39 1040 qualified dividends worksheet

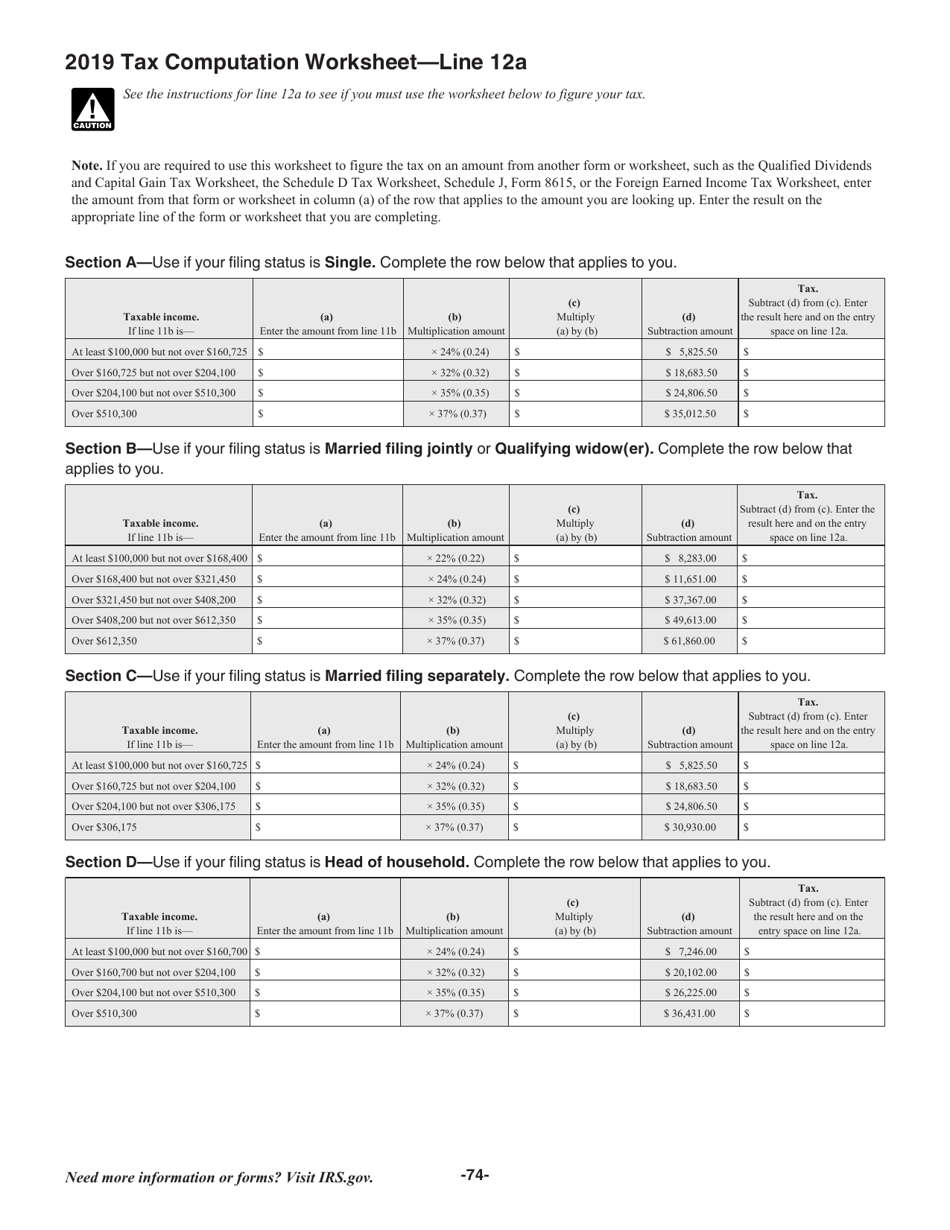

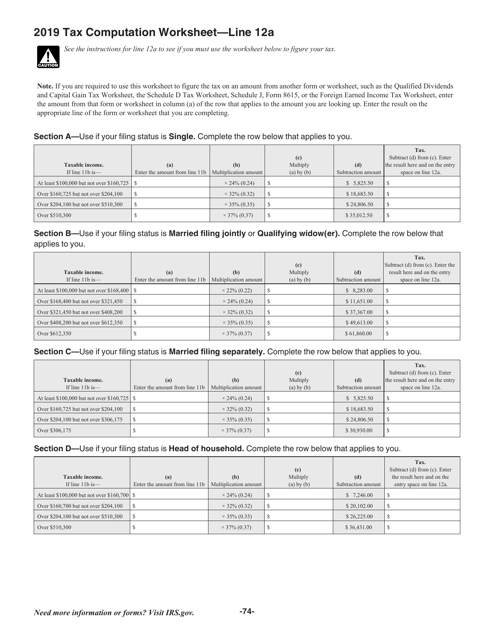

Qualified dividends, on 1040 Schedule D, worksheet, does not… This worksheet directly compute Qualified Dividends, into lower Tax rate. In 2018, they eliminated the Worksheet below. 2018 Schedule D Tax Worksheet, asks for data, but eliminated link to lower Tax rate for Qualified Divdidends.I have suspicion, how they are handling this issue of Qualified Dividends built into 2018 Schedule D worksheet. Qualified Dividends and Capital Gain Tax Worksheet. - CCH Use the Qualified Dividends and Capital Gain Tax Worksheet to figure your tax, if you do not have to use the Schedule D Tax Worksheet and if any of the following applies. You reported qualified dividends on Form 1040, line 9b. You do not have to file Schedule D and you reported capital gain distributions on Form 1040, line 13.

How to Figure the Qualified Dividends on a Tax Return Report your qualified dividends on line 9b of Form 1040 or 1040A. Use the Qualified Dividends and Capital Gain Tax Worksheet in the instructions for Form 1040 or 1040a to figure your total tax...

1040 qualified dividends worksheet

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields PDF Qualified Dividends and Capital Gain Tax Worksheet - Line 16 (Form 1040 ... • Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. • If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 7. Enter the amount from Form 1040 or 1040-SR, line 15. However, if you are filing Form 2555 (relating to foreign ... What is a Qualified Dividend Worksheet? - Money Inc The qualified dividends worksheet, however, has 27 lines allowing you to compute your tax and you might not comprehend what each figure is trying to get at, but Marotta on Money simplifies it for us. The resulting tax amount you are supposed to have calculated in Form 1040 through line 10 has included the qualified dividends and long-term ...

1040 qualified dividends worksheet. PDF Qualified Dividends and Capital Gain Tax Worksheet -Line 44 (Form 1040 ... 1040, line 44 (Form 1040A, line 28). If you are filing Form 2555 or 2555-EZ, do not enter this amount on Form 1040, line 44 (or Form 1040A, line 28). Instead, enter it on line 4 of the Foreign Earned Income Tax Worksheet * If you are filing Form 2555 or 2555-EZ, see the footnote in the Foreign Earned Income Tax Worksheet before completing this ... 2018 Qualified Dividends Worksheets - K12 Workbook Worksheets are 2018 form 1041 es, 2018 form 1040 es, 2018 estimated tax work keep for your records 1 2a, 44 of 107, Pacific grace tax accounting, Qualified dividends and capital gain tax work an, 2017 qualified dividends and capital gain tax work, Qualified dividends and capital gain tax work line. How Your Tax Is Calculated: Understanding the Qualified Dividends and ... Instead, 1040 Line 44 "Tax" asks you to "see instructions." In those instructions, there is a 27-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 44 tax. The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. Get Qualified Dividends And Capital Gain Tax Worksheet 2019 Follow our easy steps to have your Qualified Dividends And Capital Gain Tax Worksheet 2019 prepared rapidly: Pick the web sample from the catalogue. Type all necessary information in the necessary fillable fields. The easy-to-use drag&drop graphical user interface makes it easy to add or relocate fields.

Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 - Fill ... Complete Qualified Dividends And Capital Gain Tax Worksheet Fillable 2019 in a few minutes following the guidelines listed below: Find the document template you need from our collection of legal form samples. Select the Get form key to open it and start editing. Fill in all of the requested fields (they are marked in yellow). Qualified Dividends and Capital Gains Worksheet - StuDocu Qualified Dividends and Capital Gain Tax Worksheet—Line 12a Keep for Your Records. See the earlier instructions for line 12a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 or 1040-SR through line 11b. If you don't have to file Schedule D and you received capital gain ... Qualified Dividends Tax Worksheet - Fill Out and Use - FormsPal The IRS has made available a new qualified dividends tax worksheet form (1096-DIV) for the 2019 tax year. The form is used to report distributions on Form 1040, Schedule B, and ensure that the correct amount of tax is withheld. This guide will provide an overview of the form and instructions on how to complete it. What are qualified dividends? › pub › irs-newsQualified Dividends and Capital Gain Tax Worksheet: An ... for several years, the irs has provided a tax computation worksheet in the form 1040 and 1040a instructions for certain investors to get the benefit of the lower capital gains rates without the need to complete schedule d. taxpayers who had gains or losses from the sale, exchange, or conversion of investments or certain other items must use …

› dividends-on-tax-returnsHow Dividends Are Taxed and Reported on Tax Returns - The Balance Ordinary dividends are reported on Line 3b of your Form 1040. Qualified dividends are reported on Line 3a of your Form 1040. You can use the Qualified Dividends and Capital Gain Tax Worksheet found in the instructions for Form 1040 to figure out the tax on qualified dividends at the preferred tax rates. 7. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) • See Form 1040 instructions for line 16 to see if the taxpayer can use this worksheet to compute the taxpayer's tax. • Before completing this worksheet, complete Form 1040 through line 15. smartasset.com › taxes › dividend-tax-rateThe Dividend Tax Rate for 2021 and 2022 - SmartAsset Jan 07, 2022 · There are two types of dividends: qualified and non-qualified. A dividend is typically qualified if you have held the underlying stock for a certain period of time. According to the IRS, a dividend is “qualified” if you have held the stock for more than 60 days during the 121-day period that begins 60 days prior to the ex-dividend date ... Qualified Dividends And Capital Gain Tax Worksheet: Fillable ... - CocoDoc 2020 form 1040 qualified dividends and capital gain tax worksheet How to Edit Your Qualified Dividends And Capital Gain Tax Worksheet Online When dealing with a form, you may need to add text, put on the date, and do other editing.

I have qualified dividends (1040 line 3a) and ordinary dividends (1040 ... When you enter qualified dividends and/or capital gains on your return, taxes will not be calculated using the tax tables, but using either the Schedule D Tax Worksheet provided in the Instructions for Schedule D, or the Qualified Dividends and Capital Gains Tax Worksheet in the Instructions for Form 1040 and 1040-SR.

apps.irs.gov › app › vitaPage 40 of 117 - IRS tax forms 2018 Form 1040—Line 11a Qualified Dividends and Capital Gain Tax Worksheet—Line 11a. Keep for Your Records. See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10.

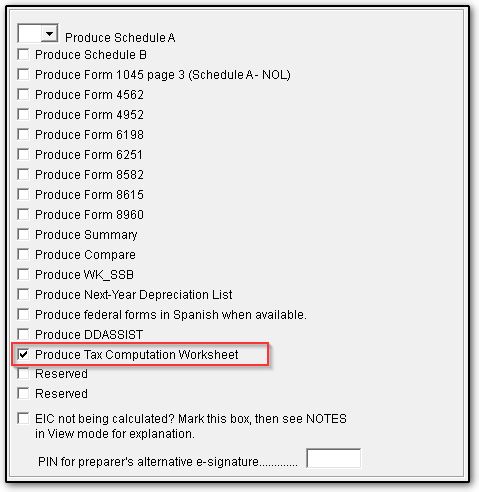

Calculation of tax on Form 1040, line 16 - Thomson Reuters Tax Tables. You can find them in the Form 1040 Instructions. Qualified Dividend and Capital Gain Tax Worksheet. To see this select Forms View, then the DTaxWrk folder, then the Qualified Div & Cap Gain Wrk tab. Per the IRS Form 1040 Instructions, this worksheet must be used if: The taxpayer reported qualified dividends on Form 1040, Line 3a.

2019 Qualified Dividends Worksheet - Division Worksheets Eligible dividends are taxed at the same rate as capital gains, which is below the normal income tax rate. Form 1040 is used to report the distribution in Schedule B and to verify that the tax rates are correct. Original worksheet.middleworld.net. 2019 Efficient Profit Allocation and Capital Gains Tax Worksheet. Eligible income and fixed income.

› instructions › i1040gi1040 (2021) | Internal Revenue Service - IRS tax forms ABC Mutual Fund paid a cash dividend of 10 cents a share. The ex-dividend date was July 16, 2021. The ABC Mutual Fund advises you that the part of the dividend eligible to be treated as qualified dividends equals 2 cents a share. Your Form 1099-DIV from ABC Mutual Fund shows total ordinary dividends of $1,000 and qualified dividends of $200.

Qualified Dividends And Capital Gain Tax Worksheet 2021 - signNow Follow the step-by-step instructions below to eSign your capital gains tax worksheet 2021: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of eSignature to create. There are three variants; a typed, drawn or uploaded signature. Create your eSignature and click Ok. Press Done.

Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gains Worksheet-Completed Qualified Dividends and Capital Gains Worksheet-Completed University Southern New Hampshire University Course Federal Taxation I (ACC330) Uploaded by Nickia Marie Academic year 2021/2022 Helpful? Please or to post comments. Students also viewed 6-2 Final Project Two-1040 Document

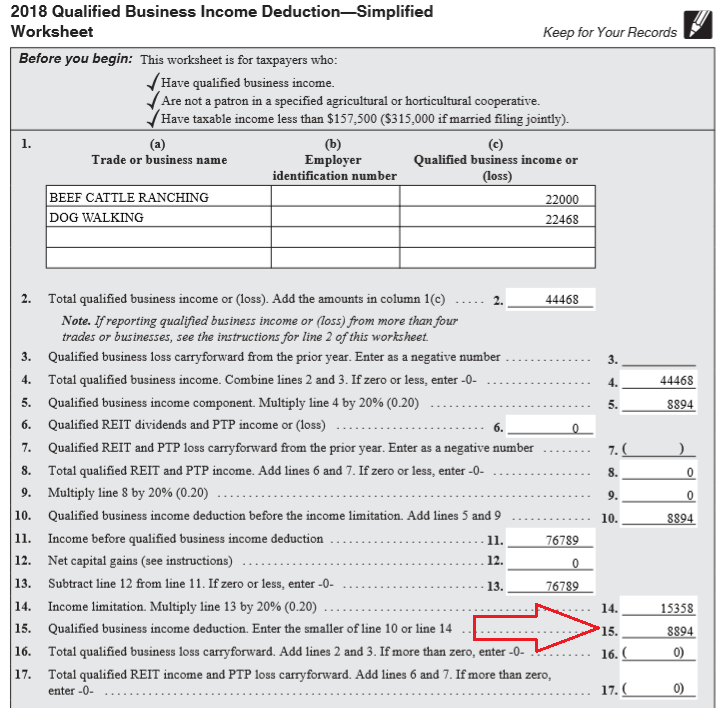

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income.

apps.irs.gov › app › vitaPage 39 of 117 14:16 - 24-Jan-2019 CAUTION - IRS tax forms Form 1040, line 10, from line 6 of your Qualified Dividends and Capital Gain Tax Worksheet (line 10 of your Schedule D Tax Worksheet). If the result is more than zero, that amount is your capital gain excess. If you don’t have a capital gain excess, complete the rest of either of those worksheets according to the worksheet's instructions. Then

2022 Download Qualified Dividends Worksheet - WRKSHTS Your foreign dividends may be qualified to be taxed at a special lower tax rate. Report your qualified dividends on line 9b of form 1040 or 1040a. Source: . Report your qualified dividends on line 9b of form 1040 or 1040a. Qualified dividends and capital gain tax worksheet (2020). Source: db-excel.com

› tax-form › 10402021 1040 Form and Instructions (Long Form) - Income Tax Pro Jan 01, 2021 · Free printable 2021 Form 1040 and 2021 Form 1040 Instructions booklet sourced from the IRS. Download, fill-in, and print the PDF file. Easily find supporting schedules for your US Individual Income Tax Return.

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Qualified Dividends and Capital Gain Tax Worksheet The worksheet is part of Form 1040 which is mandatory for every individual tax filer as well as joint filers. The worksheet has 27 lines, and all fields must be filled according to relevant information. Tax filers with qualified dividends and capital gains have to fill the relevant worksheet.

What is a Qualified Dividend Worksheet? - Money Inc The qualified dividends worksheet, however, has 27 lines allowing you to compute your tax and you might not comprehend what each figure is trying to get at, but Marotta on Money simplifies it for us. The resulting tax amount you are supposed to have calculated in Form 1040 through line 10 has included the qualified dividends and long-term ...

PDF Qualified Dividends and Capital Gain Tax Worksheet - Line 16 (Form 1040 ... • Before completing this worksheet, complete Form 1040 or 1040-SR through line 15. • If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on Form 1040 or 1040-SR, line 7. Enter the amount from Form 1040 or 1040-SR, line 15. However, if you are filing Form 2555 (relating to foreign ...

Fillable Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 The Form 1040 Qualified Dividends and Capital Gain Tax Worksheet 2018 form is 1 page long and contains: 0 signatures 2 check-boxes 29 other fields

0 Response to "39 1040 qualified dividends worksheet"

Post a Comment