38 amt qualified dividends and capital gains worksheet

Publication 525 (2021), Taxable and Nontaxable Income This is true whether you reside inside or outside the United States and whether or not you receive a Form W-2, Wage and Tax Statement, or Form 1099 from the foreign payer. This applies to earned income (such as wages and tips) as well as unearned income (such as interest, dividends, capital gains, pensions, rents, and royalties). Learn About Alternative Minimum Tax - Fidelity If you have qualified dividends and long-term capital gains, they are taxed at federal rates no higher than 20% for purposes of both the ordinary income tax and the AMT. However, the extra income could reduce or even eliminate the amount of income you can exempt from the AMT. For tax year 2021, the AMT exemption amounts are:

capital gain worksheet 2021 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet. 15 Pictures about 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet : 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet, 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 and also 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet.

Amt qualified dividends and capital gains worksheet

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments capital gains and losses worksheet Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form : Resume . capital worksheet gains irs shares form dividends qualified 1040 summary tax dividend. Capital Gains Tax Worksheet Instructions Worksheet : Resume Examples . gains. 5 capital loss carryover worksheet. Form 1041 (schedule d). What Is The Qualified Dividends And Capital Gain Tax Worksheet Used For ... Irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the capital gains. The complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. Qualified Dividends and Capital Gain Tax Worksheet—Line 44 from studylib.net.

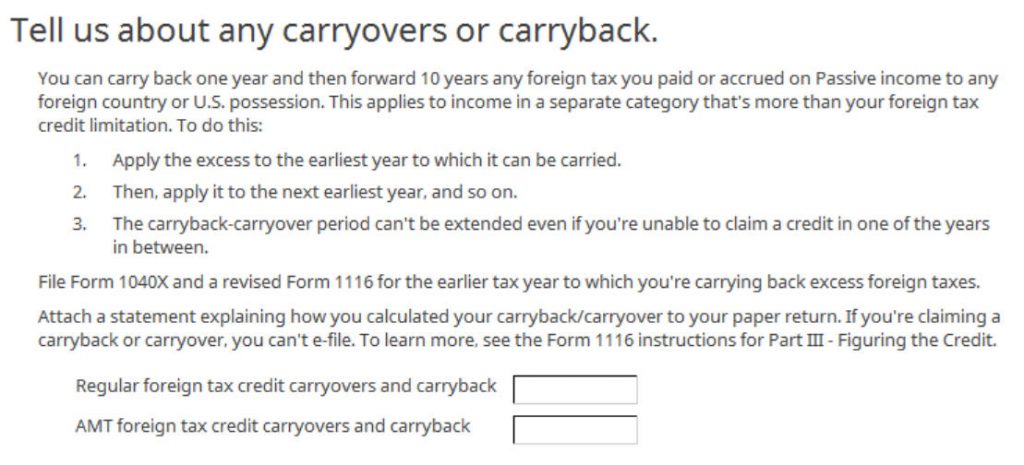

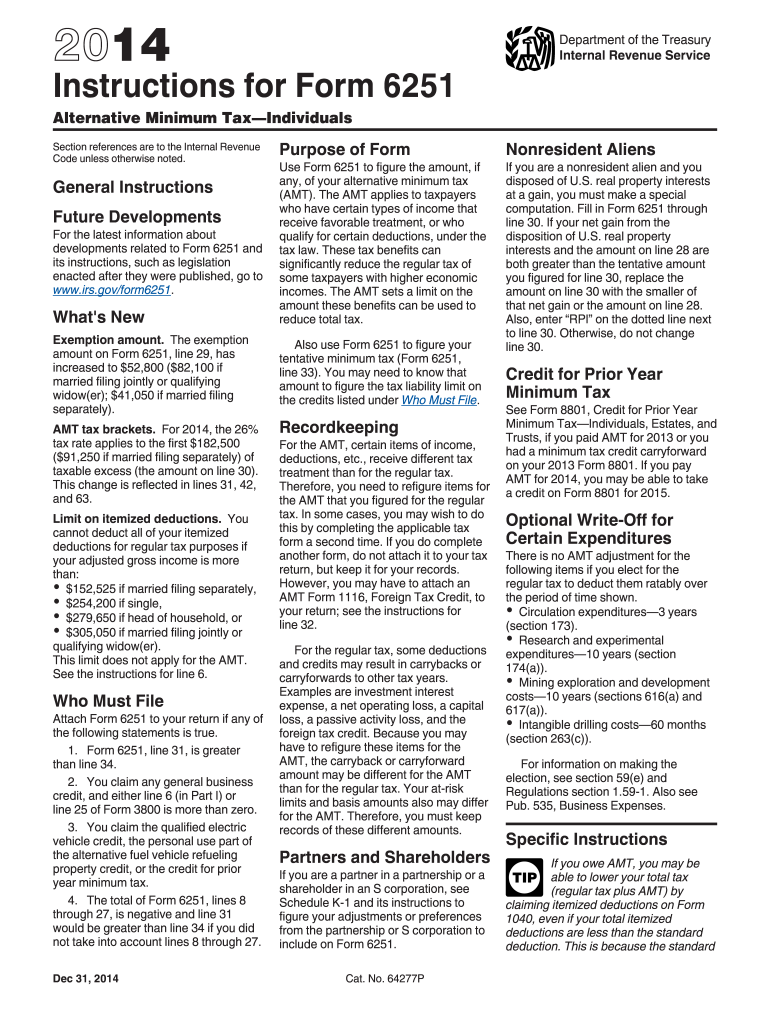

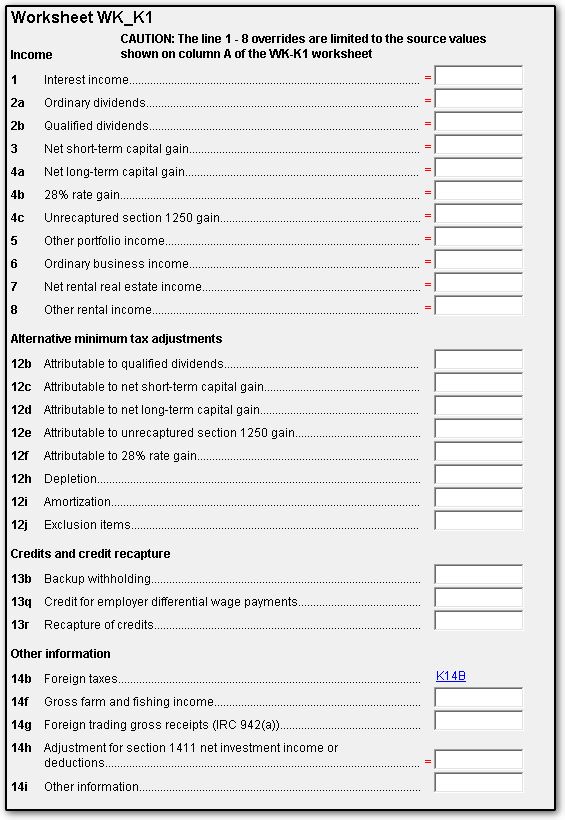

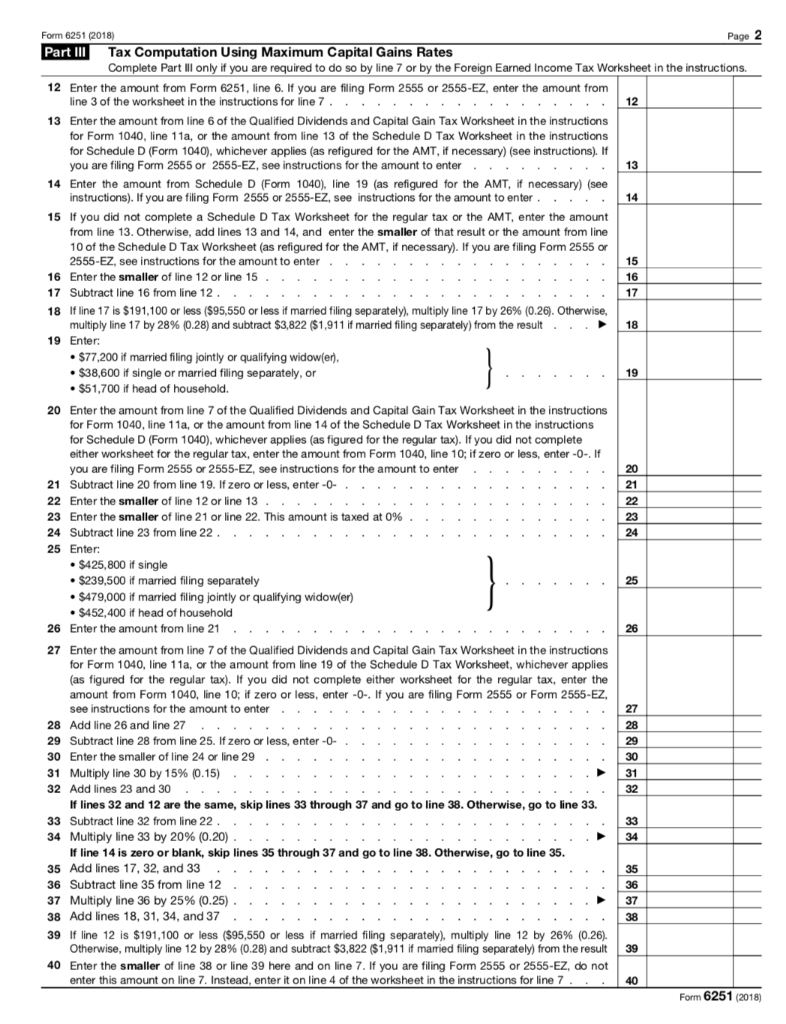

Amt qualified dividends and capital gains worksheet. Partner’s Instructions for Schedule K-1 (Form 1065) (2021) Box 6b. Qualified Dividends. Report any qualified dividends on Form 1040 or 1040-SR, line 3a. Some of the amounts reported in this box may be attributable to PTEP in annual PTEP accounts that you have with respect to a foreign corporation and are therefore excludable from your gross income. TR2 - Qualified Dividends and Capital Gain Tax Worksheet - 2021 .docx Qualified Dividends and Capital Gain Tax Worksheet - Line 16 1. Enter the amount from Form 1040 or 1040-SR, line 15. 38757 2. Enter the amount from Form 1040 or 1040-SR, line 3a* 2700 3. PDF Qualified Dividends and Capital Gain Tax Worksheet (2020) - IA Rugby.com Qualified Dividends and Capital Gain Tax Worksheet (2020) ... • If the taxpayer does not have to file Schedule D (Form 1040) and received capital gain distributions, be sure the box on line 7, Form 1040, is checked. 1) Enter the amount from Form 1040, line 15. However, if filing Form 2555 (relating to foreign earned income), enter the ... Instructions for Form 6251 (2021) | Internal Revenue Service You qualify for the adjustment exception under Qualified Dividends and Capital Gain Tax Worksheet (Individuals) or Adjustments to foreign qualified dividends under Schedule D Filers in the Instructions for Form 1116, and. Line 17 of Form 6251 isn’t more than $199,900 ($99,950 if married filing separately (on Form 1040, 1040-SR or 1040-NR)).

Qualified Worksheet Capital Dividends Gains And Amt - RPS Half Marathon May 16, 2017 · So lines 1-7 of this worksheet are figuring what is your total qualified income (line 6) and your total ordinary income (line 7 ), so they can be taxed at their different rates. Qualified Income is the sum of long-term capital gains and qualified dividends minus anything you decided to take as income on Form 4952 (don't do that). capital gains worksheet 2020 Qualified Dividends And Capital Gains Worksheet 2019 Instructions . qualified dividends irs. Schedule D Tax Worksheet 2015 - Worksheet novenalunasolitaria.blogspot.com. irs dividends instruction pdffiller signnow. 32 amt qualified dividends and capital gains worksheet. 33 capital gains tax worksheet. 33 capital gains tax ... qualified dividend and capital gains worksheet 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet dontyou79534.blogspot.com. ... Irs form 1040 qualified dividends capital gains worksheet form : resume. Gains capital worksheet tax summary. Random Posts. printable letters for kindergarten; put me in the zoo coloring page; How Do Capital Gains Affect AMT? | The Motley Fool On top of the $150 in capital gains tax, the $1,000 of capital gains income would reduce your exemption by $250. You'd end up paying AMT on that $250. At a 28% rate, that would incur...

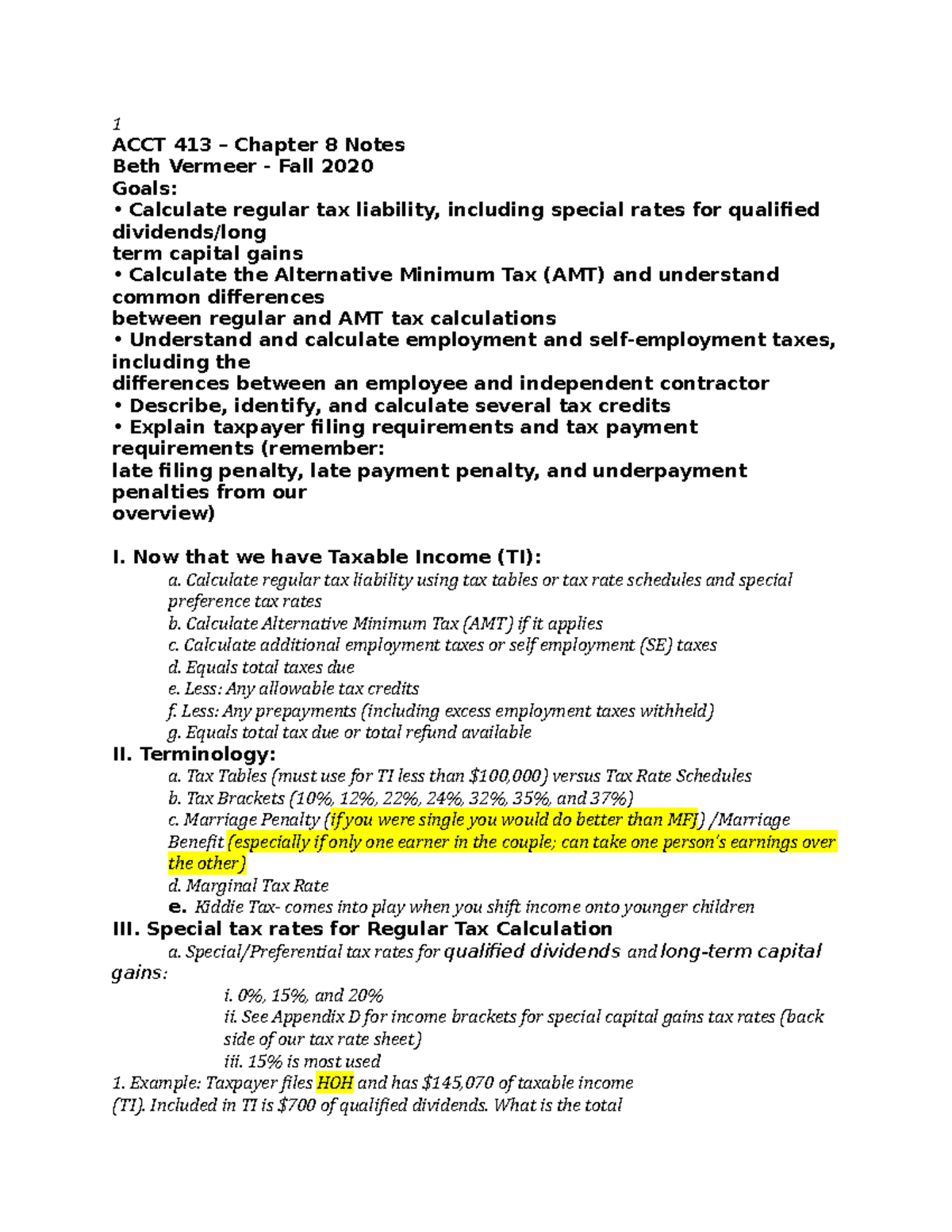

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates. Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3). Ordinary Income is everything else or Taxable Income minus Qualified Income. How to Download Qualified Dividends and Capital Gain Tax Worksheet ... Here are the tax rates for Qualified Dividends and Capital Gain: 2021 Qualified Dividend Tax Rate: For Single Taxpayers: For Married Couples Filing Jointly: For Heads of Households: 0%: ... No taxpayer entitled to the dividend income on stocks or mutual funds held is exempt from filing the Qualified Dividends and Capital Gain Tax Worksheet. PDF Qualified Dividends and Capital Gain Tax Worksheet—Line 11a See the earlier instructions for line 11a to see if you can use this worksheet to figure your tax. Before completing this worksheet, complete Form 1040 through line 10. If you don't have to file Schedule D and you received capital gain distributions, be sure you checked the box on line 13 of Schedule 1. Before you begin: 1. 21.5.9 Carrybacks | Internal Revenue Service - IRS tax forms Foreign Expropriation Capital Losses: Net Capital Loss (NCL) Carryforward 10 years: Regulated Investment Company (RIC) NCL: Carryforward indefinitely for tax years beginning on or after December 23, 2010. (For tax years beginning on or before December 22, 2010, carryforward eight years.) Biofuel Producer Credit (Form 6478) Unused general ...

Amt Qualified Dividends And Capital Gains Worksheet All groups and messages ... ...

capital gains and losses worksheet 1040 Qualified Dividends Worksheet - Worksheet List nofisunthi.blogspot.com. 1040 worksheet dividends qualified proseries postcard tax. Capitol Gains / Losses . losses gains. Form 1040 Schedule D Capital Gains And Losses | 2021 Tax Forms 1040 1044form.com. 1040 schedule form capital gains irs tax losses forms worksheet ...

Qualified Dividends and Capital Gains Flowchart - The Tax Adviser The capital gain tax computation seemingly should be easy, but often it is not. The complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. It takes 27 lines in the IRS qualified dividends and capital gain tax worksheet to work through the computations ( Form 1040 Instructions (2013), p. 43).

qualified dividends and capital gains worksheet 2020 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet dontyou79534.blogspot.com. qualified dividends gains amt. 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 dontyou79534.blogspot.com. dividends. Qualified Dividends And Capital Gains Worksheet 2019 Irs Worksheet . worksheet dividends gains

2012 Qualified Dividend And Capital Gain Tax - K12 Workbook Displaying all worksheets related to - 2012 Qualified Dividend And Capital Gain Tax. Worksheets are Capital gain tax work pdf, Capital gains and losses, Foreign earned income tax work pdf, Line 44 the tax computation work on if you are filing, 2021 form 1041 es, Individual items to note 1040, Ask anyone to tell you about an experience they had with, Net operating losses.

Qualified Dividends and Capital Gains Worksheet - StuDocu The Methodology of the Social Sciences Voices of Freedom Forecasting, Time Series, and Regression Psychology Civilization and its Discontents Qualified Dividends and Capital Gains Worksheet one of the forms due with the final project University Southern New Hampshire University Course Federal Taxation I (ACC330) Academic year 2021/2022 Helpful? 7 5

How to Download Qualified Dividends and Capital Gain Tax Worksheet ... The purpose of the Qualified Dividends and Capital Gain Tax Worksheet is to report and calculate tax on capital gains at a lower rate (applied for long-term capital gains (losses)). Every income category must be calculated separately because the ordinary tax rate is not applied to the qualified dividends.

Capital Gains Tax Calculation Worksheet - The Balance Worksheet 1: Simple Capital Gains Worksheet Here we have a single transaction where 100 shares of XYZ stock were purchased. A second transaction then sold 100 shares of XYZ stock. There are no other investment purchases or sales. It's simple to match the sale with the purchase. We must organize the data.

Calculation of the Qualified Dividend Adjustment on Form 1116 ... - Intuit The total foreign-sourced qualified dividends must be divided by the total capital gains from line 4 to arrive at the pro rata percentage. This percentage is then multiplied by the amount of capital gains taxed at 15% (line 14 of the QD&CTG worksheet) to determine the amount attributable to foreign sources.

Fill Online, Printable, Fillable, Blank 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H&Rblock) Form. Use Fill to complete blank online H&RBLOCK pdf forms for free. Once completed you can sign your fillable form or send for signing. All forms are printable and downloadable. 2020 QUALIFIED DIVIDENDS and CAPITAL GAIN TAX WORKSHEET (H ...

'Qualified Dividends And Capital Gain Tax Worksheet' - A Basic, Simple ... This year I DASHED off this quick Excel to CHECK MY MATH on the ' Qualified Dividends And Capital Gain Tax Worksheet '. But, PLEASE check my math on the Excel. It is very, very basic. I had looked around for a spreadsheet like this. SIMPLE. Not complicated. Yes, I looked at ' Excel1040 '. It was OVERKILL for my needs.

qualified dividends and capital gains worksheet 2020 33 Qualified Dividends And Capital Gain Tax Worksheet Line 44 dontyou79534.blogspot.com. dividends. 32 Amt Qualified Dividends And Capital Gains Worksheet - Worksheet dontyou79534.blogspot.com. qualified dividends gains amt. Capital Gains Tax Summary Worksheet - Worksheet : Resume Examples . gains capital worksheet ...

Instructions for Schedule I (Form 1041) (2021) | Internal ... Capital gains and qualified dividends. For tax year 2021, the 20% maximum capital gains rate applies to estates and trusts with income above $13,250. The 0% and 15% rates continue to apply to certain threshold amounts. The 0% rate applies to amounts up to $2,700. The 15% rate applies to amounts over $2,700 and up to $13,250.

Microsoft is building an Xbox mobile gaming store to take on ... Oct 19, 2022 · Microsoft’s Activision Blizzard deal is key to the company’s mobile gaming efforts. Microsoft is quietly building a mobile Xbox store that will rely on Activision and King games.

understanding taxes worksheet answers Amt Qualified Dividends And Capital Gains Worksheet - Worksheet List nofisunthi.blogspot.com. dividends amt qualified gains deduction. Taxes Worksheet . Calculating Your Paycheck Worksheet - Worksheet List nofisunthi.blogspot.com. paycheck worksheet calculating calculate teachers ella pay. 33 Chapter 2 Section 4 Creating ...

What Is The Qualified Dividends And Capital Gain Tax Worksheet Used For ... Irs introduced the qualified dividend and capital gain tax worksheet as an alternative to schedule d and added the qualified dividends and new rates to the capital gains. The complexity comes from the phaseout of the 0% and 15% rates as other taxable income rises. Qualified Dividends and Capital Gain Tax Worksheet—Line 44 from studylib.net.

capital gains and losses worksheet Irs Form 1040 Qualified Dividends Capital Gains Worksheet Form : Resume . capital worksheet gains irs shares form dividends qualified 1040 summary tax dividend. Capital Gains Tax Worksheet Instructions Worksheet : Resume Examples . gains. 5 capital loss carryover worksheet. Form 1041 (schedule d).

1040 (2021) | Internal Revenue Service - IRS tax forms Schedule D Tax Worksheet. Qualified Dividends and Capital Gain Tax Worksheet. Schedule J. Foreign Earned Income Tax Worksheet. Foreign Earned Income Tax Worksheet—Line 16; Qualified Dividends and Capital Gain Tax Worksheet—Line 16; Line 19. Nonrefundable Child Tax Credit and Credit for Other Dependents. Form 8862, who must file. Payments

0 Response to "38 amt qualified dividends and capital gains worksheet"

Post a Comment