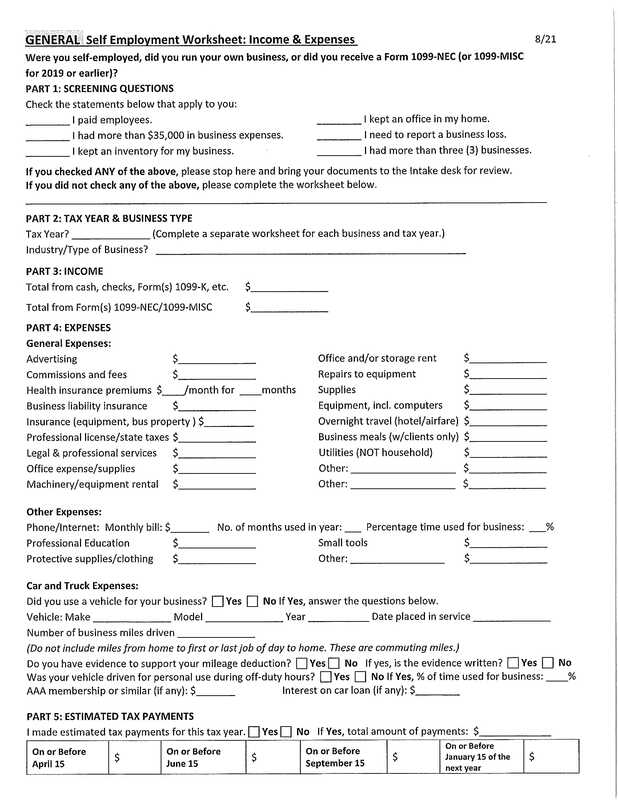

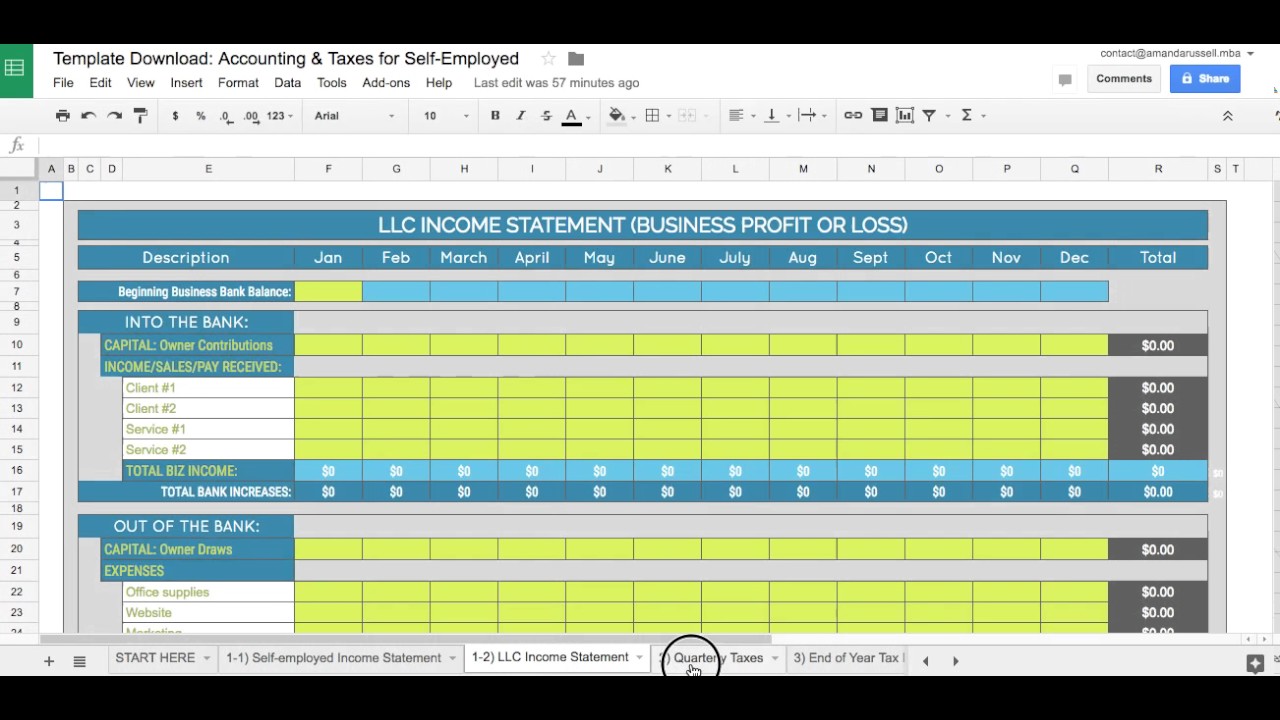

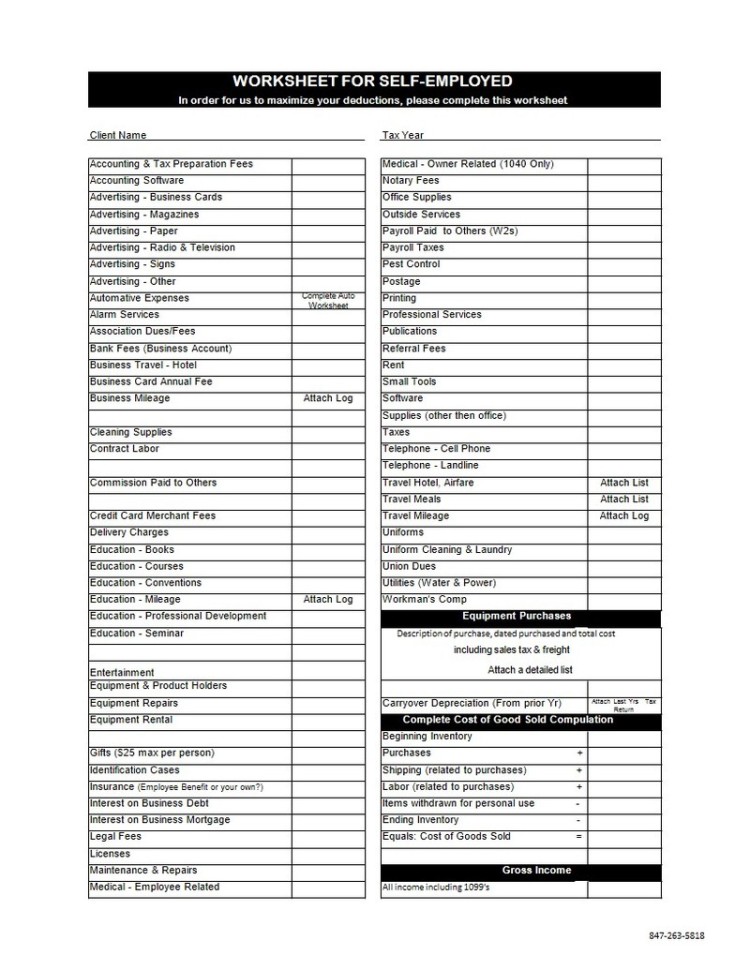

41 self employment expenses worksheet

› publications › p590aPublication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). › publications › p535Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

ttlc.intuit.comTax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics.

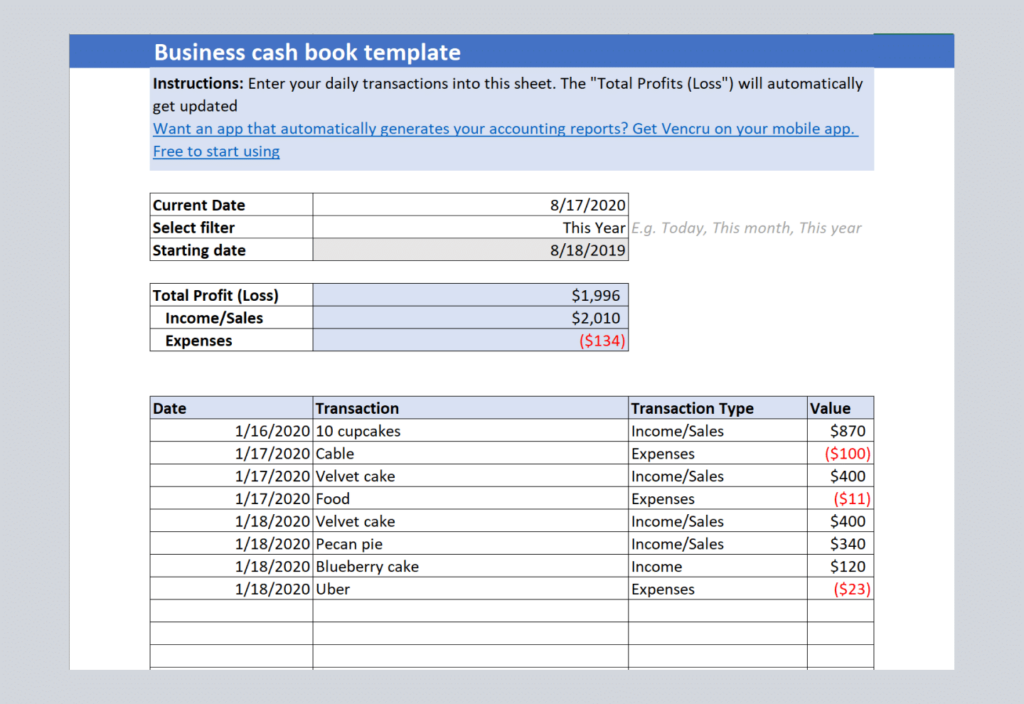

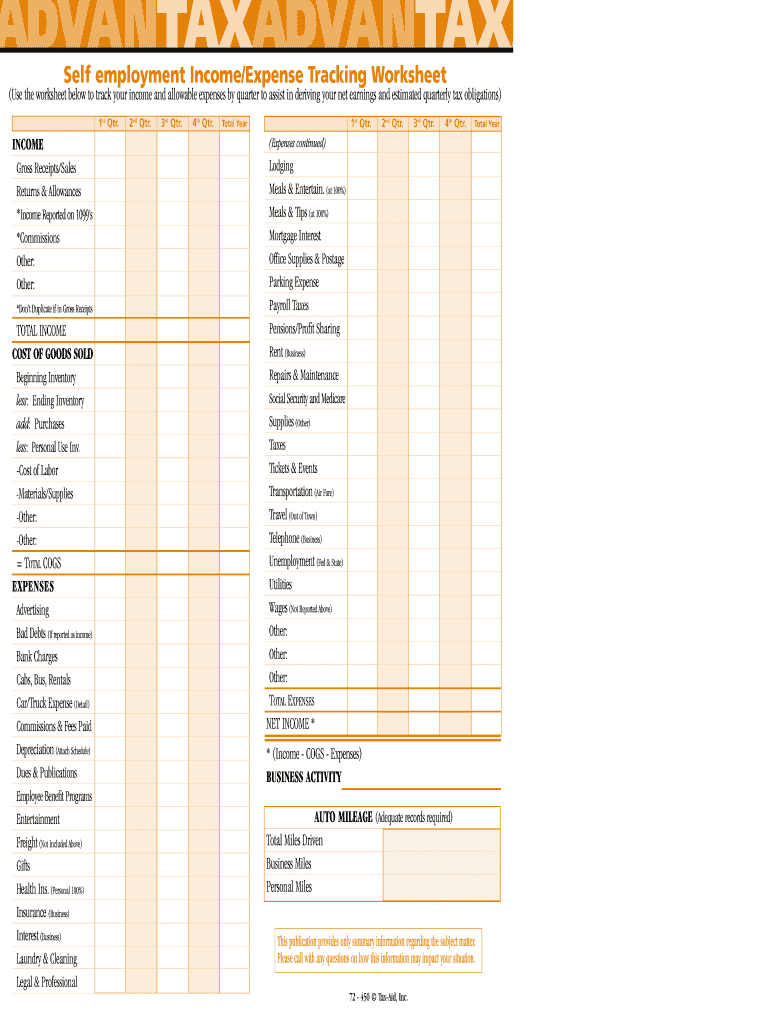

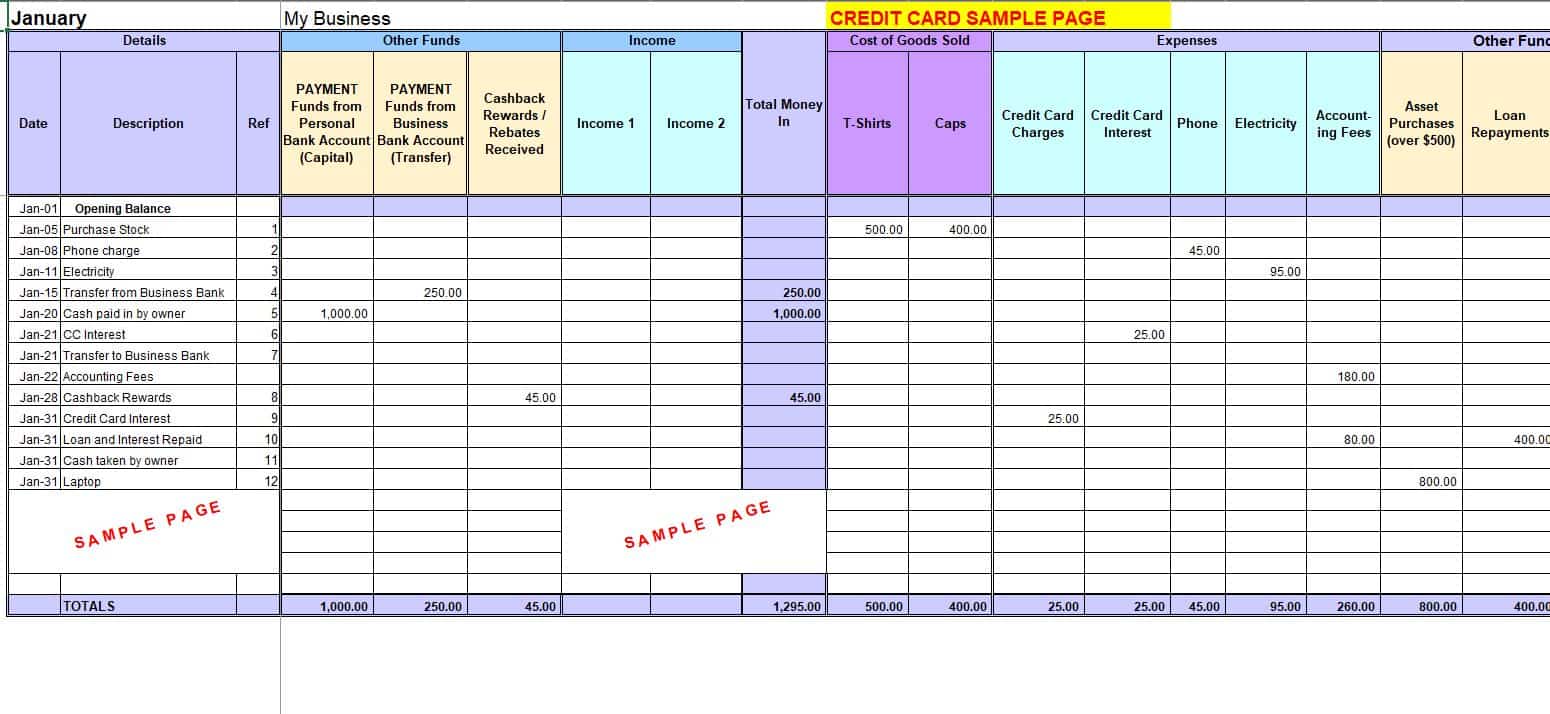

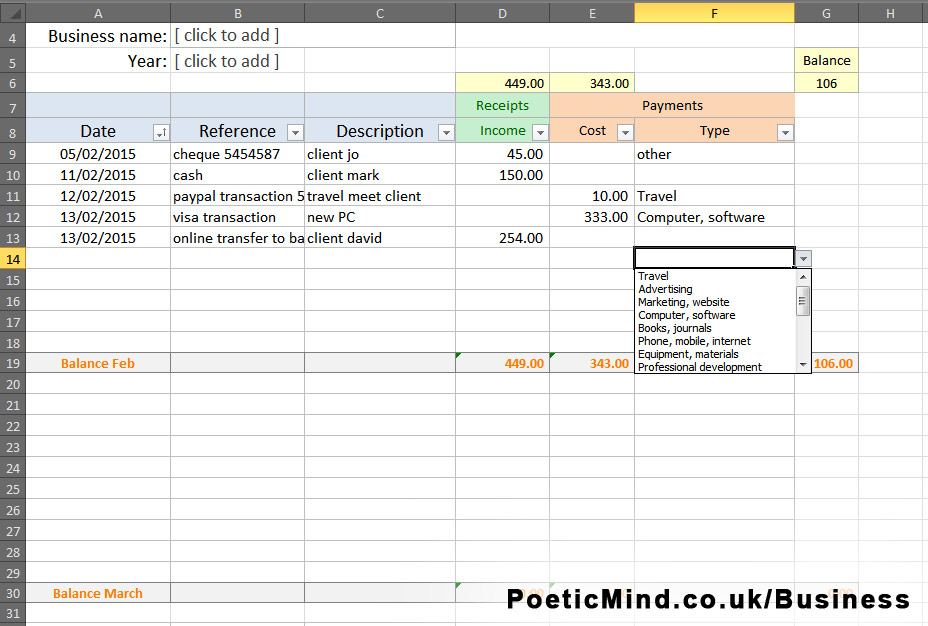

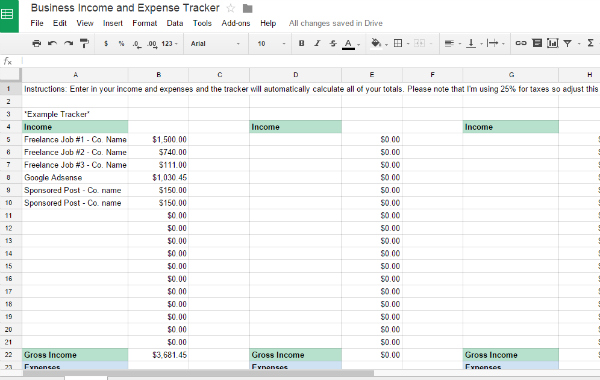

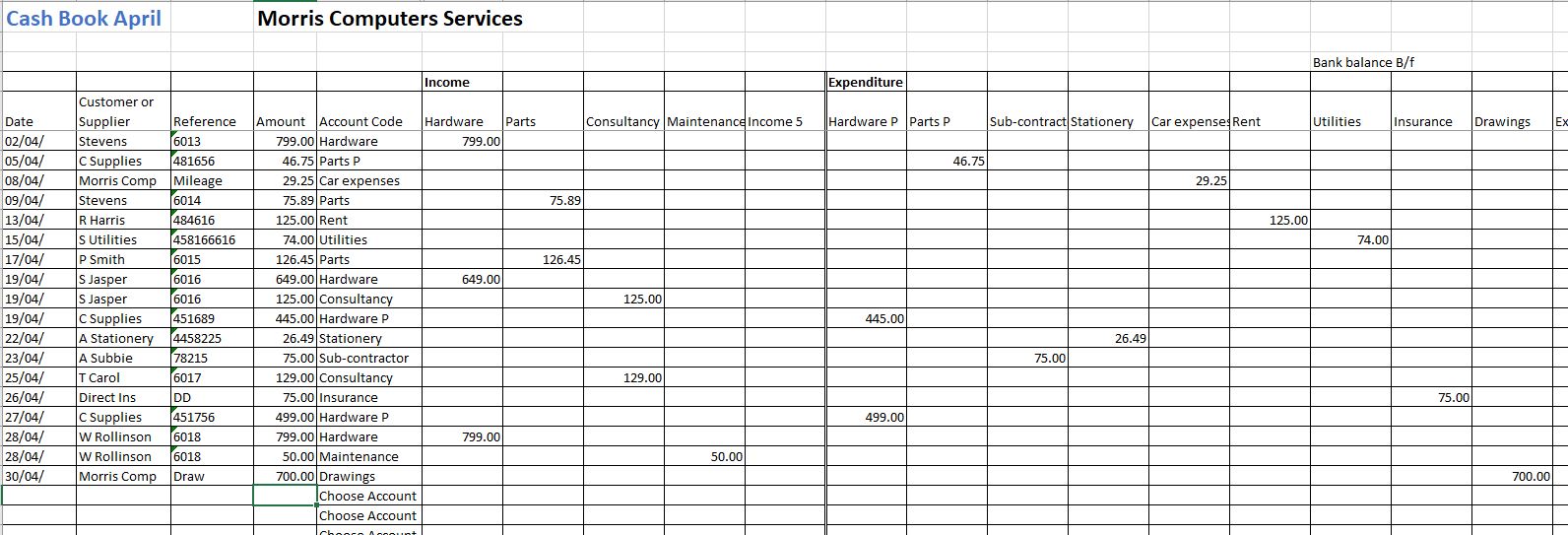

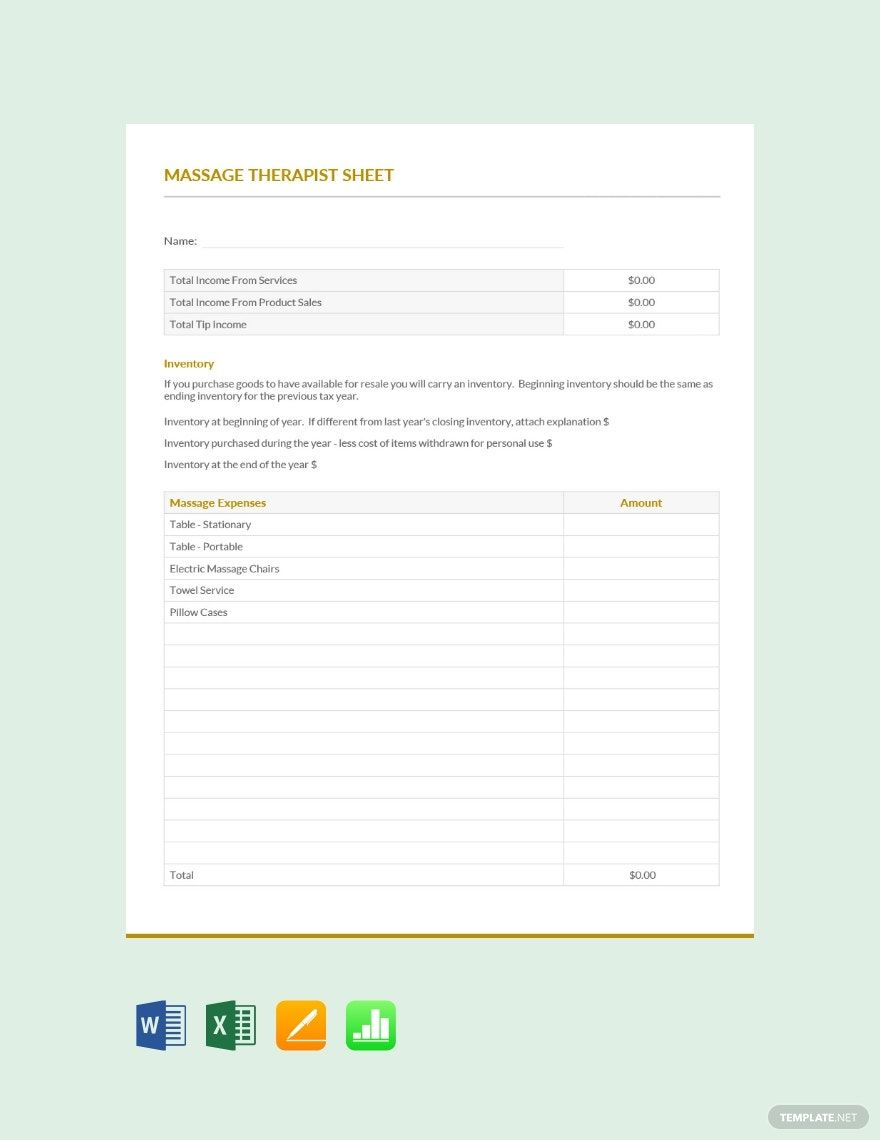

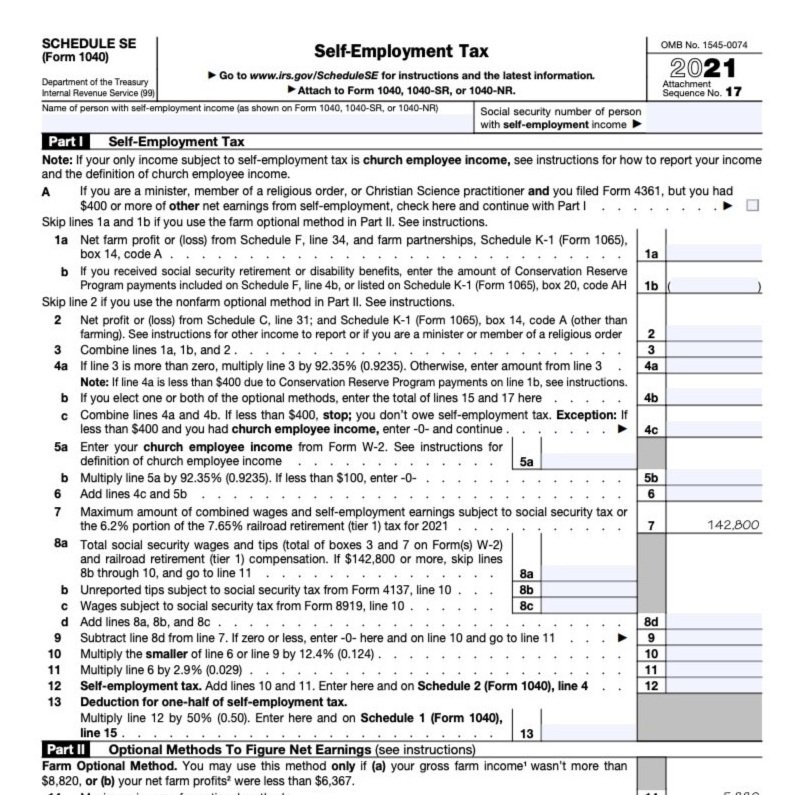

Self employment expenses worksheet

› taxtopics › tc554Topic No. 554 Self-Employment Tax | Internal Revenue Service Oct 13, 2022 · Reporting Self-Employment Tax. Compute self-employment tax on Schedule SE (Form 1040). When figuring your adjusted gross income on Form 1040 or Form 1040-SR, you can deduct one-half of the self-employment tax. You calculate this deduction on Schedule SE (attach Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF). › instructions › i1040sc2022 Instructions for Schedule C (2022) | Internal Revenue ... Federal income taxes, including your self-employment tax. However, you can deduct one-half of your self-employment tax on Schedule 1 (Form 1040), line 15 (but if filing Form 1040-NR, then only when covered under the U.S. social security system due to an international social security agreement). Estate and gift taxes. › oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site.

Self employment expenses worksheet. › pub › irs-pdf2022 Form 1040-ES - IRS tax forms self-employment) subject to the social security tax is $147,000. Adoption credit or exclusion. For 2022, the maximum adoption credit or exclusion for employer-provided . CAUTION! adoption benefits has increased to $14,890. In order to claim either the credit or exclusion, your modified adjusted gross income must be less than $263,410. Reminders › oes › currentMay 2021 National Occupational Employment and Wage Estimates Mar 31, 2022 · The .gov means it's official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you're on a federal government site. › instructions › i1040sc2022 Instructions for Schedule C (2022) | Internal Revenue ... Federal income taxes, including your self-employment tax. However, you can deduct one-half of your self-employment tax on Schedule 1 (Form 1040), line 15 (but if filing Form 1040-NR, then only when covered under the U.S. social security system due to an international social security agreement). Estate and gift taxes. › taxtopics › tc554Topic No. 554 Self-Employment Tax | Internal Revenue Service Oct 13, 2022 · Reporting Self-Employment Tax. Compute self-employment tax on Schedule SE (Form 1040). When figuring your adjusted gross income on Form 1040 or Form 1040-SR, you can deduct one-half of the self-employment tax. You calculate this deduction on Schedule SE (attach Schedule 1 (Form 1040), Additional Income and Adjustments to Income PDF).

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/6238fcf2e45bd9fa5a86e28d_schedule-c-categories.png)

0 Response to "41 self employment expenses worksheet"

Post a Comment