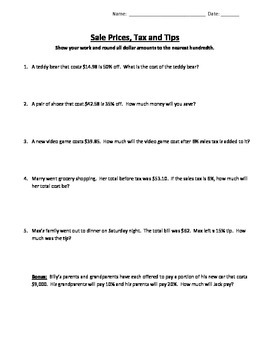

41 sales tax and discount worksheet

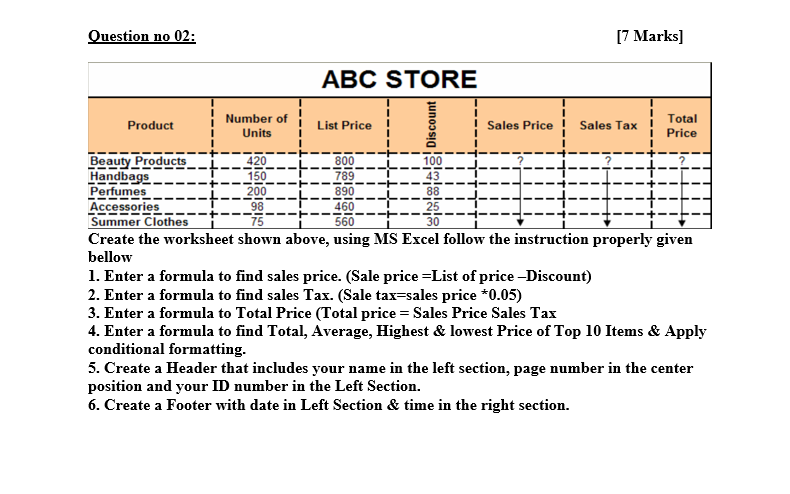

Publication 550 (2021), Investment Income and Expenses - IRS tax forms Market discount. Market discount on a tax-exempt bond is not tax exempt. If you bought the bond after April 30, 1993, you can choose to accrue the market discount over the period you own the bond and include it in your income currently as taxable interest. See Market Discount Bonds, later. If you do not make that choice, or if you bought the ... Record Special Sales Prices and Discounts - Business Central Oct 11, 2022 · If you want to copy sales prices, such as an individual customer's sales prices to use for a customer price group, you must run the Suggest Sales Price on Wksh. batch job on the Sales Price Worksheet page. Choose the icon, enter Sales Price Worksheet, and then choose the related link. Choose the Suggest Sales Price on Wksh. action.

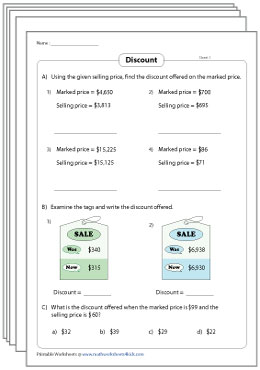

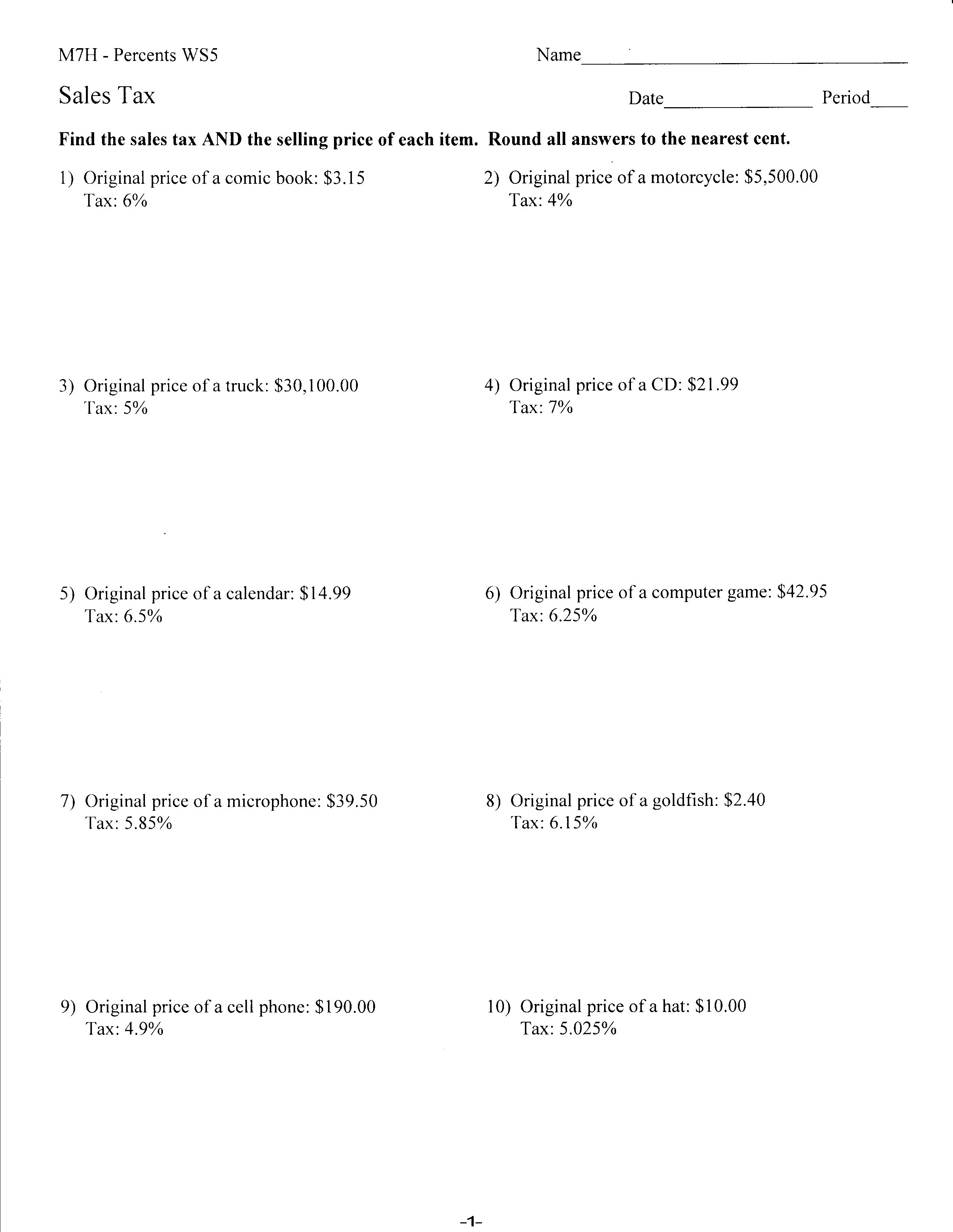

Markup, Discount, and Tax - Kuta Software Discount: 50% 14) Original price of a camera: $554.99 Discount: 48% 15) Original price of a CD: $17.00 Discount: 50% 16) Original price of a CD: $22.95 Discount: 10% 17) Original price of a book: $49.95 Tax: 3% 18) Original price of a book: $90.50 Tax: 4% 19) Original price of an MP3 player: $99.50 Tax: 4% 20) Original price of a microphone ...

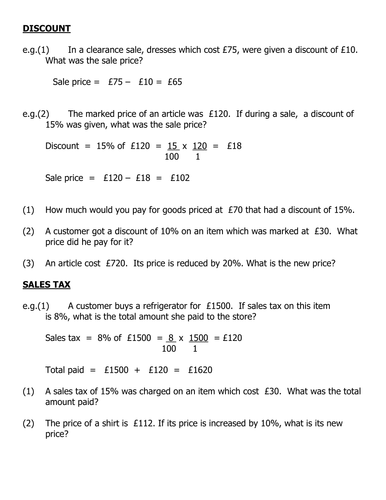

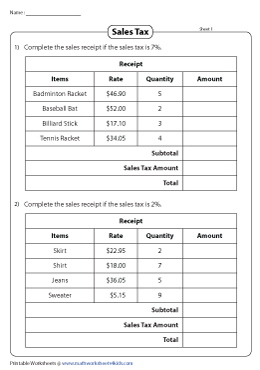

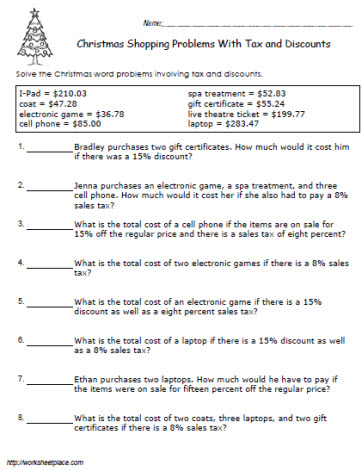

Sales tax and discount worksheet

Florida Dept. of Revenue - Forms and Publications Application for Sales and Use Tax County Control Reporting Number: PDF (82KB) Fillable PDF (179KB) ... Bond Worksheet Instructions (Form DR-157W) Fuel or Pollutants Surety Bond (Form DR-157) ... Application for Homestead Tax Discount, Veterans Age 65 and Older with a Combat-Related Disability: DOC (73KB) PDF (101KB) 1040 (2021) | Internal Revenue Service - IRS tax forms If you received any tax-exempt interest (including any tax-exempt original issue discount (OID)), such as from municipal bonds, each payer should send you a Form 1099-INT or a Form 1099-OID. In general, your tax-exempt stated interest should be shown in box 8 of Form 1099-INT or, for a tax-exempt OID bond, in box 2 of Form 1099-OID and your tax ... Selling on Etsy & Your Taxes - TurboTax Tax Tips & Videos Oct 29, 2022 · #1 best-selling tax software: Based on aggregated sales data for all tax year 2021 TurboTax products. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2022, tax year 2021. Self-Employed defined as a return with a Schedule C/C-EZ tax form.

Sales tax and discount worksheet. Tax Support: Answers to Tax Questions | TurboTax® US Support The TurboTax community is the source for answers to all your questions on a range of taxes and other financial topics. Massachusetts Department of Revenue | Mass.gov DOR manages state taxes and child support. We also help cities and towns manage their finances, and administer the Underground Storage Tank Program. Similarly, our mission includes rulings and regulations, tax policy analysis, communications, and legislative affairs. Sales Tax and Discount Worksheet - psd202.org Discount, Tax, and Tip Worksheet Name: _____ Discount: The amount saved and subtracted from the original price of an item to get the discounted price. Procedure: 1. The rate is usually given as a percent. ... If the sales tax rate is 7.25% in California, then how much would you pay in Los Angeles for a pair of shoes that cost $39.00? 6) Publication 526 (2021), Charitable Contributions - IRS tax forms Ordering tax forms, instructions, and publications. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. ... The interest, including bond discount, receivable on the bond that ...

Selling on Etsy & Your Taxes - TurboTax Tax Tips & Videos Oct 29, 2022 · #1 best-selling tax software: Based on aggregated sales data for all tax year 2021 TurboTax products. #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of 2022, tax year 2021. Self-Employed defined as a return with a Schedule C/C-EZ tax form. 1040 (2021) | Internal Revenue Service - IRS tax forms If you received any tax-exempt interest (including any tax-exempt original issue discount (OID)), such as from municipal bonds, each payer should send you a Form 1099-INT or a Form 1099-OID. In general, your tax-exempt stated interest should be shown in box 8 of Form 1099-INT or, for a tax-exempt OID bond, in box 2 of Form 1099-OID and your tax ... Florida Dept. of Revenue - Forms and Publications Application for Sales and Use Tax County Control Reporting Number: PDF (82KB) Fillable PDF (179KB) ... Bond Worksheet Instructions (Form DR-157W) Fuel or Pollutants Surety Bond (Form DR-157) ... Application for Homestead Tax Discount, Veterans Age 65 and Older with a Combat-Related Disability: DOC (73KB) PDF (101KB)

0 Response to "41 sales tax and discount worksheet"

Post a Comment