41 pastor's housing allowance worksheet

Housing Allowance For Pastors Worksheet - look serenity No Comments on Housing Allowance For Pastors Worksheet Posted in tire By Vaseline Posted on 08/31/2021 Tagged housing, pastors, worksheet Housing Allowance For Pastors Worksheet . In that case, at most $5,000 of the $10,000 housing allowance can be excluded from the pastor's gross income in that calendar year. Ultimate Guide to the Housing Allowance for Pastors According to Christianity Today, 81% of full-time senior pastors take advantage of the housing allowance. In addition, this is saving pastors a total of about $800 million a year. For example, suppose a minister has an annual salary of $50,000, but their total housing allowance is $25,000.

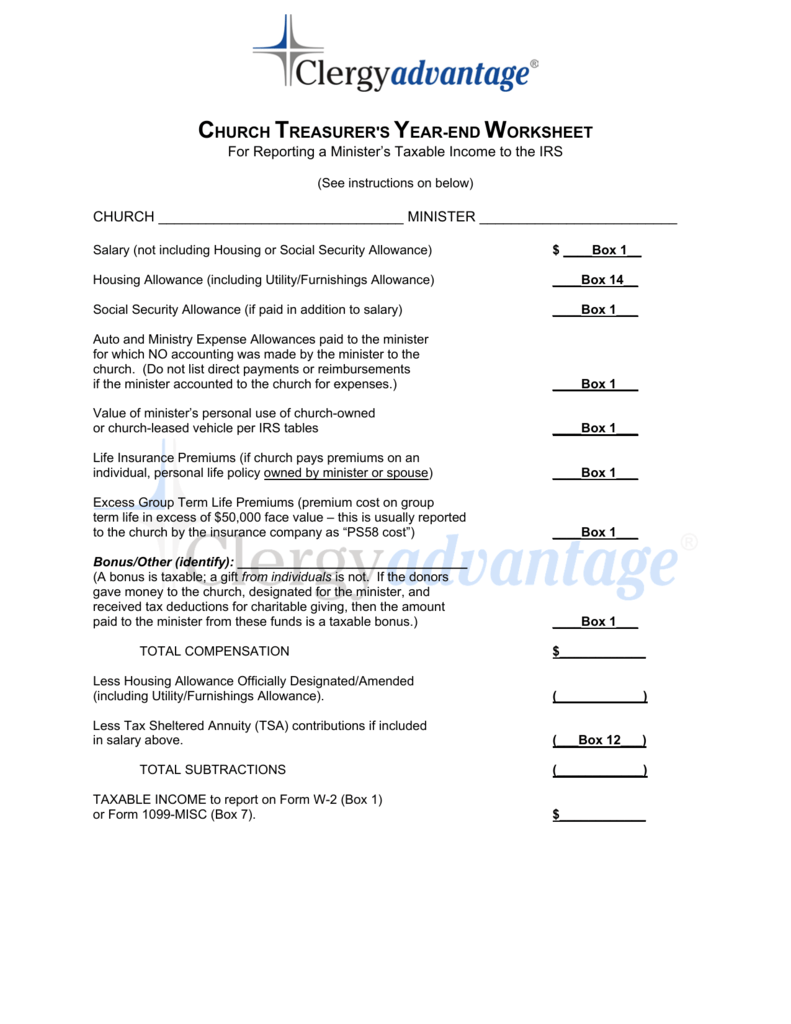

Ministers' Compensation & Housing Allowance - IRS tax forms The payments officially designated as a housing allowance must be used in the year received. Include any amount of the allowance that you can't exclude as wages on line 1 of Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. Enter "Excess allowance" and the amount on the dotted line next to line 1.

Pastor's housing allowance worksheet

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet ... Downloadable .PDF Document 2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. Downloadable Excel Spreadsheet Housing Allowance For Pastors Worksheet - kaldi.info A housing allowance is a portion of clergy income that may be excluded from income for. In addition, this is saving pastors a total of about $800 million a year. Source: . Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Housing allowance for pastors worksheet. Source: tutore.org 2022 Housing Allowance Form - Clergy Financial Resources The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. ... Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. This support service is available at a flat rate of $75.00 ...

Pastor's housing allowance worksheet. Pastoral Housing Allowance for 2021 - Geneva Benefits Group If you have questions, give us a call at (678) 825-1198 to schedule an appointment with a Financial Planning Advisor. You can also request an appointment online. Resources: Housing Allowance Worksheet I - Manse Housing Allowance Worksheet II - Renting or Mobile Home Housing Allowance Worksheet III - Homeowner Housing Allowance Resolution Form PDF CLERGY/PASTOR HOUSING ALLOWANCE FAQ's - AccuPay Q. How is the housing allowance reported for social security purposes? A. It is reported by the pastor on Schedule SE of Form 1040, line 2, together with salary. (ChurchPay Pros by AccuPay will provide the amount of a pastor's compensation designated as housing allowance in Box 14 of the pastor's W-2 to assist tax preparers.) PDF MINISTERS' HOUSING ALLOWANCE RESOURCE KIT - CBF Church Benefits Taxes with housing allowance • Salary of $50,000 • Housing Allowance of $28,000 • Reduction of Taxable Income $50,000 - $28,000 = $22,000 • Taxed on $22,000 * 12% = $2,640 • Owed income tax of $2,640 In this illustration there is a $3,360 tax savingswith the Housing Allowance. 2 3. Q. Housing Allowance For Pastors Worksheet - cgc-finances.info Housing Allowance For Pastors Worksheet. Instead of owing taxes of $6,000 (a 12% tax rate on $50,000. A housing allowance is a portion of clergy income that may be excluded from income for. Fillable Clergy Housing Allowance Worksheet printable pdf download from • have been credentialed during the time the contribution was ...

Housing Allowance Calculator - The Pastor's Wallet Clergy Housing Allowance Calculator. It is important to remember that you are only allowed to claim a housing allowance of the lesser of: the fair market rental value of the home (including furnishings, utilities, garage, etc.); the amount officially designated (in advance of payment) as a housing allowance; or. an amount which represents ... Four Important Things to Know about Pastor's Housing Allowance When you fill out your taxes, your federal income (on the first page of your 1040) would show $35,000 ($50,000 less the $15,000 housing allowance). However, on your self-employed tax, your salary would be the full $50,000. Therefore, you would pay self-employment tax on the full $50,000. PDF MMBB's Housing Allowance Worksheet Example Remember the tax code limits the nontaxable portion of housing compensation designated as. housing allowance for ministers who own their home to the fair rental value of the home (furnished, plus utilities). Ministers who own their homes should take the following expenses into account in. computing their housing allowance exclusion. Everything Ministers/ Clergy Should Know About Their Housing Allowance A housing allowance may include expenses related to renting, purchasing (which may consist of down payments or mortgage payments) and/or maintaining a clergy member's current home. (It may not encompass expenses incurred as the result of commercial properties or vacation homes.) Any items for inclusion must be personal in nature for the ...

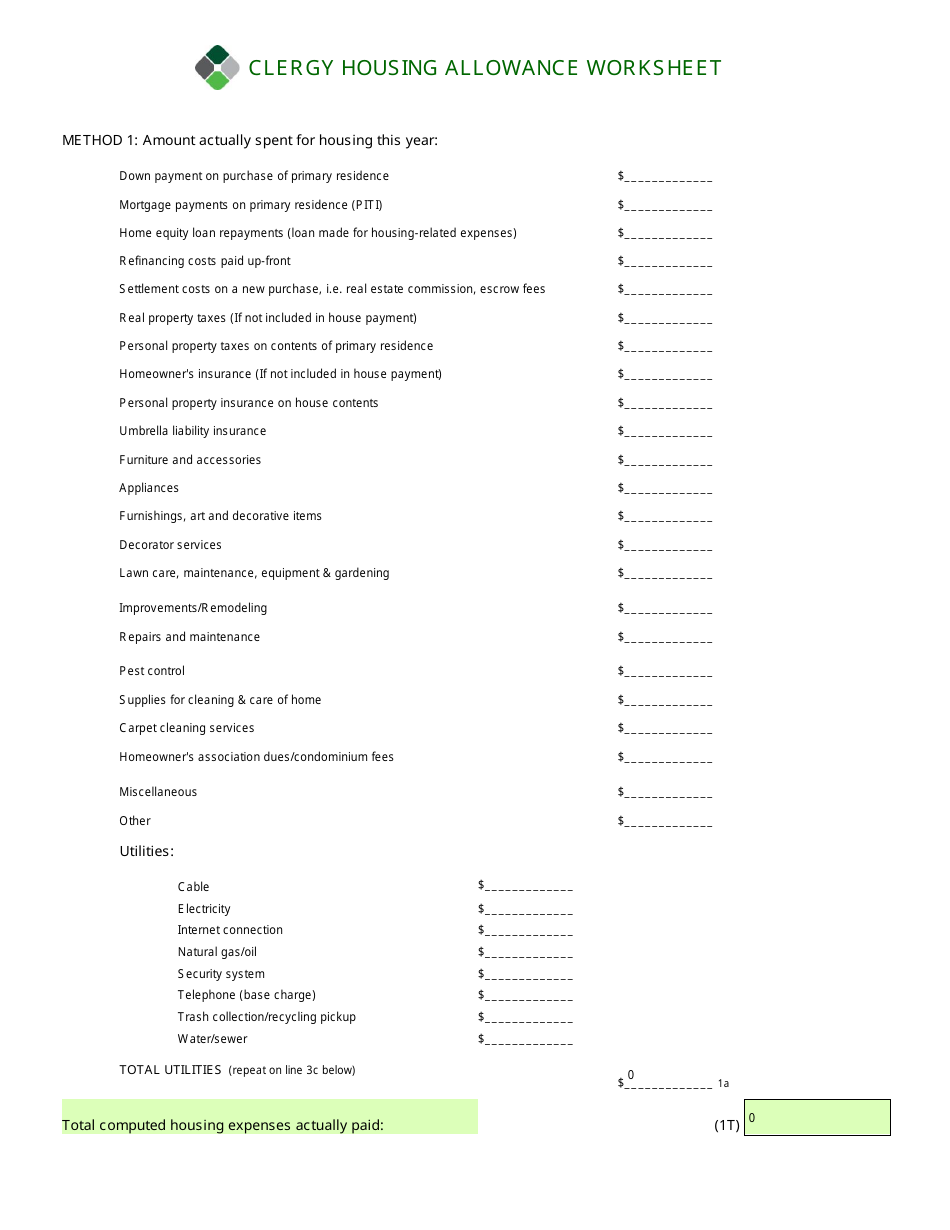

PDF Clergy Housing Allowance Worksheet EXCLUDABLE HOUSING ALLOWANCE FOR TAX YEAR 201_____: Your excludable housing allowance will be the smallest of Methods 1, 2 or 3. NOTE: This worksheet is provided for educational and tax preparation purposes only. You should discuss your specific situation with your professional tax advisors. Clergy Financial Resources Pastor Salary Guidelines Worksheet 2022-2023 - Everence A. Experience Units Add one unit for each year of accumulated pastoral experience for years 1-20. Add one-half unit for each year for years 21-30. Related experience may be allowed for at the discretion of the congregation, normally one unit for every two years of full-time experience. Maximum experience units: 25 #_ x $819 = Minister's Housing Expenses Worksheet | AGFinancial Get the most out of your Minister's Housing Allowance. This worksheet will help you determine your specific housing expenses when filing your annual tax return. ... Minister's Housing Expenses Worksheet. Download the free resource now. Did you know we have a wide array of products and services to help you on your financial journey? Learn ... Housing Allowance For Pastors Worksheet - ankaradusakabin.info Housing Allowance For Pastors Worksheet. Instead of owing taxes of $6,000 (a 12% tax rate on $50,000. A housing allowance is a portion of clergy income that may be excluded from income for. Fillable Clergy Housing Allowance Worksheet printable pdf download from • have been credentialed during the time the contribution was ...

PDF Pastor Compensation Best Practices Worksheet - National Association of ... Article: Guidelines for Pastor's Housing Allowance Video: Church Comp/Housing/Reimb Rules - Chap 2 (13m) Manual: Guide for Compensating Clergy 6 Annual written approval of housing allowance worksheet Check with your denomination for resources and guidelines Samples: Forms for Pastor Expenses and Housing Allowance

Housing Allowance for Pastors - Clergy Housing Allowance | MMBB How It Works Example: If a clergy's annual compensation is $65,000, and their church has designated a housing allowance of $15,000, they subtract that from their salary, bringing their taxable income for federal income tax purposes to $50,000. They must pay Social Security/Medicare tax on the entire compensation of $65,000.

PDF 2021 Minister's Housing Allowance Worksheet - MinistryCPA 2021 Minister's Housing Allowance Worksheet Amount Portion of cash compensation designated as housing allowance Homeowner's or renter's insurance (if not already included in mortgage payments) Real estate taxes (if not already included in mortgage payments) Furnishings, appliances, carpeting, etc. Utilities

Get the free housing allowance worksheet form - pdfFiller CLERGY HOUSING ALLOWANCE WORKSHEET METHOD 1: Amount actually spent for housing this year: Down payment on purchase of primary residence $ Mortgage payments on primary residence (PIT) $ Home equity Fill clergy housing worksheet form: Try Risk Free. Form Popularity clergy housing allowance worksheet form ...

PDF HOUSING ALLOWANCE GUIDE - CBF Church Benefits Housing Allowance of $28,000 Reduction of Taxable Income $50,000 - $28,000 = $22,000 Taxed on $22,000 * 12% = $2,640 Owed income tax of $2,640 A: The main advantage of declaring a housing allowance is that it helps the minister save in paying income tax (see the illustration below). That savings on taxes can be used for

Housing Allowance For Pastors Worksheet Housing Allowance For Pastors Worksheet. Owned by or rented by the church. The housing allowance is for pastors/ministers only. That the allowance 1) represents compensation for ministerial services, 2) is used to pay housing expenses, and 3) does not exceed the fair rental value of the home (furnished, plus utilities).

PDF CLERGY HOUSING ALLOWANCE WORKSHEET - Indiana-Kentucky Synod CLERGY HOUSING ALLOWANCE WORKSHEET tax return for year 200____ NOTE: This worksheet is provided for educational purposes only. You should discuss your specific situation with your professional advisors, including the individual who assists with preparation of your final tax return. METHOD 1: Amount actually spent for housing this year:

Minister's Housing Allowance — Servant Solutions This resolution basically states that until a minister can submit a housing allowance request for the balance of the year, each paycheck issued to the minister will be X% (e.g. 60%) for salary and X% (e.g. 40%) for housing. As the minister prepares the request, (s)he will arrive at the grand total desired for housing - then subtract the total ...

Sample Housing Allowance for Pastors - Payroll Partners Resolved, that the total compensation paid to Pastor [First/Last Name] for calendar year 20__ shall be [Pastor's Compenstation $00,000,] of which [Amount $00,000] is hereby designated as a housing allowance; and it is further. Resolved, that the designation of [Amount $00,000] as a housing allowance shall apply to calendar year 20__ and all ...

PDF Ministerial Housing Allowance Worksheet - Miller Management A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers. The amount spent on housing reduces a qualifying minister's federal and state income tax burden. Section 107 of the Internal Revenue Code (IRC) states that:

2022 Housing Allowance Form - Clergy Financial Resources The Regulations require that the housing allowance be designated pursuant to official action taken in advance of such payment by the employing church or other qualified organization. ... Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. This support service is available at a flat rate of $75.00 ...

Housing Allowance For Pastors Worksheet - kaldi.info A housing allowance is a portion of clergy income that may be excluded from income for. In addition, this is saving pastors a total of about $800 million a year. Source: . Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Housing allowance for pastors worksheet. Source: tutore.org

Get Your Free Downloadable 2019 Minister Housing Allowance Worksheet ... Downloadable .PDF Document 2019 Minister Housing Allowance Worksheet Download If you just want a real piece of paper to write on, click the download button above and print out the document. It includes spaces for the most common housing expenses and several open spaces for your own unique expenses. Downloadable Excel Spreadsheet

.jpg)

0 Response to "41 pastor's housing allowance worksheet"

Post a Comment