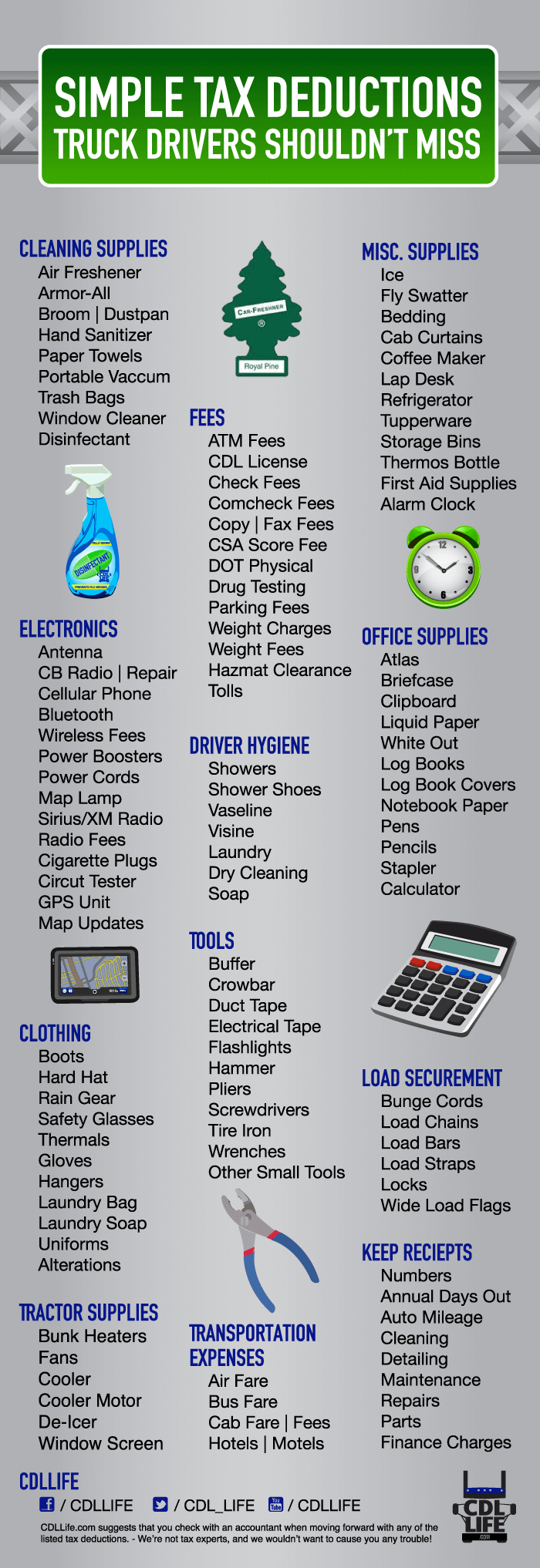

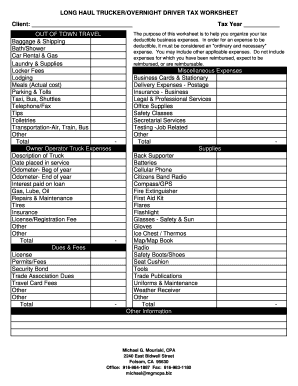

41 trucker tax deduction worksheet

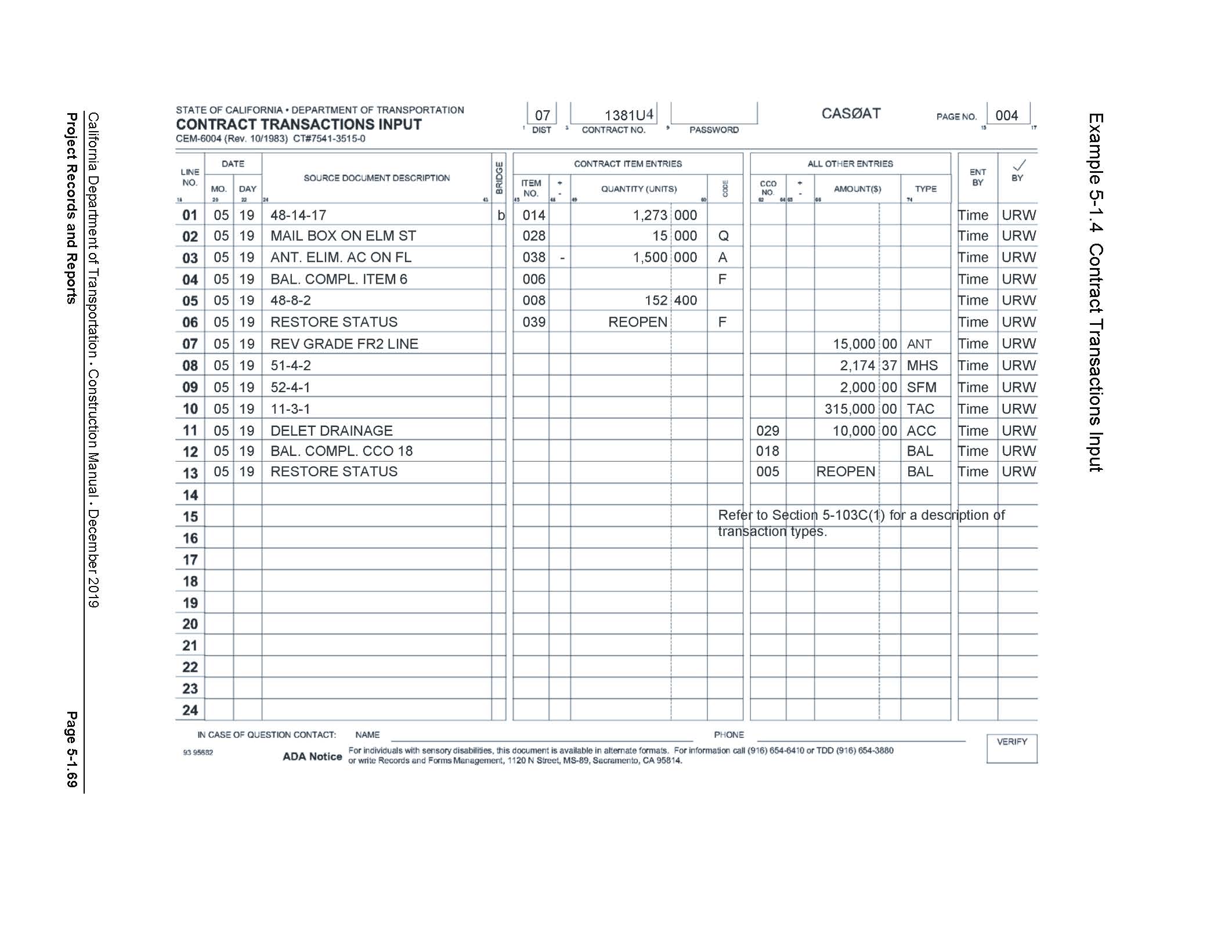

› pub › irs-pdfFrom Business Profit or Loss - IRS tax forms Heavy highway vehicle use tax. If you use certain highway trucks, truck-trail-ers, tractor-trailers, or buses in your trade or business, you may have to pay a federal highway motor vehicle use tax. See the Instructions for Form 2290 to find out if you must pay this tax and vis-it IRS.gov/Trucker for the most recent developments. Information ... › createJoin LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

› instructions › i2290Instructions for Form 2290 (07/2022) | Internal Revenue Service Jun 30, 2011 · Figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Figure and pay the tax due on a vehicle for which you completed the suspension statement on another Form 2290 if that vehicle later exceeded the mileage use limit during the period.

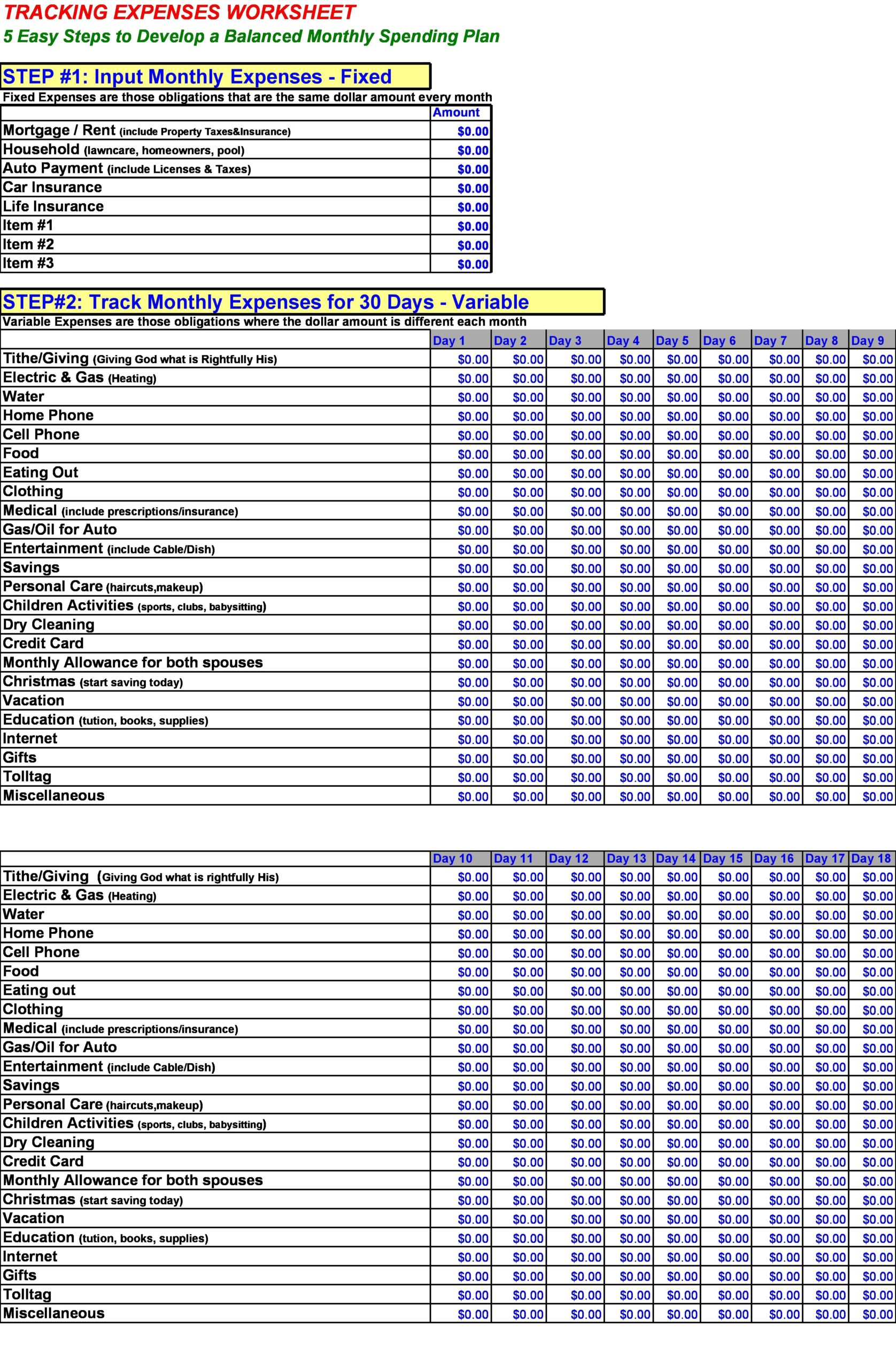

Trucker tax deduction worksheet

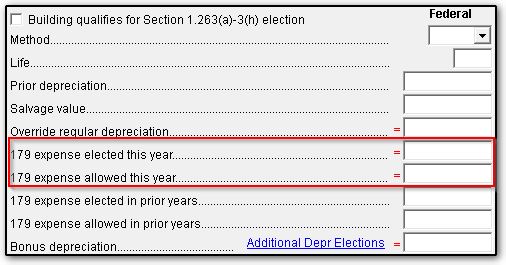

› instructions › i1040sc2021 Instructions for Schedule C (2021) | Internal Revenue ... Depreciation and section 179 expense deduction. Depreciation is the annual deduction allowed to recover the cost or other basis of business or investment property having a useful life substantially beyond the tax year. You can also depreciate improvements made to leased business property. › 33978482 › Business_ResearchBusiness Research Method - Zikmund 8th edition.pdf - Academia.edu Enter the email address you signed up with and we'll email you a reset link. bjc.edc.org › bjc-r › progEducation Development Center data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ...

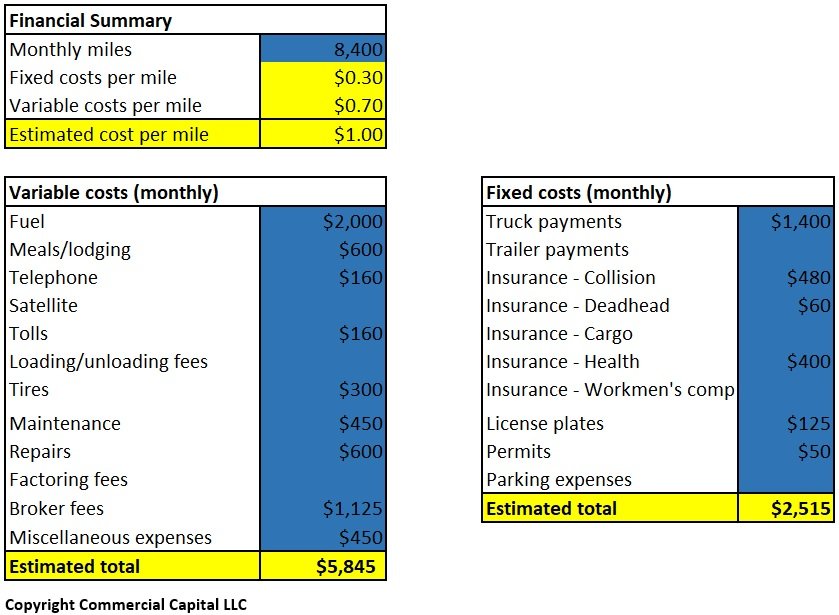

Trucker tax deduction worksheet. xyuib.spacelighting.shop › owner-operator-takeOwner operator take home pay 2021 - Delicatessen "Danuta Feb 15, 2022 · Fleet per diem savings per driver 2021 & 2022: $3,064; Owner Operator: An independent owner operator operating one-truck with an effective Federal tax rate of 18% claiming trucker per diem and averaging 280 nights away from home per year will save with the full deduction for per dieman additional $665 per year in 2021 and 2022. bjc.edc.org › bjc-r › progEducation Development Center data:image/png;base64,iVBORw0KGgoAAAANSUhEUgAAAKAAAAB4CAYAAAB1ovlvAAAAAXNSR0IArs4c6QAAArNJREFUeF7t1zFqKlEAhtEbTe8CXJO1YBFtXEd2lE24G+1FBZmH6VIkxSv8QM5UFgM ... › 33978482 › Business_ResearchBusiness Research Method - Zikmund 8th edition.pdf - Academia.edu Enter the email address you signed up with and we'll email you a reset link. › instructions › i1040sc2021 Instructions for Schedule C (2021) | Internal Revenue ... Depreciation and section 179 expense deduction. Depreciation is the annual deduction allowed to recover the cost or other basis of business or investment property having a useful life substantially beyond the tax year. You can also depreciate improvements made to leased business property.

![Independent Contractor Expenses Spreadsheet [Free Template]](https://assets-global.website-files.com/5cdcb07b95678db167f2bd86/623904ff7e759b4bc31836a2_all-business-expenses-tab.png)

0 Response to "41 trucker tax deduction worksheet"

Post a Comment