44 cancellation of debt worksheet

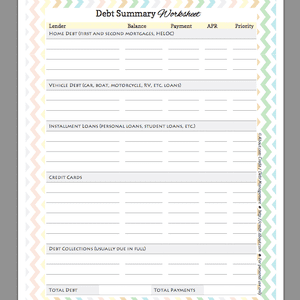

Debt Payoff Printable Worksheet {FREE} - Savor + Savvy Step One: Collect all of your current outstanding debt that charges interest. I usually don't count the mortgage, but you certainly can. Usually, the interest on the mortgage is much less than other consumer debt. Step Two: Fill in each section of the Debt Payoff Printable. There is room for two Payees for each sheet. Insolvency Worksheet | SOLVABLE 1 Canceled Debt as Income 2 The Insolvency Exception 3 Insolvency Worksheet 4 What Counts as Assets 5 Reporting and Calculating Insolvency Canceled Debt as Income When a debt (such as a credit card or a loan) gets canceled, the debtor must report the canceled debt as income.

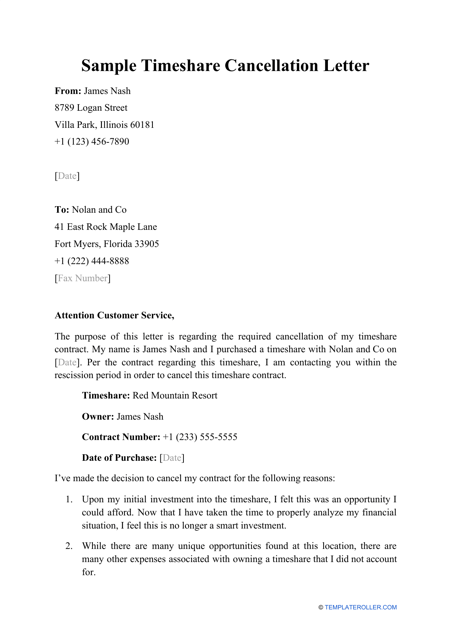

PDF 2020 Cancellation of Debt Insolvency - Tax Happens Cancellation of debt (COD) is settlement of a debt for less than the amount owed. A debt may be cancelled by a lender voluntarily or through bankruptcy or other le- gal proceedings and may result in ordinary income, in- come from the sale of assets, or both. Cancelled Debt Situation Tax Treatment Debt owed is cancelled or forgiven.

/debtrepaymentplanworksheet-56a337565f9b58b7d0d0fb38.jpg)

Cancellation of debt worksheet

Cancellation of Debt: What it Means to You - GunnChamberlain Second, the debt that was canceled may be excludable from taxable income to the extent that you are considered "insolvent" immediately prior to the cancellation of the debt. The Internal Revenue Service has provided an Insolvency Worksheet to assist taxpayers in determining whether they are considered insolvent. PDF Abandonments and Repossessions, Canceled Debts, - IRS tax forms This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as "can- celed debt." Sometimes a debt, or part of a debt, that you don't have to pay isn't considered canceled debt. These exceptions are discussed later un- der Exceptions. What Is Cancellation of Debt? | SOLVABLE Our company gets compensated by partners who appear on our website. Here is how we get compensated. Cancellation of debt form refers to IRS Form 1099-C, which will be filed by a creditor that agrees to forgive all or a portion of your debt. Under most circumstances, the amount forgiven must be reported as income for the year in question.

Cancellation of debt worksheet. Cancellation of Debt Income | Bills.com Cancellation of Debt Income Worksheet; Total Liabilities: Asset Fair Market Value: Insolvency Amount How Much Can Be Excluded From Income: Greg Example No. 1: $15,000-$7,000 = $8,000 Because this exceeds the amount of cancelled debt, Greg can exclude the entire $5,000 shown on his 1099-C. Greg Example No. 2: $10,000-$7,000 = Knowledge Base Solution - How do I enter cancellation of debt in ... - CCH Instead, depending how the cancellation of debt is to be treated, there are a few methods to get this to flow correctly to your return. Method 1: To have the amounts from the IRS 1099-C flow to the 1040 line 21 as other income. Method 2: Fill out the Deferral of Income Recognition From Discharge of Indebtedness. I Have a Cancellation of Debt or Form 1099-C In general, if you're liable for tax because a debt was canceled, forgiven, or discharged, you'll receive an Form 1099-C, Cancellation of Debt, from the lender or the person who forgave the debt. You may receive an IRS Form 1099-C while the creditor is still trying to collect the debt. If so, the creditor may not have canceled it. Cancellation Of Debt Insolvency - 2021 - CPA Clinics Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing the amount of cancelled debt to be reported as income. Generally, you must include all cancelled amounts, even if less than $600, as Other Income on Form 1040. Examples of COD Income

Understanding Your Tax Forms 2016: Form 1099-C, Cancellation of Debt If the debt is canceled and is in connection with a foreclosure or abandonment of secured property, you should not receive a form 1099-A and a form 1099-C: you should only receive a form 1099-C ... PDF Insolvency Worksheet Keep for Your Records - Asheville Tax 15. Margin debt on stocks and other debt to purchase or secured by investment assets other than real property $ 16. Other liabilities (debts) not included above $ 17. Total liabilities immediately before the cancellation. Add lines 1 through 16. $ Part II. Cancellation of Debt: What It Is, How It Works & More - LendingTree You can use the IRS' insolvency worksheet to determine if you met this criteria before the debt cancellation. Keep in mind, though, that if your debts exceed your assets by less than the amount of debt cancelled — for instance, you're insolvent in the amount of $3,000, but did not have to pay $5,000 of your debt — the remaining amount ... PDF Cancellation of Debt Insolvency Worksheet - rhtaxservices.com Cancellation of Debt -Insolvency Worksheet Taxpayer(s): SSN: Tax Year: Date of Cancellation: Total Cancelled Debt A $ Assets as of the day before the debt was cancelled

PDF Data-Entry Examples for Cancellation of Debt, Abandoned ... - Thomson 15). This amount can be used to determine how much income from the cancellation of debt may be excluded due to insolvency. After Arthur's insolvency is calculated, UltraTax CS calculates the net income from the cancellation of debt to be included on the Schedule C on the Cancellation of Debt Worksheet (Figure 1 8). The net income amount is ... Cancellation of Debt - Intuit Form 1099-C (Cancellation of Debt), fill out accordingly Form 982, you will need to indicate the reason for the discharge within Part 1 General information and you will need to include an amount within Part II Reduction of Tax Attributes (accordingly to the reason) Canceled Debt Worksheet (fill out the Part accordingly to your reason or exclusion) PDF 2021 Cancellation of Debt Insolvency - Tax Happens cancellation of debt, in addition to any gain or loss from the sale. Cancelled debt is intended as gift.Amount cancelled is not income.* * Gift tax may apply. Form 1099-C, Cancellation of Debt If a lender cancels or forgives a debt of $600 or more, it must provide the borrower with Form 1099-C, showing Cancellation of Debt - Mike Parisi Tax Consultants You can only exclude cancellation of debt income to the extent that you are considered insolvent. By applying this method you will not be taxed on the cancelled debt. Please fill out the Insolvency Worksheet provided below. Insolvency Worksheet Bankruptcy If your debt was cancelled in conjunction with Title 11 bankruptcy proceeding Chapter 7 or ...

PDF Assess Avoid Attack - USAA Assess Avoid Attack Assess| Avoid | Attack Assess your situation: The frst step toward debt reduction is understanding how much debt you really have. Use this worksheet to get a big-picture view of all your debts. • Complete the frst four columns of the worksheet. We've provided a credit card example to help get you started.

Get Insolvency Worksheet Canceled Debts - US Legal Forms Ensure the data you add to the Insolvency Worksheet Canceled Debts is up-to-date and correct. Include the date to the document using the Date tool. Select the Sign tool and make an electronic signature. Feel free to use three available alternatives; typing, drawing, or capturing one. Make sure that each field has been filled in correctly.

PDF Cancellation of debt - Center for Agricultural Law and Taxation • Using the Insolvency Worksheet: • Mark determines that immediately before the cancellation of the debt, he was insolvent to the extent of $5,000 ($15,000 total liabilities minus $10,000 FMV of his total assets • He can exclude $5,000 of his $7,500 canceled debt Example 3 Joint Debt Separate Returns: Jessica

How to Use IRS Form 982 and 1099-C: Cancellation of Debt - Pacific Debt If you have received a 1099-C for a debt forgiven after the debt's statute of limitation has run out (6 years in most states), technically that money is not income. However, because the creditor sent a 1099-C to the IRS, you need to contact the IRS to have them fill out a Form 4598. You may need to contact the creditor as well.

Guide to Debt Cancellation and Your Taxes - TurboTax For example, suppose your credit card company cancels your outstanding balance of $10,000 at a time when your only asset is an investment account worth $25,000 and your other debts total $50,000. In this case, you owe more than you have, so you may qualify for the insolvency exclusion with regards to the $10,000 canceled credit card balance.

Cancellation of Debt Insolvency Worksheet - Thomson Reuters Cancellation of Debt Insolvency Worksheet This tax worksheet calculates a taxpayer's insolvency for purposes of excluding cancellation of debt income under IRC Sec. 108. A debt includes any indebtedness whether a taxpayer is personally liable or liable only to the extent of the property securing the debt.

Knowledge Base Solution - How do I report Cancellation of debt ... - CCH Due to this, Form 1099-C for cancellation of debt is not currently in the TaxWise system. We recommend that the preparer visit the IRS website and research when and how to report cancellation of debt based on each taxpayer situation. Generally, data from a Form 1099-C, Cancelled debt (box 2) is reported on Form 1040, line 21 for 2017 and prior.

Screen 1099C - Cancellation of Debt, Abandonment (1040) - Thomson Reuters Information from this section is reported on the Cancellation of Debt Worksheet. Exclude 100% of canceled debt from income Box 2 amount excluded from gross income, if not 100% Treat canceled debt income as investment income Reason Box 2 amount is excluded from gross income Description of other reason 1099-A Facsimile

Entering canceled debt in ProSeries - Intuit Type in CAN to highlight the line labeled Canceled Debt. Click OK to open the Canceled Debt Worksheet. Scroll down to the Business, Farm, and Rental Debt Smart Worksheet below line 30. Double-click one of the following options to link the 1099-C to that activity: Schedule C, Business Schedule E, Rental Schedule F, Farm Form 4835, Farm Rental

Forms covered - Intuit Cancellation of Debt Worksheet: 1040: Form 1040: Individual Tax Return: 1040-SR: Form 1040-SR - U.S. Tax Return for Seniors: Schedule 1: Additional Income and Adjustments to Income: ... Original Issue Discount Worksheet: 1099-Q: Payments From Qualified Education Programs: 1099-R: Distributions From Pensions, Annuities, Retirement, etc.

Publication 4681 (2021), Canceled Debts, Foreclosures, Repossessions ... This publication explains the federal tax treatment of canceled debts, foreclosures, repossessions, and abandonments. Generally, if you owe a debt to someone else and they cancel or forgive that debt for less than its full amount, you are treated for income tax purposes as having income and may have to pay tax on this income. Note.

What Is Cancellation of Debt? | SOLVABLE Our company gets compensated by partners who appear on our website. Here is how we get compensated. Cancellation of debt form refers to IRS Form 1099-C, which will be filed by a creditor that agrees to forgive all or a portion of your debt. Under most circumstances, the amount forgiven must be reported as income for the year in question.

PDF Abandonments and Repossessions, Canceled Debts, - IRS tax forms This publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as "can- celed debt." Sometimes a debt, or part of a debt, that you don't have to pay isn't considered canceled debt. These exceptions are discussed later un- der Exceptions.

Cancellation of Debt: What it Means to You - GunnChamberlain Second, the debt that was canceled may be excludable from taxable income to the extent that you are considered "insolvent" immediately prior to the cancellation of the debt. The Internal Revenue Service has provided an Insolvency Worksheet to assist taxpayers in determining whether they are considered insolvent.

:max_bytes(150000):strip_icc()/debtsummaryfullpageone-56a1de5e5f9b58b7d0c3fc0e.png)

0 Response to "44 cancellation of debt worksheet"

Post a Comment