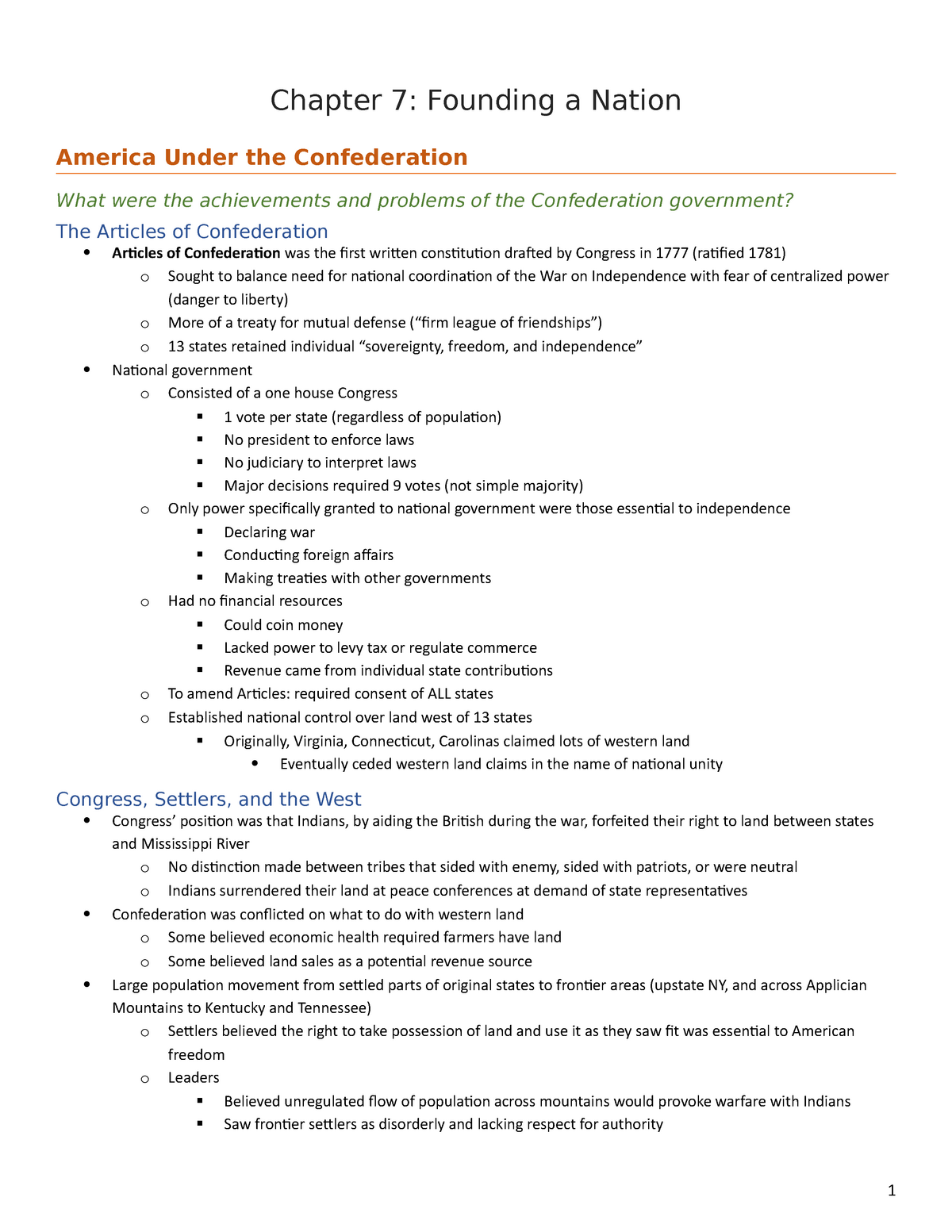

39 chapter 7 section 3 money and elections worksheet answers

Publication 3 (2021), Armed Forces' Tax Guide WebPublication 3 - Introductory Material What's New Reminders Introduction. Due date of return. File Form 1040 or 1040-SR by April 18, 2022. The due date is April 18, instead of April 15, because of the Emancipation Day holiday in the District of Columbia—even if you don’t live in the District of Columbia. CNN 10 - CNN WebNov 17, 2022 · CNN 10 is an on-demand digital news show ideal for explanation seekers on the go or in the classroom.

Achiever Papers - We help students improve their academic … WebAll our papers are original as they are all written from scratch. We also do not re-use any of the papers we write for our customers. With this guarantee feel comfortable to message us or chat with our online agents who are available 24hours a day and 7 days a week be it on a weekend or on a holiday. We offer 24/7 essay help for busy students

Chapter 7 section 3 money and elections worksheet answers

Publication 550 (2021), Investment Income and Expenses WebComments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. The Learning Network - The New York Times WebTeach and learn with The Times: Resources for bringing the world into your classroom Publication 535 (2021), Business Expenses | Internal Revenue … WebThe general rules for deducting business expenses are discussed in the opening chapter. The chapters that follow cover specific expenses and list other publications and forms you may need. ... Getting answers to your tax questions. ... attach a statement titled “Section 1.263(a)-3(n) Election” to your timely filed original tax return ...

Chapter 7 section 3 money and elections worksheet answers. Personal Finance Advice - Personal Financial Management - MarketWatch Personal finance advice and articles to help you save money and plan for retirement. My siblings and I own land worth $1.2 million. My sister wants to build a house on it. State of Oregon: FAQ - Frequently asked questions WebGenerally, no. However, if the IRS grants the employee an exemption, DOR will honor the exemption. To receive an exemption, the employee must file federal Form 8233 with you. If any portion of the employee’s wages are not exempt, use the employee’s Form OR-W-4 elections to withhold on those non-exempt wages. Advise employees to follow the ... Publication 542 (01/2022), Corporations | Internal Revenue Service WebGetting answers to your tax questions. ... For more information, see Exploration Costs and Development Costs in chapter 7 of Pub. 535. For more information on corporate preference items, see section 291 of the Internal Revenue Code. ... 8023 —Elections Under Section 338 for Corporations Making Qualified Stock Purchases: U.S. News: Breaking News Photos, & Videos on the United States - NBC News WebFind the latest U.S. news stories, photos, and videos on NBCNews.com. Read breaking headlines covering politics, economics, pop culture, and more.

Publication 535 (2021), Business Expenses | Internal Revenue … WebThe general rules for deducting business expenses are discussed in the opening chapter. The chapters that follow cover specific expenses and list other publications and forms you may need. ... Getting answers to your tax questions. ... attach a statement titled “Section 1.263(a)-3(n) Election” to your timely filed original tax return ... The Learning Network - The New York Times WebTeach and learn with The Times: Resources for bringing the world into your classroom Publication 550 (2021), Investment Income and Expenses WebComments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

0 Response to "39 chapter 7 section 3 money and elections worksheet answers"

Post a Comment