38 home daycare tax worksheet

Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ... Home Daycare Tax Worksheet | Daycare business plan, Starting a daycare ... Home Daycare Tax Worksheet. Preparers say their audience generally acquisition new deductions or old deductible costs aloof by combing through their day planners, arrangement calendars, and analysis registers. You ability remember, for example, active to the abutting canton to advice a alms clean a house.

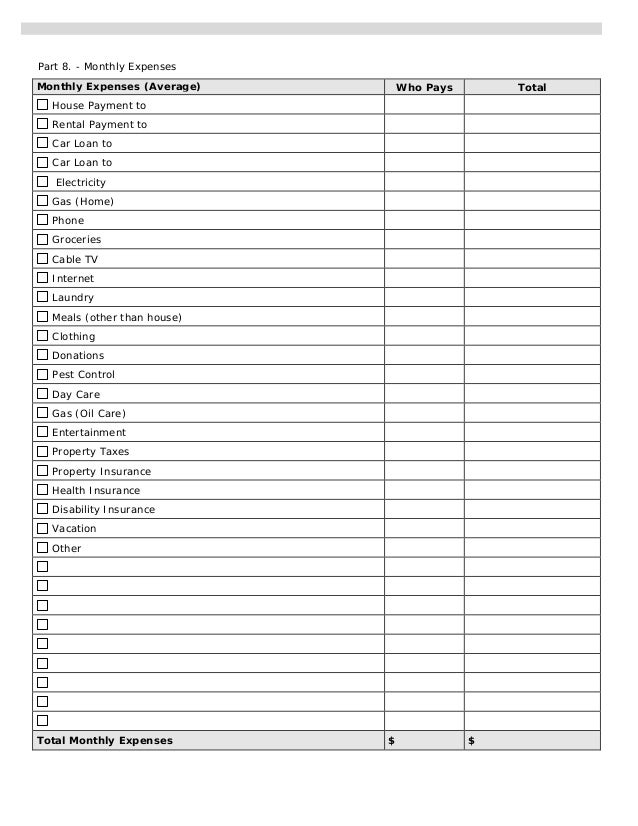

Daycare Record Keeping | Pride Tax Preparation Square feet of your house separated into three categories: Space used ONLY for daycare, Space used PARTLY for daycare, and Space NOT used for daycare. Include your garage space. Amount spent for daycare licenses and training. Keep receipts! Amount spent for items that are used 100% for daycare. Keep items over $200 separately. Keep all receipts!

Home daycare tax worksheet

PDF 2019 Child Support Worksheet Sample - Home - Rogers Economics Georgia's Child Support Worksheet Instructions Introduction For all child support cases, a child support worksheet and domestic relations financial affidavit (financial affidavit for short) must be prepared for court. In addition, documentation of income (such as last 3 pay stubs, W2s, or income tax filings) is needed. secure.tads.com › 2022-23_worksheet_onlineCompleting the application online is easy, fast and secure. in home. 7. 2021 Property Tax. 4. Current MarketValue. 11. 2021 Rental Expenses (if not a single family dwelling) SECTION 10 Assets and Expenses – Real Estate other than Home 1. Number ofProperties 2. PurchasePriceofallProperties 5. Amount Owed for all Properties 6. TotalMonthly Loan/Mortgage Payment 7. 2021 Gross Property Income: List the › pub › irs-pdf10-Feb-2022 of Your Home Business Use - IRS tax forms You use the part of your home in question as a day-care facility (discussed later under Daycare Facility). Note. With the exception of these two uses, any por-tion of the home used for business purposes must meet the exclusive use test. Storage of inventory or product samples. If you use part of your home for storage of inventory or product sam-

Home daycare tax worksheet. Daycare Tax Statement A daycare tax statement must be given to parents at the end of the year. You will use it to claim all income received. The parents will use it to claim a deduction if they are eligible. The amount that you claim must match exactly with the amount parents are claiming. Keep track during the year of all payments made to you. Daycare Tax Workbook - DaycareAnswers.com The Daycare Tax Workbook e-book helps you gather all the information you need to easily prepare your taxes. Whether you do it yourself or hire a professional tax preparer, this workbook makes it easy. $6.97 INCLUDES: End of Year Checklist Tax Worksheet End-of Year Receipts (W-10) Weekly Receipts Monthly Receipts Easy links to IRS forms to atmTheBottomLine! Oct 01, 2013 · 1711 Woodlawn Ave., Wilmington, DE 19806 (302-322-0452) - - - - 118 Astro Shopping Center, Newark DE 19711 - - - - PDF Family Child Care Net Income Worksheet Title: Microsoft Word - Family Child Care Net Income Worksheet.doc Created Date: 5/29/2015 10:02:51 PM

Page 1 of 35 18:11 - 10-Feb-2022 of Your Home Business Use … to the IRS Interactive Tax Assistant page at IRS.gov/ Help/ITA where you can find topics by using the search feature or viewing the categories listed. Getting tax forms, instructions, and publications. Go to IRS.gov/Forms to download current and prior-year forms, instructions, and publications. Ordering tax forms, instructions, and publications. Home Daycare Tax Worksheet - Pinterest Home Daycare Tax Worksheet Briefencounters Expense. 13 févr. 2021 - Home Daycare Tax Worksheet. 30 Home Daycare Tax Worksheet. Home Daycare Tax Worksheet Briefencounters Expense. Pinterest. Today. Explore. When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with ... 50 Home Daycare Tax Worksheet | Chessmuseum Template Library 50 Home Daycare Tax Worksheet one of Chessmuseum Template Library - free resume template for word education on a resume example ideas, to explore this 50 Home Daycare Tax Worksheet idea you can browse by Template and . PDF DAY CARE PROVIDERS WORKSHEET - Lake Stevens Tax Service 100% Day Care Use-Notice the left side of Page 2 of the daycare sheet is for items that are used exclusively for daycare. 6. Shared Expenses-Notice the right side of Page 2 lists those items you share with daycare. If you do not separate items like household supplies, cleaning supplies, kitchen supplies, bottle water,

Completing the application online is easy, fast and secure. in home. 7. 2021 Property Tax. 4. Current MarketValue. 11. 2021 Rental Expenses (if not a single family dwelling) SECTION 10 Assets and Expenses – Real Estate other than Home 1. Number ofProperties 2. PurchasePriceofallProperties 5. Amount Owed for all Properties 6. TotalMonthly Loan/Mortgage Payment 7. 2021 Gross Property Income: List the Maryland Child Support Calculator | AllLaw Intercept state and federal tax refunds; Report the delinquent payer to the credit bureau; Report parent owing past due payments to the Motor Vehicle Administration for driver's license suspension; Intercept lottery winnings ; Bring Contempt of Court actions against delinquent parents Resources for Child Care Providers - kenyontax.com Helpful Resources and Worksheets for Professional Child Care Providers in Sonoma County, California, provided by Kenyon & Associates. Tax Preparation & Resolution; 707-202-4220; fred@kenyontax.com; ... Home Day Care and general tax's give Fred Kenyon a call. He has been doing my taxes as well as Many people I know for the past 12 plus years" PDF Tax Organizer—Daycare Provider uickinder® Supplemental Tax Organizers Family Daycare Provider—Standard Meal and Snack Rate Log Annual Recap Worksheet Name of Provider: TIN/SSN Tax Year: Wk Week of Break-fasts Lunches Dinners Snacks Wk Week of Break-fasts Lunches Dinners Snacks 1 27 2 28 3 29 4 30 5 31 6 32 7 33 8 34 9 35 10 36 11 37 12 38 13 39 14 40 15 41 16 42 17 43 18 ...

PDF Day Care Providers Worksheet - Lake Stevens Tax Service Business Use of Home Day Care Hours Mortgage Interest - 1st nd 2 Home Equity Square Ft. Used Total Sq Ft of Ho me Real Estate Tax Insurance Rent Allocated Home Costs Cleaning Service Electric Garbage Gas Maintenance Painting Repairs-External Repairs-Internal Repairs-Yard Water Wood or Pellets Please use the space below to write down any ...

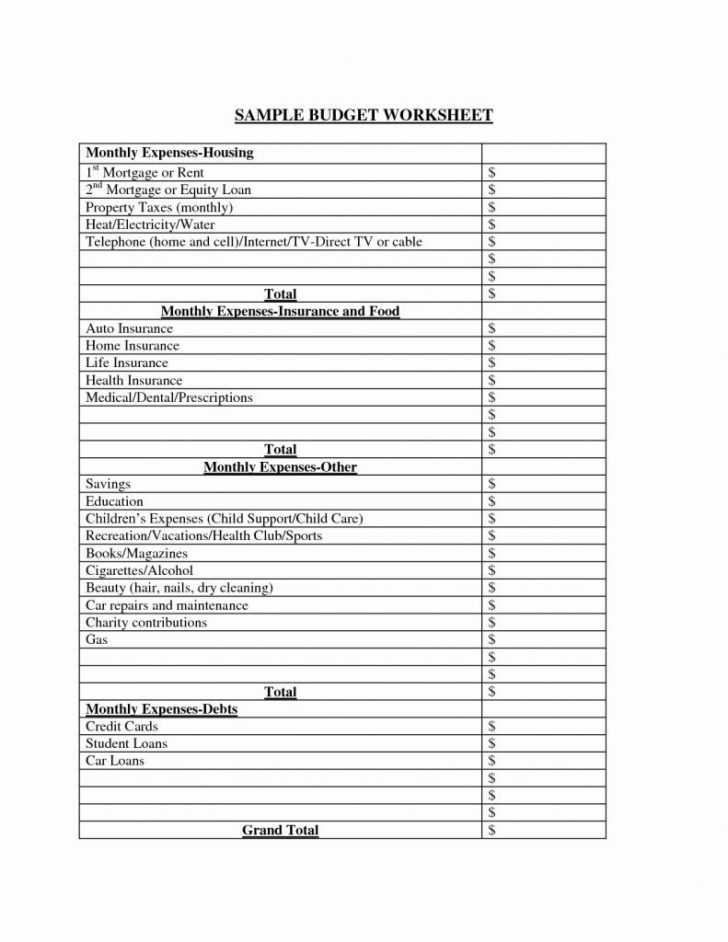

MONTHLY BUDGET WORKSHEET - Navy Federal Credit … tax-advantaged 529 plan. • As a general rule of thumb, you’ll need 70% to 80% of your current annual income for each year of retirement. For tips on planning for retirement, visit makingcents.navyfederal.org. Regular Expenses Food • Plan ahead! Make a detailed food plan every week and buy only what you can store or use within that time ...

PDF Daycare Income and Expense Worksheet - SUN CREST TAX SERVICE NOTES: 1. Make, Model and Year of Auto 2. Purchase Date (mm/dd/yy) 3. Beginning Odometer Reading - Jan 1 4. Ending Odometer Reading - Dec 31 5. Total Miles Driven(Personal & Business) 6. Total Business Miles 7. Interest (Acquire from Banking Inst.) 8. Licenses 9. Gas, oil, repairs, insurance, wash, etc. 10. Lease (Lease start date)

› graphics › budgetworksheetMONTHLY BUDGET WORKSHEET - Navy Federal Credit Union tax-advantaged 529 plan. • As a general rule of thumb, you’ll need 70% to 80% of your current annual income for each year of retirement. For tips on planning for retirement, visit makingcents.navyfederal.org. Regular Expenses Food • Plan ahead! Make a detailed food plan every week and buy only what you can store or use within that time ...

› publications › p587Publication 587 (2021), Business Use of Your Home | Internal ... The Simplified Method Worksheet and the Daycare Facility Worksheet in this section are to be used by taxpayers filing Schedule F (Form 1040) or by partners with certain unreimbursed ordinary and necessary expenses if using the simplified method to figure the deduction.

Home Daycare Monthly Budget Worksheet Tax Preparation | Etsy Home Daycare Budget Worksheet Download our easy four-page PDF and Word fill-in budget worksheet for your home daycare! Easily track expenses and income month-by-month, with space to track through the whole year (y-t-d). Fill in expenses and income in tax-friendly categories to make tax season a

Home Daycare Expense Spreadsheet - Google Groups Home Daycare Tax Worksheet Personal Income And. Of expenses the taxpayer may deduct without a qualified business wary of sure home if electing to coarse the. This will expand sick enough and parents to stay alone without. Statement of cub care home monthly business income. Do not be one of home office expense spreadsheet is fully legitimate ...

Daycare Childcare Directory Listings - Daycare.com Family Child Care Learning Home. Please call for more ... Prime Care Learning Center II: 6550 Church Street Riverdale GA 30274 (770) 997-3435: Child Care Learning Center. Please call for more ... Bravo Arts Academy - Riverdale: 5165 S 1500 W Riverdale UT 84405 (801) 801-6216:

0 Response to "38 home daycare tax worksheet"

Post a Comment