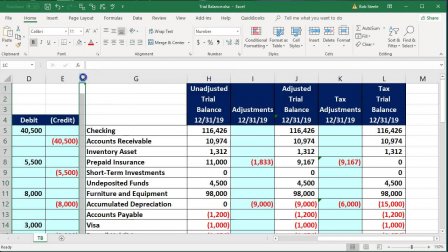

44 convert accrual to cash basis worksheet

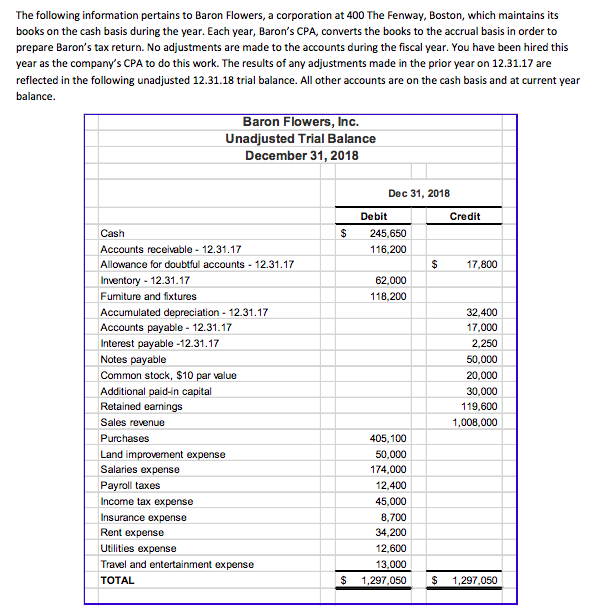

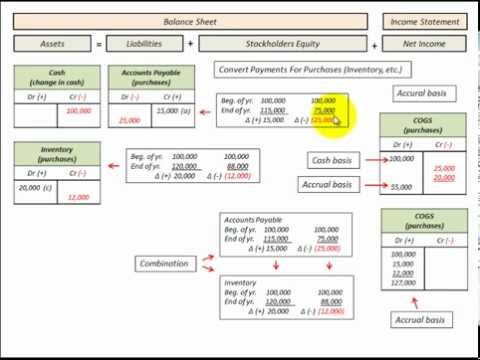

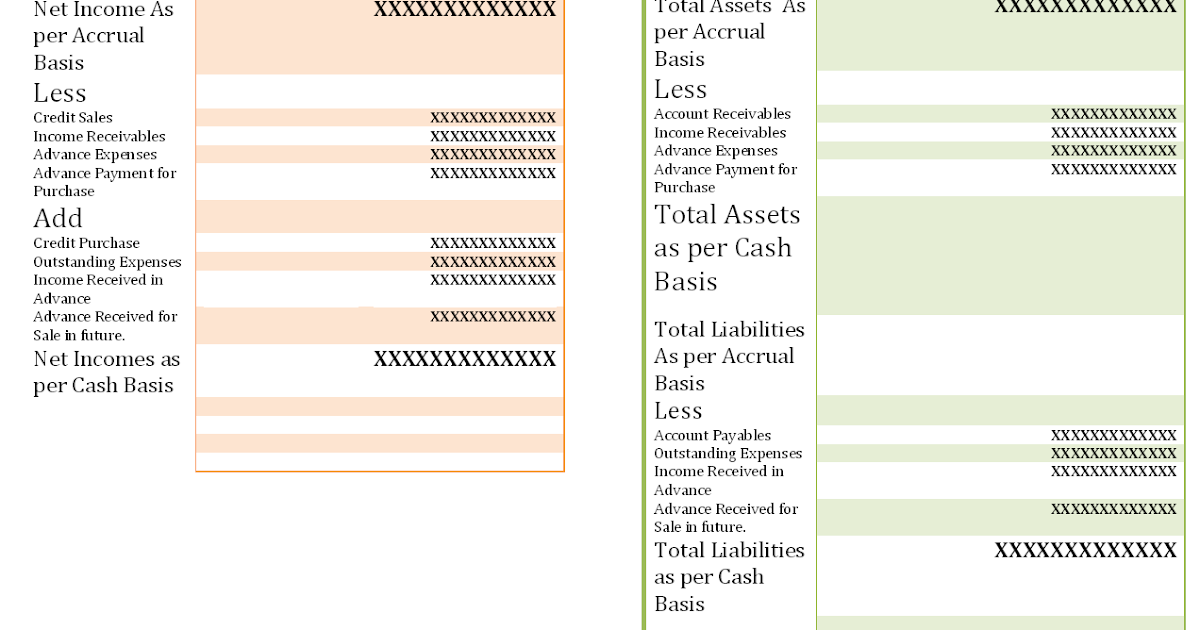

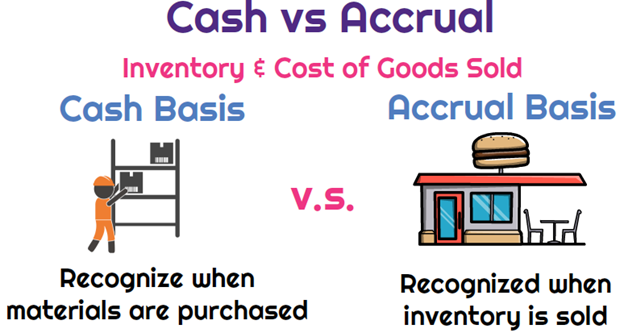

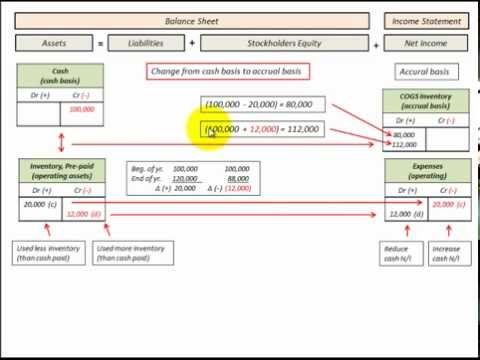

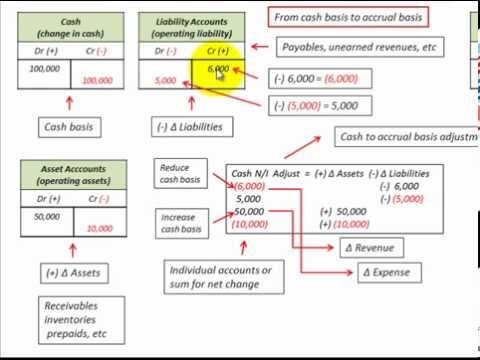

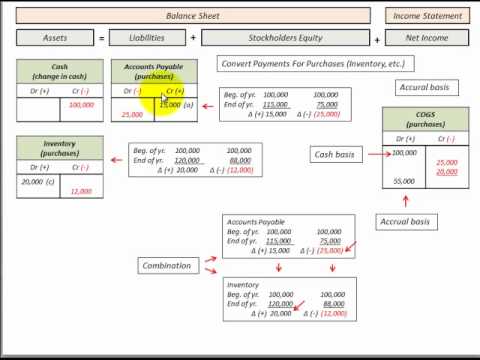

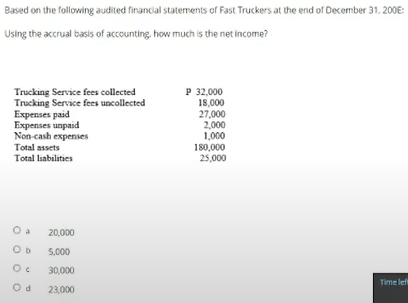

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols; How to convert accrual basis to cash basis accounting ... May 21, 2022 · To convert from accrual basis to cash basis accounting, follow these steps: Subtract accrued expenses . If an expense has been accrued because there is no supplier invoice for it, remove it from the financial statements.

Achiever Papers - We help students improve their academic ... Professional academic writers. Our global writing staff includes experienced ENL & ESL academic writers in a variety of disciplines. This lets us find the most appropriate writer for any type of assignment.

Convert accrual to cash basis worksheet

PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ... Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). Accounting Terminology Guide - Over 1,000 Accounting and ... Aug 10, 1993 · The procedure for converting the INCOME STATEMENT from an ACCRUAL to a CASH BASIS. Individual Retirement Account (IRA) A personal savings plan that allows an individual to make cash contributions per year dependent on the individual'sadjusted gross income and participation in an employer's retirement plan.

Convert accrual to cash basis worksheet. Publication 550 (2021), Investment Income and Expenses ... Line 7; also use Schedule D, Form 8824, and the Qualified Dividends and Capital Gain Tax Worksheet or the Schedule D Tax Worksheet *Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Use Part II if you held the shares more than 1 year. Use Part I if you held your mutual fund shares 1 year or less. Accounting Terminology Guide - Over 1,000 Accounting and ... Aug 10, 1993 · The procedure for converting the INCOME STATEMENT from an ACCRUAL to a CASH BASIS. Individual Retirement Account (IRA) A personal savings plan that allows an individual to make cash contributions per year dependent on the individual'sadjusted gross income and participation in an employer's retirement plan. Publication 590-A (2021), Contributions to Individual ... Modified AGI limit for certain married individuals increased. If you are married and your spouse is covered by a retirement plan at work and you aren’t, and you live with your spouse or file a joint return, your deduction is phased out if your modified AGI is more than $204,000 (up from $198,000 for 2021) but less than $214,000 (up from $208,000 for 2021). PlayStation userbase "significantly larger" than Xbox even if ... Oct 12, 2022 · Microsoft has responded to a list of concerns regarding its ongoing $68bn attempt to buy Activision Blizzard, as raised by the UK's Competition and Markets Authority (CMA), and come up with an ...

0 Response to "44 convert accrual to cash basis worksheet"

Post a Comment