39 workers comp audit worksheet

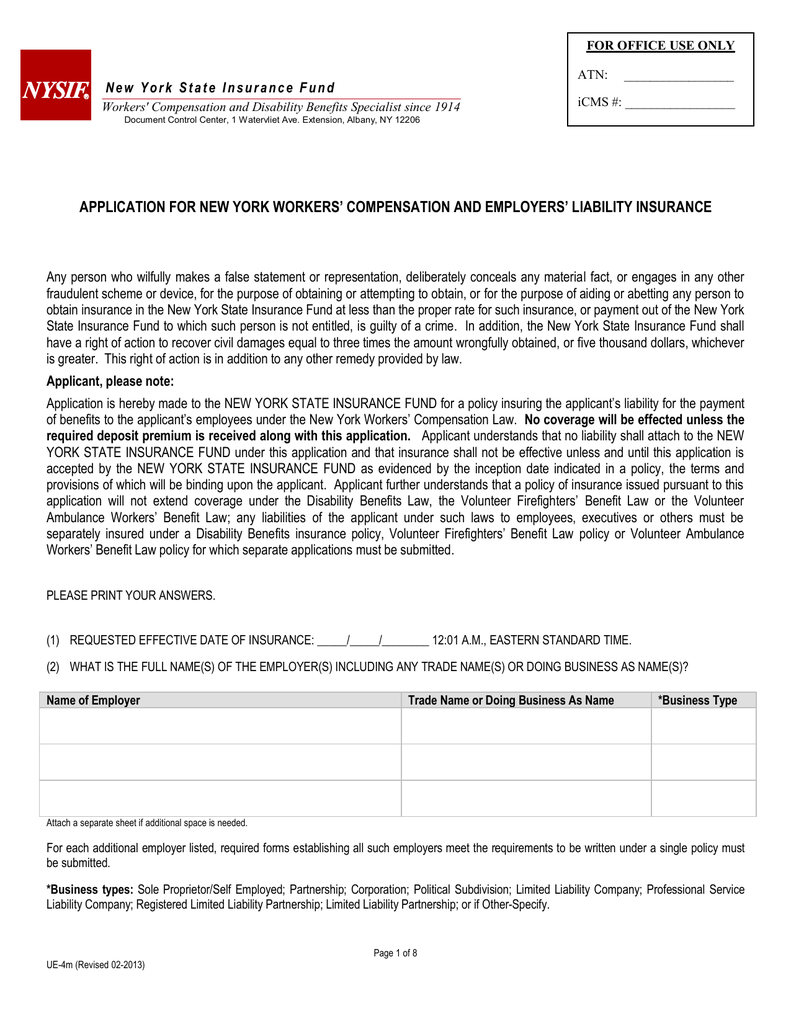

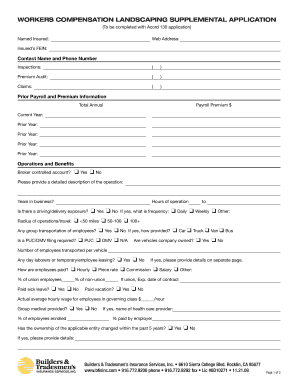

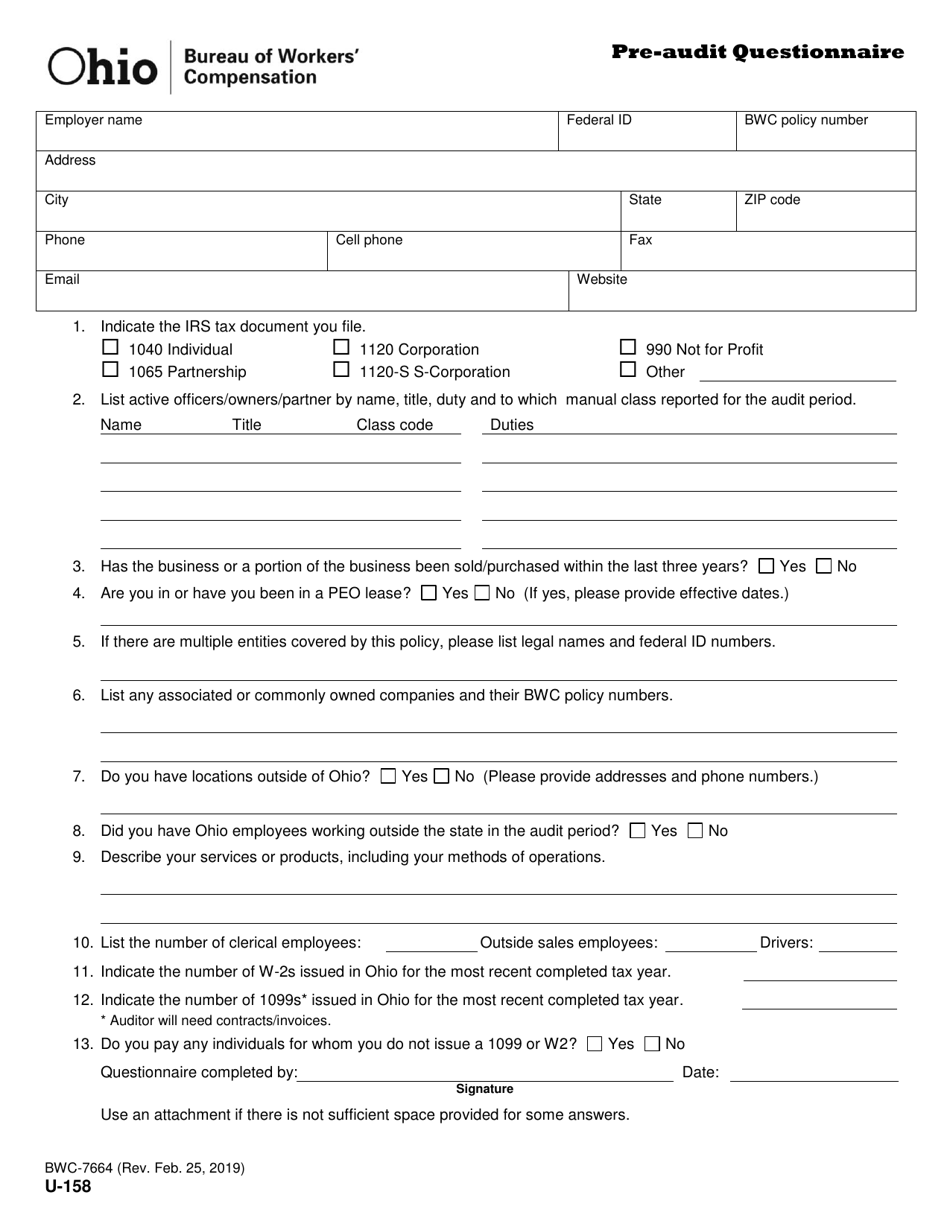

Workers’ Compensation premiums are estimated prior to the start of a policy and are based on expected business operation and payroll information. To ensure these figures are accurate and classifications remain appropriate, all Workers’ Compensation policies are subject to an audit to determine the actual premium. Irving Weber Associates is a General Insurance Agent and Specialty Insurance Agent to local insurance brokers for main street businesses.

Jul 09, 2013 · When Subcontractors Become Your Workers Compensation Employees; How Furloughed Employees and Using 0012 Will Effect Your Workers Compensation Experience Modification Rate (EMR) ANC – The Audit Noncompliant Charge – Workers Compensation Audits Have Sharp Teeth! Categories

Workers comp audit worksheet

A workers’ comp audit ensures employers are paying correct premiums and audits help businesses stay on track, so they don’t pay too much versus what they owe. Learn more about workers’ compensation audits from The Hartford and review our workers’ comp audit checklist to make sure you ... The bill is $8,000 for a part time employee who has only been here 6months and made $12,000 so far. According to state of New York workers compensation board fines shouldn’t exceed 5,000 for up to 5 employees working up to 1yr. I only have one 1 working 6months. Can I take any legal action or refute this—also, can they bill me without any notice prior? My business is fully virtual (no risk of getting hurt on job). I had no idea about this and I feel stupid, stressed, and completely blindside... Feb 18, 2020 · The best way to take control of your workers comp premiums is through an Experience Mod Rate Audit. Remember that the Experience Mod is influenced more by small, frequent losses than by large, infrequent ones. So the fewer losses you have, the better. Frequency breeds severity. Reducing the frequency of claims starts at the top.

Workers comp audit worksheet. I worked for a company trimming logs for a few weeks. I was using a big saw that needed to be pulled back and forth to smoothe out the logs. After 8 hours of trimming I slipped and hit my hip with the blade. I told my boss about the situation and went to get stitches at the hospital. He asked If I was filing for workers comp and I said yes. I had all of the paperwork for him and called to ask when to have him fill it all out, he said "no worries you can just send me the bill in the mail". I took... April 8, 2021 - Insurance providers are required to conduct a workers’ compensation audit to ensure businesses are paying the right amount for their coverage. March 10, 2020 - A workers’ compensation audit can be inconvenient, costly, and generally unpleasant. Since most states mandate this type of audit, avoiding it altogether is not an option. However, the right combination of planning and consultation can help you avoid a large and unexpected bill and move you ... So I’ve been goin threw a claim with an attorney since 2018 and my job fired me and denied my claim as soon as I got an attorney so I have the ongoing claim and wrongful termination that they filed in my behalf because they said it’s illegal to fire me for workers comp . So my question is I’m at the point where the dr is suggesting surgery for my tmj on my jaw but the reviews and results for this type or surgery are very iffy and scary , will that affect my case or possible settlement if I deny ...

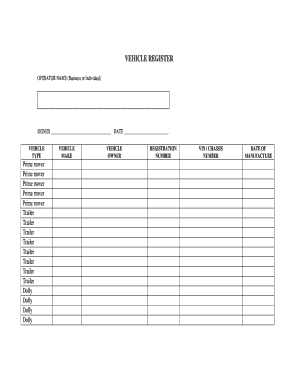

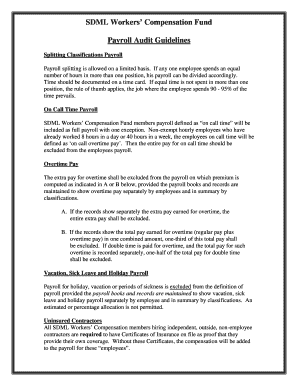

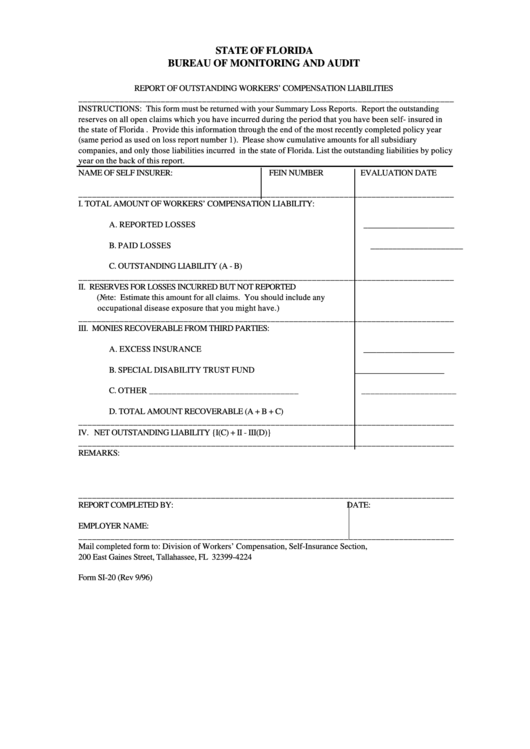

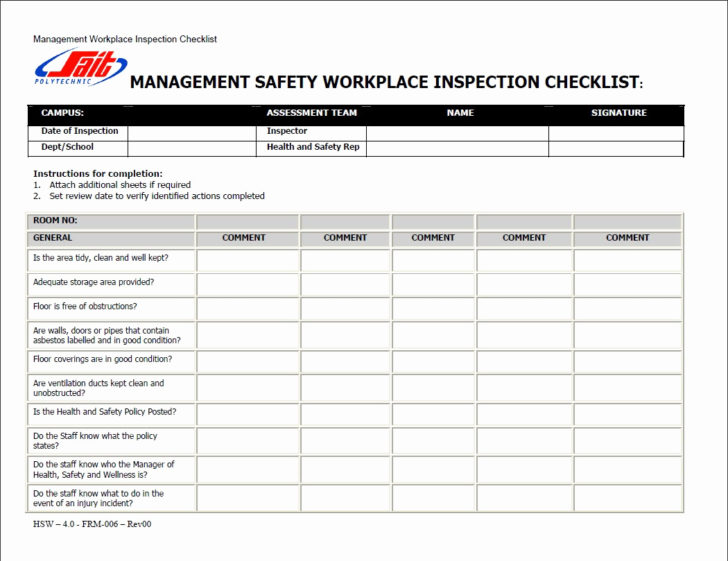

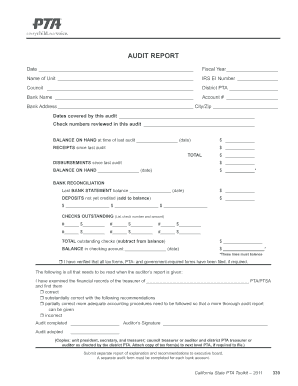

A Workers Compensation Term Defined, Described and Explained - Also a description of items we need to review your workers compensation audit, workers compensation e-mod and workers compensation premium calculations ... This is the actual worksheet the auditor uses to gather and catagorize all ... You will be asked to sign the auditors worksheet before they leave. You should never sign an incomplete worksheet. You should always ask for and keep a copy for your files. Types of Workers Compensation Audits performed There are two types of workers compensation audits performed. The auditor will review your information and may ask additional questions. KEMI will send you a summary of the audit results. Once the audit is completed, KEMI will either bill the policyholder for additional premium if the actual exposure is more than the estimate or issue the policyholder a refund if the actual exposure is less than the estimate. November 9, 2021 - Workers’ Comp audits ensure you're paying the right amount for your policies. Learn how it works when you buy coverage with NEXT Insurance.

October 17, 2019 - Review the auditor’s worksheets. Sometimes auditors make mistakes that benefit the insurance company (and hurt you). You should carefully review the auditor’s work after they finish. You will have to ask the insurer for copies of the auditor’s worksheets. Apparently at the beginning of every working well there is a disclaimer that says participation in physical exercises is voluntary. Since he messed up his back doing a "voluntary exercise" he is ineligible. He even talked to a lawyer who told him the same thing. Don't let your manager give you any grief about doing any physical activity. I work for a small company and on the job I slipped and fell and hurt my shoulder. But it was my clumsiness- not any fault of my employer in my eyes. I went to the doctor and I mentioned it happened at work and then they very adamantly stated I NEED to file for workers comp. I told them I didn’t want to because it wasn’t their fault it was my own. They refused to see me. So now I am going to another doctor and just going to lie… But I am just curious if there was a reason the doctor was so... April 10, 2013 - Ask your insurer to provide you with a copy of the audit worksheet prepared for your most recently expired workers’ compensation policy. This document provides the details of how the insurance company determined your final premium. It lists employees, classifications and payrolls.

Your workers compensation experience modification worksheet (E-mod) is a summary of prior losses and payrolls. If your account is subject to an experience modification factor you will receive a copy of this worksheet from the National Council on Compensation Insurance (NCCI) or the proper rating bureau for your state approximately three months ...

rules for Workers Compensation audits, NCCI Scopes manual, Consultant,

The concept of a workers’ compensation audit (premium audit) is simple, but the effort to make it accurate can be confusing and time consuming if you are not prepared. The information on this page is intended to assist you in preparing for an accurate and positive audit experience.

I didn't know much about this when I first started so I thought I'd take a minute to break it down. First, Workers' Comp protects you against liability in the event that one of your employees gets hurt (Falls off of a ladder, breaks their leg...etc) If that happens, they will incur a large amount of medical debt. At which point they will probably call a lawyer (Ever see the "Hurt?" billboards around town? Yeah, those guys) The lawyer will say, "Great! Just have your boss forward me the Wor...

The Basics of Contractual Risk Transfer, Additional Insureds and Certificates of Insurance

Coverage Specialists, Inc., a family-owned agency founded in 2010, has a team comprised of professionals who have been writing insurance policies for over 25 years.

Offering auto, home, business and many more insurance products in Virginia, Maryland and West Virginia.

I work in maryland and am “Salaried” at 32,000. Our company just sent out a New Years letter saying we can not use comp time anymore. The old policy was if we work 10 hours one day we could work 6 another. https://www.dllr.state.md.us/labor/wagepay/wpsalaried.shtml this says to be salaries we need to make 35,568. What should my next action be. Everyone my level is pissed. Some people have over 30 hours of comp-time.

boardroom meeting where woman in black leather jacket and man in blue checkered shirt, suit jacket and glasses, pay attention to person talking with their hands wearing black long sleeve shirt

I am in ny and received a letter that i will be audited form workers comp ​ was wondering what i should prepare? just the payroll i paid and 1099s?

Worker Comp Audits should be illegal during 'tax season'. Just venting: Who is with me? lol

May 1, 2021 - Workers Compensation Audit Worksheets are like a tool that the auditor uses to gather all the important information like payroll, classification codes, and independent contractors that are collected from the employer during the audit process. Workers Compensation Audit Worksheets are a blueprint ...

It is not uncommon for auditors to make mistakes on the audit worksheets. Remember, they work for the carrier and most mistakes are in favor of the insurance companies. Audits are a contractual obligation within the workers compensation insurance policy. It is common practice for carriers to ...

Protect your personal and business investments with Travelers Insurance. From auto insurance to homeowners or business insurance, we have the solution to suit your needs.

Hello insurance pros, I hope someone can help me out here. I am a small business owner in California and my workers comp policy is trying to do some screwy things with my policy. We have had a policy with the same company for 3 years. Every year its been \~$2000.000 a year for our policy. All of a sudden, they decide to reclassify us from Office clerical 8810 to to a retail store classification 8046. We are NOT a retail store. We are 100% wholesale. The insurance company has hit us with ...

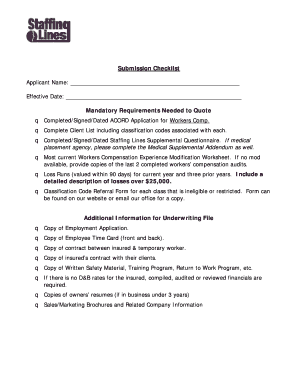

June 24, 2021 - The following steps can help you get ready, plus you can download a checklist to use when your audit rolls around

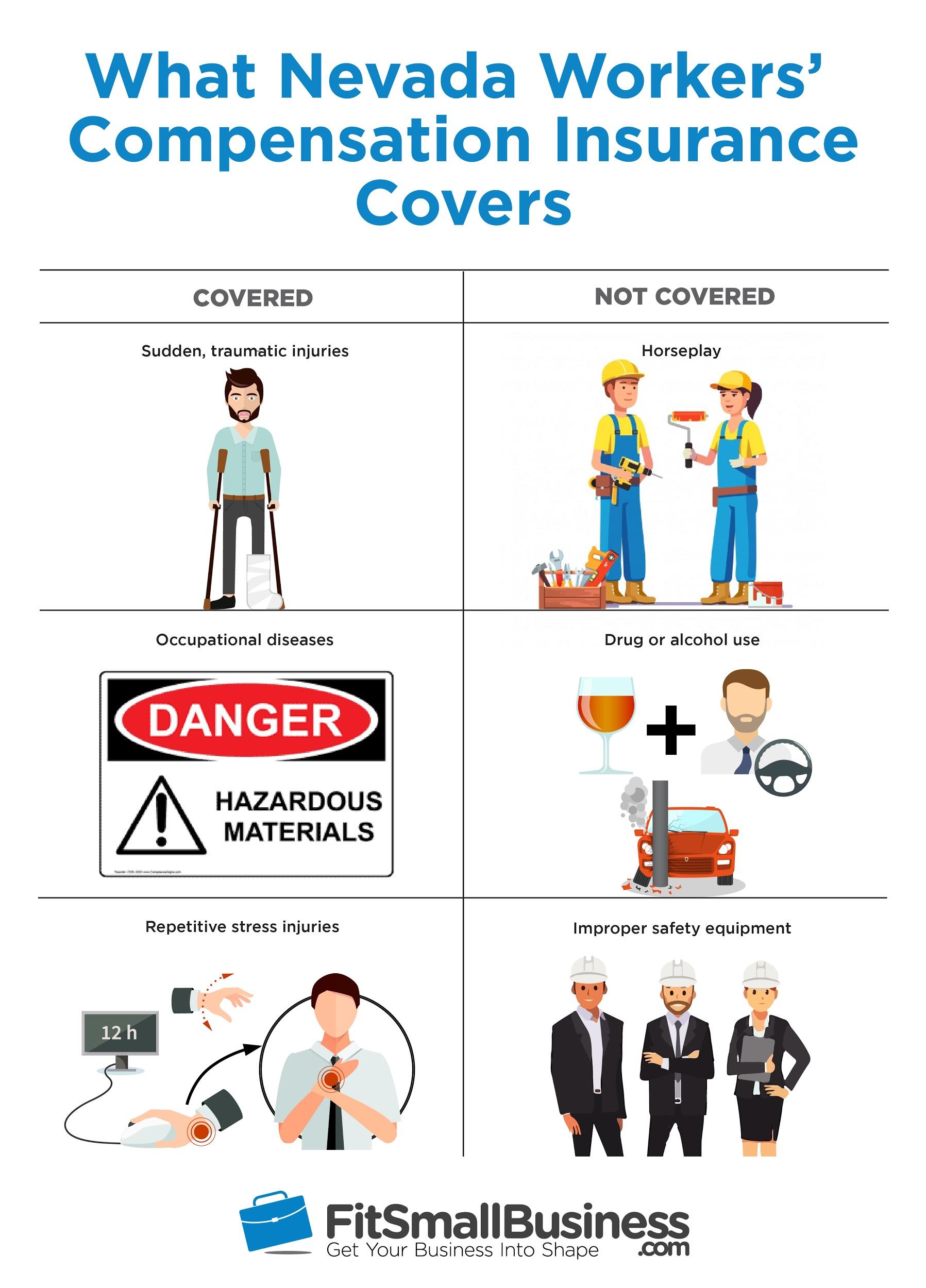

Workers' compensation insurance is vital for small businesses because it helps them cover the cost of medical expenses and lost wages for injured workers. Small businesses need workers' comp because: In most states, workers' compensation insurance is a requirement; A major claim can have a devastating financial effect on your business operations

A workers comp audit is an annual review of records at the request of an insurance company. It may be done by phone, mail, or in person depending on the assigned Auditor. Work comp audits determine if the payroll and class codes quoted at inception accurately reflect the actual payroll and scope of work performed during the policy period.

About a month ago my comp insurance sent me a letter about an audit and explained how I can schedule it but also said a rep will contact me to schedule it. Well it seems neither of us are very enthusiastic about it because they haven’t called or emailed yet. I had the lowest possible premium to meet minimum state requirements, never paid a subcontractor, and made less than $30,000 in the business they are covering. Am I just small fish and they don’t want to waste time on me or should I still d...

With offices in California, Texas, New Jersey, and Florida, Athens Administrators offers Workers' Compensation, Property & Casualty, Managed Care and Program Business solutions. Athens is proud to be a family-owned company and is dedicated to its core values of honesty and integrity, a commitment to service and results, and a caring ...

Feb 18, 2020 · The best way to take control of your workers comp premiums is through an Experience Mod Rate Audit. Remember that the Experience Mod is influenced more by small, frequent losses than by large, infrequent ones. So the fewer losses you have, the better. Frequency breeds severity. Reducing the frequency of claims starts at the top.

The bill is $8,000 for a part time employee who has only been here 6months and made $12,000 so far. According to state of New York workers compensation board fines shouldn’t exceed 5,000 for up to 5 employees working up to 1yr. I only have one 1 working 6months. Can I take any legal action or refute this—also, can they bill me without any notice prior? My business is fully virtual (no risk of getting hurt on job). I had no idea about this and I feel stupid, stressed, and completely blindside...

A workers’ comp audit ensures employers are paying correct premiums and audits help businesses stay on track, so they don’t pay too much versus what they owe. Learn more about workers’ compensation audits from The Hartford and review our workers’ comp audit checklist to make sure you ...

0 Response to "39 workers comp audit worksheet"

Post a Comment