44 renting vs owning a home worksheet answers

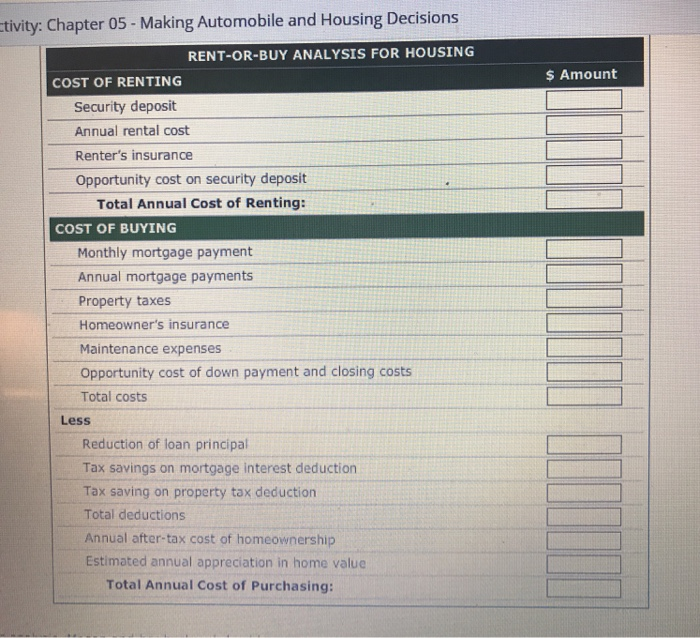

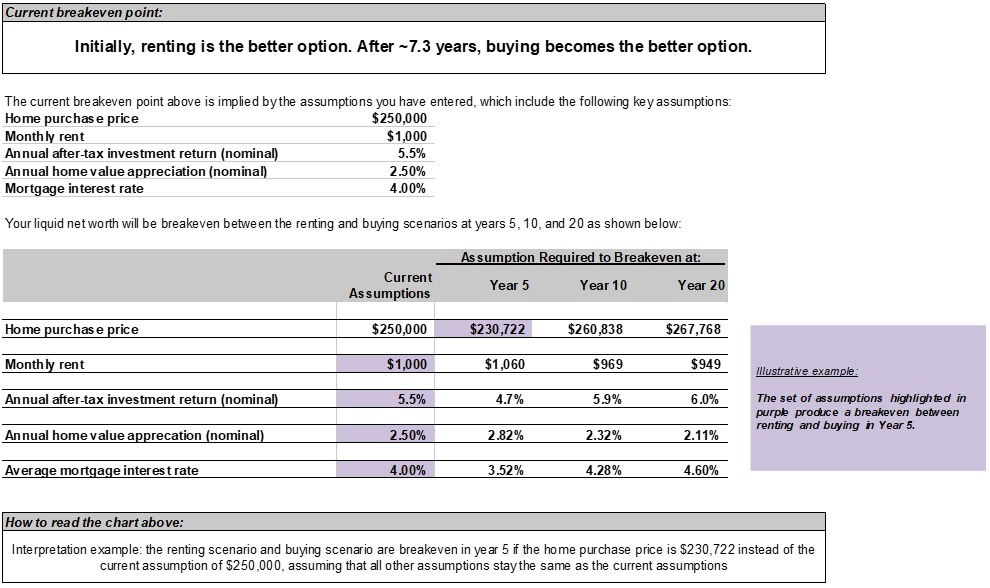

Make a Buy vs Rent calculator spreadsheet - SpreadsheetSolving From a big picture perspective, the cash outflows are the upfront down payment, as well as any costs of homeownership that you wouldn't incur while renting (property taxes, insurance, maintenance, etc). The cash inflows to owning a home are any savings or other benefits (rent paid, mortgage interest tax deduction, house price appreciation, etc). Renting vs. Buying a Home: What's the Difference? - Investopedia There is no definitive answer as to whether renting or owning a home is better. The answer depends on your own personal situation—your finances, lifestyle, and personal goals. You need to weigh out...

Is It Better to Rent or Buy? - The New York Times By MIKE BOSTOCK, SHAN CARTER and ARCHIE TSE. The choice between buying a home and renting one is among the biggest financial decisions that many adults make. But the costs of buying are more ...

Renting vs owning a home worksheet answers

Renting vs. Buying a Home: Which Is Smarter? - US News & World Report That's really a difficult question to answer, but you could make a good argument that renting is the better option if you're investing money every year. "Most people do not appreciate the fact that average year-to-year maintenance runs from 1% to 3% of a home's cost," Costa says. "On a $1 million dollar house, that's $10,000 to $30,000 per year ... PDF Personal Finance: Renting vs. Owning - Loudoun County Public Schools Personal Finance: Renting vs. Owning Go to Everfi.net and complete the Renting vs. Owning Module. During or after completing the module, answer the following questions. This short answer worksheet is worth up to 10 points and the module is worth up to 10 points. Total Possible Points is 20. PLEASE WRITE LEGIBLY OR TYPE YOUR Kahoot Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

Renting vs owning a home worksheet answers. Buying vs Renting worksheet - Liveworksheets.com ID: 1542544 Language: English School subject: Family and Consumer Science Grade/level: 8 Age: 10-13 Main content: Housing Other contents: Add to my workbooks (8) Add to Google Classroom Add to Microsoft Teams Share through Whatsapp Quiz & Worksheet - Buying or Renting a Home Comparison | Study.com Worksheet Print Worksheet 1. Which of the following is a pro of owning a house? easy to move don't have to maintain appliances no pets can paint the walls any color 2. Which of the following is a... 2021-2022 Long-Term Capital Gains Tax Rates | Bankrate Apr 07, 2022 · Capital gains tax: Short-term vs. long-term Capital gains taxes are divided into two big groups, short-term and long-term, depending on how long you’ve held the asset. Here are the differences: What are Benefits of Renting vs. Owning a Home - Better Money Habits The cost question For years, the rule of thumb stated renting is cheaper than buying—so renting freed up money for other things, such as savings. However, that may not always be the case. Shifting real estate markets mean it may be cheaper to buy than rent in certain areas, though you likely need to pay more up front.

Renting vs. Buying: The True Cost of Home Ownership TOTAL. $834. The bottom line for our hypothetical example is that home ownership actually costs about $834/month per $100,000. So, for example, if you're looking at living in a house valued at $300,000, you could assume that would cost you about 3 x $834 or about $2500/month to own. If you can rent it for less than that — which indeed you ... Insurance Articles & Information: Allstate Resources Looking for tools and resources about insurance? Visit Allstate Resources for articles, information, videos and calculators. PDF student module 10.1 Renting Versus Buying - Oklahoma State Department ... Discuss the costs and benefits of renting a place to live. 2. Discuss the costs and benefits of owning a place to live. 3. Explain the process to determine a person's best housing option. 4. How does the PACED Decision-Making Model help in determining what kind of housing to get? Student Module 10.18 © 2008. Oklahoma State Department of Education. EconEdLink - All Grades This webinar provides attendees with new and improved resources for teaching the following topics: Investing, Managing Credit, and Managing Risk....

Rent vs Buy Calculator: Should I Rent or Buy? - NerdWallet When comparing the two options, renting can often come out ahead, at least compared to the early years of a home purchase. But like the tortoise racing the hare, owning a home is more "slow and... (PDF) The 4-Hour Workweek | abc def - Academia.edu Enter the email address you signed up with and we'll email you a reset link. PDF Renting vs Owning a Home Lesson Plan 1 9 3 Revised March 09 Monthly rent: Upfront costs: Expenses covered by the rent: Expenses not covered by the rent: Advantages of the property include: Disadvantages of the property include: Restrictions on the property: (pet owners, smokers, etc.) 1. Choose one of the two apartments which best fits the needs of the scenario. State three reasons why. (4 points) Renting vs. Buying a Home: 55 Pros and Cons - The Truth About Mortgage The 1% rule basically says to purchase a rental property only if each month's rent covers 1% of the purchase price. So if a home is listed at $200,000, you need to bring in at least $2,000 in monthly rent for it to make sense. This is easier said than done. The 2% rule is a lot less forgiving, doubly less in fact.

Publication 925 (2021), Passive Activity and At-Risk Rules You can help bring these children home by looking at the photographs and calling 800-THE-LOST (800-843-5678) if you recognize a child. Introduction. This publication discusses two sets of rules that may limit the amount of your deductible loss from a trade, business, rental, or other income-producing activity. The first part of the publication discusses the passive activity rules. The …

7 Free Spreadsheets to Help You Budget for Buying a House - Tiller This spreadsheet helps you evaluate what you can afford to spend on a house, based on the four common factors above into consideration (housing expense to income ratio, debt to income ratio, available funds, housing expenses). Get the Google Sheet Template Get the template for Microsoft Excel 2007 and later

PDF Renting an Apartment The student will explain and compare the responsibilities of renting versus buying a home. Lesson Objectives Discuss the reasons that people rent. ... While renting may not allow you to get many benefits of owning a home, it does provide you with a place to live and may reduce your overall monthly expenses and obligations.

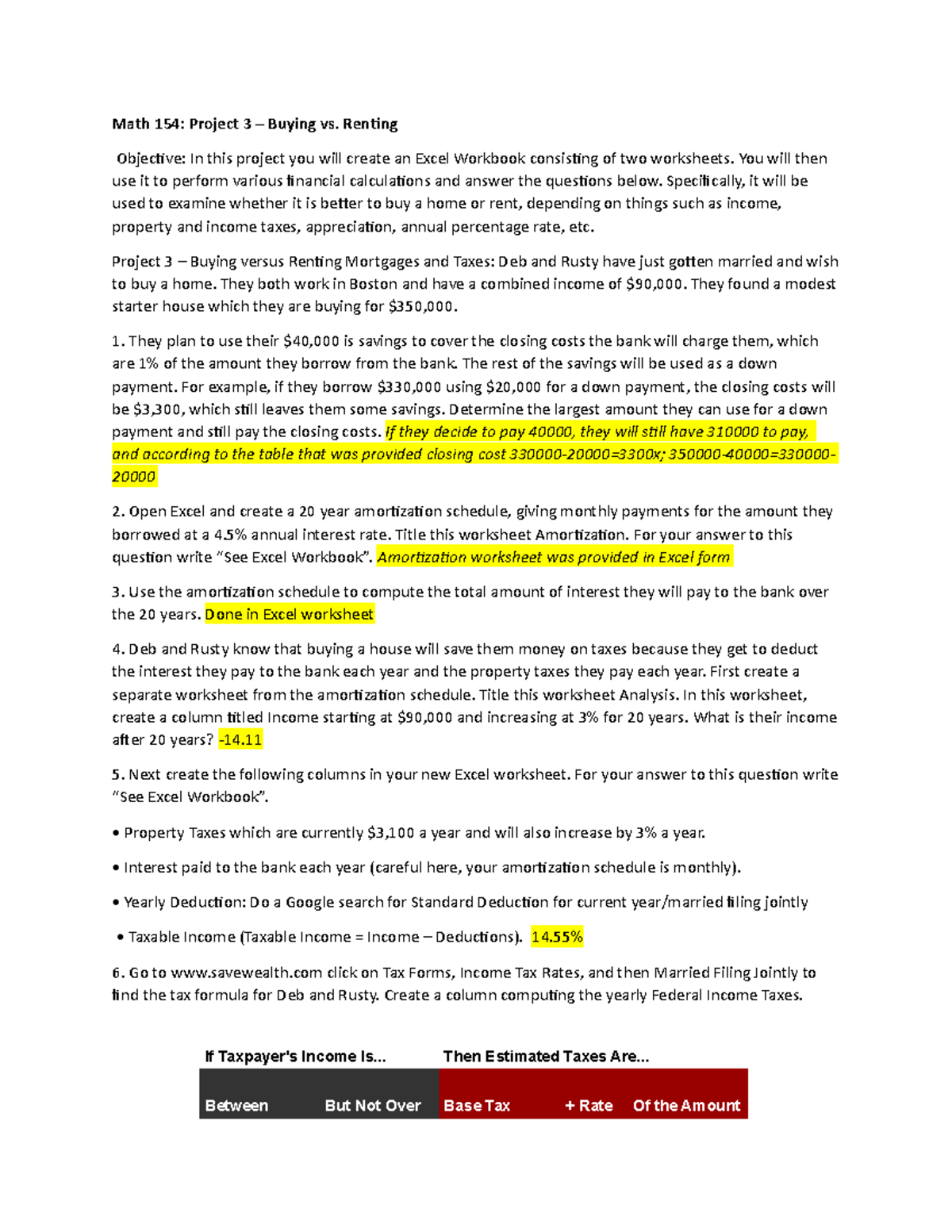

Buying Your First Home (Renting vs. Owning and 15 vs. 30 Year Mortgages) Renting as an option; Expenses associated; Using a mortgage calculator to compare and contrast a 15 year vs. 30 year loan term; Analysis of 15 vs. 30 year mortgage; Analysis of renting vs. owning; Argument for or against "a mortgage is good debt" Save $$$ by purchasing this product as part of the Personal Finance Project Bundle. You may also like:

Rent-vs.-Buy-Worksheet-_-Peter-Lazaroff.pdf - Course Hero Owning a home makes it more financially restrictive to relocate for a job opportunity, go back to school, change career paths, or start a business. If you have a high degree of career uncertainty, renting is a safer choice because it provides greater financial flexibility. Your future earnings are relevant to how a mortgage will impact your life .

PDF Lesson Three Buying a Home - Practical Money Skills This lesson will provide students with information on buying a home and where and how to begin the process. After comparing the differences between renting and buying, students will be introduced to a five-step process for home buying. This framework provides an overview for the activities involved with selecting and purchasing a home.

Renting VS. Owning a Home Flashcards | Quizlet owner of the rental property When moving into a rental, what two things are people usually required to do pay a security deposit and sign a lease Advantages of Renting low move-in costs, fixed monthly expenses, easy to move Disadvantages of Renting subject to terms of a lease, rent may change with little notice, and less privacy

Renting versus buying a home (video) | Khan Academy There's no very clear-cut answer that renting is always better than buying, or that buying is always better than renting. It really depends on the circumstances. This is a back-of-the-envelope version; in future videos we'll do a more in-depth version. But, other things that we should think about beyond just the numbers are the intangibles.

Rent vs. Buy Calculator - Is it Better to Rent or Buy? - SmartAsset Owning a Home Pros Owning a Home Cons Renting Pros Renting Cons; Can build equity: Home value can decrease : Have flexibility, can move to a new place each year: ... Today, there is no clear answer to the rent vs. buy question. In some cities, and for some individuals, buying a home may make more sense, while for others, renting a home may be ...

BibMe: Free Bibliography & Citation Maker - MLA, APA, Chicago, … BibMe Free Bibliography & Citation Maker - MLA, APA, Chicago, Harvard

PDF Renting vs. Owning a Home - Ms. Christy Garrett Ann Arbor Huron High School Tell the participants they will be completing the following activity on renting versus owning a home. a. Divide the participants into groups of 3-4. b. Give each group a poster board with markers. c. Each group should divide the poster board in half by drawing a line down the middle. Label the left side 'rent' and the right side 'own.' d.

Buying vs. Renting a Home | MyCreditUnion.gov The chart below shows a cost comparison for a renter and a homeowner over a seven-year period. The renter starts out paying $800 per month with annual increases of 5%. The homeowner purchases a home for $110,000 and pays a monthly mortgage of $1,000. After 6 years, the homeowner's payment is lower than the renter's monthly payment.

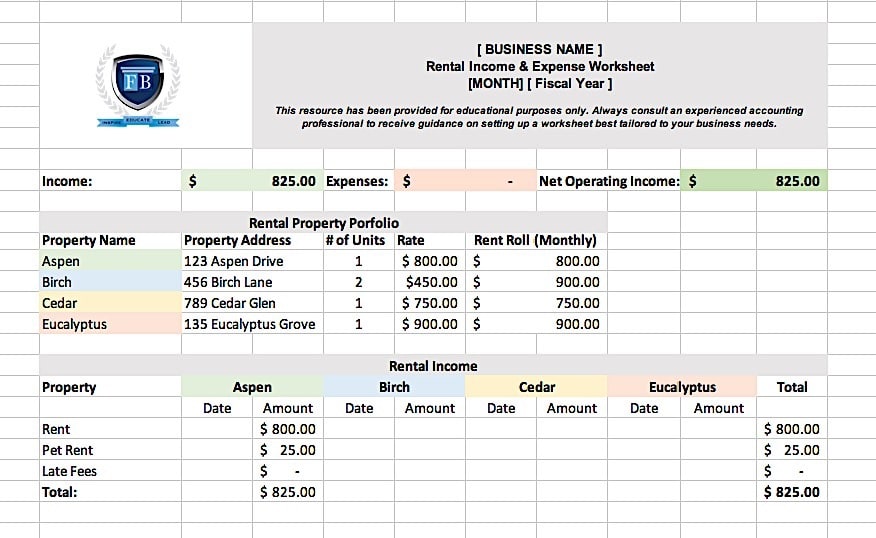

Airbnb rental arbitrage course - xbda.bioretin.shop 02.08.2017 · 1. How to Create an Empire on Airbnb without Owning a Home. The Durham real estate market moves fast, so the time it takes to find funding can mean the difference between landing a great property and missing out altogether. I’ve gotten advances from Nectar for 3 rental units I arbitrage, and each time I’ve been impressed by.

Should You Buy A House Or Rent? The Economics Of Homeownership - Forbes It's like saving. To put buying on a level playing field with renting, look at just the part of the monthly payment that will go to interest. Example: you borrow $200,000 house with a 30-year ...

PDF Owning Versus Renting a Home Worksheet - Red Canoe Credit Union Owning a home means you are nancially responsible for maintenance and repair issues. When you rent, it s your landlord s responsibility. If the thought of having to pay for major repairs freaks you out, it might be best to rent so that you can pass that stress and expense on to your landlord.

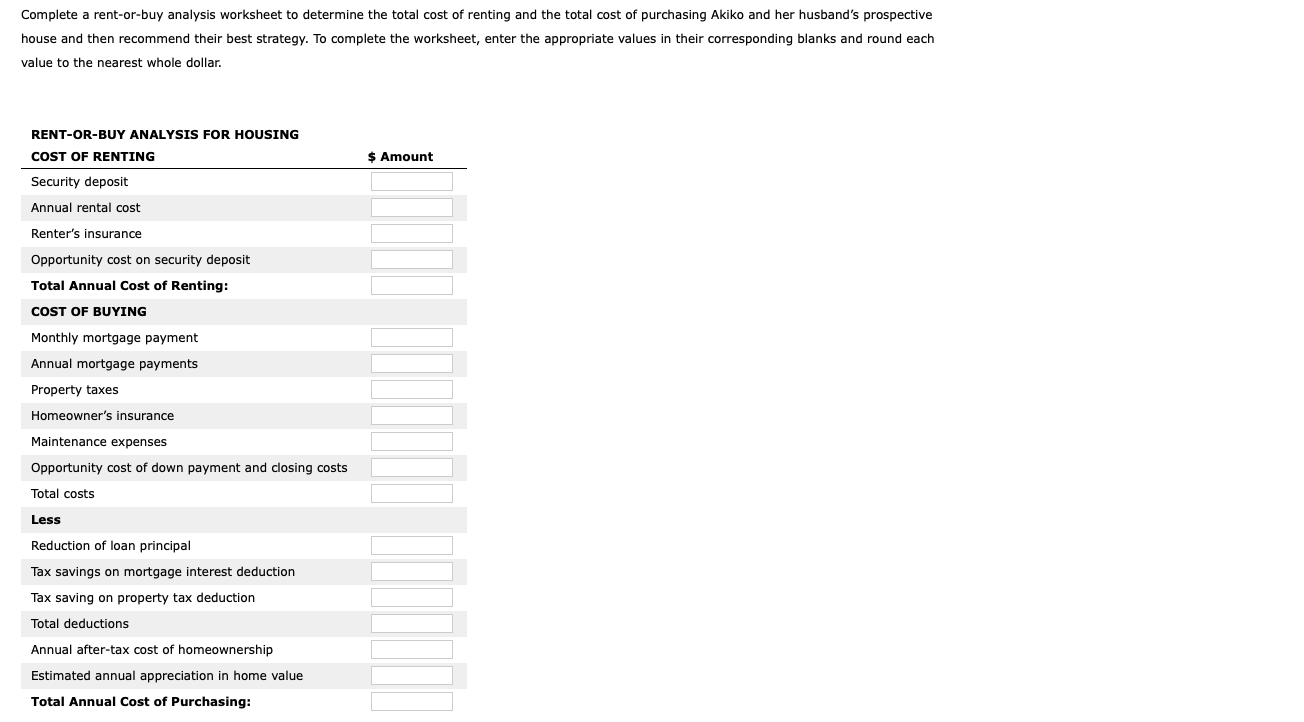

Solved 10. Rent versus buy analysis - Part 2 Which Is | Chegg.com The decision of whether to rent or buy housing is a personal decision that is based on both your lifestyle and your finances. While most financial experts argue that the financial aspect of the decision is important, it is also important not to base your rent-or-buy decision solely on. Question: 10. Rent versus buy analysis - Part 2 Which Is ...

Rent vs. Buy Calculator Rent vs. Buy Calculator Home Purchase Home Rent Your Information Average Investment Return Marginal Federal Tax Rate Marginal State Tax Rate Tax Filing Status: Result Buying is cheaper if you stay for 11.5 years or longer. Otherwise, renting is cheaper. Average Monthly Cost Buy Rent 5yr 10yr 15yr 20yr 25yr 30yr $0 $2.0K $4.0K $6.0K $8.0K

Renting vs. buying (detailed analysis) (video) | Khan Academy Now these assumptions are so that we can make a comparison to, well, what if instead of using that down payment to buy a house, what if we actually just save that down payment, put it in the bank, and rent a house instead. So this is cost of renting a similar home. This is the annual rental price inflation.

Should I Rent or Buy a House? | RamseySolutions.com Your home will most likely increase in value over time depending on the market and how well you take care of it. What you buy for $200,000 today could sell for $260,000 down the road. You have tax advantages. Many costs of owning a home—like property taxes and mortgage interest—are tax deductible. You have the freedom to renovate your house.

American Express The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your asset or property and how much you sold it for — adjusting for commissions or fees. Depending on your income level, and how long you held the asset, your capital gain will be taxed federally between 0% to 37%. The function wizard in Excel describes …

Pueblo.GPO.gov Main Page Be prepared for the next time you request your free credit report. Get to know and understand all the parts of the report, what they mean, and how they affect your credit situation.

Kahoot Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu.

PDF Personal Finance: Renting vs. Owning - Loudoun County Public Schools Personal Finance: Renting vs. Owning Go to Everfi.net and complete the Renting vs. Owning Module. During or after completing the module, answer the following questions. This short answer worksheet is worth up to 10 points and the module is worth up to 10 points. Total Possible Points is 20. PLEASE WRITE LEGIBLY OR TYPE YOUR

Renting vs. Buying a Home: Which Is Smarter? - US News & World Report That's really a difficult question to answer, but you could make a good argument that renting is the better option if you're investing money every year. "Most people do not appreciate the fact that average year-to-year maintenance runs from 1% to 3% of a home's cost," Costa says. "On a $1 million dollar house, that's $10,000 to $30,000 per year ...

/renting-vs-owning-home-pros-and-cons.asp-ADD-V2-2ce9de919eb94f62bd4e4c7a23010852.jpg)

0 Response to "44 renting vs owning a home worksheet answers"

Post a Comment