40 chapter 6 business ownership and operations worksheet answers

Publication 537 (2021), Installment Sales | Internal Revenue Service You included the full gain in income in the year of sale, so the loss is a bad debt. How you deduct the bad debt depends on whether you sold business or nonbusiness property in the original sale. See chapter 4 of Pub. 550 for information on nonbusiness bad debts and chapter 10 of Pub. 535 for information on business bad debts. State of Oregon: Businesses - Corporate Activity Tax FAQ Groups of persons that meet the common ownership requirements or constructively own stock or other ownership interest with the ability to control or determine the management of the entity, as described in OAR 150-317-1020(10), must also analyze the unitary business factors of functional integration, economies of scale, or centralized management ...

Lifestyle | Daily Life | News | The Sydney Morning Herald The latest Lifestyle | Daily Life news, tips, opinion and advice from The Sydney Morning Herald covering life and relationships, beauty, fashion, health & wellbeing

Chapter 6 business ownership and operations worksheet answers

Course Help Online - Have your academic paper written by a … Whether to reference us in your work or not is a personal decision. If it is an academic paper, you have to ensure it is permitted by your institution. We do not ask clients to reference us in the papers we write for them. When we write papers for you, we transfer all the ownership to you. Publication 519 (2021), U.S. Tax Guide for Aliens | Internal … The information in this publication is not as comprehensive for resident aliens as it is for nonresident aliens. Resident aliens are generally treated the same as U.S. citizens and can find more information in other IRS publications at IRS.gov/Forms.. Table A provides a list of questions and the chapter or chapters in this publication where you will find the related discussion. Publication 550 (2021), Investment Income and Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

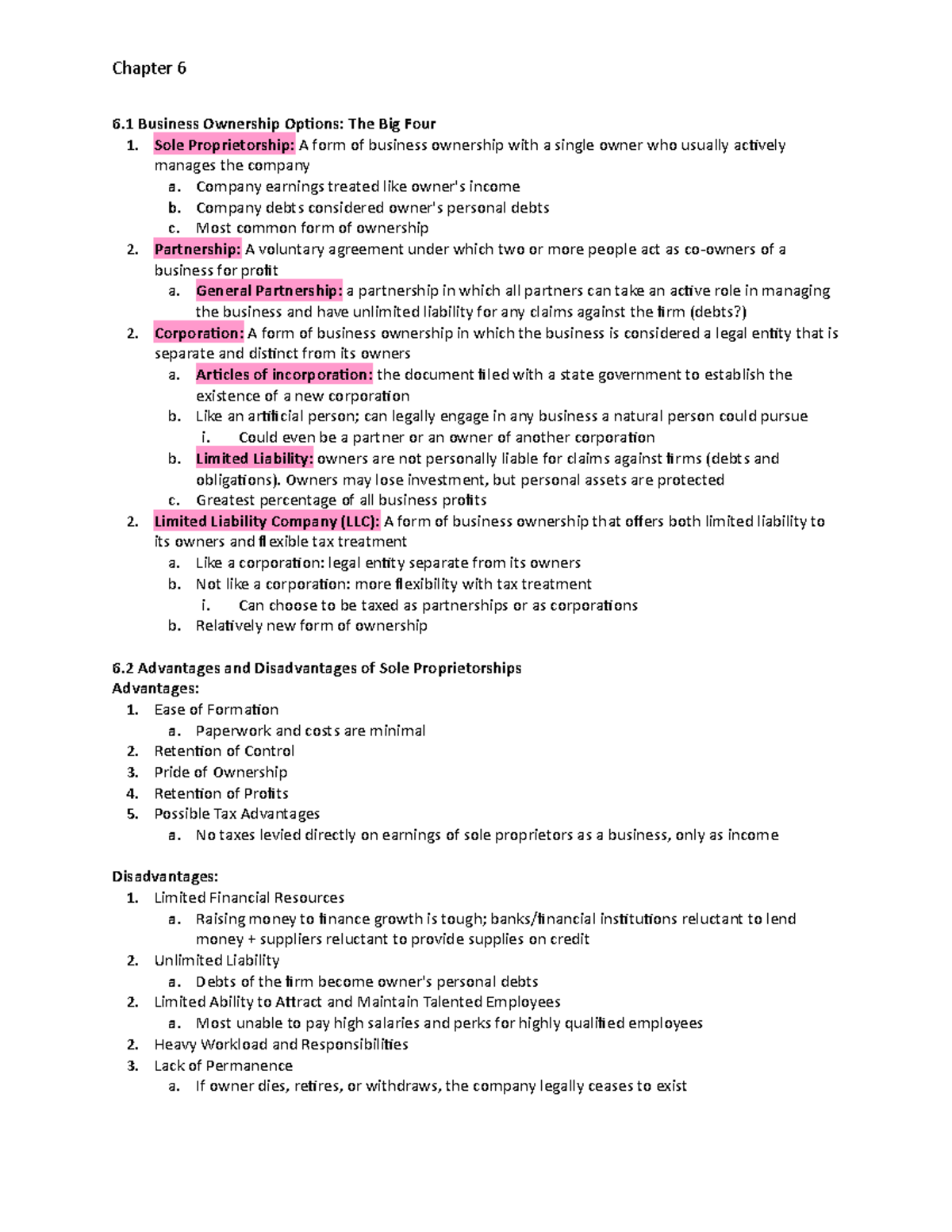

Chapter 6 business ownership and operations worksheet answers. Incorporation (business) - Wikipedia Ownership in a Corp. or LLC is easily transferable to others, either in whole or in part. Some state laws are particularly corporate-friendly. For example, the transfer of ownership in a corporation incorporated in US-DE is not required to be filed or recorded. [citation needed] Legal history of incorporation in the United States Publication 590-A (2021), Contributions to Individual Retirement ... 6. 6,000: 7. IRA deduction. Compare lines 4, 5, and 6. Enter the smallest amount (or a smaller amount if you choose) here and on your Schedule 1 (Form 1040), line 20. If line 6 is more than line 7 and you want to make a nondeductible contribution, go to line 8: 7. 5,850: 8. Nondeductible contribution. Subtract line 7 from line 5 or 6, whichever ... Publication 523 (2021), Selling Your Home | Internal Revenue Service Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 560 (2021), Retirement Plans for Small Business Getting answers to your tax questions. ... Business. A business is an activity in which a profit motive is present and economic activity is involved. ... Then, figure your maximum deduction by using the Deduction Worksheet for Self-Employed in chapter 5. Where To Deduct Contributions. Deduct the contributions you make for your common-law ...

Publication 550 (2021), Investment Income and Expenses Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Publication 519 (2021), U.S. Tax Guide for Aliens | Internal … The information in this publication is not as comprehensive for resident aliens as it is for nonresident aliens. Resident aliens are generally treated the same as U.S. citizens and can find more information in other IRS publications at IRS.gov/Forms.. Table A provides a list of questions and the chapter or chapters in this publication where you will find the related discussion. Course Help Online - Have your academic paper written by a … Whether to reference us in your work or not is a personal decision. If it is an academic paper, you have to ensure it is permitted by your institution. We do not ask clients to reference us in the papers we write for them. When we write papers for you, we transfer all the ownership to you.

0 Response to "40 chapter 6 business ownership and operations worksheet answers"

Post a Comment