43 1040 qualified dividends and capital gains worksheet

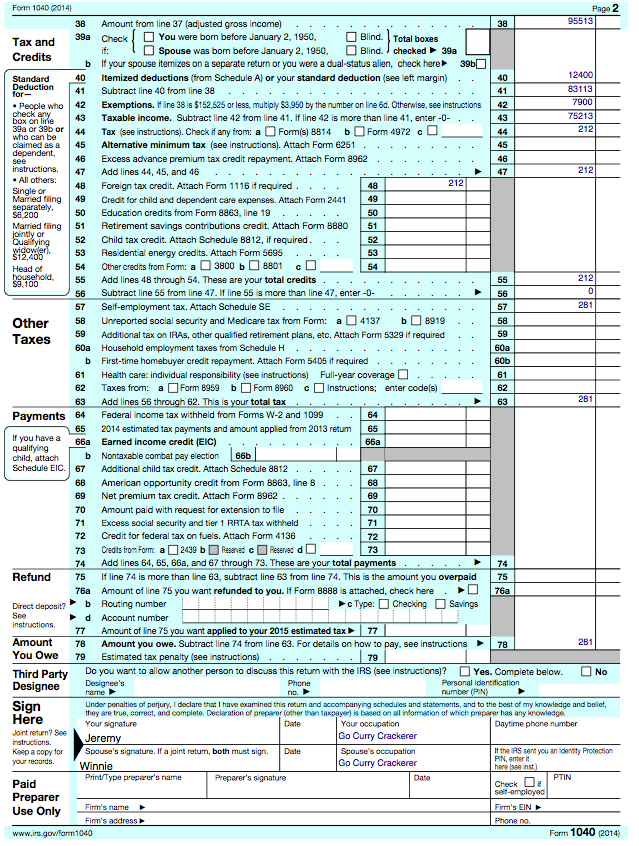

Publication 525 (2021), Taxable and Nontaxable Income Include all your pay on Form 1040 or 1040-SR, line 1, even if you don’t receive Form W-2, or you receive a Form W-2 that doesn’t include all pay that should be included on the Form W-2. If you performed services, other than as an independent contractor, and your employer didn’t withhold social security and Medicare taxes from your pay ... Publication 334 (2021), Tax Guide for Small Business However, if you held the property longer than 1 year, you may be able to treat the gain or loss as a capital gain or loss. These gains and losses are called section 1231 gains and losses. For more information about ordinary and capital gains and losses, see chapters 2 and 3 of Pub. 544.

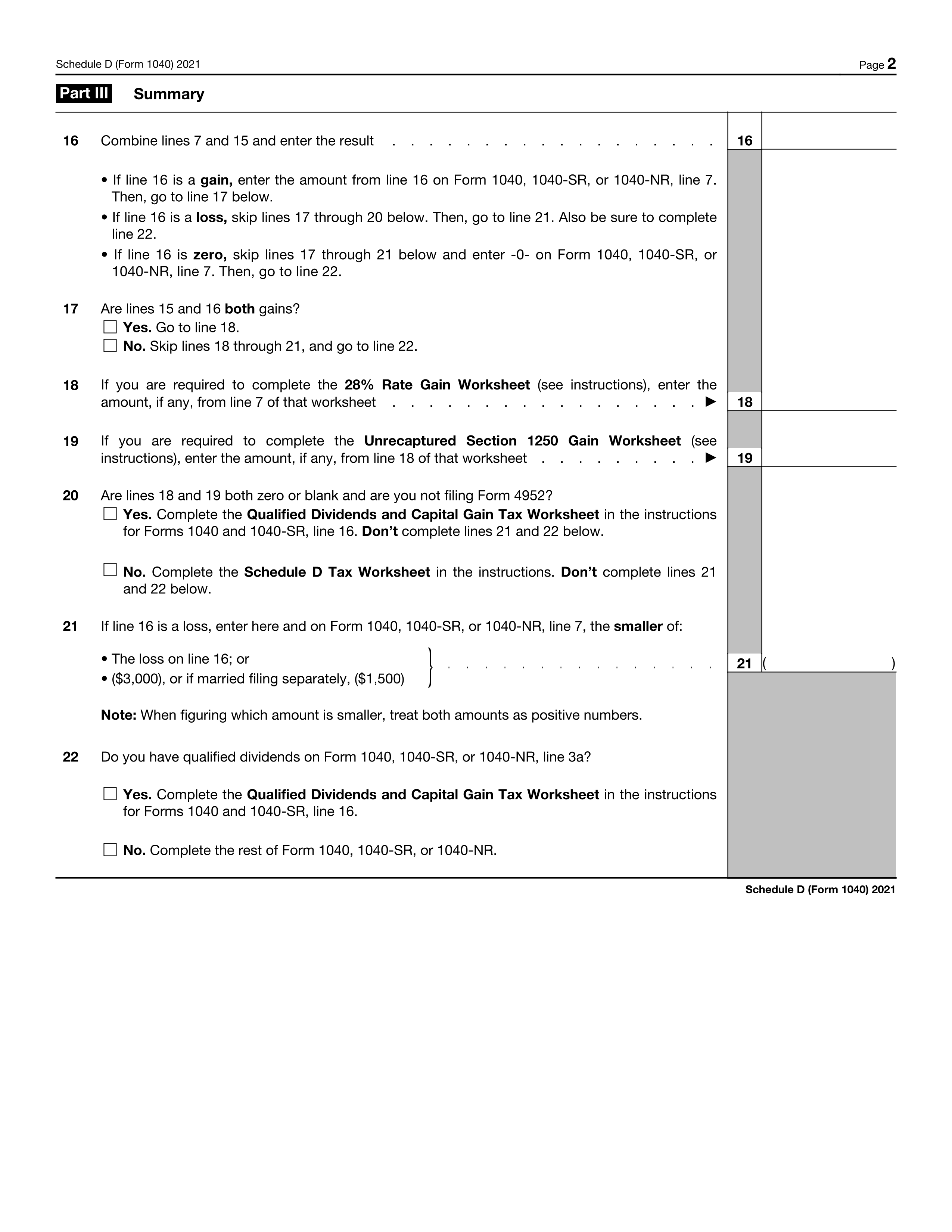

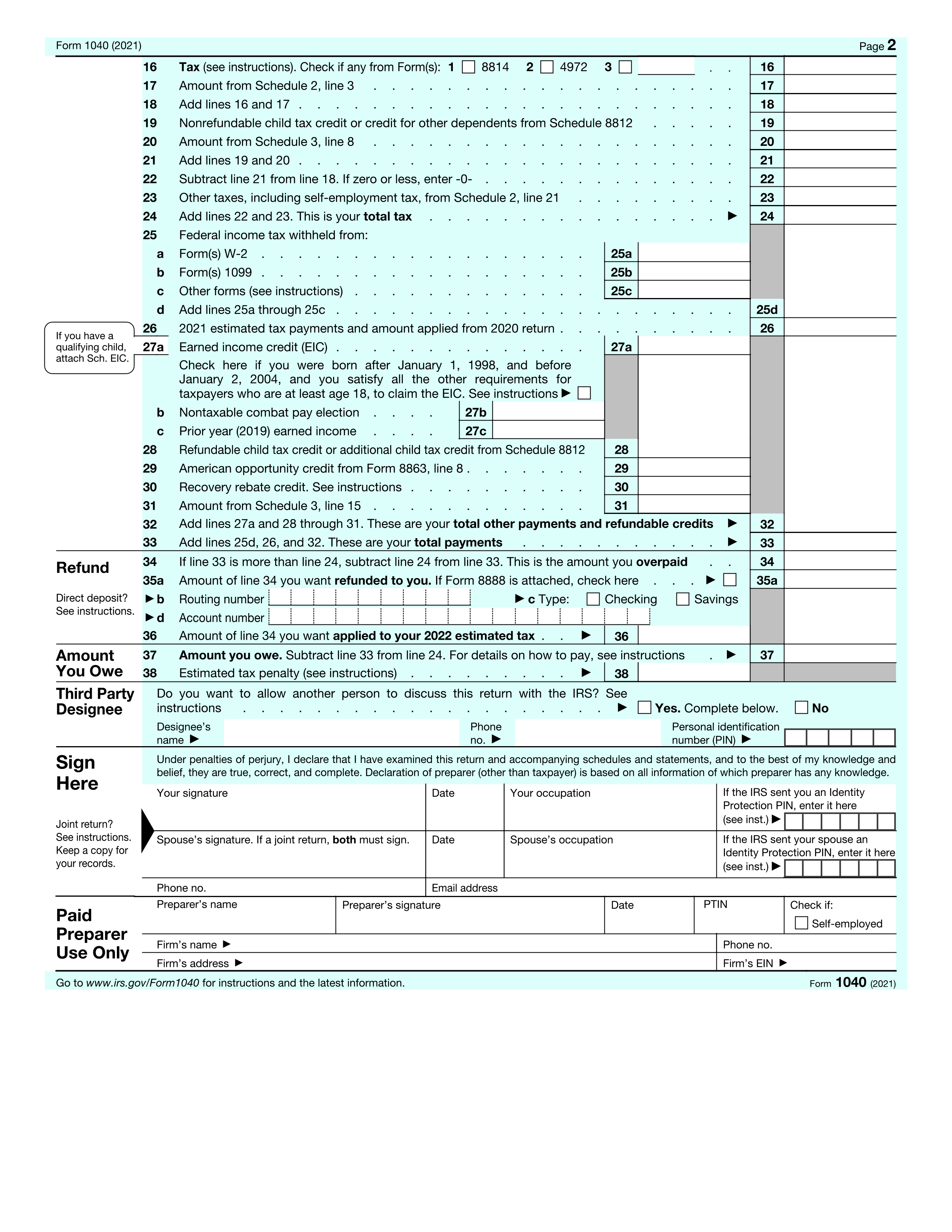

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

1040 qualified dividends and capital gains worksheet

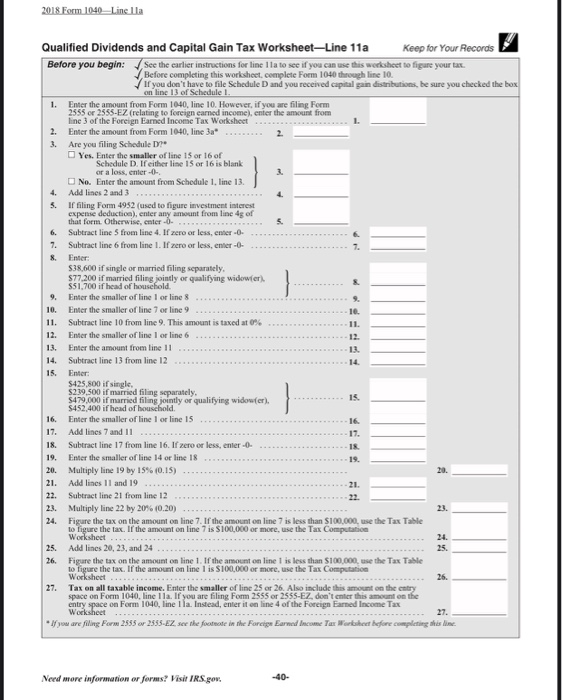

Publication 590-A (2021), Contributions to Individual ... If you are filing a joint return and your compensation is less than your spouse's, include your spouse's compensation reduced by his or her traditional IRA and Roth IRA contributions for this year. If you file Form 1040, 1040-SR, or 1040-NR, don’t reduce your compensation by any losses from self-employment: 5. _____ 6. 2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ... Page 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

1040 qualified dividends and capital gains worksheet. SCHEDULE D Capital Gains and Losses - IRS tax forms Did you dispose of any investment(s) in a qualified opportunity fund during the tax year? Yes. No. If “Yes,” attach Form 8949 and see its instructions for additional requirements for reporting your gain or loss. Part I Short-Term Capital Gains and Losses—Generally Assets Held One Year or Less (see instructions) Publication 575 (2021), Pension and Annuity Income If you elect capital gain treatment (but not the 10-year tax option) for a lump-sum distribution, include the ordinary income part of the distribution on Form 1040, 1040-SR, or 1040-NR, lines 5a and 5b. Enter the capital gain part of the distribution in Part II of Form 4972. Page 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. 2021 Instructions for Schedule D (2021) | Internal Revenue ... Complete this worksheet only if line 18 or line 19 of Schedule D is more than zero and lines 15 and 16 of Schedule D are gains or if you file Form 4952 and you have an amount on line 4g, even if you don’t need to file Schedule D. Otherwise, complete the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Forms 1040 and ...

Publication 590-A (2021), Contributions to Individual ... If you are filing a joint return and your compensation is less than your spouse's, include your spouse's compensation reduced by his or her traditional IRA and Roth IRA contributions for this year. If you file Form 1040, 1040-SR, or 1040-NR, don’t reduce your compensation by any losses from self-employment: 5. _____ 6.

0 Response to "43 1040 qualified dividends and capital gains worksheet"

Post a Comment