43 seller closing costs worksheet

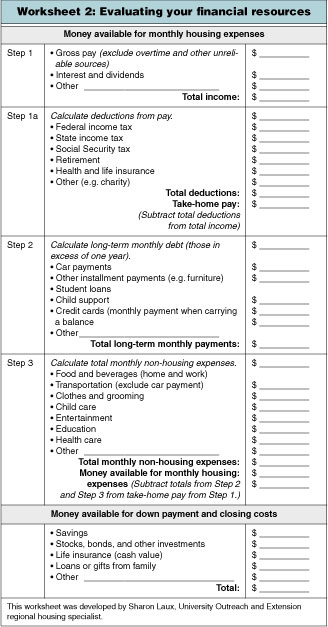

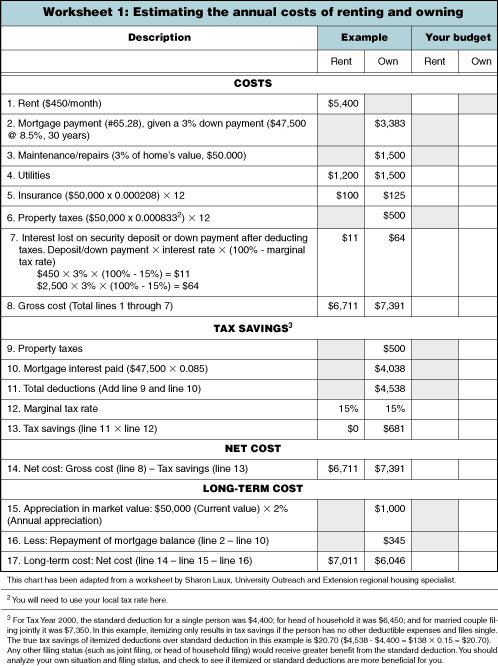

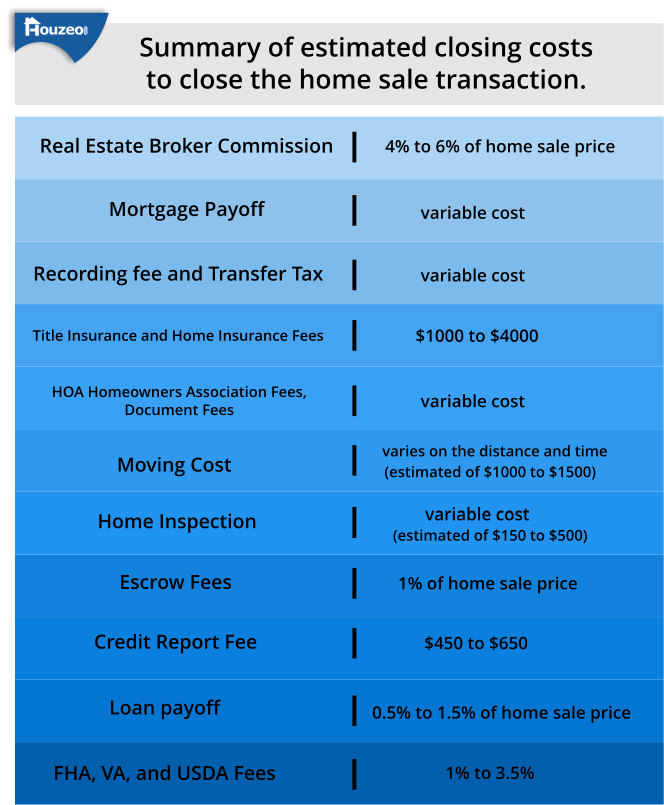

Florida Seller Closing Cost Calculator (2022 Data) - Anytime Estimate Florida sellers should expect to pay closing costs between 6.25-9.0% of the home's final selling price, including real estate agent commissions. Based on the median home value in Florida ($388,635), [1] that's anywhere from $23,290-34,980. Florida seller closing costs can vary considerably by county and circumstance. Process For Closing Costs, Down Payment, And Earnest Money Aug 31, 2022 · Paying earnest money, down payment, and closing costs. Buying a home usually occurs in stages. You’ll first provide an earnest money check to the escrow company, usually within three days of ...

Mortgage loan - Wikipedia A wraparound mortgage is a form of seller financing that can make it easier for a seller to sell a property. A biweekly mortgage has payments made every two weeks instead of monthly. Budget loans include taxes and insurance in the mortgage payment; [10] package loans add the costs of furnishings and other personal property to the mortgage.

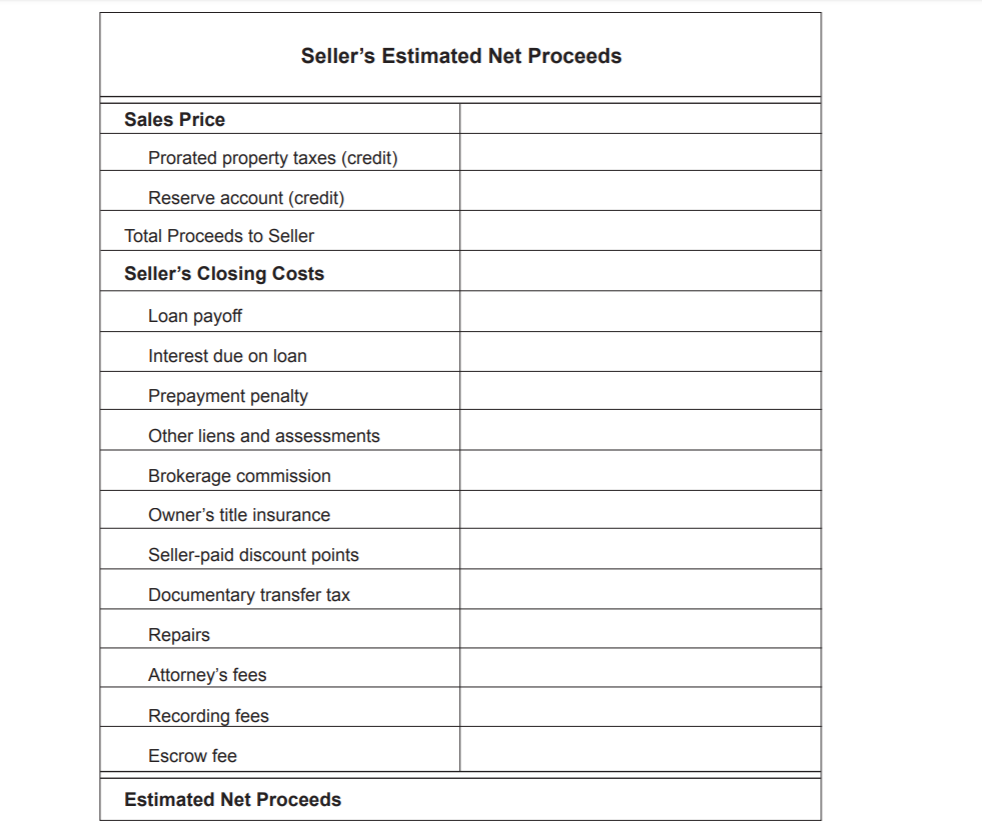

Seller closing costs worksheet

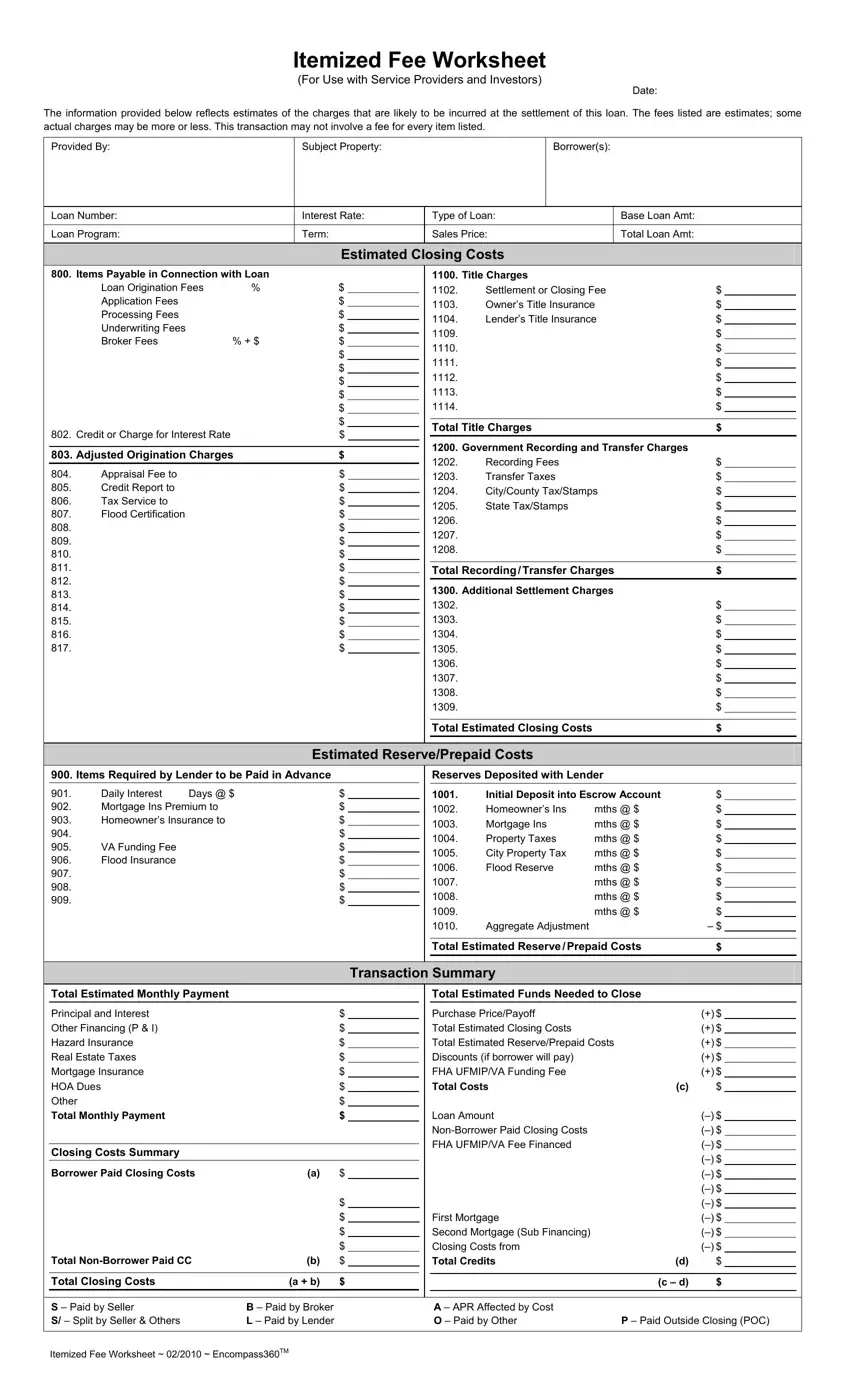

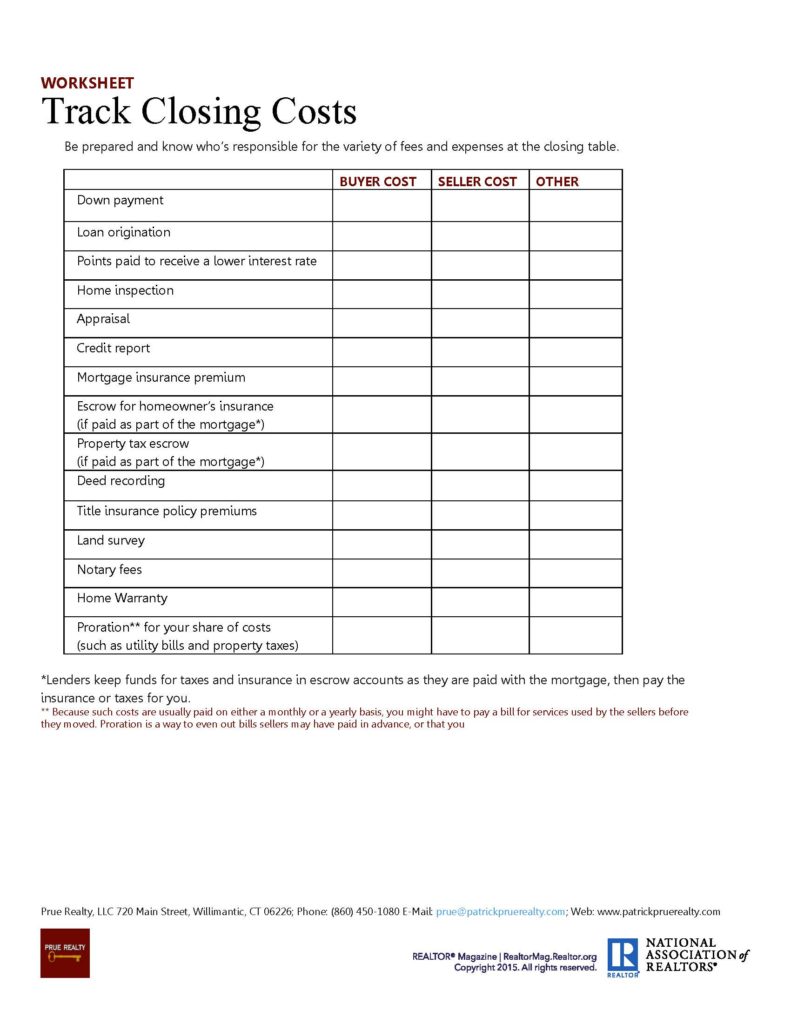

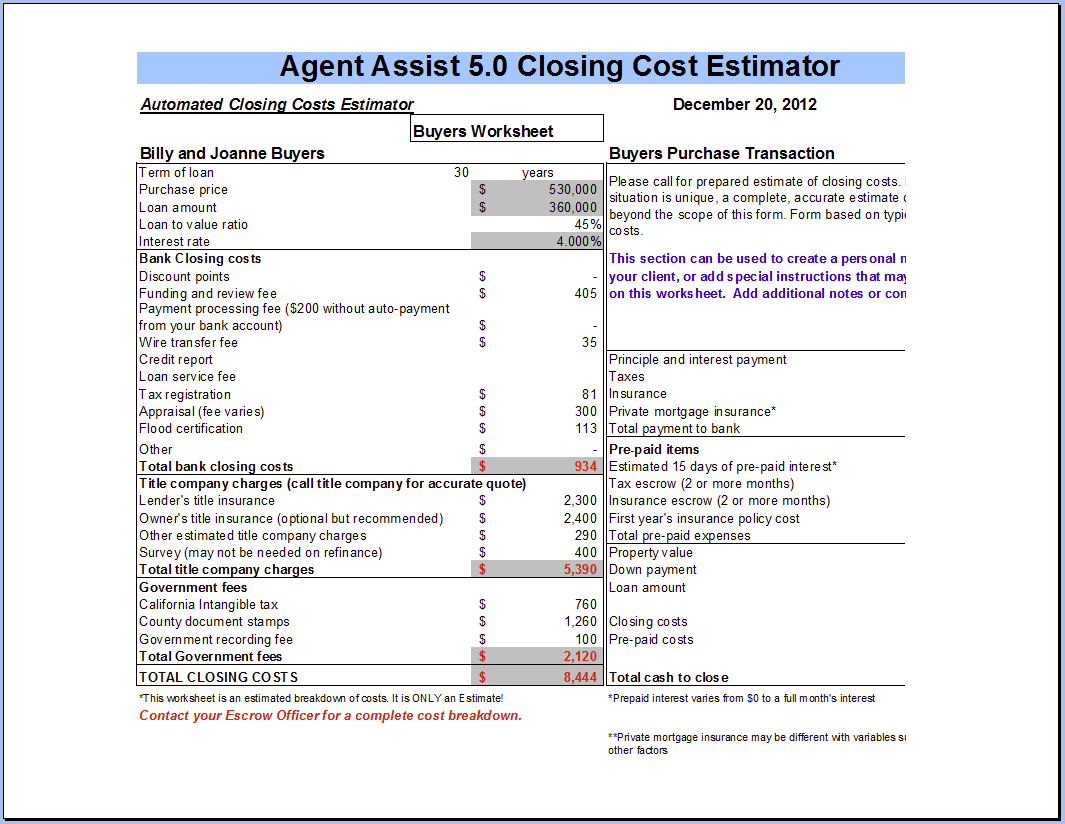

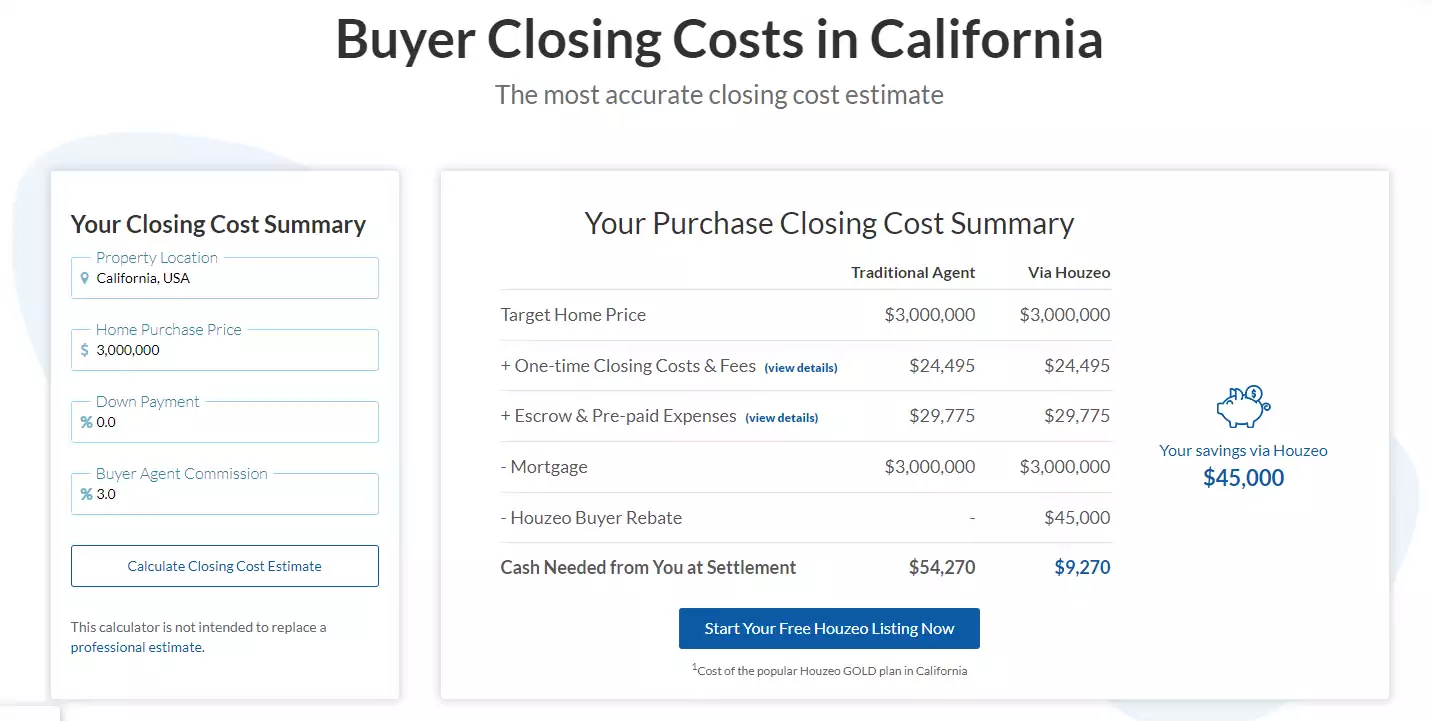

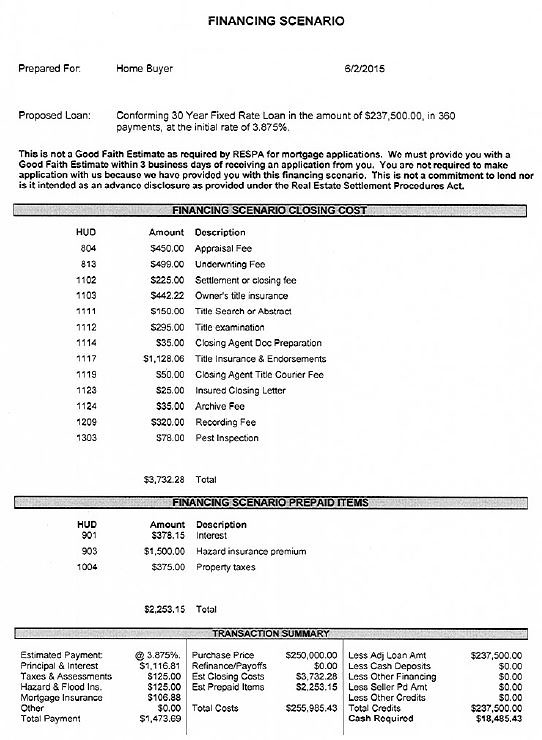

Seller Closing Cost Calculator - Mortgage Calculator Seller Closing Cost Calculator The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. Simply enter your sales price, mortgage information & closing date and we'll estimate your totals. Sellers Net Sheets Closing Fees Florida - agentfreebies.com A. PROFESSIONAL FEE: Commission at Closing. ( or % of Sale Price ) Broker Processing Fee. B. TITLE CLOSING COSTS: Owners Title Insurance. $5.75 per $1,000 for first $100,000. then $5.00 per $1,000 up to $1,000,000. Settlement/Closing Fee. Closing Costs Calculator - Estimate Closing Costs at Bank of America What are closing costs? Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about 3-5% of your loan amount and are usually paid at closing. What is included in closing costs? While each loan situation is different, most closing costs typically fall into four categories:

Seller closing costs worksheet. Publication 936 (2021), Home Mortgage Interest Deduction In the year paid, you can deduct $1,750 ($750 of the amount you were charged plus the $1,000 paid by the seller). You spread the remaining $250 over the life of the mortgage. You must reduce the basis of your home by the $1,000 paid by the seller. Complete Guide to Closing Costs | My Mortgage Insider Closing cost breakdown This table shows estimated closing costs for a $250,000 conventional loan in Washington state. Closing costs are based on your loan type, loan amount, lender and geographical area; your costs will likely look different. Lender fees Seller Net Sheet Explainer: Projecting Real Estate Proceeds A seller's net sheet removes much of the mystery surrounding how much money you'll actually receive from selling your home. As a high-level rule of thumb, sellers can expect to pay between 6-10% of the final sale price in commissions and closing costs. The net sheet helps you see exactly where that money is going. Seller Closing Costs in Nebraska | Closing Cost Calculator - Houzeo Get a quick, accurate estimate by using Houzeo's closing cost calculator which allows you to estimate your seller closing costs in Nebraska in a few clicks! We use local tax and fee data to find your savings. Products . IntelliList Listing Management ... Closing Costs Worksheet. Detailed breakdown of your costs.

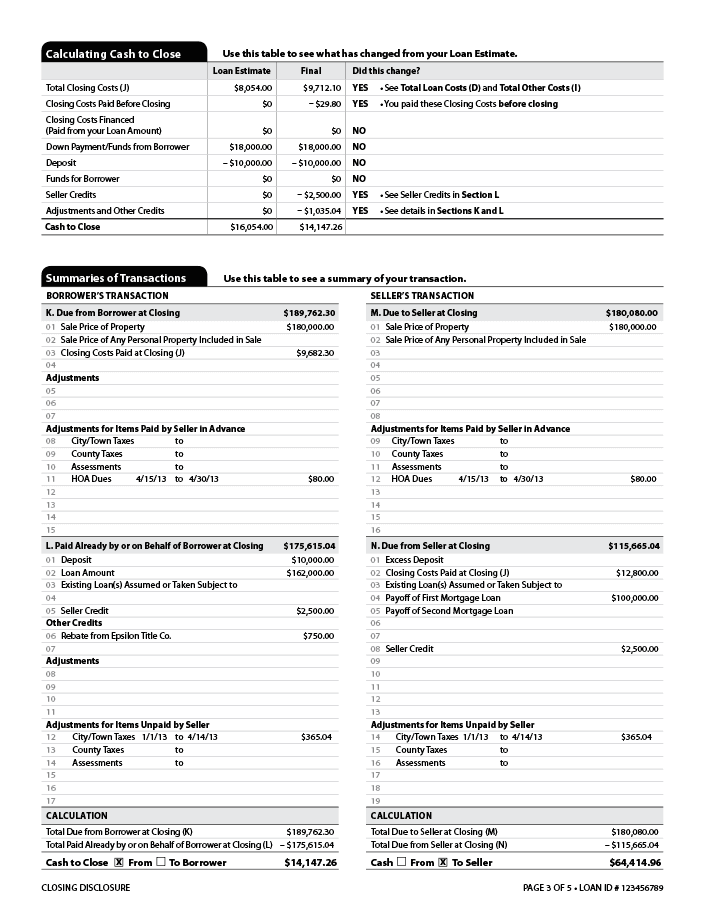

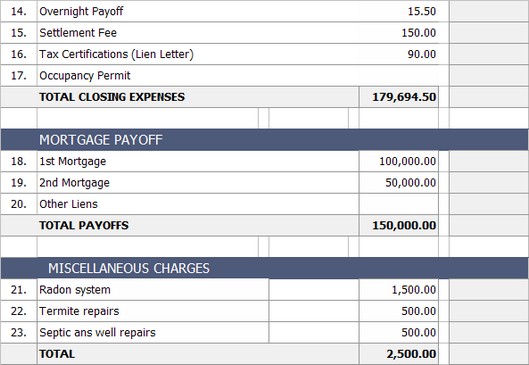

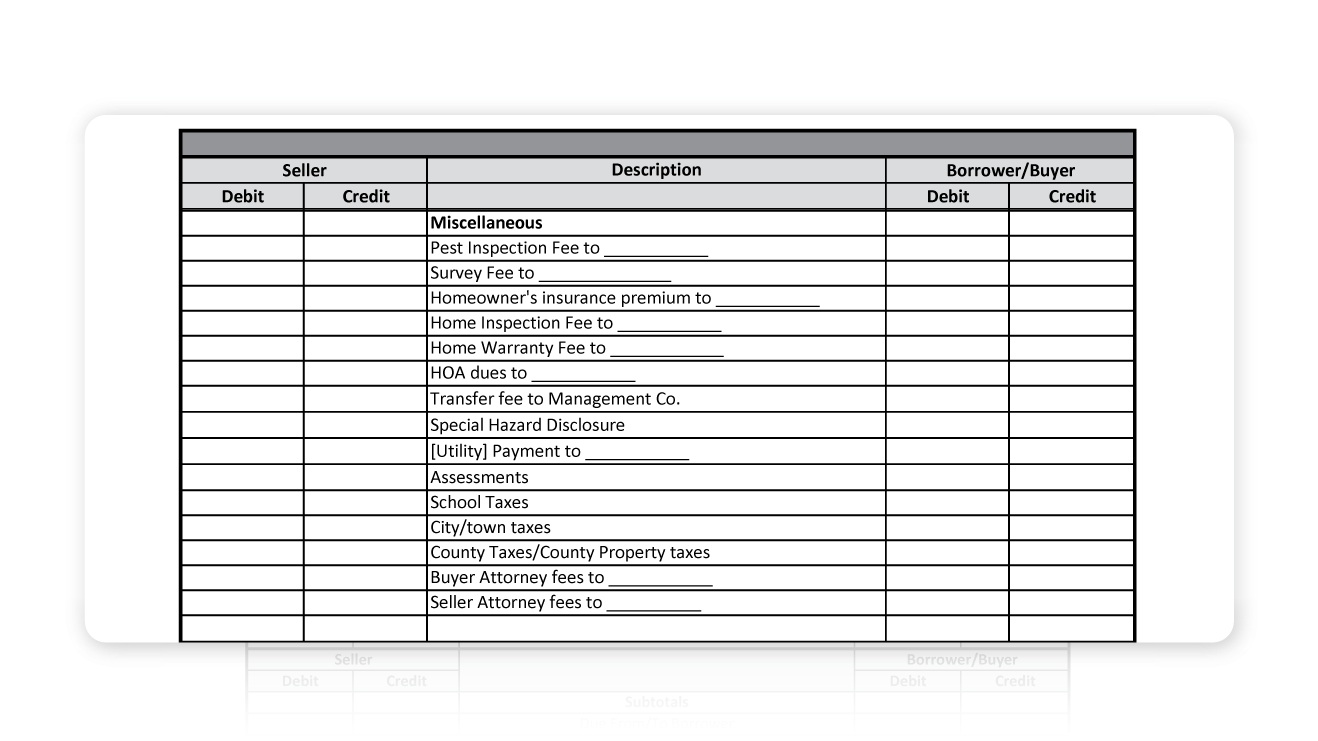

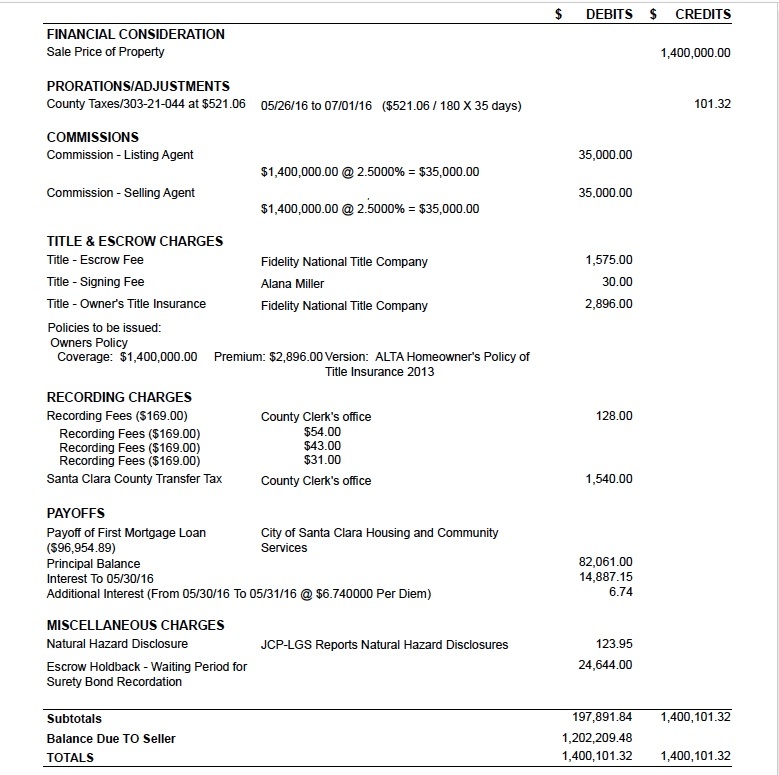

How Much Are Closing Costs for Sellers? | Zillow - Home Sellers Guide Closing costs for sellers The average closing costs for a seller total roughly 8% to 10% of the sale price of the home, or about $19,000-$24,000, based on the median U.S. home value of $244,000 as of December 2019. Seller closing costs are made up of several expenses. Here's a quick breakdown of potential costs and fees: Agent commission How to Read a Settlement Statement: Real Estate Closing Help Let's say the buyer put down a $7,000 earnest money deposit on a $100,000 home. The listing agent and buyer's agent are both owed 3% of the sale price, or a total of 6% ($6,000) at closing. That leaves $1,000 in "excess deposit" that will be paid back to the seller. PDF Home Buyer's Closing Cost Worksheet - Allstate Cost range is $40 - 60. $ Important: You can use this worksheet to get a rough cost estimate of the typical closing, but please consult an attorney for a comprehensive estimate designed specifically for your situation. Keep in mind that some of the closing costs may be paid to either the seller or added to your mortgage. TOTAL: $ Disclaimer Sellers Net Sheet Calculator - TitleSmart, Inc. Closing Fee ($325-$500) Broker Administration Fee Document Preparation Fees ($150-$300) State Deed Tax Seller Paid Closing Costs for Buyer County Conservation Fee Home Warranty Courier Fees/Payoff Processing ($50 per payoff) Work Orders Association Dues owing at closing Association Disclosure/Dues Letter Misc. Costs to Seller

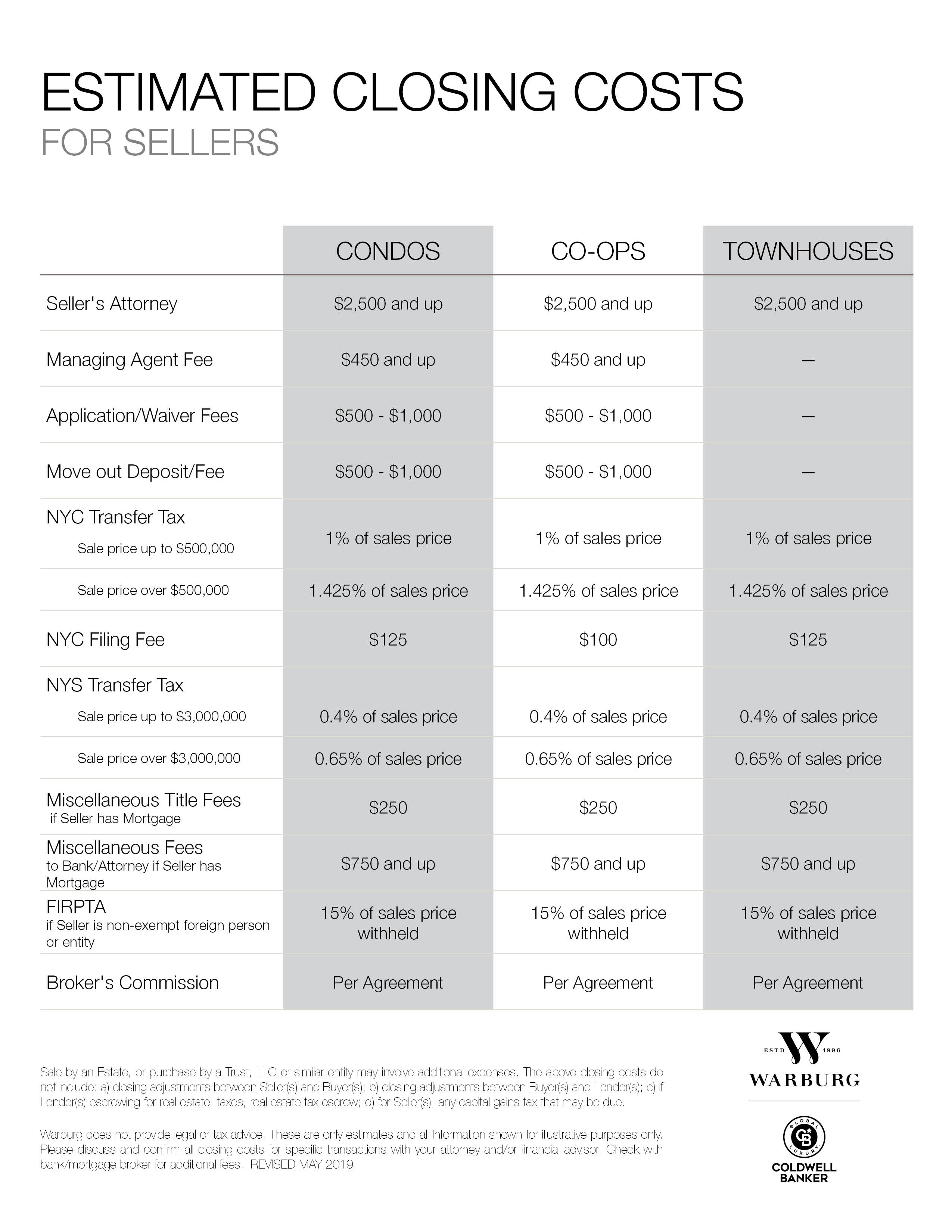

Publication 530 (2021), Tax Information for Homeowners Settlement or closing costs. If you bought your home, you probably paid settlement or closing costs in addition to the contract price. These costs are divided between you and the seller according to the sales contract, local custom, or understanding of the parties. Seller Paid Closing Costs in Florida | How Much Closing Costs For Sellers So, here's how we calculate what Happy Home Seller will owe at closing - Divide $3,500 (annual taxes) by 365 days (days per year) to get the daily rate = $9.589 per day Prorate the number of days until closing (January 31 days + February 27 days) = 58 days Seller Closing Costs: Here's What You Need to Know - Real Estate Witch Here are the most common closing costs that sellers face at closing, along with how much each typically costs. Closing Fee. Average Cost. Realtor commission. 5.5% to 6% of sale price. Transfer taxes and recording fees. 0% to 1% of sale price. Owner's title insurance. 0.1% to 0.5% of sale price. Closing Cost Calculator for Sellers | Home Sale Proceeds - Casaplorer How Much Are Seller Closing Costs? Seller closing costs can range from 8% to 10% of the home selling price. On a $500,000 home, this can be between $40,000 and $50,000 in closing costs. Although this is a lot, there are several categories of expenses that can change based on location, negotiation, and specific situations.

Sellers Estimated Costs of Sale Worksheet (P1) Inspections and obligations. Presenting your home to buyers. Showing your home. Completing the sale. Seller responsibilities. Seller estimated "Costs of Sale" worksheet (page 1) Seller estimated "Costs of Sale" worksheet (page 2) Parent's checklist. Information herein believed to be accurate but not warranted.

Closing Costs Calculator - SmartAsset The best guess most financial advisors and websites will give you is that closing costs are typically between 2% and 5% of the home value. True enough, but even on a $150,000 house, that means closing costs could be anywhere between $3,000 and $7,500 - that's a huge range!

Sellers Net Sheet Calculator - Independence Title Sellers Net Sheet Calculator. This tool is intended to help property owners with a reasonable estimate of closing costs and net proceeds from the sale of their property. For a more detailed estimate specific to your transaction, please contact your Independence Title Escrow Officer. Please complete all of the fields and press calculate. You ...

Closing Costs for Seller: FAQ & Calculator - Sundae If you include real estate agent commissions, closing costs for seller add up to anywhere between 6 and 10 percent of your home's sale price. But factoring in only costs separate from agent fees, sellers should expect to pay anywhere from 1 to 3 percent.

How Much Are Closing Costs for Sellers in California? - Clever Real Estate On average, sellers in California can expect to pay 3.45% of their home's final sale price in closing costs. For a $775,876 home — the median home value in California — you'd pay around $26,799. Realtor commission fees are also paid at closing and are usually the biggest expense for sellers in California. However, this is also the one fee ...

Mortgages | Understanding Seller Credits To Closing Costs ... Closing Costs & Prepaids = $5,000. Seller Credit To Closing Costs = $0. Seller Credit To Closing Costs = $5,000. Total Out Of Pocket Costs for Borrower = $12,000. Total Out Of Pocket Costs for Borrower = $7,175. Net Savings In Cash For Borrower = $4,825

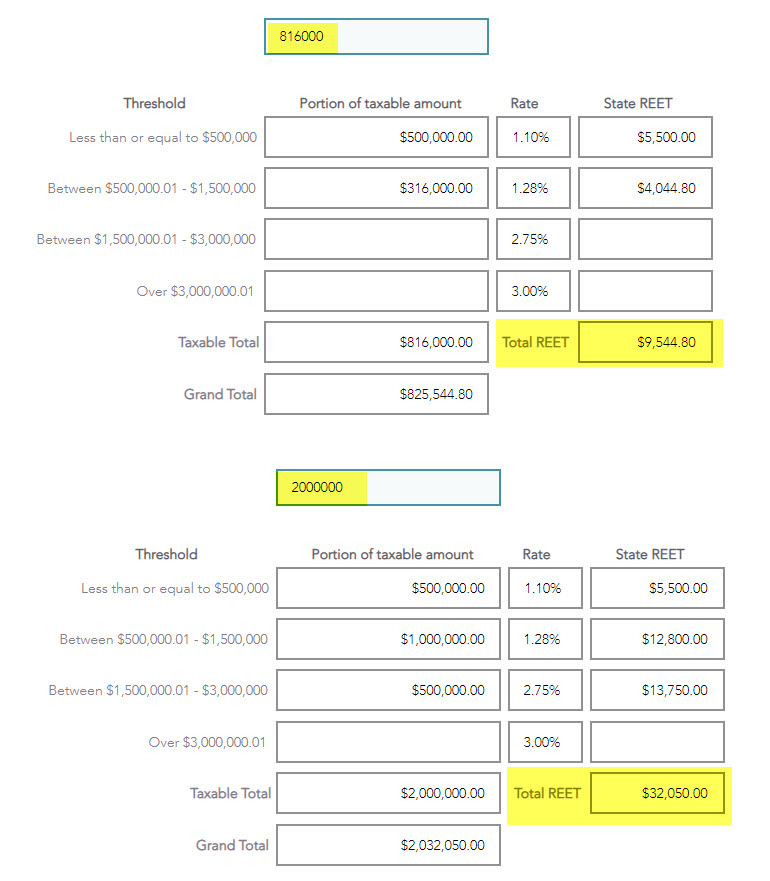

Seller's Closing Cost (Minnesota) Calculator - theWEBcentric.com Title. Sale Price. Minnesota County. Anoka Carver Dakota Hennepin Ramsey Scott Waseca Washington Winona Wright All Others. Title Service Fees. Closing Fee. $300.00.

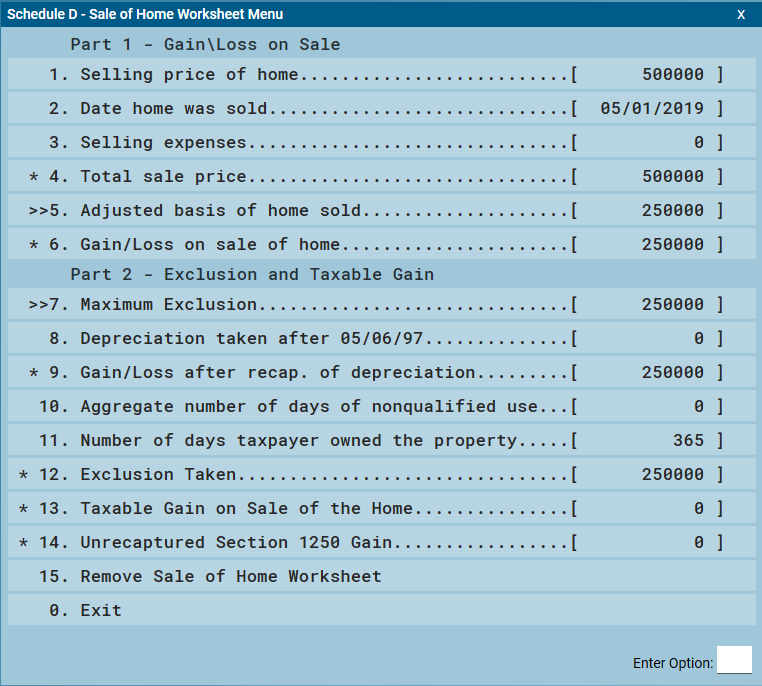

XLS Free Closing Cost Calculator - Freedom Mentor Seller Instruction - If this real estate was your principal residence, file form 2119, Sale or Exchange of Principal Residence, for any gain, with your income tax return; for other trasnsations, complete the applicable parts of form 4797, Form 6252 and/or Schedule D (Form 1040) ... Free Closing Cost Calculator Subject: Closing Costs Author ...

Closing Costs for Sellers: 5 Common Fees - realtor.com One of the larger closing costs for sellers at settlement is the commission for the real estate agentsinvolved in the real estate transaction. Commissions on real estate are negotiable and vary...

How Much Are Closing Costs for Sellers in Arkansas? - Clever Real Estate On average, sellers in Arkansas can expect to pay 3.31% of their home's final sale price in closing costs. For a $180,819 home — the median home value in Arkansas — you'd pay around $5,988. Realtor commission fees are also paid at closing and are usually the biggest expense for sellers in Arkansas.

Closing Costs For Seller | Closing Cost Calculator | Houzeo $35,299 Your savings via Houzeo $35,299 Start Your Free Listing Now Seller Closing Cost Calculator Where's your property?* What's your expected sale price?* If you have a mortage, enter estimated loan balance Seller Agent Commission Buyer Agent Commission Ready to see your closing costs estimate? Calculate My Closing Costs

Seller's Net Sheet & Seller's Costs | MortgageMark.com The seller's closing costs will be provided by the title company. The seller's fees in Texas typically consist of: settlement closing fee for $300 (ish), document prep fee for $250 (ish), courier fee estimated at $40 (ish), tax cert for $38 (ish), recording fee for $40 (ish), and a state guarantee fee for a whopping $2.

PDF Closing Cost Estimation Worksheet - Blue Water Mortgage TOTAL CLOSING COSTS OTHER COSTS CLOSING COSTS (approximately $150 - $400) (NH - .75% of Purchase Price, ME - .22% of Purchase Price, MA - N/A) (approximately .5% to 1% of the Loan) This "Fees Worksheet" is provided for informational purposes only, to assist you in determining an estimate of cash that may be required

Florida Seller Closing Cost Worksheet - BrowardResidential.com Here's a list of the customary closing costs paid by Sellers in Florida real estate transactions. 1. Real Estate Commissions: 3% to the Listing Agent and 3% to the Buyer's Agent or Selling Agent. Sometimes the listing agent is the same as the buyer's agent.

Seller Closing Cost Calculator for Texas (2022 Data) - Anytime Estimate Seller closing costs in Texas typically range between 7.7%-8.7% of your home's purchase price, which includes realtor commission fees (6% average). That average can provide a rough estimate of your total costs at closing, but your listing agent can give you a more accurate estimate. Learn more about calculating Texas closing costs. ARTICLE SOURCES

Instructions for Form 1120-IC-DISC (12/2021) | Internal ... However, for start-up or organizational costs paid or incurred before September 9, 2008, the corporation is required to attach a statement to its return to elect to deduct such costs. For more details, including special rules for costs paid or incurred before September 9, 2008, see the Instructions for Form 4562. Also see Pub. 535, Business ...

PDF CLOSING COSTS - Keller Williams Realty CLOSING COSTS Here is a list of the expenses typically incurred by the buyer of residential property. LEGAL FEES Legal fees vary; ask your lawyer so you can budget accordingly. Seller > $700 - $800 Buyer > $1,200 - $1,300 ADJUSTMENTS The annual real estate taxes will be apportioned to the seller and buyer as of the date of closing. If the seller

Closing Costs Calculator - Estimate Closing Costs at Bank of America What are closing costs? Closing costs, also known as settlement costs, are the fees you pay when obtaining your loan. Closing costs are typically about 3-5% of your loan amount and are usually paid at closing. What is included in closing costs? While each loan situation is different, most closing costs typically fall into four categories:

Sellers Net Sheets Closing Fees Florida - agentfreebies.com A. PROFESSIONAL FEE: Commission at Closing. ( or % of Sale Price ) Broker Processing Fee. B. TITLE CLOSING COSTS: Owners Title Insurance. $5.75 per $1,000 for first $100,000. then $5.00 per $1,000 up to $1,000,000. Settlement/Closing Fee.

Seller Closing Cost Calculator - Mortgage Calculator Seller Closing Cost Calculator The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. Simply enter your sales price, mortgage information & closing date and we'll estimate your totals.

![Seller Closing Cost Calculator Florida [Interactive] | Hauseit®](https://i.ytimg.com/vi/EN3E1q0d9t4/hqdefault.jpg)

![Comprehensive NYC closing Costs Guide [PDF download]](https://kohinalaw.com/wp-content/uploads/2018/05/Flyer-791x1024.jpg)

![Seller Closing Cost Calculator Florida [Interactive] | Hauseit®](https://www.hauseit.com/wp-content/uploads/2021/04/Seller-Closing-Cost-Calculator-Florida.jpg)

0 Response to "43 seller closing costs worksheet"

Post a Comment