41 gross pay vs net pay worksheet

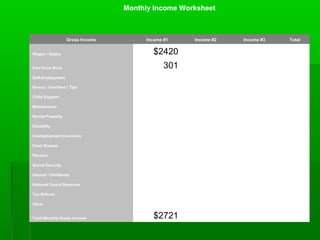

GROSS PAY AND NET PAY WORKSHEET GROSS/NET PAY PROBLEMS CONTINUED 7. Martha Green worked 40 regular-time hours at $10.00 per hour and 4 overtime hours at $15.00 per hour. Find Martha’s gross pay for the week. How To Net Pay Versus Gross Pay Gross Pay vs Net Pay: How to Calculate the Difference. › Get more: Gross to net calculatorShow All. Gross pay versus net pay: Do you know the difference. How. Details: If the job you work at includes tips or a commission and you earned $76 from tips or commissions on top of the $160...

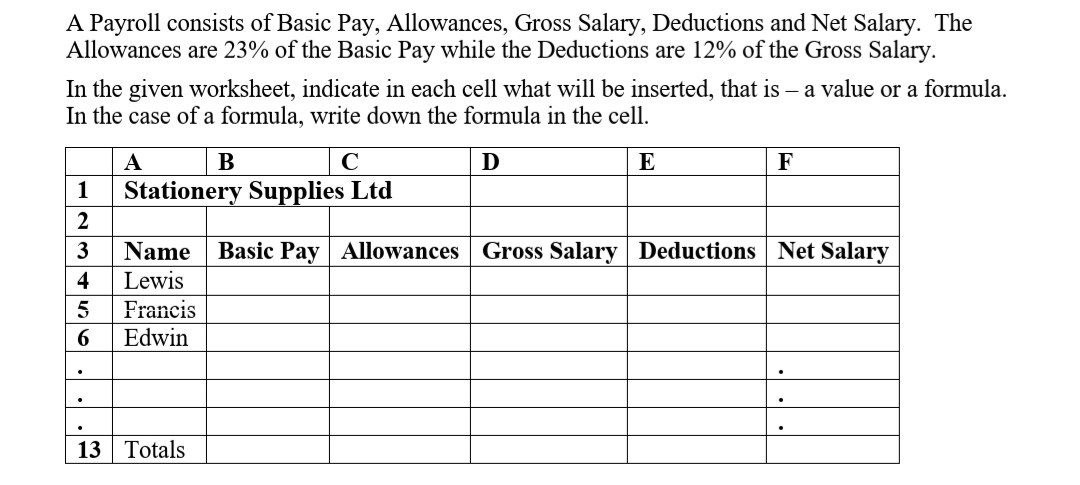

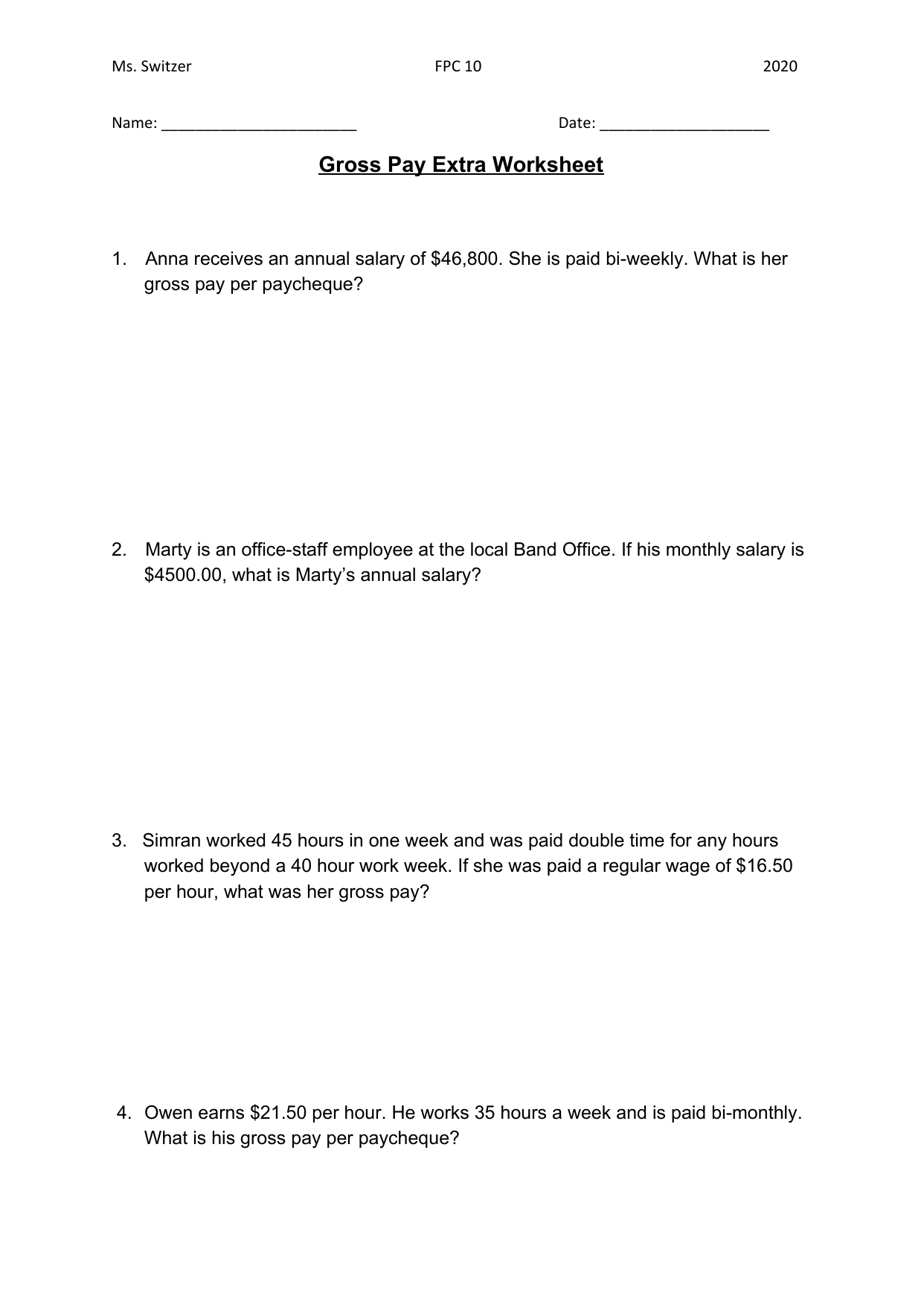

Gross Pay And Net Pay Worksheets & Teaching Resources | TpT 8. $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and asked to calculate the dollar amoun.

Gross pay vs net pay worksheet

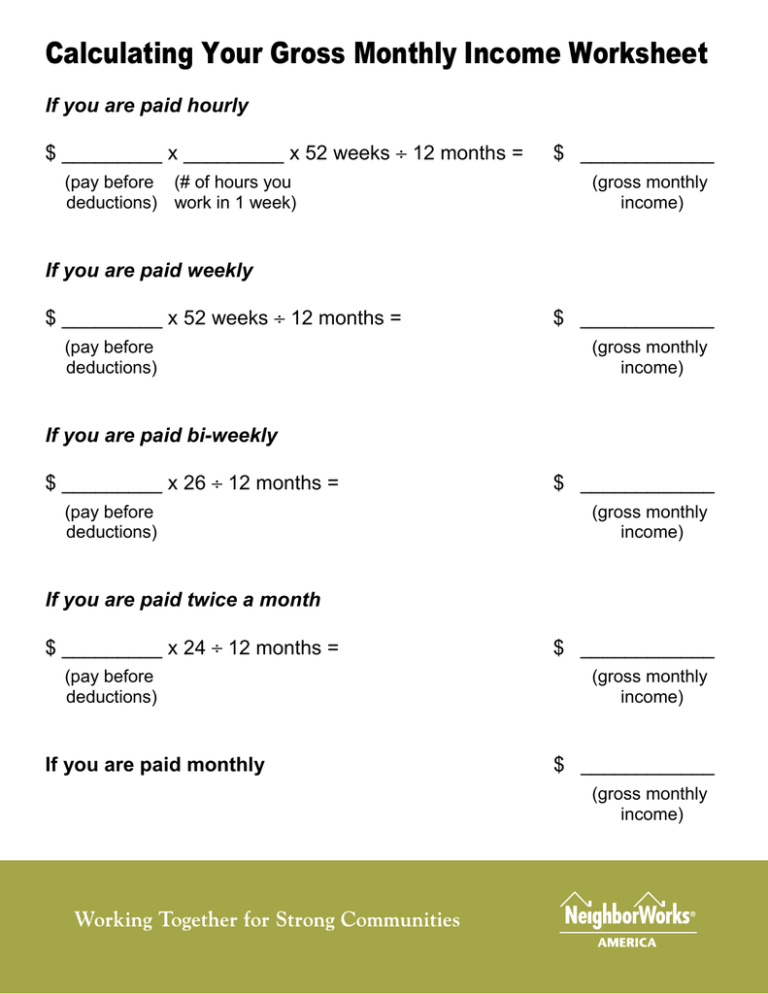

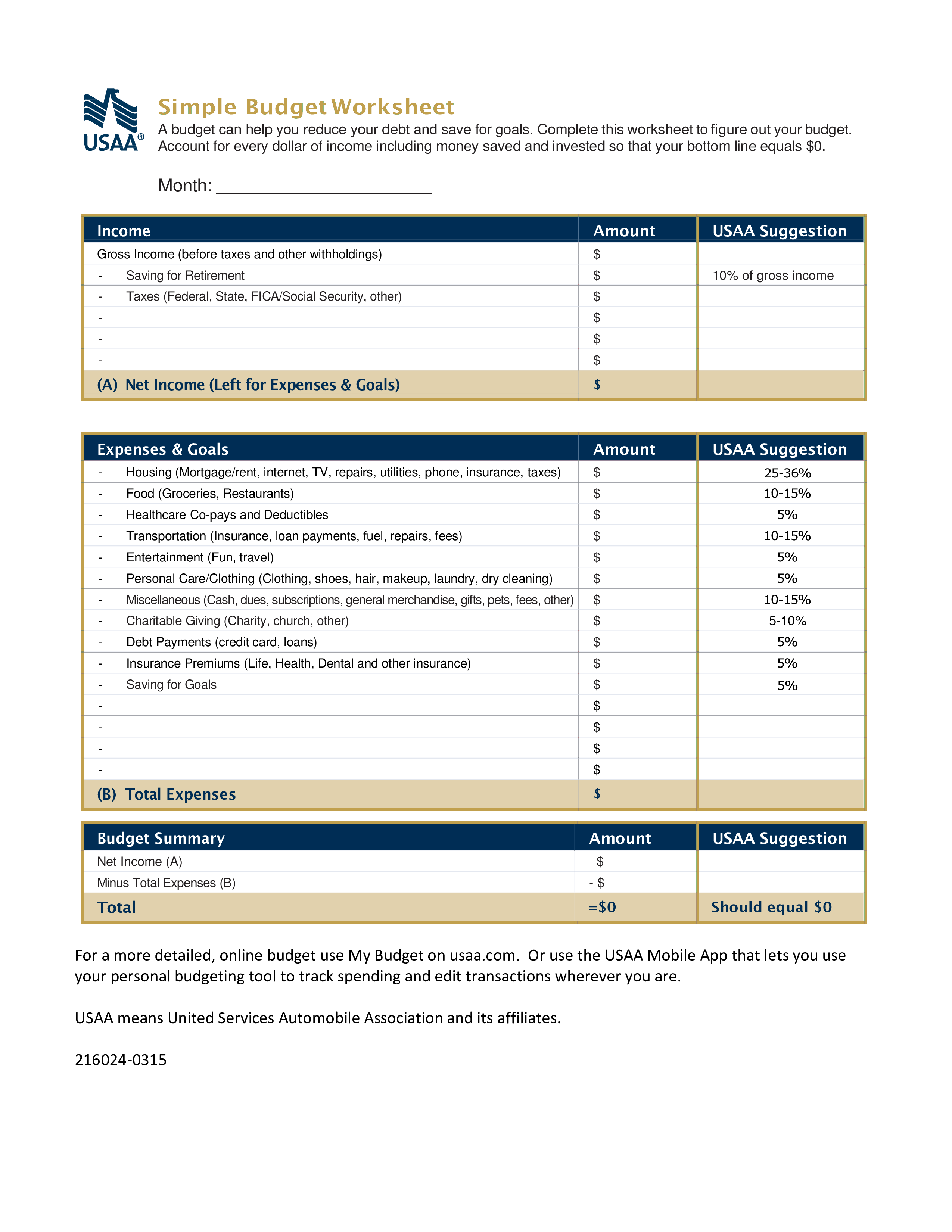

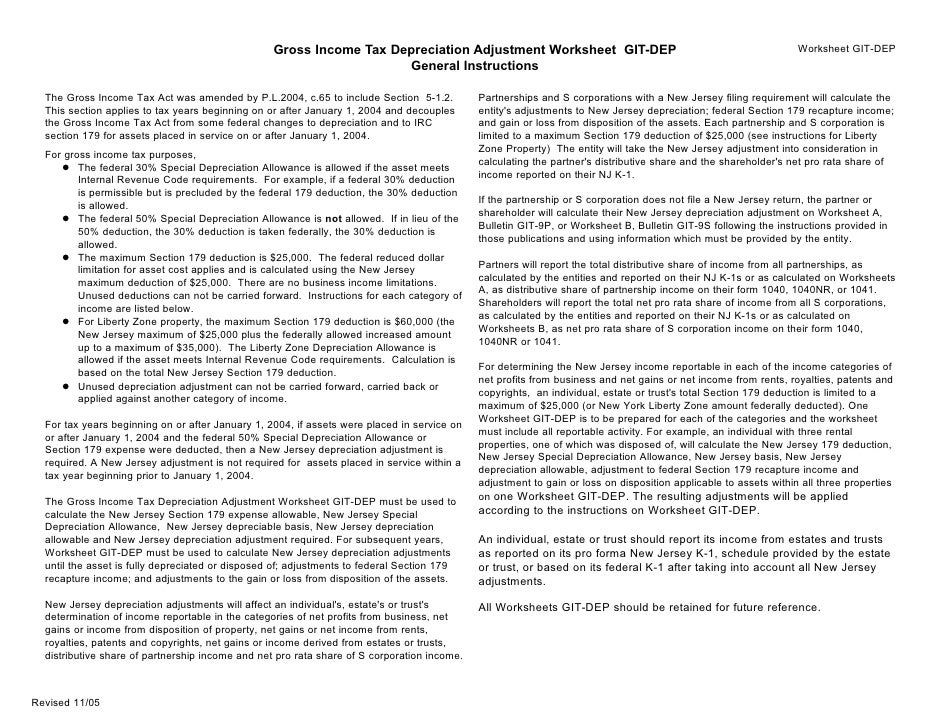

Gross Pay vs. Net Pay: Definitions and Examples | Indeed.com Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. For example, when an employer pays you an annual salary of $40,000 per year, this means you have earned $40,000 in gross pay. Gross pay vs. net pay. Gross Pay vs. Net Pay: What's the Difference? - YouTube Learn the difference between gross pay and net pay, which are common payroll terms. For more payroll basics, check out these resources: [READ] How to Read a... Payroll Deductions From Gross Pay vs. Net Pay | Your Business Gross pay is simply your employee's wages before any deductions. If you pay an employee on an hourly basis, the gross pay is the amount of hours she worked multiplied by the hourly rate. Net pay is the final result after subtracting federal income, FICA and other deductions.

Gross pay vs net pay worksheet. Gross vs. Net Pay | What's the Difference Between Gross... | Ask Gusto Find out the key differences between gross pay and net pay, and how they can be calculated from your employee's paychecks. To calculate the gross pay for an hourly employee, multiply their hourly rate by the number of hours worked. Then add any other applicable sources of income, such as... Gross vs Net Pay for Individual Salaries | Diffen Net margin is the ratio of net profit to revenue. Gross vs Net Pay for Individual Salaries. The cash that employees get every paycheck is their net pay Gross and net leases refer to what expenses the tenant is obligated to pay in addition to the agreed upon rent. Typically these include utility bills and... Gross Pay Net Pay Worksheets Excel › Get more: Net pay worksheet answer keyShow All. Gross And Net Pay Worksheets & Teaching Resources TpT. Other than the names, rates and work hours which is manually inputted, gross and net pay, income tax and relevant other deductions needs to calculating gross pay worksheet answers. Gross And Net Pay Worksheets & Teaching Resources | TpT Net and Gross Pay (Workbook- 4 Worksheets) by. Sophie's Stuff. 9. $2.00. PDF. This is a workbook I created to teach my special education students about net and gross pay. On the first worksheet, students are given the deductions in dollar amounts. On the second worksheet, the students are given the wage and the deductions in percentages and ...

Gross and Net Pay by John McCall | Gross vs. Net Complete the Net Pay Worksheet in class. You may work with a partner. On your Laptop: With a partner, create your own example of gross and net pay with deductions. Extra Credit: Add voluntary deductions such as insurance or charity. You can also use canva.com to create this example like the... Gross Pay Vs. Net Pay: What's The Difference? (With Examples) Gross pay refers to the all-encompassing number that accounts for every hour an employee has worked. This amount does not have deductions The big difference between the gross and net pay numbers is accounting for taxes and deductions. Net pay is the result of gross pay after deductions... Gross Pay vs. Net Pay: What's the Difference? | ADP Knowing the difference between gross and net pay may make it easier to negotiate wages and run payroll. Learn more about gross vs. net pay. As previously mentioned, gross pay is earned wages before payroll deductions. Employers use this figure when discussing compensation with employees... Gross Pay Vs Net Pay Worksheet - Worksheet List Net pay worksheet calculate the net pay for each situation below. 1 sandra earns 1350hour and works 32 hours. Gross pay showing top 8 worksheets in the category gross pay. So a person making 1200 per week will have 5040 042 x 1200 deducted from his or her weekly gross pay.

Gross Pay Net Pay Worksheets, Jobs EcityWorks Net Gross Pay - Displaying top 8 worksheets found for this concept. Some of the worksheets for this concept are Net pay work calculate the net pay for each, Computing gross pay, Understanding your paycheck, Teacher lesson plan, Calculating payroll deductions, Worked, Work 34 gross pay... Gross Pay Vs Net Pay - Rah Bagh Hotel Difference Between Gross Pay And Net Pay With Table. These may include your monthly grocery bill, gas for your car, credit card bill and any other costs that are typically variable. There are some basic components of gross salary used while calculating an individual's annual package. Gross Pay Net Pay Worksheets Convert Details: GROSS/NET PAY PROBLEMS CONTINUED 7. Martha Green worked 40 regular-time hours at $10.00 per hour and 4 overtime hours at $15.00 per hour. Find Martha's gross pay for the week. net pay worksheet pdf. › Verified 9 hours ago. What Is the Difference Between Net Pay and Gross Pay? Gross pay refers to the amount of money you receive before any deductions are taken out of your paycheck, while net pay is the amount of your pay after all your deductions, taxes, and payroll contributions have come out. On most paycheck stubs, the amount of your gross pay appears...

Gross Pay vs Net Pay: What's the Difference? | Payscale Gross pay (also known as gross salary) is the amount of compensation a company or organization pays an employee before any required or voluntary deductions take effect, per payment period. Gross pay is the number listed at the top of each payroll statement. For example, if an employer says, "I'll...

Gross Pay vs Net Pay: What's the Difference? Read our explanation of Gross Pay vs Net Pay, and how to calculate final income. 1. Gross pay and net pay are important concepts for employers, employees and other workers to understand. Job adverts normally quote gross pay, while employees will normally receive net pay.

9+ Amazing Gross Pay Vs Net Pay Worksheet From his gross pay. On the second worksheet the students are given the wage and the deductions in percentages and asked to calculate the dollar amoun. So net income is the income we receive after paying taxes.

Gross pay vs. net pay. What's the different between them | Sumopayroll Gross pay is the important component of CTC system. It consists of sum of one's basic salary & allowances received by govt and org policies. The gross pay is the sum of a person's basic salary, allowances to cover recurring costs, reimbursements, and the annual bonus amount based on their...

Gross Pay Vs Net Pay Worksheet Worksheet List - Music Regular Pay Vs Gross Pay Economic! Analysis economic indicators including growth, development, inflation... Net Pay vs. Gross Pay - seenlabs.indeed.com. Economy. Details: If you have salaried employees, you can express their gross pay in terms of the yearly base salary they receive.

The Difference Between Net Pay and Gross Pay... - Hourly, Inc. Gross pay is a worker's wages before deductions are taken out, while net pay is a worker's take-home pay after deductions are subtracted. The gross pay is their total salary before any taxes and other withholdings are deducted from their paycheck. The net pay is the income that an employee would...

32, Gross, Pay, Vs, Net, Pay, Worksheet - FULL HD quality ... Mar 21, 2022 · Category : Pay Worksheet » 32, Gross, Pay, Vs, Net, Pay, Worksheet Tags: pay worksheet pay worksheet pdf teachers pay teachers free worksheets Selected Resolution

9+ Beautiful Gross Pay Vs Net Pay Worksheet | Printable Worksheet... GROSS PAY AND NET PAY WORKSHEET 1. Federal State Deductions. Income tax is a tax on the amount of income people earn. Start with the employees gross pay. They will go through. Employee Pay Benefits Review Worksheet 1. So net income is the income we receive after paying taxes.

Calculating Gross and Net Pay | Scholastic Worksheet: Where Did the Money Go? printable. To make it easier for employees to save, buy insurance, invest in retirement plans, and/or give to others, many employers offer to automatically deduct money from an employee's gross pay and deposit it directly into the employee's bank account...

Gross And Net Pay Worksheets - Kiddy Math Gross And Net Pay - Displaying top 8 worksheets found for this concept.. Some of the worksheets for this concept are Calculating the numbers in your paycheck, Teen years and adulthood whats on a pay stub, Its your paycheck lesson 2 w is for wages w 4 and w 2, My paycheck, Work 34 gross pay with overtime, Bring home the gold, Everyday math skills workbooks series, Reading a pay stub extension ...

Payroll Deductions From Gross Pay vs. Net Pay - Chron.com An employee's gross pay is her wages before you take any deductions out. Gross pay includes all types of compensation, including regular wages; overtime pay; bonuses; commissions; severance pay; and paid benefit days such as vacation, bereavement and sick pay and holidays. Her net pay is her...

Gross Pay vs Net Pay: How to Calculate the Difference - Article Gross pay, also called gross wages, is the amount an employee would receive before payroll taxes and other deductions. By contrast, net pay is the Net pay is sometimes called take-home pay. Depending on the size of the payroll deductions, an employee's net pay may be significantly lower...

Net Pay vs. Gross Pay: What's the... - Glassdoor Career Guides Net pay defined Gross pay defined Gross pay deductions How to calculate gross pay How to calculate net pay. Gross pay is the total sum of money an employee makes before any deductions or taxes are removed from their income. For example, if you sign a contract to make $45,000 a year...

The Difference Between Gross Pay and Net Pay Gross pay is the total amount of money that the employer pays in wages to an employee. According to the Internal Revenue Service, "This includes all income you receive in the form of money, goods, property, and services that is not exempt from tax. It also includes income from sources outside the...

Reception Maths Worksheets Printable: Calculating Gross Pay... Calculating Gross Pay Worksheet. Is the data presented in a way that an average overall income Calculating Gross Pay Worksheet Worksheets Are A Crucial Part Of Researching English Infants Paycheck Interactive Notebook Pages Gross Net Pay Deduction Percentages Pay Consumer Math...

Gross Pay vs. Net Pay Flashcards | Quizlet His net pay will increase by $22.61. Molly has biweekly gross earnings of $839.52. By claiming 1 more withholding allowance, Molly would have Bonnie knows that her gross earnings and federal tax are correct, but she thinks that her net pay is not correct. Using the fact that Social Security is 6.2% and...

Net And Gross Income Worksheets & Teaching Resources | TpT Word Document File. This worksheet asks students to- -Find net income given an hourly wage and hours worked -Figure out how long a person needs to save to afford an item given a weekly income -Determine gross income given net income and amount paid in taxes -Fill out a simple budget form to determine the amount of mone.

Payroll Deductions From Gross Pay vs. Net Pay | Your Business Gross pay is simply your employee's wages before any deductions. If you pay an employee on an hourly basis, the gross pay is the amount of hours she worked multiplied by the hourly rate. Net pay is the final result after subtracting federal income, FICA and other deductions.

Gross Pay vs. Net Pay: What's the Difference? - YouTube Learn the difference between gross pay and net pay, which are common payroll terms. For more payroll basics, check out these resources: [READ] How to Read a...

Gross Pay vs. Net Pay: Definitions and Examples | Indeed.com Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. For example, when an employer pays you an annual salary of $40,000 per year, this means you have earned $40,000 in gross pay. Gross pay vs. net pay.

You've created an excellent post. Thank you for bringing this article to our attention. The Payroll Outsourcing Companies helping you to get the best to calculate the

ReplyDeletegross pay and net pay, full details of employees. Hope you will share more information about Hr Management Software