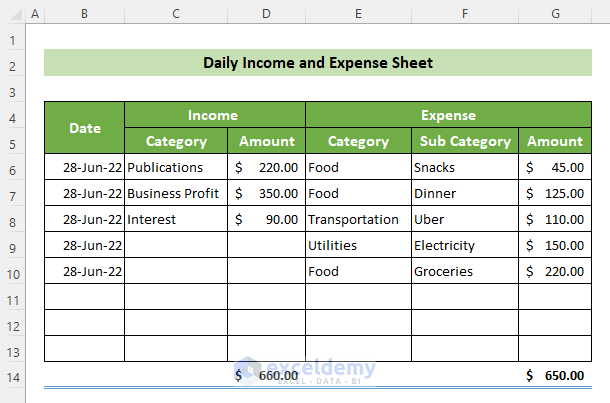

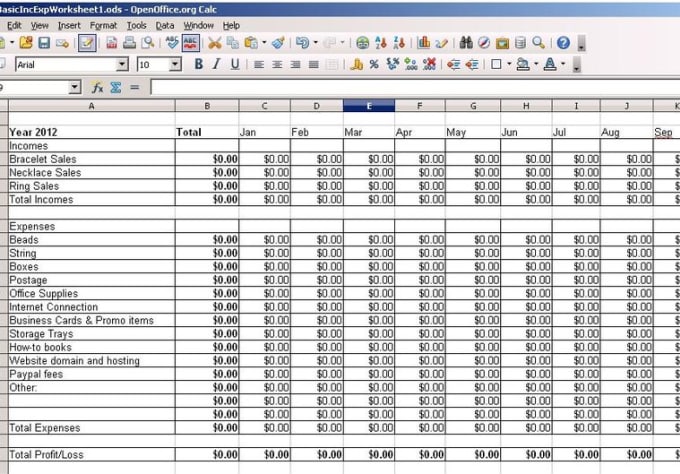

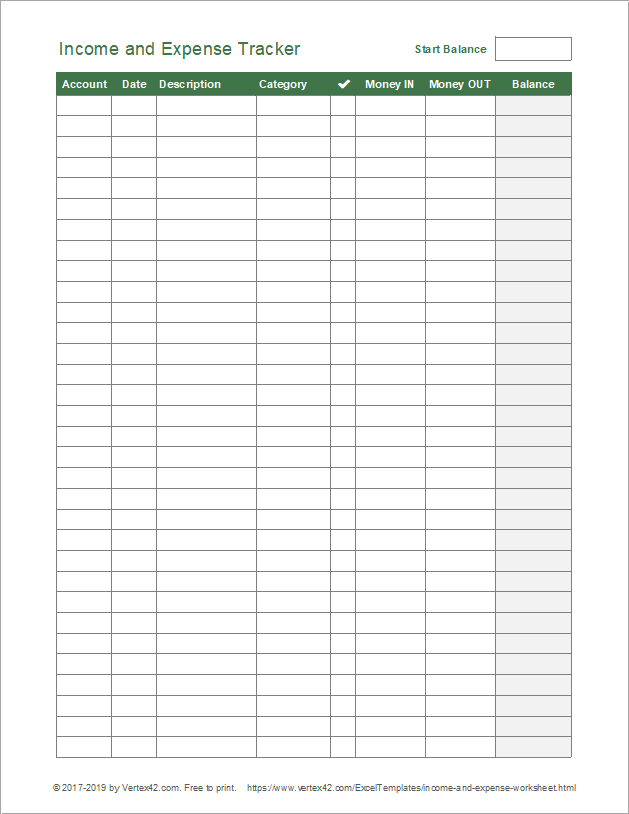

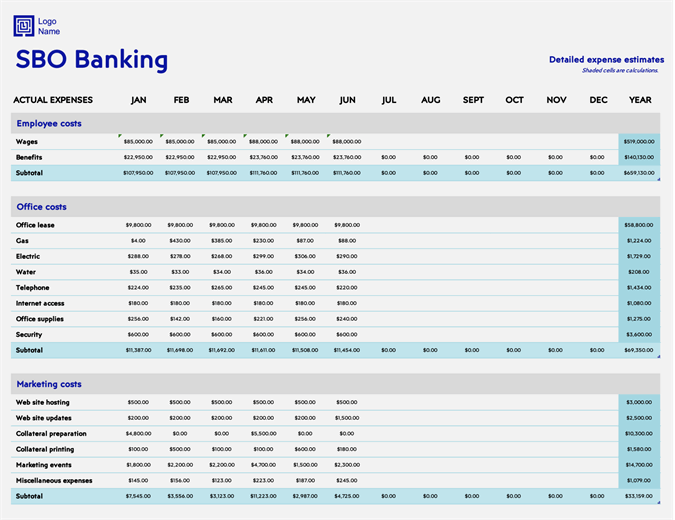

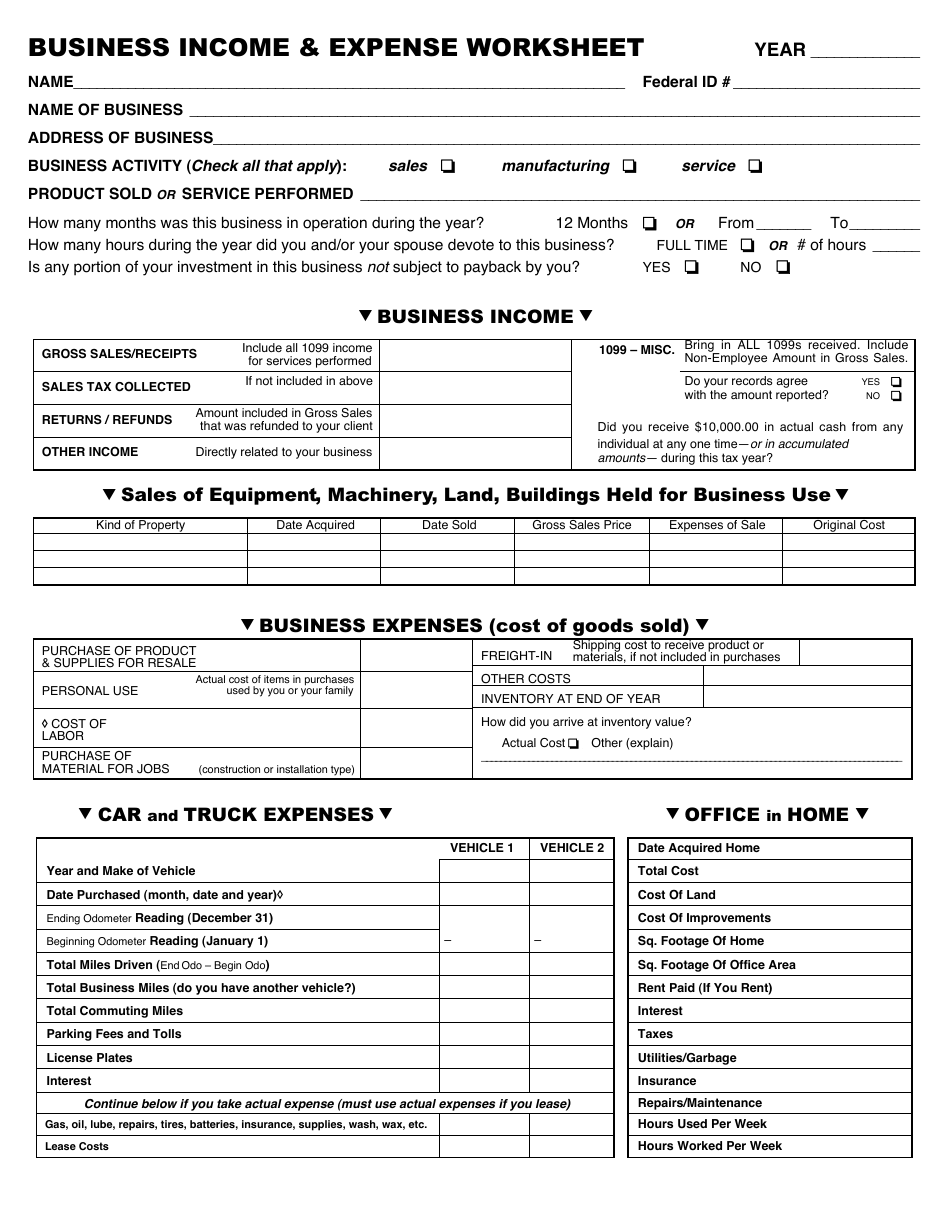

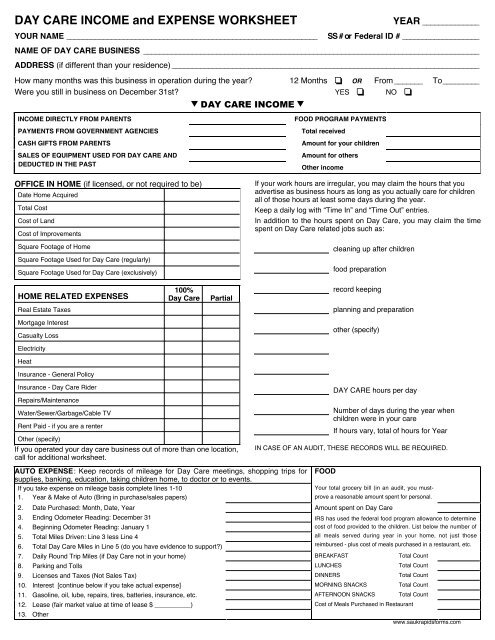

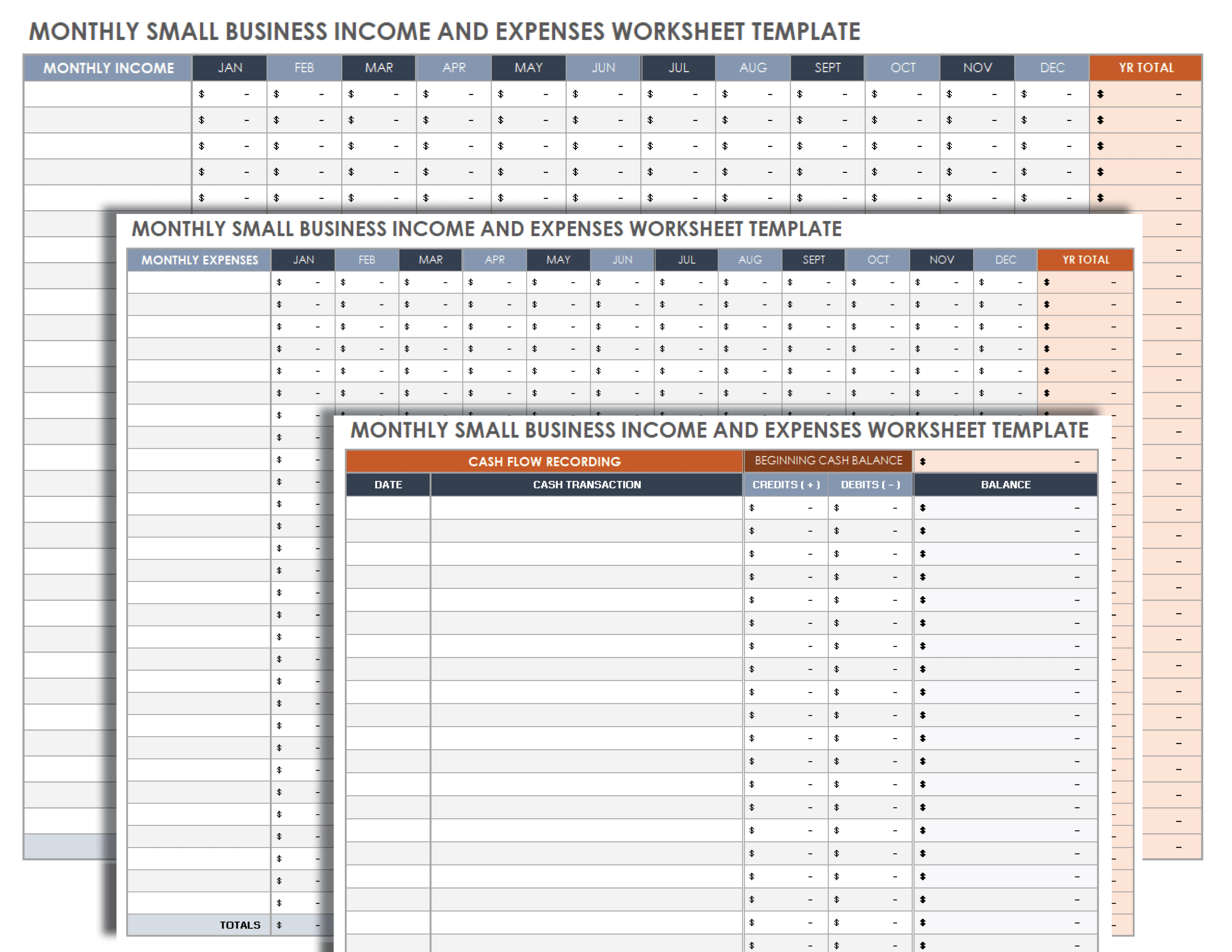

38 business income and expense worksheet

Publication 334 (2021), Tax Guide for Small Business ... Your excess business loss will be included as income on line 8o of Schedule 1 (Form 1040) and treated as a net operating loss that you must carry forward and deduct in a subsequent tax year.For more information about the excess business loss limitation, see Form 461 and its instructions. Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

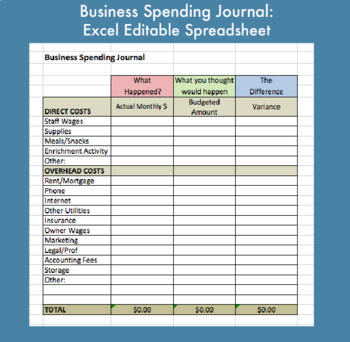

Business Income Insurance Coverage: Calculating ... - Travelers Completing a business income worksheet can help you accurately estimate how much business income coverage you may need. Together with a sound business continuity plan, it serves as a critical planning tool to help your business recover from unplanned business interruptions. To get started, choose from the industry selections below:

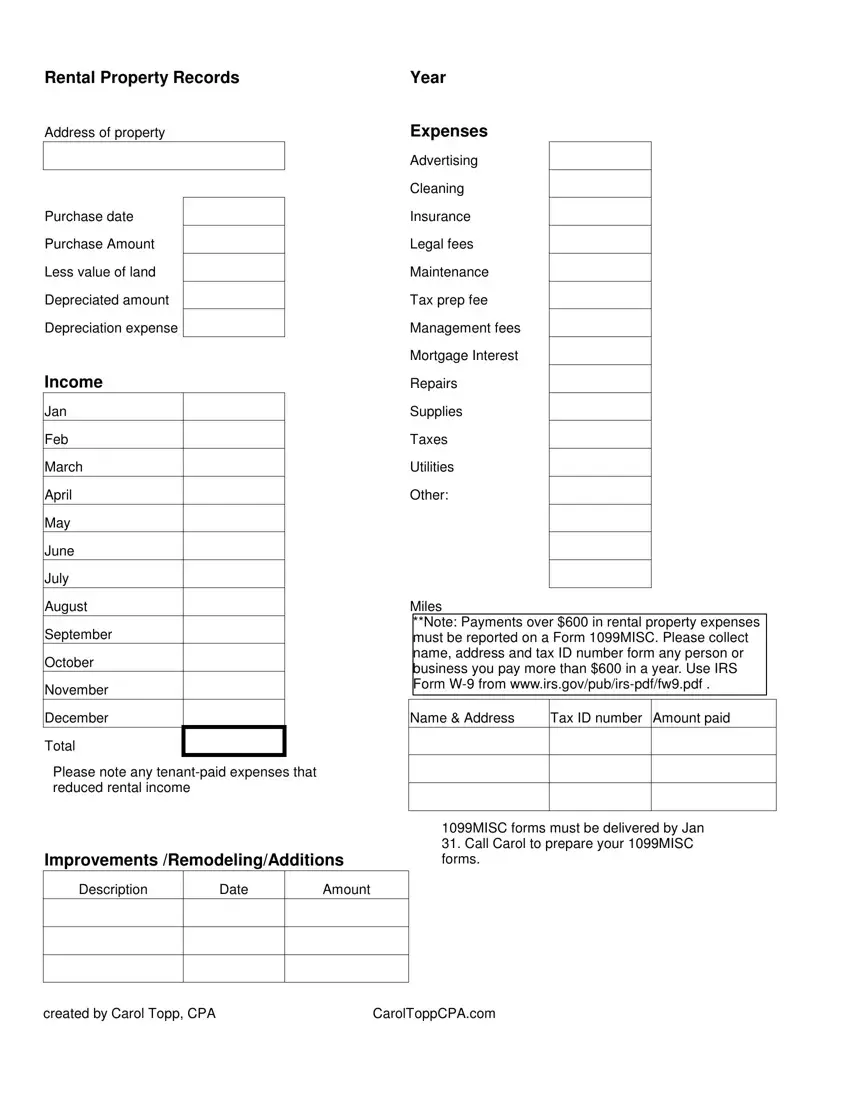

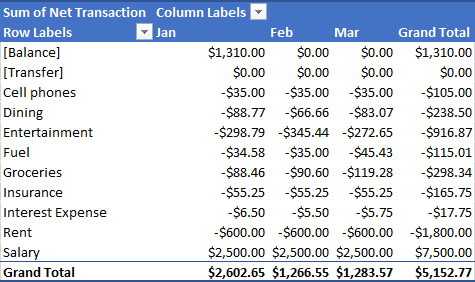

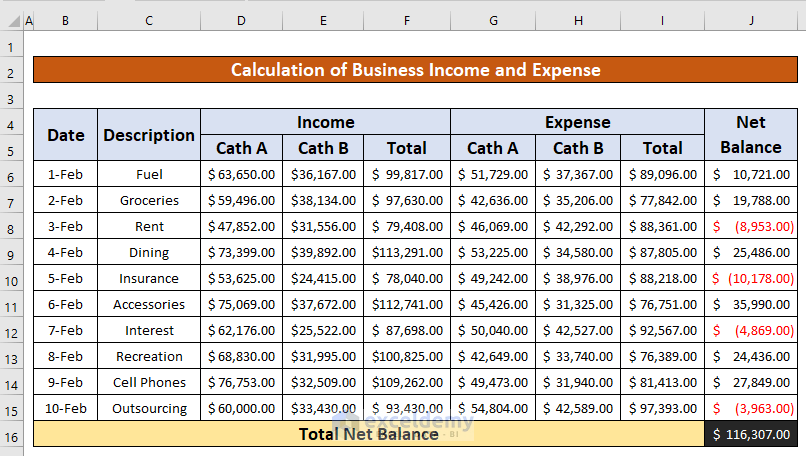

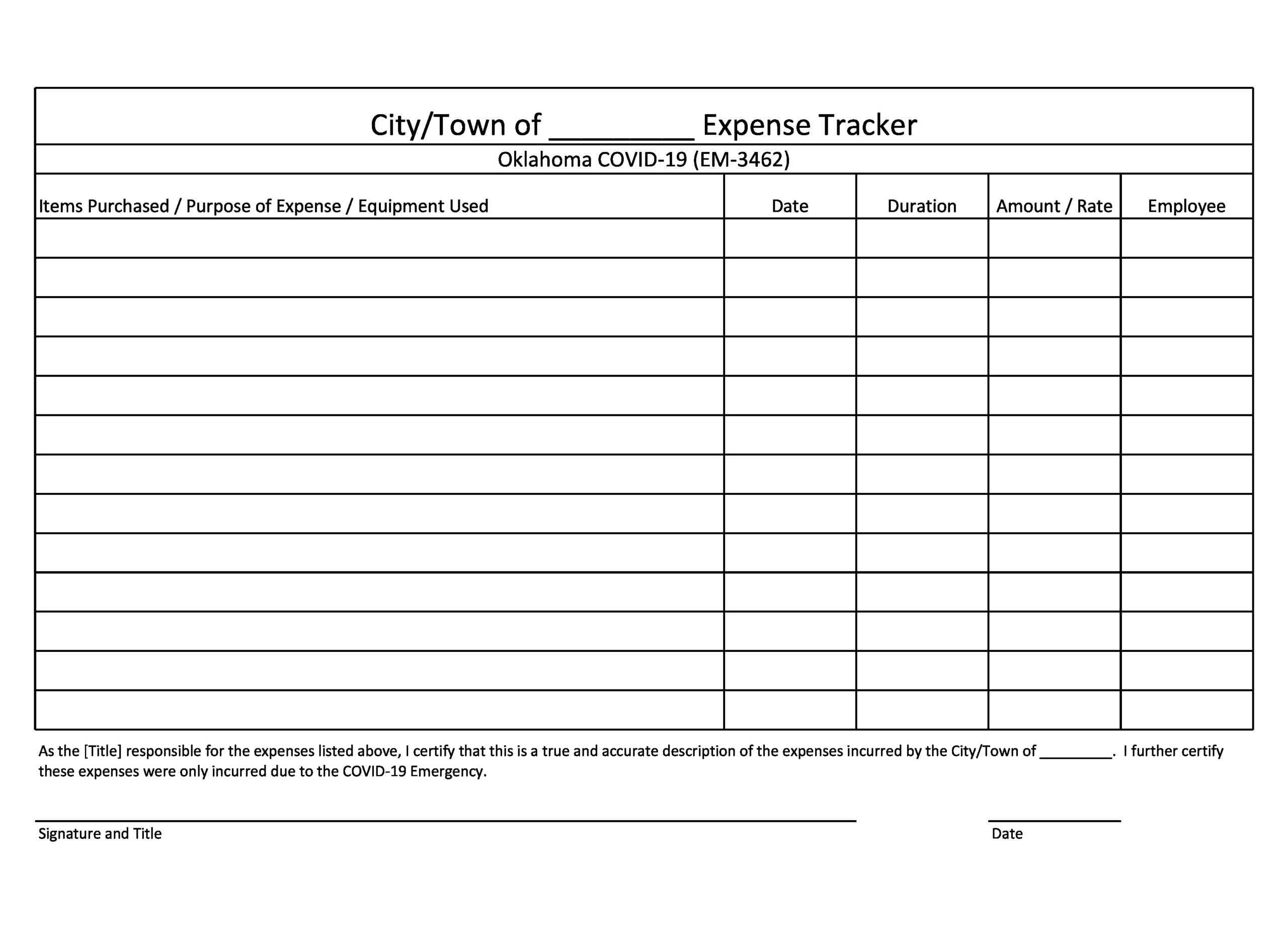

Business income and expense worksheet

Business Income and Extra Expense Insurance - Travelers Extended business income helps replace that lost income while you get your business activity back to normal levels. You could also experience losses if damage at the premises of your key suppliers disrupts your business. Business income and extra expense for dependent properties coverage can be added to help protect your business during those ... Tax Cuts and Jobs Act, Provision 11011 Section 199A ... For tax years 2019 and after, Form 8995, Qualified Business Income Deduction Simplified Computation, and Form 8995-A, Qualified Business Income Deduction, are used to compute and report the qualified business income deduction. Form 8995-A must be used if taxable income is over the threshold or if you or any of your trades or businesses are ... How to Calculate Business Income for Insurance | The Hartford Typically, the business income covered is classified as taxable income. This includes any income that results from business activity. For example, say your business’s building is damaged by a fire. Business income insurance can help pay for lost income while your business is shut down.

Business income and expense worksheet. Publication 587 (2021), Business Use of Your Home Finally, this publication contains worksheets to help you figure the amount of your deduction if you use your home in your farming business and you are filing Schedule F (Form 1040) or you are a partner and the use of your home resulted in unreimbursed ordinary and necessary expenses that are trade or business expenses under section 162 and that you are required to pay under the partnership ... How to Calculate Business Income for Insurance | The Hartford Typically, the business income covered is classified as taxable income. This includes any income that results from business activity. For example, say your business’s building is damaged by a fire. Business income insurance can help pay for lost income while your business is shut down. Tax Cuts and Jobs Act, Provision 11011 Section 199A ... For tax years 2019 and after, Form 8995, Qualified Business Income Deduction Simplified Computation, and Form 8995-A, Qualified Business Income Deduction, are used to compute and report the qualified business income deduction. Form 8995-A must be used if taxable income is over the threshold or if you or any of your trades or businesses are ... Business Income and Extra Expense Insurance - Travelers Extended business income helps replace that lost income while you get your business activity back to normal levels. You could also experience losses if damage at the premises of your key suppliers disrupts your business. Business income and extra expense for dependent properties coverage can be added to help protect your business during those ...

0 Response to "38 business income and expense worksheet"

Post a Comment