45 funding 401ks and roth iras worksheet answers

Roth IRA vs. 401(k): What's the Difference? - Investopedia This gives Roth IRA holders a greater degree of investment freedom than employees have with 401 (k) plans (even though the fees charged for 401 (k)s are typically higher ). In contrast to the 401 ... PDF Schwab IRA Worksheet Use this worksheet to help you determine which IRA is best for you. Once you decide which IRA is best for you, just complete the Schwab IRA Account Application and return it to Schwab. We recommend that you consult your tax advisor before making your final decision. 1. Are you eligible to make contributions to a Roth IRA (based on the chart below)?

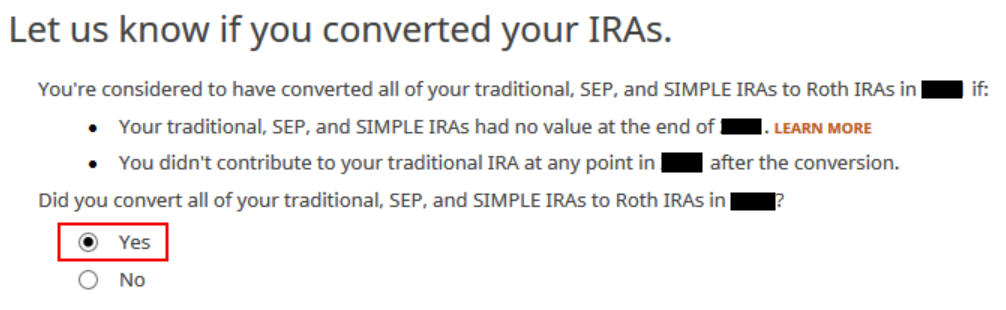

Roth IRA Flashcards | Quizlet 1)Unlike Traditional IRAs, Roth IRA contributions eligibility is not restricted by active participation in an employer's retirement plan. 2)Unlike Traditional IRAs, Roth IRA contributions can be made after age 70-1/2. 3)Roth IRAs are not subject to minimum distribution rules until DEATH of the Roth IRA owner. Roth conversions from Traditional IRA

Funding 401ks and roth iras worksheet answers

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME:... Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

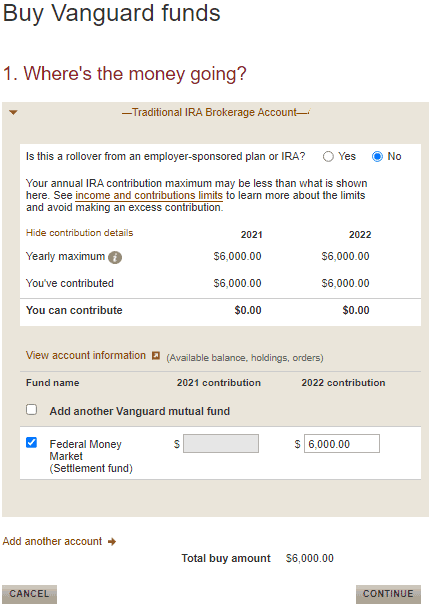

Funding 401ks and roth iras worksheet answers. Emparion - Defined Benefit Plans | Cash Balance Plans Jun 12, 2022 · Large contributions: In comparison to traditional IRAs, SEP IRAs allow high contributions ($57,000 for SEP IRA Vs. $6,000 + $1,000 for IRA). Easy setup and maintenance: SEP IRAs are easy to set up and manage in comparison to other plans. You have limited filing obligations, making it easier to manage the plan. Roth vs. Traditional 401(k) Worksheet - Morningstar, Inc. Use our free Roth vs. Traditional 401(k) Worksheet to help get your finances in order. ... ratings, and picks; portfolio tools; and option, hedge fund, IRA, 401k, and 529 plan research. Our ... Funding 401(k) and Roth IRAs (1).pdf - N A ME: DAT E:... Funding 401 (k)sand Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of investing 15% of their annual household income. Remember to follow the sequence of contributions recommended in the chapter. PDF Foundations in Personal Finance - Welcome to Mr. Bextermueller's Classroom 4 Foundations in Personal Finance dave ramsey, a personal money management expert, is an extremely popular national radio personality, and author of the New York Times best-sellers The Total Money Makeover, Financial Peace and More Than Enough.Ramsey added television host to his title in 2007 when "The

saving and investing worksheet answers Funding 401 K S And Roth Iras Worksheet Answers - Worksheet novenalunasolitaria.blogspot.com. worksheet iras funding roth answers cretive templates. Comparing Saving And Investment Products Worksheet Answers - Invest Walls investwalls.blogspot.com. 50 Pre Algebra Review Worksheet | Chessmuseum Template Library chessmuseum.org Funding 401(K)S And Roth Iras Worksheet Answer Key - US Quote Hunter Funding 401(K)S And Roth Iras Worksheet Answer Key Overview. Funding 401(K)S And Roth Iras Worksheet Answer Key A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Chapter 11 Finance Flashcards | Quizlet When is the only time that you should roll over to a Roth? 1. You have over $700,000 by age 65. 2. You can afford to pay the taxes separately, not from the IRA. 3. You understand all the taxes will become due on the rollover amount. Never borrow on your retirement plan. Never WTF is Federal thrift plan? Is Your 401(k) Enough for Retirement? | RamseySolutions.com Second, your 401(k)'s tax-deferred growth is a double-edged sword. While it works to your advantage while you're saving today, it means you'll owe taxes on the money you withdraw from your 401(k) in retirement tomorrow—unless your employer offers a Roth 401(k), which we'll get to in a minute.. That's why you usually need more than just a traditional 401(k) if you want a secure ...

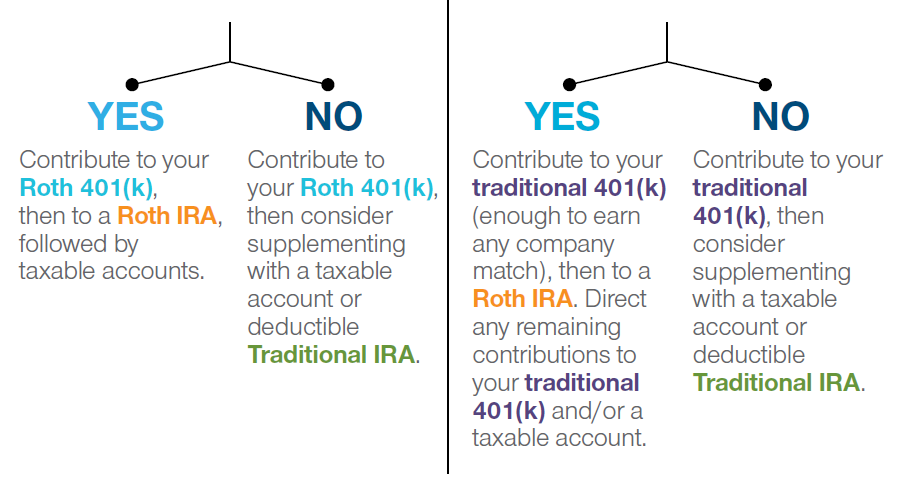

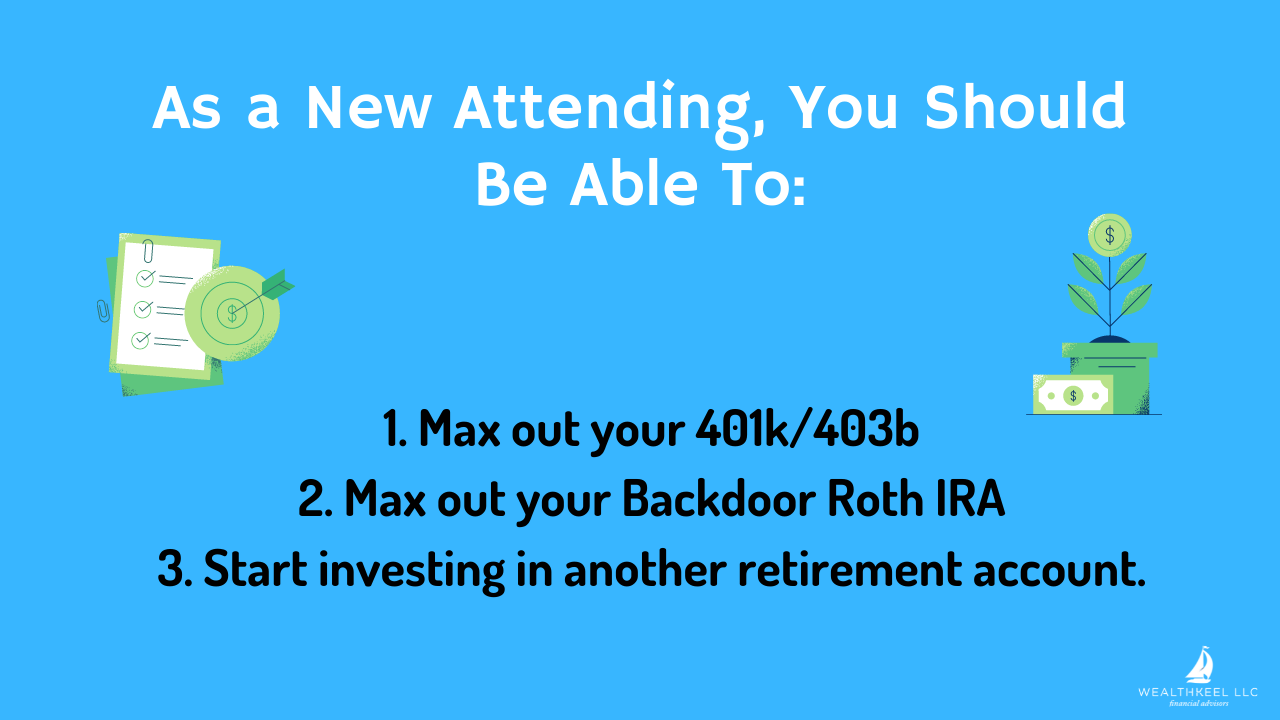

Saving in Both a 401(k) and a Roth IRA Can Be a Good Idea. - The Balance An IRA and 401 (k) are both retirement savings vehicles. An IRA is an account opened by an individual, and a Roth IRA allows you to save after-tax funds to withdraw tax-free in retirement. Whether you can contribute to a Roth IRA depends on your income. A 401 (k) is sponsored by an employer. You contribute pre-tax funds to a 401 (k), and an ... Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET N A ME: DAT E: CHAPTER 3 Name_____ Funding 401(k)s and IRAs FUndinGRoth 401(k)s And iRAs STUDENT ACTIVITY SHEET Q&A Objective The purpose of this activity is to use a mortgage calculator to examine how down payments, interest rates, and loan terms affect monthly payments and total interest paid. Uphandicrafts Funding 401 K S And Roth Iras Worksheet Answers; Dyna 4000 Pro Wiring Diagram; Switch Board Wiring Diagram Australia; Telephone House Wiring Diagram; Famous How To See Who Someone Recently Followed On... Famous How To Sleep With Uti Back Pain 2022; Famous How To Stop Bored Eating Reddit References; Famous How To Stay Sober At A Party Ideas Activity_Funding_A_401k_And_Roth_IRA.pdf - 8 CHAPTER... Review the steps to follow when funding a 401 (k) and Roth IRA, located in the workbook: 1 Always take advantage of a match and fund 401 (k). 2 Above the match, fund Roth IRAs. If there is no match, start with Roth IRAs. 3 Complete 15% of income by going back to your 401 (k) or other company plans.

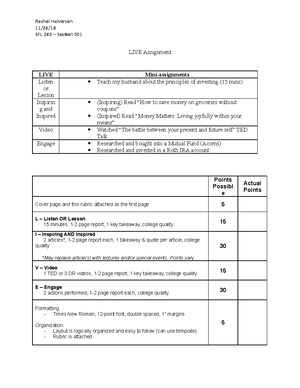

Solved Activity: Funding 401(k)s and Roth IRAs Objective ... - Chegg Activity: Funding 401 (k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of ...

PDF Roth vs. Traditional 401(k) Worksheet - Morningstar, Inc. An increasing number of 401(k) plans are offering a Roth option. The key differences are as follows: Traditional 401(k) p Pretax contributions p Tax-deferred compounding p Taxed upon withdrawal in ...

Read Online Chapter 11 Date Student Activity Sheet Answers CD5MT8 Chapter 11 Date Student Activity Sheet Answers 1 ... NAME: DATE: INVESTMENT ANNUAL SALARY COMPANY MATCH 401(K) ROTH IRA TOTAL ANNUAL IN-to 6% Chelsea $28,000 No Match CHAPTER 8 ISBN-13: 978--07-875004-5 (Student Activity Workbook) ISBN-10: -07-875004- (Student Activity ... Quiz & Worksheet - The Things They Carried Chapter 1 ...

Quiz & Worksheet - Roth IRA Rules & Benefits | Study.com This quiz and worksheet combo helps you test out the following skills: Problem solving - use acquired knowledge to solve financial practice problems. Information recall - access the knowledge you ...

Roth IRA vs. 401(k): Which Is Better for You? Married couples with only one income earner may open a spousal Roth IRA. Taxes. Contributions are made with pretax dollars, lowering your taxable income. You'll pay taxes on any money you withdraw in retirement. Contributions are made with after-tax dollars, allowing investments to grow tax-free. No taxes on withdrawals in retirement.

401(k) and roth ira Flashcards | Quizlet 401k- can be matched by an employer; taxed in retirement (pre-tax money); no max contribution. steps for investing in roth ira or 401k. 1. calculate target amount to invest (15%) 2. fund our 401 (k) up to the match. 3. Above the match, fund roth ira. 4. complete 15% of income by going back to 401 (k) single- $___________; salary max ...

Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx - Chapter 11: Funding 401 (k)s and Roth IRAs Answer Sheet Possible 40 points - each answer is worth a Wk 5_Funding 401ks and Roth IRAs Answer Sheet.xlsx -... School Wilmington University Course Title FIN FIN-101 Uploaded By AmbassadorRoseCoyote5 Pages 1 This preview shows page 1 out of 1 page.

Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 - Free Gold ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares."

PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

Funding a 401 K and Roth - financial lit Flashcards | Quizlet -They match what you put into your 401 (k) -Up to 3% of your salary -If you make $100,000 and you put $3,000 or more into your 401 (k) -Your company will also put $3,000 into your 401 (k) FOLLOW THESE STEPS TO FUND YOUR 401 (K) & ROTH IRA -Calculate 15% or your income >>This is the total you want to invest in your retirement accounts

Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME:...

/OwnYourRetirement_Worksheet-1page-ca7075ce1391471b858e44580d00d04b.jpg)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Late-Backdoor-Roth-IRA-Contributions-2020.png)

/GettyImages-137513511-572b9ffb5f9b58c34c6a8244.jpg)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

/roth_ira_401k_nesteggs_istock466132651-5bfc328ec9e77c00519bf2e6.jpg)

![How To Do A Backdoor Roth IRA [Step-by-Step Guide] | White ...](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-6.58.37-AM.png)

0 Response to "45 funding 401ks and roth iras worksheet answers"

Post a Comment