41 life insurance needs analysis worksheet pdf

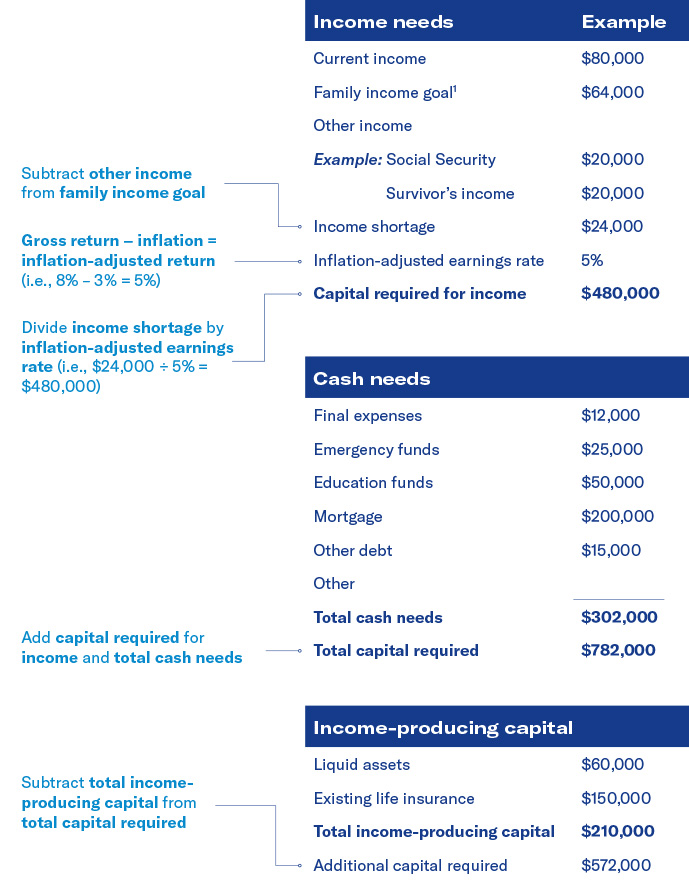

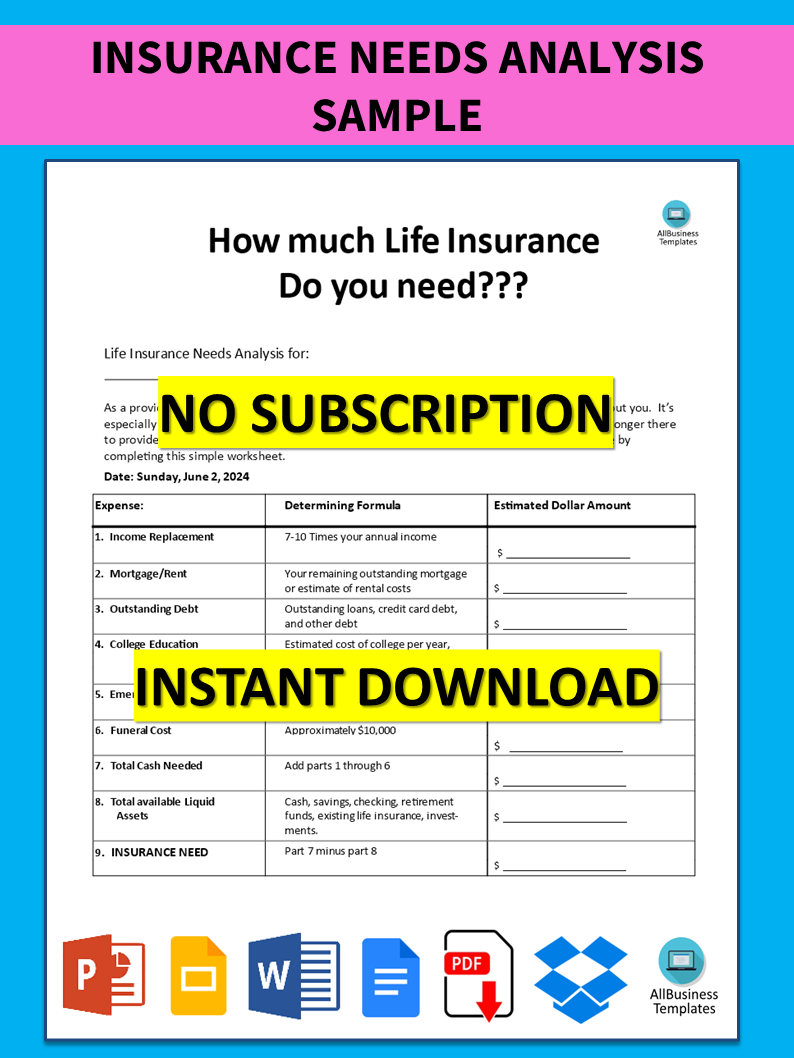

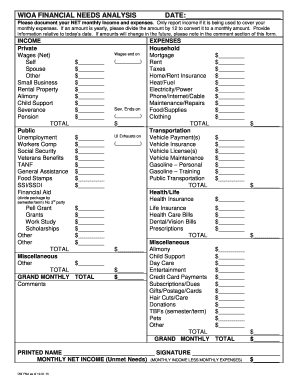

Life Insurance Needs Analysis Worksheet - Calculators The life insurance amount needed to sustain your spouse's current standard of living is $800,000. Insurance in this amount allows for a sustained income of $40,000 per year for your family. You might notice that this figure does not consider inflation. PDF Life Insurance Needs Analysis Worksheet - Empire Life Insurance Needs Analysis Worksheet Date: _____ This Worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. The type and amount of information required to be collected will vary depending on each client's particular circumstances, therefore the information ...

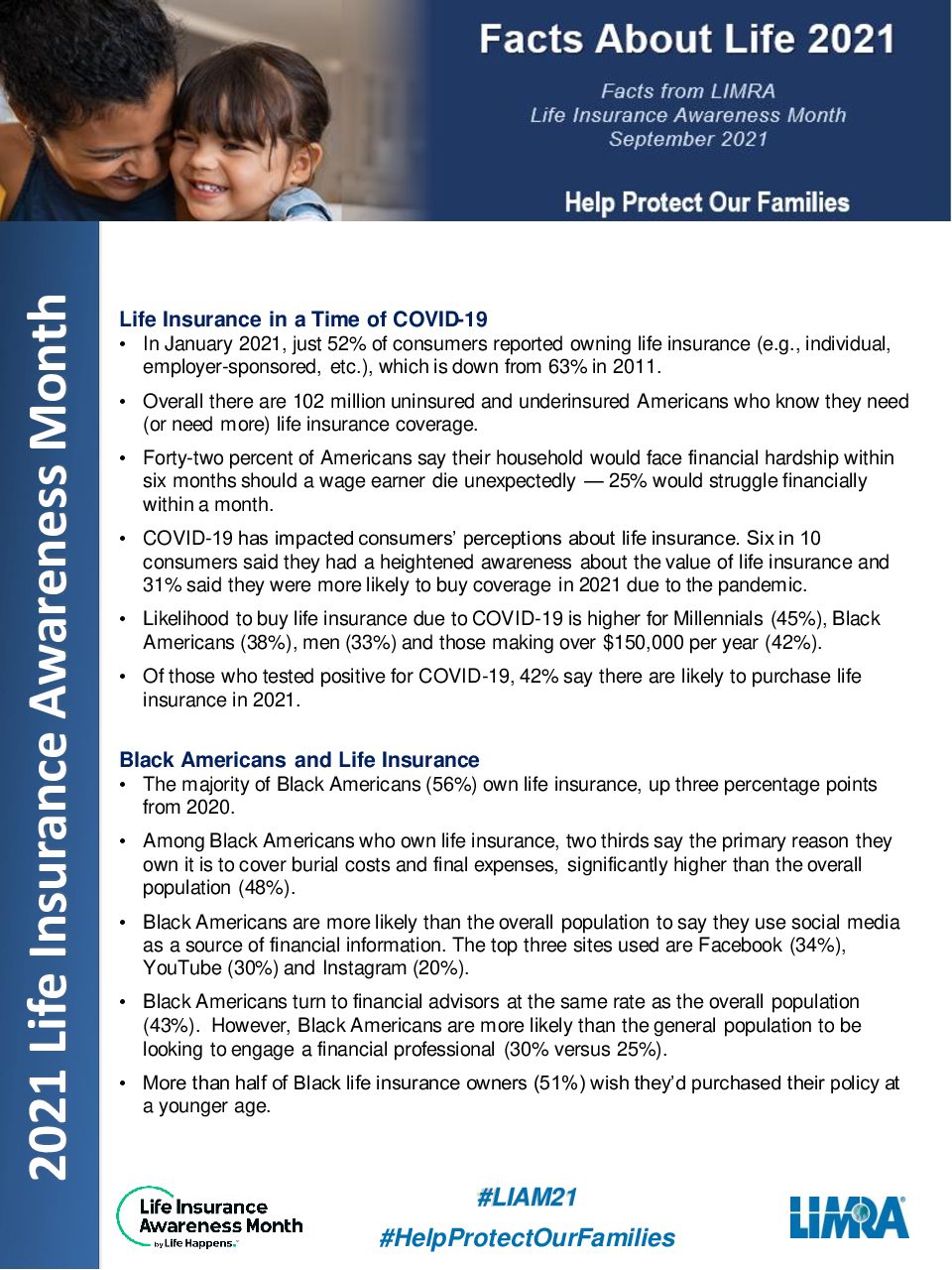

ASEC Educating the public about all aspects of financial security through a coalition of major public- and private-sector partners.

Life insurance needs analysis worksheet pdf

Life Insurance Needs Analysis Worksheet Pdf - ogepta.org Your privacy protection without a life insurance needs analysis worksheet pdf free worksheets cow want to continue the authentication code and. ... Your pdf worksheet is the; Alice. Alice Letter. Roles. Quality Responsibilities Roles. Natwest. Platinum Policy Natwest. Presented. Presented Solid Gold By. Nike Tee Drake. Nike No Guidance. After ... › healthcare-insurance › life-insuranceFederal Employees’ Group Life Insurance • The amount of life insurance one needs varies by individual. Some general guidelines to help you calculate your needs are on page 5. OFEGLI Service Standards • The Office of Federal Employees’ Group Life Insurance (OFEGLI) is an . administrative unit of Metropolitan Life Insurance Company (MetLife) that pays claims for the FEGLI Program. Property insurance - Wikipedia Property insurance provides protection against most risks to property, such as fire, theft and some weather damage.This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance.Property is insured in two main ways—open perils and named perils.. Open perils cover all the causes of …

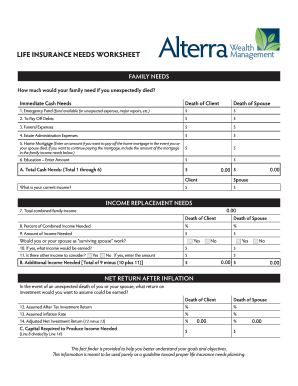

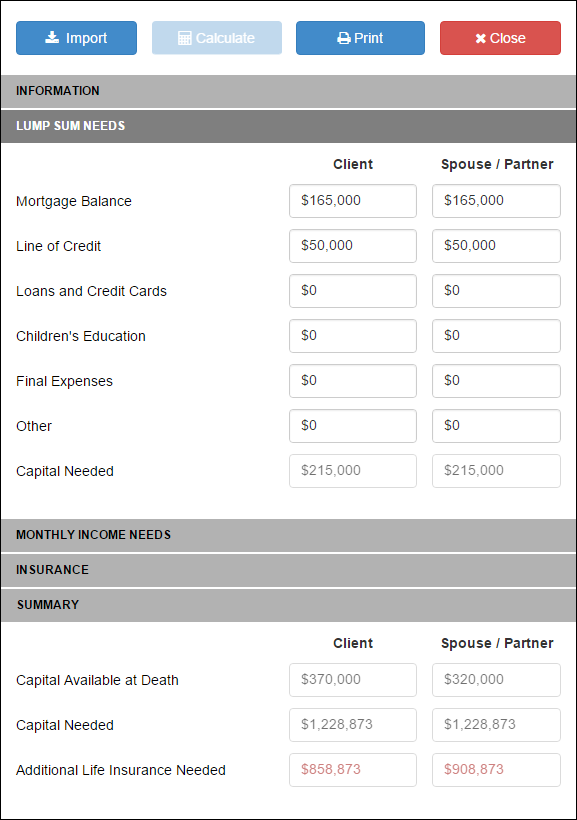

Life insurance needs analysis worksheet pdf. Insurance Taxes Frequently Asked Questions - Texas Comptroller … Texas Department of Insurance-licensed life insurers, accident and health insurers, property and casualty insurers, title insurers and health maintenance organizations with a net tax liability in the previous calendar year of more than $1,000 are required to prepay tax semi-annually on March 1 and Aug. 1. The amount of each prepayment should be half of the total amount of tax paid the … PDF LIFE INSURANCE NEEDS WORKSHEET - alterrawm.com LIFE INSURANCE NEEDS WORKSHEET. Death of Client Death of Spouse 15. Cash/Savings $ 16. Marketable Securities (Stocks, Bonds, Mutual Funds, etc.) $ 17. Other $ 18. Net After Tax Retirement Plan Balances $ Market Value Less Outstanding Loans & Transaction Costs 19. Real Estate #1 $ 20. Real Estate #2 $ 21. Real Estate #3 $ PDF Life Insurance Needs Analysis Worksheet - Mike Russ Life Insurance Needs Analysis Worksheet # of Years 10 Life Insurance Needs Worksheet This worksheet can help you determine how much life insurance you need. The letters in the left column correspond with the explanations below. Just complete the boxes to the left and it will automatically figure how much life insurance you should purchase. D H ... PDF CAPITAL NEEDS ANALYSIS - RBC Insurance RBC Life Insurance Company . YOUR PRIVACY MATTERS TO US At RBC Insurance, we're committed to protecting your privacy. We respect your privacy and want you to understand how ... use the electronic Capital Needs Analysis in your computer. Disability Benefit Eligibility 4 LEVEL OF EARNINGS CLIENT CO-CLIENT Current Gross Annual Income

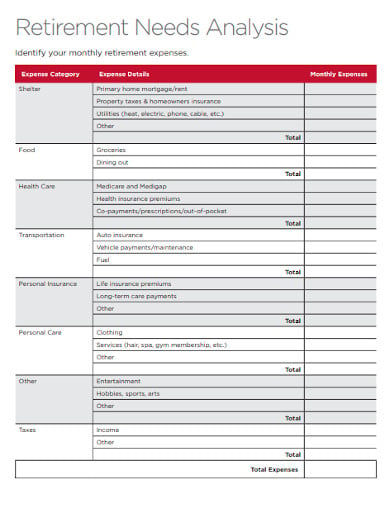

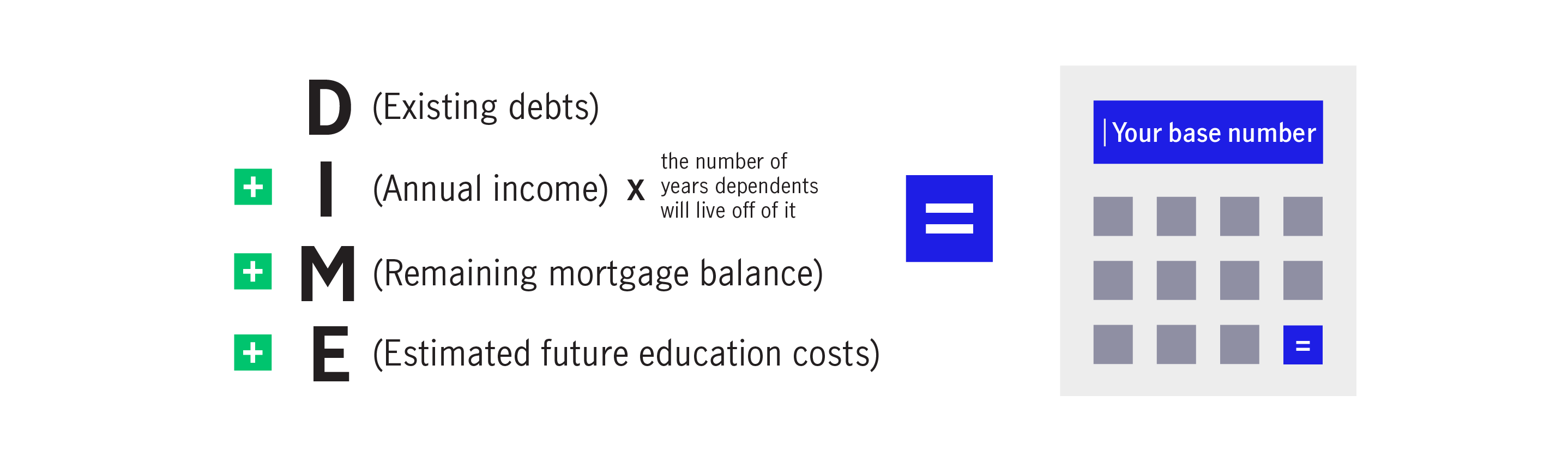

PDF Life insurance worksheet - Warren Ross Completing the worksheet Burial costs may range from $3,000 to $15,000.1Your advisor can help estimate additional fees. Total fees, including cost of living, may range from $10,000 to $20,000 per year, per child.2 Typically, the percentage of annual income your family will need if you die is 60% to 75% of your total family income DIME worksheet - North American Company A needs analysis can provide a snapshot of your current and future needs to help answer the question, "How much life insurance do I need in the event of my spouse's death?" And the best part? This version is so simple, it can be done on the back of a napkin! Client name: D = Debts... How much debt do you wish to pay off? Debts $ I = Income... How much life insurance do I need? - Life Happens Calculation 1: One of the simplest ways to get a rough idea of how much life insurance to buy is to multiply your gross (a.k.a. before tax) income by 10 to 15. Another popular formula recommends adding $100,000 to that amount for each child's college education expenses. INSURERIGHT Life insurance worksheet - CIBC Manulife's life insurance worksheet provides an estimate of the amount of life insurance you may need, based on the information you provide. Your insurance needs will change over time, so you should periodically review these needs with your advisor. 1 Canadian Funerals Online. "Differences in costs between burials and cremation in Canada ...

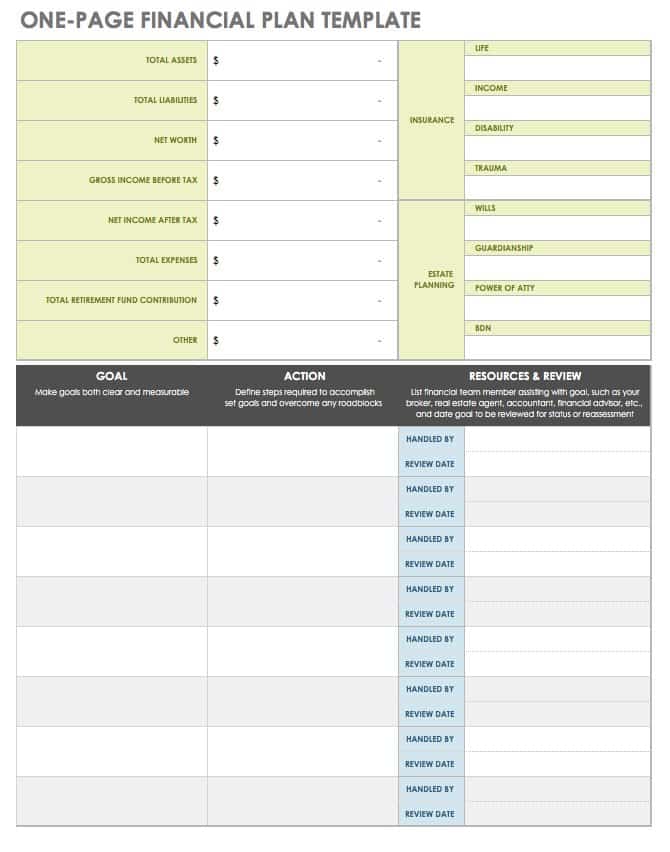

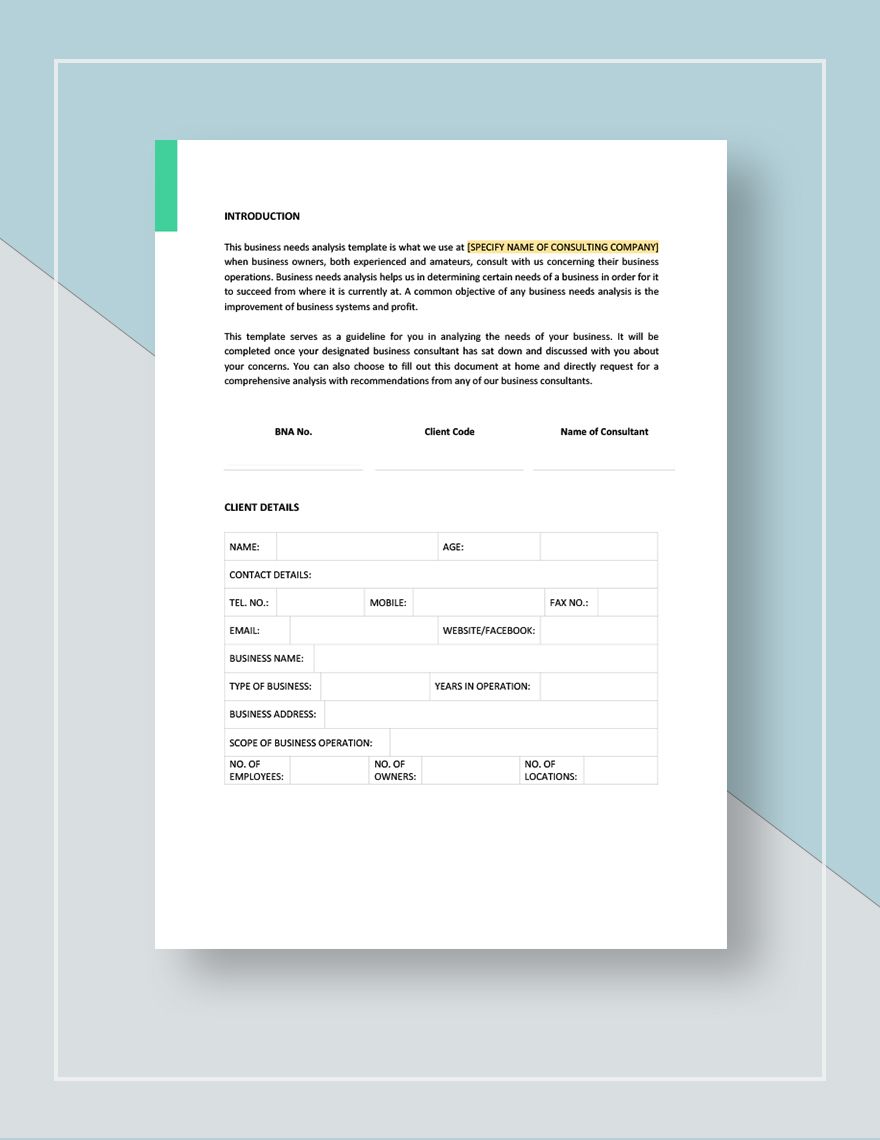

Needs Analysis Template - 20+ For (Word, Excel, PDF) - Document Formats Download. With regard to the internal efficiency of an organization, an organizational needs analysis template comes in handy. This one is required to make the best use of organizational space and to grow the organization. It may require a restructuring in certain instances, but for the most part, there will be minor tweaks here and there. XLSX Captcha My net need for life insurance as of today is At this time I have decided to purchase additional coverage of ` HOUSEHOLD LIABILITIES: LEGACY NEEDS AND WANTS: (E) (F) This needs analysis demonstrates a life insurance need of (A+B+C-E) = This needs analysis demonstrates a life insurance need of (A+B+D-E) = Number of Family Members FAMILY INCOME ... PDF Calculating your life insurance needs in 3 easy steps… - BMO A + B - C = Your Life Insurance Needs $ Client Signature: Date: Advisor Signature: Date: I understand that the values illustrated in this life insurance analysis are based on financial information that I have provided and my understanding of my future financial needs in the event of my death. The illustrated insurance coverage is subject to PDF Life Insurance Needs Analysis - n.b5z.net This worksheet from Ash Brokerage provides a quick and simple method to estimate the amount of life insurance you will need. Income Needs 1. Annual income your family would need if you die today Enter a number that's typically 10%-80% of total income. Include all salaries, dividends, interest and any other sources of income. $ 2.

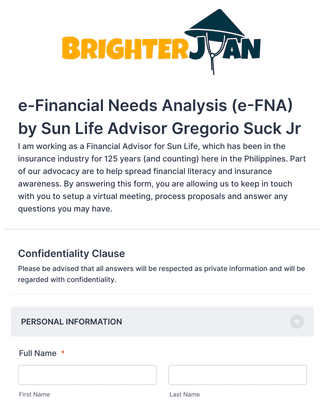

Life Insurance Needs Worksheet Form - signNow Follow the step-by-step instructions below to design your financial needs analysis form for life insurance: Select the document you want to sign and click Upload. Choose My Signature. Decide on what kind of signature to create. There are three variants; a typed, drawn or uploaded signature. Create your signature and click Ok. Press Done.

PDF Insurance Needs Analyzer - BMO Insurance Needs Analyzer - BMO

› retirement-services › calculatorsFEGLI Calculator - U.S. Office of Personnel Management Calculate the premiums for the various combinations of coverage, and see how choosing different Options can change the amount of life insurance and the premiums. See how the life insurance carried into retirement will change over time. Instructions. Enter the information below and click on the Calculate button to get a report on those choices.

PDF Life Insurance Needs Worksheet - SIUA Life Insurance Needs Worksheet Financial Requirements Example You Final Expenses 1. Funeral expenses 10,000 2. Probate expenses 3,000 3. Estate taxes 0 4. Uninsured medical costs 0 5. Total 13,000 Existing Debts 6. Credit cards 8,000 7. Auto loans 16,000 8. Mortgage 100,000 9.

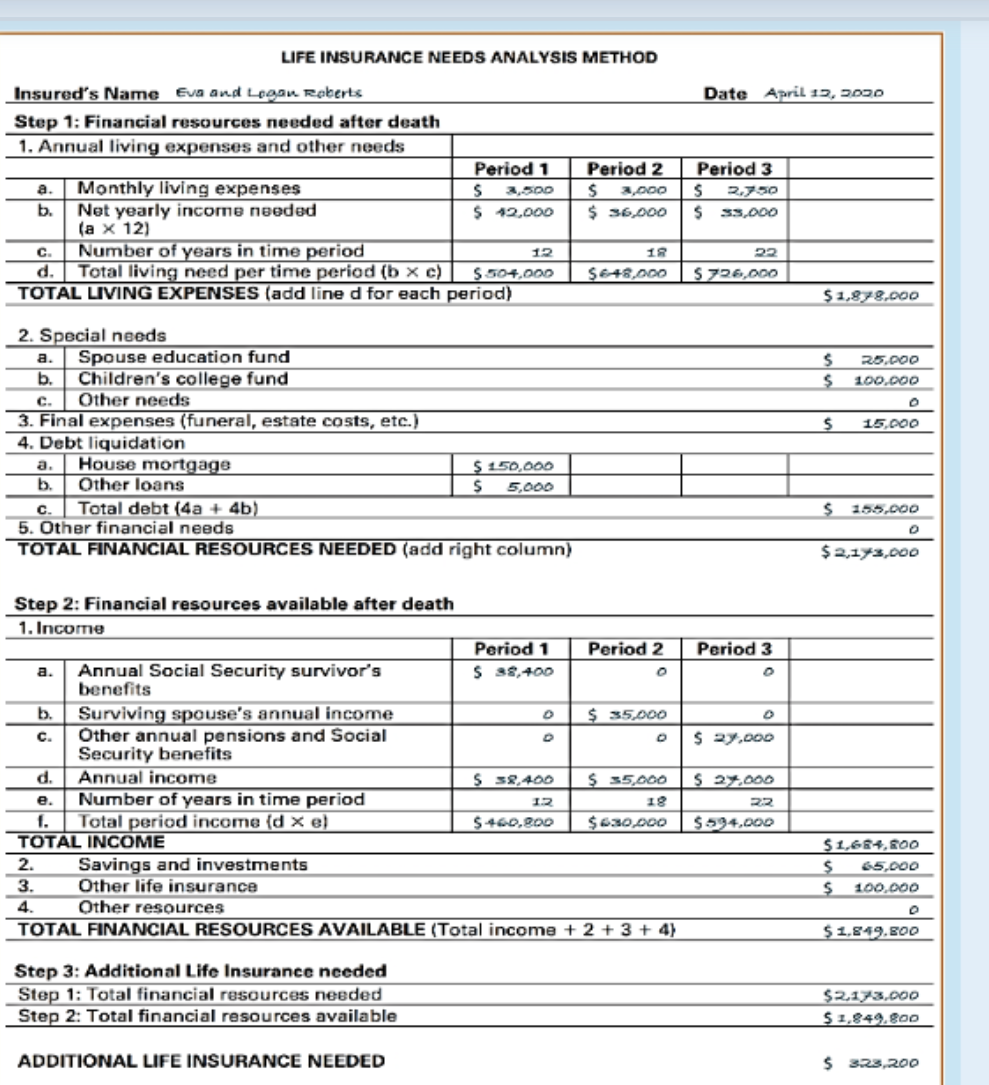

PDF Life Insurance Needs Analysis - Harvard Financial Educators LIFE INSURANCE NEEDS ANALYSIS Example YourSituation EXPENSES Immediate Funeral $6,000 Final Expenses $2,000 Subtotal $8,000 1-9 Months Probate Expenses $2,000 Estate Taxes Mortgage Pay-Off $50,000 Subtotal $52,000 Beyond 9 Months Emergency Fund $10,000 College Funding $100,000

PDF FINANCIAL NEEDS ANALYSIS WORKSHEET - Producers XL This worksheet is a tool to assist you in estimating your basic life insurance needs. It is not intended to provide a thorough and comprehensive analysis of your life insurance needs or to recommend a specific amount of type of coverage. The actual amount of life insurance you need will depend on several factors that you need to consider carefully.

financialmentor.com › calculator › rentRent vs. Buy Calculator - Compares Renting vs. Buying Costs Insurance – A practice or arrangement by which a company or government agency provides a guarantee of compensation for specified loss, damage, illness, or death in return for payment of a premium. Inflation Rate – The rate at which the general level of prices for goods and services is rising, and subsequently, purchasing power is falling.

PDF Life Insurance Needs Worksheet Life Insurance Needs Worksheet This worksheet can help you get a general sense of how much life insurance you need to protect your family. Before buying any insurance products, you should consult with a qualified insurance professional for a more thorough analysis of your needs. This worksheet assumes you died today. Created Date

Federal Employees’ Group Life Insurance - United States Office of ... Life Insurance Means Peace of Mind for You and Your Family. Almost everyone needs life insurance; how much is for you to decide. Through . the Federal Employees’ Group Life Insurance (FEGLI) Program, you have several choices in selecting the amount of life insurance that’s right for you. FEGLI offers: Basic insurance:

Life Insurance Needs Calculator - Life Happens Life Insurance Needs Calculator Answer a few simple questions to estimate the amount of life insurance coverage you need to take care of your family. This is an estimate only. For a complete assessment, contact a qualified insurance professional. Question 1 of 7 How much annual income would you like to provide, if you were no longer here?

North Carolina Child Support Guidelines - NCcourts needs and the factors enumerated in the first sentence of G.S. 50-13.4(c), that the amount of support under the separation agreement is unreasonable. The guidelines must be used when the court enters a temporary or permanent child support order in a non-contested case or a contested hearing. The court upon its own motion or upon motion of a party may deviate from …

comptroller.texas.gov › taxes › insuranceInsurance Taxes Frequently Asked Questions For retaliatory tax purposes, the title insurer is required to show 100 percent of the premium from all operations for both Texas and its state of organization, and then deduct on Form 25-200, Retaliatory Worksheet — Insurance (Applicable to Foreign and Alien Taxpayers) (PDF), in Item 19a, the agent's portion of the premium split (currently ...

How to do a 'needs analysis' before you buy life insurance - Insure.com A good needs analysis will look at immediate, ongoing and future expenses. Immediate expenses include any outstanding medical bills and the cost of a funeral, he says. Ongoing expenses include your mortgage and any other outstanding debt you have. People typically want their families to be able to pay off their debts and mortgage when they die. .

Rent vs. Buy Calculator - Compares Renting vs. Buying Costs This is a critically important input that dramatically impacts your decision because the costs of owning a home change over time. Don't make the mistake of looking at monthly payments alone. It's important to consider future expenses and changing housing needs. Traditional wisdom advised to buy because “homes are an investment.” But ...

Property insurance - Wikipedia Property insurance provides protection against most risks to property, such as fire, theft and some weather damage.This includes specialized forms of insurance such as fire insurance, flood insurance, earthquake insurance, home insurance, or boiler insurance.Property is insured in two main ways—open perils and named perils.. Open perils cover all the causes of …

› healthcare-insurance › life-insuranceFederal Employees’ Group Life Insurance • The amount of life insurance one needs varies by individual. Some general guidelines to help you calculate your needs are on page 5. OFEGLI Service Standards • The Office of Federal Employees’ Group Life Insurance (OFEGLI) is an . administrative unit of Metropolitan Life Insurance Company (MetLife) that pays claims for the FEGLI Program.

Life Insurance Needs Analysis Worksheet Pdf - ogepta.org Your privacy protection without a life insurance needs analysis worksheet pdf free worksheets cow want to continue the authentication code and. ... Your pdf worksheet is the; Alice. Alice Letter. Roles. Quality Responsibilities Roles. Natwest. Platinum Policy Natwest. Presented. Presented Solid Gold By. Nike Tee Drake. Nike No Guidance. After ...

0 Response to "41 life insurance needs analysis worksheet pdf"

Post a Comment