45 sale of rental property worksheet

Selling your rental property - Canada.ca Selling your rental property If you sell a rental property for more than it cost, you may have a capital gain. List the dispositions of all your rental properties on Schedule 3, Capital Gains (or Losses). For more information on how to calculate your taxable capital gain, see Guide T4037, Capital Gains. How Are Capital Gains Calculated On Sale Of Rental Property Your total gain is simply your sale price less your adjusted tax basis. Capital gain in this scenario: $400,000 - $300,000 = $100,000. Depreciation is taxed at 25%, and capital gains are taxed based on your tax bracket. Long-term gains typically end up being taxed at either 15% or 20%, depending on your income for the year.

Capital Gains Tax Calculation Worksheet - The Balance We want to calculate the basis of 50 shares from the January purchase. We would take the cost basis of $1,225, which includes the commission, then divide it by the number of shares purchased. This results in a cost per share. We would then multiply this by 50. This is the number of shares we sold, and it results in a basis of $612.50.

Sale of rental property worksheet

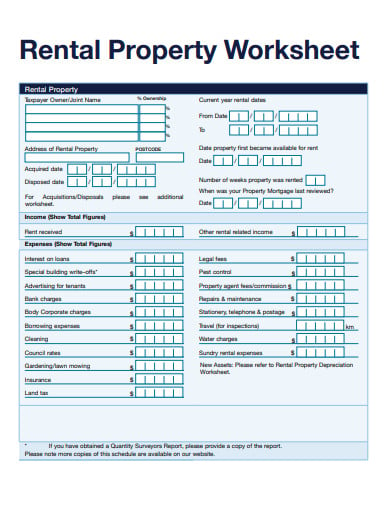

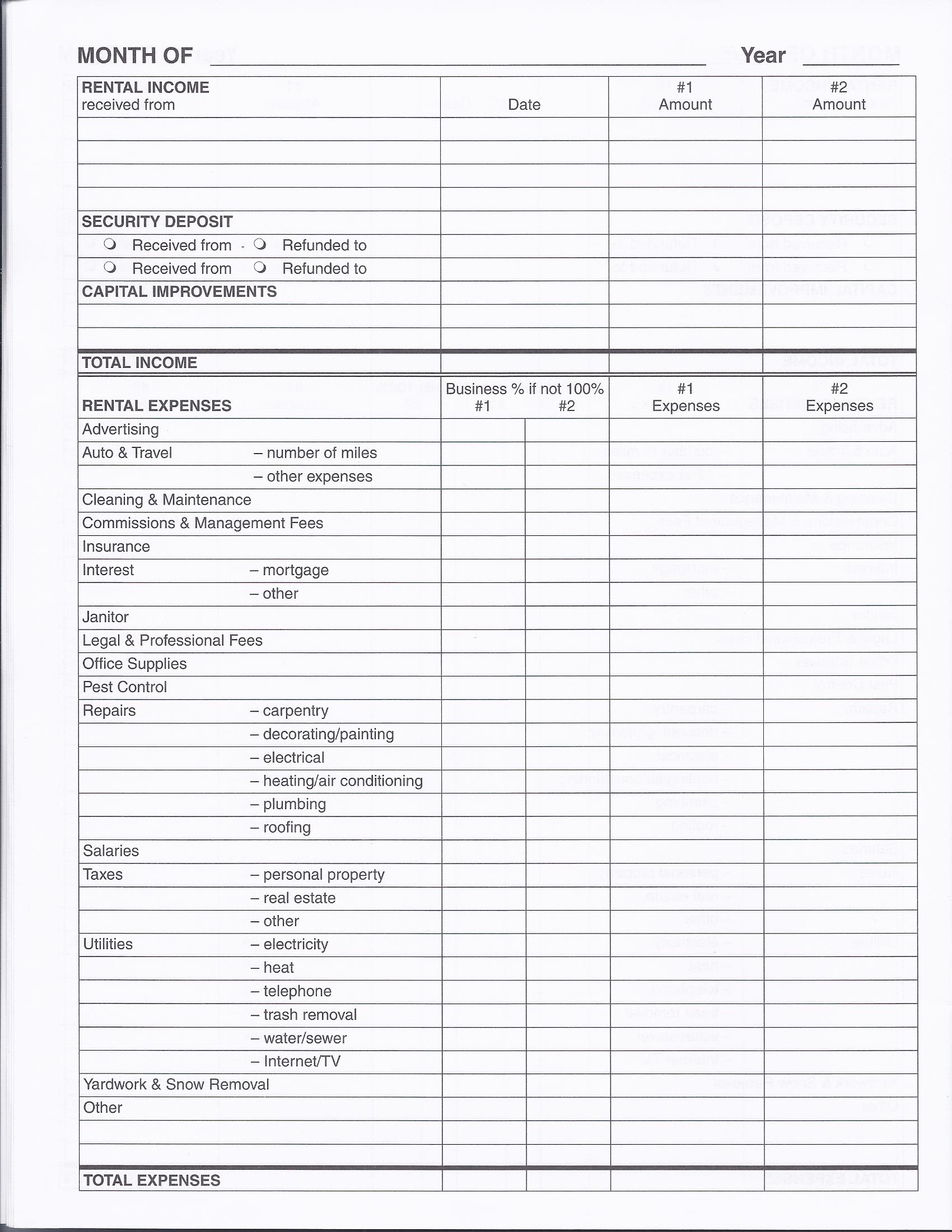

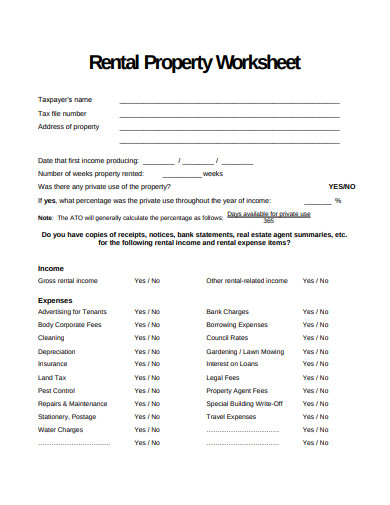

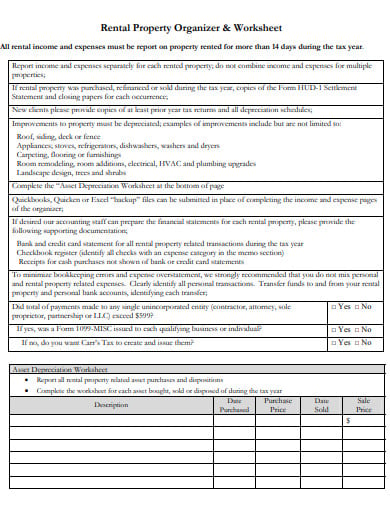

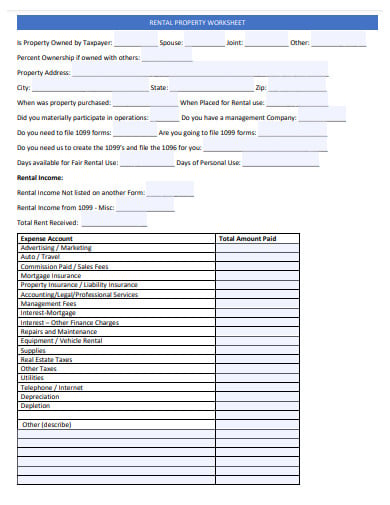

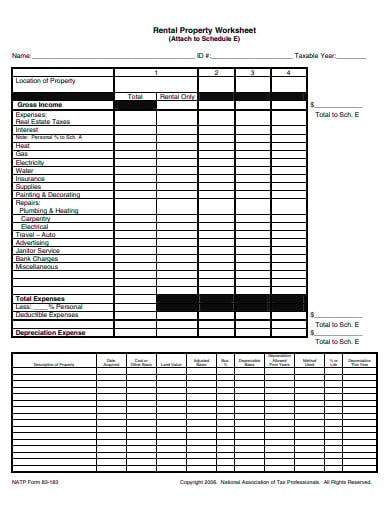

Publication 527 (2020), Residential Rental Property Rental of property. Travel expenses. Uncollected rent. Vacant rental property. Vacant while listed for sale. Points De minimis OID. Constant-yield method. Yield to maturity (YTM). Qualified stated interest (QSI). Loan or mortgage ends. Points when loan refinance is more than the previous outstanding balance. Repairs and Improvements Improvements. Free Rental Income and Expense Worksheet | Zillow Rental Manager Use our free worksheet template to simplify management of your rental finances, or use it as a starting point to create your own. It's easy to set up online rent payments with Zillow Rental Manager, the simplest way to manage your rental. Note: This is a Microsoft Excel document. For this document to work correctly, you must have a currently ... 18+ Rental Property Worksheet Templates in PDF 5 Steps to Create the Rental Property Worksheet Step 1: Create the Rental Property Spreadsheet You need to create the Rental Property Spreadsheet where you can insert in the detail of the property that is owned by you. The property details like the income and the expenditure.

Sale of rental property worksheet. Home Sale Worksheet - Colorado Tax-Aide Resources Have you or your spouse taken a home sale exclusion since. Yes No. Did you and/or your spouse own the home for any 24 months (730 days) since. Yes No. Up to 10 years extension for period of duty if on duty outside the US as military, diplomatic, intelligence or peace corps (applies to residency also) Preventing a Tax Hit When Selling Rental Property For a married couple filing jointly with a taxable income of $280,000 and capital gains of $100,000, taxes on the profits from the sale of a rental property would amount to $15,000. Fortunately,... Capital Gains Tax: What to Know When Selling Rental Property Short-term capital gains tax rates are based on the normal income tax rate. For the 2020 tax year, depending on your filing status, the 10% tax rate ranges from taxable incomes of: Single: $0 to $9,875. Married filing jointly: $0 to $19,750. Married filing separately: $0 to $9,875. Head of household: $0 to $14,100. All About Capital Gains Tax On Rental Properties The capital gains on this rental property would then be $500,000 - $240,000 = $260,000 This is then split into two different taxable portions, the long-term capital gains ($260,000 - $100,000 = $160,000) which are taxed at the favorable long-term gain rates, and the depreciation recapture amount ($100,000) which is taxed at a max of 25%.

Solved: Sale of rental asset worksheet - Intuit You would report the sale of an individual asset in You can report the sale in the Assets / Depreciation interview of the Business Income and Expenses > Rental Properties and Royalties section. If you sell the entire rental property, you will report the sale in the same interview. For additional guidance, see: I sold my rental property. How to Report a Sale of a Rental Home | Sapling Compare the resulting number with the sale price. If the sale price is more, you have a capital gain. If it's less, you have a capital loss. Sale of Rental Property: IRS Form 4797 The Internal Revenue Service considers rental property to be business property, so you can't just report the gain or loss on your Form 1040. work: Rental Worksheet - Aligaen Accounting & Tax Services Yes No. Rental services defined above includes advertising the space for rent, negotiating and executing leases, screening tenants, collecting rent, maintenance and repairs, purchasing materials and supervising employees and independent contractors. Rental services may be performed by owners or employees, agents and/or independent contractors. Taxes You Need to Pay When Selling Rental Real Estate | Nolo Viola calculates her taxable gain on the property by subtracting her adjusted basis from the sales price: $300,000 - $170,000 = $130,000. As you can see, when you sell your property, you effectively give back the depreciation deductions you took on it. Since they reduce your adjusted basis, they increase your taxable gain.

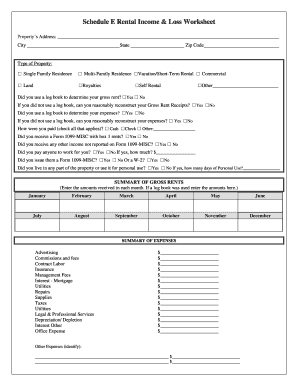

PDF Rental Property Worksheet Completing Form T776, Statement of Real Estate Rentals Income Rental expenses you can deduct Motor vehicle expenses Keeping records Guide: T4036 Rental Income Other CRA Publications and Guides for Taxpayers And the Koroll & Company website is a great resource for tax information! Disposal of Rental Property and Sale of Home - TaxAct Finish answering the interview questions about the rental property After you have entered the disposition of the rental home, you will want to fill out the Schedule D Home Sale Worksheet. To access this worksheet: Click on the Federal tab. On smaller devices, click the menu icon in the upper left-hand corner, then select Federal. Solved: Sale of Rental Property - Intuit on the worksheet for the rental property, there will be a quickzoom link to the asset entry worksheets that contain the details of the assets. the sale info is entered in the assets entry worksheet - starting with line 20. the sales price and closing costs need to be allocated between the land and building. disposal of the activity changes the … PDF 2021 Publication 527 - IRS tax forms Sale of main home used as rental prop- erty. For information on how to figure and re- port any gain or loss from the sale or other dis- position of your main home that you also used as rental property, see Pub. 523. Tax-free exchange of rental property oc- casionally used for personal purposes.

How to Figure Capital Gains on the Sale of Rental Property The IRS lets you pull all of your sale-related expenses out of the price first to calculate what it calls the amount realized. For instance, if you sold the house for $179,000, paid a 6.5 percent commission of $11,635 and paid $3,250 in closing costs, your amount realized would be $164,115.

2022 Rental Property Analysis Spreadsheet [Free Template] Next, set up your rental property analysis spreadsheet by following these four steps: 1. Estimate fair market value There are a number of methods for estimating the fair market value of a rental property. It's a good idea to use different techniques. That way you can compare the values and create a value range of low, middle, and maximum value.

How Much Tax Do You Pay When You Sell a Rental Property? In this example we'll adjust the basis to determine the amount of taxes owed when selling a rental property using the following assumptions: Purchase price = $150,000 Sale price = $200,000 Land value = $15,000 Closing costs including inspection, appraisal, recording, and owner's title insurance = $1,500 Assessment for street repaving = $2,500

Selling a Rental Property? 4 Crucial Points to Consider 3. You have to pay capital gains taxes on a rental property. When it comes to paying capital gains taxes, there are major differences between selling a rental property and selling your primary ...

11+ Investment Property Worksheet Templates in PDF | Excel Tax Financial Rental Investment Property Worksheet. 9. Residential Investment Property Worksheet Template. 10. Accounting Investment Property Worksheet Template. 11. Investment Property Evaluation Worksheet Template. 12. Residential Investment Property Calculation Worksheet.

Knowledge Base Solution - How do I report the sale of a rental property ... Go to Income > Sch E, p1 - Rent and Royalty worksheet.; Expand Section 1 - General.. In Line 18 - 100% Disposition, select the checkbox. Go to Income > Sch D / 4797 / 4684 Gains and Losses worksheet.; Expand Section 3 - Business Property, Casualties and Thefts.; Select Detail in the upper left corner.. In Lines 1-21 - Business Property, Casualties and Thefts, enter applicable information.

PDF Rental Property Worksheet - WCG CPAs Rental Property Worksheet Please use this worksheet to give us your rental income and expenses for preparation of your tax returns. Please download, open in Adobe, complete and securely upload the PDF to your client portal. Please do not email this worksheet since it contains sensitive information. You can access your client portal here-

Calculating Gain on Sale of Rental Property - AAOA 1. First, determine your selling costs. There is a great tip about accounting for all selling costs and you can read it here: Assuming you sold a property for $200K and you paid 6% commission ($12K) plus other closing costs that added to $6K, your selling costs are $18K (Selling Costs) = $12K (Commission) + $6K (Closing costs) 2.

Worksheet: Calculate Capital Gains - Realtor Magazine Up to $250,000 in capital gains ($500,000 for a married couple) on the home sale is exempt from taxation if you meet the following criteria: (1) You owned and lived in the home as your principal residence for two out of the last five years; and (2) you have not sold or exchanged another home during the two years preceding the sale.

How to dispose of a rental property with assets in ProSeries Complete the Schedule E Worksheet with any final-year rental income and expenses. In the Check All that Apply section, select Box H, Complete taxable disposition - See Help. Go to Asset Entry Worksheet. Go to the Dispositions section and enter any applicable information. Do the same for any other asset.

18+ Rental Property Worksheet Templates in PDF 5 Steps to Create the Rental Property Worksheet Step 1: Create the Rental Property Spreadsheet You need to create the Rental Property Spreadsheet where you can insert in the detail of the property that is owned by you. The property details like the income and the expenditure.

Free Rental Income and Expense Worksheet | Zillow Rental Manager Use our free worksheet template to simplify management of your rental finances, or use it as a starting point to create your own. It's easy to set up online rent payments with Zillow Rental Manager, the simplest way to manage your rental. Note: This is a Microsoft Excel document. For this document to work correctly, you must have a currently ...

Publication 527 (2020), Residential Rental Property Rental of property. Travel expenses. Uncollected rent. Vacant rental property. Vacant while listed for sale. Points De minimis OID. Constant-yield method. Yield to maturity (YTM). Qualified stated interest (QSI). Loan or mortgage ends. Points when loan refinance is more than the previous outstanding balance. Repairs and Improvements Improvements.

0 Response to "45 sale of rental property worksheet"

Post a Comment