43 worksheet for figuring net earnings loss from self employment

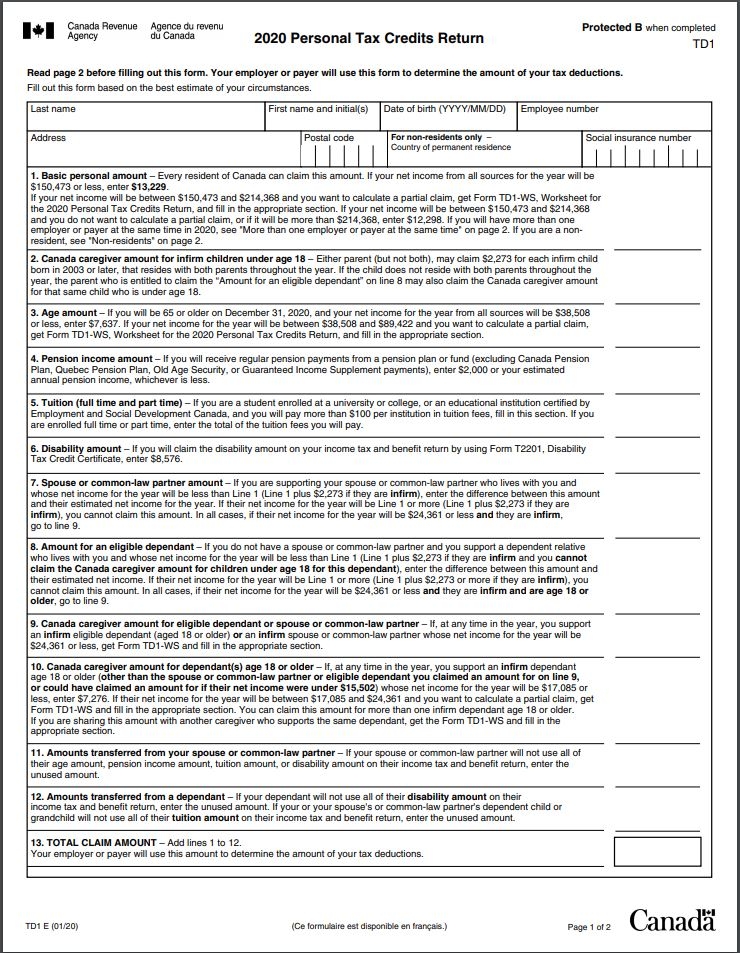

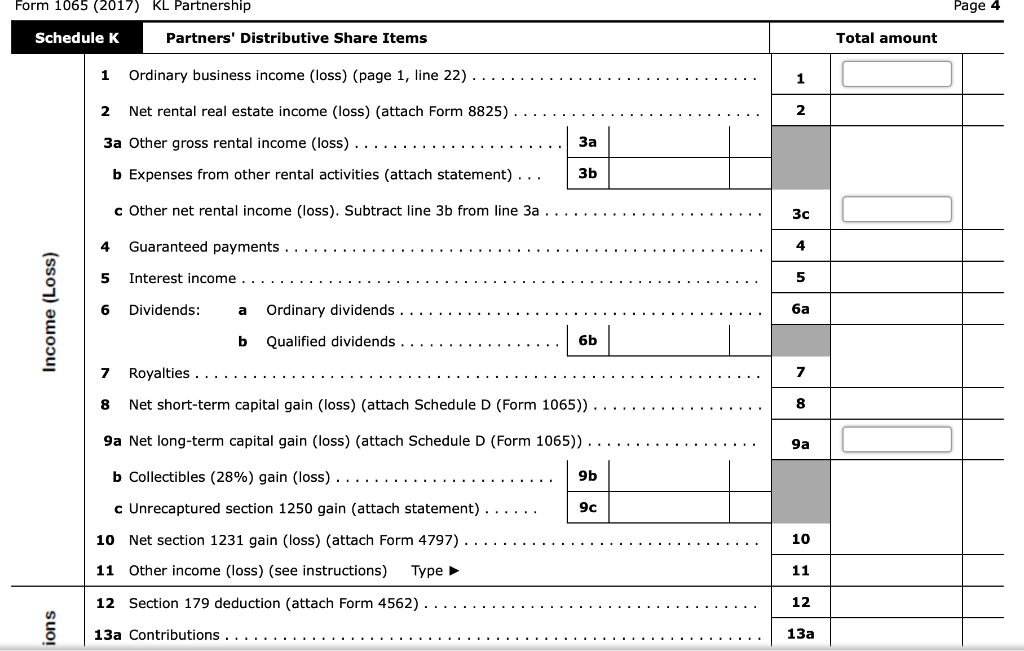

5 Look at the Worksheet for Figuring Net Earnings Loss ... 5. Look at the Worksheet for Figuring Net Earnings (Loss) from Self-Employment (p. 35 for 2014) of the Form 1065 instructions. What lines from Schedule K are, in general, involved in the calculation of Self-Employment income? What guaranteed payments are included in a partner's self-employment income? However, look at Rev. Rul. 65-272 and Technical Advice Memorandum 9750001. Topic No. 554 Self-Employment Tax | Internal Revenue Service Feb 18, 2022 · If you had a loss or small amount of income from your self-employment, it may be to your benefit to use one of the two optional methods to compute your net earnings from self-employment. Refer to the Instructions for Schedule SE (Form 1040) PDF to see if you qualify to use an optional method.

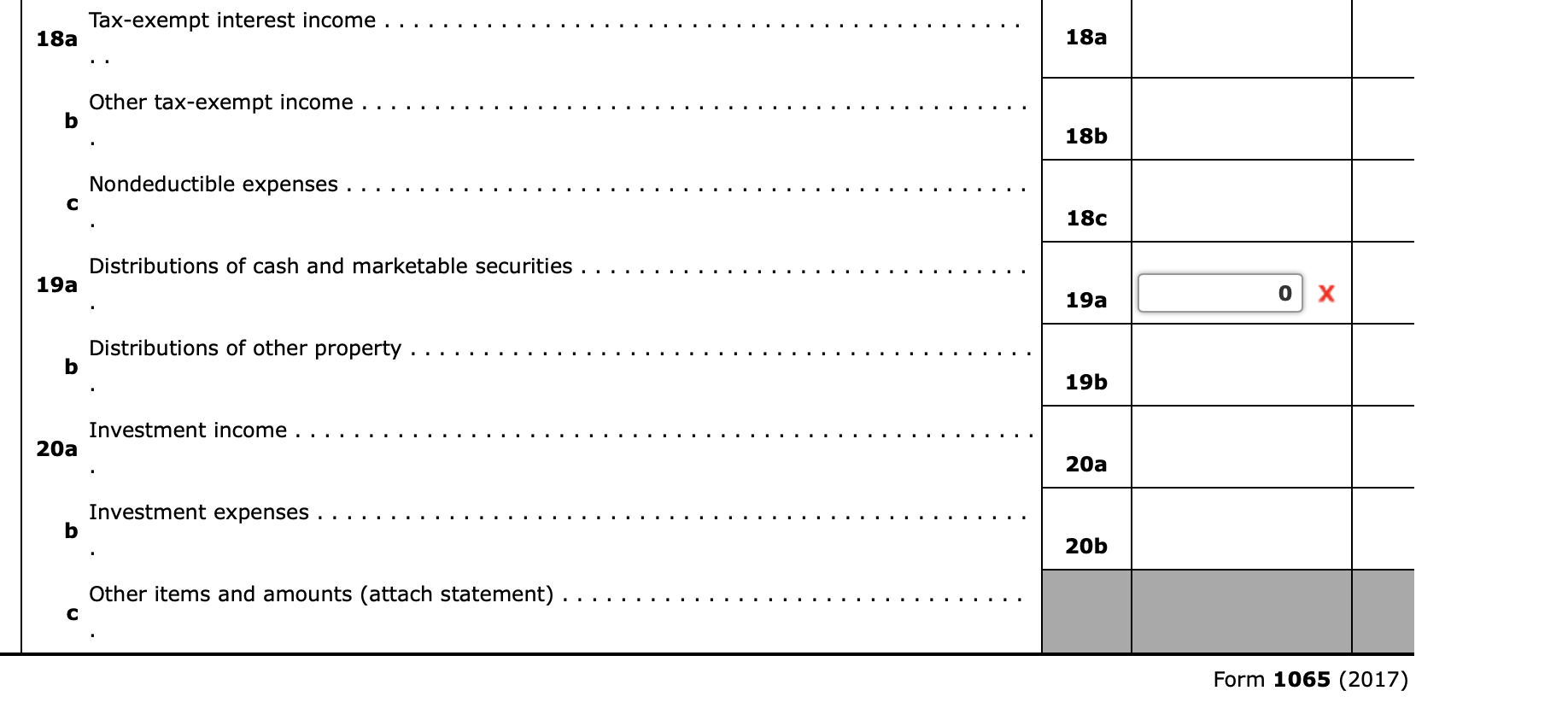

46c47fef8fd0ce49ad0c46fe7ac2204e ... - Course Hero Worksheet for Figuring Net Earnings (Loss) From Self-Employment 1a Ordinary business income (loss) (Schedule K, line 1) 1a b Net income (loss) from certain rental real estate activities (see instructions) 1b c Other net rental income (loss) (Schedule K, line 3c) 1c d Net loss from Form 4797, Part II, line 17, included on line 1a, above.

Worksheet for figuring net earnings loss from self employment

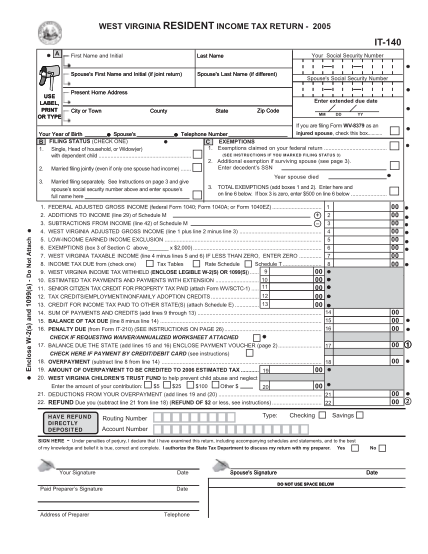

SSA Handbook § 1200 Note: If you have more than one business, calculate net earnings by adding up the net profits or losses from all the businesses. Net earnings also include any ordinary income or loss from partnerships. If any part of your income is included in gross earnings from self-employment, expenses connected with this income cannot be deducted. PDF Self-Employment Income Worksheet - caclmt.org - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify sources): 3. Total Gross Income PDF Based on the calculations shown on his worksheet, Manuel's ... 12 Self-employment tax. Add lines 10 and 11. Enter here and in Part I, line 3 . . . . . . . . . 12 Part VI Optional Methods To Figure Net Earnings— See instructions for limitations. Note: If you are filing a joint return and both you and your spouse choose to use an optional method to figure net earnings, you must each complete and attach a ...

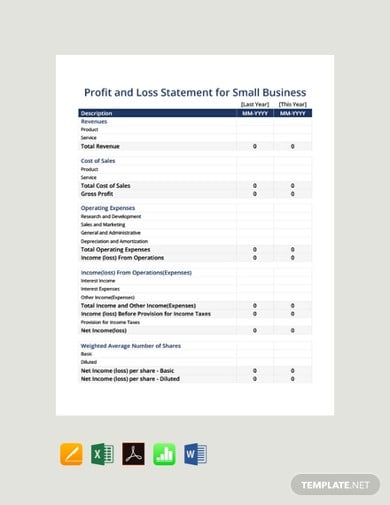

Worksheet for figuring net earnings loss from self employment. PDF Self-employment Income Worksheet - Wshfc SELF-EMPLOYMENT INCOME WORKSHEET . ... To Calculate Income from Schedule C Profit or Loss From Business: Line 31: Net profit or (loss) Add . Line 11: Contract labor: Add any part of the amount for contract labor that is paid to self or household members living in the unit. Publication 560 (2021), Retirement Plans for Small Business Distributions of other income or loss to limited partners aren't net earnings from self-employment. For SIMPLE plans, net earnings from self-employment are the amount on line 4 Schedule SE (Form 1040), Self-Employment Tax, before subtracting any contributions made to the SIMPLE plan for yourself. Self-Employed Individuals - Calculating Your Own ... You calculate self-employment (SE) tax using the amount of your net earnings from self-employment and following the instructions on Schedule SE, Self-Employment Tax. However, you must make adjustments to your net earnings from self-employment to arrive at the amount of "plan compensation" to use to determine the plan contribution/deduction for ... Knowledge Base Solution - How do I generate Schedule SE ... Self employment income entered will automatically produce Schedule SE if earnings are above $400. Business Income: Go to the Income/Deductions > Business worksheet. Select section 2 - Income and Cost of Goods Sold.. Enter line 1 - Gross Receipts or sales.; Partnership Passthrough:. Go to the Income/Deductions > Partnership Passthrough worksheet. Select section 1 - General.

1065-US: Calculating Schedule K, line 14a - Net earnings ... Question. How does UltraTax CS calculate Schedule K, line 14a - Net earnings from self-employment? Answer. UltraTax CS calculates self-employment earnings (SE) per activity for partners in the Partner's Self-Employment Worksheet based on the type of partner selected in the Partner tab in the Partner Information window in View > Partner Information. LoanToolBox.com Self-Employed Income Calculator General Instructions: For self-employed individuals (Sole Proprietor, Partnership, S-Corporation, and/or C-Corporation), you can include a printout of this worksheet in your application to show the underwriter how you figured your client's Monthly Income Average. Keep in mind, the underwriter will still make his/her own calculation based on the tax returns in the file. Net Earnings from Self-Employment - loopholelewy.com Net Earnings from Self-Employment. Net Earnings from Self-Employment and Net Profit on Schedule C, Line 31 are two different amounts. Self-employment tax is computed on Schedule SE where net earnings from self-employment is calculated. Schedule C net profit is computed first. Next, Schedule C net profit is carried to Schedule SE, Line 2. Net Earnings from Self-Employment - SocialSecurityHop.com Net earnings also include any ordinary income or loss from partnerships. If any part of your income is included in gross earnings from self-employment, expenses connected with this income cannot be deducted. 1200.2 Are there other ways of calculating net earnings from self-employment? Under certain circumstances, optional methods of computing ...

2021 Instructions for Schedule SE (2021) | Internal ... Use Schedule SE (Form 1040) to figure the tax due on net earnings from self-employment. The Social Security Administration uses the information from Schedule SE to figure your benefits under the social security program. This tax applies no matter how old you are and even if you are already getting social security or Medicare benefits. Worksheet For Figuring Net Earnings Loss From Self Employment Worksheet for figuring net earnings loss from self employment. To calculate income from schedule c profit or loss from business. You may find worksheets 1 through 3 helpful in figuring your net earnings from self employment. You can change the method used to figure your net earnings from self employment after you file your return. PDF SEP IRA CONTRIBUTION WORKSHEET - Fidelity Investments Calculating Your Contribution if You Are Self-Employed Individuals with self-employed income must base their contributions on "earned income." For self-employed individu - als, earned income refers to net business profits derived from the business, reduced by a deduction of one-half of your self-employment tax, less your SEP IRA contribution. PDF FHA Self-Employment Income Calculation Worksheet Job Aid should not be completed if the worksheet is also b eing used for any other type of self -employment (ex . 1065 or 1120s). a. Net Profit or (Loss) Use the bottom line net income or loss reported for the business. If this is income, enter a positive number; if this is a loss, enter a negative number with a leading ( -). (Form 1040

Understanding Schedule K-1 self-employment income for ... The program creates a worksheet to show the calculation of net earnings from self-employment. Follow these steps to view the Self-Employment Worksheet: Go to the Forms tab. Select Worksheets from the left-side Form window. Select Self-Emp. Worksheet from the left-side Page window. How do I enter adjustments or overrides for self-employment income?

Schedule K Line 14a (Form 1065) Calculating Self ... - Intuit Lacerte computes line 14a using the Worksheet for Figuring Net Earnings (Loss) From Self-Employment from page 41 of the 1065 form instructions. To generate Lacerte's version of the Self-Employment worksheet: Click on Settings. Click on Options. Select the Tax Return tab. Scroll down to the Federal Tax Options section.

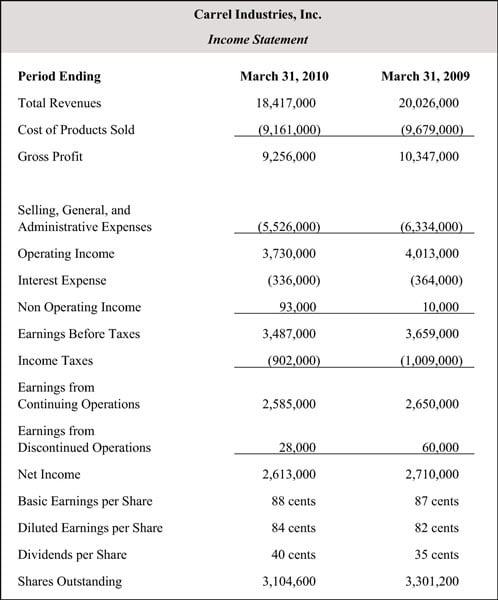

PDF Income Calculations - Freddie Mac Form 91 is to be used to document the Seller's calculation of the income for a self-employed Borrower. This form is a tool to help the Seller calculate the income for a self-employed Borrower; the Seller's calculations must be based on the requirements and guidance for the determination of stable monthly income in Topic 5300.

PDF F-16036 (06/2019) Self-employment Income Worksheet ... f16036, f-16036, self-employment income worksheet partnership, schedule k, 1065, sei, taxes, income, internal revenue service, irs Created Date 6/4/2019 9:50:20 AM

Self-Employed Cash Flow Calculator - Radian Home Cash Flow Analysis. This self-employed income analysis and the included descriptions generally apply to individuals: Who have 25% or greater interest in a business. Who receive variable income, have earnings reported on IRS 1099, or cannot otherwise be verified by an independent and knowable source. To estimate and analyze a borrower's cash ...

PDF Self- Purpose: Employment Income Special Mention ... - WSHFC Self-Employment Income Worksheet Instruction Purpose: To assist in determining self-employment income. Special Mention: The line numbers mentioned in this form are from Schedule C, IRS 1040 forms (2011). Income from a Business When calculating annual income, owners must include the net income

How To Calculate Self Employment Income for a Mortgage | 2022 For example, say year one the business income is $80,000 and year two $83,000. The income used for qualifying purposes is $80,000 + $83,000 = $163,000 then divided by 24 = $6,791 per month. Declining Self-Employed Income: But the lender also looks at something else when reviewing years one and two: consistency.

Income Analysis Worksheet | Essent Guaranty Keep Your Career On The Right Track Our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Use our PDF worksheets to total numbers by hand or let our Excel calculators do the work for you.

Schedule K-1 (Form 1065) - Self-Employment Earnings (Loss) Line 14A - Net Earnings (Loss) from Self-Employment - Amounts reported in Box 14, Code A represent the amount of net earnings from self-employment. For Limited Partners this amount generally includes any guaranteed payments received for services rendered to or on behalf of the partnership. Enter the amount from Box 14, Code A will be entered as ...

Cash Flow Analysis (Form 1084) - Fannie Mae This worksheet may be used to prepare a written evaluation of the analysis of income related to self-employment. The purpose of this written analysis is to determine the amount of stable and continuous income that will be available to the borrower for loan qualifying purposes.

SEB cash flow worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income. Liquidity ratios. Rental income.

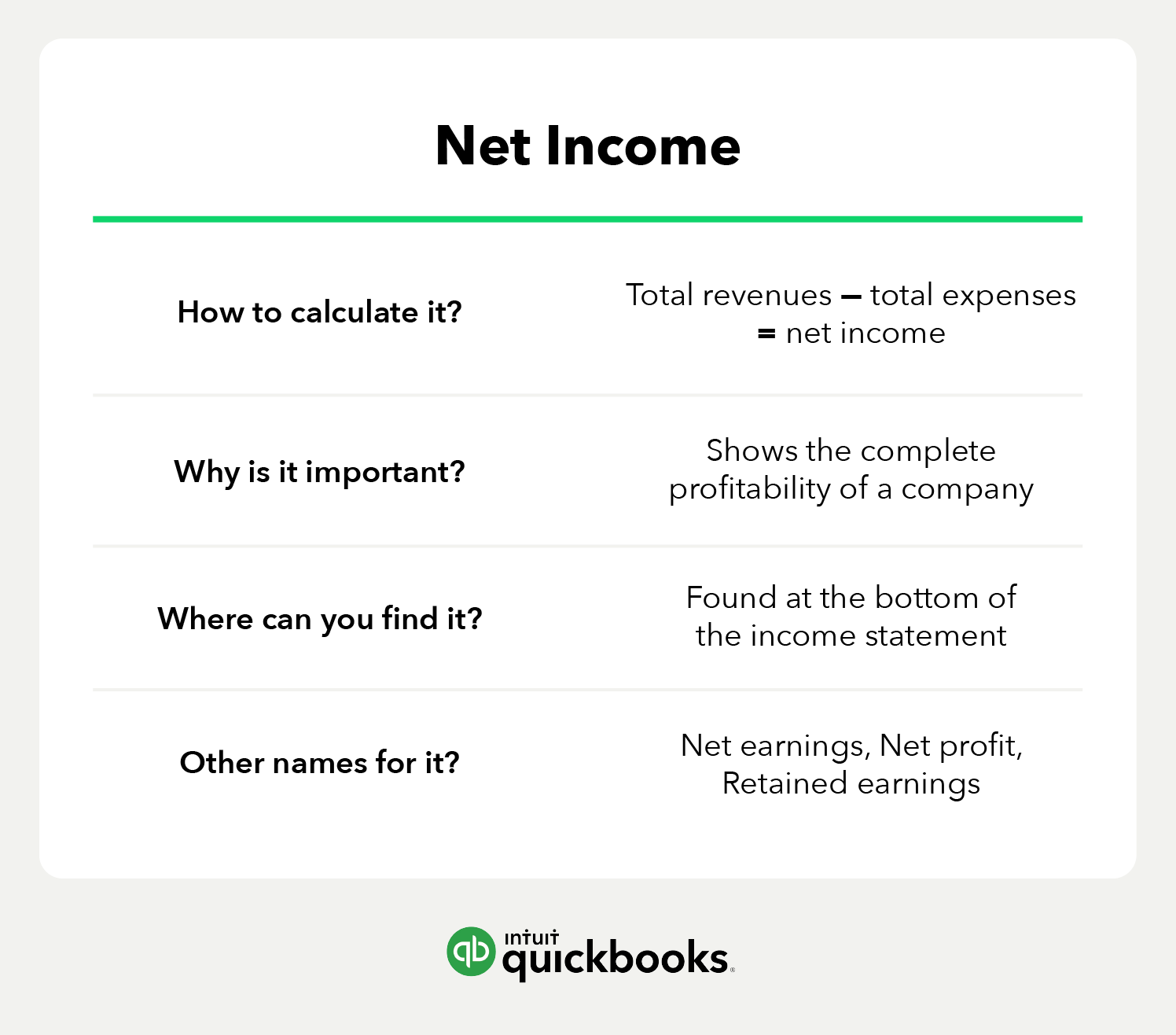

PDF U.S. Department of Housing and Urban Development Office of ... Net Income/Loss 12 Type Definition Net Income Profits or net earnings of a company determined by gross income less deductible expenses and depreciation. Net Earnings Certain income is not considered in net earnings for income tax purposes including dividend income, interest from loans, income from a limited partnership. Eligible Self-Employed ...

PDF Based on the calculations shown on his worksheet, Manuel's ... 12 Self-employment tax. Add lines 10 and 11. Enter here and in Part I, line 3 . . . . . . . . . 12 Part VI Optional Methods To Figure Net Earnings— See instructions for limitations. Note: If you are filing a joint return and both you and your spouse choose to use an optional method to figure net earnings, you must each complete and attach a ...

PDF Self-Employment Income Worksheet - caclmt.org - Net Losses (if a net loss is incurred during any of the months listed, then that month's income will equal zero, not a negative value.) > Allowable expenses that can be deducted from income are listed below within the worksheet (#4-17). -Income Taxes (federal, state, and local) EXPENSES: 2. Other Income (specify sources): 3. Total Gross Income

SSA Handbook § 1200 Note: If you have more than one business, calculate net earnings by adding up the net profits or losses from all the businesses. Net earnings also include any ordinary income or loss from partnerships. If any part of your income is included in gross earnings from self-employment, expenses connected with this income cannot be deducted.

/HeroImagesGettyImages-65a9475bbae746848eee99e8fff09f2d.jpg)

.jpg)

/how-to-make-a-budget-1289587-Final2-updated-17bbe4528d38430ca42f4138f599ed56.png)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-556673833-56a0a4c95f9b58eba4b26260.jpg)

0 Response to "43 worksheet for figuring net earnings loss from self employment"

Post a Comment