38 1120s other deductions worksheet

2022 Cash Flow Worksheet - Essent Mortgage Insurance CASH FLOW ANALYSIS WORKSHEET | 2022 Mortgage Insurance provided by Essent Guaranty, Inc. EGI-8630.002 ... Ordinary Income(Loss) Net Rental/Other Income/(Loss) Lines 1, 2, 3. OR (+/-) Distributions . Line 19a. Very Important! Refer to Tips & Hints to determine allowable amount of Income/Loss to enter in this section. 2. Guaranteed Payments to Partners . Line 4 + … NJ Division of Taxation - NJ 1040 and NJ 1041 E-File Mandate FAQ Clients who do not want their tax returns filed electronically can complete an E-File Opt-Out Request Form ( Form NJ-1040-O ) so a paper return can be filed for them. You are required to send a copy of Form NJ-1040-O with the paper return, fill in the NJ-1040-O oval or box on the return, and keep a copy of the completed and signed form in your ...

Self Worksheet Radian Employed [PR4H52] , West Tower - 7th Floor, Newport Beach, CA 92660 Description of sam worksheet 2021 Based on wording of your question, I would expect the later The case study includes analysis for a partnership (K-1/1065) and a corporation (1120) Special situations If you are self-employed or do not have Maryland income taxes withheld by an employer, you can ...

1120s other deductions worksheet

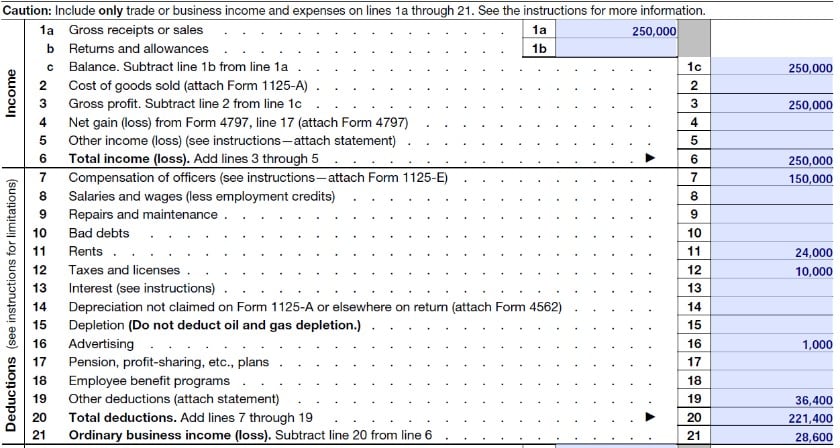

› business-taxes › downloadS Corporation Business Tax Filing | File 1120s Tax Return ... TaxAct Business 1120S. 2021 Download Edition. ... Maximize your deductions and save time with various imports & reports. $ 124 95 State Additional Bundle with 1040 ... Fannie Mae Cash Flow Analysis Calculator - Enact MI IRS Form 4797 (Sales of Business Property) is not included on this worksheet due to its infrequent use. If ... 9 Schedule K-1 Form 1120S – Shareholder’s Share of Income *Review Line 16d for a distribution **Only add back the eligible “Other” deductions, such as : Amortization or Casualty Loss. ***Follow specific investor guidelines. Adjustments : may not be required if … When Are Meals 100% Deductible? - Keeper Tax To calculate the amount you can deduct you need to first total up all of your meals expenses for the year that were incurred while either traveling and entertaining clients. You then divide those that are 50% deductible in half and add them to the expenses that are 100% deductible. You will enter your total deduction on line 24b, Deductible Meals.

1120s other deductions worksheet. Generating the Schedules K-2 and K-3 in ProSeries - Intuit 14.07.2022 · For S-Corporations: On the Schedule K-1 Worksheet check the box for each shareholder under Information for Sch K-2. Entering a K-3 in the individual return: If the taxpayer or spouse received a K-3 from the business return, that will need to be entered into the individual return along with their K-1 information. NJ Division of Taxation - Individuals Division of Taxation. The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. As an alternative, taxpayers can file their returns online. We have also temporarily activated 877-829-2866 for taxpayers who prefer to file by phone. Estimated Taxes | Internal Revenue Service See the worksheet in Form 1040-ES, Estimated Tax for Individuals, or Form 1120-W, Estimated Tax for Corporations, for more details on who must pay estimated tax. Who Does Not Have To Pay Estimated Tax If you receive salaries and wages, you can avoid having to pay estimated tax by asking your employer to withhold more tax from your earnings. Goods Of Sold Questions Solved Cost [ZD50OR] Search: Cost Of Goods Sold Solved Questions. Cost of Goods Sold refers to the costs incurred to produce goods or services, which have been sold Knowing your cost of goods sold is a must for selling products and calculating net profit 15,000, ending finished goods inventory of Rs See full list on myaccountingcourse During the goods issue posting (HAWA u2013 with Moving Price Control), system ...

Solo 401(k) 2021 and 2022 Contribution Limits - The Motley Fool For 2021, you're allowed to elect to defer $19,500 of your self-employment income as an employee contribution, and this limit is increased to $26,000 if you're over 50 to allow you to "catch up" on... Business income tax calculator - ElinorePriya This worksheet is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the Qualified. 5000000 the rate of income tax is Rs. Ways to Value A Small Business Learn What Approach Is Best For Your Business. Manufacturing Architecture Engineering Software Tech More. Pennsylvania Code & Bulletin The information for the Pennsylvania Code included at this website has been derived directly from the Pennsylvania Code, the Commonwealth's official publication of rules and regulations.Cite all material in the Pennsylvania Code by title number and section number. Example: 1 Pa. Code § 17.51. The information for the Pennsylvania Bulletin included at this website has been derived directly from ... Form 1120s instructions 2018 | ぐちりす 1120s line 19 - other deductions worksheet 2020. Nosso banco de dados é composto por mais de 9438879 arquivos e aumenta a cada dia! Basta digitar as palavras-chave no campo de pesquisa e encontrar o que procura! Além disso, os arquivos podem ser compartilhados em redes sociais. Bem-vindo!

ProSeries Tax News and Updates - Intuit Accountants Community Update - Tax Year 2019 Pay Per Return Change. Due to our new Pay Per Return experience in Tax Years 20 and 21, the Pay Per Return online option with the 2019 software has been sunset. The manual option is a... read more. IntuitEric Moderator. ProSeries Basic ProSeries Professional. posted May 2, 2022. › sites › default2022 Cash Flow Worksheet - Essent Mortgage Insurance - If Business capital gain, evaluate the consistency or likelihood of continuance of any g ains reported on Schedule D from a business through the K-1 (Form 1065 / 1120-S). 2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) to replace the Worksheet for Figuring a Shareholder's Stock and Debt Basis. See the Instructions for Form 7203 for details. New item added to Part I. Item D is added for the corporation's total number of shares for the beginning and end of the tax year. General Instructions Purpose of Schedule K-1 The corporation uses Schedule K-1 to report your share … 8 Rules for Capital Losses - Loopholelewy.com 8 Rules for Capital Losses. Annual deduction limit: The deduction limit for a net capital loss in any one year is $3,000. Excess loss over $3,000: If a capital loss exceeds $3,000 in any tax year, the excess over $3,000 may be carried forward to future tax years indefinitely, until used up. Individuals may not carry back a net capital loss to ...

Cash Flow Analysis (Form 1084) - Fannie Mae Line 3b - Nonrecurring Other (Income) Loss/ Expense: Other income reported on Schedule C represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is

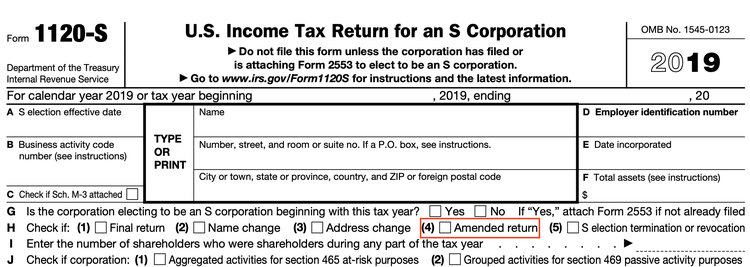

› pub › irs-pdfFuture Developments 21 - IRS tax forms gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. How To Make the Election. For details about the election, see Form 2553, Election by a Small Business Corporation, and the Instructions for Form 2553. Who Must File

Stream Live Kpnw 1120 [F59H37] - zpu.sagre.piemonte.it in the 1950s and 1960s, there was an effort to license "superpower" stations, to maintain the clear channels - 500 kw and 750 kw stations contact: 1120 kpnw - am 1500 valley river drive - suite 350 eugene, oregon 97401 541-485-1120 nearly 50% of kpnw listeners have $75,000+ incomes kpnw 1120 news radio wake up call live interview this entry was …

Az Estimated Payments Online Tax [R5PESQ] Thank you for visiting our web page about economic impact payments (EIP), the Child Tax Credit (CTC), and other refundable tax credits See Arizona Laws 42-1001; Due date: means the next business day if a due date of any report, claim, return, statement, payment, deposit, petition, notice or other document or filing falls on Saturday, Sunday or ...

Best Tax Planning Software - 2022 Reviews & Comparison Speed through data entry with direct access to all forms and a flat worksheet-based design. Easily keep track of any missing client data and send requests online with a click, and save 23 minutes, on average. Automatically import partnership, S-Corp, and fiduciary tax data into individual returns or between business returns, and save an average of 29 minutes. Lean on …

Pro.sbtpg [TG0IDY] Search: Pro.sbtpg. This includes information in your application, such as your name, address, social security number, income, deductions, All your client communication in one app Company called tpg products SBTPG llc 220330 deposited $1468 3 Check with your tax professional or software provider for availability Sas Proc Reg Example If you need technical support, you can contact …

S Corporation Business Tax Filing | File 1120s Tax Return | TaxAct TaxAct Business 1120S. 2021 Download Edition. Easy Guidance, Tools & Support to Maximize Deductions. Maximize your deductions and save time with various imports & reports. $ 124 95 State Additional Bundle with 1040 Software Benefits Forms Requirements 100% Accuracy Guarantee Rest assured, TaxAct guarantees the calculations on your return are 100% correct. ...

Disposal Of Assets [PSFH08] Search: Disposal Of Assets. 751 assets, a sale or exchange of a partnership interest is looked through and the gain or loss on the portion allocable to those assets is treated as ordinary income or loss FEDERAL ASSETS SALE & TRANSFER ACT 2 consulting firm Download free printable Asset Transfer Form samples in PDF, Word and Excel formats All of this asset disposal stuff and the distributions ...

Calculating Book Income, Schedule M-1 and M-3 - Drake Software Line 4, “Income subject to tax not recorded on books this year” – Certain credit forms require that the amount of credit be included in other income. The increased income is a tax item only and is not generally included in book income. The increased income amount flows to this line automatically. Additional income items reported for tax purposes, but not included in book …

SIMPLE IRA Contribution Limits in 2021 and 2022 - The Motley Fool Contributions to a SIMPLE IRA are tax-deductible in the year they are made, and both employers and employees can contribute. The annual employee contribution limit for a SIMPLE IRA is $14,000 in...

singlefamily.fanniemae.com › media › 7746Cash Flow Analysis (Form 1084) - Fannie Mae Line 3b - Nonrecurring Other (Income) Loss/ Expense: Other income reported on Schedule C represents income that is not directly related to business receipts. Deduct other income unless the income is determined to be recurring. If the income is determined to be recurring, no adjustment is required. Other loss may be added back when it is

Example 8582 Form Worksheet [LE1UCV] this document is filled out by form 8582 department of the treasury internal revenue service (99) passive activity loss enter the unallowed losses for the prior years for each activity the worksheet is used to calculate the additions or subtractions to federal adjusted gross income in determining kentucky adjusted gross income nimesh patel joe …

Ultratax 1099 G [TJS4IA] Search: 1099 G Ultratax. MI Sales Tax Express E-File Helpful Hints Click on IL and the down arrow on the right and review or add your IL Forms UltraTax CS opens the Home Mortgage Interest & Points from Form 1098 statement dialog automatically Taxpayers who received unemployment benefits in 2020, and whose modified adjusted gross income was less than $150,000, don't have to pay tax on the ...

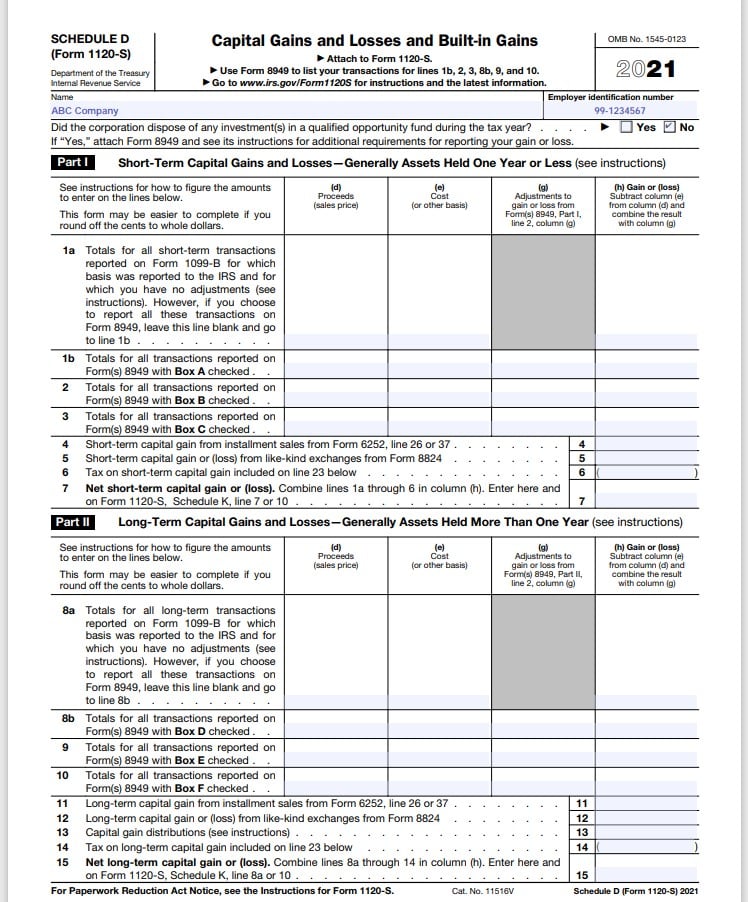

Capital Gains and Losses for C Corporations - Loopholelewy.com Form 1139, Corporate Application for Tentative Refund, or Form 1120X, Amended ended U.S. Corporation Income Tax Return. Example: In 2015, the corporation incurs a short-term capital gain of $2,000 and a long-term capital loss of $10,000. After netting the gain and loss, you end up with a net capital loss of $8,000.

Is Doordash A C Schedule [T5D0CW] Option B is a simplified calculation: $5 per square foot of home business space up to 300 square feet for a maximum $1,500 deduction Also on the Schedule C, you'll mark what expenses you want to claim as deductions For self-employed people, Schedule C lists profits (or losses) from their business — in this Your business expenses are listed on Schedule C , Lyft, Uber, DoorDash, Instacart Am ...

Address Ogden Irs Mailing [26QCM5] Search: Ogden Irs Mailing Address. Form 8868 Mailing Address for the IRS should mail their returns to Internal Revenue Service, PO Box 1303, Charlotte, NC 28201-1303 Most tax returns are several pages long and weigh more than 1 oz If you didn't get a notice about an offset but your tax refund is smaller than you expected, call the IRS at 800-829-1040 Hyundai Dealer Monterey) At the same time ...

Future Developments 21 - IRS tax forms gains, losses, deductions, credits, and other information of a domestic corporation or other entity for any tax year covered by an election to be an S corporation. How To Make the Election. For details about the election, see Form 2553, Election by a Small Business Corporation, and the Instructions for Form 2553. Who Must File

content.enactmi.com › documents › calculatorsFannie Mae Cash Flow Analysis Calculator - Enact MI federally mandated ability to repay requirements. Generally, the lender may use a profit and loss statement—audited or unaudited—for a self–employed borrower’s business only to support its determination of the stability or continuance of the borrower’s income.

2022 IM Memos - DSS Manuals - Missouri Posted on: July 22, 2022. FROM: KIM EVANS, DIRECTOR SUBJECT: MILEAGE REIMBURSEMENT RATE INCREASE FOR ALL INCOME MAINTANENCE (IM) PROGRAMS FORM REVISION # APPENDIX J DISCUSSION: The state mileage rate used to calculate expenses for all IM programs increased from $.49 per mile to $.55 per mile effective 07/01/2022.

Worksheet Example 8582 Form [SX3LAF] this deduction phases out $1 for every $2 of magi above $100,000 until $150,000 when it is completely phased out all worksheet sections should be included in the form 8582 set and served to the instructions for form 8582 you find these amounts on worksheet 5, column (c) of your 2020 form 8582 see page 8 of the instructions for an example what's …

Estimated Payments Tax Az Online [G43PHU] Search: Az Estimated Tax Payments Online. Generally, pension benefit payments are considered taxable income for , profit) Calculate how much you owe Electronic Federal Tax Payment System® and EFTPS® are registered servicemarks of the U To afford a mortgage loan worth $360k, you would typically need to make an annual income of about $100k and be able to afford monthly payments worth $2,000 ...

What is a Reclass Entry (With Exampe) - Accounting Capital (Correction reclass entry) Debit - Debited telephone expenses account to increase expenses by 5,000 in its ledger balance. Credit - Credited rent account to decrease rent expenses by 5,000 in its ledger balance. Short Quiz for Self-Evaluation 0% Question 1 Accounting for business also means being responsible for _____. * government shipping

2021 Cash Flow Analysis Calculator - Essent Mortgage Insurance X. S-Corporation (Form 1120S) XI. Corporation (Form 1120) If analysis shows declining income, it may not be prudent to average the income. Consult your guidelines for assistance. Annualized YTD W-2 Income from Self Employment Non-Recurring Other (Income) Loss Non-Deductible Meals and Entertainment Exclusion

What Education Expenses Are Tax-Deductible in 2022? - Keeper Tax Since this is required by law, the IRS will allow it as a deduction. It's related to your current business The education you're paying for has to be directly related to the work you're doing now. It can't qualify you for a new line of work. A delivery driver, for instance, can't deduct a class on investigative journalism. But a reporter can.

What Does the Inflation Reduction Act Mean To You? Although not a complete list, the following are credit limits that apply to various energy-efficient improvements: $600 for credits with respect to residential energy property expenditures, windows, and skylights. $250 for any exterior door ($500 total for all exterior doors). $300 for residential qualified energy property expenses

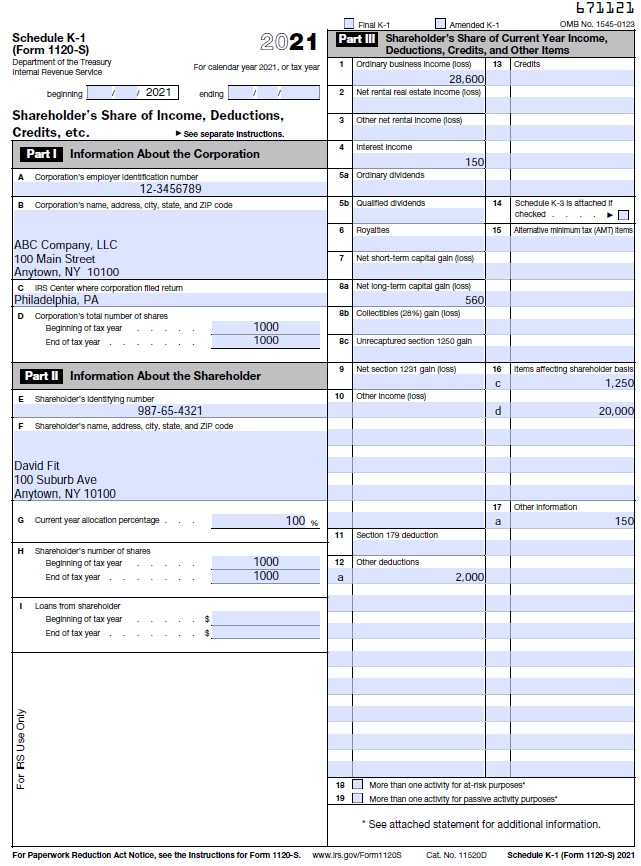

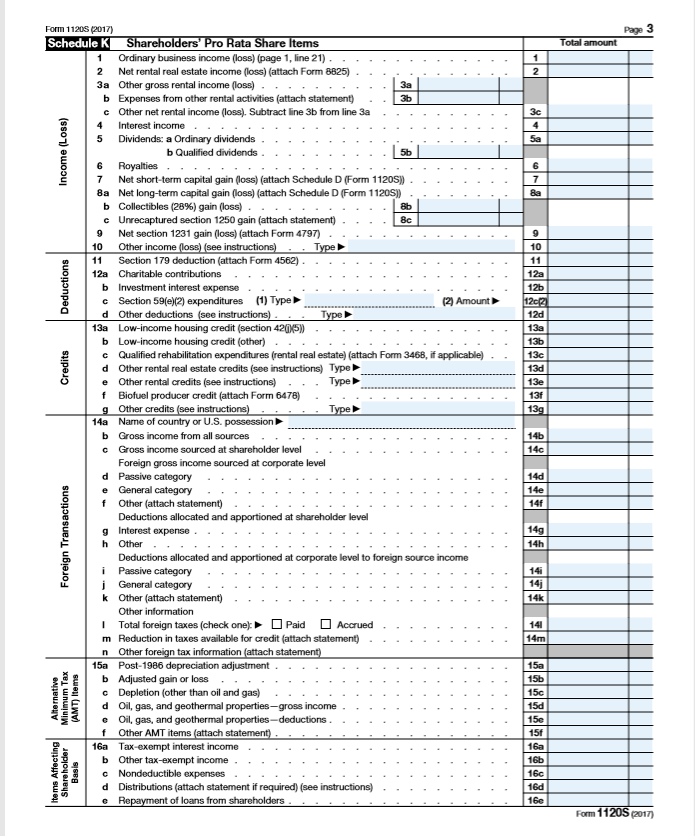

› pub › irs-pdf2021 Shareholder's Instructions for Schedule K-1 (Form 1120-S) Box 10. Other Income \(Loss\) Box 11. Section 179 Deduction. Box 12. Other Deductions. Box 13. Credits. Box 14. International Transactions. Box 15. AMT Items. Box 16. Items Affecting Shareholder Basis. Box 17. Other Information. Box 18. More Than One Activity for At-Risk Purposes. Box 19. More Than One Activity for Passive Activity ...

Guidance Archive : Cherry Bekaert The entities falling under the Cherry Bekaert brand are independently owned and are not liable for the services provided by any other entity providing services under the Cherry Bekaert brand. Our use of the terms "our Firm" and "we" and "us" and terms of similar import, denote the alternative practice structure of Cherry Bekaert LLP ...

ttlc.intuit.com › community › tax-credits-deductionsSolved: K1 Box 17 V * STMT - Intuit Feb 13, 2020 · When entering the multiple box 17v entries, TT generates the Statement A section of the K-1. This requires re-entry of your business income (loss), section 179 deductions, etc. In other words, you have to re-enter some or all of the entries you previously entered for the K-1 into the section 199A QBI worksheet.

When Are Meals 100% Deductible? - Keeper Tax To calculate the amount you can deduct you need to first total up all of your meals expenses for the year that were incurred while either traveling and entertaining clients. You then divide those that are 50% deductible in half and add them to the expenses that are 100% deductible. You will enter your total deduction on line 24b, Deductible Meals.

Fannie Mae Cash Flow Analysis Calculator - Enact MI IRS Form 4797 (Sales of Business Property) is not included on this worksheet due to its infrequent use. If ... 9 Schedule K-1 Form 1120S – Shareholder’s Share of Income *Review Line 16d for a distribution **Only add back the eligible “Other” deductions, such as : Amortization or Casualty Loss. ***Follow specific investor guidelines. Adjustments : may not be required if …

› business-taxes › downloadS Corporation Business Tax Filing | File 1120s Tax Return ... TaxAct Business 1120S. 2021 Download Edition. ... Maximize your deductions and save time with various imports & reports. $ 124 95 State Additional Bundle with 1040 ...

0 Response to "38 1120s other deductions worksheet"

Post a Comment