42 itemized deduction worksheet 2015

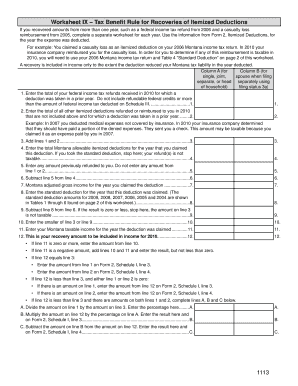

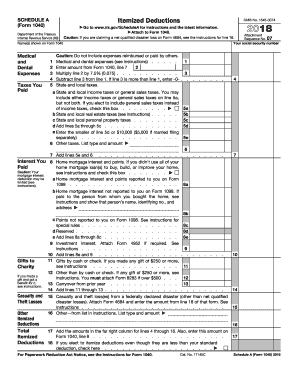

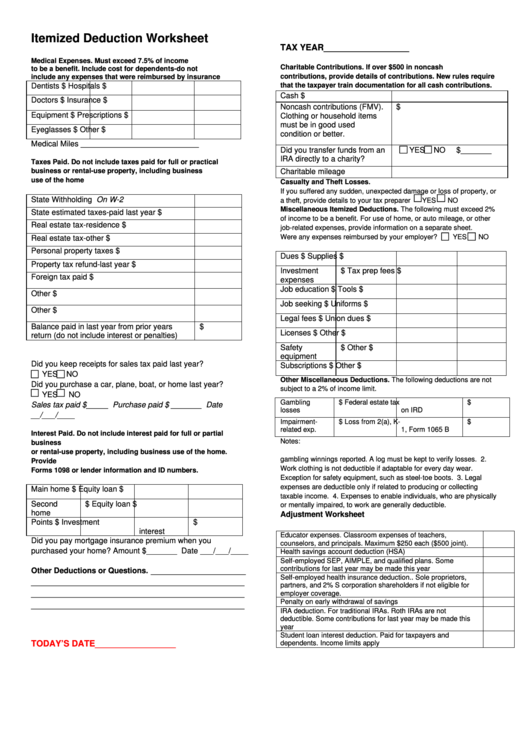

Itemized Deductions Worksheet You will need: Tax information documents (Receipts, Statements, Invoices, Vouchers) for your own records. Otherwise, reporting total figures on this form indicates your acknowledgement that such figures are accurate and that you vouch for their accuracy as reported on your Federal and/or State return. Your deduction is not limited. Add the amounts in the far right column for lines 4 through 28. Also, enter this amount on Form 1040, line 40.}.. Yes. Your deduction may be limited. See the Itemized Deductions Worksheet in the instructions to figure the amount to enter. 30 . If you elect to itemize deductions even though they are less than your ...

Itemized Deductions 20-1 Itemized Deductions Introduction This lesson will assist you in determining if a taxpayer should itemize deductions. Generally, taxpayers should itemize if their total allowable deductions are higher than the standard deduction amount. Objectives At the end of this lesson, using your resource materials, you will be able to:

Itemized deduction worksheet 2015

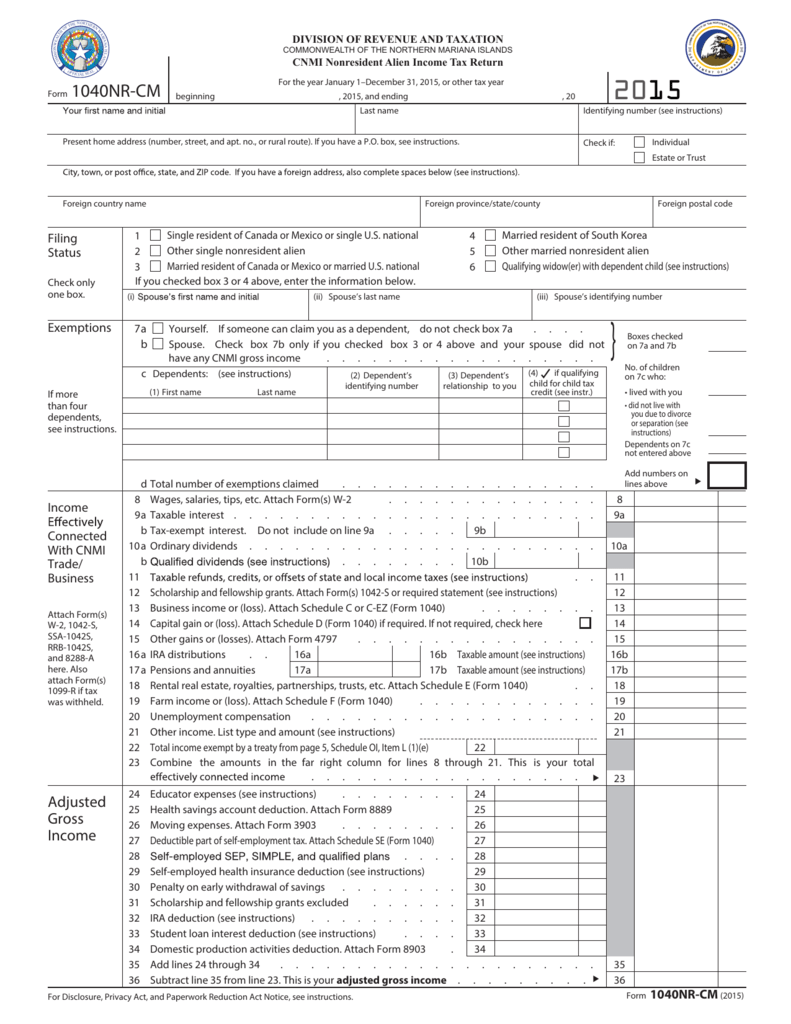

Dec 16, 2021 · Key takeaways. For the self-employed, health insurance premiums became 100% deductible in 2003. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.; If you have an S-corp, you should be aware of a 2015 notice regarding reimbursement for health … 2015. FileIT. IT-112-R - New York State Tax Resident Credit. 2015. FileIT. IT-2 - New York Summary of W-2 Statements. 2015. ... IT-203-B - New York Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet. 2015. FileIT. IT-209 - New York Claim for Noncustodial Parent New York State Earned Income ... Dec 10, 2021 · IRS Standard Tax Deductions 2021, 2022. by Annie Spratt. These standard deductions will be applied by tax year for your IRS and state return(s) respectively. As a result of the latest tax reform, the standard deductions have increased significantly, however many other deductions got discontinued as a result of the same tax reform. If all this reading is not for you, …

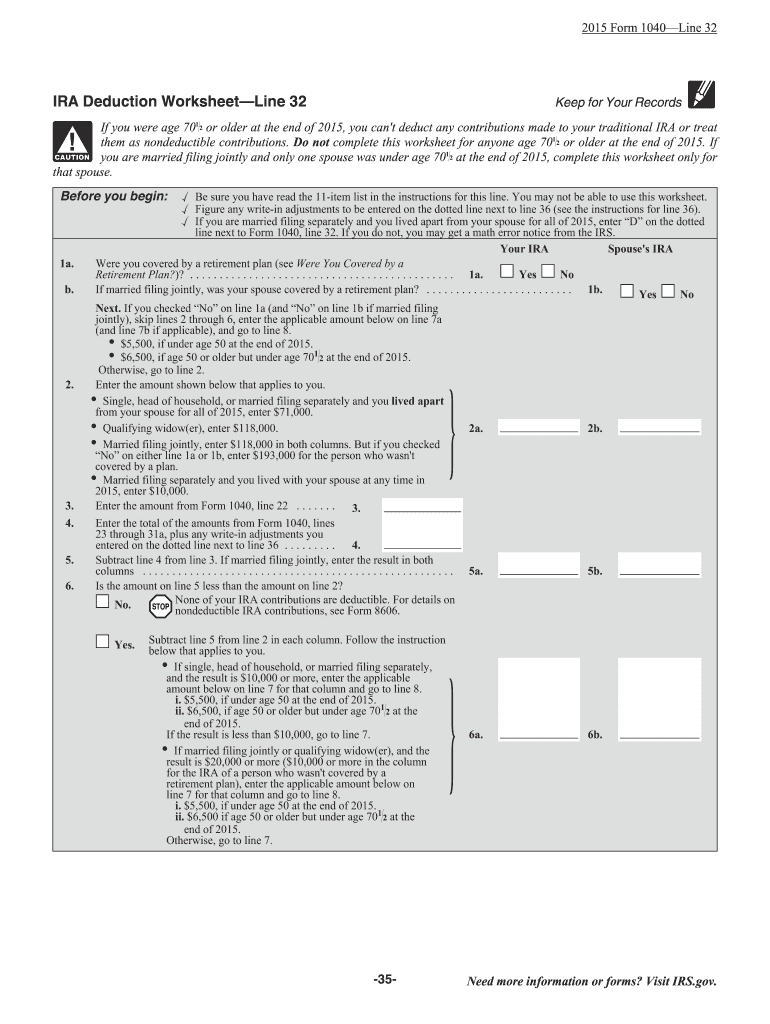

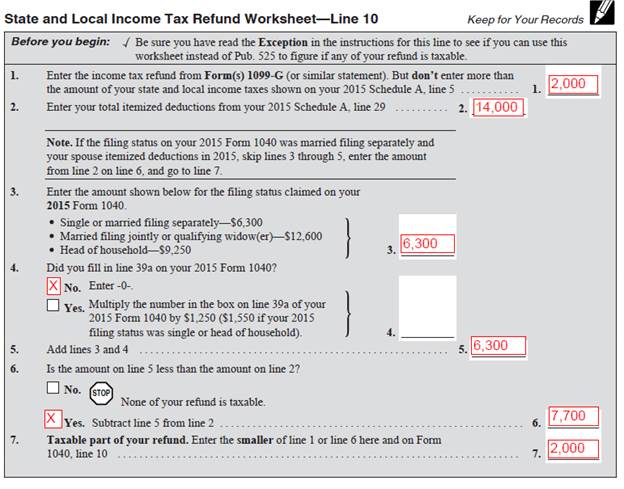

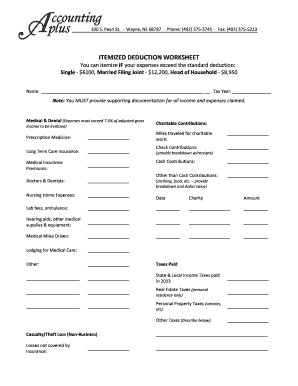

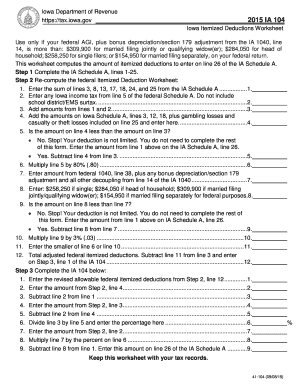

Itemized deduction worksheet 2015. Schedule A - Itemized Deductions (continued) To enter multiple expenses of a single type, click on the small calculator icon beside the line. Enter the first description, the amount, and Continue. Enter the information for the next item. They will be totaled on the input line and carried to Schedule A. If taxpayer has medical insurance 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. ITEMIZED DEDUCTIONS. Kansas itemized deductions are now calculated using 100 percent charitable contributions, 50 percent qualified residential interest, and 50 percent real and personal property taxes as claimed on your federal itemized deductions. See Part C of Schedule S. SOCIAL SECURITY NUMBER (SSN) REQUIREMENT. Line 12a Itemized Deductions or Standard Deduction. Itemized Deductions; Standard Deduction. Exception 1—Dependent. Exception 2—Born before January 2, 1957, or blind. Exception 3—Separate return or dual-status alien. Exception 4—Increased standard deduction for net qualified disaster loss. Standard Deduction Worksheet for Dependents ...

Maryland Nonresident Itemized Deduction Worksheet: Worksheet for nonresident taxpayers who were required to reduce their federal itemized deductions. Resident Individuals Income Tax Forms. Number ... Form and instructions to be used by resident individuals for amending any item of a Maryland return for tax year 2015. 588: 2015 ITEMIZED DEDUCTIONS WORKSHEET For 2015 the "Standard Deduction" is $12,600 on a Joint Return, $9,250 for a Head of Household, and $6,300 if you are Single. If you normally itemize your personal deductions or even think that itemized deductions might benefit you this year, we will need to know the following expenses. If the amount on Form 1040 or 1040-SR, line 11, is more than $100,000 ($50,000 if married filing separately), your deduction is limited and you must use the Mortgage Insurance Premiums Deduction Worksheet to figure your deduction. The Standard Mileage Rate for operating expenses of a vehicle for medical reasons is 23 cents per mile. 2015 itemized deductions worksheet for 2015 the standard deduction is 12600 on a joint return 9250 for a head of household and 6300 if you are single. The amounts will be reported on the Schedule KPI KS or KF you received from the entity.

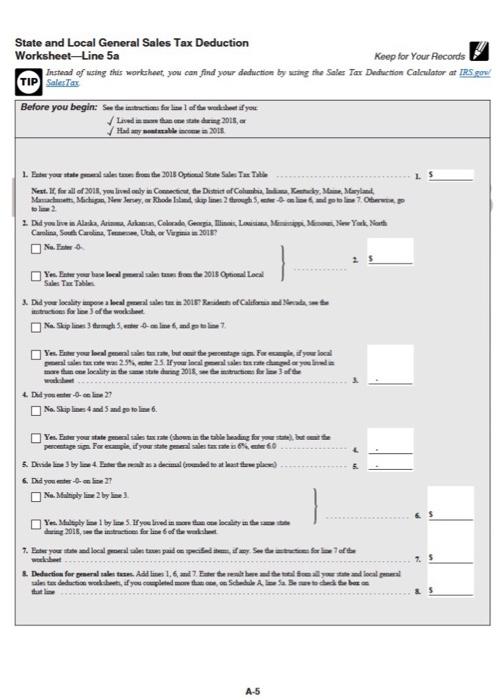

Student Loan Interest Deduction Worksheet. Enter the total amount from Schedule CA (540), line 20, column A. If the amount on line 1 is zero, STOP. You are not allowed a deduction for California. Enter the total interest you paid in 2019 on qualified student loans but … Instructions for Schedule A (Form 1040), Itemized Deductions 2015 Form 1040 (Schedule A) Itemized Deductions 2015 Inst 1040 (Schedule A) Instructions for Schedule A (Form 1040), Itemized Deductions 2014 Form 1040 (Schedule A) Itemized Deductions 2014 ... 2015 Instructions for Schedule A (Form 1040)Itemized Deductions Use Schedule A (Form 1040) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. If you itemize, you can deduct a part of your medical and dental expenses and unre- Let's talk about the deduction for charitable contributions the Internal Revenue Code requires that for you to be able to deduct charitable contributions that several rules be met the primary rule is that the charity must be an approved IRS charity to be an approved IRS charity that of course means it must be US based, and it must be formally approved meaning for example if you give …

Adjustment Worksheet Educator expenses. Classroom expenses of teachers, counselors, and principals. Maximum $250 each ($500 joint). Health savings account deduction (HSA) Self-employed SEP, AIMPLE, and qualified plans. Some contributions for last year may be made this year Self-employed health insurance deduction.. Sole proprietors,

Dec 10, 2021 · IRS Standard Tax Deductions 2021, 2022. by Annie Spratt. These standard deductions will be applied by tax year for your IRS and state return(s) respectively. As a result of the latest tax reform, the standard deductions have increased significantly, however many other deductions got discontinued as a result of the same tax reform. If all this reading is not for you, …

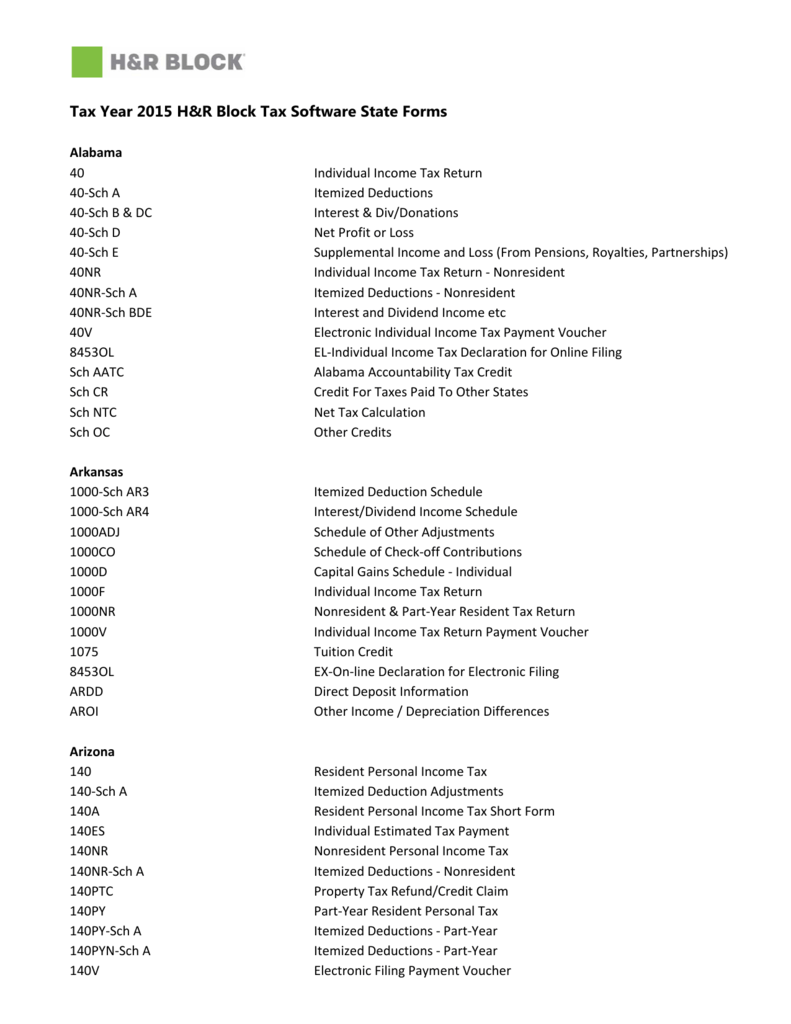

2015. FileIT. IT-112-R - New York State Tax Resident Credit. 2015. FileIT. IT-2 - New York Summary of W-2 Statements. 2015. ... IT-203-B - New York Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet. 2015. FileIT. IT-209 - New York Claim for Noncustodial Parent New York State Earned Income ...

Dec 16, 2021 · Key takeaways. For the self-employed, health insurance premiums became 100% deductible in 2003. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year.; If you have an S-corp, you should be aware of a 2015 notice regarding reimbursement for health …

0 Response to "42 itemized deduction worksheet 2015"

Post a Comment