39 funding 401ks and roth iras worksheet

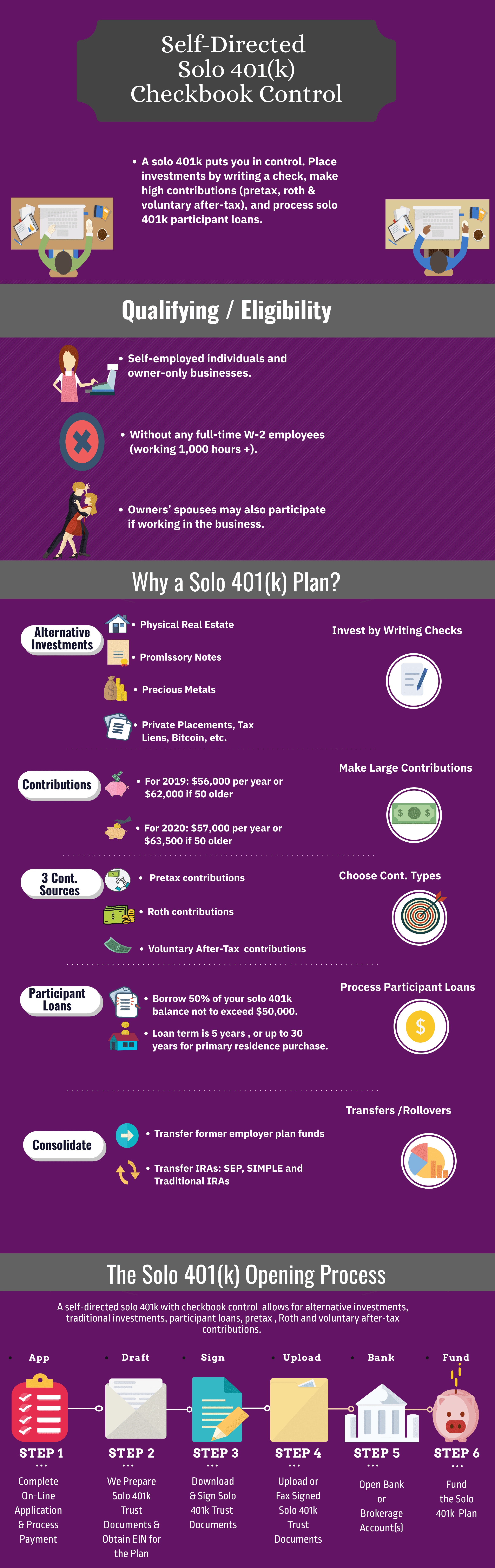

Funding 401K And Roth Ira Worksheet - Free Gold IRA ... Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." 7+ Creative Funding 401ks And Iras Worksheet - Mate ... Funding 401ks And Roth Iras Worksheet Promotiontablecovers Funding 401ks and iras worksheet A worksheet is usually a notepad distributed by an instructor to students that lists tasks for the students to accomplish. Funding 401ks and iras worksheet. Traditional 401k worksheet an increasing number of 401k.

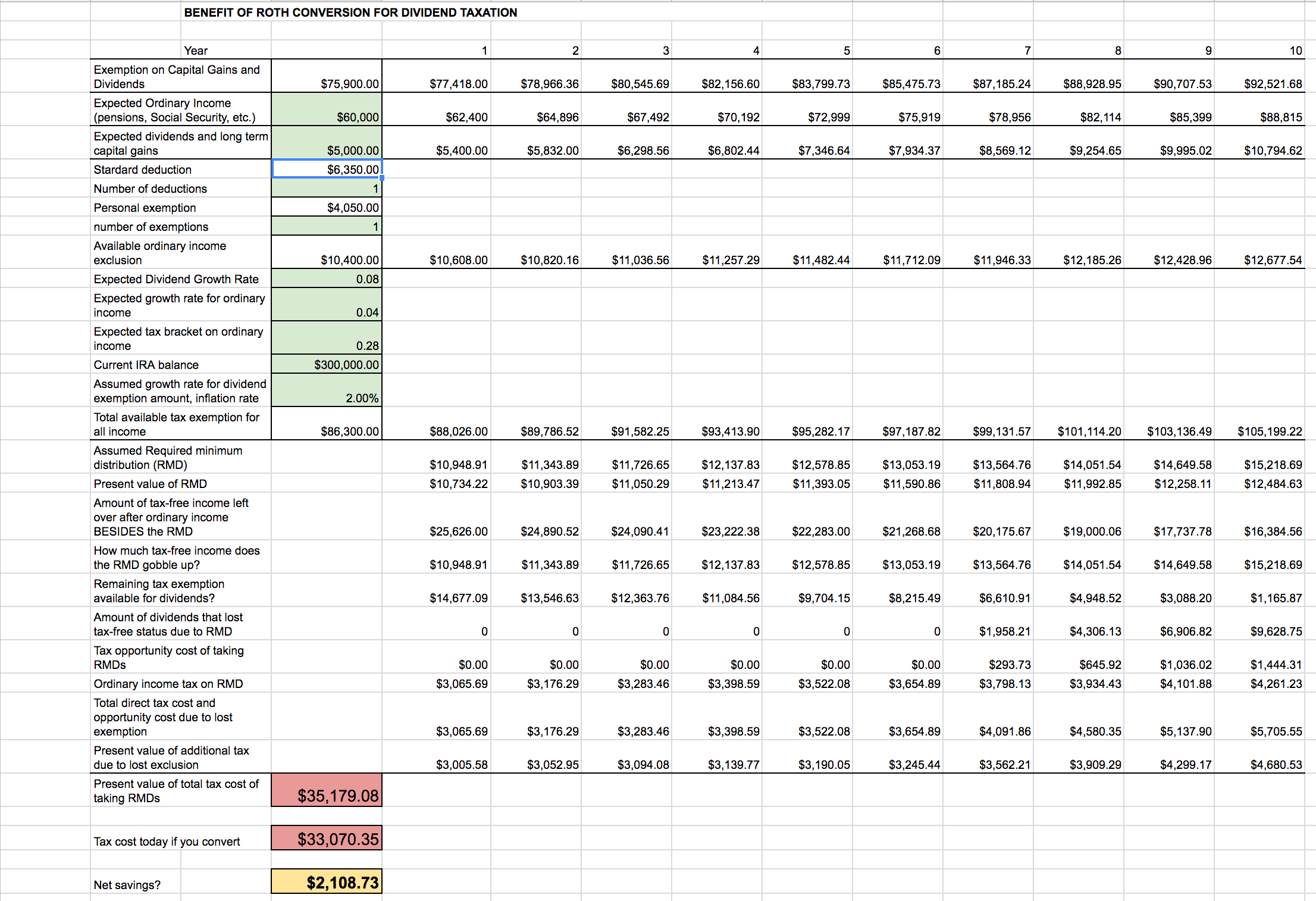

What Happens to a 401(k) After You Leave Your Job? - Investopedia Jan 25, 2022 · Money in other 401(k) plans and traditional IRAs is subject to RMDs. Roll It Over Into an IRA If you’re not moving to a new employer, or if your new employer doesn’t offer a retirement plan ...

Funding 401ks and roth iras worksheet

Funding 401 Ks And Roth Iras Worksheet Answers - Worksheet ... Funding 401 Ks And Roth Iras Worksheet Answers Youngsters take pleasure in locating remedies to problems. Single-digit reproduction is the primary focus of this worksheet. There are advanced steps for children to learn after mastering enhancement. 401(k) and roth ira Flashcards | Quizlet 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k) 41 funding 401ks and roth iras worksheet answers ... Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Act-Ch12-L03-S.pdf - Funding 401 (k)s and Roth IRAs ...

Funding 401ks and roth iras worksheet. Funding 401(K)S And Roth Iras Worksheet Answers Chapter 8 ... Funding 401 (K)S And Roth Iras Worksheet Answers Chapter 8 A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." PDF Funding 401ks and roth iras worksheet answers Funding 401ks and roth iras worksheet answers Funding 401ks and roth iras worksheet answers chapter 8. Funding 401ks and roth iras worksheet answers pdf. If you even behave carefully, it is likely to be able to locate all to have fun and still have enough money to pay the rental in time and get enough on your authable to drive home. Your favorite homework help service - Achiever Essays ALL YOUR PAPER NEEDS COVERED 24/7. No matter what kind of academic paper you need, it is simple and affordable to place your order with Achiever Essays. Funding 401ks And Iras Worksheet - Diy Color Burst Funding 401 K S And Roth Iras Worksheet Answers And Fidelity 401k Traditional 401k worksheet an increasing number of 401k. The estimating worksheet was made to direct you. Discover learning games guided lessons and other interactive activities for children. 45 Funding 401Ks And Roth Iras Worksheet Answers Chapter 8 Pics.

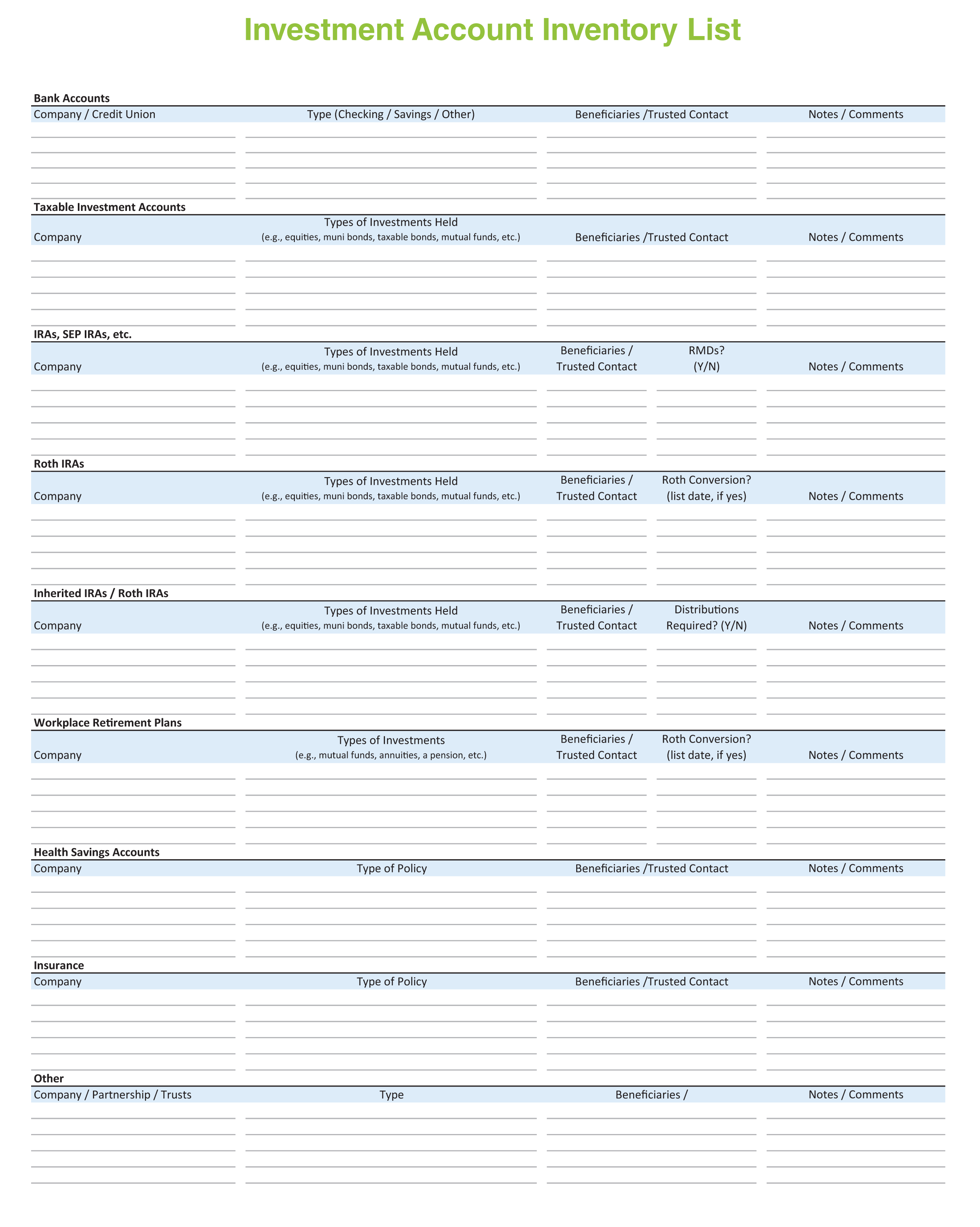

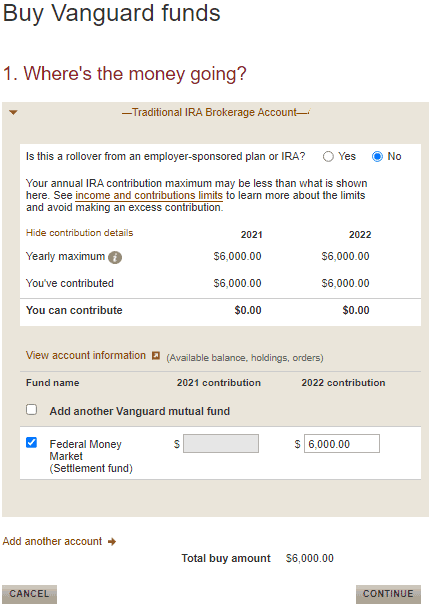

Forms & Applications | Charles Schwab Find the forms you need in one convenient place. Open an account, roll over an IRA, and more. Roth IRA vs. SEP IRA: What's the Difference? Roth and SEP IRAs are not created equally. Roth IRAs require you to make contributions, while SEPs put the burden of funding on the employer. The low annual contribution limits of a Roth IRA might not be the ideal single solution for retirement income, but a SEP IRA might be, especially if an employer is willing to make maximum contributions. Complete Funding 401ks and Roth IRAs Worksheet.jpg - NAME ... View Complete Funding 401ks and Roth IRAs Worksheet.jpg from AA 1NAME: DATE: Funding 401(k)s and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Assume PDF Roth vs. Traditional 401(k) Worksheet - Morningstar p Roth 401(k): Multiply the maximum allowable amount by 1 plus your tax rate (for example, 1.24 if you're in the 24% tax bracket). Then divide that amount by your total salary to arrive at your ...

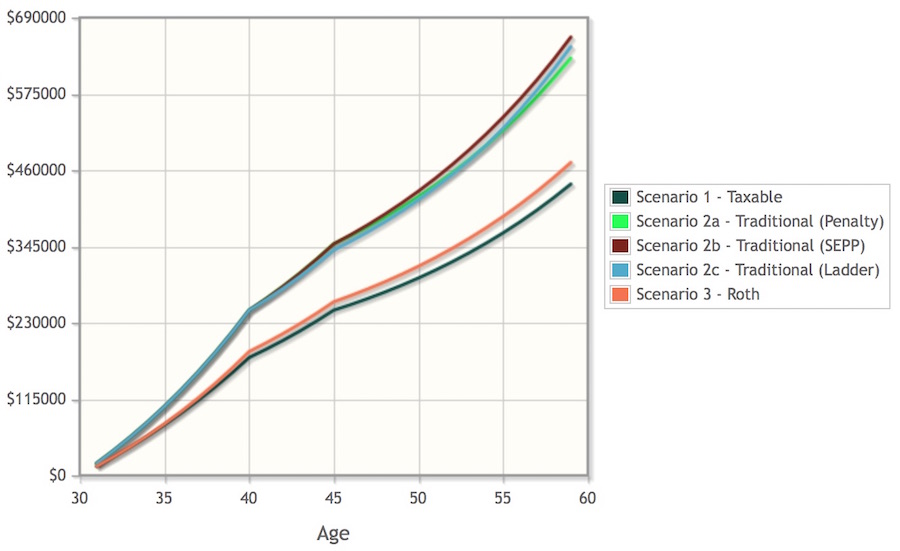

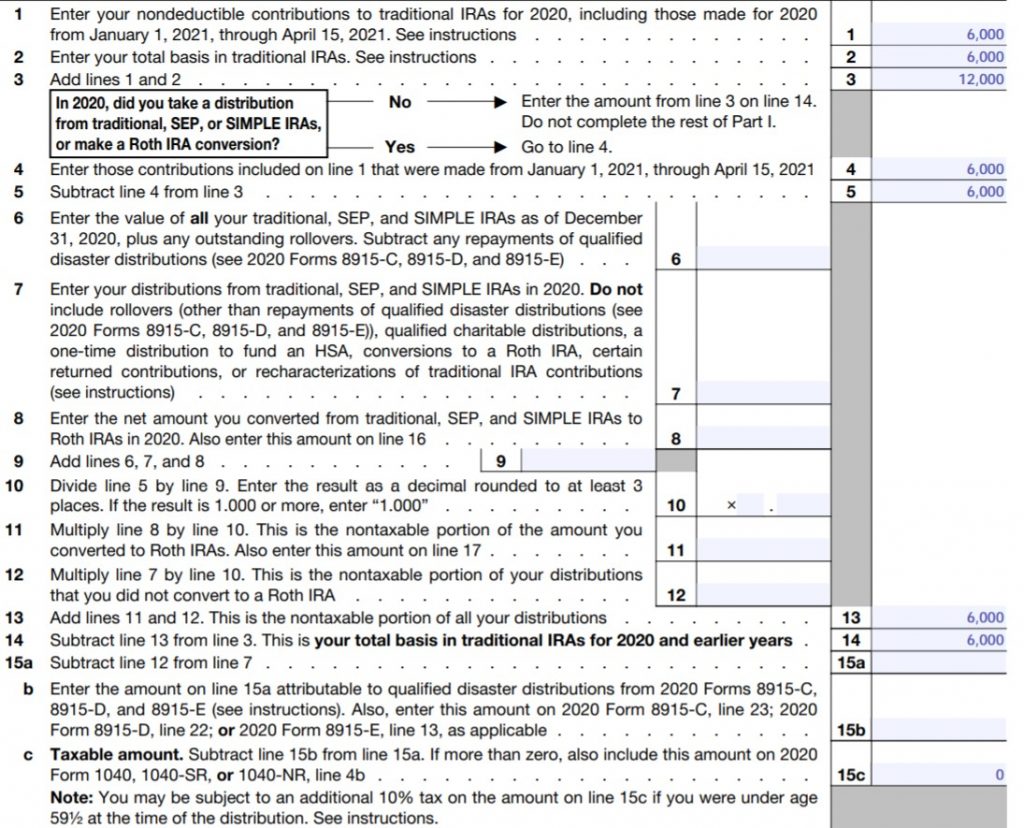

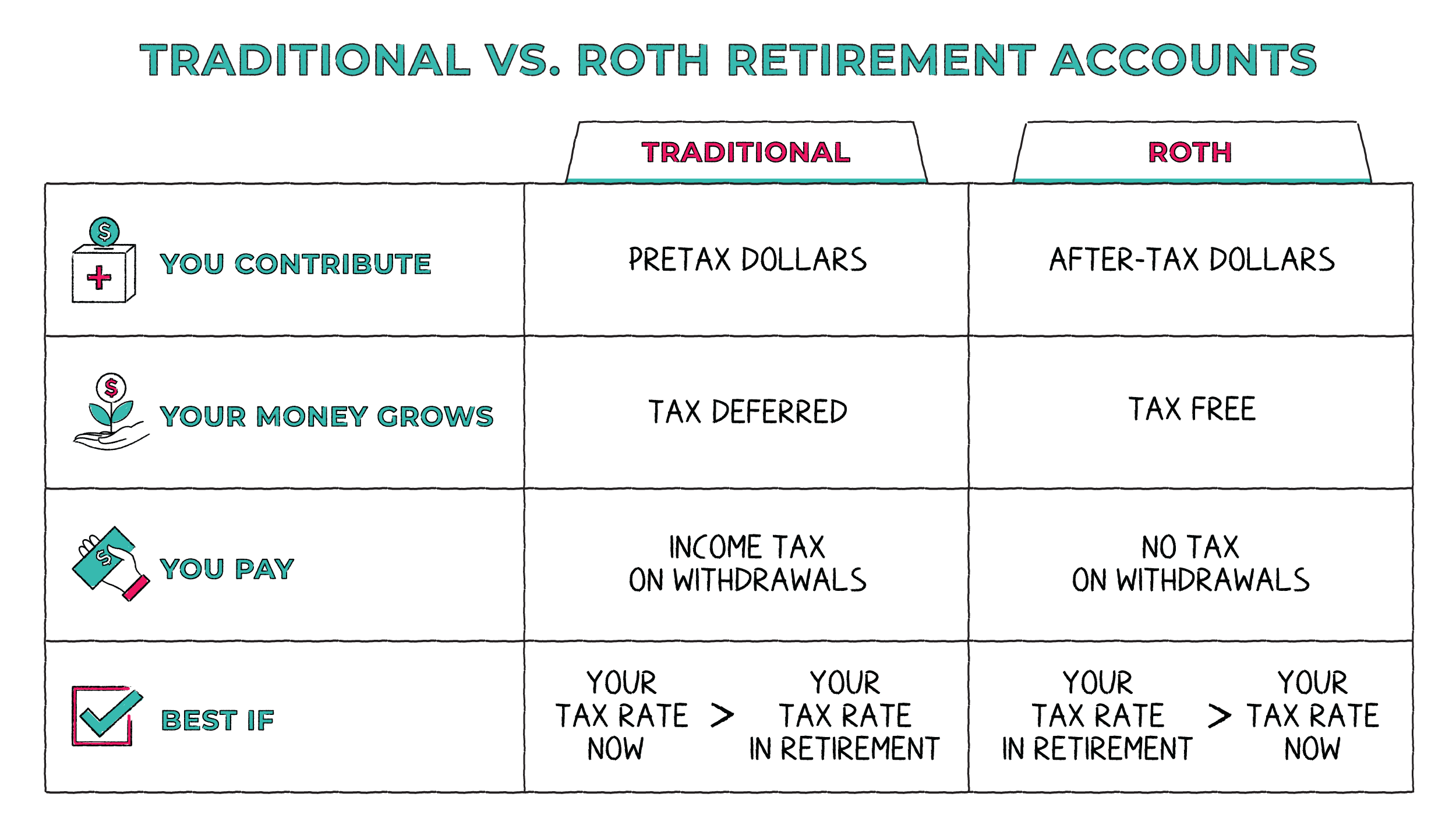

How Much is TOO MUCH in your 401(k)? - Mr. Money Mustache 11-11-2011 · Example: Married couple in early 30s has around $100K in Roth IRAs, $30K in a 401(k) and $100K in a taxable brokerage account, but the cost basis of the brokerage account is $80K. Wife works right now and makes $30K/yr and husband is going back to school and next year hopes to start job making 60K/yr. Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET ... View Copy of Funding 401(k)'s and Roth IRA's - WORKSHEET from MATH 12345 at New Life Academy, Woodbury. Investment Joe Melissa Tyler & Megan Adrian David & Britney Brandon Chelsea Annual Funding 401ks And Roth Iras Worksheet - Studying Worksheets Funding 401ks and roth iras worksheet work extremely well from a teachertutorparent to enrich the content an understanding of their studentchild. Funding 401ks and Roth IRAs Directions Complete the investment chart based on the facts given for each situation. Funding 401ks and roth iras worksheet answers chapter 8. Backdoor Roth IRA 2022: A Step by Step ... - Physician on FIRE Jan 06, 2022 · Money contributed to Roth accounts does not result in a tax deduction, unlike contributions to tax-deferred accounts. Both Roth and tax-deferred accounts benefit from tax-free growth, unlike a taxable account that is subject to tax drag (which can be minimized). The Roth dollars, unlike tax-deferred dollars, will not be taxed when withdrawn.

40 funding 401ks and roth iras worksheet answers ... Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Copy of Funding 401 (k)'s and Roth IRA's - WORKSHEET ...

What Happens to a 401(k) After You Leave Your Job? 25-01-2022 · There are several options for your 401(k) when you leave your job, including leaving it where it is or rolling it over to another retirement account.

How Much is TOO MUCH in your 401(k)? - Mr. Money Mustache Nov 11, 2011 · Example: Married couple in early 30s has around $100K in Roth IRAs, $30K in a 401(k) and $100K in a taxable brokerage account, but the cost basis of the brokerage account is $80K. Wife works right now and makes $30K/yr and husband is going back to school and next year hopes to start job making 60K/yr.

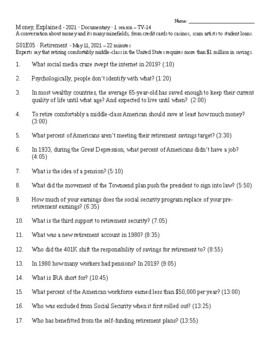

Solved Activity: Funding 401(k)s and Roth IRAs Objective ... Activity: Funding 401 (k)s and Roth IRAs. Objective: The purpose of this activity is to learn to calculate 15% of an income to save for retirement and to understand how to fund retirement investments. Directions: Complete the investment chart based on the facts given for each situation. Assume each person is following Dave's advice of ...

Funding 401Ks And Iras Worksheet - Weavingaweb View funding 401(k)s & roth iras chart.docx from fin misc at university of kentucky. With no match, fund the roth first (based on 2013 contribution of $5,500 per individual). Funding 401ks and roth iras worksheet answers funding 401ks and roth iras worksheet answers chapter 8.

Funding a 401 K and Roth - financial lit Flashcards | Quizlet 401 (K) defined contribution plan offered by a corporation to its employees, which allows employees to set aside tax-deferred income for retirement purposes; in some cases, employers will match their contributions. 403b. same as 401k but is used for nonprofit organizations such as schools, hospitals, and churches.

PDF NAME: DATE: Funding 401(k)s and Roth IRAs - Weebly Melissa will fund the 401(k) up to the match and put the remainder in her Roth IRA. Tyler and Megan can each fund a Roth IRA then put the remainder in the 401(k). With no match, fund the Roth first (based on 2013 contribution of $5,500 per individual). Adrian is not eligible to open a Roth IRA because he makes too much money.

Forms & Applications | Charles Schwab Find the forms you need in one convenient place. Open an account, roll over an IRA, and more.

41 funding 401ks and roth iras worksheet answers ... Funding 401K And Roth Ira Worksheet A gold IRA or protected metals IRA is a Self-Directed IRA where the owner maintains ownership of the accounts receivable and the value of the accounts balance. The IRA owns shares in a company, also referred to as "protocol shares." Act-Ch12-L03-S.pdf - Funding 401 (k)s and Roth IRAs ...

401(k) and roth ira Flashcards | Quizlet 1. calculate target amount to invest (15%) 2. fund our 401(k) up to the match 3. Above the match, fund roth ira 4. complete 15% of income by going back to 401(k)

Funding 401 Ks And Roth Iras Worksheet Answers - Worksheet ... Funding 401 Ks And Roth Iras Worksheet Answers Youngsters take pleasure in locating remedies to problems. Single-digit reproduction is the primary focus of this worksheet. There are advanced steps for children to learn after mastering enhancement.

0 Response to "39 funding 401ks and roth iras worksheet"

Post a Comment