39 non cash charitable donations worksheet

Donation value guide - Goodwill NNE Below is a donation value guide of what items generally sell for at Goodwill locations. To determine the fair market value of an item not on this list, use 30% of the item’s original price. About Form 8283, Noncash Charitable Contributions | Internal ... Form 8283 is used to claim a deduction for a charitable contribution of property or similar items of property, the claimed value of which exceeds $500. Individuals, partnerships, and corporations file Form 8283 to report information about noncash charitable contributions when the amount of their deduction for all noncash gifts is more than $500.

Publication 526 (2021), Charitable Contributions | Internal ... If you make cash contributions or noncash contributions (other than capital gain property) during the year (1) to an organization described earlier under Second category of qualified organizations, or (2) “for the use of” any qualified organization, your deduction for those contributions is limited to 30% of your AGI, or if less, 50% of your AGI minus all your contributions to 50% limit organizations (other than contributions subject to a 100% limit or qualified conservation ...

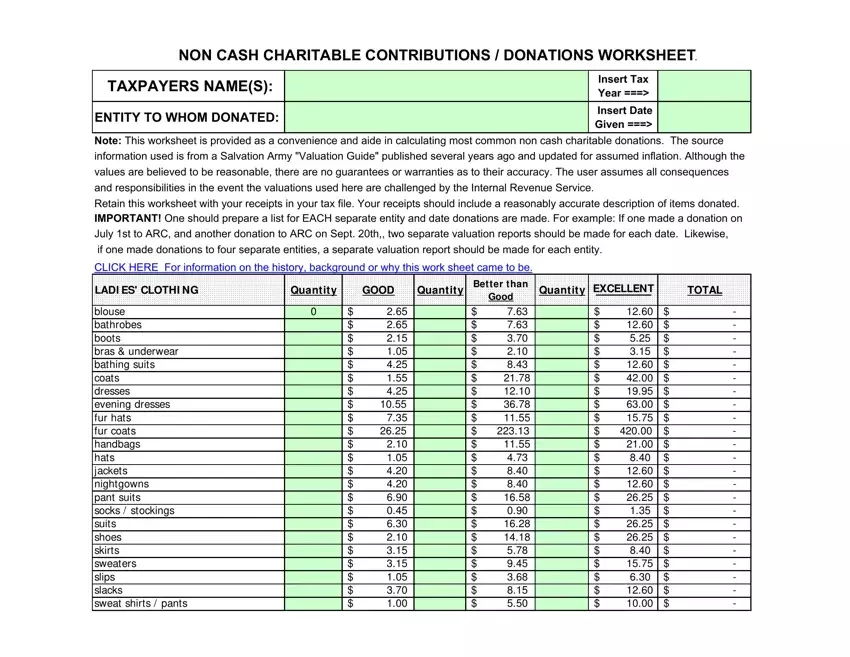

Non cash charitable donations worksheet

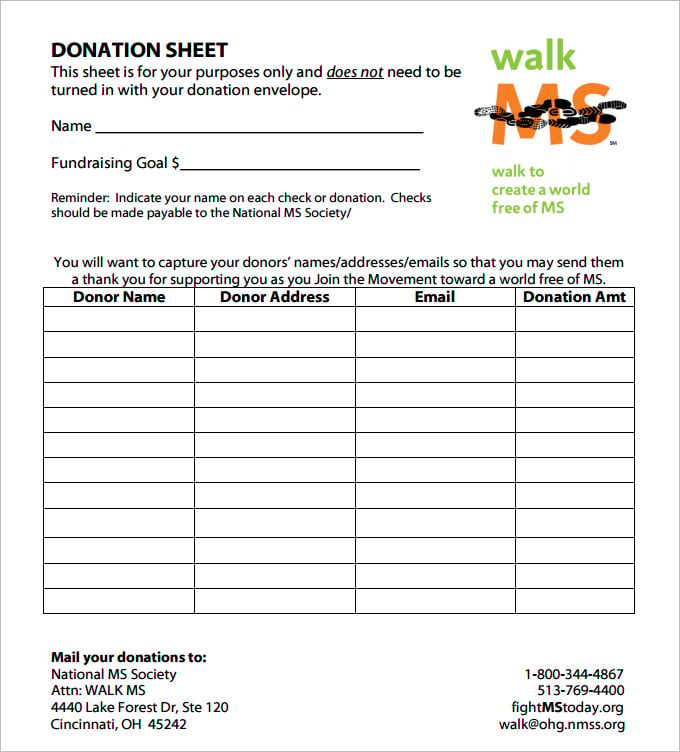

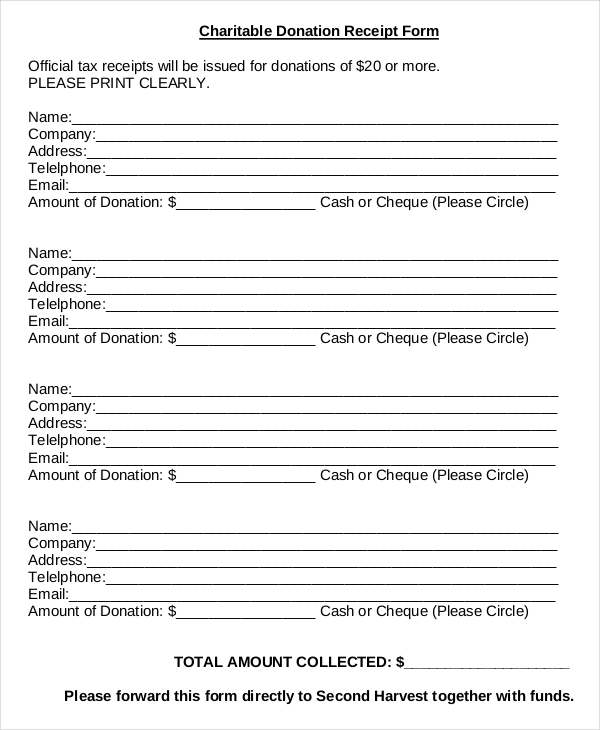

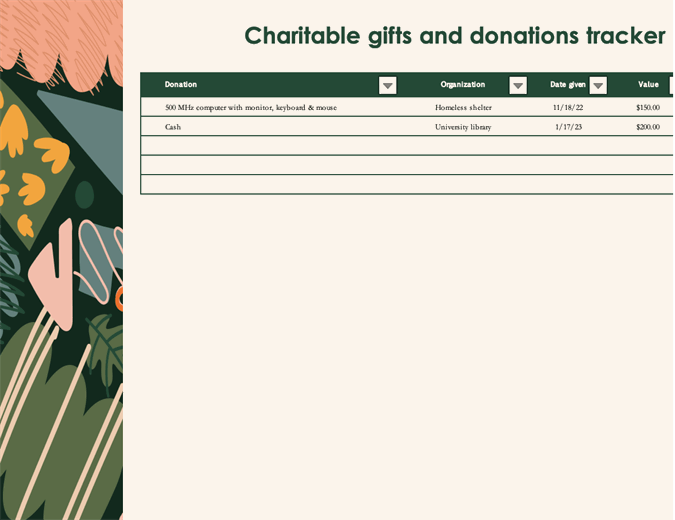

NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET TAXPAYERS NAME(S): Insert Tax Year ===> ENTITY TO WHOM DONATED: Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source Charitable Organizations - Substantiating Noncash Contributions Aug 01, 2022 · For more information, get Publication 561, Determining the Value of Donated Property PDF. Form 8283 For noncash donations over $5,000, the donor must attach Form 8283 to the tax return to support the charitable deduction. The donee must sign Part IV of Section B, Form 8283 unless publicly traded securities are donated. IRS tax forms IRS tax forms

Non cash charitable donations worksheet. Get NON-CASH DONATION WORKSHEET - US Legal Forms Ensure the details you fill in NON-CASH DONATION WORKSHEET is updated and accurate. Add the date to the record with the Date feature. Click on the Sign tool and create a digital signature. There are 3 available choices; typing, drawing, or uploading one. Be sure that every area has been filled in correctly. non cash charitable contributions/donations worksheet 2007 ... Tax Deductions - ItsDeductible Those old clothes are worth more than you think. Get the most of what you're giving. > Learn More IRS tax forms IRS tax forms

Charitable Organizations - Substantiating Noncash Contributions Aug 01, 2022 · For more information, get Publication 561, Determining the Value of Donated Property PDF. Form 8283 For noncash donations over $5,000, the donor must attach Form 8283 to the tax return to support the charitable deduction. The donee must sign Part IV of Section B, Form 8283 unless publicly traded securities are donated. NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET NON-CASH CHARITABLE CONTRIBUTIONS / DONATIONS WORKSHEET TAXPAYERS NAME(S): Insert Tax Year ===> ENTITY TO WHOM DONATED: Insert Date Given ===> Note: This worksheet is provided as a convenience and aid in calculating most common non-cash charitable donations. The source

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/xlmedia/NRING3A7HVENNGTFLES5VGHIUI.png)

0 Response to "39 non cash charitable donations worksheet"

Post a Comment