39 2012 child tax credit worksheet

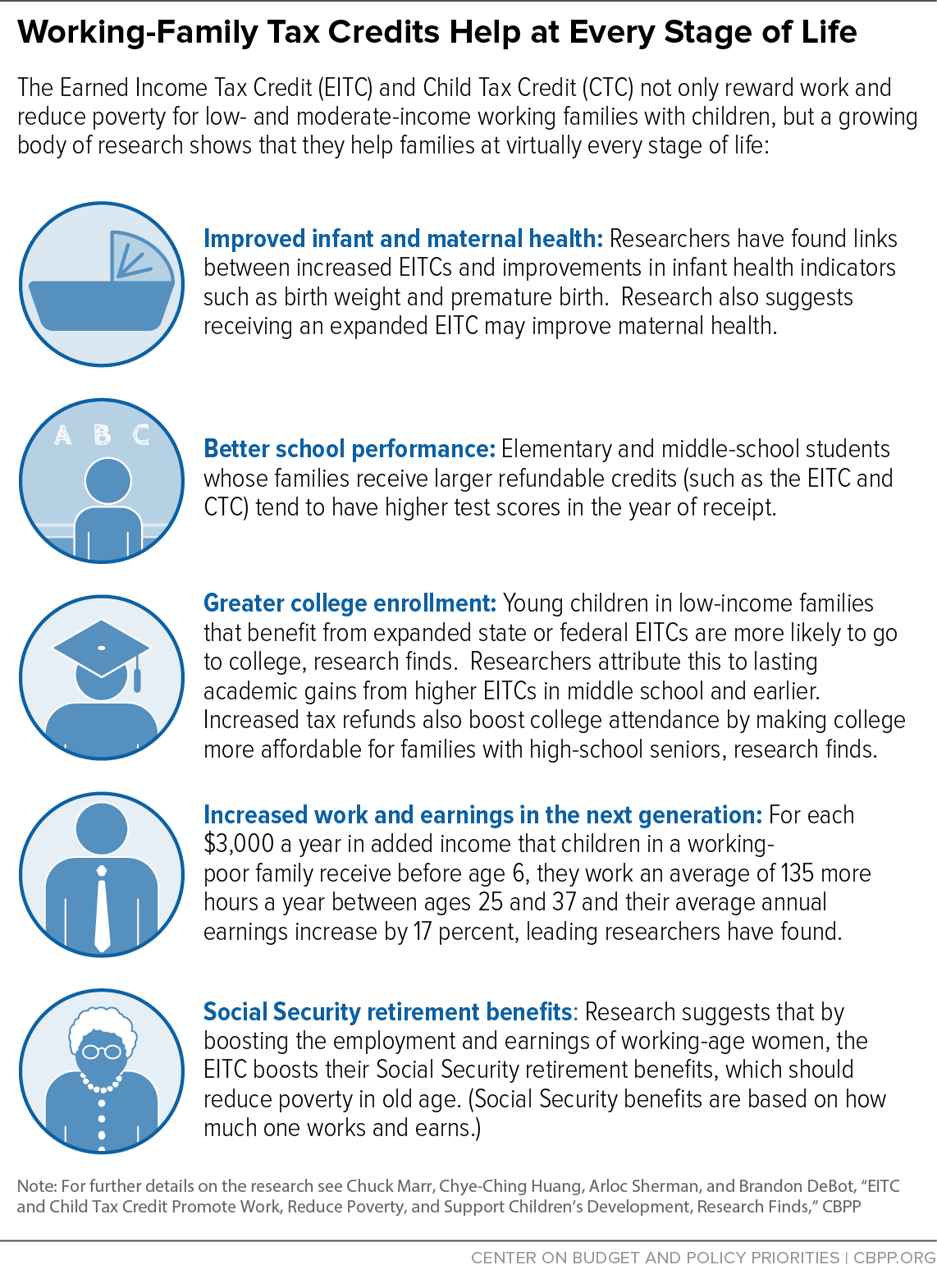

Publication 575 (2021), Pension and Annuity Income Advance Child Tax Credit; ... His completed worksheet is shown later. Bill's tax-free monthly amount is $100 ($31,000 ÷ 310) as shown on line 4 of the worksheet ... Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021).

2012 Publication 972 - IRS Jan 11, 2013 ... To figure the amount of earned income you enter on line 4a of Schedule 8812 (Form 1040A or 1040), Child. Tax Credit. This publication is ...

2012 child tax credit worksheet

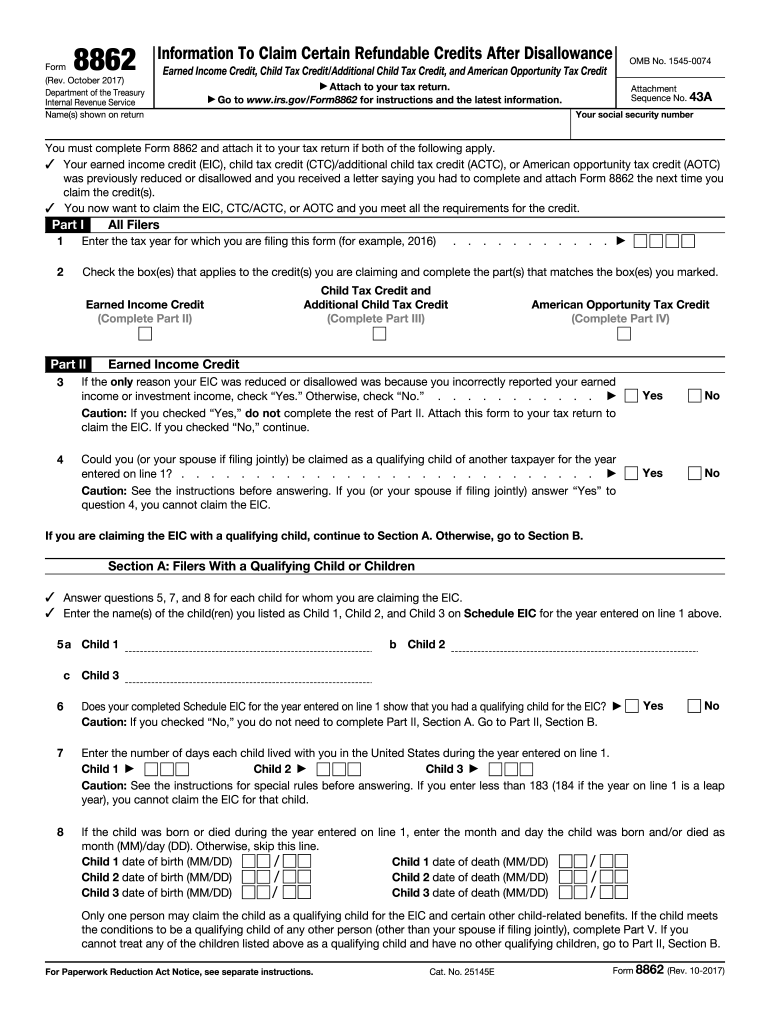

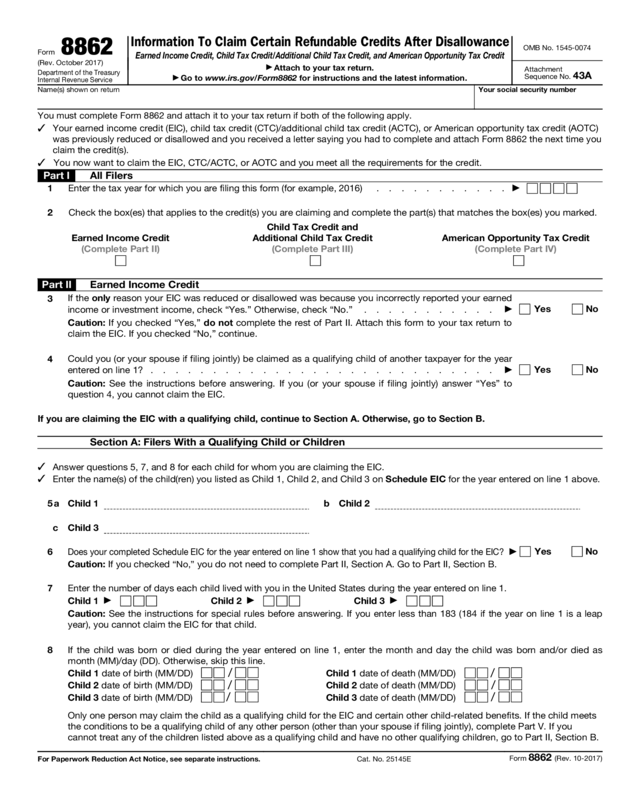

What is the IRS Form 8812? - TurboTax Tax Tips & Videos - Intuit Oct 18, 2022 ... If you have children and a low tax bill, you may need IRS Form 8812 to claim all of your Child Tax Credit. Publication 15 (2022), (Circular E), Employer's Tax Guide Paying the deferred amount of the employer share of social security tax. The CARES Act allowed employers to defer the deposit and payment of the employer share of social security tax. The deferred amount of the employer share of social security tax was only available for deposits due on or after March 27, 2020, and before January 1, 2021, as well as deposits and payments due after January 1 ... 2012 personal income tax forms - Tax.NY.gov Jul 14, 2022 ... 2012 personal income tax forms ... Child and Dependent Care Credit. See Form DTF-216 for recordkeeping suggestions for child care expenses.

2012 child tax credit worksheet. Publication 501 (2021), Dependents, Standard Deduction, and ... If a child is treated as the qualifying child of the noncustodial parent under the rules described earlier for children of divorced or separated parents (or parents who live apart), only the noncustodial parent can claim the child as a dependent and claim the refundable child tax credit, nonrefundable child tax credit, additional child tax ... p40201201F - WV State Tax Department F West Virginia Personal Income Tax Return 2012 ... 5 Widow(er) with dependent child ... Low-Income Earned Income Exclusion (see worksheet on page 24). 2012 Schedule 8812 (Form 1040A or 1040) - IRS Child Tax Credit. ▷ Attach to Form 1040, Form 1040A, or Form 1040NR. ▷ Information about Schedule 8812 and its separate instructions is at ... Educational Opportunity Tax Credit FAQ - Maine For tax years beginning on or after January 1, 2013 but before January 1, 2016, eligible education loan payments may include payments made for loans associated with earning up to 30 credit hours after 2007 for the degree at an accredited non-Maine college, community college or university by a qualifying graduate who transferred to an accredited ...

12_1040_Schedule A_downloadable.indd - Maine.gov EARNED INCOME TAX CREDIT - Enter amount from federal Form 1040, line 64a or ... 2012 - Worksheet for Child Care Credit - Schedule A, Line 5 (Enclose with ... Publication 525 (2021), Taxable and Nontaxable Income Changes to dependent care benefits for 2021. The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employee's income through a dependent care assistance program. For 2021, the amount is incre Publication 502 (2021), Medical and Dental Expenses Jan 13, 2022 · If you were an eligible TAA recipient, ATAA recipient, RTAA recipient, or PBGC payee, see the Instructions for Form 8885 to figure the amount to enter on the worksheet. Use Pub. 974, Premium Tax Credit, instead of the worksheet in the 2021 Instructions for Forms 1040 and 1040-SR if the insurance plan established, or considered to be established ... 2012 Instructions 1040 - Dependents 2012 Form 10402Line 6c. Line 6c—Dependents. Dependents and ualifying Child for Child. Tax Credit. Follow the steps below to find out if a person qualifies ...

Individual Income Tax Return 2012 - NCDOR If you are entitled to claim the federal child tax credit and your federal adjusted gross income (Form D-400, Line 6) is less than the following amounts shown. Child Tax Credit Overview - National Conference of State Legislatures Jul 11, 2022 ... The American Taxpayer Relief Act of 2012 increased the value of the federal child tax credit to $1,000 and increased the income threshold to ... Federal Form 8812 Instructions - eSmart Tax The additional child tax credit may give you a refund even if you do not ... 183 days during the 3-year period that includes 2014, 2013, and 2012, counting:. 2012 personal income tax forms - Tax.NY.gov Jul 14, 2022 ... 2012 personal income tax forms ... Child and Dependent Care Credit. See Form DTF-216 for recordkeeping suggestions for child care expenses.

Publication 15 (2022), (Circular E), Employer's Tax Guide Paying the deferred amount of the employer share of social security tax. The CARES Act allowed employers to defer the deposit and payment of the employer share of social security tax. The deferred amount of the employer share of social security tax was only available for deposits due on or after March 27, 2020, and before January 1, 2021, as well as deposits and payments due after January 1 ...

What is the IRS Form 8812? - TurboTax Tax Tips & Videos - Intuit Oct 18, 2022 ... If you have children and a low tax bill, you may need IRS Form 8812 to claim all of your Child Tax Credit.

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-05.jpg)

![23 Latest Child Tax Credit Worksheets [+Calculators & Froms]](https://templatearchive.com/wp-content/uploads/2017/05/child-tax-credit-worksheet-06.jpg)

0 Response to "39 2012 child tax credit worksheet"

Post a Comment