38 schedule d tax worksheet 2014

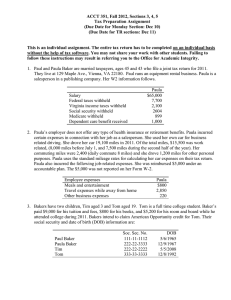

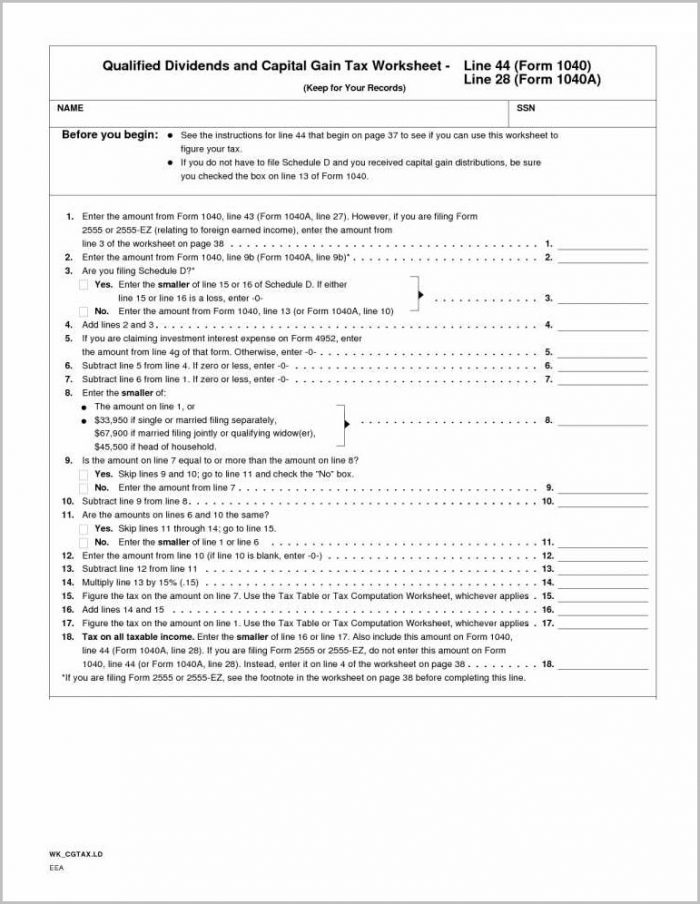

IRS 1041 - Schedule D 2014 - Fill out Tax Template Online ... Fill in all the details required in IRS 1041 - Schedule D, utilizing fillable fields. Add photos, crosses, check and text boxes, if it is supposed. Repeating details will be filled automatically after the first input. In case of difficulties, turn on the Wizard Tool. You will see useful tips for easier finalization. Schedule D - Viewing Tax Worksheet - taxact.com Schedule D - Viewing Tax Worksheet. If there is an amount on Line 18 (from the 28% Rate Gain Worksheet) or Line 19 (from the Unrecaptured Section 1250 Gain Worksheet) of Schedule D, according to the IRS the tax is calculated on the Schedule D Tax Worksheet instead of the Qualified Dividends and Capital Gain Tax Worksheet. To view the tax calculation on the Schedule D Tax Worksheet which will show the calculation of the tax which flows to Form 1040, Line 44 or Form 1040NR, Line 42:

2014 Instructions for Schedule D (Form 1041) For tax year 2014, the 20% maximum capital gain rate applies to estates and trusts with income above $12,150. The 0% and 15% rates continue to apply to certain threshold amounts. The 0% rate applies up to $2,500. The 15% rate applies to amounts over $2,500 and up to $12,150. Section 1202 exclusion. Line 2 of the 28% Rate Gain Worksheet was revised

Schedule d tax worksheet 2014

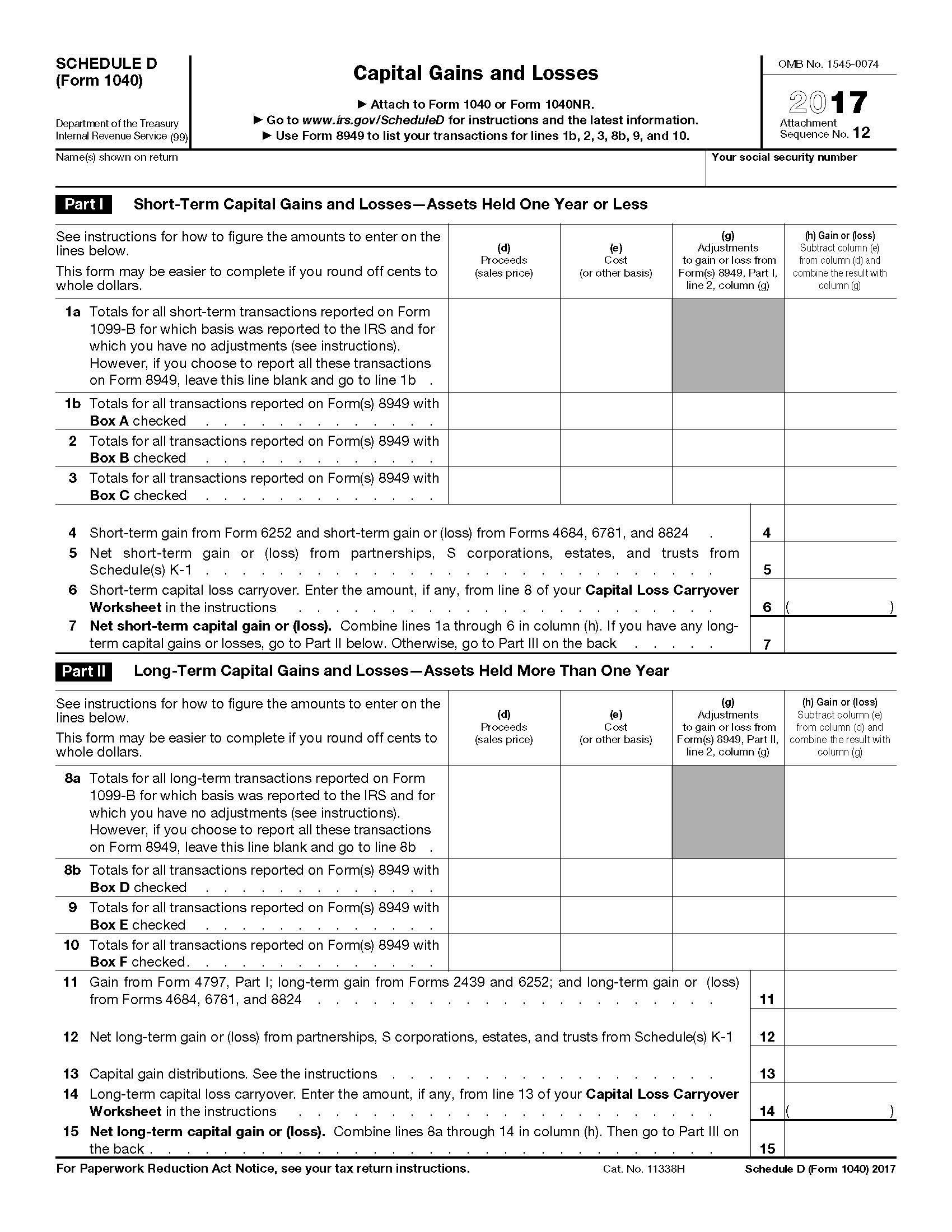

Capital Gains and Losses - IRS tax forms SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses. . Attach to Form 1040 or Form 1040NR. . Information about Schedule D and its separate instructions is at . . . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074. 2014. Attachment and Losses Capital Gains - IRS tax forms 2014 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949,

Schedule d tax worksheet 2014. and Losses Capital Gains - IRS tax forms 2014 Instructions for Schedule DCapital Gains and Losses These instructions explain how to complete Schedule D (Form 1040). Complete Form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of Schedule D. Use Schedule D: To figure the overall gain or loss from transactions reported on Form 8949, Capital Gains and Losses - IRS tax forms SCHEDULE D (Form 1040) Department of the Treasury Internal Revenue Service (99) Capital Gains and Losses. . Attach to Form 1040 or Form 1040NR. . Information about Schedule D and its separate instructions is at . . . Use Form 8949 to list your transactions for lines 1b, 2, 3, 8b, 9, and 10. OMB No. 1545-0074. 2014. Attachment

0 Response to "38 schedule d tax worksheet 2014"

Post a Comment