39 income tax deduction worksheet

Quiz & Worksheet - Income Tax Liability & Deductions | Study.com Worksheet Print Worksheet 1. Tax liability is calculated based on _____. taxable income standard deduction adjusted gross income gross income 2. What is TRUE about the tax code? The... Bharat Agri Fert & Realty Ltd Vs Assistant Commissioner of Income-tax ... The Mumbai bench of the Income Tax Appellate Tribunal (ITAT) has held that the sales proceeds of car parking spaces being an integral part of the housing project shall be eligible for income tax deduction under section 80-IB(10) of income tax Act, 1961. The assessee company, M/s Bharat Agri Fert & Realty Ltd, is engaged […]

taxfoundation.org › 2020-tax-brackets2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates Nov 14, 2019 · An individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment.

Income tax deduction worksheet

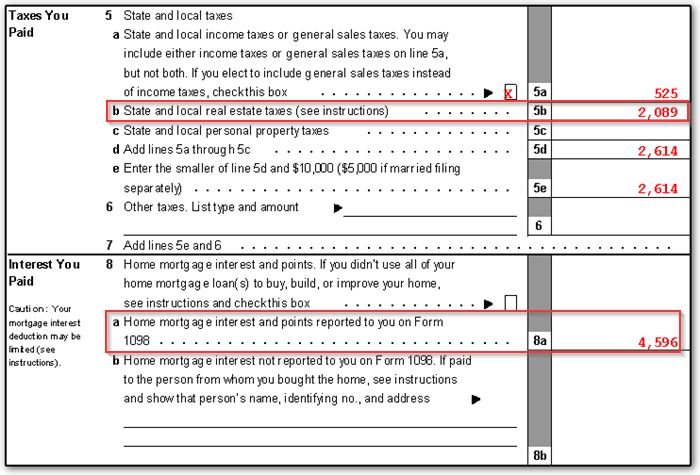

About Schedule A (Form 1040), Itemized Deductions Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Current Revision Schedule A (Form 1040) PDF Instructions for Schedule A (Form 1040) | Print Version PDF | eBook (epub) EPUB Recent Developments Numerical list by form number: IT-2 through IT-2664 Sep 11, 2001 · Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet: IT-203-C (Fill-in) Instructions on form: ... Estimated Income Tax Payment Voucher for Fiduciaries; Payments due April 18, June 15, September 15, 2022, and January 17, 2023: IT-2106.1 (Fill-in) Frequently Asked Questions About International Individual Tax Matters ... If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555, you must calculate your tax liability using the Foreign Earned Income Tax Worksheet (for Line 16) in the Form 1040 and 1040-SR Instructions or your income tax preparation software.

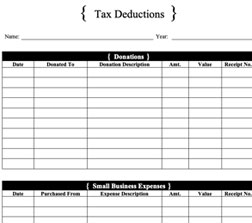

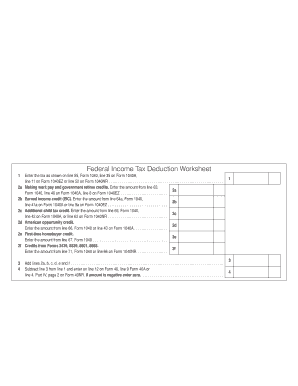

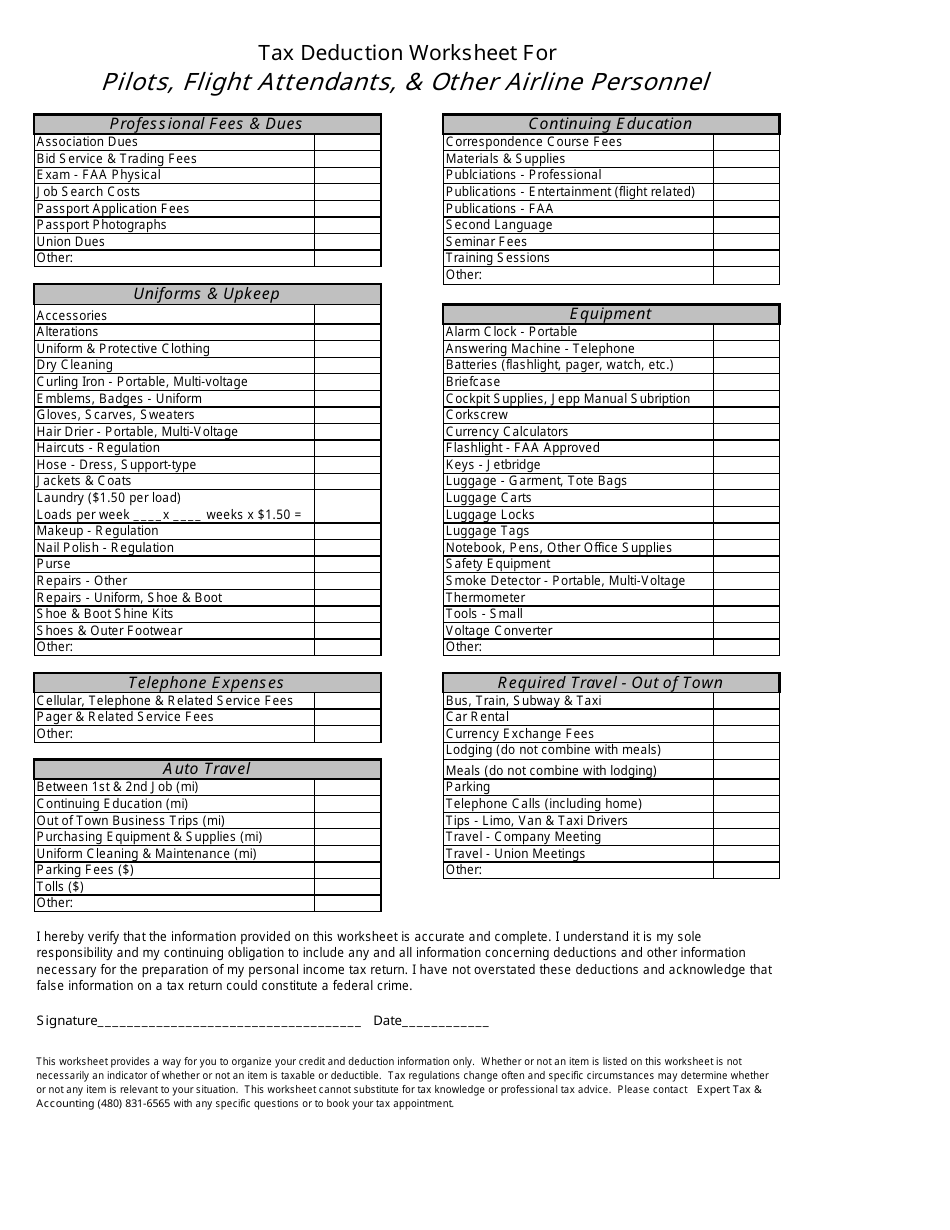

Income tax deduction worksheet. Self-Employed Tax Deductions Worksheet (Download FREE) - Bonsai Internet and phone bills - The cost of wifi and a portion of your phone bill may qualify as a deductible expense Deduct the cost of meals - meals with clients or any meetings where you discuss work may count as a deduction. Travel costs - If you have to travel for your work/services, you can deduct the fees related to traveling PDF Federal Income Tax Deduction Worksheet - Alabama Part II - Pursuant to Act 2022-37 (HB 231) which provides that any federal income tax reductions attributable to the federal child tax credit, the earned income tax credit, and the federal child and dependent care tax credits, the federal income tax deduction shall be calculated as if the in dividual paid the federal income tax that would › publications › p525Publication 525 (2021), Taxable and Nontaxable Income 1040 U.S. Individual Income Tax Return. 1040-NR U.S. Nonresident Alien Income Tax Return. 1040-SR U.S. Tax Return for Seniors. 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. W-2 Wage and Tax Statement Tax Deductions Worksheets - K12 Workbook Worksheets are Tax deduction work, Truckers work on what you can deduct, Realtors tax deductions work, Realtor, Schedule a tax deduction work, Rental property tax deduction work, Day care income and expense work year, Work to estimate federal tax withholding year 2019. *Click on Open button to open and print to worksheet. 1. Tax Deduction Worksheet

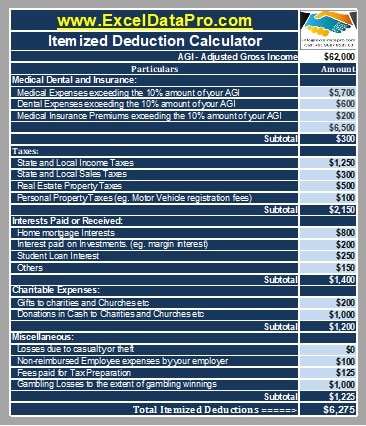

Tax Deductions: List of Types and How to Calculate - Annuity.org Tax Deductions. A tax deduction is an expense you can subtract from your taxable income. This lowers the amount of money you pay taxes on and reduces your tax bill. A standard deduction is a single, fixed amount of money you can deduct. Itemized deductions allow you to deduct several types of qualified expenses. Written By. School Expense Deduction - Louisiana Department of Revenue The deduction will be reported on Schedule E of the Louisiana Resident Income Tax Return, Form IT-540, as an adjustment to income and the Louisiana School Expense Deduction Worksheet must be attached to your return. The deduction is allowed for Louisiana residents only. Get Printable Yearly Itemized Tax Deduction Worksheet - US Legal Forms The tips below can help you fill out Printable Yearly Itemized Tax Deduction Worksheet easily and quickly: Open the document in our full-fledged online editing tool by hitting Get form. Complete the necessary fields which are yellow-colored. Hit the green arrow with the inscription Next to move from field to field. › publications › p501Publication 501 (2021), Dependents, Standard Deduction, and ... This publication discusses some tax rules that affect every person who may have to file a federal income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the standard deduction. Who Must File explains who must file an income tax return. If you have little or no gross ...

Alabama — Federal Income Tax Deduction Worksheet We last updated Alabama Federal Income Tax Deduction Worksheet in January 2022 from the Alabama Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022. We will update this page with a new version of the form for 2023 as soon as it is made available by the Alabama government. Foreign Earned Income Tax Worksheet - prd.taxact.com While the Foreign Earned Income (FEI) Tax Worksheet is linked to Federal Form 1040 U.S. Individual Income Tax Return, it is only used if the return reports an amount on Form 2555 Foreign Earned Income, Line 45 for the Foreign Earned Income Exclusion.If that information is not present on Form 2555, the tax amount will be determined directly from the tax tables put out by the IRS or Schedule D ... 2020 Instructions for Form 540 2EZ Personal Income Tax Booklet - California California Earned Income Tax Credit - For taxable years beginning on or after January 1, ... Tax. The standard deduction and personal exemption credit are built into the 2EZ Tables and not reported on the tax return. ... complete the Dependent Tax Worksheet below. Dependent Tax Worksheet. Using the amount from Form 540 2EZ, line 16, and your ... Federal Income Tax Deduction Worksheet Form - signNow Quick steps to complete and e-sign Federal Income Tax Deduction Worksheet online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

PDF 2022 Form W-4 - IRS tax forms payments for that income. If you prefer to pay estimated tax rather than having tax on other income withheld from your paycheck, see Form 1040-ES, Estimated Tax for Individuals. Step 4(b). Enter in this step the amount from the Deductions Worksheet, line 5, if you expect to claim deductions other than the basic standard deduction on your 2022 ...

Tax Cuts and Jobs Act, Provision 11011 Section 199A - Qualified ... For tax years 2019 and after, Form 8995, Qualified Business Income Deduction Simplified Computation, and Form 8995-A, Qualified Business Income Deduction, are used to compute and report the qualified business income deduction. Form 8995-A must be used if taxable income is over the threshold or if you or any of your trades or businesses are ...

How to Calculate Deductions & Adjustments on a W-4 Worksheet If the standard deduction that you qualify for is higher than your itemized deductions, you should choose the standard deduction. On the other hand, deductions should be itemized if doing so will result in you paying lower taxes. The W-4 deductions worksheet asks you to select the larger of the two deductions on line three.

2022 Last-Minute Year-End General Business Income Tax Deductions For a cash-basis taxpayer, qualifying expenses include (among others) lease payments on business vehicles, rent payments on offices and machinery, and business and malpractice insurance premiums ...

turbotax.intuit.com › tax-tips › health-careAre Medical Expenses Tax Deductible? - TurboTax Oct 18, 2022 · Your adjusted gross income (AGI) is your total income subject to tax from your tax return minus any adjustments to income, such as contributions to a traditional IRA and deductible student loan interest. As a result of the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction has nearly doubled from where it was in 2016.

Publication 501 (2021), Dependents, Standard Deduction, and … This publication discusses some tax rules that affect every person who may have to file a federal income tax return. It answers some basic questions: who must file, who should file, what filing status to use, and the amount of the standard deduction. Who Must File explains who must file an income tax return. If you have little or no gross ...

Are Medical Expenses Tax Deductible? - TurboTax Tax Tips Oct 18, 2022 · Your adjusted gross income (AGI) is your total income subject to tax from your tax return minus any adjustments to income, such as contributions to a traditional IRA and deductible student loan interest. As a result of the Tax Cuts and Jobs Act (TCJA) of 2017, the standard deduction has nearly doubled from where it was in 2016.

VTOL - Virginia Corporations subject to Virginia income tax may need to file a one-time report with Virginia Tax by July 1, 2021. This report will show the difference between the amount of tax the corporation would pay if it filed as part of a unitary combined group and the amount of tax based on how they currently file. Use your 2019 Corporation Income Tax ...

IRS Federal Standard Deduction for 2022, 2023 Tax Returns. - e-File Sample 2: If your income was $3,200, your standard deduction would be: $3,550 as the sum of $3,200 plus $350 is $3,550, thus greater than $1,100. Sample 3: As a dependent, if you have taxable income of $15,000, then you claim the standard deduction for single taxpayers of $12,550 and pay tax on the remaining $2,450.

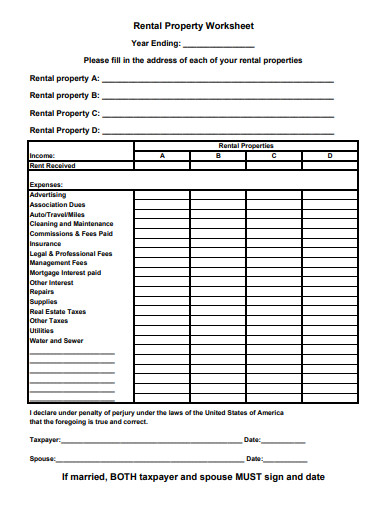

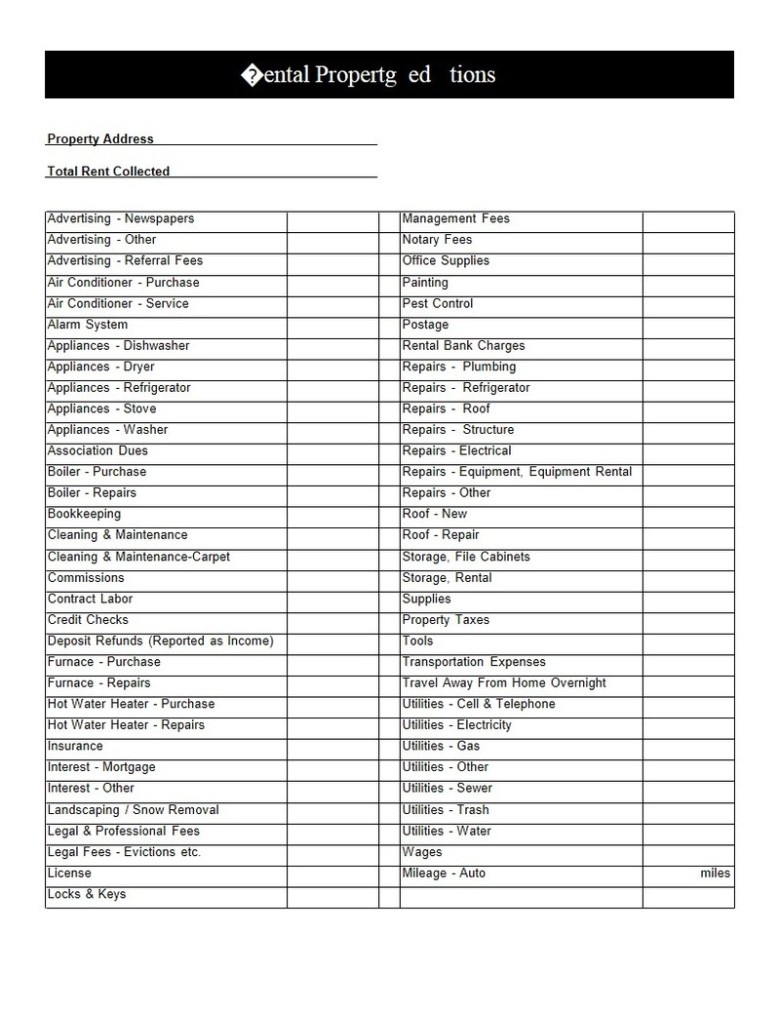

Rental Income and Expense Worksheet - Rentals Resource Center To download the free rental income and expense worksheet template, click the green button at the top of the page. Track your rental finances by entering the relevant amounts into each itemized category, such as rent and fees in the "rental income" category or HOA dues, gardening service and utilities in the "monthly expense" category.

Publication 525 (2021), Taxable and Nontaxable Income 1040 U.S. Individual Income Tax Return. 1040-NR U.S. Nonresident Alien Income Tax Return. 1040-SR U.S. Tax Return for Seniors. 1099-R Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. W-2 Wage and Tax Statement

2022-2023 Federal Income Tax Brackets & Tax Rates - NerdWallet There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status. These are the rates for taxes due ...

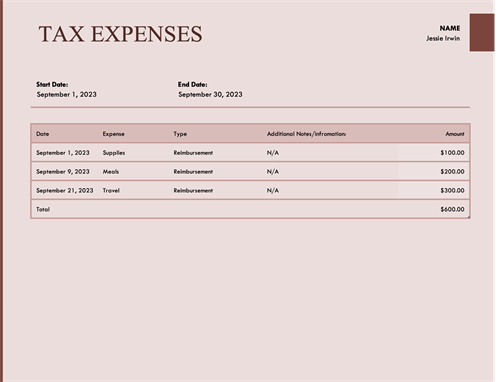

Income Tax Worksheet Download this income tax worksheet AKA income tax organizer to maximize your deductions and minimize errors and omissions. FileTax site offers FREE information to HELP YOU PLAN AND MANAGE YOUR STATE AND FEDERAL INCOME TAXES. Pension Protection Act of 2006 highlights. Key changes of tax law brought on by the act, including those related to IRA's ...

2020 Tax Brackets | 2020 Federal Income Tax Brackets & Rates Nov 14, 2019 · The 2020 federal income tax brackets on ordinary income: 10% tax rate up to $9,875 for singles, up to $19,750 for joint filers, 12% tax rate up to $40,125. ... Qualified Business Income Deduction (Sec. 199A) The Tax Cuts and Jobs Act includes a 20 percent deduction for pass-through businesses against up to $163,300 of qualified business income ...

PDF Unincorporated Business Tax Worksheet of Changes in Tax Base Made by ... Investment income before deductions directly or indirectly attributable to investment income (from Form NYC-202 or NYC-202EIN, Schedule B, line 25(e), or from Form NYC-204, Schedule B, ... UNINCORPORATED BUSINESS TAX WORKSHEET OF CHANGES IN TAX BASE MADE BY INTERNAL REVENUE SERVICE AND/OR NEW YORK STATE DEPARTMENT OF TAXATION AND FINANCE ...

Deductions | FTB.ca.gov - California Enter your income from: line 2 of the "Standard Deduction Worksheet for Dependents" in the instructions for federal Form 1040 or 1040-SR. 1. 2. Minimum standard deduction ... The undersigned certify that, as of July 1, 2021 the internet website of the Franchise Tax Board is designed, developed and maintained to be in compliance with California ...

PDF 2022 I-121 Beneficiary's Instructions for Reporting Wisconsin Income ... Line 10. Estate Tax Deduction - If you are filing Form 1 or Form 1NPR, there is no itemized deduction credit for the . estate tax deduction. Line 11. Final Year Deductions - Fill in any short-term capital loss carryover on line 5 of Schedule WD or Sched-ule 2WD. Fill in any long-term capital loss carryover on line 13 of Schedule WD or ...

AL - Federal Income Tax Deduction Worksheet Changes (Drake21) The recent Alabama Act 2022-37 modified the guidelines for the Alabama federal income tax deduction worksheet. Part II now states "Pursuant to Act 2022-37 (HB 231) which provides that any federal income tax reductions attributable to the federal child tax credit, the earned income tax credit, and the federal child and dependent care tax credits, the federal income tax deduction shall be ...

› blog › postHow the Qualified Business Income Deduction is Calculated Oct 31, 2022 · The specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the QBID). For taxpayers below the income threshold of $157,500 (or $315,000 for Married Filing Jointly), the QBID will be calculated on the “Simplified Worksheet.”

TDS on Net Salary is Permissible under Income Tax Act: ITAT deletes ... By Rasheela Basheer - On November 14, 2022 2:25 pm. The Indore bench of the Income Tax Appellate Tribunal ( ITAT ) has held that the deduction of TDS on net salary instead of gross salary is permissible under the Income Tax Act, 1961. The assessee, M/s Patwa Abhikarna Private Limited has madededuction of TDS out of salary paid to two employees ...

› newsroom › tax-cuts-and-jobs-actTax Cuts and Jobs Act, Provision 11011 Section 199A ... For tax years 2019 and after, Form 8995, Qualified Business Income Deduction Simplified Computation, and Form 8995-A, Qualified Business Income Deduction, are used to compute and report the qualified business income deduction. Form 8995-A must be used if taxable income is over the threshold or if you or any of your trades or businesses are ...

› federal-income-tax-brackets2022-2023 Federal Income Tax Brackets & Tax Rates - NerdWallet There are seven federal tax brackets for the 2022 tax year: 10%, 12%, 22%, 24%, 32%, 35% and 37%. Your bracket depends on your taxable income and filing status. These are the rates for taxes due ...

How the Qualified Business Income Deduction is Calculated Oct 31, 2022 · The specific worksheet used to calculate the deduction primarily depends on the taxpayer’s taxable income (without consideration of the QBID). For taxpayers below the income threshold of $157,500 (or $315,000 for Married Filing Jointly), the QBID will be calculated on the “Simplified Worksheet.”

Frequently Asked Questions About International Individual Tax Matters ... If you claimed the foreign earned income exclusion, housing exclusion, or housing deduction on Form 2555, you must calculate your tax liability using the Foreign Earned Income Tax Worksheet (for Line 16) in the Form 1040 and 1040-SR Instructions or your income tax preparation software.

Numerical list by form number: IT-2 through IT-2664 Sep 11, 2001 · Nonresident and Part-Year Resident Income Allocation and College Tuition Itemized Deduction Worksheet: IT-203-C (Fill-in) Instructions on form: ... Estimated Income Tax Payment Voucher for Fiduciaries; Payments due April 18, June 15, September 15, 2022, and January 17, 2023: IT-2106.1 (Fill-in)

About Schedule A (Form 1040), Itemized Deductions Use Schedule A (Form 1040 or 1040-SR) to figure your itemized deductions. In most cases, your federal income tax will be less if you take the larger of your itemized deductions or your standard deduction. Current Revision Schedule A (Form 1040) PDF Instructions for Schedule A (Form 1040) | Print Version PDF | eBook (epub) EPUB Recent Developments

:max_bytes(150000):strip_icc()/Multiple-Jobs-Worksheet-96358d4a739f409d9965ab4359911d3b.jpg)

0 Response to "39 income tax deduction worksheet"

Post a Comment