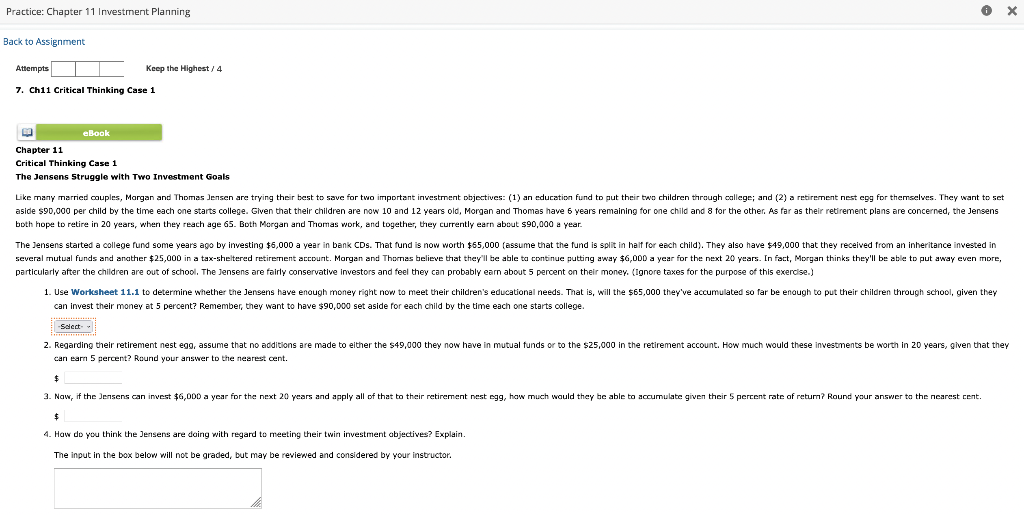

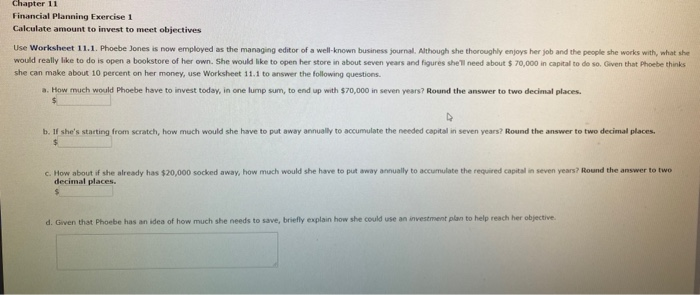

39 chapter 11 investing for your future worksheet answers

Publication 590-A (2021), Contributions to Individual ... Tom can take a deduction of only $5,850. Using Worksheet 1-2, Figuring Your Reduced IRA Deduction for 2021, Tom figures his deductible and nondeductible amounts as shown on Worksheet 1-2. Figuring Your Reduced IRA Deduction for 2021—Example 1 Illustrated. He can choose to treat the $5,850 as either deductible or nondeductible contributions. SurveyMonkey: The World’s Most Popular Free Online Survey Tool Use SurveyMonkey to drive your business forward by using our free online survey tool to capture the voices and opinions of the people who matter most to you.

Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Chapter 11 investing for your future worksheet answers

Personal Finance Advice - Personal Financial Management ... MarketWatch offers personal finance advice and articles to help you save money and plan for retirement. Publication 17 (2021), Your Federal Income Tax | Internal ... Your unearned income was more than $2,800 ($4,500 if 65 or older and blind). • Your earned income was more than $14,250 ($15,950 if 65 or older and blind). • Your gross income was more than the larger of: • $2,800 ($4,500 if 65 or older and blind), or • Your earned income (up to $12,200) plus $2,050 ($3,750 if 65 or older and blind). 1040 (2021) | Internal Revenue Service - IRS tax forms Don’t include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2021, or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly).

Chapter 11 investing for your future worksheet answers. Publication 560 (2021), Retirement Plans for Small Business We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments. Or you can write to: Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. NW, IR-6526 Washington, DC 20224 1040 (2021) | Internal Revenue Service - IRS tax forms Don’t include any social security benefits unless (a) you are married filing a separate return and you lived with your spouse at any time in 2021, or (b) one-half of your social security benefits plus your other gross income and any tax-exempt interest is more than $25,000 ($32,000 if married filing jointly). Publication 17 (2021), Your Federal Income Tax | Internal ... Your unearned income was more than $2,800 ($4,500 if 65 or older and blind). • Your earned income was more than $14,250 ($15,950 if 65 or older and blind). • Your gross income was more than the larger of: • $2,800 ($4,500 if 65 or older and blind), or • Your earned income (up to $12,200) plus $2,050 ($3,750 if 65 or older and blind). Personal Finance Advice - Personal Financial Management ... MarketWatch offers personal finance advice and articles to help you save money and plan for retirement.

![PDF] The Role of Distressed Debt Markets, Hedge Funds and ...](https://d3i71xaburhd42.cloudfront.net/dd4a49f7cfbf241d25c401e47c00f0150d36725d/20-Figure6-1.png)

:max_bytes(150000):strip_icc()/journal-4194014-01-FINAL-f49f4adcfab54f858309e375d03a8719.png)

0 Response to "39 chapter 11 investing for your future worksheet answers"

Post a Comment