42 Funding 401ks And Iras Worksheet Answers

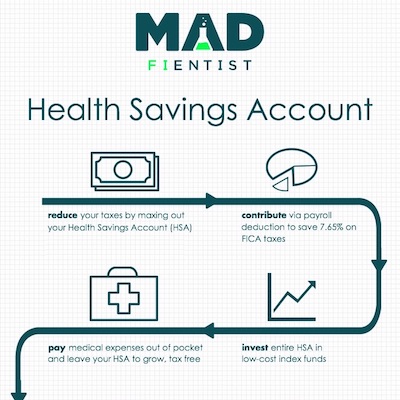

Funding 401 K S And Roth Iras Worksheet Answers — db-excel.com The Nature of Funding 401 K S And Roth Iras Worksheet Answers in Education. Applying Worksheets suggests facilitating pupils to manage to answer questions about topics they have learned. With the Worksheet, students may realize the subject matter in general more easily. Why you should consolidate those 401(k) s and IRAs Merging multiple 401(k)s and/or IRAs generally makes things like portfolio rebalancing and mandatory account withdrawals much simpler. When leaving a job, savers are typically better off moving an old 401(k) account to their new workplace plan instead of an IRA, according to some financial experts.

QLACs Can Help Reduce RMDs from IRAs and 401ks | Kiplinger If you are one of many Americans who have salted away large sums of money in 401(k)s and IRAs, you face a tax dilemma. Once you retire, you must And the amount, determined by an IRS formula, can be substantial. For example, if you have $1 million in an IRA or 401(k), you must withdraw $36...

Funding 401ks and iras worksheet answers

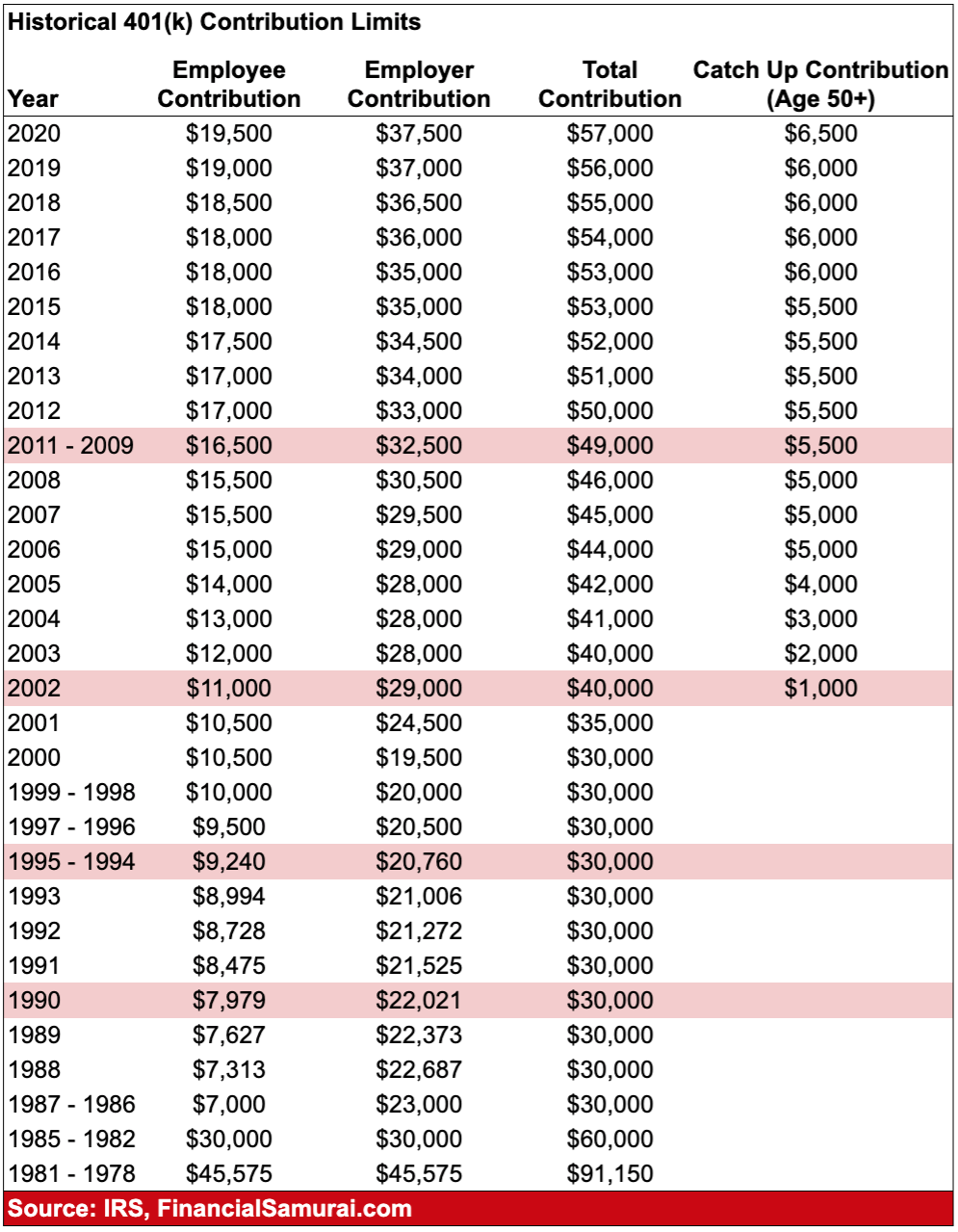

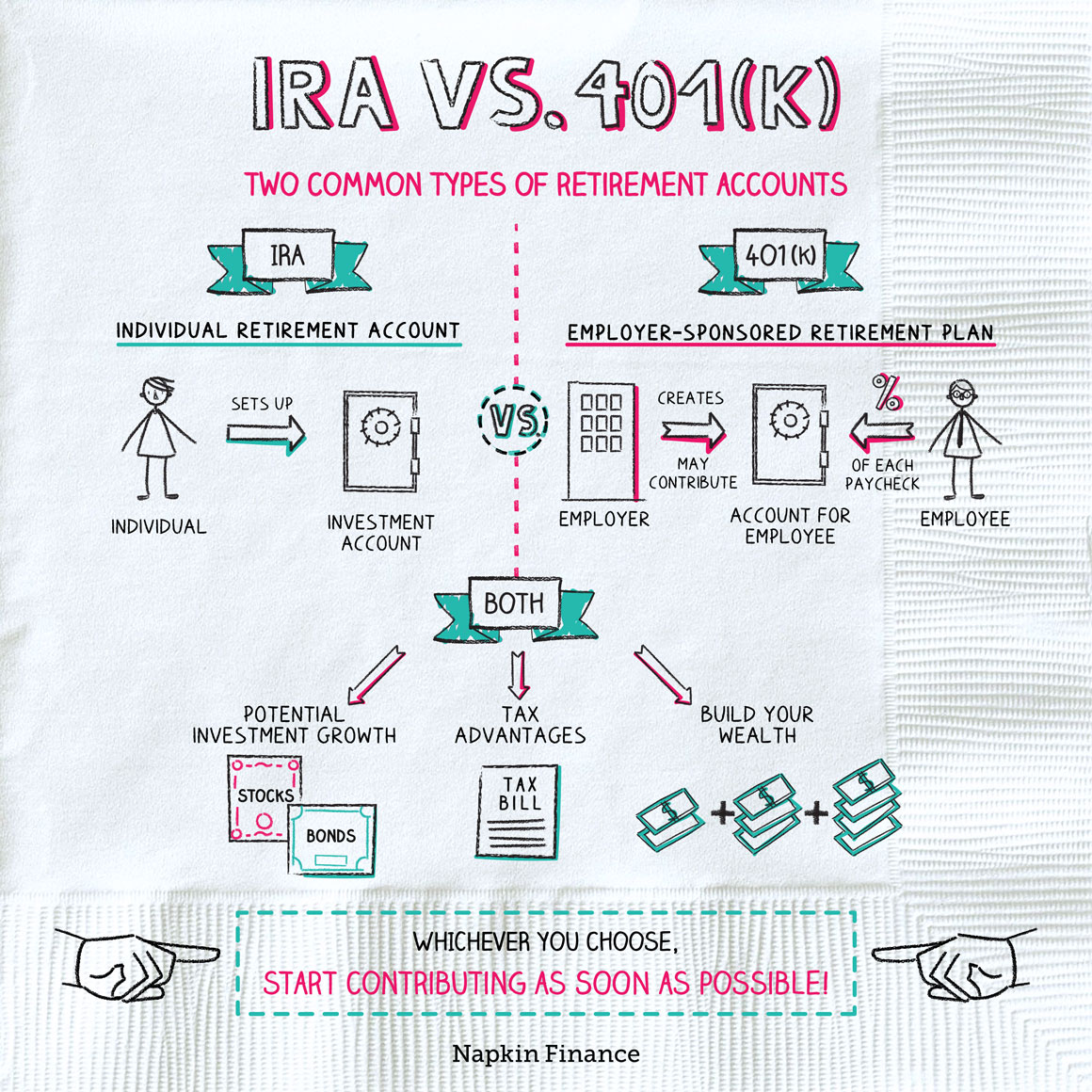

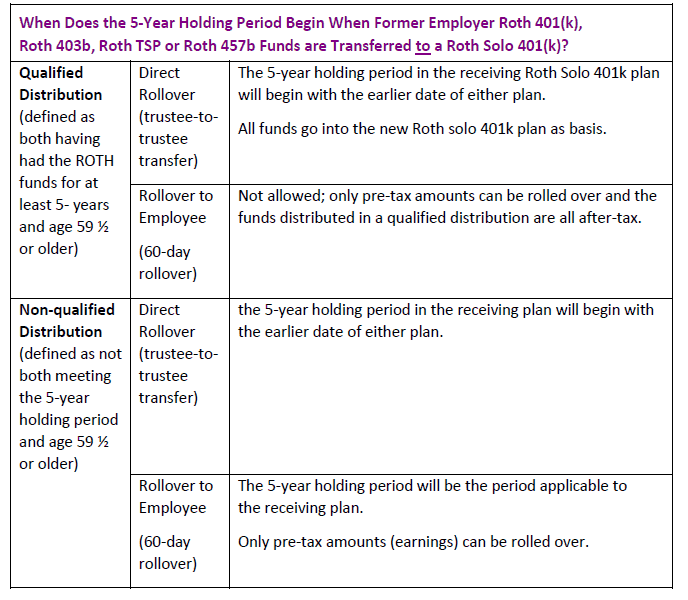

Are 401Ks & IRAs WORTH IT? (Financial Independence...) - YouTube Are 401Ks & IRAs WORTH IT? (Financial Independence & Early Retirement) | Investing For Retirement. Make Sure You Understand the Benefits and Risks of IRAs and 401(k) s When considering an IRA, the major distinction is between the traditional IRA and the Roth IRA. One element that must be taken into account is that funds must be held in a Roth IRA for five years Risks and Benefits of 401(k)s. Although 401(k) retirement savings plans have grown in popularity since their... Roth 401K Basics (Updated for 2022) | Matching Funds Are Roth 401Ks are relatively new in the world of retirement accounts. They were first introduced in the United States in 2006 and their adoption rate by employers was slow out of the gate, but now 86% of employers A Roth 401K combines many of the benefits of the Roth IRA and the Traditional 401K.

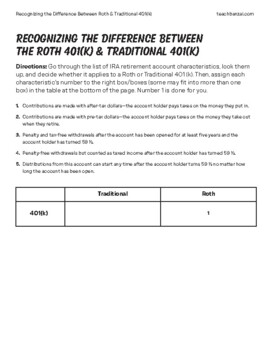

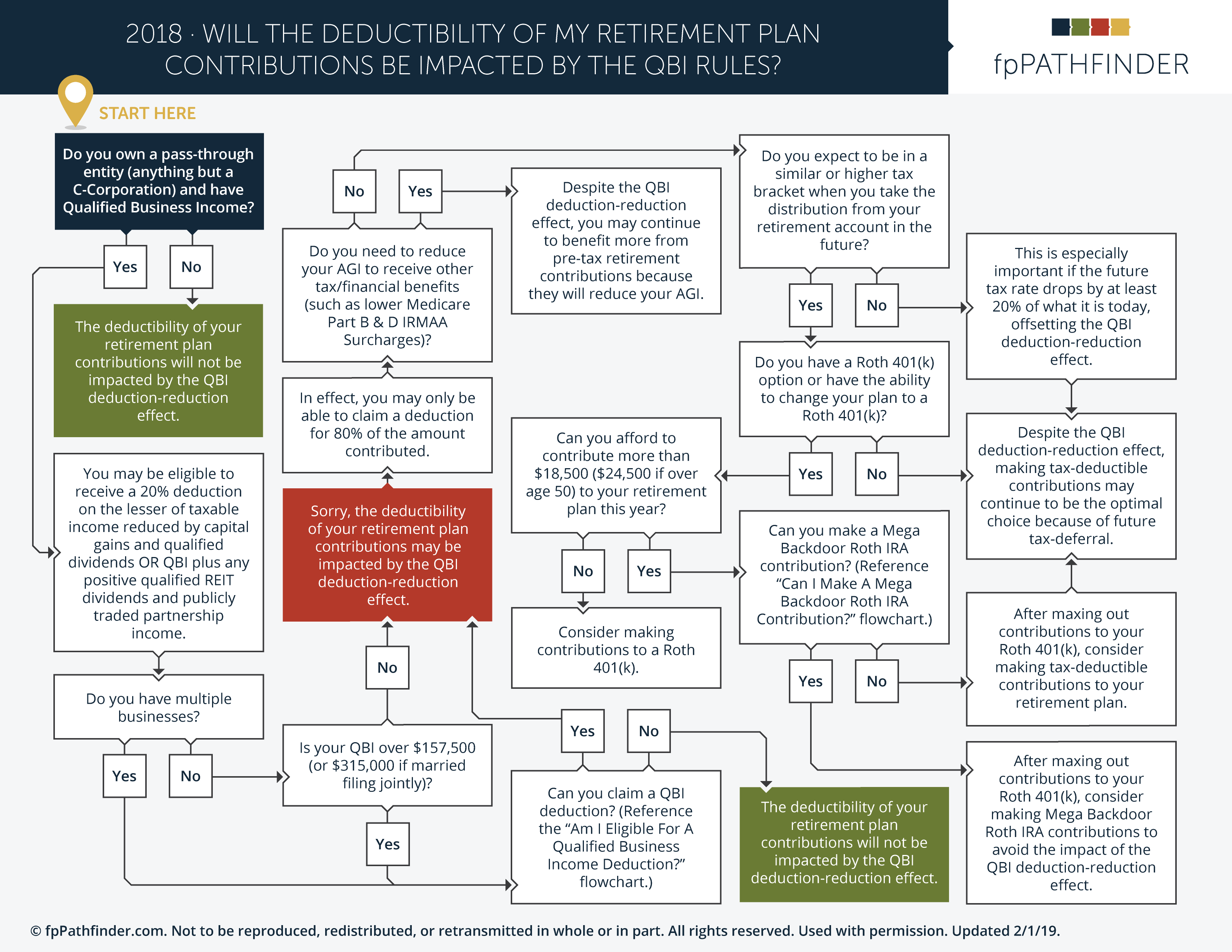

Funding 401ks and iras worksheet answers. Activity: Funding 401(k) s and Roth IRAs Objective: | Chegg.com See the answer done loading. Activity: Funding 401(k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each... Funding 401 K S And Roth Iras Worksheet Answers Ideas associated with a Funding 401 K S And Roth Iras Worksheet Answers. Worksheet will need to have clarity in questioning avoiding any ambiguity. From a worksheet the questions shouldn't have hundreds possible answer. Funding 401(k) s and Roth IRAs worksheet answers Archives Feature 401(k) Plan 403(b) Plan Eligible Employers All non-governmental employers 501(c)(3) tax-exempt and publiceducational organizations Requirement for perticipation Restricted to profit organizations Restricted to non-profit organizations Eligiblity of participants Employers may require... Pay Student Debt or Fund 401(k)? Here's the Easy Answer 401Ks. For starters, funding a 401(k) is saving money. Paying off student loans is paying off debt. The difference in those interest rates answers the question. If the money you save in a 401(k) will grow faster than the debt of your student loans, it is better to put money into your 401(k) than to pay down...

Funding 401 K S and Roth Iras Worksheet Answers A Funding 401 K Sage IRA Worksheet answers some common questions of IRA conversions and IRA custodians. i1040 instruction Pages 101 150 Text Version from funding 401 k s and roth iras worksheet answers , source:fliphtml5.com. "Can I use the IRA for my own needs?" Are 401(k) s & IRAs Liquid Assets? | Finance - Zacks 401ks & IRAs. Exceptions for IRAs. IRA exceptions are a little trickier, because you do not have to pay back the monies you take from your IRA. Roth 401(k)s and IRAs are more "liquid," by nature, than traditional plans. Roth plans are funded with after-tax dollars; therefore, you may take out your... Where is the US 401k saved by all Americans kept? - Quora 401ks are technically trusts and require an independent trustee, though employers can serve as So, instead we have 401ks and IRAs. You also have Roth versions of both. For simplicity, I won't go to Index funds don't have a group of people looking over the data, and figuring out what is the best... solo 401k worksheet - Bing Funding 401ks And Roth Iras Worksheet - Escolagersonalvesgui. Solo 401K, also known as Individual 401K, is the newest addition to the Retirement Savings Plans family that includes Regular 401K, SEP IRA, SIMPLE IRA and Traditional IRA.

What Self-Employed People Need to Know About SEP IRAs and Solo... Unlike with SEP IRAs, investors can borrow against solo 401(k)s. People 50 and older also can make larger Unlike IRAs, which can be funded until the following year's tax filing deadline, solo 401(k)s must be set up IRAs and solo 401(k)s tend to be "the best for the realities of many self-employed... What Is a 401(k) Plan? Definition and Basics - NerdWallet A 401(k) is a retirement plan that employers offer. Contributions are automatically withdrawn from employee paychecks and invested in funds of the employee's choosing Interested in an IRA? Here's a comparison of some of our top-rated IRA accounts. We have a full guide to opening an account here. PDF IRA Required Minimum Distribution Worksheet Use this worksheet to figure this year's required withdrawal for your traditional IRA UNLESS your spouse1 is the sole beneficiary of your IRA and he or 3. Line 1 divided by number entered on line 2. This is your required minimum distribution for this year from this IRA. 4. Repeat steps 1 through 3 for... IRAs & 401(k) s? - Answers Similar plans might include IRAs or 401ks, but those are generally run through private businesses. Shares in tax-deferred retirement plans such as IRAs and 401ks do not generate capital gains, even if you sell them. (There is one exception: Net Unrealized Appreciation on employer stock distributed...

Self-Directed 401Ks / IRAs Investing Retirement Funds in Real Estate. Benefits of Self-Directed IRAs and 401ks For You Increases Your Buyer Pool Increases Your Buyer Client Purchasing Power Offers Added Value Service vs Other 16 Single LLCs and Multi Partner LLCs Can include multiple partners Can include SD IRA, personal funds and debt Cannot be paid for...

SS means testing, RMDs and 401ks/IRAs (increase, wealthy, collecting) i have no problem with anyone who dies and leaves more money in the pot . those who die pay to support those who live . Then people should be able to opt out while self-funding their own retirement.

How Much is TOO MUCH in your 401(k)? Overall, any of these strategies will work, but the issue remains the same for early retirees - because of contribution limits, your 401k will probably not be My own strategy was in Vanguard index funds, a paid-off house, and some rental properties, but you will surely find other places depending on your...

401(k) - Wikipedia In the United States, a 401(k) plan is an employer-sponsored defined-contribution pension account defined in subsection 401(k) of the Internal Revenue Code. Employee funding comes directly off their paycheck and may be matched by the employer.

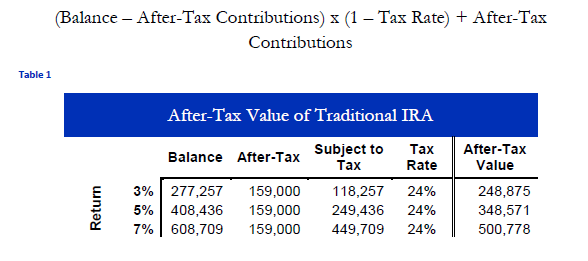

45+ Funding 401Ks And Roth Iras Worksheet Answers Chapter 8 Pics The main difference between 401(k)s and iras is that employers. If your 401(k) is a roth 401(k), you can roll it over directly into a roth ira without intermediate Traditional ira and 401(k) account owners both typically need to wait until age 59 1/2 to withdraw funds to avoid penalties. The answer is, if i pull it...

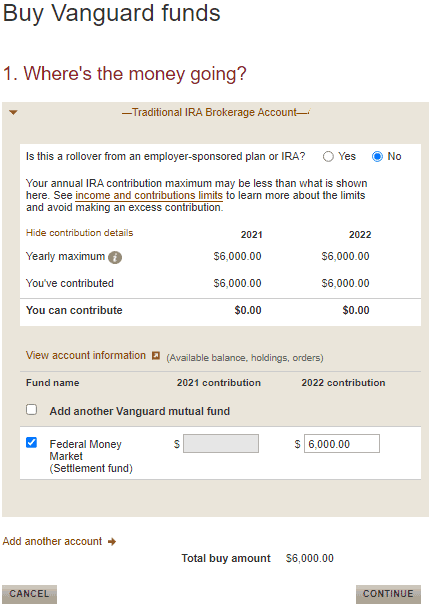

New Retirement Account Rules in Response to Coronavirus | 401ks The CARES Act permits 401(k) and IRA withdrawals for coronavirus costs, and retirees can... Savers have three years to put withdrawn funds back in a retirement account. The 2019 IRA contribution deadline has been extended to July 15, 2020.

Funding 401ks And Iras Worksheet Answers | TUTORE.ORG... Funding 401 K S And Roth Iras Worksheet Answers Kids. Copy Of Funding 401 K S And Roth Ira S Worksheet.

united states - How can I consolidate multiple 401Ks? - Personal... Roll over funds from your former employers 401Ks into the 401K for your current employer. 401k vs IRA: -This is a personal decision. You could move all your prior 401ks into an IRA you set up for yourself. Generally the limitations of a 401k are the lack of funds to invest in that fit your retirement...

401(k) Plan: The Complete Guide Funds withdrawn from your 401(k) must be rolled over to another retirement account within 60 days to avoid taxes and penalties. It could be a wise move if the employee isn't comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work...

Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET -. Complete Funding 401ks and Roth IRAs Worksheet.jpg. Finance. Funding_401K_s_and_IRA_s.png. 1. Funding 401(k)s & Roth IRAs Chart.docx. University of Kentucky. FIN MISC.

Spreadsheet: Roth vs. traditional 401ks and IRAs : investing I made a spreadsheet to calculate returns from investing in Roth and traditional versions of 401ks and IRAs. I did this because it's a recurring topic of confusion on the part of newbies (which is totally understandable) but also of debate among well-meaning people. One piece of traditional wisdom has...

If You Have a 401(k), Do You Need an IRA, Too? | Charles Schwab Combining 401Ks. Working together, a 401(k) and an IRA can help you maximize both your savings and your tax advantages. But the type of IRA that makes sense for you personally will depend on your filing status and your income, so there's a bit more to consider.

Roth 401K Basics (Updated for 2022) | Matching Funds Are Roth 401Ks are relatively new in the world of retirement accounts. They were first introduced in the United States in 2006 and their adoption rate by employers was slow out of the gate, but now 86% of employers A Roth 401K combines many of the benefits of the Roth IRA and the Traditional 401K.

Make Sure You Understand the Benefits and Risks of IRAs and 401(k) s When considering an IRA, the major distinction is between the traditional IRA and the Roth IRA. One element that must be taken into account is that funds must be held in a Roth IRA for five years Risks and Benefits of 401(k)s. Although 401(k) retirement savings plans have grown in popularity since their...

Are 401Ks & IRAs WORTH IT? (Financial Independence...) - YouTube Are 401Ks & IRAs WORTH IT? (Financial Independence & Early Retirement) | Investing For Retirement.

![Backdoor Roth IRA 2021 [Step-by-Step Guide] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2020/06/Screen-Shot-2020-06-20-at-6.58.37-AM.png)

![Backdoor Roth IRA 2021 [Step-by-Step Guide] | White Coat Investor](https://i.ytimg.com/vi/w244kccgl84/maxresdefault.jpg)

![Backdoor Roth IRA 2021 [Step-by-Step Guide] | White Coat Investor](https://www.whitecoatinvestor.com/wp-content/uploads/2018/09/Backdoor-Roth-IRA-part-2-3.png)

0 Response to "42 Funding 401ks And Iras Worksheet Answers"

Post a Comment