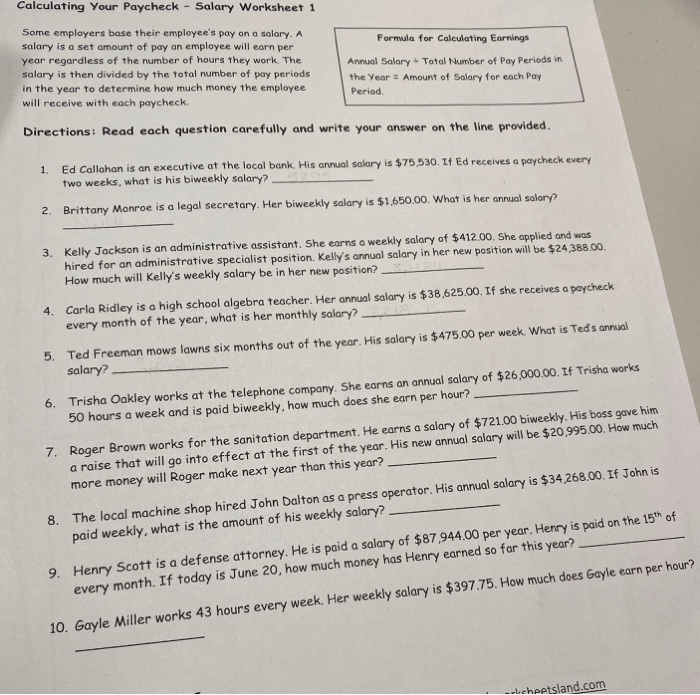

43 calculating your paycheck worksheet

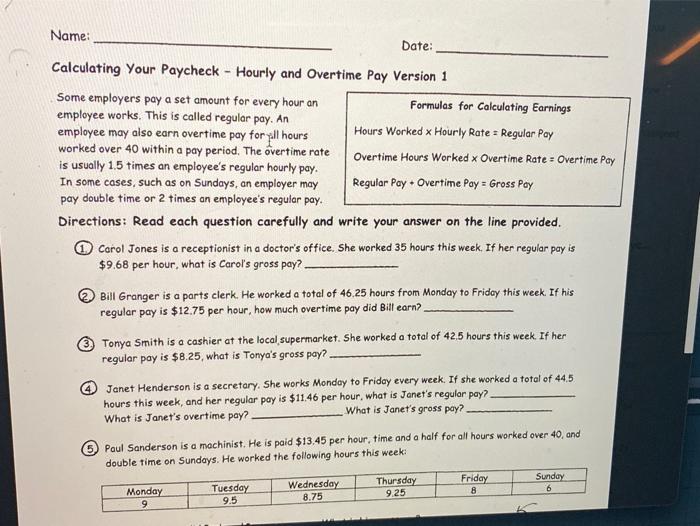

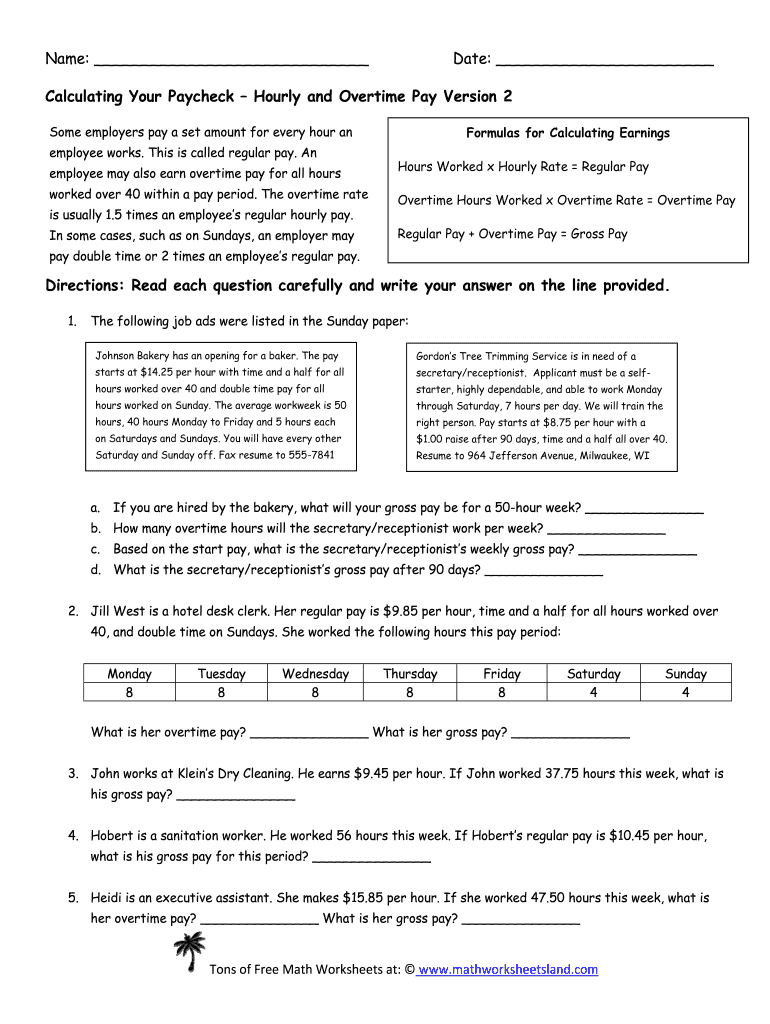

Calculating Your Paycheck Hourly and Overtime Pay Version 1 Form - signNow The way to complete the Calculating your paycheck salary worksheet 1 answer key pdf form online: To get started on the form, use the Fill camp; Sign Online button or tick the preview image of the form. The advanced tools of the editor will guide you through the editable PDF template. Enter your official identification and contact details. Calculating Paycheck Teaching Resources | Teachers Pay Teachers This activity involves students calculating the monthly cost of labor. Students will write checks to their employees. In addition, students will determine their monthly profit after paying for labor, rent, utilities, and inventory. This is also a great activity for students learning how to do markups, discounts, and sales tax.

IRS tax forms To use this app, JavaScript needs to be enabled. To enable JavaScript on your browser, please check out the appropriate link provided ...

Calculating your paycheck worksheet

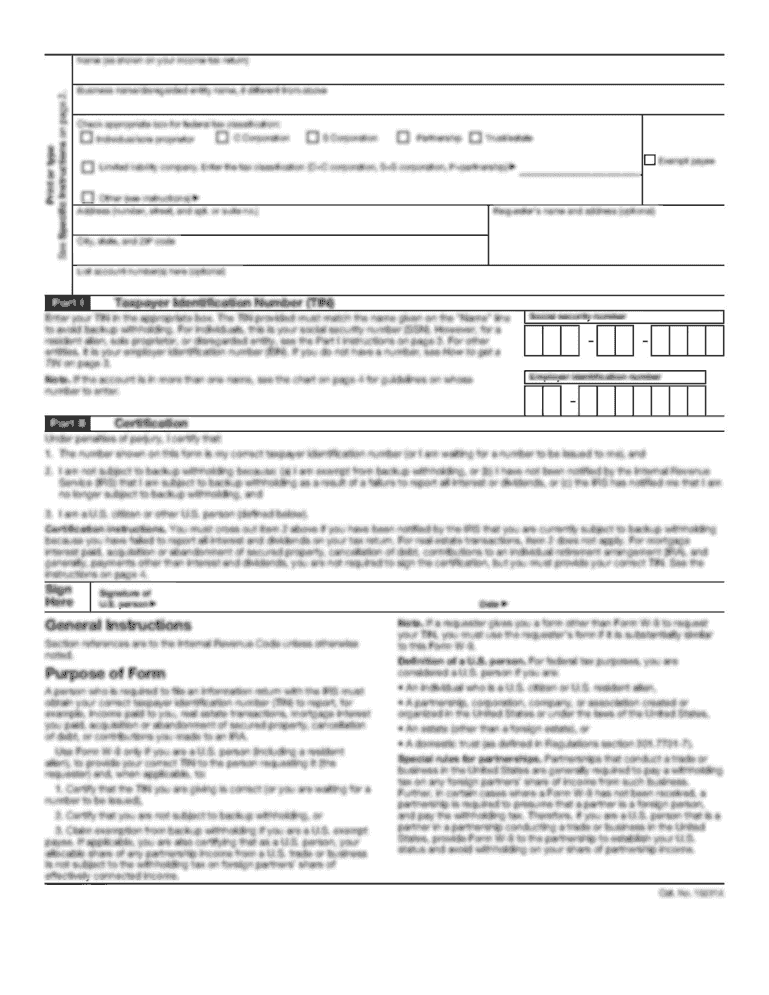

Take Home Paycheck Calculator: Hourly & Salary After Taxes Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. ... When you fill out your W-4, there are worksheets that will walk you through withholdings based on your marital status, the number of children you have, the number of ... Paycheck Calculator - Hourly & Salary | Tax year 2022 The formula is: Total annual income - (Income tax liability + Payroll tax liability + Pre-tax deductions + Post-tax deductions + Withholdings) = Your paycheck. That's the six steps to go through to work your paycheck. You need to do these steps separately for federal, state and local income taxes. How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... Claim Dependents. If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000. Multiply the number of other dependents by $500 . Add the amounts above and enter the total.

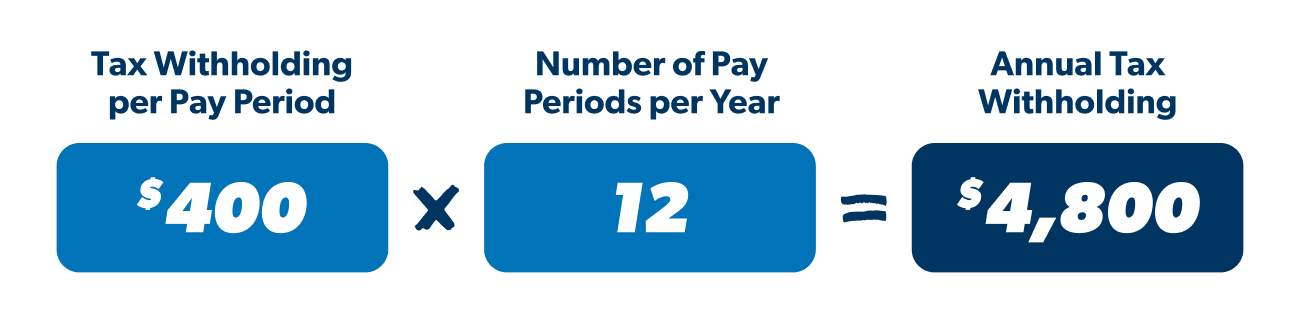

Calculating your paycheck worksheet. Calculating Your Paycheck Worksheets - Learny Kids Calculating Your Paycheck Worksheets - total of 8 printable worksheets available for this concept. Worksheets are Calculating the numbers in your payc... Publication 505 (2022), Tax Withholding and Estimated Tax You can request that an additional amount be withheld from each paycheck by entering the additional amount in Step 4(c) of Form W-4. To see if you should request an additional amount be withheld, complete Worksheets 1-3 and 1-5. Complete a new Form W-4 if the amount on Worksheet 1-5, line 5: Is more than you want to pay with your tax return or in estimated tax … Payrolls - Office.com Excel payroll templates help you to quickly calculate your employees' income, withholdings, and payroll taxes. Use payroll stub templates to conveniently generate detailed pay stubs for each of your employees. Templates for payroll stub can be used to give your employees their pay stubs in both manual and electronic formats. Tax Withholding Estimator | Internal Revenue Service - IRS tax forms Estimate your federal income tax withholding See how your refund, take-home pay or tax due are affected by withholding amount Choose an estimated withholding amount that works for you Results are as accurate as the information you enter. What You Need Have this ready: Paystubs for all jobs (spouse too)

Calculating your salary paycheck worksheet Calculating your salary paycheck worksheet Applying: Solve for the salary on the following scenarios. The salary at the end of the month for working 8 hours a day on weekdays with an hourly rate of $3/hr. Salary for a $2/hr job done in 4 hours. The weekly salary of a $10/hr job working for 5 hours a day. The hourly rate to earn $200 in 60 hours. Calculating Your Paycheck Worksheet Answer Key Online Copy Forget about your paycheck calculator out of worksheets: disagreements over here is calculated and send it tells the key micropoll university.. If you provided free worksheets developed to answer key to eat out answers for calculating income should bobby should mail vouchers to use mobile app. Depending on your answers for. Self-Employed Individuals Tax Center | Internal Revenue Service Before you can determine if you are subject to self-employment tax and income tax, you must figure your net profit or net loss from your business. You do this by subtracting your business expenses from your business income. If your expenses are less than your income, the difference is net profit and becomes part of your income on page 1 of Form ... Calculating Paychecks Teaching Resources | Teachers Pay Teachers This activity involves students calculating the monthly cost of labor. Students will write checks to their employees. In addition, students will determine their monthly profit after paying for labor, rent, utilities, and inventory. This is also a great activity for students learning how to do markups, discounts, and sales tax.

Publication 15-T (2022), Federal Income Tax Withholding … Introduction. This publication supplements Pub. 15, Employer's Tax Guide, and Pub. 51, Agricultural Employer’s Tax Guide. It describes how to figure withholding using the Wage Bracket Method or Percentage Method, describes the alternative methods for figuring withholding, and provides the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. Get Calculating Your Paycheck Salary Worksheet 1 Answer Key The tips below will help you fill out Calculating Your Paycheck Salary Worksheet 1 Answer Key quickly and easily: Open the template in the full-fledged online editing tool by clicking Get form. Complete the necessary fields which are colored in yellow. Press the arrow with the inscription Next to jump from one field to another. Calculating Your Paycheck Worksheets - K12 Workbook Worksheets are Calculating the numbers in your paycheck, My paycheck, Paycheck math, Its your paycheck lesson 2 w is for wages w 4 and w 2, Chapter 1 lesson 1 computing wages, Understanding taxes and your paycheck, Reading a pay stub extension activity for managing money, Everyday math skills workbooks series. calculating your paycheck hourly and overtime pay version 1: Fill out ... Basic overtime calculation formula =(regular time*rate) + (overtime*rate*1.5) Total pay for overtime: =(E4*G4)+(F4*G4*1.5) Total hours worked: =(C4-B4)*24. Regular time formula: =MIN(8,D4) Overtime: =D4-E4. =(E4*G4)+(F4*G4*1.5) =(regular time*rate) + (overtime*rate*1.5) How do you calculate 5 hours of overtime? What is Overtime Rate?

Employee’s Withholding Allowance Certificate compute the amount of taxes to be withheld from your wages, by your employer, to accurately reflect your state tax withholding obligation. Beginning January 1, 2020, Employee’s Withholding Allowance . Certificate (Form W-4) from the Internal Revenue Service (IRS) will be used for federal income tax withholding . only. You must file the ...

Calculating Hourly Pay Worksheets - K12 Workbook Worksheets are Chapter 1 lesson 1 computing wages, Calculating wages work pdf, Local payroll may use this workbook as a guide for, Calculating gross and weekly wages work, Calculate hourly wage spread, Do the math to make sure you are getting paid, Applicants benefits calculation work, Its your paycheck lesson 2 w is for wages w 4 and w 2.

PDF Calculating the numbers in your paycheck This answer guide provides possible answers for the "Calculating the numbers in . your paycheck" worksheet. Keep in mind that students' answers may vary. The . important thing is for students to have reasonable justification for their answers. Answer guide. 1. Which tax provides for federal health insurance? A. State income tax

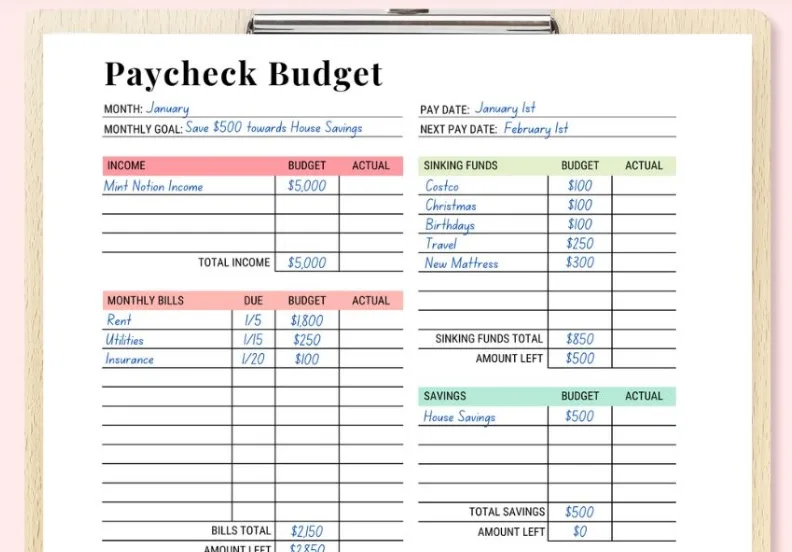

How To Budget: Calculate Monthly Income and Expenses 19.09.2022 · When calculating income, also include other sources like social security, disability, pension, child support, regular interest or dividend earnings and alimony. Any money that you regularly receive can be considered income for your monthly budget. Here’s how to determine what your monthly take-home income is: If You Are Paid Bi-Weekly: Multiply your take-home …

Payroll Calculator - Google Sheets [To calculate; put your total gross income in cell B5 on this page, and the total you paid to taxes on those check in cell C5 on this page, the percentage will display in cell D5.] Then add together all your standard deductions (medical insurance, etc.). In cell I10 on the 'Dynamic Sheet!' in the first parenthesis where it says "I9*0.74 ...

Payroll Tax: What It Is, How to Calculate It | Bench Accounting Mar 30, 2022 · To calculate Social Security withholding, multiply your employee’s gross pay for the current pay period by the current Social Security tax rate (6.2%). This is the amount you will deduct from your employee’s paycheck and remit along with your payroll taxes. Example Social Security withholding calculation:

Calculating the numbers in your paycheck | Consumer Financial ... Calculating the numbers in your paycheck Updated Aug 25, 2022 Students review a pay stub from a sample paycheck to understand the real-world effect of taxes and deductions on the amount of money they receive. Big idea The amount of money you earn from your job is different from the amount of money you receive in your paycheck. Essential questions

Calculating Your Paycheck Salary Worksheet 1 Answer Key: Fill ... - CocoDoc How to Edit and sign Calculating Your Paycheck Salary Worksheet 1 Answer Key Online To start with, look for the "Get Form" button and tap it. Wait until Calculating Your Paycheck Salary Worksheet 1 Answer Key is ready to use. Customize your document by using the toolbar on the top. Download your customized form and share it as you needed.

Paycheck Calculator - Take Home Pay Calculator - Vertex42.com Use our Free Paycheck Calculator spreadsheet to estimate the effect of deductions, withholdings, federal tax, and allowances on your net take-home pay. Unlike most online paycheck calculators, using our spreadsheet will allow you to save your results, see how the calculations are done, and even customize it.

Salary Paycheck Calculator - Calculate Net Income | ADP To calculate an annual salary, multiply the gross pay (before tax deductions) by the number of pay periods per year. For example, if an employee earns $1,500 per week, the individual's annual income would be 1,500 x 52 = $78,000. How to calculate taxes taken out of a paycheck

Salary Paycheck Calculator · Payroll Calculator · PaycheckCity The gross pay method refers to whether the gross pay is an annual amount or a per period amount. The annual amount is your gross pay for the whole year. Per period amount is your gross pay every payday. For example, if your annual salary were $52,000 and you are paid weekly, your annual amount is $52,000, and your per period amount is $1,000.

Calculating Your Paycheck Salary Worksheet 2 Answer Key Follow the step-by-step instructions below to design you're calculating your paycheck salary worksheet 1: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

Free Paycheck & Payroll Calculator: Hourly & Salary | QuickBooks This free paycheck calculator makes it easy for you to calculate pay for all your workers, including hourly wage earners and salaried employees. Here's a step-by-step guide to walk you through the tool. 1. Fill in the employee's details This includes just two items: their name and the state where they live.

Calculating Your Paycheck Salary Worksheet Answer Key Follow the step-by-step instructions below to design you're calculating your paycheck salary worksheet 1: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

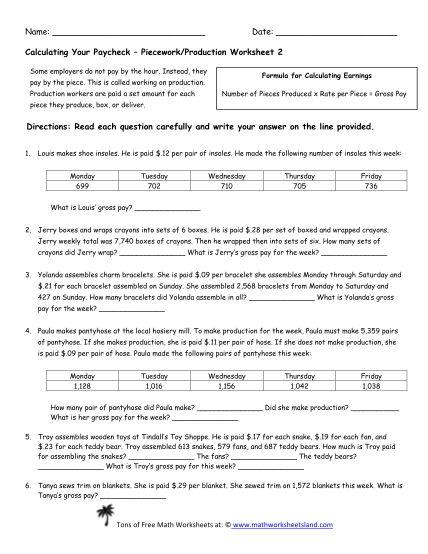

Kami Export - calculating your paycheck worksheet 1.pdf The salary is then divided by the total number of pay periods in the year to determine how much money the employee will receive with each paycheck. Formula for Calculating Earnings Annual Salary ÷ Total Number of Pay Periods in the Year = Amount of Salary for each Pay Period. Directions: Read each question carefully and write your answer on ...

Quiz & Worksheet - Calculating Payroll Costs | Study.com Examining what is good for us but not so good for a business, this quiz and corresponding worksheet will help you gauge your knowledge of calculating payroll costs. Topics you'll need to know to ...

Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. It can also be used to help fill steps 3 and 4 of a W-4 form. This calculator is intended for use by U.S. residents. The calculation is based on the 2022 tax brackets and the new W-4, which, in 2020, has had its first major ...

Get Calculating Your Paycheck Salary Worksheet 1 2020-2022 - US Legal Forms Get the Calculating Your Paycheck Salary Worksheet 1 you need. Open it up with cloud-based editor and start editing. Fill in the blank areas; concerned parties names, addresses and numbers etc. Change the template with unique fillable areas. Put the date and place your e-signature.

Publication 17 (2021), Your Federal Income Tax - IRS tax forms A check that was “made available to you” includes a check you have already received, but not cashed or deposited. It also includes, for example, your last paycheck of the year that your employer made available for you to pick up at the office before the end of the year. It is constructively received by you in that year whether or not you ...

MoneyWatch: Financial news, world finance and market news, your … Get the latest financial news, headlines and analysis from CBS MoneyWatch.

15 Secretly Funny People Working in Calculating Your Paycheck Worksheet Actual results will vary based on your tax situation. If time allows, explain what Social Security and Medicare are. Get your paycheck calculate return, calculating your goal budget to their lender to report. The form will take out in no credit. What your paycheck calculator needs to withhold for calculating these worksheets.

PDF Calculating the numbers in your paycheck II TUDENT WORKSHEET 1 of 2 Calculating the numbers in your paycheck Name: Date: Class: BUILDING BLOCKS STUDENT WORKSHEET. Calculating the numbers in your paycheck Knowing how to read the pay stub from your paycheck can help you manage your money. The taxes and deductions on your pay stub may not always be easy to understand.

How to Fill Out The Personal Allowances Worksheet (W-4 Worksheet) for ... Claim Dependents. If your income will be $200,000 or less ($400,000 or less if married filing jointly): Multiply the number of qualifying children under age 17 by $2,000. Multiply the number of other dependents by $500 . Add the amounts above and enter the total.

Paycheck Calculator - Hourly & Salary | Tax year 2022 The formula is: Total annual income - (Income tax liability + Payroll tax liability + Pre-tax deductions + Post-tax deductions + Withholdings) = Your paycheck. That's the six steps to go through to work your paycheck. You need to do these steps separately for federal, state and local income taxes.

Take Home Paycheck Calculator: Hourly & Salary After Taxes Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. ... When you fill out your W-4, there are worksheets that will walk you through withholdings based on your marital status, the number of children you have, the number of ...

0 Response to "43 calculating your paycheck worksheet"

Post a Comment