia Beach Tax ...

Foreign Income Worksheet - Capital Group Foreign Income Worksheet 2021 Worksheet instructions For each fund and share class owned, enter the Total Ordinary Dividends reported in Box 1a of Form 1099-DIV next to the fund's name in the worksheet.

Item 20 - Foreign source income and foreign assets or property - PS Help Tax Australia 2021 ...

Foreign Earned Income Tax Worksheet - Free Worksheet U S Individual Income Tax Return Forms Instructions Tax Table, image source: issuu.com. Irs Section 121 Exclusion Skasktsbuindonesia Com, image source: skasktsbuindonesia.com. 1040ez Earned Income Credit Worksheet The Best Worksheets Image, image source: bookmarkurl.info. Worksheet Earned Income Credit Eic Worksheet Grass Fedjp Worksheet, image source: grassfedjp.com

Foreign earned income Exclusion and foreign tax credit However, IRS Form 2555 Foreign Earned Income, Form 1116 Foreign Tax Credit, or Schedule A (Form 1040) Itemized Deductions may provide income tax benefits. Form 2555 This form allows an exclusion of up to $107,600 of your foreign earned income if you are a U.S. citizen or a U.S. resident alien living and working in a foreign country.

Foreign Earned Income - Internal Revenue Service your 2021 tax year for services you performed in a foreign country. If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in a later tax year (such as a bonus), see the instructions.

Foreign Earned Income Tax Worksheet - TaxAct While the Foreign Earned Income Tax Worksheet is linked to Federal Form 1040, it is only used if there is foreign earned income in the return (if the return is reporting an amount on Form 2555, Line 45 for the Foreign Earned Income Exclusion).If Form 2555 does not apply to the return, the tax amount will be determined directly from the tax tables put out by the IRS or Schedule D (Form 1040 ...

Foreign Earned Income Tax Worksheet - Fill and Sign ... Fill out each fillable area. Ensure that the info you add to the Foreign Earned Income Tax Worksheet is updated and accurate. Add the date to the sample using the Date option. Select the Sign tool and create an electronic signature. You will find 3 available alternatives; typing, drawing, or uploading one.

Expat Tax Services, Preparation, & Consultation - CPA for ... But, if you earn wages as an employee or have self-employment income while working in a foreign country as an ex-patriate or expat, you might be able to use the foreign earned income exclusion to exclude up to $107,600 (for the 2021 tax year) as tax-free income (or 2 x $108,700 or $217,400 if married to another foreign income earner).

Question about Foreign Earned Income Tax Worksheet | Expat ... Form 2555 applies only to "earned income" - i.e. salary income or your earnings from a personal business that are equivalent to salary for the work you do in the business. (Pub. 54 explains this in much more detail.) And form 1116 just allows you to reduce any US tax by amounts of income tax paid to a foreign government on the same income.

0 Response to "45 foreign earned income tax worksheet"

Post a Comment