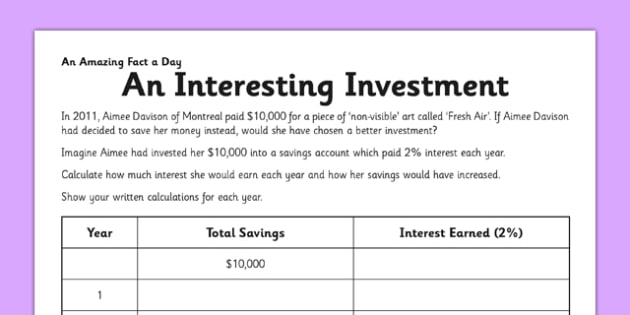

44 saving and investing worksheet

Saving Money | goals, strategies, saving for retirement | Fidelity Planning for the future: Automatic deposits and transfers can help you stay disciplined.; Creating your investment strategy: Investing may help you reach your goals faster.; Saving for retirement: Save as much as you can through 401(k)s, IRAs, and other retirement accounts.; Diversifying your investments: Spreading your investments across multiple asset classes can help boost … Free Simple Savings Calculator | InvestingAnswers Investing, such as in a brokerage account or retirement account, should not be seen as savings. Investing often means putting your money in the kinds of higher risk/higher reward assets -- such as stocks -- that can fall in value and require a commitment of many years. Savings, by contrast, is held in safekeeping for immediate or near-term use.

› articles › personal-financeCharitable Contributions: Tax Breaks and Limits - Investopedia Jul 30, 2022 · Charitable contributions are one of the best tax-saving opportunities available. Not only does the charity benefit, but taxpayers enjoy tax savings by deducting part or all of their contributions ...

Saving and investing worksheet

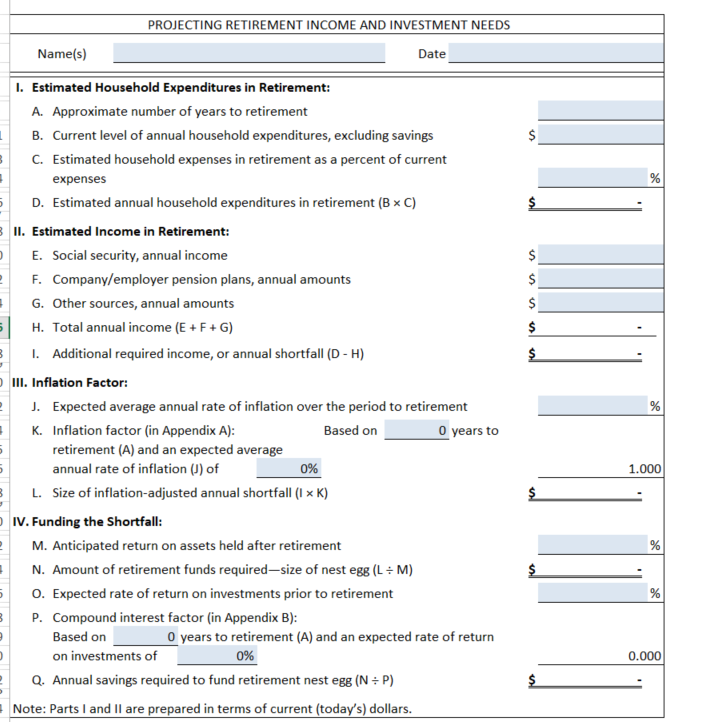

Retirement Income Planning & Overview | USAA Your assets and investment income could be vulnerable to inflation and market volatility over time. Products like annuities could help ensure you don't outlive your savings. ... Use our worksheet to understand your ideal life in retirement, risks and questions you should ask your specialist. This will help you prepare for a productive ... IRS Form 5695 For 2022, 2023 - Energy Tax Credit Instructions Here's how to fill out form 5695 using TurboTax: To enter your Residential Energy Credits (Form 5695) into TurboTax Online: Login to TurboTax Online. Click My Account (top right of your screen). Click Tools. In the pop-up window, click Topic Search. In the search bar, type 5695. Saving vs. Investing: Which Route Should You Take? Relative to investing, saving offers three advantages: Pro: Cash doesn't change in value. Your savings account balance doesn't fluctuate in response to external factors. The stock market could ...

Saving and investing worksheet. › learn › topicRetirement | Charles Schwab Investing involves risks, including loss of principal. Hedging and protective strategies generally involve additional costs and do not assure a profit or guarantee against loss. With long options, investors may lose 100% of funds invested. › free-budget-spreadsheetThe Best Budget Spreadsheets - The Balance Jan 30, 2022 · As you become more familiar with spreadsheet use, you will be able to generate graphics that can show you your habits for spending, saving, or earning. While offering you control over your finances, spreadsheets make personal finance planning, tracking, and viewing much simpler than it was in the past. Frequently Asked Questions (FAQs) Money Under 30 | Advice On Credit Cards, Investing, Student Loans ... There are plenty of investing apps that offer many of the same features and benefits as Robinhood. Here are the top 10 Robinhood alternatives. Gift tax rules allow tax-free gifts up to $16,000. If you pass this threshold, the lifetime exclusion may still shield you from paying taxes. Best High-Yield Savings Accounts - NextAdvisor with TIME FNBO Direct Online Savings Account. FNBO Direct's high yield savings account offers a 1.90% APY. You'll need at least $1 minimum deposit to open the account, and maintain at least $0.01 in ...

Download Ebook Ft Guide To Saving And Investing For Retirement The ... The Financial Times Guide to Saving and Investing for Retirement will lead you through a bewilder-ing maze of financial tools and provide advice on crucial investment decisions. It provides every-thing you need to know about how to save and invest so that you can successfully plan for your re-tirement. How to Get your Savings Results. › pdf › quizansrAnswers - SEC Facts on Saving and Investing Campaign 1. If you buy a company™s stock, A. you own a part of the company. 2. If you buy a company™s bond, B. you have lent money to the company. 3. Over the past 70 years, the type of investment that has earned the most money, or the highest rate of return, for investors has been A. stocks. Monthly Bill Organizer and Tracker Worksheet - Better Money … Investing. How to invest, build wealth and save for retirement. ... Saving & Budgeting . Organizing your bills. Share. Close share. Save. Close save Added to My Priorities. Print. Use this worksheet to track when your bills are due and when you plan to pay them each month. And remember: You can often work with billers to change your due dates ... Series I Savings Bonds | The Motley Fool Savings bonds are long-term loans that you can make to the federal government. You buy savings bonds, and the government will pay you a certain rate of interest over the term of the bond. When the ...

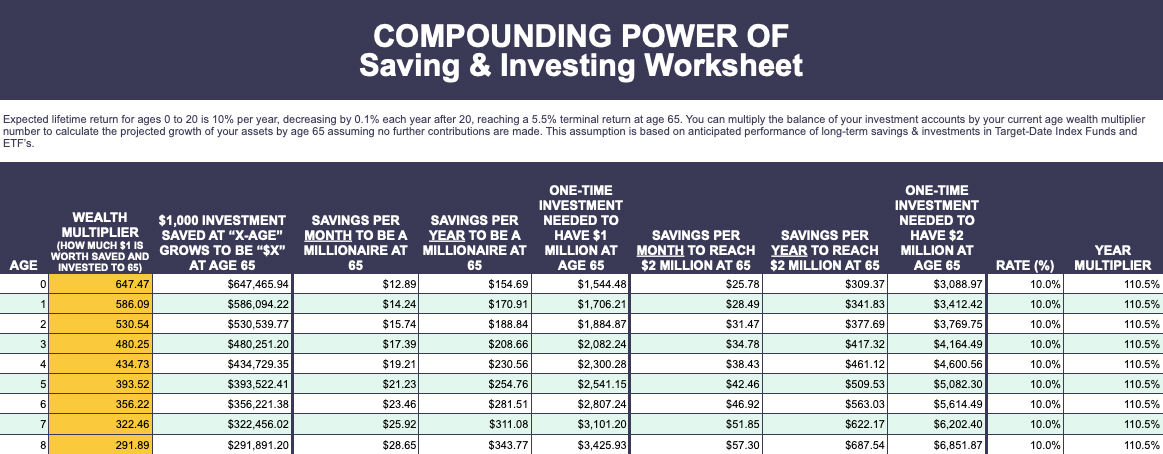

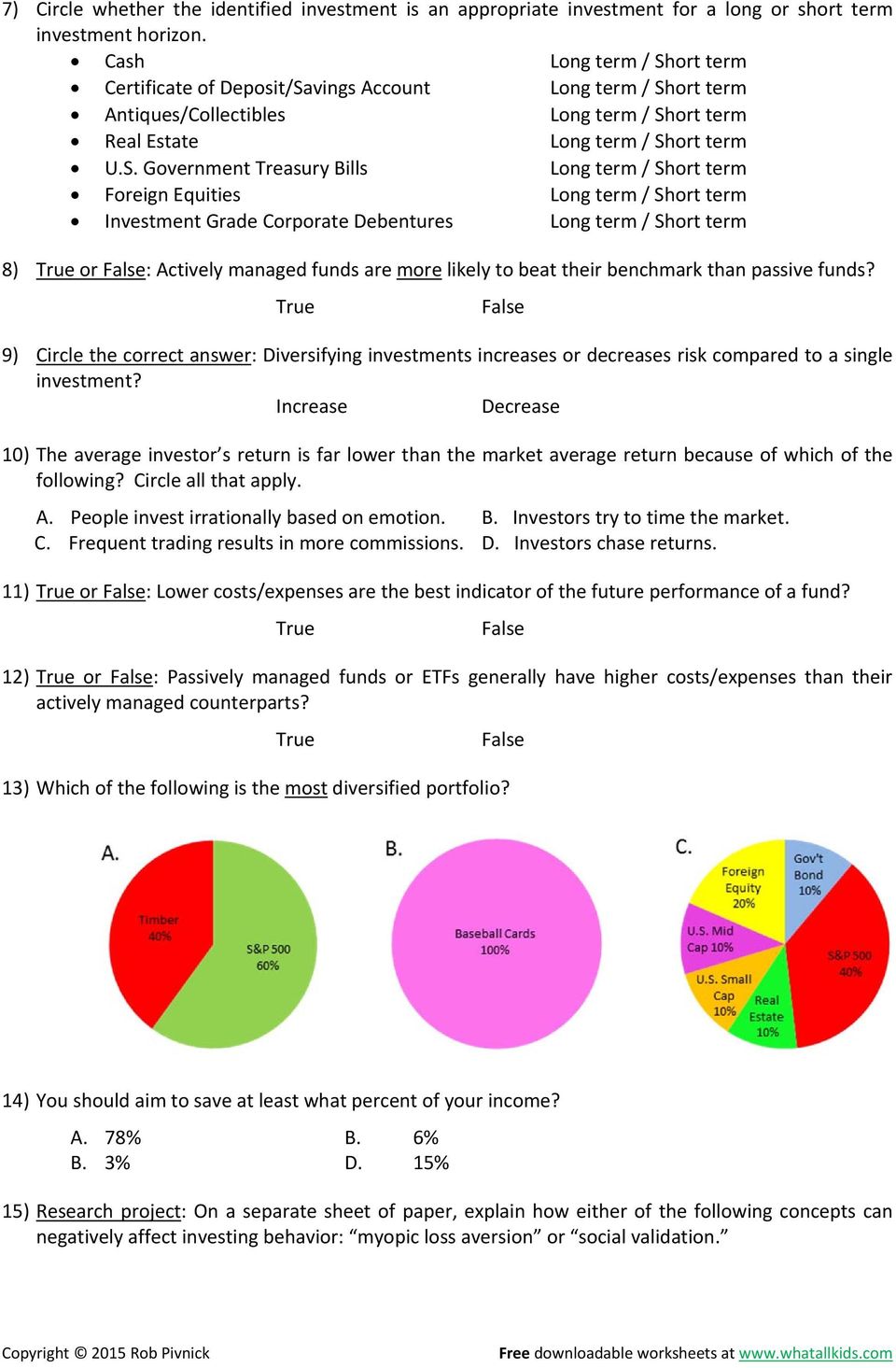

Personal Investment Plans | Fifth Third Bank Investment products to meet your needs. Different goals call for different financial strategies. That's why we offer a wide range of investment products and services, including: IRAs - Start with as little as $500. Stocks and bonds. Mutual funds. Which of the following ways of investing/saving is the most liquid ... Weegy: Comparing products according to price per ounce is an example Unit pricing.User: It's advisable to start saving and investing as early as possible in order to Question 12 options: A) allow for more spending later. B) take advantage of low interest rates. C) take advantage of compound interest. D) avoid paying taxes. Weegy: It's advisable to start saving and investing as early as ... Answers - SEC Facts on Saving and Investing Campaign 1. If you buy a company™s stock, A. you own a part of the company. 2. If you buy a company™s bond, B. you have lent money to the company. 3. Over the past 70 years, the type of investment that has earned the most money, or the highest rate of return, for investors has been A. stocks. ACS financial readiness webinar: Saving and Investing Mr. Leary Henry, from Army Community Services (ACS) will host "Saving and Investing," identify reasons to save and how to set goals for a saving plan. Participants will explore the difference between short term savings and long term investments. This virtual event can be accessed on A356 Teams utilizing the following link:

Sustainable investing and 401(k)s: What are my options? 3. Faith-Based Options. As we've seen, funds can be sustainable when attached to goals set by reputable organizations or when backed by data on how companies turn a profit in relation to fossil fuel consumption. Another structured approach aligns with faith-based criteria.

SEC Saving and Investing of saving and investing by following this advice: always pay yourself or your family first. Many people find it easier to pay themselves first if they allow their bank to automatically re-move money from their paycheck and deposit it into a savings or investment account. Likely even better, for tax purposes, is to participate in an

Planning to Retire in 2022: A Complete Guide | The Motley Fool If you determine that you'll need $60,000 annually in retirement and you expect $25,000 from Social Security and $15,000 from annuities, that leaves $20,000 in needed income. You can invert and ...

eupolcopps.euThe EU Mission for the Support of Palestinian Police and Rule ... Aug 31, 2022 · EUPOL COPPS (the EU Coordinating Office for Palestinian Police Support), mainly through these two sections, assists the Palestinian Authority in building its institutions, for a future Palestinian state, focused on security and justice sector reforms. This is effected under Palestinian ownership and in accordance with the best European and international standards. Ultimately the Mission’s ...

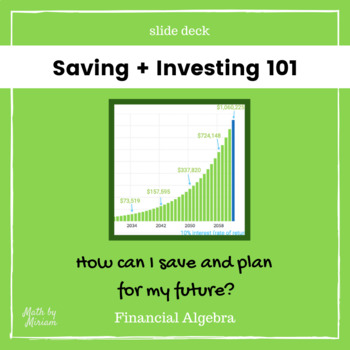

Investing For Beginners: How To Read A Chart | MoneyUnder30 13/06/2022 · Simply put, a stock chart is a graph that shows you the price of a stock over a specific period of time — for example, five years. More advanced stock charts will show additional data, and by understanding the basics you can pull out a lot of information about a stock’s historic, current, and expected performance.

Create Your Perfect Budget With This Worksheet - GOBankingRates In terms of retirement, start setting goals and saving as soon as you can. Investment brokerage Fidelity says you'll need 50% to 80% of your pre-retirement income to maintain your current lifestyle[x]. To reach that goal, it advises that you try to save 15% of your pre-tax income, including matching funds from your employer, for retirement.

How to Set Financial Goals for Your Future - Investopedia Short-Term Financial Goals. Setting short-term financial goals give you the foundation and the confidence boost that you'll need to achieve the bigger goals that take more time. These first steps ...

Explain the Relationship Between Consumption and Saving The economic expansion of a country leads to a development in the measure of living of its people linked with a sustained extension rate. The students can learn more about the discussion in brief about consumption, savings, and investment and draw out the connection between the relationship between consumption and saving variables as per the classical system.

8 Expert Money Tips for the LGBTQ+ Community - msn.com Start Saving and Investing ASAP "Get an early start on your savings," said Ameriprise Financial's Billard. "It has been consistently true that time is an investor's best friend.

› blog › the-best-budget7 of The Best Budget Templates And Tools | Clever Girl Finance Jul 28, 2022 · A budget is a critical piece of any successful financial picture. Without a budget, it hard to know where you stand financially. Even if you have a healthy emergency fund, a budget will allow you to track how much money you are earning, saving, and investing every single month.

The Best Investments For Teens And How To Start 1. To pay for college. There's no doubt that college is expensive. In fact, the cost of higher education has resulted in Americans nationwide carry $1.6 tri l lion in student debt. By investing as a teen, you can help set money aside to cover some or all of your college tuition without going into debt. 2.

› investor › pubsSEC Saving and Investing of saving and investing by following this advice: always pay yourself or your family first. Many people find it easier to pay themselves first if they allow their bank to automatically re-move money from their paycheck and deposit it into a savings or investment account. Likely even better, for tax purposes, is to participate in an

Best Savings Account Interest Rates of October 2022 - The Balance E*TRADE Bank. 2.75%. $0.01 to open and earn stated APY. We partnered with the following banks to bring you the savings account offers in the table below. Under that, you'll find additional details on our editors' picks for the best high-interest savings accounts and rates as of Oct. 4, 2022.

New 6-Month and 12-Month Singapore T-Bill (est. 3.3%) Available on ... Here are your other Higher Return, Safe and Short-Term Savings & Investment Options for Singaporeans in 2022. You may be wondering whether other savings & investment options give you higher returns but are still relatively safe and liquid enough. Here are different other categories of securities to consider:

Saving vs. Investing: Which Route Should You Take? Relative to investing, saving offers three advantages: Pro: Cash doesn't change in value. Your savings account balance doesn't fluctuate in response to external factors. The stock market could ...

IRS Form 5695 For 2022, 2023 - Energy Tax Credit Instructions Here's how to fill out form 5695 using TurboTax: To enter your Residential Energy Credits (Form 5695) into TurboTax Online: Login to TurboTax Online. Click My Account (top right of your screen). Click Tools. In the pop-up window, click Topic Search. In the search bar, type 5695.

Retirement Income Planning & Overview | USAA Your assets and investment income could be vulnerable to inflation and market volatility over time. Products like annuities could help ensure you don't outlive your savings. ... Use our worksheet to understand your ideal life in retirement, risks and questions you should ask your specialist. This will help you prepare for a productive ...

:max_bytes(150000):strip_icc()/dotdash-TheBalance-saving-money-vs-investing-money-358062-Final-729ad1c64fdc460ca99144c105173cbb.jpg)

0 Response to "44 saving and investing worksheet"

Post a Comment