39 irs form 886 a worksheet

Irs Form 5129 Printable: Fillable, Printable & Blank PDF ... How to Edit and fill out Irs Form 5129 Printable Online. Read the following instructions to use CocoDoc to start editing and completing your Irs Form 5129 Printable: Firstly, look for the "Get Form" button and click on it. Wait until Irs Form 5129 Printable is loaded. Customize your document by using the toolbar on the top. 8863 Credit Limit Worksheet ≡ Fill Out Printable PDF Forms ... The 8863 Credit Limit Worksheet is a document that helps you calculate the maximum credit limit for each of your business locations. The perfect place to get access to and use this form is here. Our simple PDF tool will let you get your PDF in no time. Virtually any system you go for, whether it is a PC, laptop, phone, or tablet, can be used.

Head of Household Filing Status - Support To claim a spouse's exemption, from the Main Menu of the Tax Return (Form 1040) select: Personal Information; Other Categories (Form 8914 - Housing Exemptions) HOH or MFS and Claiming Spouse Exemption; Additional Information: IRS Form 886-H-HOH - Supporting Documents to Prove Head of Household Filing Status

Irs form 886 a worksheet

PDF Form 886-I Explanation of Items - ncpe Fellowship Form 886-I (October 2011) Catalog Number 58489B Explanation of Items Department of the Treasury - Internal Revenue Service Schedule Number . Name of taxpayer Tax Identification Number . Taxable Year Ended We need documentation to verify that you are eligible to claim the Employee Business Expenses listed on your Form IRS Form 886A | Tax Lawyer Shows What to do in Response Most often, Form 886A is used to request information from you during an audit or explain proposed adjustments in an audit. This form is extremely important because the IRS will want their questions answered by you! Audit Procedure You will need to provide more than just a few cancelled checks to the government. PDF Head of Household Worksheet You must complete the Dependent/Child Tax/Education Credit Worksheet and provide a copy of the Divorce/Separation/Child support agreement. You affirm you have reviewed Form 886-H-HOH Supporting Documents to Prove Head-of-Household status

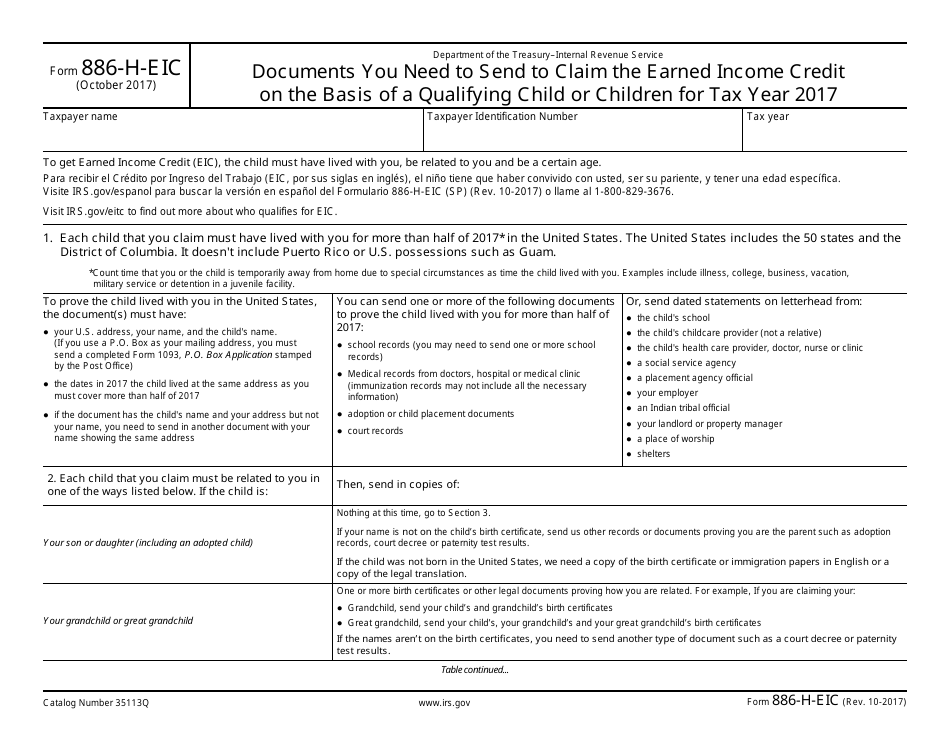

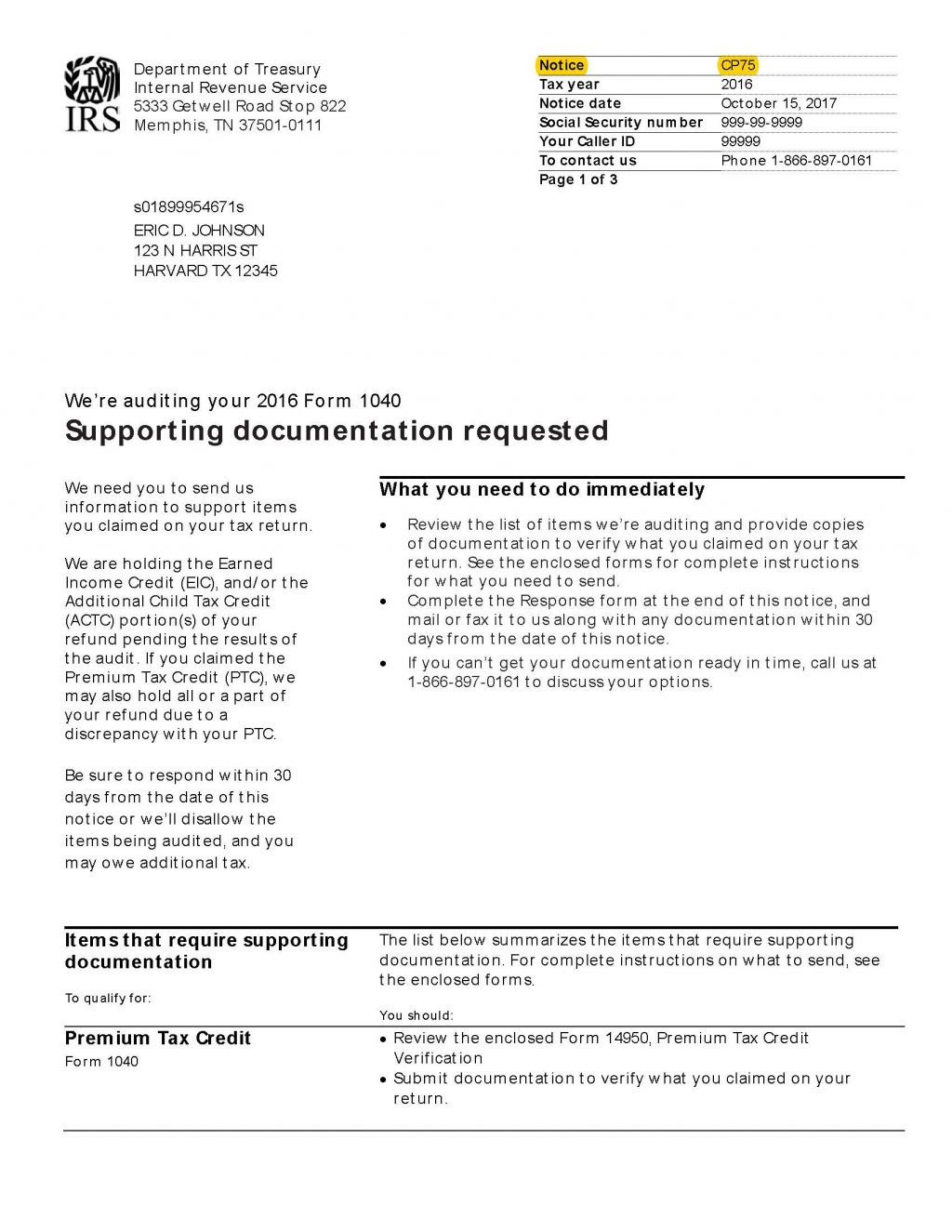

Irs form 886 a worksheet. Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP: Supporting Documents for Dependency Exemptions 1019 07/31/2020 Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children ... Rec'd a Form 886-A worksheet pre Qualified Loan limit and ... Sent Form 886-A Worksheet for Qualified … read more Mark Taylor Certified Public Accountant Masters 2,866 satisfied customers Form 886-A Deductible Home Mortgage Interest Taxpayer has Form 886-A Deductible Home Mortgage Interest Taxpayer has $1,000,000 in Grandfathered debt. Line 9 Form 886-A - is this line amount after … read more Lane PDF 886-H-HOH (October 2020) Supporting ... - IRS tax forms Form . 886-H-HOH (October 2020) Department of the Treasury - Internal Revenue Service . Supporting Documents to Prove Head of Household Filing Status. You may qualify for Head of Household filing status if you meet the following three tests: Marriage Test, Qualifying Person Test, and Cost of Keeping up a Home Test. ... Is there a downloadable/fillable version of Schedule C-7 ... The IRS uses Form 886A to requests information or to explain items they propose to adjust in an audit. They often request more information than what they really need but you also have a duty to supply sufficient evidence to win your case. Income Issues: The IRS has reviewed and has noticed a discrepancy in the items reported.

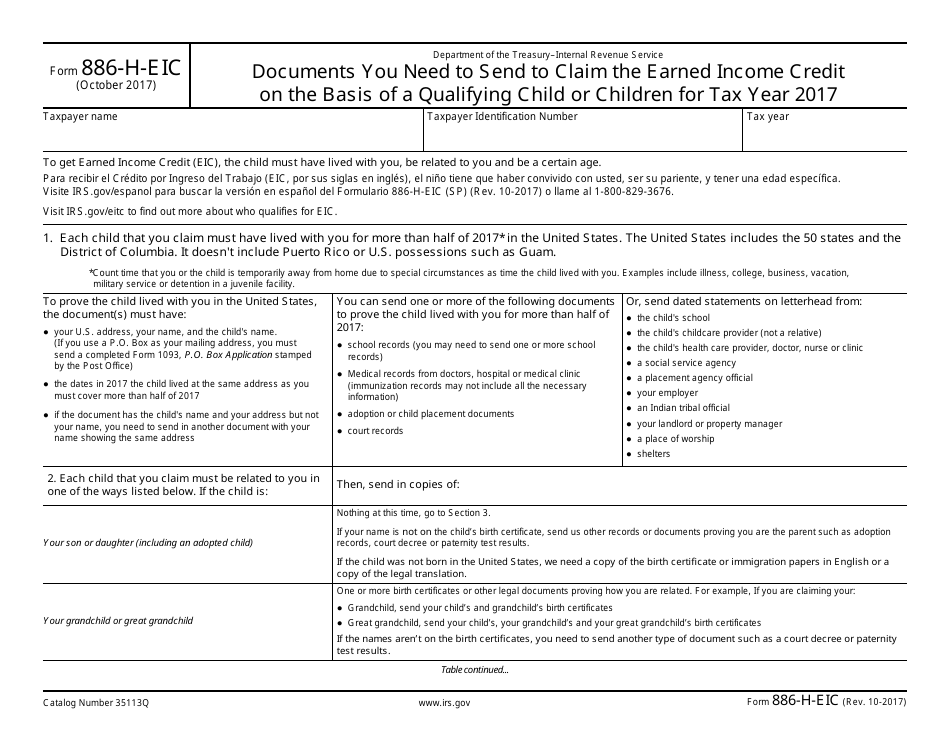

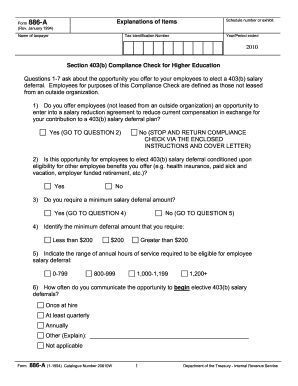

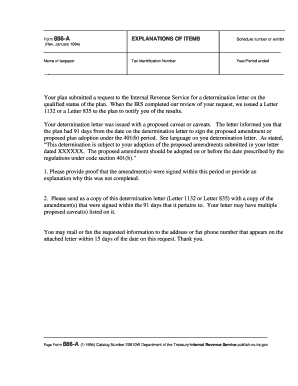

PDF Form 886-L (Rev. December 2014) Form 886-L (Rev. 12-2014) Catalog Number 73202A Department of the Treasury - Internal Revenue Service Form 886-L (Rev. December 2014) Supporting Documents Please provide a photocopy of the document or documents requested below. Return the photocopies with this form in the envelope provided. Schedule C 4 Form 886 A - FAVENI Form a department of the treasury internal revenue sch'el'c. Form 886a, explanation of items explains specific changes to your return and why the irs didn't ... Form 886-A - Internal Revenue Service Form 886-A EXPLANATIONS OF ITEMS Schedule number or exhibit (Rev. January 1994) Name of taxpayer Tax Identification Number Year/Period ended __ Your plan submitted a request to the Internal Revenue Service for a determination letter on the qualified status of the plan. Fillable Form 1040: 2021 U.S. Individual Income Tax Return ... Form 15111: Earned Income Credit Worksheet (CP 09) (IRS) Form 886-H-HOH: Supporting Documents to Prove Head of (IRS) F1096 21 2021 Form 1096 (IRS) FORM 1040, PAGE 1 of 2: 20 05 (IRS) FORM 1040, PAGE 1 of 2: 07 20 (IRS) Form 5329: Additional Taxes on Qualified Plans (Including (IRS)

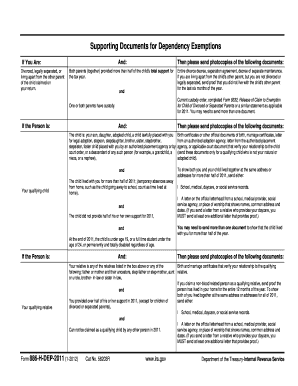

PDF Form 886-H-DEP Supporting Documents for Dependency Exemptions Form 886-H-DEP (Rev. 10-2016) Catalog Number 35111U publish.no.irs.gov . Department of the Treasury - Internal Revenue Service. Form . 886-H-DEP (October 2016) Department of the Treasury-Internal Revenue Service . Supporting Documents for Dependency Exemptions. Taxpayer Name Taxpayer Identification Number Tax Year. If You Are: And: Then ... Fill - Free fillable IRS PDF forms IRS e-file Signature Authorization for an Exempt Organization Form 8879-E0. Installment Sale Income Form 6252. Request for Public Inspection or Copy of Exempt or Political Organization IRS Form 4506-A. Payment Card and Third Party Network Transactions Form 1099-K. Compensation Information Schdul J Form 990. Form 886 A Worksheet Fillable - US Legal Forms Follow these simple instructions to get Form 886 A Worksheet Fillable prepared for sending: Select the form you require in the collection of templates. Open the template in our online editor. Read through the recommendations to find out which details you will need to give. Click on the fillable fields and include the necessary details. Form 886 - Fill Online, Printable, Fillable, Blank | pdfFiller Fill Form 886, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ✓ Instantly. Try Now!

IRS Form 886-H-EIC Download Fillable PDF or Fill Online Documents You Need to Send to Claim the ...

PDF Deduction Interest Mortgage - IRS tax forms Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publica- tions; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don't resubmit requests you've al- ready sent us.

Forms 886 Can Assist You | Earned Income Tax Credit Forms 886 Can Assist You Some tax preparers told us they are uncomfortable asking the probing, sometimes sensitive questions necessary to meet the due diligence knowledge requirement. Consider using the forms IRS uses to request documentation during audits. Tell your clients here's what you need to support your claim if you are audited by IRS.

Form 886 A - Fill Out and Sign Printable PDF Template ... Use a form 886 a 1994 template to make your document workflow more streamlined. Show details How it works Open the form 886a and follow the instructions Easily sign the irs 886a with your finger Send filled & signed form or save Rate form 4.8 Satisfied 136 votes be ready to get more Create this form in 5 minutes or less Get Form

IRS ID - nebula.wsimg.com If 1 i you don't agree with our changes Return a copy ofthis letter along with your explanation and any supporting documents. Form 886 attached to the Form 4549 explains documentation you need to give us. Publication 3498-A describes the audit process and explains other options, including your appeal rights, ifyou disagree with our proposed changes. Ifwe don t hear from you Ifwe don't ...

Now Is The Time For You To Know The Truth About Form 11 Line 11 | Form 11 Line 11 - amlvideo.com ...

Form 886 A Worksheet - Fill and Sign Printable Template Online Make sure the information you add to the Form 886 A Worksheet is up-to-date and accurate. Add the date to the document using the Date tool. Click the Sign tool and create an electronic signature. Feel free to use 3 available choices; typing, drawing, or uploading one. Make sure that each field has been filled in properly.

Tax Dictionary - Form 886A, Explanation of Items | H&R Block Form 886A, Explanation of Items explains specific changes to your return and why the IRS didn't accept your documentation. In addition to sending Form 4549 at the end of an audit, the auditor attaches Form 886A to provide an explanation as to why your documentation was not accepted.

PDF Mortgage Deduction Limit Worksheet Mortgage Deduction Limit Worksheet Part I Qualified Loan Limit 1) Enter the average balance of all grandfathered debt..... 1) 2) Enter the average balance of all home acquisition debt incurred prior to December 16, 2017 ... (Form 1040)..... 12) 13) Enter the total amount of interest paid ...

Forms and Publications (PDF) - IRS tax forms Form 886-H-DEP (SP) Supporting Documents for Dependency Exemptions (Spanish Version) 1019 07/31/2020 Form 886-H-EIC: Documents You Need to Send to Claim the Earned Income Credit on the Basis of a Qualifying Child or Children 1019 07/31/2020 Form 886-H-EIC (SP)

irs form 886-a worksheet - Fill Online, Printable ... How to complete any Form 866 online: On the site with all the document, click on Begin immediately along with complete for the editor. Use your indications to submit established track record areas. Add your own info and speak to data. Make sure that you enter correct details and numbers throughout suitable areas.

Audit defense Benefits from Tax Lawyer - TaxHelpLaw Audit Defense Benefits: Getting an IRS Audit Letter is scary & confusing. Mistakes can be costly. Our Tax Attorneys have been practicing law for over 27 years and experience has shown that thorough preparation is the only way to defeat the IRS. Lack of preparation is usually why taxpayers lose. Our tax lawyers can represent you before the IRS ...

Foreign Income Worksheet - Capital Group IRS Form 1116 or IRS Form 1118 (if a corporation) — call (800) 829-3676 to order, or download from the Forms & Publications section at irs.gov To determine your individual tax situation, please consult your tax advisor.

Form 886 A Worksheet - Fill Online, Printable, Fillable ... form 886 a worksheet Internal Revenue Service. Department of the Treasury. 2637 N Washington Blvd #164. North Ogden, UT 84414. Letter 1562-G (Rev. 6-2011). Catalog Number ... form 886a Please provide the information requested in the attached Form 886-A, Explanation of Items, within 20 days of the date of this letter. Failure to provide

PDF Head of Household Worksheet You must complete the Dependent/Child Tax/Education Credit Worksheet and provide a copy of the Divorce/Separation/Child support agreement. You affirm you have reviewed Form 886-H-HOH Supporting Documents to Prove Head-of-Household status

IRS Form 886A | Tax Lawyer Shows What to do in Response Most often, Form 886A is used to request information from you during an audit or explain proposed adjustments in an audit. This form is extremely important because the IRS will want their questions answered by you! Audit Procedure You will need to provide more than just a few cancelled checks to the government.

PDF Form 886-I Explanation of Items - ncpe Fellowship Form 886-I (October 2011) Catalog Number 58489B Explanation of Items Department of the Treasury - Internal Revenue Service Schedule Number . Name of taxpayer Tax Identification Number . Taxable Year Ended We need documentation to verify that you are eligible to claim the Employee Business Expenses listed on your Form

0 Response to "39 irs form 886 a worksheet"

Post a Comment