39 affordable care act worksheet form

Questions and Answers on the Individual Shared Responsibility Provision ... Under the Affordable Care Act, the federal government, state governments, insurers, employers and individuals are given shared responsibility to reform and improve the availability, quality and affordability of health insurance coverage in the United States. ... Individuals who file a Form 1040NR or Form 1040NR-EZ (including a dual-status tax ... Modified Adjusted Gross Income under the Affordable Care Act 05/11/2013 · The Affordable Care Act definition of MAGI under the Internal Revenue Code [2] and federal Medicaid regulations [3] is shown below. For most individuals who apply for health coverage under the Affordable Care Act, MAGI is equal to Adjusted Gross Income. This document summarizes relevant federal regulations; it is not personalized tax or legal ...

Affordable Care Act - Tax Guide • 1040.com - File Your Taxes Online The Affordable Care Act (ACA) is a health care reform law that was passed in 2010. The ACA has three main goals: Make affordable health insurance available to more people. Expand the Medicaid program. Lower the costs of healthcare by supporting innovative methods of medical care. When you hear about the ACA (or "Obamacare," as it's often ...

Affordable care act worksheet form

PDF Affordable Care Act: 6055 & 6056 Reporting - BASIC More Information on the New Forms 1095-A Form 1095-A will be used by Health Care Exchanges and web-based health insurance marketplaces. This form will provide information on each individual enrolled in "qualified health plans" (QHPs). Every year, the Health Care Exchanges will be required to provide Form 1095-A to the individual. PDF Application for Health Coverage and Help Paying Costs Form Approved OMB No. 0938-1191 Application for Health Coverage & Help Paying Costs Apply faster online at . HealthCare.gov Use this application • Marketplace plans that offer comprehensive coverage to help you stay well. to see what coverage • A tax credit that can immediately help lower your premiums for health coverage. you qualify for • PDF Average Total Number of Employees (ATNE) Worksheet Average Total Number of Employees (ATNE) Worksheet P.O. Box 25610 | L ittle R ock, AR 72211 | 501.228.7111 | 800.235.7111 | QualChoice.com The size of an employer group determines benefit design and Center for Medicare & Medicaid Services reporting ... The Patient Protection and Affordable Care Act (PPACA) defines the number of employees as ...

Affordable care act worksheet form. › COMMUNITYCARE › indexCommunity Care Home - Veterans Affairs May 26, 2022 · Community care is based on specific eligibility requirements, availability of VA care, and the needs and circumstances of individual Veterans. Learn about Veteran community care VA also provides health care to Veterans’ family members and dependents through programs like the Civilian Health and Medical Program of the Department of Veterans ... Birth Plan Template Editable - Fill Online, Printable, Fillable, Blank ... A recent study conducted by the Joint Committee on Taxation found that the Affordable Care Act may have reduced the likelihood of high-cost enrollees who have incomes above 500 percent of the poverty level from increasing their premiums this year to next year. ... Birth Plan Worksheet NAME: ATTENDANTS I'd like the following people to be present ... PDF Is your individual coverage Health - HealthCare.gov coverage HRA" in this worksheet, but your employer may call it something else. Employers can't offer both a "traditional" job-based coverage and an individual coverage HRA to the same employee. If your employer is offering an individual coverage HRA, you'll get a notice. It'll explain that there are different kinds 1040-US: Affordable Care Act - Form 1095-A, 1095-B, and 1095-C overview Question. What are Forms 1095-A, 1095-B, and 1095-C? Answer. Form 1095-A is the reporting document for health insurance purchased through the Health Insurance Marketplace. Each pe

PDF Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet Affordable Care Act - 2022 ACA Compliance Form Filing Submission Worksheet . Attach this worksheet to the Compliance Checklist and Certification. Provide the following information (all entries are required and must be populated): 1. Company name: _____ 2. NAIC number: _____ 3. › perspay › rates-informationRates information | Washington State Health Care Authority Jan 01, 2020 · State agency and higher education institution rates State agencies, four-year higher education institutions, community and technical colleges and commodity commissions 2022 July-December 2022 January-June 2021 July-December 2021 January - June 2020 July - December 2020 January - June 2019 July - December 2019 January - June 2018 July - December 2018 January - June 2017 July - Other Resources | CMS May 16, 2012. Paperwork Reduction Act (PRA) display of Draft Blueprint for Approval of Affordable State-based and State Partnership Insurance Exchanges (click on CMS - 10416). August 14, 2012 (Revised November 16, 2012) Final Blueprint for Exchanges (PDF) (PDF - 731 KB) November 9, 2012. Health Insurance Care Tax Forms, Instructions & Tools This form includes details about the Marketplace insurance you and household members had in 2021. You’ll need it to complete Form 8962, Premium Tax Credit. Get a quick overview of health care tax Form 1095-A — when you’ll get it, what to do if you don’t, how to know if it’s right, and how to use it. See a sample 1095-A (PDF, 132 KB).

Affordable Care Act | Internal Revenue Service - IRS tax forms The Affordable Care Act contains comprehensive health insurance reforms and includes tax provisions that affect individuals, families, businesses, insurers, tax-exempt organizations and government entities. These tax provisions contain important changes, including how individuals and families file their taxes. The law also contains benefits and ... Affordable Care Act | U.S. Department of Labor - DOL Español. Employee Benefits Security Administration. An agency within the U.S. Department of Labor. 200 Constitution Ave NW. Washington, DC 20210. 1-866-4-USA-DOL. 1-866-487-2365. . Federal Government. › books › NBK241401F Key Features of the Affordable Care Act by Year On March 23, 2010, President Obama signed the Affordable Care Act. The law puts in place comprehensive health insurance reforms that will roll out over 4 years and beyond. Essential Tax Forms for the Affordable Care Act (ACA) The Affordable Care Act (ACA), also referred to as Obamacare, affects how millions of Americans will prepare their taxes in the new year. The Internal Revenue Service (IRS) has introduced a number of essential tax forms to accommodate the ACA: Form 1095-A, Form 1095-B, Form 1095-C, and Form 8962. TABLE OF CONTENTS. The 1095 series for information.

› affordable-care-act › individuals-andQuestions and Answers on the Individual Shared Responsibility ... Enacted in December 2017, the Tax Cuts and Jobs Act (TCJA) reduced the shared responsibility payment to zero for tax year 2019 and all subsequent years. For January 1, 2019 and beyond, taxpayers are still required by law to have minimum essential coverage or qualify for a coverage exemption.

Form 8965 - Affordability Worksheet - Support Coverage Affordability Worksheet Menu. Step One in completing the Affordability Worksheet is to calculate the Affordability Threshold which is 8.16% of Household Income.the tax program will automatically pull into the Household Income calculation all amounts that have been previously entered into the tax return on behalf of the taxpayer and/or ...

PDF Affordable Care Act - IRS tax forms Affordable Care Act 3-1 Introduction This lesson covers some of the tax provisions of the Affordable Care Act (ACA). You will learn how to deter-mine if taxpayers are eligible to receive the premium tax credit. A list of terms you may need to know is ... The form includes information about the coverage, who was covered, and when.

laborcenter.berkeley.edu › modified-adjusted-grossModified Adjusted Gross Income under the Affordable Care Act ... Nov 05, 2013 · The Affordable Care Act definition of MAGI under the Internal Revenue Code [2] and federal Medicaid regulations [3] is shown below. For most individuals who apply for health coverage under the Affordable Care Act, MAGI is equal to Adjusted Gross Income. This document summarizes relevant federal regulations; it is not personalized tax or legal ...

Affordable Care Act Worksheet | Worksheet for Education Dec 31, 2020 - Affordable Care Act Worksheet. Affordable Care Act Worksheet. Affordable Care Act Worksheet

› tax-forms-and-toolsHealth Insurance Care Tax Forms, Instructions & Tools ... Form 1095-A, Health Insurance Marketplace® Statement. This form includes details about the Marketplace insurance you and household members had in 2021. You'll need it to complete Form 8962, Premium Tax Credit. Get a quick overview of health care tax Form 1095-A — when you'll get it, what to do if you don't, how to know if it's right ...

PDF Affordable Care Act Notification Checklist - California Affordable Care Act (ACA) Notification Checklist California Department of Human Resources State of California This Checklist is intended to document and ensure that departments/agencies are providing the legally required notices to employees for compliance with the ACA. Parts I and II must be completed, if applicable.

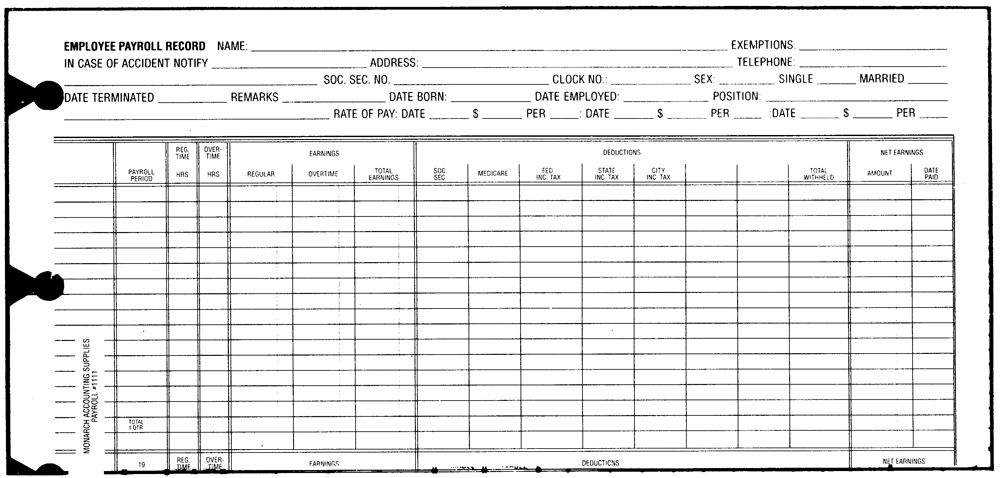

PDF OR Affordable Care Act (ACA) Newly Hired Temporary Employee Offer of Coverage Worksheet This worksheet is used to document the agency's reasonable expectations regarding the "full-time" status of a newly hired temporary employee. PLACE A COPY OF THIS COMPLETED FORM IN THE EMPLOYEE FILE 1.AGENCY NAME: 2. EMPLOYEE NAME: 2. DATE OF HIRE: 3.

Viewpoint Help - Processing - Affordable Care Act Processing Import Worksheet. On the Form 1095-C Maintenance screen, click the Import Worksheet button to import information from the Employee Worksheet (saved as a .csv file). ... Click the Import Data link and select the 'Affordable Care Act Reporting' Form Type and select the File to Import. Upload your .CSV file to the Nelco site from your Downloads ...

Forms | Federal Communications Commission Documents saved as PDF files can be viewed and printed from any Windows, DOS, UNIX, MAC, or OS-2 platform that has Acrobat reader software (free from Adobe Systems, Inc.) installed and configured for use with the browser. Get the Free Reader. All forms are PDF format unless otherwise noted. - Forms with this symbol are fillable in the Acrobat reader.

Affordable Care Act PSID Configuration For information on Form 1094-C, go to the Employers section of the Affordable Care Act Tax Provisions at the IRS website ( ). Affordable Care Act report training. Guides and web-based-training (WBT) are available for learning more about your responsibility in maintaining compliance with the Patient Protection and Affordable Care Act.

F Key Features of the Affordable Care Act by Year OVERVIEW OF THE HEALTH CARE LAW. 2010: A new Patient's Bill of Rights goes into effect, protecting consumers from the worst abuses of the insurance industry. Cost-free preventive services begin for many Americans. 2011: People with Medicare can get key preventive services for free, and also receive a 50 percent discount on brand-name drugs in the Medicare “donut …

Self-employed health insurance deduction - healthinsurance.org For the self-employed, health insurance premiums became 100% deductible in 2003. The deduction that allows self-employed people to reduce their adjusted gross income by the amount they pay in health insurance premiums during a given year. If you have an S-corp, you should be aware of a 2015 notice regarding reimbursement for health premiums.

PDF Affordable Care Act Worksheet - cnccpa.com Affordable Care Act Worksheet Are you required to comply with the Act? How many employees does your Company employ: 200 or more fulltime (FT) employees. (Continue to Step 2. You are required to comply with the Act and must automatically enroll all FT employees in health insurance.)

PEBB benefit eligibility tools and worksheets - Wa Step 2. Click on the title of the specific worksheet that describes the employee or employee's situation. The worksheet will display in Excel. Step 3. Complete the worksheet electronically. Do not save worksheets to your computer, as they are updated often and employees may be issued outdated information. Step 4.

How To Calculate ACA FT and FTE | The ACA Times As part of their annual filing of healthcare coverage information with the IRS, organizations must determine if they are Applicable Large Employers (ALEs) for purposes of the Affordable Care Act (ACA) - that is, whether they have an average of 50 or more full-time (FT) or full-time-equivalent employees (FTE) over the course of a year.

0 Response to "39 affordable care act worksheet form"

Post a Comment