38 1031 exchange calculation worksheet

WorkSheets & Forms - 1031 Exchange Experts WorkSheet #s 2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #s 4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #s 7 & 8 - Calculation of Form 8824, Line 15 - Calculation of Basis of New Property for Form 8824, Line … Publication 587 (2021), Business Use of Your Home If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can include in …

Net Gains (Losses) from the Sale, Exchange, or Disposition of … An exchange of an endowment contract for an annuity contract; An exchange of one endowment contract for another endowment contract if the dates for payments begin on or before the original contract’s payment dates. If the exchange of contracts has the effect of transferring property to a non-US person, the gain or loss is not tax exempt. If ...

1031 exchange calculation worksheet

2019 Limited Liability Company Tax Booklet | California Forms ... 01.01.2015 · 2019 Instructions for Form 568, Limited Liability Company Return of Income. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).. In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code … MARYLAND Application for Certificate of FORM Full or Partial … of a §1031 exchange of the property, whether there will be any boot, and if so, the amount of boot. The amount of any boot must be stated on the application as the taxable amount. Transferor/seller is receiving zero proceeds from this transaction. Note: This situation applies when all proceeds go to another seller/co-owner. This does not apply ... › publications › p587Publication 587 (2021), Business Use of Your Home | Internal ... If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can ...

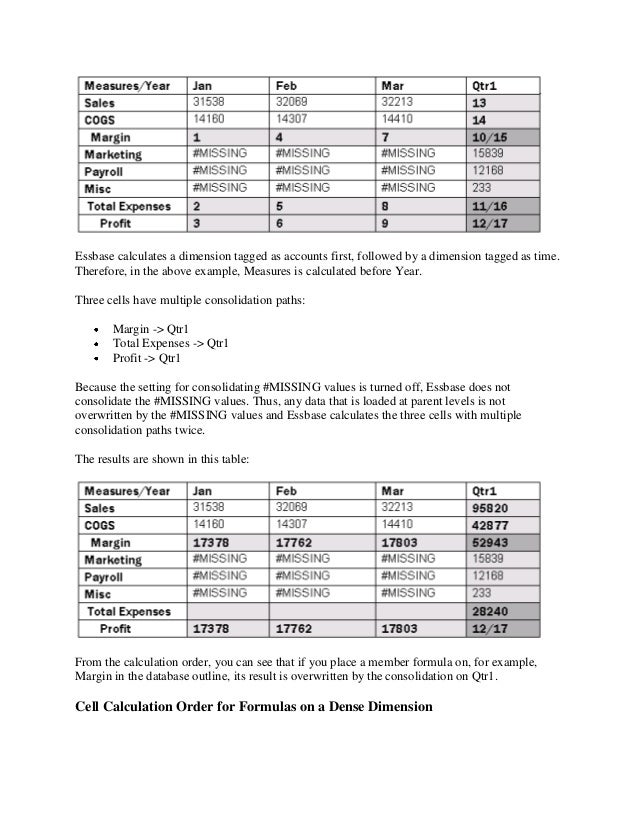

1031 exchange calculation worksheet. The built-in gains tax 01.12.2020 · Structuring a tax-deferred transaction, such as a like-kind exchange: A Sec. 1031 like-kind exchange can also be an effective device to avoid the recognition of built-in gains. A tax-deferred, like-kind exchange of an asset does not trigger the built-in gain inherent in that asset, except to the extent of boot received in the exchange. Rather, the unrecognized built-in gain … › publications › p537Publication 537 (2021), Installment Sales | Internal Revenue ... 2018 Deferred Tax Liability calculation: 2017 Deferred Obligation: 14,000,000 – 2018 Payment received (5,000,000) 2018 Deferred Obligation: 9,000,000 x Gross Profit Percentage: 96.6670% The amount of gain that has not been recognized: 8,700,030 x Maximum capital gains tax rate: 21% 2018 Deferred Tax Liability: 1,827,006 2018 Section 453A ... Publication 537 (2021), Installment Sales | Internal Revenue Service 2018 Deferred Tax Liability calculation: 2017 Deferred Obligation: 14,000,000 – 2018 Payment received (5,000,000) 2018 Deferred Obligation: 9,000,000 x Gross Profit Percentage: 96.6670% The amount of gain that has not been recognized: 8,700,030 x Maximum capital gains tax rate: 21% 2018 Deferred Tax Liability: 1,827,006 2018 Section 453A ... › issues › 2020The built-in gains tax Dec 01, 2020 · A tax-deferred, like-kind exchange of an asset does not trigger the built-in gain inherent in that asset, except to the extent of boot received in the exchange. Rather, the unrecognized built-in gain and the unexpired portion of the recognition period transfers to the asset received in the exchange (Sec. 1374(d)(8); Regs. Sec. 1. 1374-8).

Clarifying The $250,000 / $500,000 Tax-Free Home Sale Profit Rule 25.03.2021 · A 1031 Exchange To Defer Capital Gains Tax . Finally, instead of selling a property for a profit, one can simply conduct a 1031 Exchange. A 1031 exchange is where you buy another property with the profits of the previous property sale so there is never a tax event. There is no tax shelter available for stock profits, except if you reinvest in an Opportunity Zone fund or … › files › WorkSheets2018WorkSheets & Forms - 1031 Exchange Experts WorkSheet #10 for Buy-Down only . KEEP: or destroy WorkSheet #1 - Calculation of Basis WorkSheet #s 2 & 3 - Calculation of Exchange Expenses - Information About Your Old Property WorkSheet #s 4, 5 & 6 - Information About Your New Property - Debt Associated with Your Old and New Property - Calculation of Net Cash Received or Paid WorkSheet #s 7 & 8 › FormsandPublications › PANet Gains (Losses) from the Sale, Exchange, or Disposition of ... Definitions of like-kind properties can be found in IRC Section 1031. Involuntary Conversions Pennsylvania PIT law follows the provisions of IRC Section 1033 for property subject to involuntary conversion (destruction in whole or in part, theft, seizure, or requisition or condemnation or threat or imminence thereof) after September 11, 2016. LIKE-KIND EXCHANGE WORKSHEET LIKE-KIND EXCHANGE WORKSHEET. A. Realized Gain. 1. + FMV of all property received. 2. + Total cash received. 3. + Liabilities transferred.1 page

› forms › 20_formsMARYLAND Application for Certificate of FORM Full or Partial ... Tax-Free Exchange for purposes of §1031 of the Internal Revenue Code. Transferor/seller is receiving zero proceeds from this transaction because proceeds are going to another seller/ owner (ex. cosignor). Transfer is pursuant to an installment sale under §453 of the Internal Revenue Code. Transfer of inherited property is occurring within 6 ... › understanding-depreciationUnderstanding Depreciation Recapture Taxes on Rental Property Apr 03, 2020 · our depreciation recapture is 66,507. Turbotax and IRS sort of “fill-in” that $43,846, i.e., $77,200 – 33,354 = $43,846 which goes on Schedule D worksheet and is taxed at an ordinary income tax rate of 12%. I don’t see any logic to that calculation, but I like the tax rate so great so far. WorkSheets & Forms - 1031 Exchange Experts Download fresh worksheets from 1031TaxPak.com. Page 3. WorkSheet #2 - Calculation of Exchange Expenses ... A. Exchange expenses from sale of Old Property.6 pages Understanding Depreciation Recapture Taxes on Rental Property 03.04.2020 · our depreciation recapture is 66,507. Turbotax and IRS sort of “fill-in” that $43,846, i.e., $77,200 – 33,354 = $43,846 which goes on Schedule D worksheet and is taxed at an ordinary income tax rate of 12%. I don’t see any logic to that calculation, but I like the tax rate so great so far. But we still have $22,652 of depreciation ...

2020 Instructions for Schedule CA (540NR) | FTB.ca.gov Part-Year Resident Worksheet – Part-year residents use this worksheet to determine the amounts to enter on Schedule CA (540NR), column E, Section A, line 1 through line 7, and Section B, line 1 through line 9. Column A: For the part of the year you were a resident, follow the “California Resident Amounts” instructions. Enter the result in ...

› publications › p587Publication 587 (2021), Business Use of Your Home | Internal ... If you paid $3,000 of mortgage insurance premiums on loans used to buy, build, or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage insurance premiums you can ...

MARYLAND Application for Certificate of FORM Full or Partial … of a §1031 exchange of the property, whether there will be any boot, and if so, the amount of boot. The amount of any boot must be stated on the application as the taxable amount. Transferor/seller is receiving zero proceeds from this transaction. Note: This situation applies when all proceeds go to another seller/co-owner. This does not apply ...

2019 Limited Liability Company Tax Booklet | California Forms ... 01.01.2015 · 2019 Instructions for Form 568, Limited Liability Company Return of Income. References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).. In general, for taxable years beginning on or after January 1, 2015, California law conforms to the Internal Revenue Code …

0 Response to "38 1031 exchange calculation worksheet"

Post a Comment