44 truck driver expenses worksheet

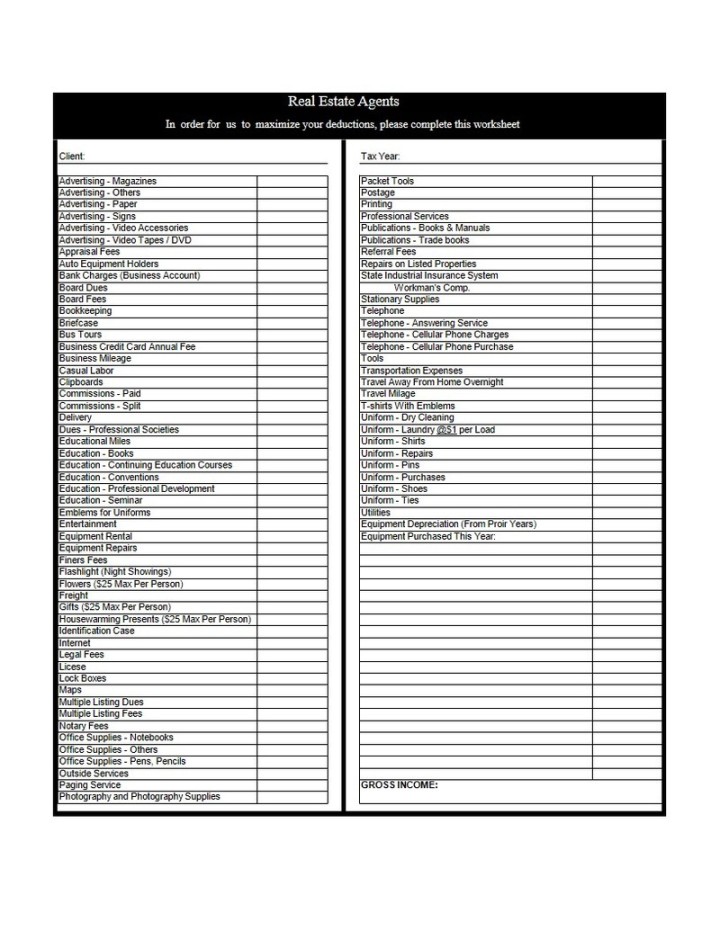

Truck Expenses Worksheet | Spreadsheet template, Printable worksheets ... May 7, 2021 - The Car and Truck Expenses Worksheet is used to determine what the deductible vehicle expenses are, using either the standard mileage rate Vehicle Expense Worksheet. ... Truck Drivers. Trucks. Rv Clubs. Rv Insurance. Tax Deductions. Income Tax. Knowledge. Templates. Business. Our Actual Full-timing Expenses for 2009. Sage and Sky ... 1 Great Trucking Expenses Spreadsheet Excel - Ginasbakery Free templates trucking expenses spreadsheet spreadsheets cost per mile 972. In this spreadsheet, all expenses including salaries of all driver and owner/members, truck purchases, insurance, office, legal expenses, truck maintenance, devices, and more will be populated automatically from your trucking business report.

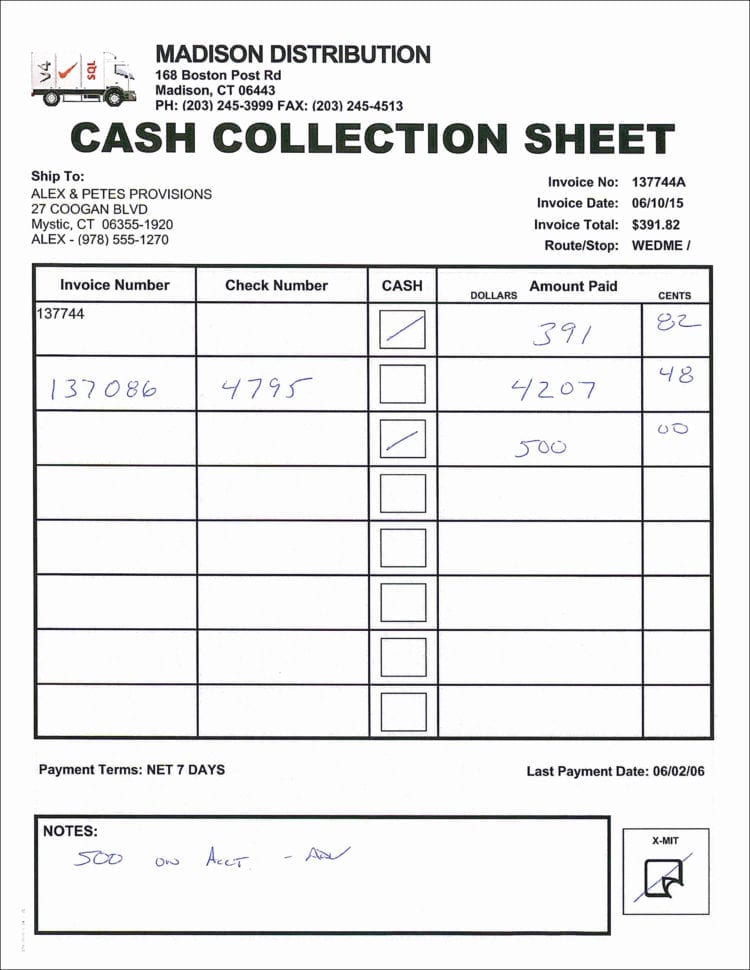

Complete List Of Owner Operator Expenses For Trucking 100,000 operating expenses /75,000 miles = 1.33 cents a mile If you want to increase profitability you can lower your costs or raise your miles (although some costs will go up accordingly). Once you get on the road, you may find that your numbers were way off, but it gives you the ability to begin to plan.

Truck driver expenses worksheet

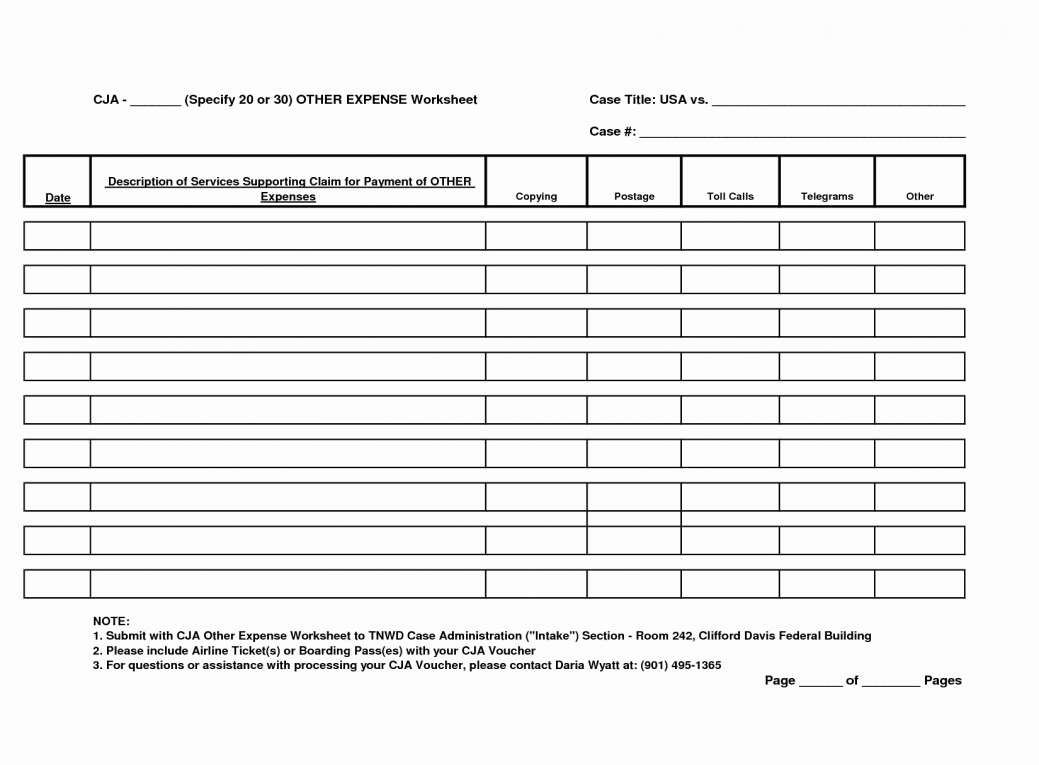

PDF Car and Truck Expense Deduction Reminders - IRS tax forms using the actual expense method is $1,875 ($2,500 x 75 percent). Recordkeeping. It is important to keep complete records to substantiate items reported on a tax return. In the case of car and truck expenses, the types of records required depend on whether the taxpayer claims the standard mileage rate or actual expenses. What You Need to Know About Truck Driver Tax Deductions If you're a self-employed driver, on the other hand, you can deduct expenses related to your work. As an owner/operator, you should receive a 1099-NEC at year-end from any customer that paid you more than $600 during the year. Trucking Cost per Mile Calculator: Free Spreadsheet - Routific Using the trucking cost per mile spreadsheet. Start by entering your total annual mileage — actual or estimated — for all the vehicles in your fleet (even if it's only one). Then enter your total monthly fixed and variable expenses (sometimes the spreadsheet asks for annual figures — be careful to follow the notes).

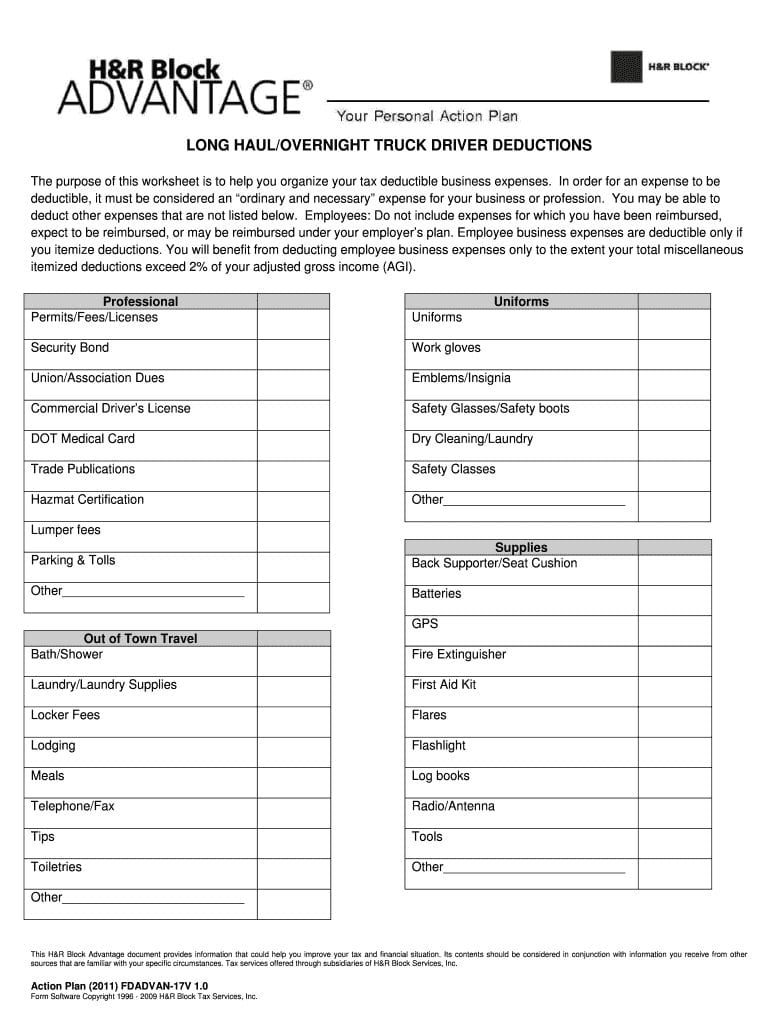

Truck driver expenses worksheet. Truck Driver Expense Spreadsheet - LAOBING KAISUO Mar 27, 2021 - Free Templates Truck Driver Expense Spreadsheet, truck driver expense sheet, tax deduction worksheet for truck drivers, trucking spreadsheet download, owner operator expense spreadsheet, truck driver expense list, truck driver expense report, truck driver expenses irs, owner operator spreadsheet, trucking spreadsheet templates, Owner Operator Truck Driver Tax Deductions Worksheet Feb 22, 2021 · owner operator and company drivers alike can lower their tax liability by creating a truck driver tax deductions worksheet that includes all of the expenses you incur in the course of doing business. Download 2019 per diem tracker. Tax Deductions for Truck Drivers - Support Mileage, daily meal allowances, truck repair (maintenance), overnight hotel expenses, and union dues are some of the tax deductions available. However, local truck drivers typically cannot deduct travel expenses. For more information regarding the standard meal allowance, please refer to the U.S. General Services Administration (GSA) website ... Car & Truck Expenses Worksheet: Cost must be entered Car & Truck Expenses Worksheet: Cost must be entered. "schedule C -- Car & Truck Expenses Worksheet: Cost must be entered." Hi everyone, I almost complete my tax return but at the end the program asked me to entered my vehicle cost. There are an empty box next to the question and I need to enter a number before I can file my tax return ...

PDF Truck Drivers Worksheet - Accounting Unlimited TRUCK DRIVERS WORKSHEET THIS IS AN INFORMATIONAL WORKSHEET FOR OUR CLIENTS CALL IF YOU NEED HELP WITH IT. Total Income (Gross Amount Of All Checks) ... Pager Fees Health Insurance Physical Damage Reserve Withdrawals Truck Washes -Other Deductions- Fuel & Oil Expenses Showers On The Road Tolls & Scales Fees Truck Insurance Repairs & Maintenance ... a spreadsheet for truckdriver expense records. [SOLVED] I'm looking for a speadsheet that i can record my truck expenses on. for example atm fees, tools, clothes, motels, ect. Register To Reply. 08-23-2005, 02:33 PM #2. Excel_Geek. View Profile View Forum Posts Visit Homepage Registered User Join Date 08-18-2005 Posts 59. Truck Driver Tax Deductions | H&R Block As a truck driver, you must claim your actual expenses for vehicles of this type. So, you can't use the standard mileage method. To deduct actual expenses for the truck, your expenses can include (but aren't limited to): Fuel Oil Repairs Tires Washing Insurance Any other legitimate business expense Trucking Cost per Mile Calculator: Free Spreadsheet - Routific Using the trucking cost per mile spreadsheet. Start by entering your total annual mileage — actual or estimated — for all the vehicles in your fleet (even if it's only one). Then enter your total monthly fixed and variable expenses (sometimes the spreadsheet asks for annual figures — be careful to follow the notes).

What You Need to Know About Truck Driver Tax Deductions If you're a self-employed driver, on the other hand, you can deduct expenses related to your work. As an owner/operator, you should receive a 1099-NEC at year-end from any customer that paid you more than $600 during the year. PDF Car and Truck Expense Deduction Reminders - IRS tax forms using the actual expense method is $1,875 ($2,500 x 75 percent). Recordkeeping. It is important to keep complete records to substantiate items reported on a tax return. In the case of car and truck expenses, the types of records required depend on whether the taxpayer claims the standard mileage rate or actual expenses.

0 Response to "44 truck driver expenses worksheet"

Post a Comment