38 section 125 nondiscrimination testing worksheet

PDF Section 125 Nondiscrimination Testing purposes of non-discrimination testing. What is Required The IRS requires that these tests are performed on an annual basis, once the plan year is complete. This requirement include short plan years as well. Unlike other benefits testing, the Section 125 and FSA tests are not filed with any government agency. What is Section 125 nondiscrimination testing? What is Section 125 nondiscrimination testing? A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. These tests are designed to ensure that the plan does not discriminate in favor of highly compensated employees.

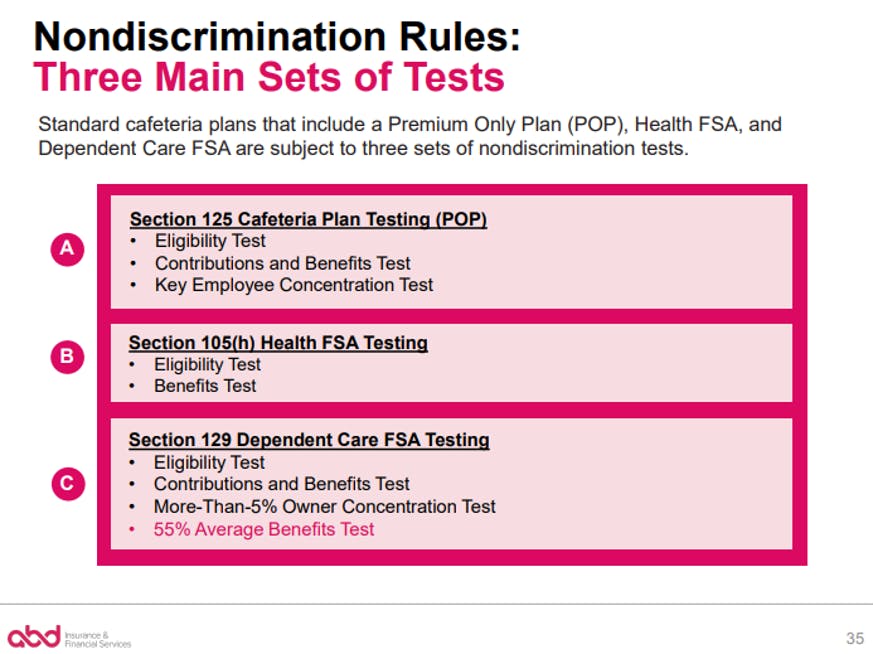

Nondiscrimination Rules for Section 125 Plans and Self-funded ... - VCG Section 125 Plans There are three categories of nondiscrimination rules, which potentially apply to a Section 125 plan. Category 1 - Plan as a Whole. Three nondiscrimination tests apply to the plan as a whole: the eligibility test, the contributions test, and the 25% concentration test.

Section 125 nondiscrimination testing worksheet

(WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin To access all Sections within a Chapter, click the plus sign (+) on the right of a Chapter title. Once you are within a Section, you can navigate to other Sections by using the slide-out Table of Contents on the upper left side of the page. Content will be added as it is approved and only Chapters and Sections with content will be clickable. Section 125 Nondiscrimination Testing Suite - Sentinel Benefits Section 125 Section 125 Nondiscrimination Testing Suite What Tests Are Required? If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health Flexible Spending Account (FSA) or Dependent Care FSA benefits, there are additional tests to complete. All of the possible tests are listed below. PDF Nondiscrimination Tests for Cafeteria Plans - Sullivan Benefits A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. To receive this tax advantage, the cafeteria plan must generally pass the following three nondiscrimination tests: Eligibility to participate test;

Section 125 nondiscrimination testing worksheet. Syrian Refugee Health Profile | CDC - Centers for Disease ... All vaccines administered through the Vaccination Program for U.S.-bound Refugees, as well as records of historical/prior vaccines provided by NGOs and national programs, will be documented on the DS-3025 (Vaccination Documentation Worksheet) form. U.S. providers are strongly encouraged to review each refugee’s records to determine which ... Nondiscrimination Testing - Section 125 | Employer Help Center Subtest #1: The plan benefits 70% of all non-excludable employees. Subtest #2: The plan benefits 80% or more of all non-excludable employees who are eligible to benefit, if 70% or more of all non-excludable employees are eligible to benefit under the plan. Subtest #3: Nondiscriminatory Classification Test. PDF Section 125 Cafeteria Plans Nondiscrimination Testing Guide and ... - Basic There are nine different tests that can be applicable to benefits provided under a Section 125 plan. As noted above, some tests are related to eligibility and availability of benefits, and other tests are based on actual benefits elected (utilization). The Section 125 Cafeteria Plan 1. Eligibility Test 2. Contributions and Benefits Test 3. PDF Section 125 Plan Nondiscrimination Testing - SIMA Financial Group Section 125 Plan Nondiscrimination Testing A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. Employees who participate in a cafeteria plan can pay for qualified benefits, such as group health

Nondiscrimination Testing - Wrangle 5500: ERISA Reporting and Disclosure What are the tests to be conducted for Section 125, Section 129 and 105h? 4. What does each test entail? Answer: Typically, a detailed census is required to run a test, as well as a completed worksheet to provided needed plan information, such as the aggregate premium pre-tax collected for all employees vs highly compensated employees. Section 125 Nondiscrimination Testing Worksheet 2021 - signNow Use a section 125 nondiscrimination testing worksheet 2021 2010 template to make your document workflow more streamlined. Show details How it works Upload the section 125 plan document template Edit & sign section 125 cafeteria plan from anywhere Save your changes and share section 125 nondiscrimination testing worksheet 2020 Rate form 4.8 PDF NONDISCRIMINATION TESTING GUIDE - amben.com nondiscrimination testing guide Source: Thomson Reuters Checkpoint (EBIA) 2 American Benefits Group • PO Box 1209, Northampton, MA 01061-1209 • Tel: 800-499-3539 • Fax: 877-723-0147 • Section 125 testing: All your "w" questions answered Who is required to do this plan testing? All employers who allow for pre-tax payroll deductions for employer-sponsored health plans must do annual Section 125 nondiscrimination testing. This includes public and private companies, regardless of size, with no exceptions. If your company has a pre-tax cafeteria plan, Section 125 testing is mandatory.

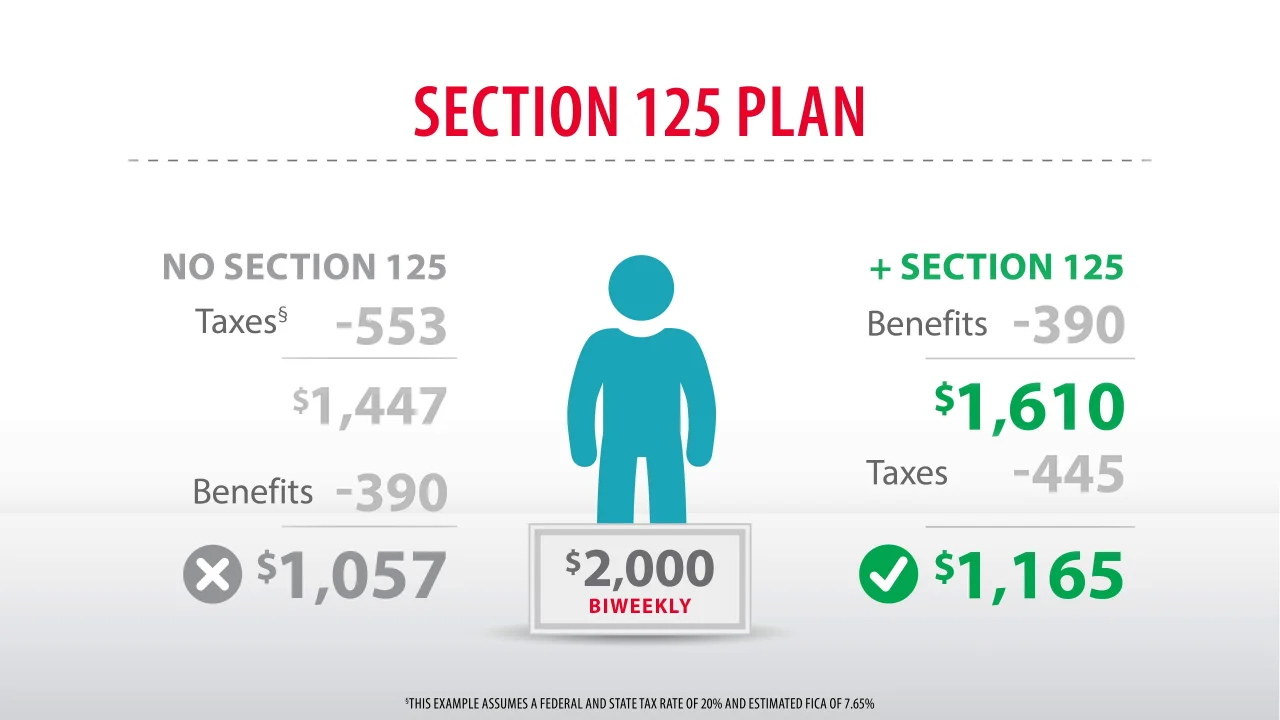

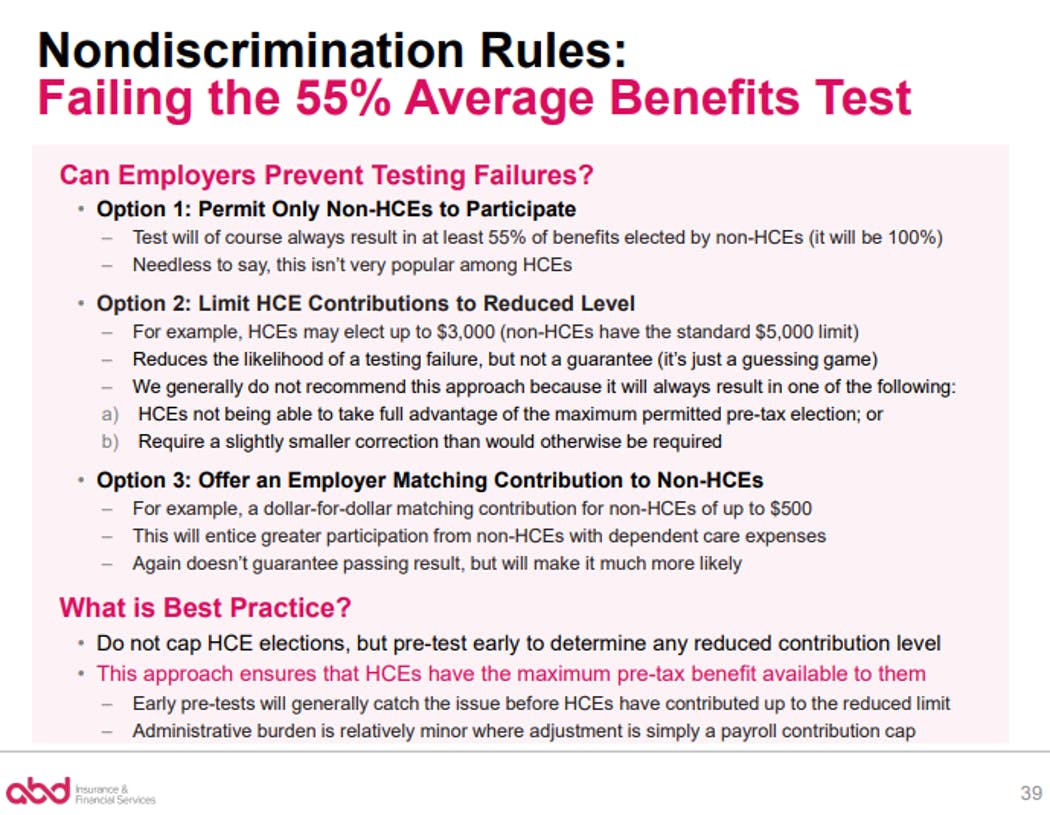

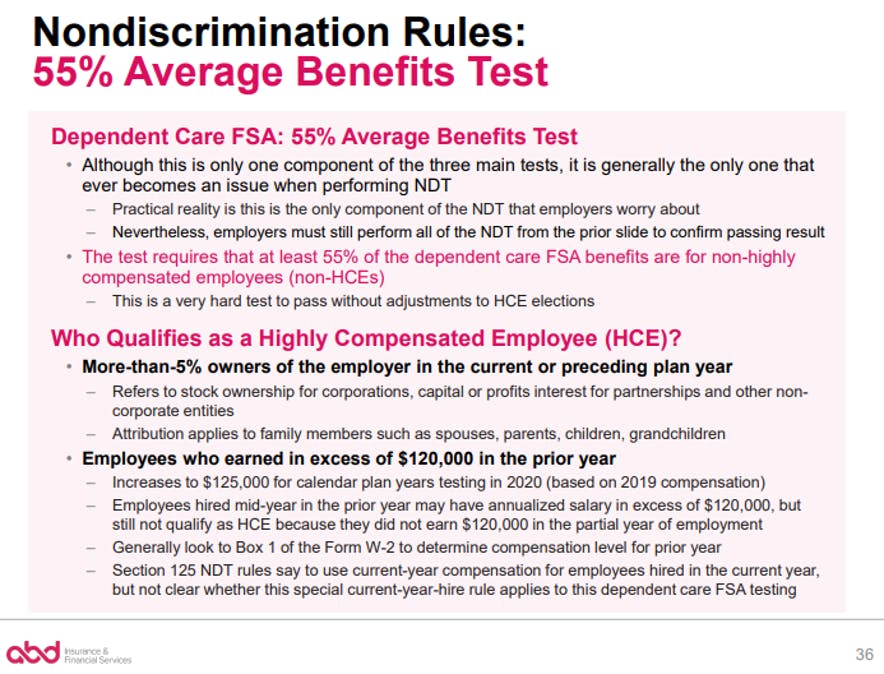

About Our Coalition - Clean Air California About Our Coalition. Prop 30 is supported by a coalition including CalFire Firefighters, the American Lung Association, environmental organizations, electrical workers and businesses that want to improve California’s air quality by fighting and preventing wildfires and reducing air pollution from vehicles. Nondiscrimination Testing | Employee Welfare And Benefits | Buck This section describes the nondiscrimination tests that apply to dependent care assistance program (DCAPs), how each test operates, and what data you need to collect in order to conduct the tests. Background Section 129 of the Code provides an income tax exclusion for benefits received through an employer-sponsored DCAP. PDF Section 125 Nondiscrimination Testing - Sentinel Benefits better benefit than other employees. All Section 125 Benefits should be included in order to carry out the testing. Please see 'About the Tests' below for more information on each test. About the Tests If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health PDF Section 125 Flexible Benefit Plan DISCRIMINATION TESTING DATA Testing Plan Year Begin Date:_____ End Date:_____ Testing Date:_____ INSTRUCTIONS Tax savings from an IRC Section 125 Flexible Benefit Plan are available to Highly Compensated Employees and Key Employees ONLY if they are provided and utilized on a non-discriminatory basis when compared to other employees.

Nondiscrimination Testing - American Benefits Group - amben.com A 5% (or greater) shareholder in the current or prior year; An employee paid $130,000 in 2021 or $135,000 in 2022 An employee whose salary is in the top 20% of all employees. How Can You Prevent Discrimination Problems? Nondiscrimination Testing Guide Please complete our Nondiscrimination Testing Request Form and email it to ndx@amben.com

Non-discrimination testing: What you need to know | WEX Inc. The IRS requires non-discrimination testing for employers who offer plans governed by Section 125, which includes a flexible spending account (FSA). And though they aren't part of Section 125, testing is also required for health reimbursement arrangements (HRAs) and self-insured medical plans (SIMPs). Why does non-discrimination testing matter?

4.72.5 Top-Heavy Plans | Internal Revenue Service - IRS tax forms Apr 01, 2021 · The top-heavy rules were added to the Internal Revenue Code (IRC 416) by the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA), P.L. 97–248, Section 240, effective for plan years beginning after December 31, 1983, and amended by Sections 524 and 713(f) of the Tax Reform Act of 1984 (P.L. 98-369).

Meningitis Lab Manual: Antimicrobial Susceptibility Testing | CDC Antimicrobial susceptibility testing of S. pneumoniae This section describes the optimal media, inoculum, antimicrobial agents to test, incubation conditions, and interpretation of results for S. pneumoniae by the disk diffusion method and the antimicrobial gradient strip method. Although disk diffusion will provide information for most ...

PDF Nondiscrimination Testing - benstrat.com Nondiscrimination Testing In order to retain tax-favored status, the IRS Code requires that section 125, 105(h) and 129 plans pass a series of nondiscrimination test each year. The plans must not discriminate in favor of highly compensated employees (HCEs) and/or key employees with respect to the benefits provided under

Unbanked American households hit record low numbers in 2021 Oct 25, 2022 · The number of American households that were unbanked last year dropped to its lowest level since 2009, a dip due in part to people opening accounts to receive financial assistance during the ...

Microsoft takes the gloves off as it battles Sony for its ... Oct 12, 2022 · Microsoft pleaded for its deal on the day of the Phase 2 decision last month, but now the gloves are well and truly off. Microsoft describes the CMA’s concerns as “misplaced” and says that ...

Section 125 Nondiscrimination — ComplianceDashboard: Interactive Web ... This is referred to as cafeteria plan nondiscrimination testing under section 125 of the IRS code. Plans Subject to Testing Section 125 testing must be performed on self-insured benefit programs that are paid on a pre-tax basis as a component of the cafeteria plan. This test is often performed after these programs pass 105 (h) testing.

PDF Nondiscrimination Tests for Cafeteria Plans - Sullivan Benefits A Section 125 plan, or a cafeteria plan, allows employers to provide their employees with a choice between cash and certain qualified benefits without adverse tax consequences. To receive this tax advantage, the cafeteria plan must generally pass the following three nondiscrimination tests: Eligibility to participate test;

Section 125 Nondiscrimination Testing Suite - Sentinel Benefits Section 125 Section 125 Nondiscrimination Testing Suite What Tests Are Required? If you sponsor a Cafeteria/Section 125 Plan, there are three tests to complete. If you also offer Health Flexible Spending Account (FSA) or Dependent Care FSA benefits, there are additional tests to complete. All of the possible tests are listed below.

(WIOA) Titles I-A and I-B Policy & Procedure Manual - Wisconsin To access all Sections within a Chapter, click the plus sign (+) on the right of a Chapter title. Once you are within a Section, you can navigate to other Sections by using the slide-out Table of Contents on the upper left side of the page. Content will be added as it is approved and only Chapters and Sections with content will be clickable.

0 Response to "38 section 125 nondiscrimination testing worksheet"

Post a Comment