41 kentucky sales and use tax worksheet

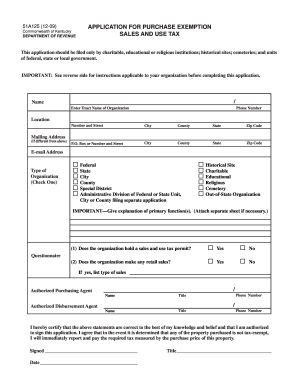

Kentucky Sales Tax Exemptions | Agile Consulting Group - sales and use tax The state of Kentucky levies a 6% state sales tax on the retail sale, lease or rental of most goods and some services. There are no local sales taxes in the state of Kentucky, and as a result, there are no direct Kentucky sales tax exemptions. Use tax is also collected on the consumption, use or storage of goods in Kentucky if sales tax was not ... KENTUCKY SALES AND USE TAX INSTRUCTIONS (51A205) Download KENTUCKY SALES AND USE TAX INSTRUCTIONS (51A205) – Department of Revenue (Kentucky) form.

PDF Enter Applicable Number: SSN - Kentucky services subject to use tax, and enter the total on Line 1. All tangible personal property, digital property, and extended warranty services purchased for storage, use or consumption without payment of Kentucky sales and use tax should be listed and included on Line 1.

Kentucky sales and use tax worksheet

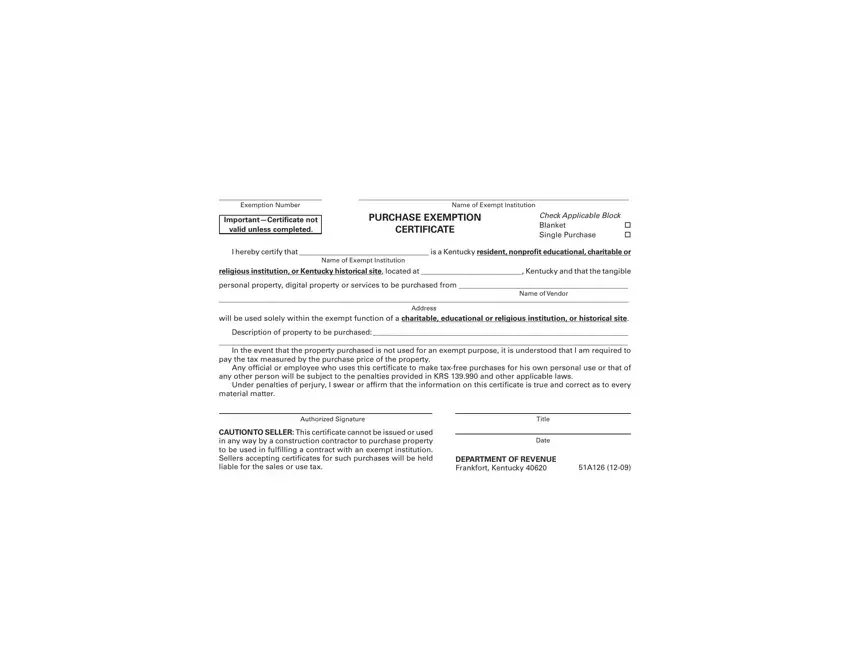

Sales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes. Kentucky Sales And Use Tax Worksheets - K12 Workbook Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. *Click on Open button to open and print to worksheet. How Kentucky sales and use taxes apply to manufacturing and equine ... Like most states, Kentucky imposes a sales tax on the retail sale of tangible personal property, digital property, and some services. Kentucky also imposes a complementary use tax on the storage, use, or other consumption of taxable property in the state if no sales tax was paid to Kentucky when the property was purchased.

Kentucky sales and use tax worksheet. Search - kentucky.gov Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross ... issuing the Kentucky Resale Certificate (Form 51A105) or a Streamlined Sales Tax ... Sales and Use Tax in Kentucky - OnDemand Course | Lorman Education Services Learn detailed information on sales and use tax rules and regulation in Kentucky.Over the past several years, Sales and Use Tax in Kentucky has become one of the most complex areas of Kentucky's tax system given the lack of clarity or guidance on key topics, multitude of exemptions and exclusions from the tax, advancements in technologies and traditional processes, and significant ... PDF Sales and Use Tax K - Kentucky entucky's first entry into the sales tax field occurred in 1934 when the General Assembly enacted a tax of 3 percent on general retail gross receipts. The tax was subsequently re-pealed by the 1936 General Assembly. Kentucky again enacted a sales and use tax effective on July 1, 1960. The sales tax is imposed upon all retailers for the privilege KENTUCKY SALES AND USE TAX WORKSHEET Sales for which resale certificates received (Revenue Form 51A105)... 3. Sales for which agricultural certificates ... KENTUCKY SALES AND USE TAX WORKSHEET.

Kentucky.gov Login - Kentucky.gov Account Stay logged in? Log In. Don't have an account? Sign Up. Forgot Username? Request Username PDF KENTUCKY SALES AND USE TAX WORKSHEET Period Beginning: Period Ending: Account No.. To avoid penalties mail by the due date. Cents If during this period you did not make any sales and did not purchase any items subject to tax on line 23(a) or 23(b), sign the return on the back and mail to the Department of Revenue by the due date. Dollars Kentucky Sales Tax Form - Fill Online, Printable, Fillable, Blank 51A205 (4-14) Commonwealth of Kentucky DEPARTMENT OF REVENUE KENTUCKY SALES AND USE TAX INSTRUCTIONS Due Date The return must be postmarked on or before the ... PDF Kentucky sales and use tax worksheet 51a102 - Weebly Kentucky sales and use tax worksheet 51a102 Nevada is known for its opulent casinos, high-end restaurants and world-class hotels. Travel and tourism companies are flourishing in this state. Whether you plan to open a bar, casino or retail store, there are a few things you need to know in advance. Entrepreneurs and business owners are subject to ...

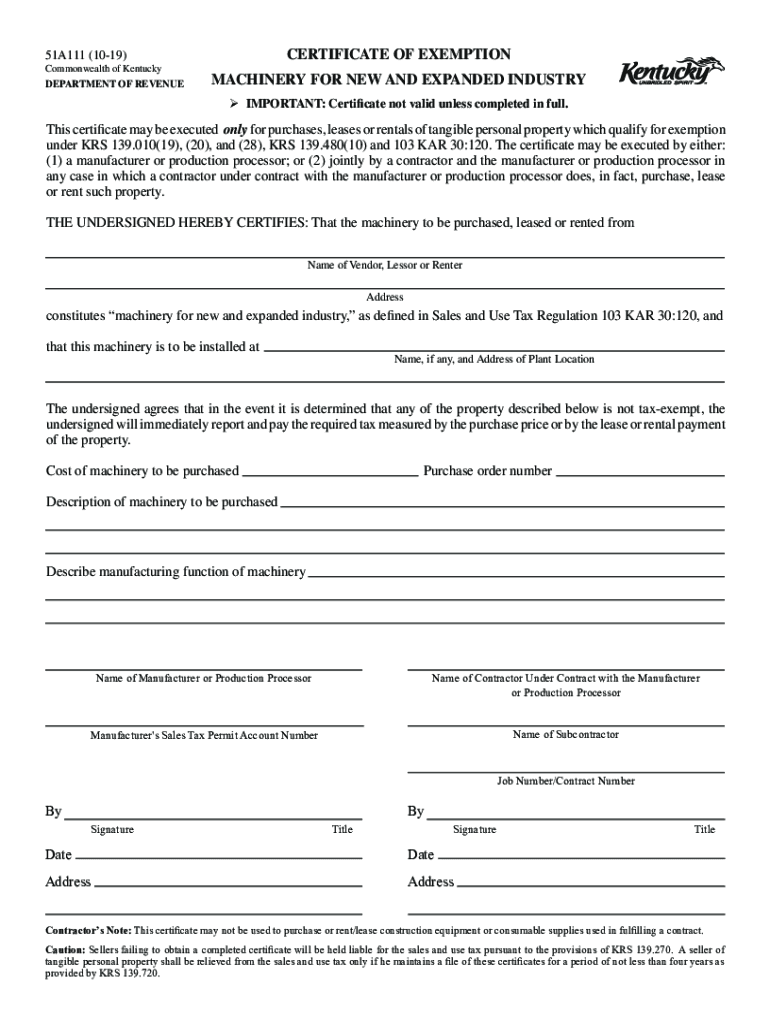

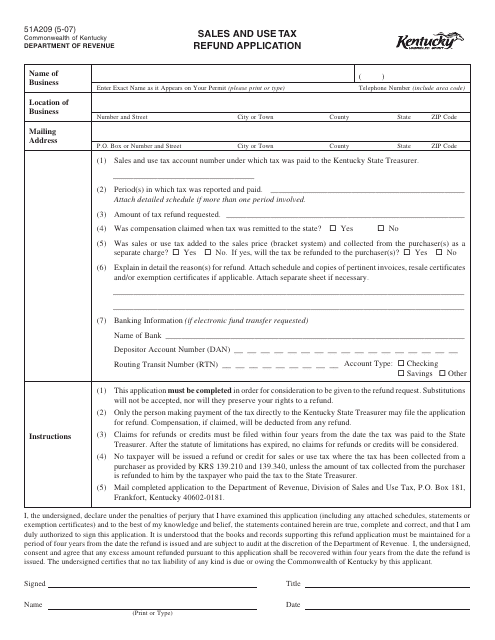

Exemptions from the Kentucky Sales Tax - SalesTaxHandbook While the Kentucky sales tax of 6% applies to most transactions, there are certain items that may be exempt from taxation. This page discusses various sales tax exemptions in Kentucky. Sales Tax Exemptions in Kentucky . In Kentucky, certain items may be exempt from the sales tax to all consumers, not just tax-exempt purchasers.. Several exceptions to the state sales tax are goods and machinery ... Kentucky Sales And Use Tax - Printable Worksheets Showing top 8 worksheets in the category - Kentucky Sales And Use Tax. Some of the worksheets displayed are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. Division of Sales and Use Tax - Kentucky The Division of Sales and Use Tax manages collection and administration of Sales and Use Taxes for the Department of Revenue. How Do You Fill Out a Kentucky Sales Tax Form? | Bizfluent Step 3. Calculate your tax liability. Once you have calculated your gross receipts and listed your deductions, subtract your deductions from your gross receipts. For example, if you have $1,200 in gross receipts and $200 in deductions, you owe 6 percent of $1,000 in sales taxes. Six percent of $1,000 is $60.

Forms - Department of Revenue - Kentucky Tax Type Tax Year (Select) Current 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 Clear Filters

PDF RETAIL PACKET - Kentucky At present the Sales and Use Tax returns and the Consumer's Use Tax form (51A113) can be filed online. Form numbers include 51A102, 51A102E, 51A103, and 51A103E.

Kentucky - Sales Tax Handbook 2022 KY Sales Tax Calculator. Printable PDF Kentucky Sales Tax Datasheet. Kentucky has a statewide sales tax rate of 6%, which has been in place since 1960. Municipal governments in Kentucky are also allowed to collect a local-option sales tax that ranges from 0% to 2.75% across the state, with an average local tax of 0.008% (for a total of 6.008% ...

Form 51A102 "Sales and Use Tax Worksheet" - Kentucky - TemplateRoller Download Printable Form 51a102 In Pdf - The Latest Version Applicable For 2022. Fill Out The Sales And Use Tax Worksheet - Kentucky Online And Print It Out For Free. Form 51a102 Is Often Used In Kentucky Tax Forms, Kentucky Department Of Revenue, United States Tax Forms, Kentucky Legal Forms, Tax And United States Legal Forms.

Kentucky Sales And Use Tax Form Worksheets - K12 Workbook Displaying all worksheets related to - Kentucky Sales And Use Tax Form. Worksheets are 51a205 4 14 kentucky sales and department of revenue use, 2018 kentucky individual income tax forms, Sales tax return work instructions, Sales and use tax audit manual, 01 117 texas sales and use tax return, Efo026 idaho business income tax payments work, Application for fueltax refund for use of power ...

9th Annual Navigating Sales Tax and Use in Kentucky Pricing. $399/Kentucky Chamber Member*. $499/Non-member*. * Registered attendees who participant will receive a certificate of completion following the training. Register - May 26, 2022 - Louisville. Special Offer: Send 1 and receive the 2nd HALF OFF! Special pricing not available online.

51a102 Kentucky Sales Anduse Tax Worksheets - K12 Workbook Displaying all worksheets related to - 51a102 Kentucky Sales Anduse Tax. Worksheets are Retail packet, Kentucky sales and use tax work help, Tax alert, Nebraska and local sales and use tax return form. *Click on Open button to open and print to worksheet. 1. RETAIL PACKET. 2. Kentucky Sales And Use Tax Worksheet Help. 3. Tax Alert.

Kentucky Sales Tax Guide and Calculator 2022 - TaxJar Or file by paper using the Kentucky 10A100 form. You can also register for a sales tax permit when you register your business. A sales and use tax permit is ...

Ky Sales And Use Tax Worksheets - K12 Workbook Displaying all worksheets related to - Ky Sales And Use Tax. Worksheets are Retail packet, Kentucky general information use tax, Kentucky general information use tax contributions, Tax alert, 2020 kentucky individual income tax forms, Kentucky tax alert, Kentucky tax alert, Kentucky tax alert. *Click on Open button to open and print to worksheet.

Consumer Use Tax - Department of Revenue - Kentucky.gov Consumer Use Tax Return - Form 51A113(O) may be filed during the year each time you make taxable purchases. · You can report and pay use tax on an annual basis ...

Kentucky Accelerated Sales And Use Tax Worksheets - K12 Workbook Worksheets are Retail packet, Local option sales tax and kentucky cities, Kentucky sales and use tax work help, Kentucky sales and use tax work help voor, Kentucky tax alert, Guidelines for the accelerated sales tax payment, 2316 questions answers about paying your sales use tax, Money and sales tax work. *Click on Open button to open and print ...

Kentucky Sales & Use Tax Guide - Avalara - Taxrates Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services. Kentucky first adopted a general state sales tax in 1960, and since that time, the rate has risen to 6 percent. In many states, localities are able to impose local sales taxes on top of the state sales tax. However, as of June 2019, there are ...

PDF Kentucky Business One Stop end of the worksheet. 1.1.1.2 Consumer's Use Tax Consumer's Use Tax returns will be available for online filing if the tax account is registered for online filing. 1.1.1.2.1 Return To file a Consumer's Use Return first enter the 'Cost of tangible and digital property purchased for use without payment of Sales and Use tax'.

What transactions are subject to the sales tax in Kentucky? In the state of Kentucky, legally sales tax is required to be collected from tangible, physical products being sold to a consumer. Several exceptions to this tax are most types of farming equipment, prescription medication, and equipment used for construction. This means that someone selling furniture would be required to charge sales tax, but ...

How Kentucky sales and use taxes apply to manufacturing and equine ... Like most states, Kentucky imposes a sales tax on the retail sale of tangible personal property, digital property, and some services. Kentucky also imposes a complementary use tax on the storage, use, or other consumption of taxable property in the state if no sales tax was paid to Kentucky when the property was purchased.

Kentucky Sales And Use Tax Worksheets - K12 Workbook Worksheets are Kentucky general information use tax contributions, Tax alert, Kentucky tax alert, Manners for the real world, State and local refund work, Building contractors guide to sales and use taxes, Eftps direct payment work, Tax year 2020 small business checklist. *Click on Open button to open and print to worksheet.

Sales & Use Tax - Department of Revenue - Kentucky The use tax is a "back stop" for sales tax and generally applies to property purchased outside the state for storage, use or consumption within the state. The Kentucky Sales & Use Tax returns (forms 51A102, 51A102E, 51A103, 51A103E, and 51A113) are not available online or by fax. The forms are scannable forms for processing purposes.

0 Response to "41 kentucky sales and use tax worksheet"

Post a Comment