41 income tax worksheet excel

Nithya's Tax Calculator This is a Microsoft Excel-based Indian Income Tax Calculator that can be used to compute tax liabilities for salaried individuals (I do not have a version for professionals or businessmen) (ver 25.0 for FY2022-23 released on 15-Apr-2022) Previous years' versions: After downloading, please read the instructions in the first sheet carefully before entering data. You would need Microsoft … Income tax calculating formula in Excel - javatpoint It is a simple way to calculate income tax and easy to understand. Step 1: Open the Excel worksheet that contains the income details of someone. We have this income dataset: Step 2: As we want to calculate the taxable income and tax. So, create two rows: one for the taxable value and another for the tax.

Income Tax Formula - Excel University If the taxable income was $50,000, we would like Excel to perform the following math. It needs to multiply all $50,000 by 10% because all $50,000 is taxed by at least 10%. To that, we need Excel to add 5% of 40,925 (50,000-9,075), because the differential rate of the next bracket is 5% (15%-10%).

Income tax worksheet excel

Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 … 11/12/2014 · Over the years I have fine-tuned my Excel spreadsheet to require as little input as necessary, especially when it comes to correctly calculate my income tax withholding, based on the various brackets. I tried to find an example for Excel that would calculate federal and state taxes based on the 2017/2018/2019/2020 brackets. What I found was ... Tax Spreadsheet For Self Employed - Tax Twerk Using Schedule C, you'll first calculate your net taxable income from self employment. Basically, you'll indicate your total gross self employment income for the year, deduct company expenses, and arrive at your net taxable self employment income. . You'll use this amount on Schedule SE. If you need help in completing Schedule C\/C-EZ, or ... Estimated Income Tax Spreadsheet - Mike Sandrik Now the spreadsheet can calculate your effective tax rate based on the estimated amount of income you expect to make. The tax rates calculated depend on the tax tables on the right side of the sheet, which define the income tax brackets. You'll need to update the data in yellow each year for the new brackets and for your filing status.

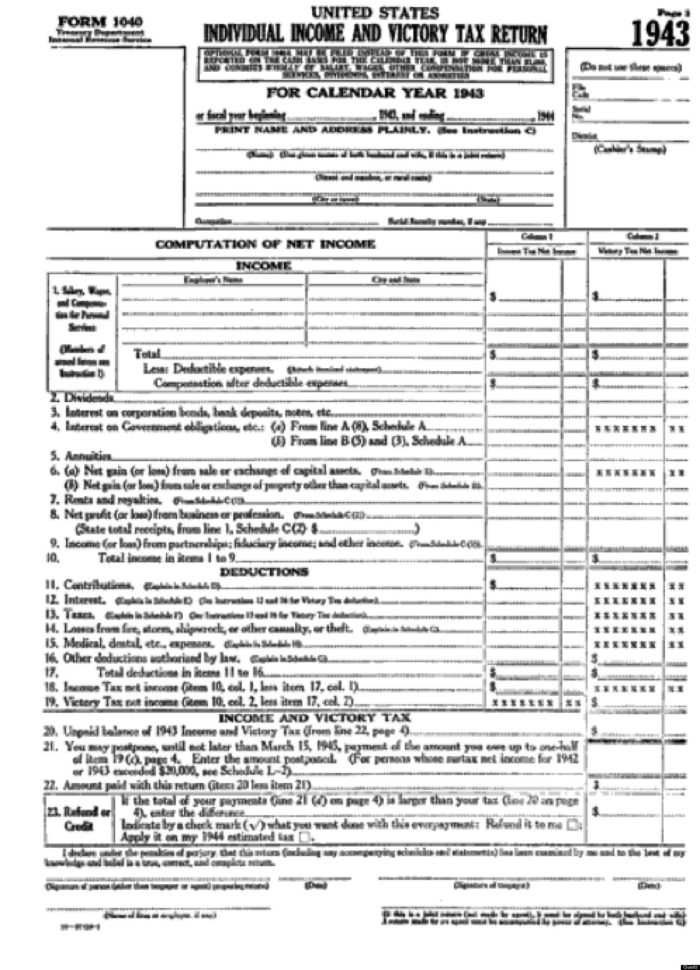

Income tax worksheet excel. Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator This site makes available, for free, a spreadsheet that may be used to complete your U.S. Federal Income Tax Return. Download - Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator Federal Income Tax Form 1040 (Excel Spreadsheet) Income Tax Calculator How to calculate income tax in Excel? - ExtendOffice Actually, you can apply the SUMPRODUCT function to quickly figure out the income tax for a certain income in Excel. Please do as follows. 1. In the tax table, right click the first data row and select Insert from the context menu to add a blank row. See screenshot: 2. Income Tax Withholding Assistant for Employers Save a copy of the spreadsheet with the employee's name in the file name. Each pay period, open each employee's Tax Withholding Assistant spreadsheet and enter the wage or salary amount for that period. The spreadsheet will then display the correct amount of federal income tax to withhold. Single-Family Homepage | Fannie Mae Rental Income Worksheet Individual Rental Income from Investment Property(s): Monthly Qualifying Rental Income (or Loss) Documentation Required: § Schedule E (IRS Form 1040) OR § Lease Agreement or Fannie Mae Form 1007 or Form 1025 Enter Investment Property Address Step 1. When using Schedule E, determine the number of months the property was in service …

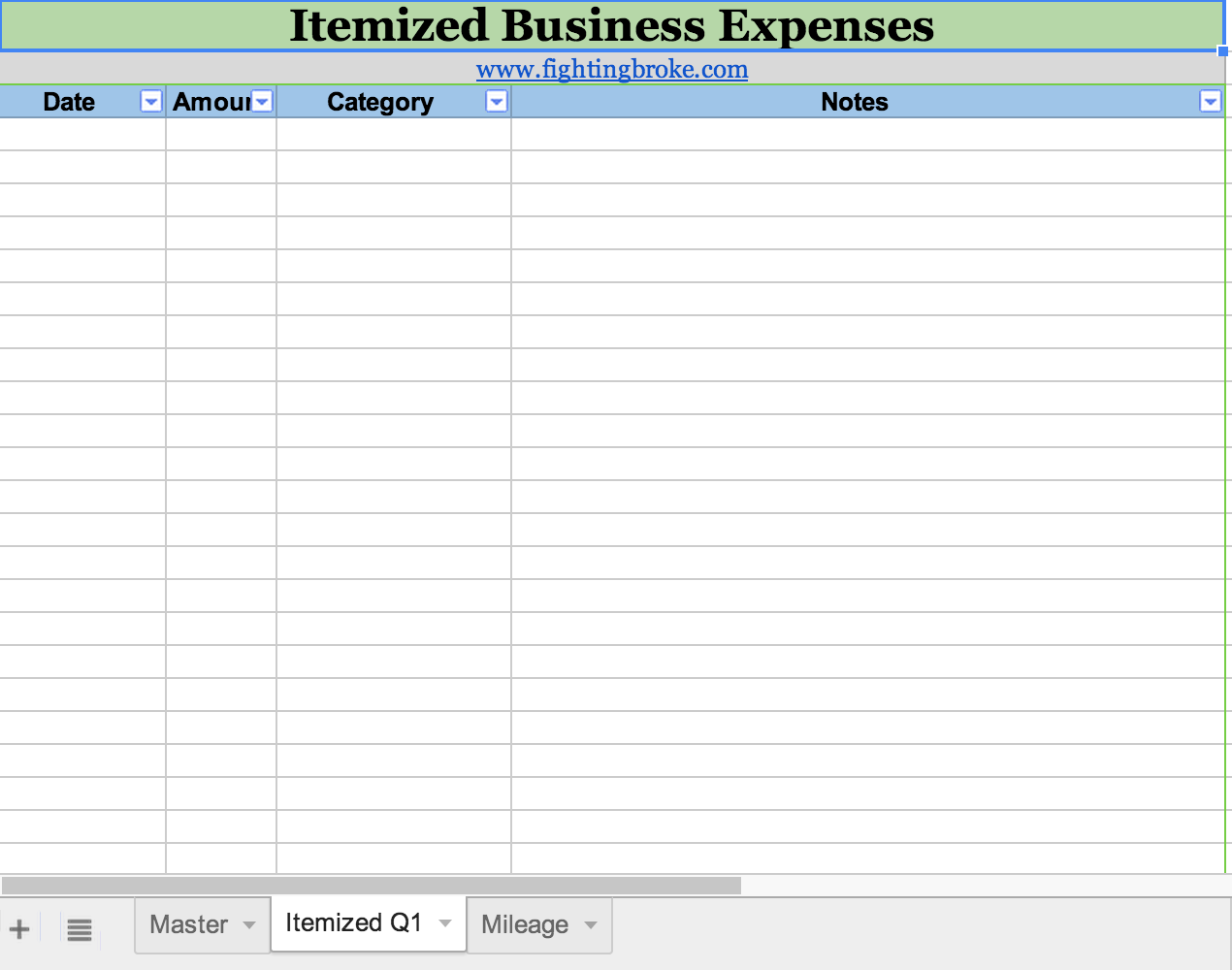

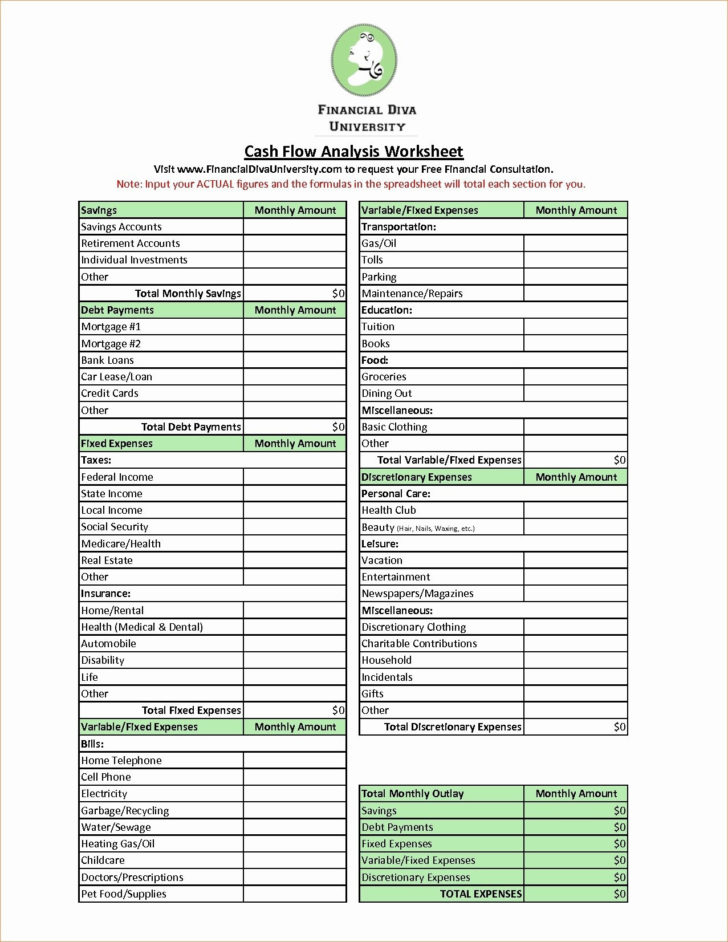

Computation Of Income Tax In Excel - Excel Skills TaxCalc - this sheet contains the annual income tax, monthly salary and annual bonus calculations. Only the cells with yellow cell backgrounds require user input and all calculations are automated. Monthly - this sheet enables users to perform monthly income tax calculations based on variable monthly earnings and annual bonus amounts. Free Tax Forms & Worksheets | Tax Preparation & Bookkeeping The purpose of these forms and worksheets is so you can be as prepared as possible so the tax preparation process is quick and painless as possible. We have created over 25 worksheets, forms and checklists to serve as guidance to possible deductions. There are over 300 ways to save taxes and are presented to you free of charge. How to Do Taxes in Excel - Free Template Included Armed with your transaction records and the tax tracker template provided, you can take the following steps to fill out your Income statement: Copy and paste your Excel versions of bank or credit card statements, including headings, into the Inc Stmt Detail tab of the template. Free Income and Expense Tracking Templates (for Excel) Step 2: Run the Excel program and select a pre-installed template for tracking personal expenses or spreadsheet. Pre-installed templates can be obtained by clicking the "File" tab and selecting "New" and then select "Sample templates" and choose "Personal Monthly Budget" and finalize by clicking "Create."

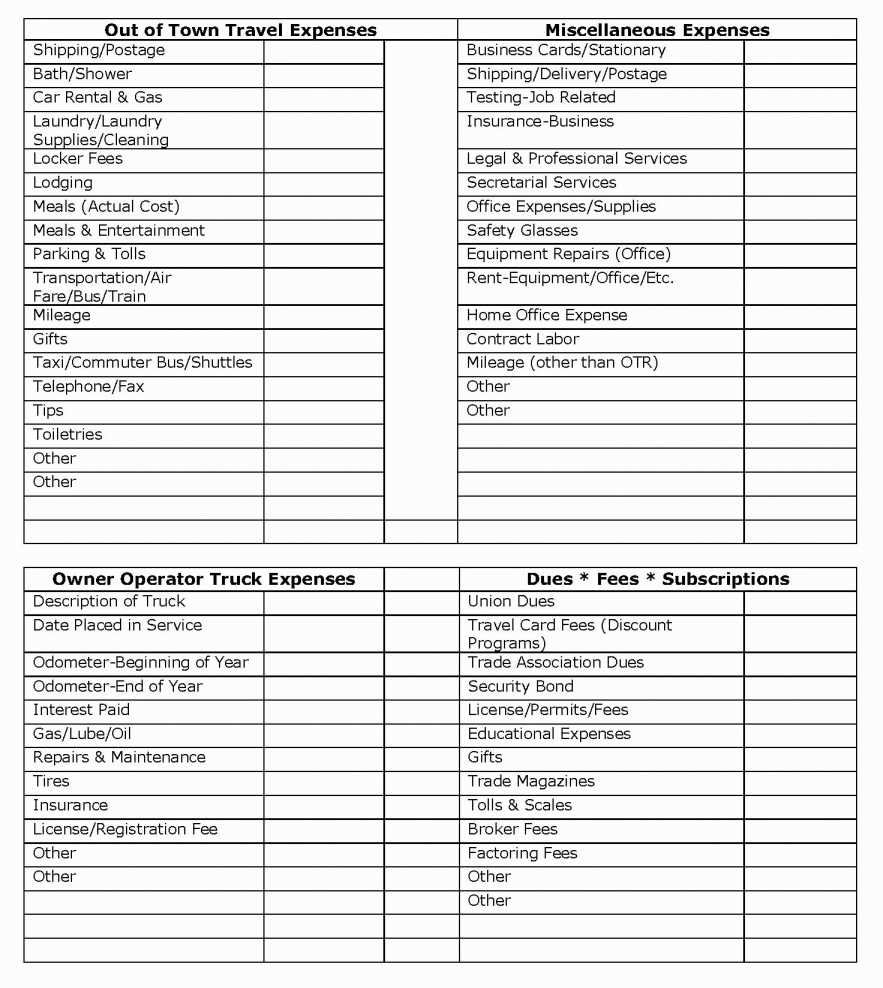

Downloadable tax organizer worksheets This downloadable file contains worksheets for, wages and pensions, IRA distributions, interest and dividends, Miscellaneous income (tax refunds, social security, unemployment, other income). Don't forget to attach W-2's and 1099 forms to you worksheets. business.pdf Free Rental Income and Expense Worksheet | Zillow Rental Manager To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category. Independent Contractor Expenses Spreadsheet [Free Template] - Keeper Tax The sheet will take this and automatically calculate your total tax deduction in Column E. (Leave the business-use percentage column blank for a purchase, and you'll get your gross expense amount counted as your total tax deduction.) Making sure your deduction amount is correct Excel 1040ES - Estimated Federal income tax spreadsheet With Excel1040ES, your estimated tax compliance can be achieved in four simple steps: Enter your estimated tax inputs on the "Inputs" worksheet tab. The best place to start is with amounts from your prior year tax return. Enter your P&L each month into the workbook "Dashboard" page. Set aside the corresponding income tax liability ...

How to Calculate Capital Gains Tax | H&R Block Note: Gains on the sale of collectibles (rental real estate income, collectibles, antiques, works of art, and stamps) are taxed at a maximum rate of 28%. More help with capital gains calculations and tax rates . In most cases, you’ll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D.

Estimated Tax Worksheet Estimated Tax Worksheet. Clear and reset calculator Print a taxpayer copy. Basic Filing Information for tax year (Some tax rate data is preliminary or estimated) Taxpayer's Name: Click here for the AARP RMD Calculator: Filing Status: TP is 50 - 64 65 or older blind has retirement plan SP is 50 - 64 65 or older blind has retirement plan Check if you will be living with your …

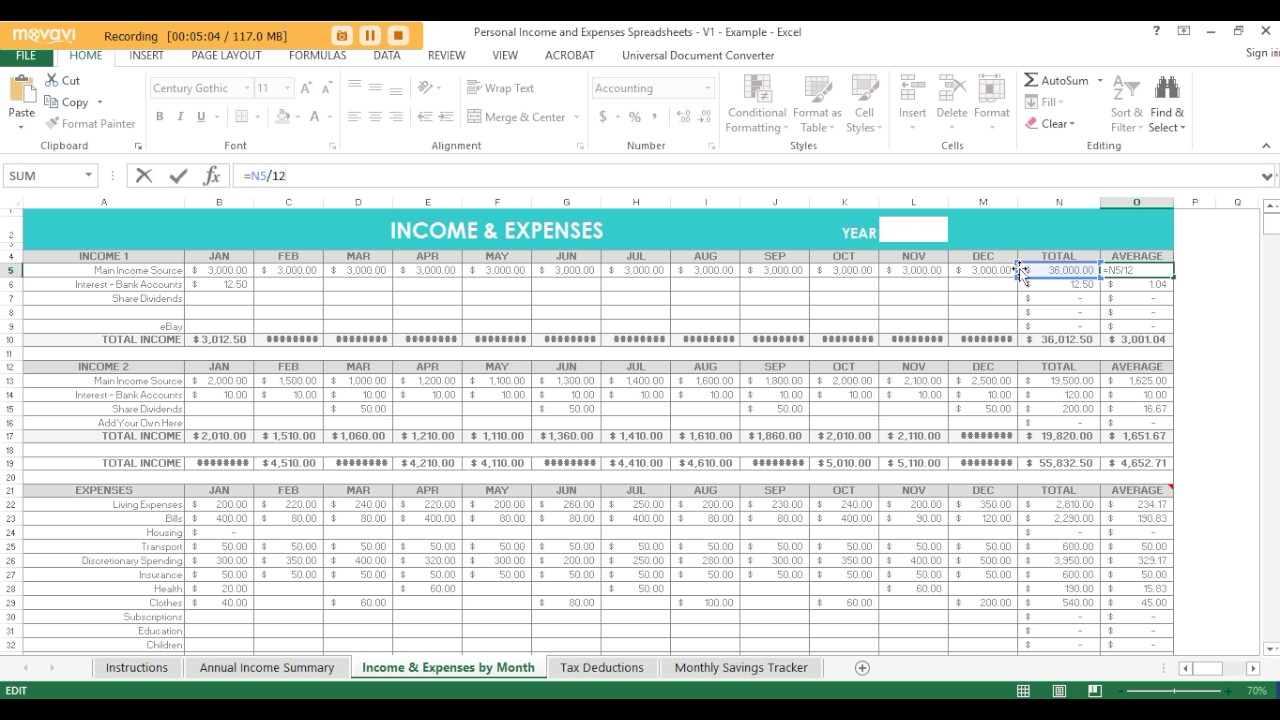

Income and Expenses Excel Spreadsheet for Income and Expenses This spreadsheet doesn't calculate the sum of income and expenses by category for you. However, if you know how to use Excel you could use a pivot table to analyze your income and expenses. Step 1: Clear the trial data, but don't clear the formulas in the column.

Tax Return Worksheets and Templates - Newtown Tax Services Tax Return Worksheets and Templates - Newtown Tax Services Organising Your Tax Return We Use Online Tax Return Questionnaires Save Paper by uploading your electronic information to our Secure Portal in a questionnaire before you visit us. We'll email you a link to our Online Questionnaire after you call to book a meeting.

SEB cash flow worksheets - MGIC Updated for the 2021 tax year, our editable and auto-calculating cash flow analysis worksheets are fitted specifically for loan officers and mortgage pros. MGIC's self-employed borrower worksheets are uniquely suited for analyzing: Cash flow and YTD profit and loss (P&L) Comparative income; Liquidity ratios; Rental income; Get the worksheets. Self-employed …

Excel formula: Income tax bracket calculation | Exceljet Summary. To calculate total income tax based on multiple tax brackets, you can use VLOOKUP and a rate table structured as shown in the example. The formula in G5 is: = VLOOKUP( inc, rates,3,1) + ( inc - VLOOKUP( inc, rates,1,1)) * VLOOKUP( inc, rates,2,1) where "inc" (G4) and "rates" (B5:D11) are named ranges, and column D is a helper column ...

10 Excel Templates To Prepare Federal Income Tax Return Let us discuss the usefulness of these templates in short. 1. Simple Tax Estimator. Simple Tax Estimator helps you estimate your tax liability in general. It will give you an approximate idea of your tax liability or tax refund. It consists of 3 sections and all the three sections are interlinked.

Tax expense journal - templates.office.com Track your tax expenses with this accessible tax organizer template. Utilize this tax expense spreadsheet to keep a running total as you go. ... Excel College loan calculator Excel Small business cash flow forecast Excel Find inspiration for your next project with thousands of ideas to choose from. Address books. Agendas. All holidays.

Estimated Tax Worksheet Estimated Payments Needed:by:JointTPSP. 90% of estimated total tax ( 66 2/3% for farmers and fishermen) 0. Enter 100% of 2021 's income tax ( Check if 2021 's AGI was > $ 150 K) Choose which to use... Smaller of above or ... Use 100 % of 2021 's amount from the line above. Use 100% of the 2022 estimated total tax.

Free Tax Estimate Excel Spreadsheet for 2019/2020/2021 [Download] How to estimate your taxes using Excel Excel Formula to Calculate Tax Federal Tax: =VLOOKUP (TaxableIncome,FederalTaxTable,4) + (TaxableIncome - VLOOKUP (TaxableIncome,FederalTaxTable,1)) * VLOOKUP (TaxableIncome,FederalTaxTable,3)

Income Tax Calculator Excel : AY 2021-22 - Karvitt Download Excel file to Calculate and compare Taxable Income and Income Tax Liability as per the Existing and New Regimes (Tax Provisions & Tax Rates) for AY 2021-22 (FY 2020-21). Save your calculations on your computer for future reference. Download Income Tax Calculator AY 2021-22 | 2022-23 in Excel

Income Tax Calculator India in Excel★ (FY 2021-22) (AY 2022-23) Download Income Tax Calculator Excel India (FY 2021-22) How to Calculate Income Tax in India? In case you want to calculate your income tax without using the Income Tax India calculator, it's not very difficult. You need to follow following steps using the below example. Amit is salaried employee with following salary structure.

Download Free Federal Income Tax Templates In Excel Prepare your Federal Income Tax Return with the help of these free to download and ready to use ready to use Federal Income Tax Excel Templates. These templates include Simple Tax Estimator, Itemized Deduction Calculator, Schedule B Calculator, Section 179 Deduction Calculator and much more. All excel templates are free to download and use.

Preparing the income tax footnote: A comprehensive study in Excel 01/11/2017 · Enter the amount of each difference in the first worksheet of the accompanying Excel template, ... U.S. Corporation Income Tax Return, notably the book-tax reconciliation on Schedule M-1 or M-3. For more advanced tax courses, more complex book-tax differences can be incorporated. The case study can be used to explain and emphasize differences such as …

0 Response to "41 income tax worksheet excel"

Post a Comment